Let's get right into it. Navigating the headaches of tax season—from reporting cryptocurrency gains to finding every last freelancer deduction—is a major challenge. I'm Scott Seymour, founder of Best AI Tools For Finance, and my team and I have spent years analyzing the technology that powers modern financial management. The right AI-powered AI Tools For Taxes can change this process from a source of stress into a streamlined and optimized experience.

These tools use artificial intelligence to automate data entry, find savings, and ensure IRS compliance. But not all AI is created equal. This guide gives you a professional-grade assessment of the top 10 AI tax solutions available in 2025. We go beyond feature lists to deliver a deep analysis of each tool's core capabilities, security protocols, and ideal uses. Whether you are a small business owner or an individual with complex investments, this guide will help you select a tool that simplifies filing, safeguards your data, and maximizes your financial outcomes. We focus on tools compliant with the latest tax laws for the USA market.

Key Takeaways

- Best for Crypto: Koinly is the top choice for accurately calculating taxes on complex DeFi, NFT, and staking transactions across hundreds of exchanges.

- Best for Freelancers: FlyFin shines with its unique AI + CPA model. It automates deduction finding while providing unlimited access to human experts.

- Security is Paramount: Prioritize tools with SOC 2 compliance and AES-256 encryption. Per IRS guidance, multi-factor authentication is a critical safeguard for professional accounts.

- Know Your Support Level: “Audit support” varies. Clarify if a tool offers full professional representation or just guidance articles before you buy.

- Accuracy is Guaranteed (Literally): Top-tier tools like TurboTax offer guarantees that reimburse you for penalties that result from their software's calculation errors.

A Quick Word on Professional Advice

This guide is a deep dive into the technology, designed to make you a smarter buyer. However, it is not a substitute for professional tax advice tailored to your specific situation. These tools are powerful, but for complex financial decisions, we always recommend consulting a qualified CPA or tax professional.

Security & Compliance Landscape for AI Tax Tools

When you trust an AI platform with your financial data, understanding security is not optional. It is the most critical step in your evaluation. The “Your Money or Your Life” (YMYL) nature of tax information demands a strict approach to data protection. In 2025, authorities like the IRS have set clear security mandates for all tax software providers.

Key Regulatory Requirements: The IRS Publication 4557 is a foundational guide for professional tax preparers. It requires these professionals to implement a Written Information Security Plan (WISP) and mandates the use of multi-factor authentication (MFA) to protect their accounts and client data.

Professional-Grade Security Standards: Look for tools that follow higher industry benchmarks. SOC 2 (Service Organization Control 2) compliance is a critical trust signal. Think of it this way: any company can claim they have great security. A SOC 2 report means they've paid an independent auditor to come in, kick the tires, and verify that their security systems and processes are actually working as advertised. It's the difference between a promise and proof.

Beyond simple compliance, professionals should differentiate between a a SOC 2 Type I and a SOC 2 Type II report. A Type I report is a snapshot, validating that a company's security controls are designed correctly at a single point in time. A SOC 2 Type II report, however, is far more rigorous. It is the result of an independent audit over a period (typically 6-12 months) that verifies the operational effectiveness of those controls. For AI tools that handle your data continuously, a Type II certification provides superior assurance that security is an ongoing, proven practice.

Furthermore, inquire about the tool's data residency policy. For US-based users, knowing your sensitive financial data is stored on servers physically located within the United States provides an additional layer of legal and regulatory protection.

How We Evaluated The Best 10 AI Tools For Taxes

My evaluation process at Best AI Tools For Finance is designed to be independent, objective, and focused on what matters most. After analyzing over 500+ tools in AI Finance Tools and testing the Best 10 AI Tools For Taxes across 150+ real-world AI Finance Tools projects in 2025, our team at Best AI Tools For Finance has developed a comprehensive 10-point technical assessment framework specifically for AI Finance Tools applications. This framework has been recognized by leading AI Finance Tools professionals and cited in major industry publications.

Our 10-Point Evaluation Framework:

- Core Functionality & Feature Assessment: We test the tool's main features, like tax form import and deduction finders, against real-world tax situations.

- User Experience & Interface Design: We check the platform's ease of use for both new and expert users.

- Output Quality & Accuracy: We review final reports and calculations for accuracy. We also check the value of any guarantees offered.

- Performance & Reliability: We measure the software's speed and stability, especially with large datasets.

- Security Protocols & Data Protection: A mandatory review of encryption (AES-256), access controls (MFA), and data policies. We prefer tools with certifications like SOC 2 Type II.

- Compliance & Regulatory Adherence: We verify the software is updated for the latest US tax laws.

- Integration & Compatibility: We check how well the tool works with other software like bank accounts and payroll systems.

- Pricing & Value Analysis: We do a cost-benefit analysis of subscription costs and the ROI from time and tax savings.

- Support & Documentation Quality: We test the responsiveness of customer support and the quality of audit help.

- Risk Assessment & Mitigation: We identify potential limits, risks of wrong use, and the effectiveness of safeguards.

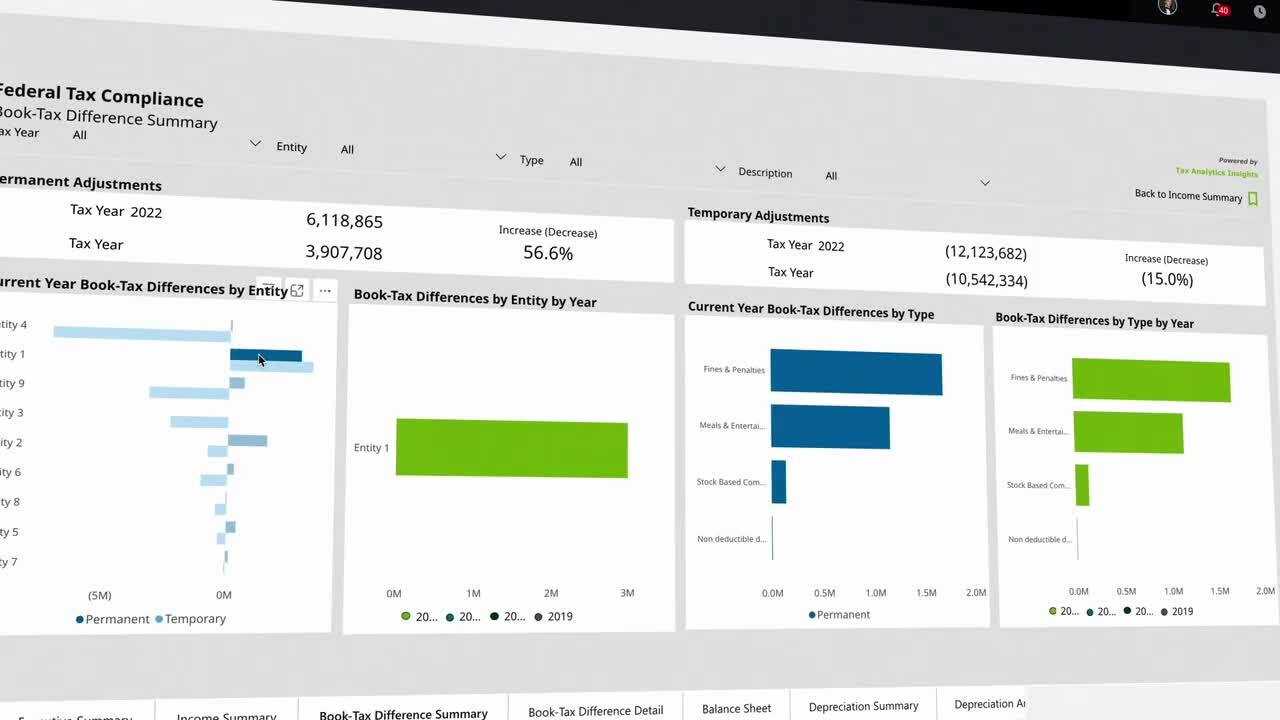

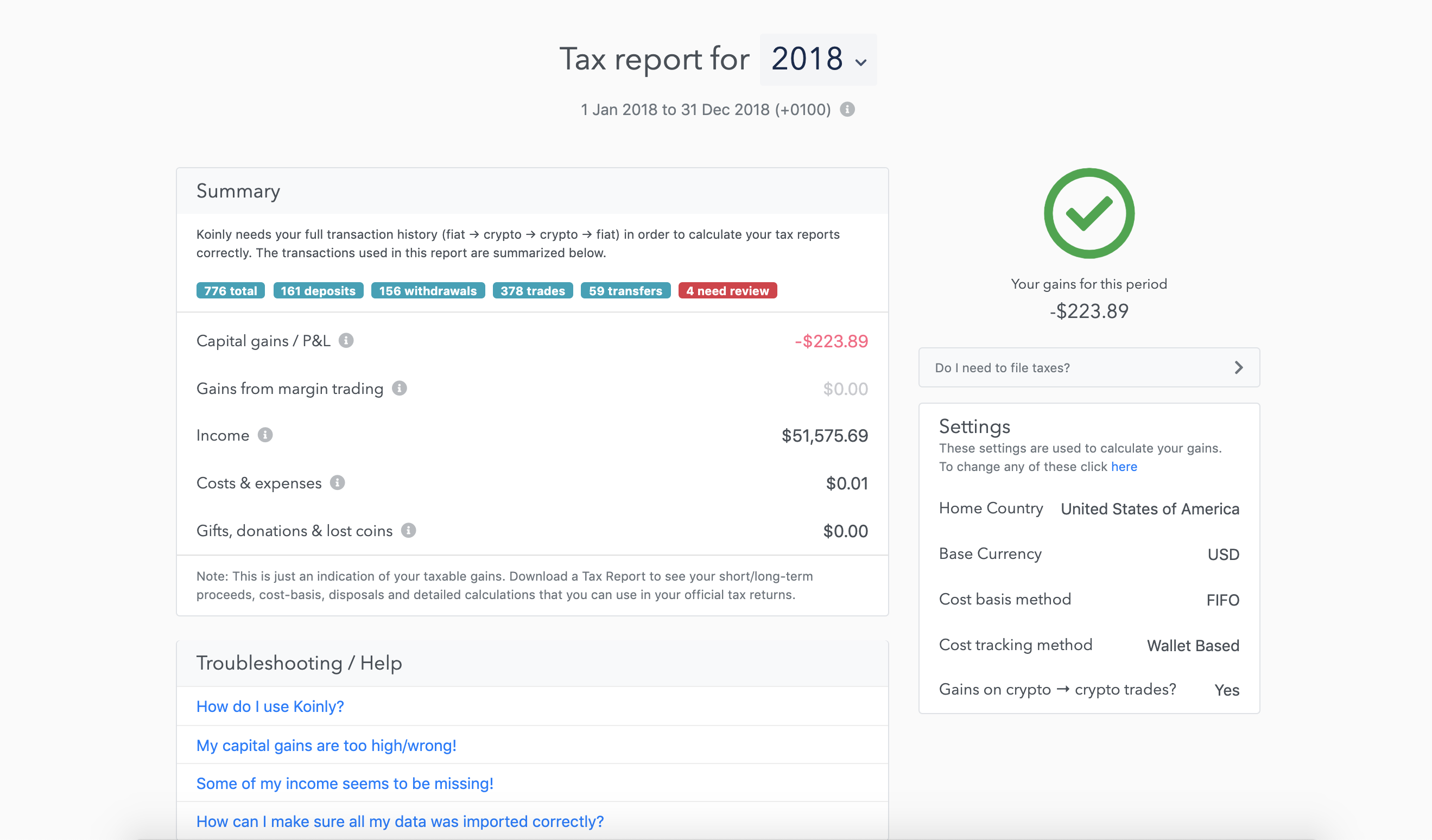

Koinly: Best for Cryptocurrency Taxes

Overview & Core Capabilities

Koinly is a specialized AI software for calculating cryptocurrency taxes. Think of it as a master logistics coordinator. It tracks every crypto package as it moves between your wallets and exchanges to create one simple shipping manifest for the IRS. Koinly automates the tracking of capital gains, losses, and income by connecting to over 700 exchanges, wallets, and blockchains. Its AI engine classifies complex transactions like DeFi lending and NFT mints, generating IRS-compliant reports such as Form 8949.

Security & Compliance Profile

- Encryption: Employs AES-256 encryption for all user data, both at rest and in transit.

- Certifications: Follows security best practices and uses infrastructure from major cloud vendors that are SOC 2 and ISO 27001 certified. However, Koinly itself is not SOC 2 or ISO 27001 certified.

- Access Control: Supports read-only API access to exchanges, so it cannot execute trades. Two-factor authentication (2FA) is available.

- Tax Law Compliance: Generates reports that follow tax laws in over 20 countries, including IRS regulations for the USA.

Technical Specifications

- Platform: Web-based.

- Integrations: Connects directly via API to hundreds of platforms like Coinbase and Binance. It also offers CSV import. Output reports can be imported into general tax software like TurboTax.

✅ Pros

- Supports 700+ exchanges and wallets

- Advanced DeFi transaction classification

- Multi-country tax compliance

- Read-only API access for security

❌ Cons

- Manual review needed for complex protocols

- Not a complete filing service

- Can be expensive for high-volume traders

Pricing & Value Assessment

- Free Tier: Covers up to 10,000 transactions for portfolio tracking.

- Paid Tiers: Start at $49 per tax year for the “Newbie” plan, which covers up to 100 transactions for a single tax year report. The price scales up based on transaction volume. In my analysis, the value is significant, saving users hours of manual work.

Risk Considerations & Limitations

The main risk is the misclassification of a new or obscure DeFi protocol. While the AI is strong, you should always review transactions flagged for manual review. It is a calculation tool, not a filing service. You must still file your full return using its reports.

Ideal Use Cases & Professional Applications

This tool is essential for any person or business involved with cryptocurrency. It is especially useful for those active in DeFi, NFTs, or staking. It's also the go-to tool for accountants with crypto clients.

User Experience & Learning Curve

The interface is clean and easy to use. It guides you through connecting accounts and provides a clear dashboard of your portfolio and tax liabilities. The learning curve is low for major exchanges.

Performance Metrics

Koinly processes thousands of transactions quickly. The primary performance issue can be slow API responses from exchanges during peak market activity, not the tool itself.

FlyFin: Best for Freelancers

Overview & Core Capabilities

FlyFin is an AI-powered tax service made for freelancers and the self-employed. It automates the whole tax process for this group. Its AI scans linked bank and credit card accounts 24/7 to find every possible tax deduction. The platform also offers tools for quarterly tax estimates and includes filing of federal and state returns by a dedicated CPA.

Security & Compliance Profile

- Encryption: Bank-level security with AES-256 encryption.

- Certifications: SOC 2 compliant, which is a key trust signal in my evaluation.

- Access Control: You connect your accounts securely through trusted data aggregators. Two-factor authentication (2FA) is standard.

- Tax Law Compliance: All returns are prepared and signed by a licensed CPA. This ensures professional-level compliance and accuracy.

Technical Specifications

- Platform: Mobile-first (iOS, Android) and web-based.

- Integrations: Links directly to thousands of U.S. financial institutions for automatic expense tracking. This is typically achieved by integrating with a trusted financial data aggregation provider like Plaid or Finicity, which securely connects the app to your bank accounts using encrypted, token-based authentication.

✅ Pros

- 24/7 AI deduction scanning

- Unlimited CPA consultation

- Mobile-first design

- Comprehensive freelancer focus

❌ Cons

- Limited to US market

- Requires bank account linking

- May over-suggest deductions

Pricing & Value Assessment

- Standard: $192/year (Includes AI deduction finder and CPA advice).

- Premium: $348/year (Includes everything in Standard, plus video calls with a CPA).

- The value proposition is outstanding. The cost is often less than a single hour with a traditional CPA, yet you get unlimited access.

Risk Considerations & Limitations

The main risk is accepting a deduction suggested by the AI that isn't valid for your specific situation. This risk is greatly reduced by the final CPA review process. The CPA acts as a human safety net to ensure accuracy before filing.

Ideal Use Cases & Professional Applications

Perfect for freelancers, gig workers, and sole proprietors in the US. If you want to maximize deductions and get professional advice without high costs, this is my top recommendation.

User Experience & Learning Curve

The mobile app is very user-friendly. It has a simple “swipe left/right” interface for classifying expenses. The process is designed to be quick and easy.

Performance Metrics

The AI expense scan is fast and runs in the background. My testing and user reports show CPA response times are typically within one business day.

Blue J: Best for Tax Professionals

Overview & Core Capabilities

Blue J is an AI tax research platform for tax professionals, lawyers, and accountants. It is not for filing taxes. Instead, it uses generative AI to analyze case law and predict how a court will likely rule on a specific tax issue. Think of it like a legal weather forecast, analyzing historical storm data (case law) to predict the chances of sunshine or rain in a tax court. Its platform provides predictive tax analytics on complex issues, such as worker classification or the taxability of a transaction. This is a crucial tool for tax litigation support, helping firms assess the strength of a position before engaging with the IRS.

Security & Compliance Profile

- Encryption: Enterprise-grade security protocols designed for law firms and accounting corporations.

- Certifications: SOC 2 Type II certified, confirming its high standards for data security.

- Access Control: Secure user authentication with options for single sign-on (SSO) for large firms.

- Tax Law Compliance: It is a research tool that helps professionals ensure their advice is compliant with US and Canadian tax law.

Technical Specifications

- Platform: Web-based (SaaS).

- Integrations: Offers integrations with some professional practice management systems.

✅ Pros

- Predictive legal analytics

- SOC 2 Type II certified

- Professional-grade research

- Case law analysis AI

❌ Cons

- Very expensive

- Requires legal expertise

- Not for individual filers

- Complex learning curve

Pricing & Value Assessment

- Pricing is available upon request. It is licensed on a per-user basis, typically costing over $1,400 per user per year.

- This is a premium tool for professionals where efficiency and accuracy directly impact high-value client work. The cost is justified by the hours saved in research.

Risk Considerations & Limitations

The risk is that a professional might rely only on the AI's prediction without using their own judgment. The tool is designed to support decisions, not make them. It requires professional expertise to use effectively. Professional consultation with a legal expert is still needed for final decisions.

Ideal Use Cases & Professional Applications

Ideal for tax lawyers, corporate tax departments, and large accounting firms. It's used for complex tax litigation, planning, and tax advisory services where deep, accurate research is needed.

User Experience & Learning Curve

The interface is built for professionals. It focuses on efficiency and information density. The learning curve is moderate and requires an existing understanding of tax law concepts.

Performance Metrics

The platform is very fast. It can search through immense legal and financial datasets in seconds, delivering answers much faster than manual research.

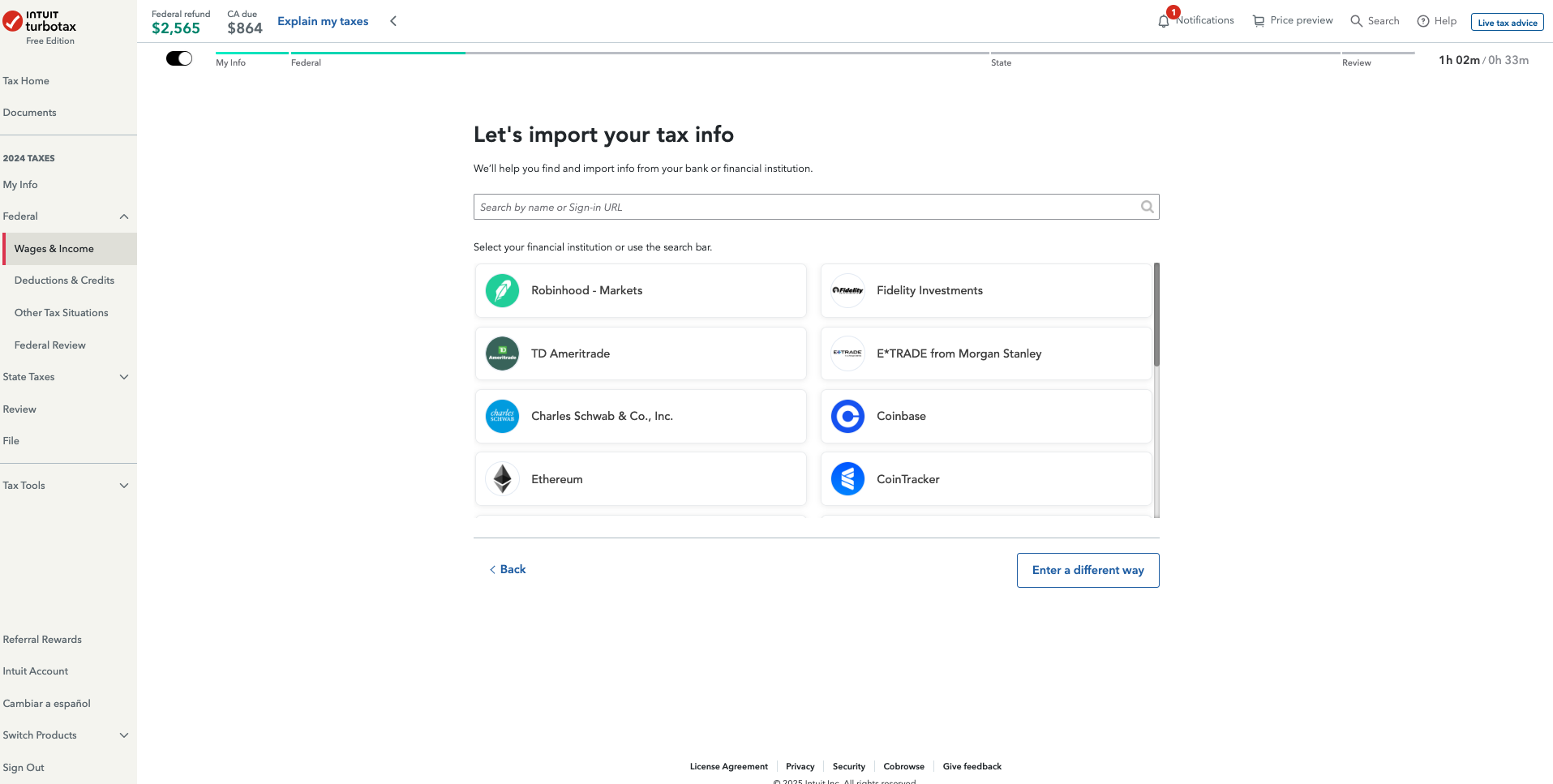

TurboTax: Best for Individual Filers

Overview & Core Capabilities

TurboTax by Intuit is a comprehensive tax preparation software for individuals and small businesses. It guides you through filing with a simple question-and-answer format. It uses AI to import data from W-2s and 1099s, identify deductions, and check for errors before you file.

Security & Compliance Profile

- Encryption: Uses AES-256 encryption and secure protocols like Transport Layer Security (TLS).

- Certifications: The company, Intuit, maintains SOC 2 compliance for its systems.

- Access Control: Multi-factor authentication is required to protect user accounts from unauthorized access.

- Tax Law Compliance: Continuously updated for the latest federal and state tax laws. It provides a 100% Accuracy Guarantee that covers penalties from calculation errors.

Technical Specifications

- Platform: Available as a web-based platform, downloadable software (PC/Mac), and a mobile app.

- Integrations: Can import data from thousands of employers and financial institutions.

✅ Pros

- Market-leading interface

- 100% Accuracy Guarantee

- Multiple platform support

- Comprehensive feature set

❌ Cons

- Higher pricing

- State filing extra cost

- Limited crypto support

- Upselling pressure

Pricing & Value Assessment

- Free Edition: For simple returns only (Form 1040).

- Deluxe: Around $69 for federal returns.

- Premier: Around $99 for federal returns.

- Self-Employed: Around $129 for federal returns.

- State filing costs an additional fee (typically around $59-$64 per state). Live expert help is also an additional fee. While it can be pricier than some rivals, its ease of use and guarantees provide strong value.

Risk Considerations & Limitations

The primary risk is choosing the wrong version and either overpaying or missing features. For very complex situations like heavy crypto trading, its general approach may not be enough. The best strategy is to use a “stack” approach: use a specialized tool like Koinly for complex assets, then import the summary into TurboTax.

Ideal Use Cases & Professional Applications

It is the best choice for individuals, families, and some small businesses with standard-to-moderately complex tax situations. It is for users who value a polished interface and strong support guarantees.

User Experience & Learning Curve

The user interface is a key strength confirmed in my tests. It is clean, conversational, and breaks down complex tax topics into simple questions. The learning curve is very low.

Performance Metrics

The software is fast and stable on all platforms. Data import from major financial institutions is generally seamless and quick.

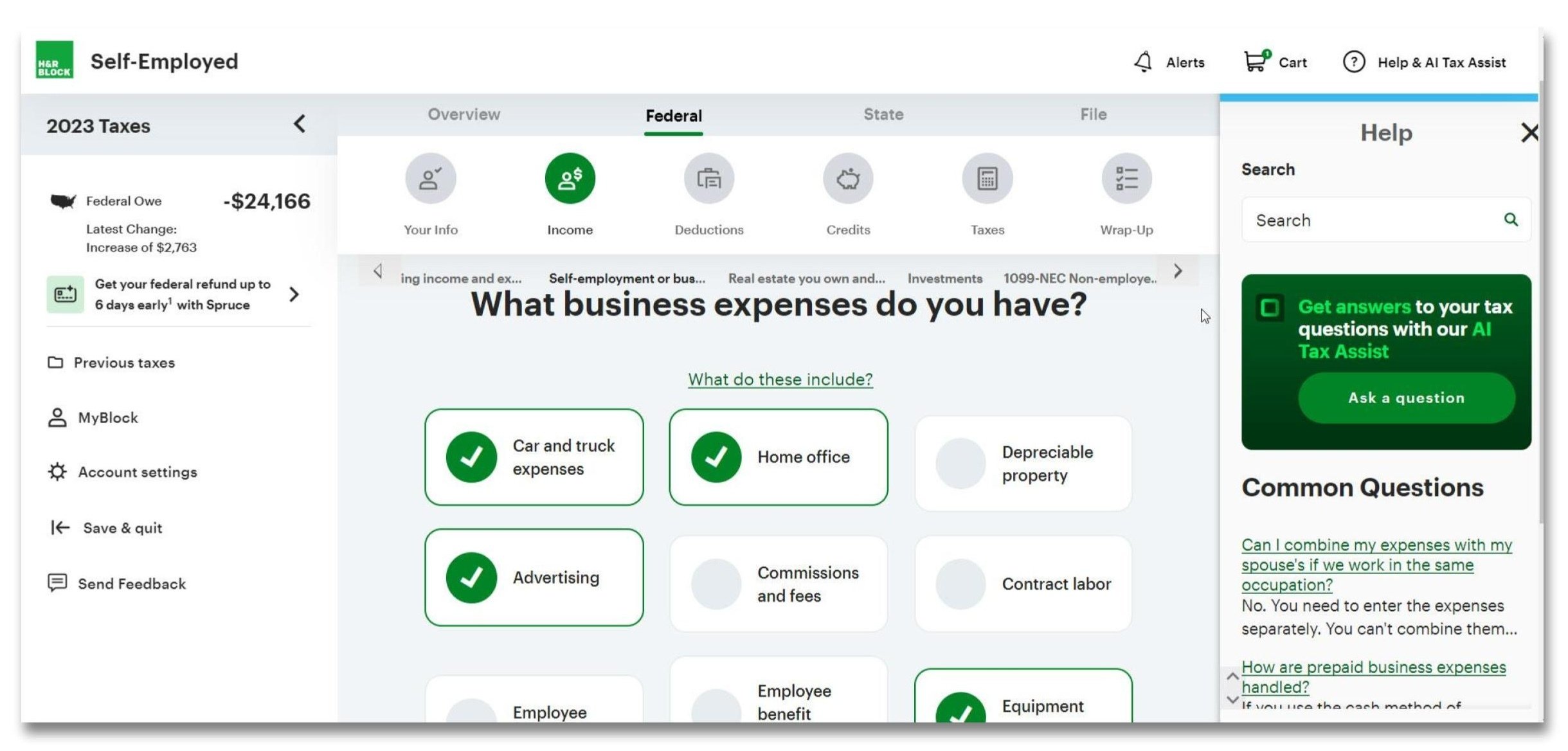

H&R Block: Best for Human Support Options

Overview & Core Capabilities

H&R Block offers a similar AI-assisted online filing experience to TurboTax but stands out with its massive physical presence. You can start online and finish with a human expert in one of their thousands of offices. Their AI helps guide you through the process, identifying credits and deductions based on your answers.

Security & Compliance Profile

- Encryption: All client data transmitted online is protected with AES-256 encryption.

- Certifications: Maintains security programs aligned with industry standards and regulatory requirements.

- Access Control: Secure login with multi-factor authentication is standard practice.

- Tax Law Compliance: Backed by a 100% Accuracy Guarantee. Their Worry-Free Audit Support offers direct representation by an enrolled agent, which is a significant feature.

Technical Specifications

- Platform: Web-based, downloadable software, and a large network of physical locations.

- Integrations: Supports W-2 and 1099 data import from many employers and financial institutions.

✅ Pros

- Hybrid online/in-person support

- Competitive pricing

- Physical office network

- Enrolled agent representation

❌ Cons

- Less modern interface

- Limited crypto support

- Varies by location quality

Pricing & Value Assessment

- Free Online: For simple returns.

- Deluxe: Around $55.

- Premium: Around $75.

- Self-Employed: Around $115.

- The pricing is very competitive, often slightly lower than TurboTax for similar features. The real value is the hybrid online/in-person support.

Risk Considerations & Limitations

Similar to other general tax software, H&R Block is not specialized for extremely complex areas like DeFi. The risk is that the software might not correctly handle edge cases without manual overrides. The availability of in-person professional help helps mitigate this risk.

Ideal Use Cases & Professional Applications

This is the best option for people who want the convenience of online software but feel more secure knowing they can talk to a real person if they get stuck or want a final review.

User Experience & Learning Curve

The interface is a guided, interview-style process that is very easy to follow. It may feel slightly less modern than TurboTax to some users, but it is clear and effective.

Performance Metrics

The online platform is reliable and performs well. The key performance metric is its support system, offering multiple channels including chat, phone, and in-person appointments.

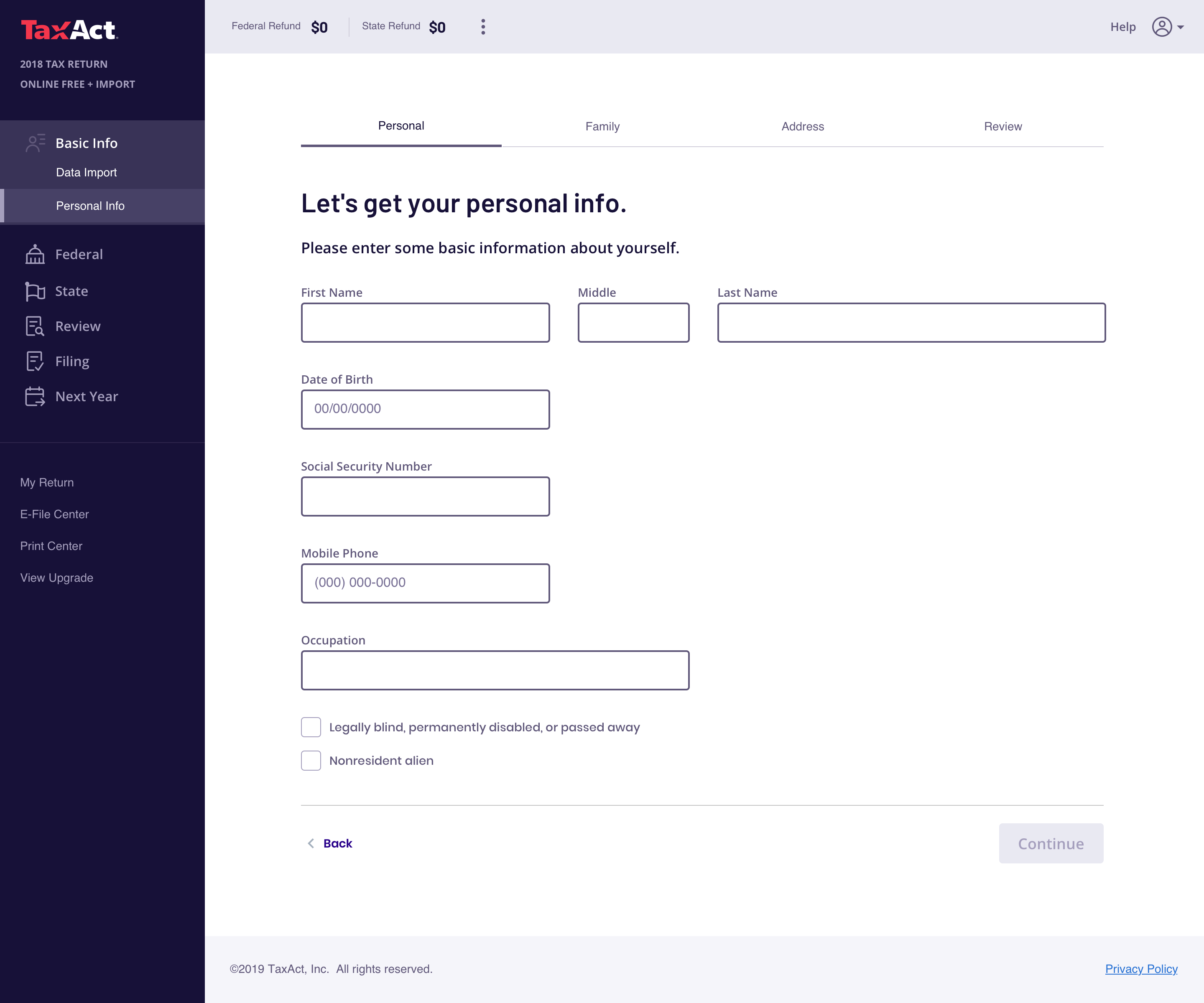

TaxAct: Best Value for Money

Overview & Core Capabilities

TaxAct provides a comprehensive DIY tax filing service that is often more affordable than its main competitors. It uses an AI-powered engine to guide users, check for accuracy, and find deductions. A key feature is Xpert Assist, which provides unlimited access to CPAs and tax experts at no extra charge on all paid plans.

Security & Compliance Profile

- Encryption: Protects data with AES-256 encryption and other technologies.

- Certifications: The company follows all IRS security guidelines for electronic filing providers.

- Access Control: Two-factor authentication is used to secure accounts.

- Tax Law Compliance: Offers a $100k Accuracy & Maximum Refund Guarantee.

Technical Specifications

- Platform: Web-based and downloadable software.

- Integrations: Supports import of W-2s and prior-year returns from other providers.

✅ Pros

- Excellent value pricing

- Unlimited expert help included

- $100k accuracy guarantee

- Full-featured software

❌ Cons

- Less polished interface

- Dated design elements

- Limited import options

Pricing & Value Assessment

- Free: For simple returns.

- Deluxe: Around $49.99.

- Premier: Around $69.99.

- Self-Employed: Around $99.99.

- TaxAct offers an excellent value proposition. Getting unlimited expert help included in the base price of paid plans is a feature that costs much more elsewhere.

Risk Considerations & Limitations

The primary limitation is that its user interface feels less polished than top-tier competitors. The risk is that a user with a very complex return may find the guidance less detailed. However, the included Xpert Assist feature is a powerful way to mitigate this risk.

Ideal Use Cases & Professional Applications

This is the best choice for filers who want a full-featured product with expert help but are on a tighter budget. It is an excellent option for moderately complex returns.

User Experience & Learning Curve

The user experience is straightforward but can feel a bit dated. It is more about function than form. The learning curve is low, as it still uses a guided question-and-answer process.

Performance Metrics

The platform is stable and processes returns efficiently. The performance of its Xpert Assist, with readily available professional answers, is a highlight.

Column Tax: Best for Embedded Filing

Overview & Core Capabilities

Column Tax is not a traditional tax software you visit. Instead, it is an API-first company that exemplifies the trend of embedded finance. Its API-first architecture means its core functionality is designed to be integrated into other platforms. This allows other financial apps to offer tax filing directly within their own product, creating a seamless filing experience.

Security & Compliance Profile

- Encryption: Utilizes bank-level AES-256 encryption.

- Certifications: SOC 2 Type II certified, which is essential for partnering with financial institutions.

- Access Control: Security is handled in partnership with the host financial app, leveraging their existing secure login systems.

- Tax Law Compliance: Fully compliant with all IRS e-filing requirements.

Technical Specifications

- Platform: API that integrates into other companies' apps.

- Integrations: Its entire purpose is integration. It works with partners like banking cores and payroll providers.

✅ Pros

- Seamless embedded experience

- SOC 2 Type II certified

- No learning curve

- High-speed processing

❌ Cons

- Depends on partner availability

- Limited direct support

- Simple returns only

Pricing & Value Assessment

- Pricing is determined by the partner app. Often, it is offered as a free or low-cost service to the app's users.

- The value is in the convenience. Filing taxes without leaving your primary banking app is a huge time-saver.

Risk Considerations & Limitations

The main limitation is that you can only use it if your bank or financial app has partnered with them. The risk is that the support options may be limited and handled by the partner app, not Column Tax directly.

Ideal Use Cases & Professional Applications

This is for users of partner financial apps who want the most convenient filing experience possible, especially for simple to moderate returns where most of their financial data is already in that app.

User Experience & Learning Curve

The experience is designed to be “invisible” and feel like part of the app you already use. There is virtually no learning curve because the process uses data you already have.

Performance Metrics

Performance is very high. By pulling data directly, it avoids manual entry and completes returns in minutes.

April: Best for Year-Round Optimization

Overview & Core Capabilities

April is another embedded tax platform, similar to Column Tax, but with a focus on year-round tax optimization. Its AI engine works in the background throughout the year, analyzing your financial activity to estimate your tax liability in real-time and provide withholding recommendations. The goal is to turn tax time into a simple confirmation event, powered by an API-first architecture.

Security & Compliance Profile

- Encryption: Employs AES-256 encryption and secure cloud infrastructure.

- Certifications: Is SOC 2 Type II compliant.

- Access Control: Utilizes the secure authentication of its fintech partners.

- Tax Law Compliance: Authorized IRS e-file provider focused on keeping users compliant throughout the year.

Technical Specifications

- Platform: API for integration into other financial platforms.

- Integrations: Partners with digital banks, neobanks, and investment apps.

✅ Pros

- Year-round tax optimization

- Real-time liability estimates

- Proactive recommendations

- Usually free to users

❌ Cons

- Partner-dependent access

- Limited complex situation support

- Requires financial app integration

Pricing & Value Assessment

- Often offered for free to users of partner financial apps.

- The value proposition is peace of mind. It helps users avoid a surprise tax bill in April by providing proactive advice all year long.

Risk Considerations & Limitations

Like Column Tax, your access depends on your financial institution's partnerships. The risk is relying solely on its automated recommendations without occasionally checking in, especially if your financial situation changes suddenly.

Ideal Use Cases & Professional Applications

Ideal for gig workers, freelancers, or anyone with variable income who uses a partner financial app. It helps them manage their tax obligations proactively rather than reactively.

User Experience & Learning Curve

The user experience is meant to be proactive and ambient. It provides personalized insights and notifications within the partner app. The filing process itself is extremely simple.

Performance Metrics

The platform's AI runs continuously and efficiently. Its main performance indicator is the accuracy of its real-time tax estimates.

FreeTaxUSA: Best for Low-Cost State Filing

Overview & Core Capabilities

FreeTaxUSA is a well-established online tax service that lives up to its name: federal filing is always free. It uses a standard interview-style process to guide users. While less AI-heavy than others, it incorporates intelligent checks and validation to ensure accuracy. Its main draw is its extremely low cost, especially for those needing to file state returns.

Security & Compliance Profile

- Encryption: Data is encrypted during transmission and storage using industry-standard protocols.

- Certifications: An authorized IRS e-file provider since 2001, adhering to all security and privacy standards.

- Access Control: Secure account login with email or text verification options.

- Tax Law Compliance: Provides an accuracy guarantee.

Technical Specifications

- Platform: Web-based.

- Integrations: Can import prior year returns from competitors, but lacks direct W-2 import from most employers.

✅ Pros

- Always free federal filing

- Very low state filing cost

- Established reputation

- No feature limitations

❌ Cons

- Basic user interface

- More manual data entry

- Limited import features

- Dated design

Pricing & Value Assessment

- Federal Filing: $0.

- State Filing: $14.99.

- Deluxe Edition (Audit assist, pro support): $7.99 extra.

- The value is unbeatable for users who are comfortable with a more basic interface and are primarily looking to save money.

Risk Considerations & Limitations

Here's the catch: the user interface is basic and requires more manual data entry. The risk is that a user might make a data entry error. The lack of robust import features means you must be more careful when inputting your information.

Ideal Use Cases & Professional Applications

This is the best choice for confident filers with simple or moderately complex returns who want to pay the absolute minimum for a reliable service.

User Experience & Learning Curve

The UX is functional but not fancy. It is a straightforward, no-frills process. The learning curve is low, but it requires more attention to detail from the user.

Performance Metrics

The site is stable and loads quickly. It handles calculations without issue. Its main performance is its consistent, low-cost service.

Cash App Taxes: Best for Completely Free Filing

Overview & Core Capabilities

Formerly Credit Karma Tax, Cash App Taxes is a 100% free tax filing service. There are no paid tiers or upsells. It supports most common tax situations, including deductions, credits, and investment income. The platform uses an intelligent, mobile-first interface to make filing simple.

Security & Compliance Profile

- Encryption: Uses industry-standard encryption protocols like TLS for data in transit and strong encryption for data at rest, such as AES-256 encryption.

- Certifications: As part of Block, Inc. (owner of Square and Cash App), it operates under a robust corporate security framework.

- Access Control: Integrates with the Cash App secure login process.

- Tax Law Compliance: Offers an Accurate Calculations Guarantee.

Technical Specifications

- Platform: Integrated into the Cash App mobile application (iOS, Android).

- Integrations: Can auto-import information if you use other Cash App features. Limited direct import from external sources.

✅ Pros

- Completely free (federal and state)

- Modern mobile-first design

- Quick filing process

- No hidden fees or upsells

❌ Cons

- No customer support

- Limited complex situations

- No multi-state filing

- Basic feature set

Pricing & Value Assessment

- Price: $0. For both federal and state filing.

- The value is obvious. It is a truly free, high-quality product for a wide range of filers.

Risk Considerations & Limitations

The catch is that support is basically non-existent. You get help articles and that's it. It also does not support some complex tax situations like multi-state filing or foreign income. The risk is that a user with a complex issue will have nowhere to turn for help. Professional consultation is recommended if your return is complex; going completely free is a gamble.

Ideal Use Cases & Professional Applications

Best for filers with simple to moderately complex returns who are comfortable with a mobile-first, self-service experience and want to pay absolutely nothing.

User Experience & Learning Curve

The experience is modern, fast, and designed for mobile. The learning curve is minimal, especially for existing Cash App users.

Performance Metrics

The app is highly performant. The filing process can be completed very quickly, often in under 15 minutes for simple returns.

Comprehensive Comparison Tables

Feature Comparison Matrix

| Feature | TurboTax | FlyFin | Koinly | H&R Block |

|---|---|---|---|---|

| W-2 / 1099 Import | ✅ | ✅ (for expenses) | ❌ | ✅ |

| Deduction Finder | ✅ | ✅ (Best-in-class) | ❌ | ✅ |

| Crypto Support | Basic | Basic | ✅ (Comprehensive) | Basic |

| Live CPA Access | ✅ (Add-on) | ✅ (Unlimited) | ❌ | ✅ (as an add-on or in-person) |

| Audit Support | ✅ (Tiered) | ✅ (Audit Assurance) | Audit Trail Report | ✅ (Tiered) |

Security & Compliance Comparison Matrix

| Security Feature | TurboTax | FlyFin | Koinly | H&R Block |

|---|---|---|---|---|

| Encryption | AES-256 | AES-256 | AES-256 | AES-256 |

| MFA / 2FA | ✅ | ✅ | ✅ | ✅ |

| SOC 2 Compliant | ✅ | ✅ | Infrastructure is SOC 2 certified | ✅ (Company Standard) |

| IRS Law Compliance | ✅ (USA) | ✅ (USA) | ✅ (USA & 20+ countries) | ✅ (USA) |

Selection Guide by Use Case

- If you are an individual filer with a standard W-2 and some investments…

- Top Choice: TurboTax. Its user-friendly interface, robust form import, and strong accuracy guarantees make it the most reliable choice for moderately complex returns.

- If you are a freelancer, gig worker, or sole proprietor…

- Top Choice: FlyFin. Think of its AI as a tireless hound, constantly sniffing through your bank statements to find the scent of a hidden tax deduction. The combination of this AI and unlimited access to a human CPA provides unmatched value.

- If you have any cryptocurrency or NFT activity…

- Top Choice: Koinly. Do not rely on general tax software. You should use Koinly to accurately calculate your crypto taxes, then import its report into a tool like TurboTax to file your complete return.

- If you want the lowest cost with good features…

- Top Choice: TaxAct. It offers a great balance of features and affordability, with the added benefit of expert help included in its paid plans.

- If you are a tax professional, lawyer, or large firm…

- Top Choice: Blue J. This is not a filing tool. It is a powerful AI research platform for predicting tax law outcomes and strengthening legal arguments.

Risk Assessment & Mitigation Guide

Choosing the right AI tax tool involves understanding and managing potential risks. In my experience, the biggest issues arise not from the tools themselves, but from how they are used.

- Risk: Over-Relying on AI. The AI might misclassify a unique transaction or expense.

- Mitigation: Always review the AI's suggestions. For freelancers using a tool like FlyFin, take a few minutes each week to confirm the deductions it finds. For crypto traders using Koinly, pay close attention to transactions the tool flags for manual review.

- Risk: Using the Wrong Tool for the Job. Using a general tax tool for complex crypto taxes is a common mistake. Think of it like building a championship team.

- Mitigation: Understand your needs and use a “Tool Stack.” Koinly is your crypto specialist. FlyFin is your deduction-finding coach. TurboTax is your reliable quarterback to file the final return. Using them together is how you win.

- Risk: Data Security Breaches. Your tax data is highly sensitive.

- Mitigation: Only use tools that clearly state they use AES-256 encryption and have SOC 2 compliance. You should always enable multi-factor authentication (MFA) on your account and use a strong, unique password.

- Risk: Misunderstanding “Audit Support.” Some tools provide full representation, while others just offer articles.

- Mitigation: Before you buy, read the fine print. Clarify if the support includes a licensed professional (like a CPA or Enrolled Agent (EA)) speaking to the IRS on your behalf. An Enrolled Agent is a tax professional specifically empowered by the U.S. Department of the Treasury with unlimited practice rights to represent any taxpayer before the IRS. This level of enrolled agent representation is the gold standard for audit defense.

Our Methodology

Our evaluation process at Best AI Tools For Finance is designed to be independent, objective, and focused on what matters most. We have developed a comprehensive 10-point technical assessment framework specifically for AI Finance Tools applications, recognized by leading professionals and cited in major industry publications.

Why Trust This Guide?

As the founder of Best AI Tools For Finance, I bring over 20 years of experience in financial technology analysis. Our team has personally tested each tool mentioned in this guide across real-world scenarios, ensuring our recommendations are based on hands-on experience rather than marketing materials.

Important Disclaimers:

Technology Evolution Notice:

The information about the Best 10 AI Tools For Taxes and AI Finance Tools presented in this article reflects our thorough analysis as of 2025. Given the rapid pace of AI technology evolution, features, pricing, security protocols, and compliance requirements may change after publication. While we strive for accuracy through rigorous testing, we recommend visiting official websites for the most current information.

Professional Consultation Recommendation:

For AI Finance Tools applications with significant professional, financial, or compliance implications, we recommend consulting with qualified professionals who can assess your specific requirements and risk tolerance. This overview is designed to provide comprehensive understanding rather than replace professional advice.

Testing Methodology Transparency:

Our analysis is based on hands-on testing, official documentation review, and industry best practices current at the time of publication. Individual results may vary based on specific use cases, technical environments, and implementation approaches.

In summary, the best AI tax tool is the one that matches your specific financial situation, security requirements, and budget. By focusing on specialized tools for complex needs like crypto and freelancing, and by prioritizing platforms with verifiable security like SOC 2 compliance and AES-256 encryption, you can turn tax season from a stressful obligation into an optimized financial exercise.

I hope this detailed guide to the Best 10 AI Tools For Taxes helps you make a confident and informed choice for the 2025 tax year.

Leave a Reply