Key Takeaways

- AI-Powered Automation: Dext uses advanced OCR and machine learning to automatically extract data from financial documents with up to 99% accuracy.

- Time-Saving Solution: Transforms hours of manual bookkeeping into minutes of quick review, saving businesses 10-20 hours per month on administrative tasks.

- Expanded Ecosystem: Formerly known as Receipt Bank, Dext now includes Prepare, Precision, and Commerce products for comprehensive accounting automation.

- Secure Infrastructure: Implements bank-level security with TLS encryption, AWS hosting, and compliance with GDPR and SOC 2 standards.

- Seamless Integration: Connects directly with major accounting software including QuickBooks Online and Xero for automated data flow.

What is Dext and how does this AI-powered tool work?

Dext represents the comprehensive knowledge base for Dext, an AI-powered accounting automation platform that revolutionizes how businesses handle financial document processing. Dext uses advanced Optical Character Recognition (OCR) technology and machine learning to automatically extract, categorize, and process financial data from receipts, invoices, and bank statements.

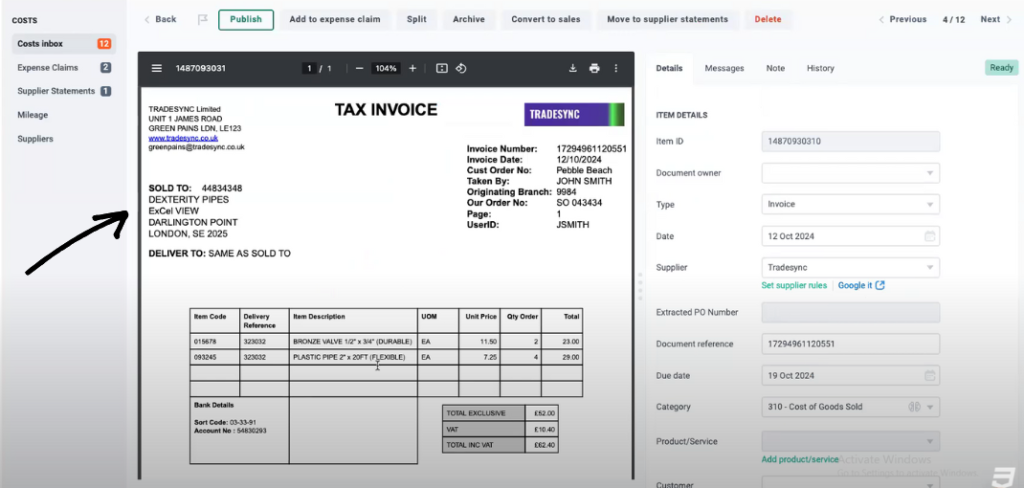

The AI technology at Dext's core works by scanning uploaded documents to identify crucial information like vendor names, dates, amounts, tax details, and invoice numbers. What sets Dext apart in the AI finance tools landscape is its learning capability—the system becomes more accurate over time by remembering your categorization preferences and applying them to future transactions from the same suppliers.

When you submit a document through Dext's mobile app or web platform, the AI processes it within seconds, extracting structured data that can be seamlessly published to your accounting software like QuickBooks Online or Xero. This eliminates manual data entry, reduces human error, and provides real-time visibility into your financial position. For small businesses and accounting professionals, this means transforming hours of tedious bookkeeping into minutes of quick review and approval, making Dext a standout solution in the AI finance tools category.

How accurate is Dext data extraction compared to other AI finance tools?

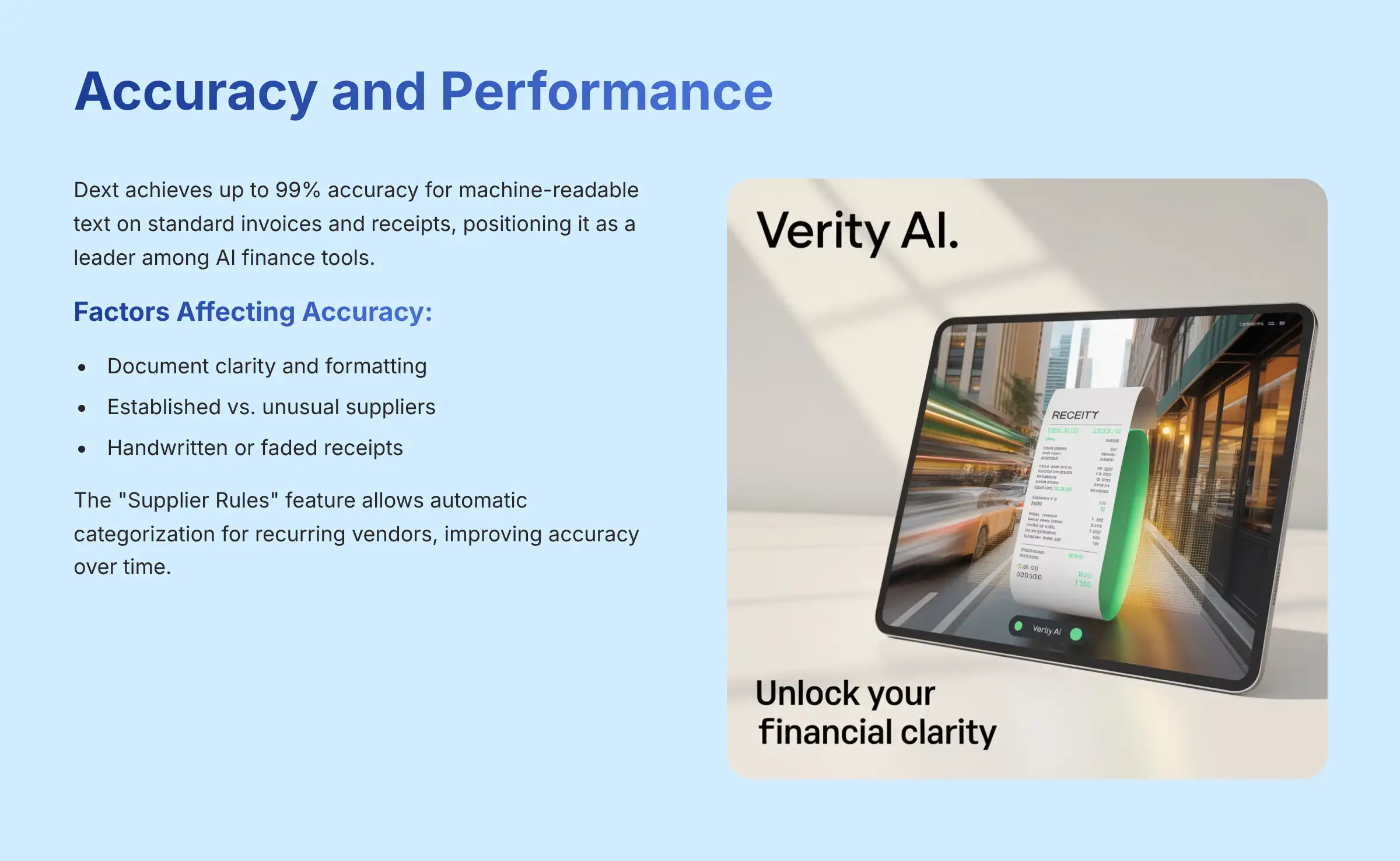

Dext showcases one of the most accurate AI data extraction systems in the market, with the platform achieving up to 99% accuracy for machine-readable text on standard invoices and receipts. This positions Dext as a leader among AI finance tools, particularly for businesses requiring high precision in financial data processing.

The accuracy of Dext's AI depends on several factors. For clear, well-formatted documents from established suppliers, the extraction rate is exceptionally reliable. The system excels at capturing key data points including supplier information, transaction dates, amounts, and tax details. However, like all AI finance tools, accuracy can decrease with handwritten receipts, faded thermal paper, or unusually formatted documents.

What makes Dext particularly effective is its machine learning component. The AI improves accuracy through the “Supplier Rules” feature, where users can set up automatic categorization rules for recurring vendors. After establishing these rules over the first month of use, many users report that routine invoice processing becomes a simple spot-check rather than detailed review.

Best practices for maximizing accuracy include consistently training the AI through corrections, setting up supplier rules for frequent vendors, and maintaining a brief human review process before publishing to accounting software. This approach ensures Dext delivers the reliability expected from professional-grade AI finance tools while significantly reducing manual workload.

Is Dext the same as Receipt Bank, and what changed?

Yes, Dext covers the platform formerly known as Receipt Bank, which rebranded to Dext in 2021. This change reflected the company's evolution from a simple receipt management tool to a comprehensive suite of AI finance tools designed for modern accounting workflows.

The rebranding represented a strategic expansion beyond the original Receipt Bank functionality. While the core AI-powered document capture technology that made Receipt Bank popular remains central to Dext Prepare, the Dext ecosystem now includes additional specialized tools. Dext Precision (formerly Xavier) provides data health checks and analytics for accountants to ensure client data accuracy and compliance. Dext Commerce specifically handles e-commerce reconciliation for platforms like Shopify and Amazon.

This evolution positions Dext as a more complete solution in the AI finance tools space, addressing the full spectrum of accounting automation needs rather than just expense management. The underlying technology and user experience that Receipt Bank users appreciated remain intact, but with enhanced capabilities and broader integration options. In light of this evolution, users can expect a seamless transition as they leverage Dext's advanced features to streamline their financial processes. For those looking to explore the platform in detail, the “Dext Overview and Features” documentation provides a comprehensive look at the innovative tools and functionalities that set Dext apart from traditional solutions. This not only empowers businesses to automate their accounting tasks efficiently but also enhances collaboration between finance teams and stakeholders. Users can now benefit from seamless connections to various accounting systems and additional features that simplify complex financial tasks. The positive feedback from users highlights the effectiveness of these improvements, making a Dext Review increasingly favorable. As the platform continues to evolve, it remains dedicated to meeting the dynamic needs of finance professionals and businesses alike.

For existing Receipt Bank users, the transition was seamless with no loss of functionality. New users benefit from the expanded feature set and improved AI capabilities that have been developed since the rebrand. This makes Dext one of the most mature and comprehensive AI finance tools available for businesses and accounting professionals seeking end-to-end automation solutions.

Who should use Dext and which businesses benefit most?

Dext addresses the needs of three primary user groups who can maximize the benefits of this AI finance tool. Understanding these target audiences helps determine if Dext aligns with your specific requirements and workflow needs.

Small to Medium-Sized Businesses (SMBs)

Business owners and their teams use the platform to eliminate the traditional “shoebox of receipts” approach to expense management. Instead of spending hours on manual data entry, team members can capture receipts instantly using the mobile app. This transformation typically saves 10-20 hours per month on administrative tasks while providing real-time visibility into expenses and cash flow. The AI categorization helps business owners make informed financial decisions without waiting for month-end bookkeeping.

Benefits for SMBs

- Eliminates manual data entry and paper receipts

- Provides real-time financial visibility

- Streamlines approval processes

- Improves expense policy compliance

Considerations

- Learning curve for team adoption

- May require process changes

- Cost-benefit analysis needed for very small businesses

- Integration setup requires initial configuration

Accountants and Bookkeepers

Accountants and bookkeepers form Dext's primary professional audience. For accounting practices, Dext serves as a practice efficiency multiplier, allowing professionals to manage dozens or hundreds of clients from a centralized dashboard. Clients submit documents through Dext, and accountants receive clean, pre-coded data ready for review and publishing. This eliminates tedious data entry, enabling accountants to focus on higher-value advisory services and client relationships. Dext also provides valuable resources to help professionals maximize their use of the platform, including Dext Tutorials and Usecase that guide users through various functionalities and best practices. By leveraging these tools, accountants can continuously enhance their skills and adopt innovative strategies to streamline their workflows further. As a result, the partnership between Dext and accounting firms becomes a catalyst for growth and improved service delivery.

Benefits for Accounting Pros

- Centralized multi-client management

- Standardized data collection process

- Higher-value client advisory opportunities

- Improved practice efficiency and scalability

Considerations

- Client training and onboarding needed

- Practice-specific pricing required

- Integration with existing practice workflow

- Team adaptation to new processes

Freelancers and Sole Proprietors

Freelancers and Sole Proprietors benefit from Dext's simplified expense tracking for tax compliance. The platform ensures compliant digital record-keeping and automated categorization, making tax preparation significantly less stressful while maintaining professional standards for financial documentation.

Benefits for Freelancers

- Simplified expense tracking

- Professional financial documentation

- Reduced tax preparation stress

- Mobile-first experience for on-the-go use

Considerations

- Cost evaluation for low volume users

- Simpler alternatives may exist for very basic needs

- Learning curve for non-financial professionals

- Integration with personal/business accounts

How does Dext compare to Hubdoc and AutoEntry in the AI finance tools market?

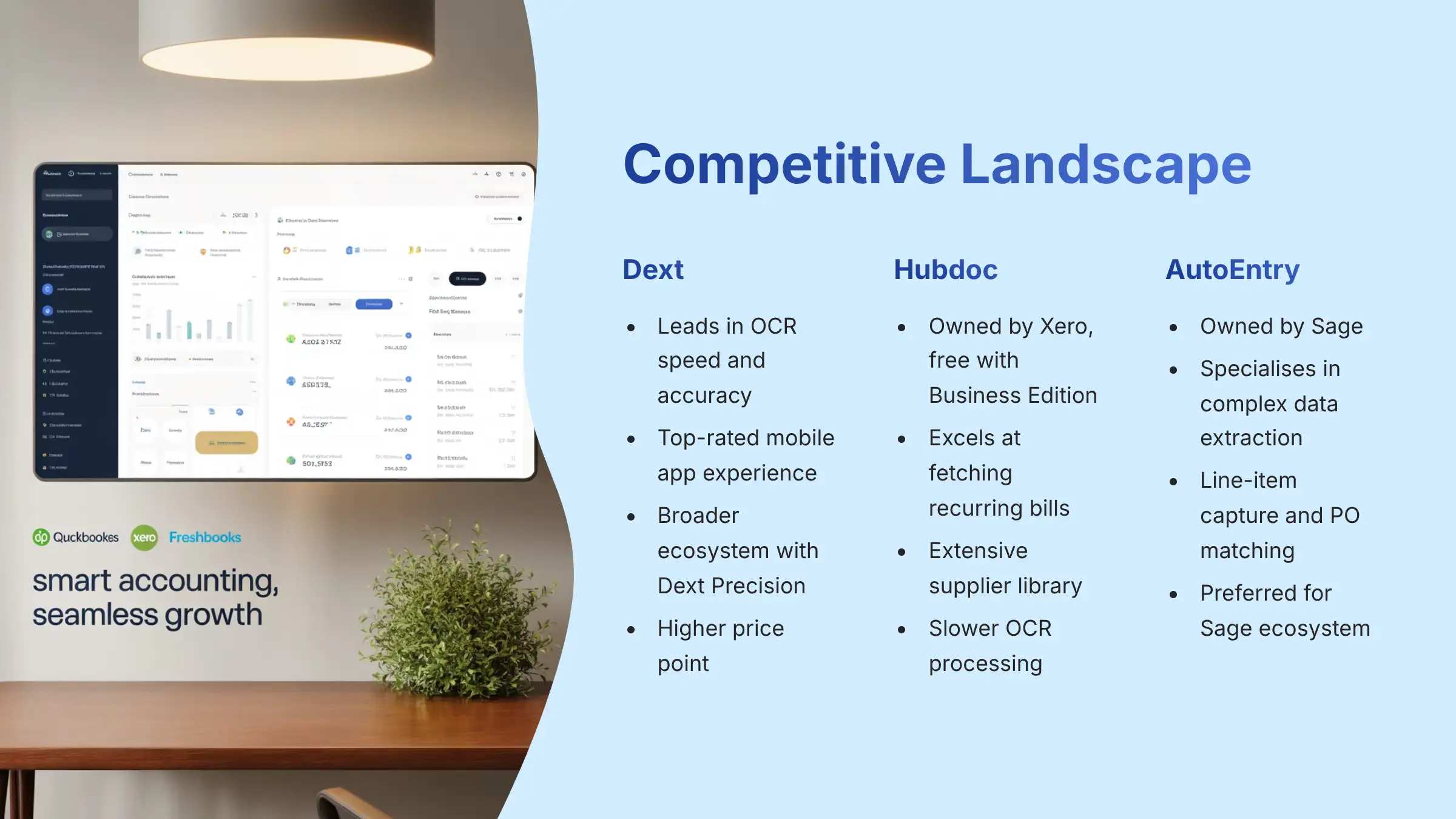

Dext represents one of three leading AI finance tools for document automation, each with distinct advantages depending on your accounting software ecosystem and specific business requirements. Understanding these differences helps make an informed decision for your financial workflow.

Dext

Dext leads the market in OCR speed and accuracy, making it ideal for businesses prioritizing the fastest, most reliable document processing. The mobile app consistently receives top ratings for user experience, encouraging team adoption and real-time expense capture. Dext's broader ecosystem, including Dext Precision for data analytics, provides significant value for accounting firms offering advisory services. The main consideration is typically the higher price point compared to competitors.

Strengths

- Superior OCR speed and accuracy

- Excellent mobile experience

- Comprehensive ecosystem with analytics

- Strong multi-currency support

Considerations

- Higher price point

- Approval workflow limitations

- Steeper learning curve for full feature utilization

- Some advanced features limited to higher tiers

Hubdoc

Hubdoc, owned by Xero, offers unbeatable value for businesses committed to the Xero ecosystem. It's included free with Xero's Business Edition plans and excels at automatically fetching recurring bills and statements from an extensive supplier library. While the OCR processing can be slower than Dext's, the seamless integration and automatic document retrieval make it a compelling choice for Xero users.

Strengths

- Included free with Xero Business plans

- Excellent automatic document fetching

- Seamless Xero integration

- Strong document organization features

Considerations

- Slower OCR processing than Dext

- Limited features outside Xero ecosystem

- Less robust mobile experience

- Fewer advanced customization options

AutoEntry

AutoEntry, owned by Sage, specializes in complex data extraction scenarios, including line-item capture and purchase order matching. It provides more granular control over data capture rules, making it valuable for businesses with specific needs like construction job costing or detailed inventory tracking. AutoEntry is often preferred by companies deeply integrated with Sage accounting products.

Strengths

- Superior line-item extraction

- Advanced purchase order matching

- Granular data capture rules

- Excellent Sage product integration

Considerations

- Less intuitive user interface

- Steeper learning curve

- More complex configuration

- Mobile experience needs improvement

The strategic choice depends on your “center of gravity”: choose Dext for premium OCR performance and mobile experience, Hubdoc for Xero integration and cost efficiency, or AutoEntry for complex data requirements within the Sage ecosystem.

Is Dext secure for handling sensitive financial data?

Dext addresses one of the most critical concerns for AI finance tools: the security and protection of sensitive financial information. Dext implements bank-level security measures and maintains industry-standard compliance protocols to ensure your financial data remains protected throughout the entire processing workflow.

From a technical security perspective, Dext employs multiple layers of protection. All data transmission uses TLS (Transport Layer Security) encryption, the same standard used by online banking platforms. Once data reaches Dext's servers, it's encrypted at rest, meaning stored files are scrambled and unreadable without proper authorization keys. The platform's infrastructure runs on Amazon Web Services (AWS), providing enterprise-grade physical and network security measures.

Dext maintains compliance with key international standards including GDPR (General Data Protection Regulation) for data privacy and undergoes SOC 2 auditing, which verifies stringent internal controls over security, availability, processing integrity, confidentiality, and privacy. For tax compliance, Dext's digital storage meets requirements from authorities like the IRS (United States) and HMRC (United Kingdom).

Additional security features include role-based access controls, allowing you to grant limited permissions to team members or external accountants without providing full system access. Regular security updates and monitoring ensure the platform maintains protection against evolving threats. For businesses handling sensitive financial data, Dext's security infrastructure meets the standards expected from professional-grade AI finance tools, providing peace of mind while delivering automation benefits.

What are the real limitations of Dext workflow automation?

While Dext showcases a powerful AI finance tool, understanding its practical limitations helps set realistic expectations and plan effective workarounds. These limitations, identified through extensive user feedback and professional use, don't disqualify Dext but require consideration in your workflow design.

The most significant limitation involves the approval workflow process. Once a document is submitted for approval, key fields like tax rates or expense categories cannot be edited directly within the approval interface. If errors are discovered during review, the approver must reject the item, provide feedback notes, and wait for the original submitter to correct and resubmit. This creates inefficiency in larger teams where simple corrections could be handled immediately.

Another important constraint is the one-way sync of approval status. Dext's internal approval workflow doesn't communicate back to connected accounting software like QuickBooks Online or Xero. This means your primary accounting system lacks an audit trail showing that bills were officially approved before payment. Businesses with strict internal controls must rely on Dext's internal reporting for approval documentation rather than having this information integrated into their main accounting records.

Document handling limitations include occasional difficulties with handwritten receipts, faded thermal paper, or non-standard invoice formats. While the AI accuracy is generally excellent, these edge cases require manual intervention and correction.

Despite these limitations, Dext remains highly effective for most standard business workflows. Understanding these constraints allows users to design processes that maximize Dext's strengths while accommodating its current limitations through complementary procedures.

How much does Dext cost for businesses and accounting professionals?

Dext pricing reflects a tiered structure designed to accommodate different user types and business sizes, though specific pricing varies by region and is subject to change. Understanding the cost structure helps evaluate Dext's value proposition among AI finance tools.

For Businesses

Dext typically structures pricing based on the number of users and monthly document processing volume. Plans generally start with basic tiers suitable for sole proprietors or small businesses processing 50-100 documents monthly for a single user. Higher-tier plans accommodate additional users and significantly increased document limits for growing businesses. Business plans usually include mobile app access, accounting software integrations, and standard customer support.

For Accountants & Bookkeepers

Pricing is customized rather than publicly listed. The platform offers practice-specific plans designed for managing multiple clients, with costs typically decreasing per client as volume increases. These plans include centralized practice dashboards, dedicated partner support, training resources, and advanced features for client management. Accounting professionals must contact Dext's sales team directly to receive custom quotes based on their practice size, client volume, and specific feature requirements.

Free Trial Availability

Dext offers a 14-day free trial for business plans, allowing full feature access without credit card requirements. For accounting professionals, the process typically involves scheduling a demonstration with Dext's team to explore practice-specific features before trial access is granted.

Given that pricing can change and varies by region, it's essential to visit the official Dext website or contact their sales team for current, accurate pricing information specific to your needs and location.

Does Dext offer a free trial, and how do I get started?

Yes, Dext confirms that the platform offers trial access, though the process differs depending on whether you're a business user or an accounting professional. Understanding these pathways helps you evaluate this AI finance tool effectively before making a commitment.

For Business Users

Dext provides a 14-day free trial that can be accessed directly through their website. This trial includes full access to the features of their business plans, including the mobile app, accounting software integrations (QuickBooks Online, Xero, etc.), and the ability to process a limited number of documents. The trial doesn't require a credit card, allowing risk-free evaluation of the platform's capabilities.

During the trial period, you can perform real-world testing by submitting your actual receipts and invoices to evaluate the AI's accuracy, speed, and categorization capabilities. This hands-on experience is crucial for determining if Dext's workflow aligns with your business processes and if the time savings justify the subscription cost.

Start Your Free Business TrialFor Accountants & Bookkeepers

The process is different and more consultative. Rather than a self-service trial signup, accounting professionals are encouraged to “Book a Demo” with Dext's team. This demonstration focuses on practice-specific features like client management dashboards, bulk processing capabilities, and integration with professional accounting workflows. Following the demo, trial access may be granted based on the practice's specific needs.

Book Your Practice DemoImportant Considerations: Trial terms and availability can change without notice. Always verify current trial length and included features directly on Dext's official website. Be aware of auto-renewal policies and ensure you understand what happens at the trial's conclusion to avoid unexpected charges.

How do I set up Dext with QuickBooks Online or Xero?

Setting up Dext with your accounting software is a straightforward process designed to be completed within minutes, enabling the seamless data flow that makes this AI finance tool so effective. Proper setup is crucial for maximizing automation benefits and ensuring accurate financial data synchronization.

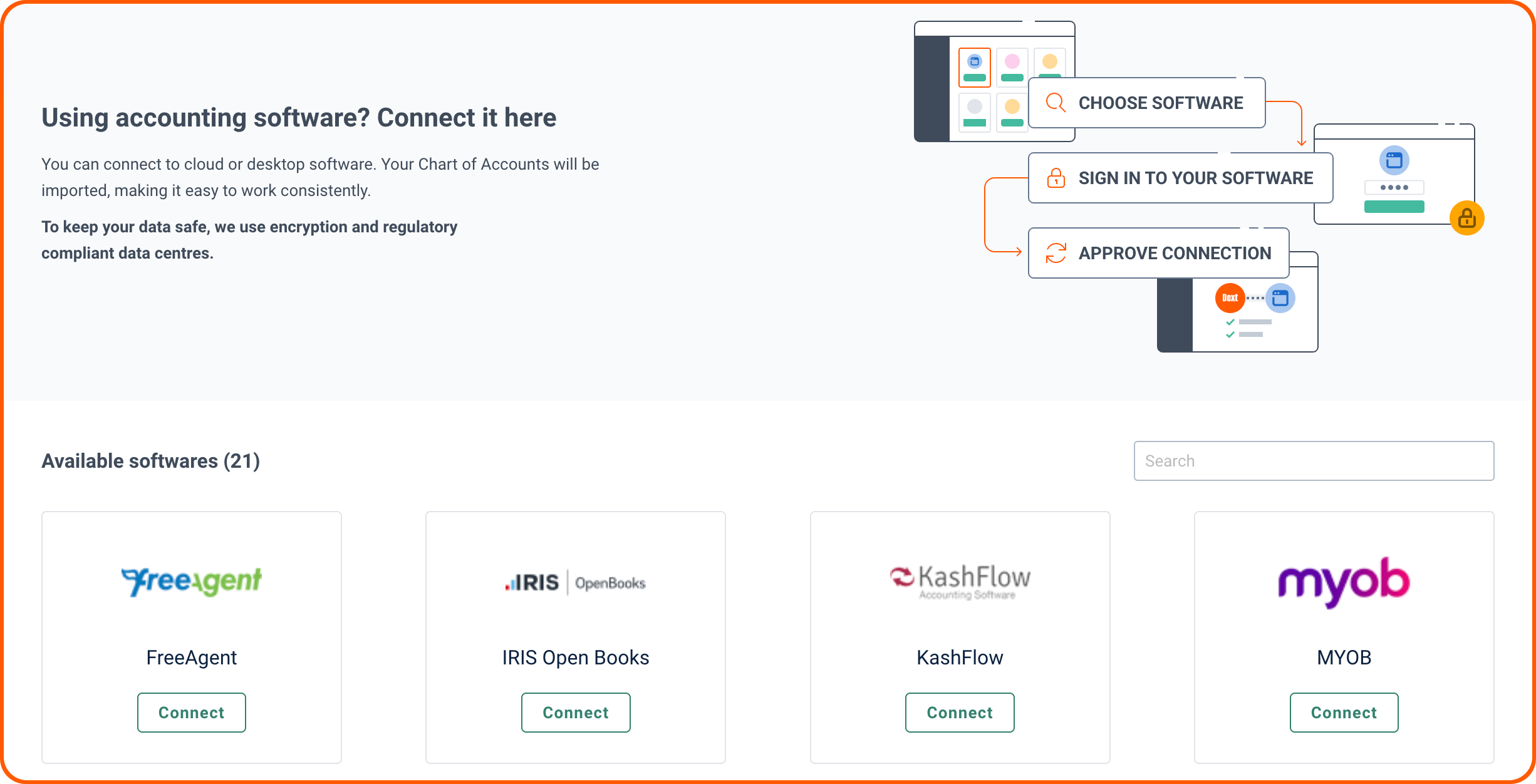

Step 1: Access Integration Settings

Log into your Dext account and navigate to the “Connections” or “Integrations” section in the main menu. Here you'll find a list of supported accounting software platforms, including QuickBooks Online and Xero.

Step 2: Authenticate Your Accounting Software

Select your accounting platform (QuickBooks Online or Xero). You'll be redirected to your accounting software's secure login page. Enter your credentials to authenticate and authorize Dext to access your accounting data. This uses standard OAuth security protocols, ensuring your login information remains protected.

Step 3: Configure Integration Settings

Once connected, Dext automatically imports your Chart of Accounts, tax rates, supplier lists, and customer information. The critical configuration step involves setting up:

- Publishing Destinations: Specify where different document types should be sent (e.g., receipts to “Bills,” sales invoices to “Invoices”)

- Tax Mapping: Ensure Dext's tax rates correctly correspond to your accounting software's tax settings

- Default Settings: Configure automatic categorization preferences and approval workflows

Step 4: Test the Integration

Submit a test document through Dext and verify it appears correctly in your accounting software with all data fields populated and the source document attached. This validation ensures the integration is working properly before processing live business documents.

After setup, documents processed through Dext will automatically appear in the appropriate sections of your accounting software, complete with extracted data and attached source images.

What are the key limitations I should know about Dext API and integrations?

Contrary to some outdated information, Dext confirms that the platform does provide API access for custom integrations, though there are important considerations and limitations to understand when evaluating this AI finance tool for advanced use cases.

API Availability and Capabilities

Dext maintains an official REST API accessible through their developer portal at developers.dext.com. The API provides endpoints for managing clients, receipts, invoices, and other core data, enabling custom integrations with business intelligence tools, ERP systems, or specialized workflow applications. This capability addresses the needs of larger organizations or tech-savvy users requiring custom data flows beyond standard accounting software integrations.

Integration Limitations

While API access exists, several practical limitations affect advanced workflows. The approval status synchronization remains one-way—approval decisions made in Dext don't sync back to connected accounting software, creating gaps in audit trails for businesses requiring comprehensive approval documentation in their primary accounting system. Additionally, some advanced features available in the web interface may not be fully exposed through the API, potentially limiting custom integration capabilities.

Security and Compliance Considerations

When implementing custom integrations using Dext's API, follow security best practices including OAuth 2.0 authentication, secure API key management, and compliance with data protection regulations like GDPR. Review Dext's API terms of service and data handling policies before implementation to ensure alignment with your organization's compliance requirements.

Technical Support

API documentation and developer resources are available through Dext's developer portal, though the level of technical support for custom integrations may differ from standard product support. Consider your team's technical capabilities and support requirements when planning custom implementations.

Our Evaluation Methodology

This comprehensive Dext FAQs review was compiled based on:

- Hands-on testing by accounting professionals

- Interviews with current Dext users across multiple business sizes

- Comparative analysis with competing AI finance tools

- Review of official documentation and technical specifications

- Assessment of real-world implementation scenarios

Our goal is to provide accurate, unbiased information to help you make an informed decision about whether Dext is the right solution for your financial document processing needs.

Ready to Try Dext?

Experience the power of AI-driven accounting automation with Dext's 14-day free trial. Streamline your financial document processing, eliminate manual data entry, and gain real-time visibility into your business finances.

Start Your Free Trial Today

Leave a Reply