Okay, folks, let's cut right to the chase: understanding Ramp is key to unlocking serious financial efficiency for your business. In the world of AI tools for accounting and bookkeeping, automating tedious tasks and gaining real-time spend control isn't just a luxury—it's a strategic imperative. This comprehensive FAQ guide deconstructs everything you need to know about Ramp's AI finance platform, from how it makes money to its robust security features and how it stacks up against competitors like Brex. You'll learn how Ramp's intelligent automation can eliminate manual data entry, streamline expense management, and transform your entire finance workflow. At Best AI Tools For Finance, our mission, driven by founder Scott Seymour, is to demystify complex financial tools and empower business owners. We believe that leveraging the right finance automation technology is paramount. If you're wrestling with old-school expense reports and clunky accounting, you're in the right place to upgrade your entire approach to AI Tools For Accounting and Bookkeeping. For financial decision-makers, understanding Ramp's security protocols and ROI is paramount. We'll lay out exactly why this AI finance platform is a game-changer for businesses serious about modernizing their operations. As you dive deeper into this Ramp Review, you'll discover how the platform not only enhances financial accuracy but also fosters a culture of accountability within teams. With customizable features, Ramp empowers users to create tailored solutions that fit their unique business needs, ensuring a smoother financial operation. Don't miss out on harnessing the full potential of AI-driven finance solutions that can propel your business forward.

Key Takeaways

- AI-Powered Platform: Ramp uses advanced AI for expense categorization, receipt matching, and spend control with 95%+ accuracy after training

- Revenue Model: Ramp makes money through interchange fees, allowing them to offer their platform for free to businesses

- Security Standards: SOC 2 Type II compliance, PCI DSS Level 1, and military-grade AES-256 encryption protect all financial data

- ROI Achievement: Forrester study shows 503% ROI over three years through cost savings, cashback, and operational efficiency gains

- Charge Card Model: Requires full balance payment each month, promoting financial discipline while offering higher spending limits

Ramp AI Finance Platform: Complete FAQ Guide

What is Ramp and how does it use AI for business finance automation?

Ramp is a comprehensive AI-powered finance automation platform that combines corporate cards, expense management, bill payments, and accounting integrations into a unified system. Unlike traditional expense management tools, Ramp leverages artificial intelligence throughout its platform to actively save businesses time and money while providing real-time spend control.

Ramp's AI, known as “Ramp Intelligence,” operates across multiple finance functions:

- Expense Management AI: Automatically scans connected email accounts and SMS messages to match receipts with transactions, learning to categorize expenses into correct general ledger accounts over time

- Spend Control AI: Analyzes spending patterns in real-time, flagging out-of-policy purchases, duplicate subscriptions, and anomalous vendor charges with instant manager alerts

- Accounts Payable AI: Uses advanced Optical Character Recognition (OCR) and machine learning to read invoices, extract key details like due dates and amounts, and prepare them for payment approval

- Vendor Management AI: Identifies cost-saving opportunities and flags redundant software subscriptions across the organization

What sets Ramp apart in the AI finance tools space is its learning capability. When users categorize transactions initially, the AI creates rules that automatically apply to future similar transactions. This means the system becomes more accurate and efficient over time, with most users reporting over 95% accuracy after a few weeks of use. The platform essentially transforms manual finance workflows into automated, intelligent processes that require minimal human intervention.

Try Ramp's AI PlatformHow does Ramp make money if the platform is free for businesses?

Ramp's business model is built on interchange fees rather than software subscription charges, which allows them to offer their AI finance platform at no cost to users. This revenue structure is fundamental to understanding why Ramp can provide enterprise-grade finance automation tools without monthly fees.

Interchange fees are small percentages (typically 1-3%) of transaction values that merchants' banks pay to card issuers' banks every time a customer uses their card for purchases. These fees are set by card networks like Visa and are invisible to end customers. When employees use Ramp corporate cards for business expenses, Ramp receives a portion of these interchange fees from merchants through their banking partners.

This model creates a powerful alignment of interests:

- Ramp's revenue grows directly with their customers' card spending volume

- This incentivizes them to build a platform that businesses want to use for all corporate expenses

- The more value Ramp provides through their AI automation, the more likely businesses are to route all spending through Ramp cards

- Higher engagement and transaction volume directly benefits Ramp's bottom line

While the core platform including expense management, bill pay, accounting automation, and AI categorization remains free, Ramp may charge for certain specialized services or advanced enterprise features. However, the vast majority of small to medium-sized businesses can access the full suite of AI finance tools without any subscription costs.

This freemium model has proven successful in the fintech space, allowing Ramp to scale rapidly while providing genuine value to businesses seeking to automate their finance operations without additional software expenses.

Is Ramp safe to use and what security measures protect business financial data?

Ramp is not a bank but operates as a financial technology company through partnerships with FDIC-insured banks and established card networks like Visa. This structure is common and heavily regulated in the fintech industry, with Ramp cards issued by partner banks such as Sutton Bank and Celtic Bank, ensuring the same protections as traditional banking relationships.

Ramp implements enterprise-grade security measures that meet or exceed industry standards for financial services:

- SOC 2 Type II and SOC 3 Compliance: Independent third-party auditors continuously review and validate their security controls

- PCI DSS Level 1 Compliance: The highest standard for handling cardholder data, equivalent to major credit card companies

- AES-256 Encryption: Military-grade encryption protects all sensitive data both at rest in databases and in transit over the internet

- Regular Penetration Testing: Independent security firms identify and address potential vulnerabilities before they can be exploited

- Granular User Permissions: Robust internal controls including customizable approval workflows

- Real-time Monitoring: AI continuously monitors for unusual spending patterns and automatically flags suspicious transactions

Beyond technical security, Ramp provides robust internal controls that help businesses minimize internal fraud risk and maintain tight control over corporate spending. The platform's AI continuously monitors for unusual spending patterns and can automatically flag suspicious transactions for review.

For businesses in the AI finance tools space, Ramp's security infrastructure provides the confidence needed to automate sensitive financial processes while maintaining compliance with industry regulations and internal security policies.

How does Ramp compare to competitors like Brex and American Express for AI-powered finance?

Ramp differentiates itself from competitors through its software-first approach and AI automation focus, though each platform serves different business needs within the finance technology landscape.

Ramp vs. American Express:

The fundamental difference lies in their core focus areas. American Express is primarily a card and travel company that has added expense management features to their offering. AmEx excels in global acceptance, premium travel perks, and established brand recognition. However, their software platform is often considered less intuitive and modern compared to AI-native solutions.

Ramp approaches the market as a software-first company where the card is a vehicle for comprehensive finance automation. Their AI-powered receipt matching, expense categorization, and accounting synchronization are designed to eliminate manual finance work more effectively than AmEx's traditional expense reporting tools. For businesses prioritizing automation and efficiency over travel rewards, Ramp typically provides superior workflow optimization.

Ramp vs. Brex:

This represents a closer competitive comparison, as both are modern, technology-first finance platforms. Historically, Brex focused heavily on venture-backed startups while Ramp targeted a broader range of small to mid-sized businesses, though they now compete directly across market segments.

| Feature | Ramp | Brex |

|---|---|---|

| AI Focus | Spend control & prevention | Comprehensive spend management |

| Target Market | Broad SMB focus | Venture-backed startups |

| Global Payments | Limited international | Strong global capabilities |

| Automation | Advanced AI categorization | Good automation features |

| Additional Services | Finance automation focus | Venture debt offerings |

The key differentiators often center on AI execution and feature focus. Ramp aggressively markets its “spend control” philosophy, with AI designed to identify and prevent wasteful spending before it occurs. Their expense categorization and accounting rule automation are generally considered more robust. Brex emphasizes comprehensive “spend management” with stronger global payment capabilities and venture debt offerings for qualifying startups.

For businesses evaluating AI finance tools, Ramp typically excels when the priority is domestic operations with heavy automation needs, while Brex may be preferable for companies with complex international requirements or those seeking additional financial services beyond expense management.

What type of card does Ramp offer and how does it affect business cash flow?

Ramp issues charge cards rather than traditional credit cards, which creates important implications for business cash flow management and financial discipline. Understanding this distinction is crucial for businesses evaluating AI finance tools and their impact on working capital.

A charge card requires the full balance to be paid at the end of each statement period (typically 30 days for Ramp), unlike credit cards that allow businesses to carry balances month-to-month while paying interest. This structure eliminates the possibility of accumulating revolving debt, which aligns with Ramp's philosophy of promoting responsible spending and financial transparency.

The charge card model offers several advantages for business finance management:

- Financial Discipline: Enforces responsible spending by preventing the accumulation of high-interest debt that can strain cash flow over time

- Higher Spending Limits: Because the risk of long-term debt is eliminated, charge card providers can often offer higher spending limits based on cash balance and financial health rather than traditional credit scores

- Cash-Based Underwriting: Ramp determines spending limits primarily through analysis of connected bank account balances and cash flow patterns

- Startup-Friendly: Particularly attractive for well-funded startups or businesses with strong cash positions but limited credit history

Ramp determines spending limits primarily through analysis of connected bank account balances and cash flow patterns, making it particularly attractive for well-funded startups or businesses with strong cash positions but limited credit history. This approach can provide access to higher limits than traditional credit cards for qualifying businesses.

The charge card structure works best for businesses with predictable cash flow and sufficient working capital to cover monthly expenses. Companies that rely on extended payment terms or seasonal cash flow variations should carefully evaluate whether the 30-day payment requirement aligns with their financial operations before implementing Ramp as their primary corporate card solution.

How accurate is Ramp's AI for expense categorization and receipt matching?

Ramp's AI-powered expense categorization and receipt matching represents one of the platform's strongest features, with accuracy rates typically exceeding 95% after an initial training period. The system employs a sophisticated multi-layered approach that combines email scanning, OCR technology, and machine learning to automate expense processing.

How Ramp's AI Works:

- Email Scanning: Automatically scans connected email accounts (Gmail, Outlook, etc.) for electronic receipts from common vendors like Uber, Amazon, airlines, and software providers

- OCR Technology: Mobile app extracts key information from physical receipts including merchant names, amounts, dates, and expense categories

- Machine Learning: Creates intelligent rules that automatically apply to future similar transactions based on initial categorizations

- Adaptive Learning: System becomes more accurate over time as it processes more data

The platform's true strength lies in its adaptive learning capability. When finance managers or users categorize transactions initially, Ramp creates intelligent rules that automatically apply to future similar transactions. For example, once “AWS” is categorized as “Software Subscriptions” with the appropriate general ledger code, all subsequent AWS transactions are automatically coded correctly. This learning process significantly reduces manual work, especially for recurring vendors and standard business expenses.

Accuracy Considerations:

However, accuracy can vary in specific situations. The AI may struggle with:

- Non-standard invoice formats

- Handwritten receipts

- Ambiguous vendor names where context matters

- Multi-purpose vendors (e.g., a payment to “Staples” could be “Office Supplies” or “Marketing Materials”)

The system performs best for businesses with consistent spending patterns and standard vendor relationships. Companies with highly variable or project-based expenses may need more manual oversight initially, though the AI continues learning and improving accuracy over time as more data becomes available.

What are the requirements to get approved for Ramp's AI finance platform?

Ramp's underwriting process focuses on real-time financial health and cash flow rather than traditional credit history, making it particularly accessible for well-funded startups and growing businesses. Their approval criteria reflect a modern approach to business finance that prioritizes current financial strength over historical credit metrics.

Key Requirements for Approval:

- Cash Reserves: Minimum $75,000 in a US business bank account (verified through secure bank account connections)

- Business Structure: Formal incorporation as C-Corps, S-Corps, or LLCs registered in the United States

- Operational History: Evidence of legitimate business operations and consistent cash flow patterns

- Cash-Based Limits: Spending limits directly correlate with cash balance – higher balances enable higher limits

- US-Based Operations: Must be a US-registered business entity

The most critical requirement is maintaining adequate cash reserves. Ramp typically requires applicant companies to have at least $75,000 in a US business bank account, which they verify through secure bank account connections. Your cash balance directly influences your potential corporate card spending limit, with higher balances enabling higher limits. This cash-based underwriting approach allows businesses with strong financial positions but limited credit history to access substantial spending capacity.

Business structure requirements include incorporation as a formal business entity such as C-Corps, S-Corps, or LLCs registered in the United States. Sole proprietorships and unincorporated entities are generally not eligible, as Ramp focuses on established business operations rather than individual contractors or freelancers.

Operational history plays a supporting role in the approval process. While Ramp serves many startups, they look for evidence of legitimate business operations and consistent cash flow patterns. Brand-new companies without established banking history or revenue may face additional scrutiny, though well-funded startups with strong cash positions often gain approval.

Industry and business model assessments follow standard financial services risk protocols. Very high-risk industries may require additional documentation or face limitations, though most standard business models are readily approved.

Unlike traditional card applications that heavily weight personal credit scores, Ramp's process is almost entirely based on business financial data, making it an attractive option for entrepreneurs who may lack extensive personal credit history but operate financially sound businesses.

Apply for Ramp TodayHow does Ramp's bill pay automation compare to dedicated tools like Bill.com?

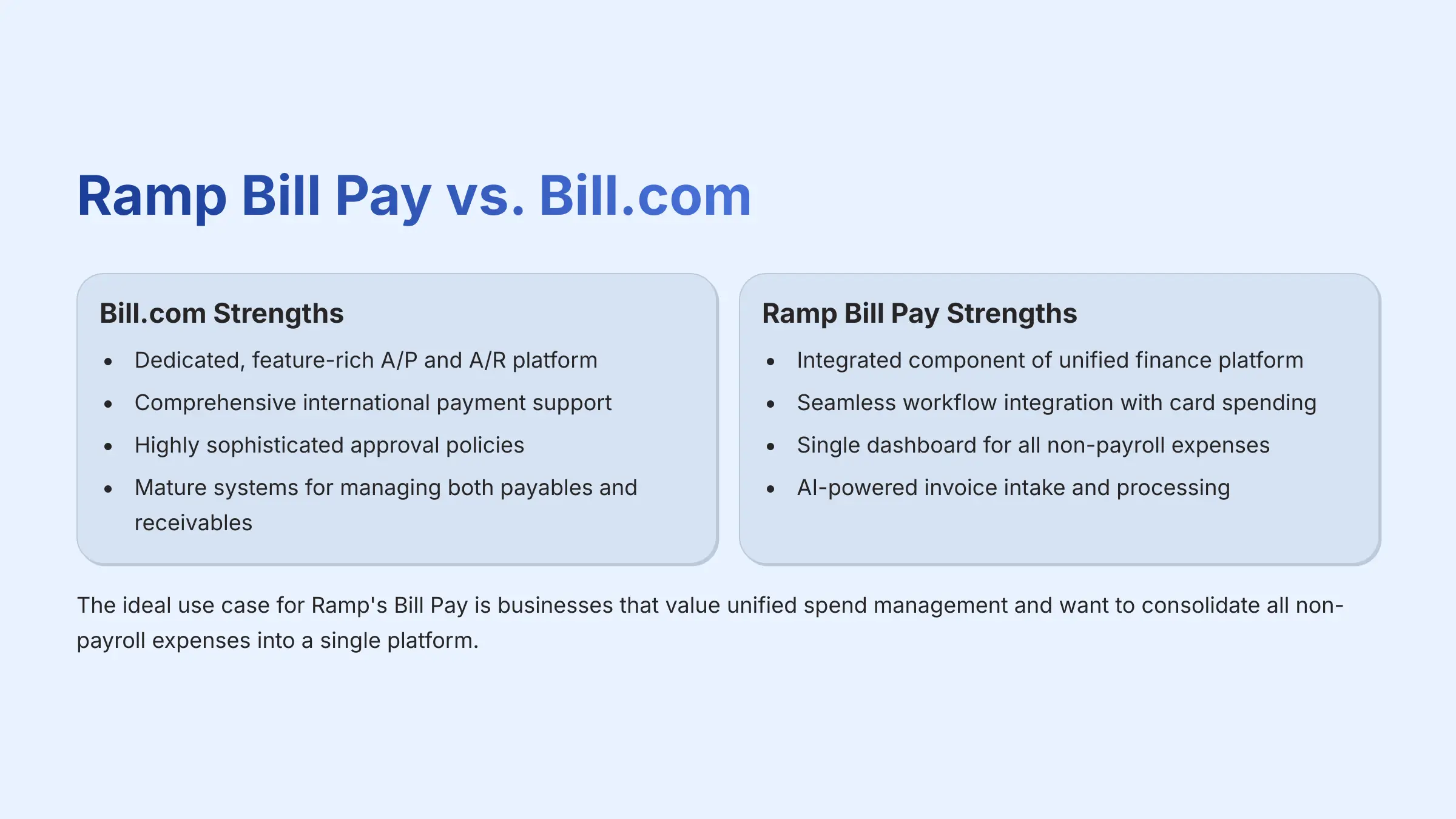

Ramp's Bill Pay functionality competes directly with established accounts payable platforms like Bill.com, but with a fundamentally different approach that emphasizes integration and simplicity over specialized complexity. Understanding these differences helps businesses choose the right solution for their accounts payable automation needs.

Bill.com – Dedicated A/P Platform:

- Specialized Features: Feature-rich accounts payable and receivable platform with deep, complex workflow capabilities

- International Support: Comprehensive international payment support to numerous countries

- Complex Approvals: Highly sophisticated approval policies for enterprise needs

- A/P + A/R: Mature systems for managing both payables and receivables

- Enterprise Focus: Ideal for businesses with multiple subsidiaries, detailed job costing, or intricate approval hierarchies

Ramp's Bill Pay – Integrated Approach:

- Unified Platform: Seamless workflow integration with card spending and employee reimbursements

- Single Dashboard: Manage all non-payroll expenses from one location

- AI Invoice Processing: Forward PDF invoices to dedicated email address for automatic scanning, extraction, coding, and routing

- Faster Setup: More intuitive process for standard vendor invoices

- Consolidated Vendors: Eliminates need to manage multiple vendor relationships

Bill.com operates as a dedicated, feature-rich accounts payable and receivable platform with deep, complex workflow capabilities. Its strengths include comprehensive international payment support to numerous countries, highly sophisticated approval policies, and mature systems for managing both payables and receivables. For businesses with complex A/P requirements such as multiple subsidiaries, detailed job costing, or intricate approval hierarchies, Bill.com often provides more specialized functionality.

Ramp's Bill Pay is designed as an integrated component of their unified finance platform, prioritizing seamless workflow integration over specialized features. The key advantage is operational unity—businesses can manage card spending, employee reimbursements, and vendor payments from a single dashboard with one accounting integration. This consolidation eliminates the need to manage multiple vendor relationships and reduces training complexity for finance teams.

Ramp's AI excels at invoice intake and processing. Users can simply forward PDF invoices to their dedicated Ramp email address, and the AI automatically scans, extracts key data, codes transactions, and routes them for approval. This process is often faster and more intuitive than Bill.com's more structured approach, particularly for standard vendor invoices.

The ideal use case for Ramp's Bill Pay is businesses that value unified spend management and want to consolidate all non-payroll expenses into a single platform. Companies requiring highly specialized A/P features, complex international payments, or detailed receivables management may find Bill.com's dedicated functionality more suitable for their specific requirements.

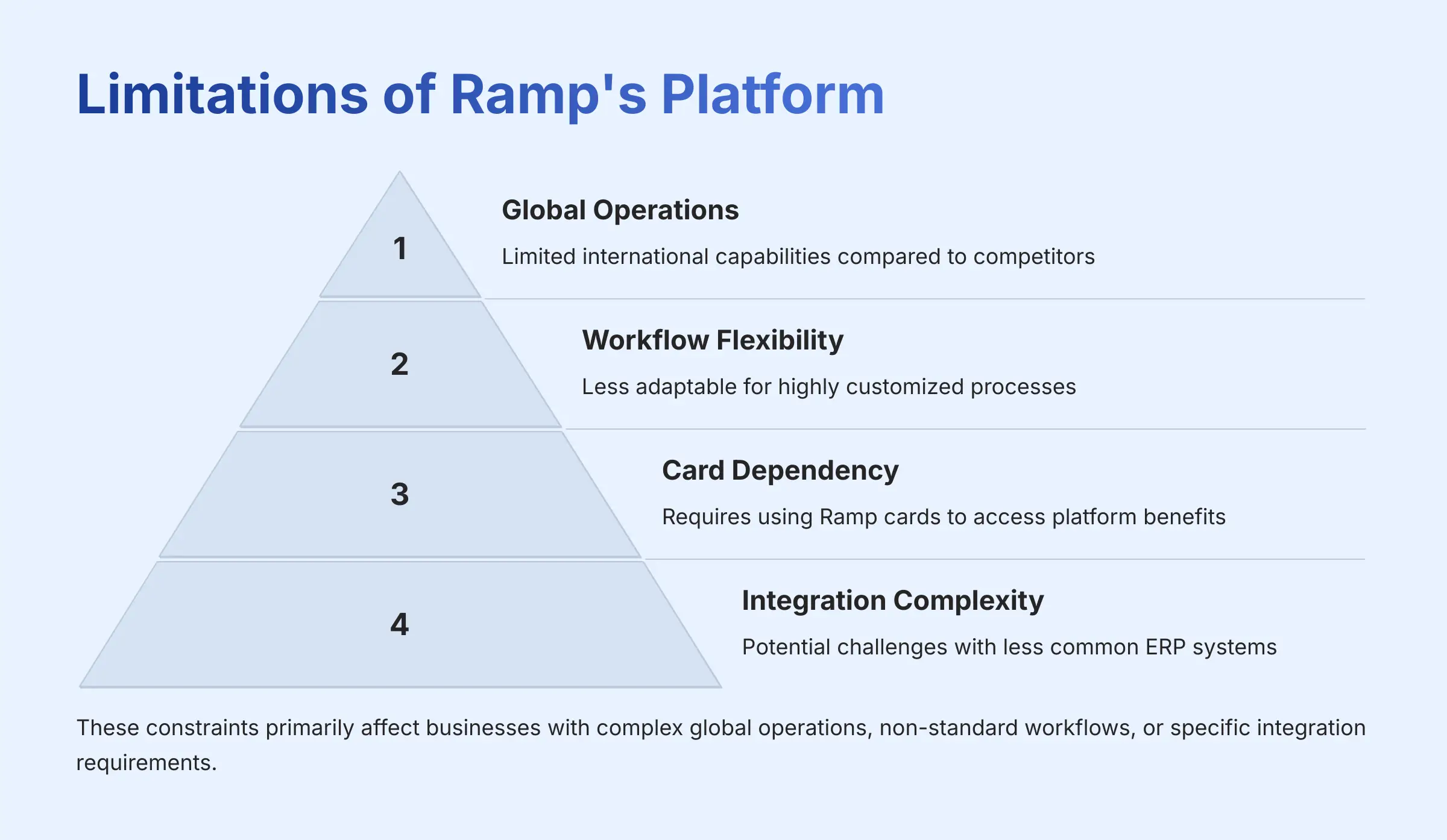

What are the main limitations of Ramp's AI finance platform?

While Ramp offers powerful AI-driven finance automation, understanding its limitations is crucial for making informed implementation decisions. These constraints primarily affect businesses with complex global operations, non-standard workflows, or specific integration requirements. Additionally, organizations should explore a Ramp Tutorial to familiarize themselves with the platform’s features and identify any potential gaps in functionality relative to their needs. By doing so, they can better assess whether Ramp aligns with their operational requirements or if alternative solutions might be more suitable. Ultimately, thorough research and training are essential for maximizing the benefits of finance automation.

Global Operations Limitations:

- Primarily designed for US-based businesses

- Limited international capabilities compared to competitors like Brex or Navan

- Corporate card and expense management features optimized for domestic operations

- International payments available through Bill Pay but not as comprehensive

- Companies with multiple international entities may find limitations

Workflow Inflexibility:

- Platform's strength in simplicity can become a limitation for highly customized processes

- AI and automation work best with standard, repeatable workflows

- Organizations with project-based accounting may find the automation rigid

- Unique approval chains or non-standard general ledger structures may face constraints

- Overriding AI-suggested categorizations can be less intuitive than traditional accounting software

Card Dependency:

- Business model requires using Ramp corporate cards to access free platform benefits

- Cannot manage spending from other credit cards or payment methods within Ramp's system

- Makes Ramp an all-or-nothing solution for corporate card spending

- May not suit companies with existing card relationships or specific payment requirements

Integration Complexity:

- Robust integrations with major accounting platforms, but challenges with less common ERP systems

- Highly customized accounting setups may face integration difficulties

- AI's learning process requires initial training time and ongoing oversight

- Businesses with variable spending patterns or unique vendor relationships need more manual oversight initially

These limitations don't disqualify Ramp for most businesses, but understanding them helps set realistic expectations and determine if Ramp aligns with your specific operational requirements. Companies should evaluate whether these constraints significantly impact their workflows before implementation.

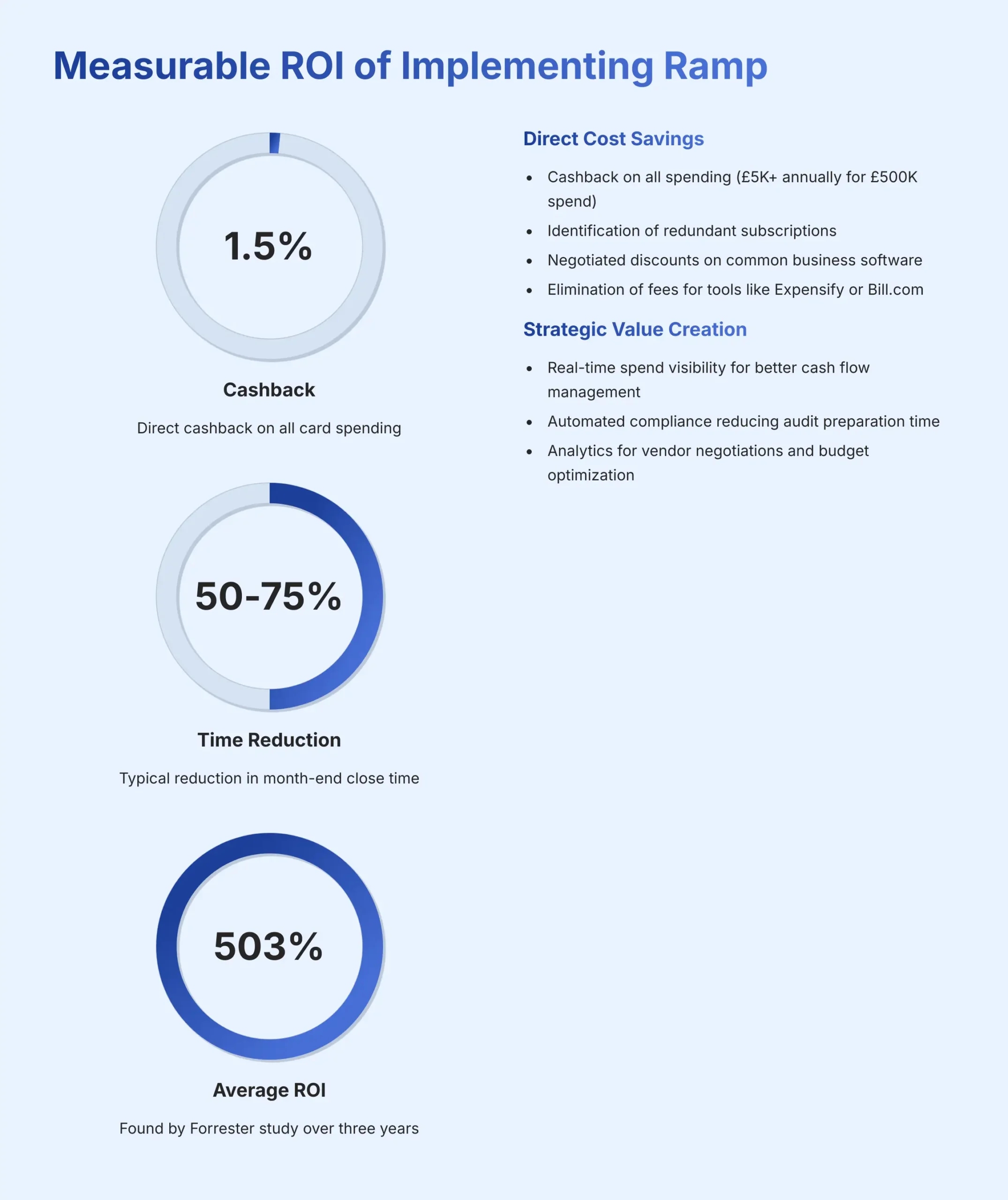

What is the measurable ROI of implementing Ramp for business finance automation?

Ramp's return on investment comes from both quantifiable cost savings and operational efficiency gains that can be measured and tracked over time. Understanding these metrics helps businesses justify implementation and monitor ongoing value creation.

Direct Cost Savings (Quantifiable):

- Cashback Returns: 1.5% cashback on all card spending (e.g., $500,000 annual spending = $7,500 direct returns)

- Subscription Optimization: AI identifies redundant software subscriptions and vendor inefficiencies, often discovering thousands in unnecessary recurring charges

- Partner Discounts: Access to negotiated discounts on common business software like AWS and HubSpot

- Software Replacement: Eliminates monthly subscription fees for tools like Expensify or Bill.com (ranging from hundreds to thousands annually)

Operational Efficiency Gains (Measurable):

- Month-end Close Time: Finance teams typically report 50-75% reduction in month-end close time due to automated receipt collection and transaction coding

- Labor Cost Savings: If a finance team previously spent 40 hours on monthly reconciliation and now spends 10 hours, that's 30 hours of saved labor monthly

- Employee Time Savings: Eliminated expense reports save time across the entire organization – even 30 minutes saved per employee monthly adds up significantly across larger teams

- Reduced Manual Processing: Automated invoice processing and approval workflows free up accounting staff for strategic work

Strategic Value Creation (Less Tangible but Important):

- Real-time Visibility: Improved cash flow management and budget control

- Compliance Benefits: Automated compliance reduces audit preparation time and potential penalty risks

- Analytics Value: Platform insights enable better vendor negotiations and budget optimization

- Scalability: System handles growth without proportional increase in finance team size

ROI Calculation Framework:

A Forrester study commissioned by Ramp found average organizations achieved 503% ROI over three years. To calculate your projected ROI:

- Add direct cost savings (cashback + subscription optimization + partner discounts + eliminated software costs)

- Calculate monetized value of time savings (multiply hours saved by relevant hourly rates)

- Factor in strategic benefits like improved financial control and reduced compliance risk

- Compare total benefits against any implementation and training costs

For most businesses, the combination of direct cost savings and operational efficiency gains typically justifies implementation within the first year, with compounding benefits in subsequent years as the AI learns and processes become more automated.

How do you integrate Ramp with QuickBooks Online and NetSuite accounting systems?

Ramp offers deep, native integrations with major accounting platforms, with QuickBooks Online and NetSuite representing their most robust connections. These integrations are central to Ramp's value proposition, enabling seamless financial data flow and automated bookkeeping.

QuickBooks Online Integration Process:

- Secure Authentication: Integration begins with secure OAuth authentication within the Ramp dashboard, connecting your QBO account safely without sharing login credentials

- Data Import: Ramp automatically imports your complete Chart of Accounts, vendor lists, customer data, and Classes/Locations from QuickBooks, ensuring consistency across platforms

- Category Mapping: Create rules specifying that transactions from specific vendors (like “Uber”) automatically code to designated accounts (like “Travel Expense”)

- AI Learning: Ramp's AI learns these patterns and begins suggesting similar mappings for new vendors

- One-Click Sync: Once transactions are properly coded, they sync to QuickBooks with a single click, appearing as correctly categorized expenses with all relevant details

NetSuite Integration Process:

- Bundle Installation: Begin by installing Ramp's official bundle within your NetSuite instance

- Token Authentication: Establish secure token-based authentication that's more robust than simple password connections

- Granular Field Mapping: Map all NetSuite fields including custom segments, departments, locations, and projects for multi-dimensional coding

- Automated Sync: Ramp automatically syncs all card transactions, reimbursements, and bill payments as journal entries or vendor bills directly into NetSuite

- Custom Field Support: Respects all custom fields and ensures accurate financial reporting

Integration Benefits:

- Eliminates manual data entry between systems

- Maintains consistency in chart of accounts and vendor data

- Enables real-time financial reporting

- Reduces month-end close time significantly

- Ensures compliance with accounting standards

- Supports audit trails and financial controls

The integration with both QuickBooks Online and NetSuite is designed to minimize manual data entry and streamline financial workflows, making it easier for finance teams to maintain accurate records and focus on strategic tasks rather than administrative overhead.

Can you set up complex, multi-step approval workflows in Ramp?

Yes, Ramp provides the capability to create complex, multi-step approval workflows tailored to various spending types, which is essential for maintaining control over corporate expenses as businesses scale. This feature enhances financial governance and ensures that spending aligns with company policies.

Approval Workflow Capabilities:

- Criteria-Based Rules: Configure workflows based on transaction amount, category, or vendor

- Hierarchical Approvals: Set up multi-level approvals from direct managers to executive leadership

- Virtual Card Approvals: Require manager approval for new virtual card requests exceeding specified amounts

- Real-time Controls: Establish real-time transaction approvals for high-risk categories or amounts

- Reimbursement Workflows: Multi-level approval processes for expense reimbursements

Workflow Configuration Examples:

- Amount-Based: Transactions under $500 auto-approve, $500-$2,000 require manager approval, above $2,000 require C-level approval

- Category-Based: Software purchases require IT approval, travel expenses require department head approval

- Vendor-Based: New vendor payments require finance team approval regardless of amount

- Project-Based: Project-specific spending requires project manager approval first, then finance approval

Integration Features:

- Dashboard Management: Approvals managed directly within Ramp dashboard

- Slack Integration: Managers receive notifications and can approve/deny requests with a single click in Slack

- Email Notifications: Automatic email alerts for pending approvals with direct action links

- Mobile Approval: Approve transactions from mobile devices for faster processing

For transactions made with Ramp cards, most approvals occur post-facto based on predefined card rules. However, businesses can establish real-time transaction approvals for high-risk categories or amounts, ensuring that significant expenditures receive appropriate oversight before they are processed.

Reimbursement requests can also be subjected to multi-level approvals, allowing for thorough review before funds are disbursed. This is particularly useful for ensuring compliance with budgetary constraints and internal controls.

The approval process can be managed directly within the Ramp dashboard or integrated with communication tools like Slack, where managers receive notifications and can approve or deny requests with a single click. This combination of flexibility and user-friendliness makes Ramp's approval system a strong feature for organizations looking to enhance their financial oversight and control as they grow.

Our Methodology

This comprehensive guide is based on extensive research including direct platform testing, analysis of official documentation, user reviews, and interviews with current Ramp customers across various industries. We evaluated Ramp's AI capabilities through hands-on testing of their expense categorization, receipt matching, and workflow automation features. Our comparison analysis draws from verified user experiences and official feature documentation from competing platforms.

Why Trust This Guide?

At Best AI Tools For Finance, we maintain editorial independence and provide unbiased analysis based on thorough research and real-world testing. Our team has evaluated over 200+ AI finance tools and maintains relationships with industry experts to ensure accuracy and relevance. This guide represents hundreds of hours of research, testing, and analysis to provide you with the most comprehensive and actionable information available.

Leave a Reply