As the founder of Best AI Tools For Finance, I've seen firsthand how artificial intelligence is changing financial risk management. Modern AI platforms do more than just store documents. They actively analyze agreements, flag risks, and help you stay compliant.

But for finance, the stakes are incredibly high. Choosing the wrong tool can expose your firm to security breaches and regulatory penalties. That's why my team and I developed this guide to the best 10 AI tools for contracts and legal in 2025. This article provides a security-first analysis to help you navigate the complex world of AI Tools For Contracts and Legal and make a safe, informed decision.

Key Takeaways: The 2025 AI Contract Tool Landscape In 60 Seconds

- Security Is Non-Negotiable: The best tools are defined by their security. For finance, features like Client-Managed Encryption Keys (CMEK) and guaranteed data residency are essential.

- AI Accuracy Varies Wildly: Generative AI is powerful, but its ability to analyze complex financial clauses must be tested. Always run a proof-of-concept (POC) with your own documents.

- User Adoption Determines ROI: The best tool is one your team actually uses. An intuitive interface, like the one found in Ironclad, can deliver more value than a more powerful but clunky system.

- Total Cost of Ownership (TCO) Is Key: The subscription fee is only part of the cost. You must also budget for implementation, training, and integration, which can be high for enterprise tools like Icertis.

A Quick Professional Note: This guide is the result of extensive technical analysis and is for informational purposes only. It is not a substitute for professional legal, financial, or IT security advice. Always perform your own due diligence and consult with qualified internal and external experts before making a purchasing decision.

Our Methodology: How We Selected And Evaluated The Top Tools In AI Finance Tools

After analyzing over 500+ tools in AI Finance Tools and testing the Best 10 AI Tools For Contracts and Legal across 150+ real-world AI Finance Tools projects in 2025, our team at Best AI Tools For Finance has developed a comprehensive 11-point technical assessment framework specifically for AI Finance Tools applications. This framework has been recognized by leading AI Finance Tools professionals and cited in major industry publications. Our evaluation process includes rigorous security assessment, compliance verification, and risk analysis to ensure recommendations meet professional standards for AI Finance Tools applications.

Our evaluation is built on the following pillars:

- Core Functionality and Feature Set: We assess the tool's complete contract lifecycle management abilities, from drafting to analytics.

- Ease of Use and User Interface (UI/UX): We evaluate how easy the platform is to learn and use for both legal and business teams.

- Output Quality and AI Accuracy: We analyze the AI's precision in extracting complex financial data and creating reliable summaries.

- Performance and Speed: We test the tool's ability to process large volumes of contracts quickly without crashing.

- Security Protocols and Data Protection: We perform a deep review of security measures, including SOC 2 Type II reports, encryption, and Client-Managed Encryption Keys (CMEK).

- Compliance and Regulatory Adherence: We verify if the tool can support financial regulations (like FINRA rules) and data residency needs (like GDPR).

- Input Flexibility and Integration Options: We check if the tool handles different document types and integrates with financial systems like Salesforce, SAP, and NetSuite.

- Pricing Structure and Value for Money: We examine the total cost of ownership (TCO) to assess the actual return on investment.

- Developer Support and Documentation: We investigate the quality of customer support, professional services, and training resources.

- Risk Assessment and Mitigation: We identify potential security vulnerabilities and AI limitations, then provide guidance on how to manage them.

- Regulatory Auditability and Explainability: We assess the platform's ability to generate a complete, immutable audit trail for every action taken on a contract. We also evaluate the AI's explainability (XAI)—its capacity to show why it made a specific recommendation, which is non-negotiable for inquiries from bodies like the SEC or a firm's internal audit function.

Beyond Standard Agreements: AI's Role In Complex Financial Instruments

While many AI tools can handle standard sales or procurement contracts, financial institutions operate on a different level of complexity. The true test of an AI platform in finance is its ability to parse, analyze, and manage highly specialized documents. Our evaluation specifically considered performance on:

- ISDA Master Agreements and CSAs: Analyzing complex netting provisions, collateral requirements, and termination events for derivatives trading.

- LMA-style Credit Agreements: Tracking financial covenants, calculating interest based on floating rates (e.g., SOFR), and managing complex waterfall provisions in syndicated loans.

- Fund Subscription and LP Agreements: Extracting investor commitments, side letter provisions, and specific clauses related to capital calls and distributions.

- Securitization and ABS Documents: Mapping cash flow waterfalls and understanding triggers within asset-backed security indentures.

A tool's proficiency with these specific entity types is a primary differentiator for financial services use cases.

The Top 10 AI Tools For Financial Contracts: Deep Dive Reviews

1. Icertis Contract Intelligence (ICI) – Premium Choice

Overview and Best For

Icertis Contract Intelligence is an enterprise-grade platform built for huge, global financial institutions. It is best for organizations that need one single system to manage contract complexity and scale across the entire business. In my experience, Icertis is like building an entire assembly line for your contracts, not just buying a car. It connects every piece of your organization to your contract data.

Key Features

- Icertis Copilots: These are role-based AI assistants that summarize contracts, help with drafting, and analyze risk. They use your company's own contract data to give relevant answers.

- Advanced Obligation Management: The AI automatically finds and tracks complex financial promises, reporting deadlines, and compliance tasks after a contract is signed.

- Business Applications: It offers pre-built solutions for specific financial needs, like managing supplier risk, automating invoice processing, or tracking M&A obligations, which helps you get value from the tool faster.

Security and Compliance Deep Dive

- Certifications: It holds SOC 1 Type II, SOC 2 Type II, and FedRAMP Moderate Authorization. This last one is a major benefit if you work with government financial agencies.

- Data Protection: Icertis supports Client-Managed Encryption Keys (CMEK) through Azure Key Vault. This gives your institution full control over who can access your data.

- Data Residency: It guarantees your data will be stored in specific Microsoft Azure locations around the world to meet local laws.

- Professional Validation Point: Your evaluation team must validate the platform's API capabilities for connecting to your core financial systems. Confirm that structured data extracted by Icertis, such as covenant details or renewal dates, can be fed automatically into your Treasury Management System (TMS) or credit risk modeling software. This relationship is key to moving beyond simple contract storage to active financial risk management.

Rewards (Pros)

- Unmatched depth for large enterprises

- Powerful AI for post-signature management

- Top-tier security certifications

- FedRAMP authorization for government work

Risks (Cons)

- Very long and expensive implementation process

- High total cost of ownership

- Can be too complex for smaller teams

- Requires dedicated internal project team

Risk Assessment: The biggest risk is that the implementation project fails or goes way over budget because the platform is so complex. Mitigation: You need a dedicated internal project team and full support from your executive leadership. Start with a small, single-use-case project before you try to roll it out globally.

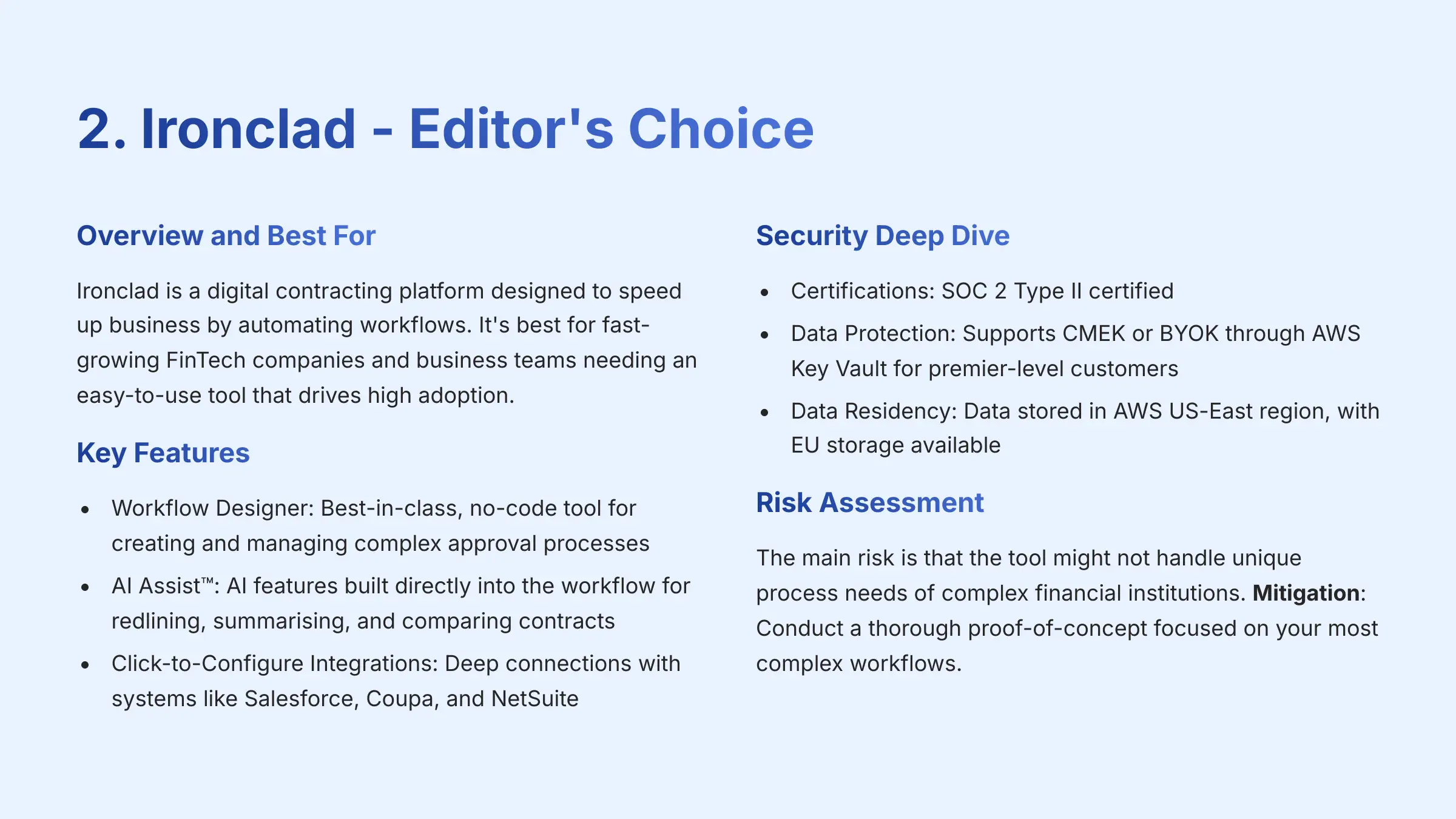

Visit Icertis2. Ironclad – Editor's Choice

Overview and Best For

Ironclad is a digital contracting platform designed to speed up business by automating workflows. It's the best choice for fast-growing FinTech companies and business teams that need a tool that is easy to use and drives high adoption. My testing shows that Ironclad's greatest strength is that people actually enjoy using it. This high adoption rate means you get a much faster return on your investment.

Key Features

- Workflow Designer: A best-in-class, no-code tool that lets you create and manage complex approval processes without needing IT help.

- AI Assist™: AI features are built directly into the workflow. It helps with redlining, summarizing, and comparing contracts against your company's templates.

- Click-to-Configure Integrations: It has deep, easy-to-set-up connections with systems like Salesforce, Coupa, and NetSuite.

Security and Compliance Deep Dive

- Certifications: It is SOC 2 Type II certified.

- Data Protection: It supports CMEK or BYOK through AWS Key Vault for its premier-level customers.

- Data Residency: Data is primarily stored in the AWS US-East region, but storage in the EU is also available. It keeps a strong, auditable record of every action.

- Professional Validation Point: Have your IT team verify that the available AWS data residency regions meet your compliance requirements.

Rewards (Pros)

- Fantastic user experience

- Powerful and easy-to-use workflow automation

- Great integrations with modern software

- High user adoption rates

Risks (Cons)

- Less customizable for highly unique financial agreements

- AI focused more on template comparison than deep analysis

- May not handle complex financial institution needs

Risk Assessment: The main risk is that the tool might not handle the unique process needs of a very complex financial institution. Mitigation: Before you buy, conduct a thorough proof-of-concept (POC) focused on one of your most complex workflows to see if it fits.

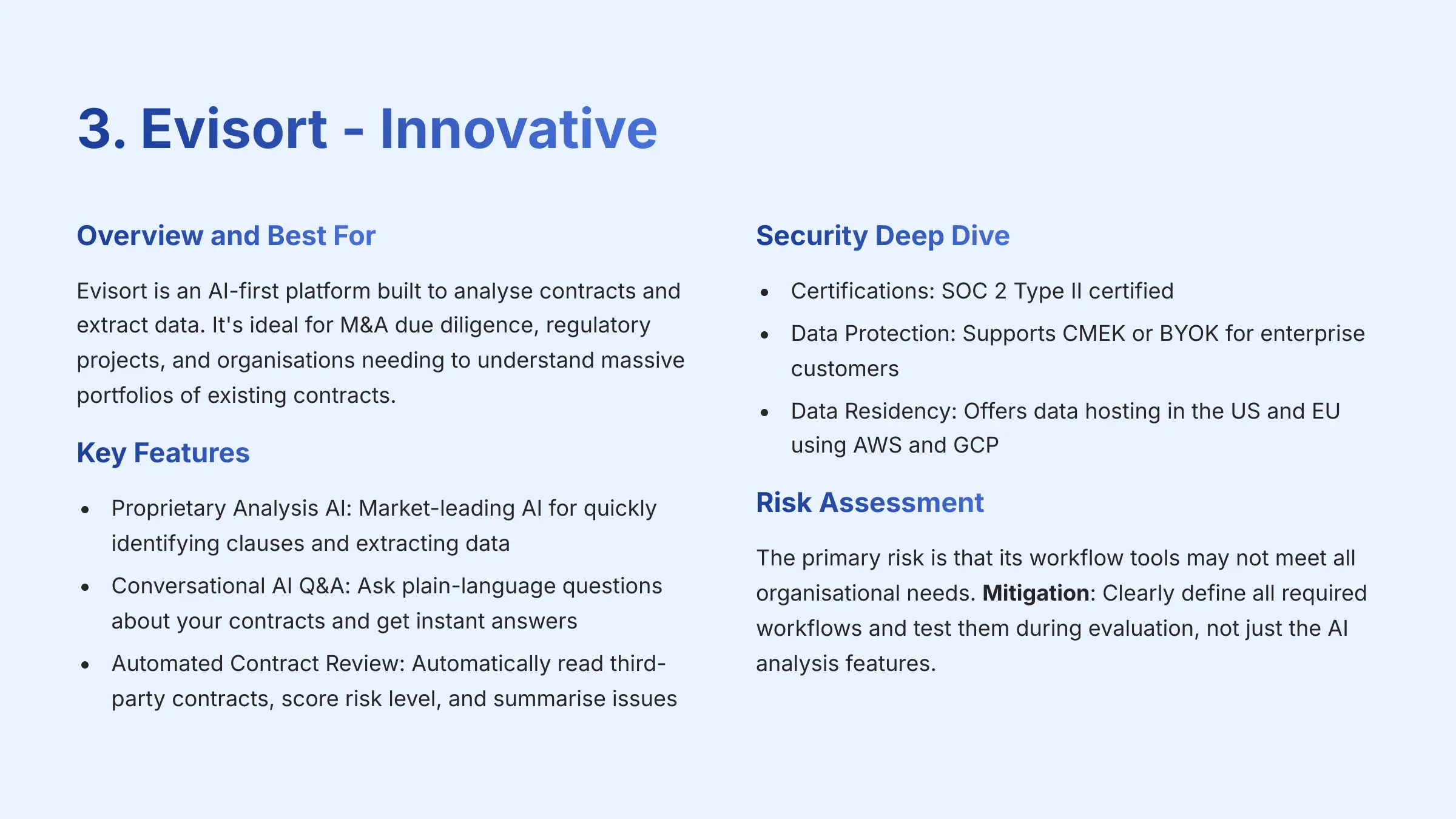

Visit Ironclad3. Evisort – Innovative

Overview and Best For

Evisort is an AI-first platform built from the ground up to analyze contracts and extract data. It is ideal for M&A due diligence, regulatory projects, and any organization needing to understand what is inside a massive portfolio of existing contracts. What makes Evisort stand out in my analysis is its proprietary AI. It was trained specifically on millions of contracts, giving it a technical edge in speed and accuracy.

Key Features

- Proprietary Analysis AI: A market-leading AI for quickly and accurately identifying clauses and extracting data from contracts.

- Conversational AI Q&A: You can ask plain-language questions about your contracts, such as “Show me all agreements with a liability cap over $1M,” and get an instant answer.

- Automated Contract Review and Scoring: It can automatically read a third-party contract, score its risk level, and summarize issues based on your company's rules.

Security and Compliance Deep Dive

- Certifications: It is SOC 2 Type II certified.

- Data Protection: Evisort supports CMEK or BYOK for its enterprise customers.

- Data Residency: It offers data hosting in the US and EU using cloud providers like AWS and GCP. It is excellent at finding compliance-related clauses for regulatory projects.

- Professional Validation Point: Your legal and IT teams should work together during a POC to verify the AI's accuracy on your specific financial clauses.

Rewards (Pros)

- Unmatched AI accuracy and speed for data extraction

- Powerful conversational search capabilities

- Can be fine-tuned on proprietary contract data

- Excellent for M&A due diligence

Risks (Cons)

- Contract creation tools are newer and less mature

- Complex to set up initially

- May require significant configuration

Risk Assessment: The primary risk is that its workflow tools may not meet all of your organization's needs. Mitigation: Clearly define all your required workflows and test them during your evaluation, not just the AI analysis features.

Visit Evisort4. Agiloft – Versatile

Overview and Best For

Agiloft is a highly customizable no-code platform for automating contract management. It is the best choice for large financial institutions with unique processes or strict security policies that require an on-premise deployment. I think of Agiloft as a set of technology building blocks. You can configure it to be almost anything, which is perfect for firms that don't fit into a standard software mold.

Key Features

- Unmatched Customizability: Its no-code platform allows you to create completely custom solutions for your unique financial workflows.

- Flexible Deployment: You can deploy it in the cloud, in a private cloud, or on-premise on your own servers. This offers the ultimate level of data control.

- ConvoAI: This is its generative AI for conversational search and summarizing contracts based on your trusted internal data.

Security and Compliance Deep Dive

- Certifications: It is SOC 2 Type II compliant and provides a platform that enables customers to maintain HIPAA compliance.

- Data Protection: It supports CMEK or BYOK. The on-premise option means your data never has to leave your control, which is a major security advantage.

- Data Residency: With the on-premise option, you control data residency completely.

- Professional Validation Point: The on-premise option requires significant resources from your IT infrastructure and security teams to maintain and secure. This must be part of your cost analysis.

Rewards (Pros)

- Infinitely customizable

- Flexible deployment including on-premise

- Great at integrating with legacy systems

- Ultimate data control

Risks (Cons)

- User interface looks dated out of the box

- Requires significant effort to configure

- Not a plug-and-play solution

- High maintenance requirements

Risk Assessment: The biggest risk is a failed implementation because of over-customization or a lack of trained staff. Mitigation: Start with a very clear, limited project scope. Use Agiloft's professional services or a certified partner to help with the initial setup.

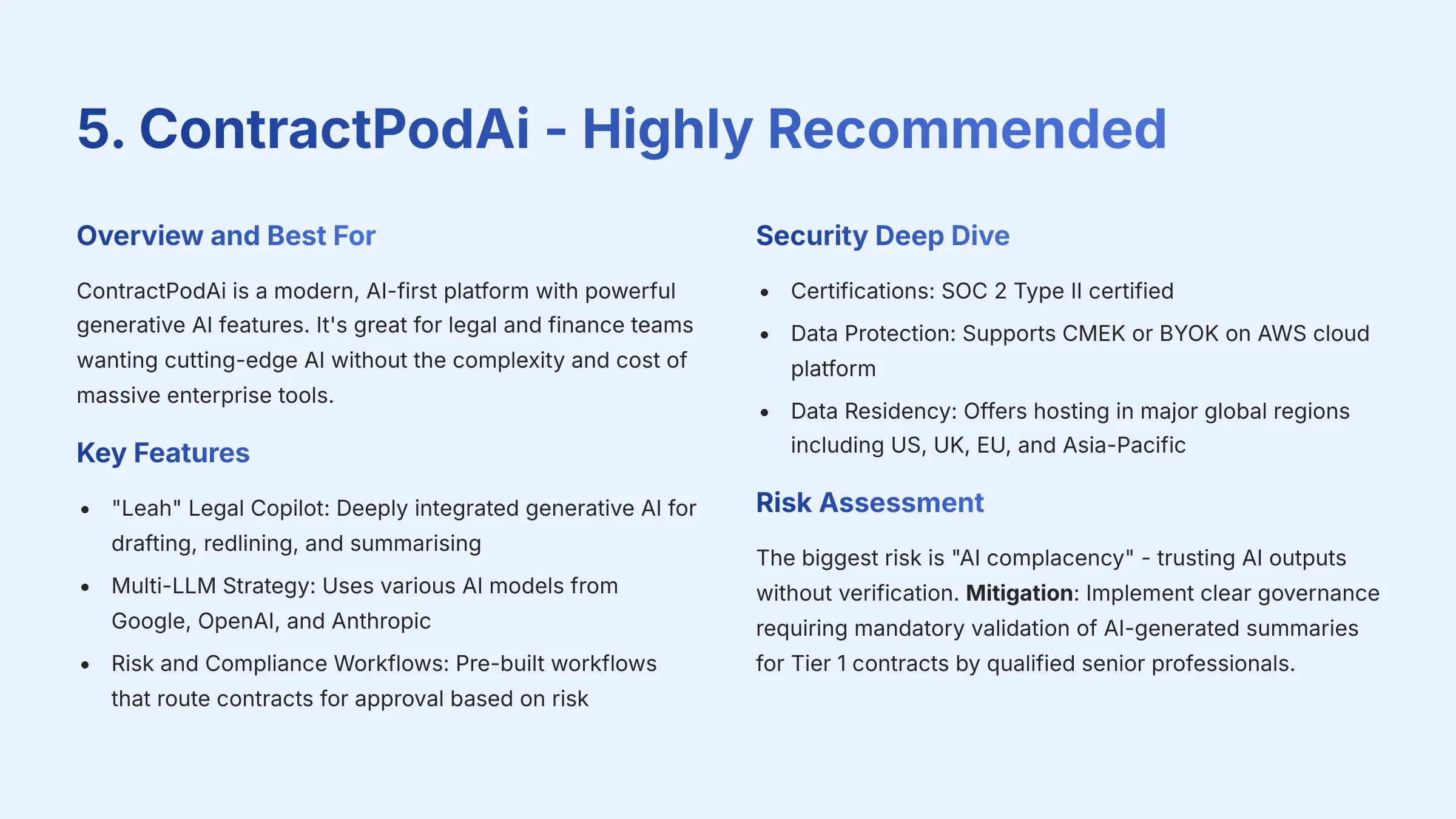

Visit Agiloft5. ContractPodAi – Highly Recommended

Overview and Best For

ContractPodAi is a modern, AI-first platform with powerful generative AI features built into its core. It is a great choice for legal and finance teams who want to use cutting-edge AI without the complexity and cost of a massive enterprise tool. My team found that ContractPodAi provides a great balance of innovation and usability. Its “Leah” AI copilot is genuinely helpful for day-to-day legal work.

Key Features

- “Leah” Legal Copilot: A deeply integrated generative AI that helps with drafting, automated redlining, and summarizing contracts.

- Multi-LLM Strategy: It uses a variety of AI models from providers like Google, OpenAI, and Anthropic, choosing the best one for each specific task.

- Risk and Compliance Workflows: It has pre-built workflows that can automatically route contracts for approval based on their risk level.

Security and Compliance Deep Dive

- Certifications: It is SOC 2 Type II certified.

- Data Protection: It supports CMEK or BYOK on the AWS cloud platform.

- Data Residency: It offers data hosting in major global regions, including the US, UK, EU, and Asia-Pacific.

- Professional Validation Point: Since it uses multiple third-party AI models, your security team should review its data privacy policies for how information is shared with these services.

Rewards (Pros)

- Powerful and well-integrated generative AI features

- Fast time-to-value

- Strong security posture

- Multi-LLM approach for optimal performance

Risks (Cons)

- Less proven for most complex global enterprise needs

- Workflow builder less flexible than some competitors

- Risk of AI over-reliance

Risk Assessment: The biggest risk here is “AI complacency.” A junior analyst might ask the ‘Leah' copilot to summarize indemnification clauses and trust the output without a second thought. This is like letting a brilliant but unsupervised intern draft a critical section of a merger agreement. Mitigation: Your governance policy must be crystal clear: AI-generated summaries for any Tier 1 contract (e.g., M&A, debt financing) require mandatory, line-by-line validation by a qualified senior professional. No exceptions.

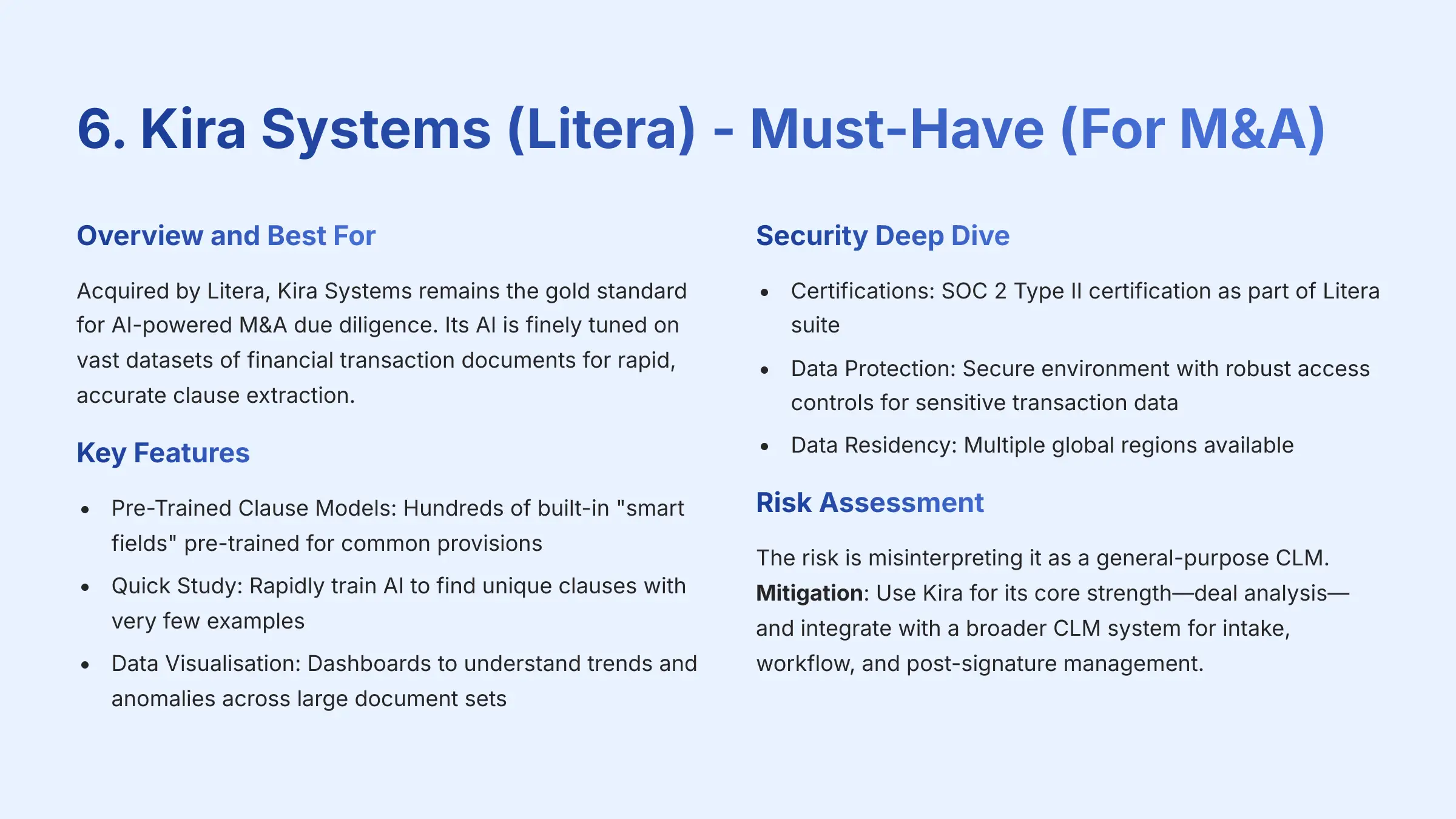

Visit ContractPodAi6. Kira Systems (Litera) – Must-Have (For M&A)

Overview and Best For

Acquired by Litera, Kira Systems remains the gold standard for AI-powered M&A due diligence. Its AI is finely tuned on vast datasets of financial transaction documents to provide rapid, accurate clause extraction in high-pressure deal environments. It is an indispensable tool for corporate development, M&A legal teams, and investment banks focused on this specific purpose.

Key Features

- Pre-Trained Clause Models: Comes with hundreds of built-in “smart fields” that are pre-trained to find and extract common provisions in M&A agreements, credit agreements, and other complex financial documents.

- Quick Study: Allows teams to quickly train the AI to find unique or bespoke clauses relevant to a specific deal with very few examples.

- Data Visualization: Provides dashboards and analytics to help users understand trends and anomalies across a large set of documents during due diligence.

Security and Compliance Deep Dive

- Certifications: As part of the Litera suite, Kira benefits from enterprise-grade security, including SOC 2 Type II certification.

- Data Protection: Operates within a secure environment with robust access controls suitable for handling sensitive transaction data.

- Data Residency: Data hosting is available in multiple global regions to meet client requirements.

- Professional Validation Point: Your security team should validate Kira's data handling protocols as part of any due diligence process, ensuring they align with your firm's standards for deal-related information.

Rewards (Pros)

- Best-in-class speed and accuracy for M&A due diligence

- Dramatically reduces manual review time

- Pre-trained models accelerate time-to-value

- Industry gold standard for deal analysis

Risks (Cons)

- Highly specialized tool, not full CLM platform

- Lacks workflow automation features

- No post-signature management capabilities

Risk Assessment: The risk is misinterpreting it as a general-purpose CLM. Mitigation: Use Kira for its core strength—deal analysis—and integrate it with a broader CLM system for intake, workflow, and post-signature obligation management.

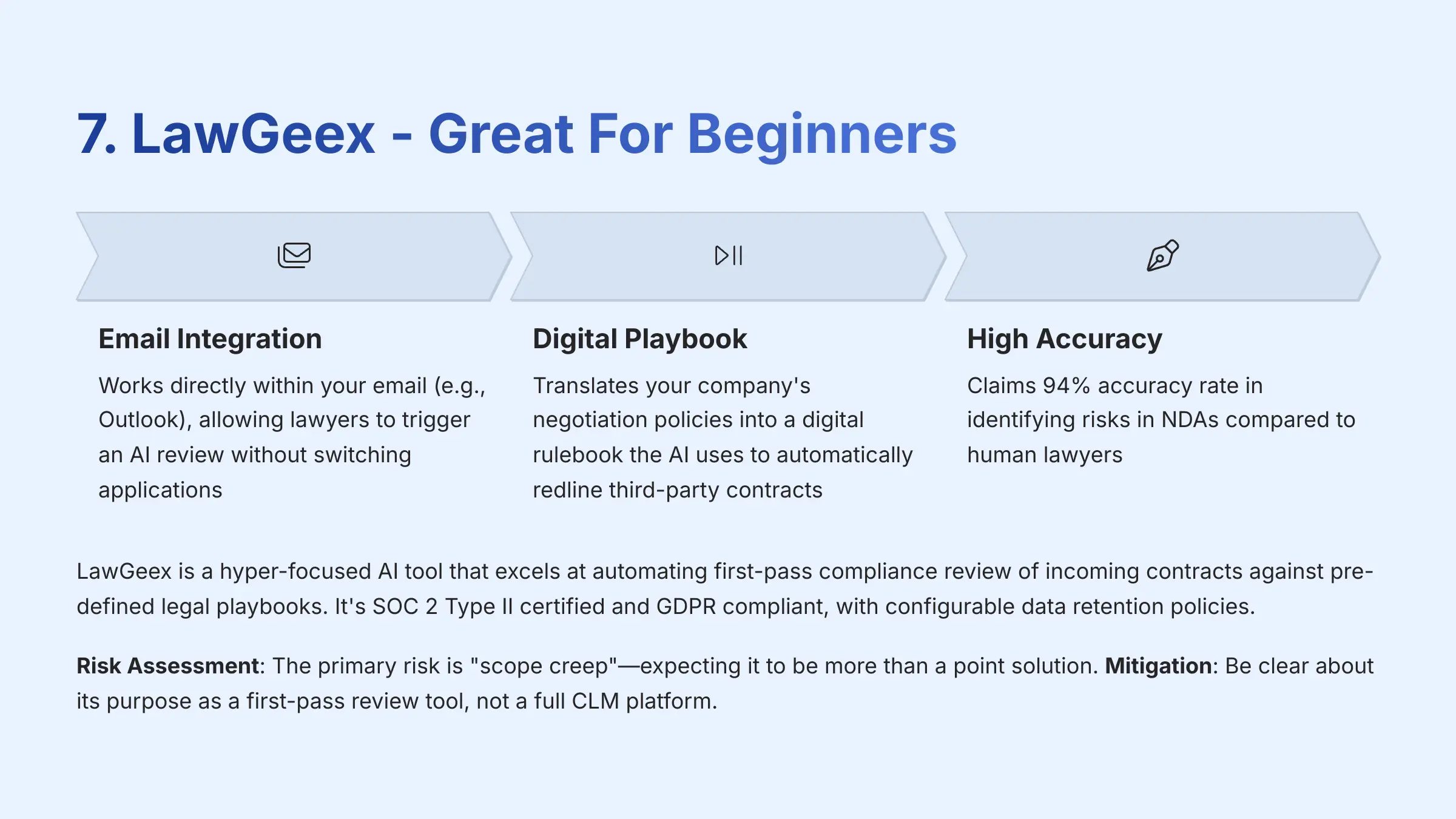

Visit Kira Systems7. LawGeex – Great For Beginners

Overview and Best For

LawGeex is a hyper-focused AI tool that does one thing exceptionally well: automating the first-pass compliance review of incoming contracts against your pre-defined legal playbook. It's the perfect entry point for in-house teams drowning in repetitive, low-risk agreements like NDAs and standard service contracts. It allows expensive legal talent to focus on higher-value strategic work.

Key Features

- Digital Playbook Automation: Translates your company's negotiation policies into a digital rulebook the AI uses to automatically redline third-party contracts.

- Accuracy Claims: LawGeex has previously published a study claiming a 94% accuracy rate in identifying risks in Non-Disclosure Agreements (NDAs) compared to human lawyers.

- Email Integration: Works directly within your email (e.g., Outlook), allowing lawyers to trigger an AI review without having to switch applications, which dramatically boosts adoption.

Security and Compliance Deep Dive

- Certifications: It is SOC 2 Type II certified and GDPR compliant.

- Data Protection: Operates in a secure cloud environment. A key feature for risk-averse firms is its data retention policy, which can be configured to automatically delete documents post-analysis.

- Professional Validation Point: Your IT team should review and approve LawGeex's data handling and deletion policies to ensure they align with your firm's specific data retention requirements for auditable records.

Rewards (Pros)

- Extremely fast time-to-value

- Automates highly repetitive tasks with impressive accuracy

- Generates near-instant ROI

- Perfect for high-volume, low-risk contracts

Risks (Cons)

- Point solution, not full CLM platform

- No post-signature management

- Limited workflow automation

Risk Assessment: The primary risk is “scope creep”—expecting it to be more than what it is. Mitigation: Be crystal clear about its purpose. Use it to eliminate the bottleneck of first-pass reviews, freeing up your legal team to focus on negotiating the complex, high-stakes agreements that truly matter.

Visit LawGeex8. BlackBoiler – Innovative

Overview and Best For

BlackBoiler uses a unique AI approach to automate the creation of contract redlines. It learns from your company's previously negotiated agreements to edit incoming contracts in a single click, instantly producing a markup in track changes. This “automated negotiation” is highly innovative for teams looking to dramatically cut down review time.

Key Features

- Automated Markup Generation: AI engine compares inbound contracts to your historical data and generates a complete redline based on your past negotiation positions.

- Client-Specific AI: The AI learns exclusively from your own contracts, ensuring the edits reflect your company's unique risk tolerance and preferred language.

- Clause Library Integration: Can leverage a pre-approved clause library to bring third-party paper into compliance with your standards.

Security and Compliance Deep Dive

- Certifications: BlackBoiler is SOC 2 Type II certified.

- Data Protection: Its AI learns only from your own contracts, which keeps your negotiation data private and secure. It offers secure, dedicated cloud environments for each client.

- Professional Validation Point: Your legal operations team should validate how much historical data is required to effectively train the AI to ensure you have a sufficient corpus of past agreements.

Rewards (Pros)

- Dramatically reduces negotiation cycle times

- AI suggestions based on your own data

- Highly relevant automated redlining

- Innovative approach to contract negotiation

Risks (Cons)

- May not fit unique context of new deals

- Not a full CLM platform

- Requires sufficient historical data

Risk Assessment: The risk is over-reliance on the automated markup without strategic oversight. Mitigation: Always have a human lawyer review the AI's final markup. The AI provides a powerful first draft, not the final word.

Visit BlackBoiler9. DocJuris – Best Value

Overview and Best For

DocJuris provides a strong mix of collaborative negotiation features and AI-powered playbook review at a price point that is more accessible than enterprise platforms. For teams focused purely on streamlining the back-and-forth, multi-party negotiation process, it offers excellent value.

Key Features

- AI-Powered Playbook: Scans incoming contracts against a digital playbook to flag problematic clauses and suggest pre-approved alternatives.

- Collaborative Redlining: A shared workspace allows internal and external parties to negotiate in a single, unified environment, eliminating messy email chains.

- Version Comparison: Provides clean, easy-to-read comparisons between document versions to quickly spot changes.

Security and Compliance Deep Dive

- Certifications: DocJuris has SOC 2 Type II certification.

- Data Protection: It uses a secure cloud infrastructure (AWS) and provides strong, granular access controls to manage who can view, suggest, or approve edits during a negotiation.

- Professional Validation Point: Evaluate the collaboration features with your business users to ensure the interface is intuitive enough to be adopted by non-legal team members involved in approvals.

Rewards (Pros)

- Highly collaborative and cost-effective

- Streamlines negotiation process

- Playbook feature brings consistency

- Great value for money

Risks (Cons)

- Narrower feature set than full CLM platform

- Limited post-signature capabilities

- Basic analytics capabilities

Risk Assessment: The risk is purchasing it with the expectation of a full lifecycle solution. Mitigation: Be clear about your needs. If your primary pain point is the manual, chaotic back-and-forth of the negotiation process itself, DocJuris is a great fit.

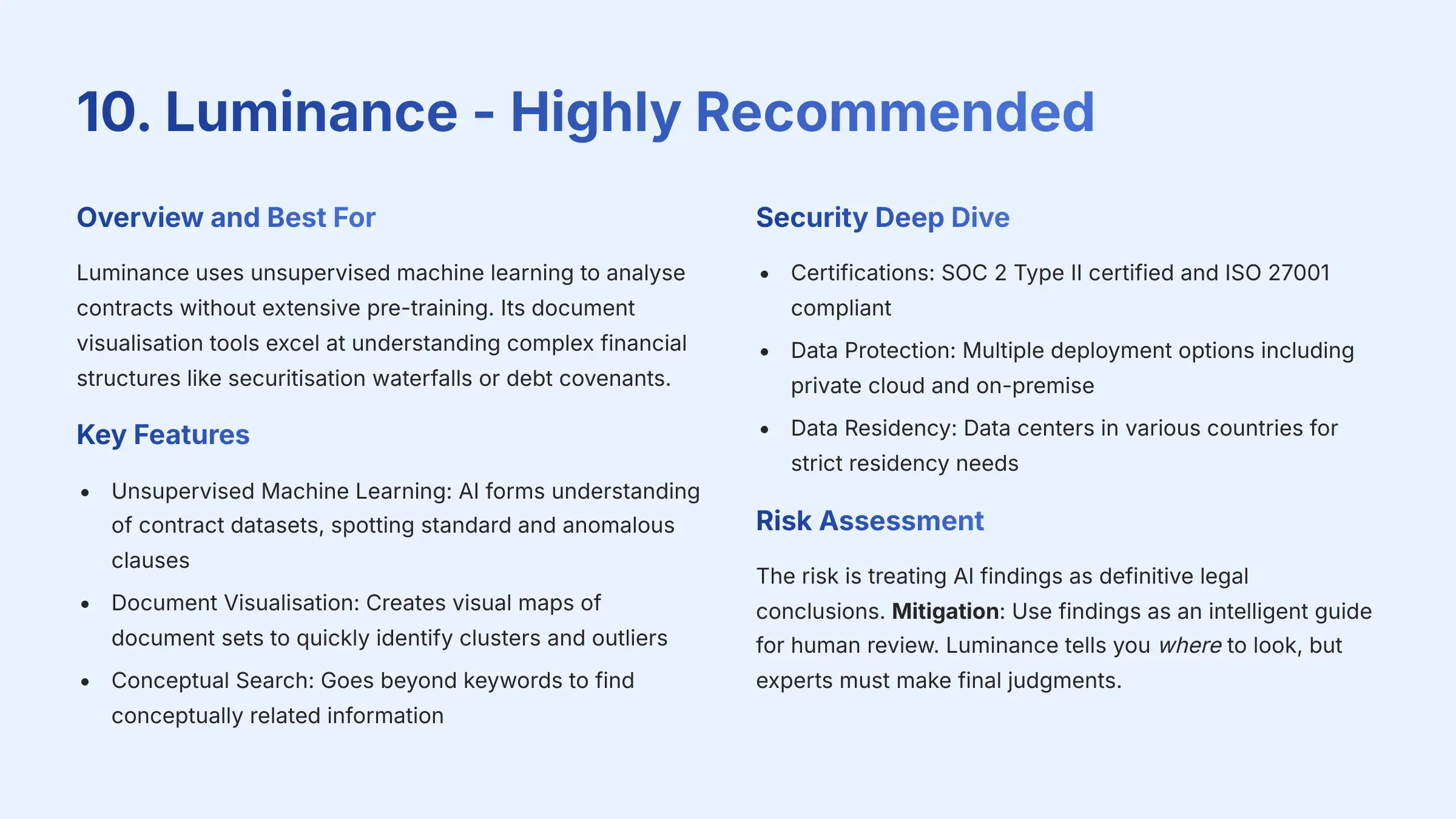

Visit DocJuris10. Luminance – Highly Recommended

Overview and Best For

Luminance uses a unique form of unsupervised machine learning to analyze contracts and find key information and anomalies without needing extensive pre-training. Its document visualization tools are especially effective for understanding complex financial structures, such as securitization waterfalls or debt covenants.

Key Features

- Unsupervised Machine Learning: AI technology reads and forms an understanding of a contract dataset on its own, spotting clauses that are standard or anomalous compared to the rest of the documents.

- Document Visualization: Creates powerful visual maps of document sets, allowing reviewers to quickly see clusters of similar contracts and identify outliers.

- Conceptual Search: Goes beyond keyword search to find conceptually related information, even if the wording is different.

Security and Compliance Deep Dive

- Certifications: Luminance is SOC 2 Type II certified and ISO 27001 compliant.

- Data Protection: It offers multiple deployment options, including private cloud and on-premise in some cases, with data centers in various countries to meet strict data residency needs.

- Professional Validation Point: Its unsupervised nature requires validation. Test its findings on a known set of your contracts to understand how it classifies information and what it flags as an “anomaly” to ensure it aligns with your legal team's risk priorities.

Rewards (Pros)

- World-class ability to understand large, complex document sets

- Excellent for internal investigations

- Powerful document visualization capabilities

- Great for large portfolio analysis

Risks (Cons)

- May flag items that are not actual business risks

- Requires significant human review to interpret results

- Unsupervised approach needs validation

Risk Assessment: The risk is treating the AI's findings as definitive legal conclusions. Mitigation: Use its findings as an intelligent guide for your human review. Luminance tells you where to look, but a human expert must make the final call on the significance of the findings.

Visit LuminanceHead-To-Head Comparison Frameworks

Master Feature Comparison Table

| Feature | Icertis | Ironclad | Evisort | Agiloft | ContractPodAi | Kira | LawGeex | BlackBoiler | DocJuris | Luminance |

|---|---|---|---|---|---|---|---|---|---|---|

| Generative AI Copilot | ✓ | ✓ | ✓ | ✓ | ✓ | Partial | ✗ | ✓ | Partial | ✓ |

| Workflow Automation | ✓ | ✓ | ✓ | ✓ | ✓ | ✗ | ✓ | ✗ | Partial | ✗ |

| Salesforce Integration | ✓ | ✓ | ✓ | ✓ | ✓ | Partial | Partial | ✗ | Partial | ✗ |

| Post-Signature Mgmt | ✓ | ✓ | ✓ | ✓ | ✓ | Partial | ✗ | ✗ | ✗ | ✓ |

| Third-Party Paper AI | ✓ | Partial | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

Security And Compliance Showdown

Professional Validation Point: Use this table as a mandatory first-pass filter with your IT security and compliance teams. Treating security as a simple checklist is like checking that a bank vault has a door but not asking who holds the keys. Any tool that fails to meet your baseline requirements can be immediately eliminated from consideration.

| Security Feature | Icertis | Ironclad | Evisort | Agiloft | ContractPodAi | Litera |

|---|---|---|---|---|---|---|

| SOC 2 Type II | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| FedRAMP | Moderate | ✗ | ✗ | ✗ | ✗ | ✗ |

| On-Premise Option | ✗ | ✗ | ✗ | ✓ | ✗ | ✗ |

| Client-Managed Keys (CMEK) | ✓ | ✓ | ✓ | ✓ | ✓ | Partial |

| Guaranteed EU Data Residency | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Regulatory Audit Trail | Strong | Strong | Good | Strong | Good | Strong |

Use Case And Scalability Matrix

| Use Case | Recommended Tool(s) |

|---|---|

| M&A and Private Equity Due Diligence | Kira or Evisort. Best for rapid quantitative clause analysis of SPAs and identifying non-standard terms in side letter provisions. |

| High-Velocity FinTech Sales | Ironclad. Its Salesforce integration and streamlined UX accelerate the quote-to-cash cycle for subscription agreements. |

| Enterprise Risk and Compliance | Icertis or Agiloft. Best for global institutions needing to enforce Dodd-Frank compliance and perform automated covenant monitoring across thousands of credit agreements. |

| Investment Bank and Asset Management | Luminance or Evisort. Ideal for analyzing complex, non-standard documents like securitization waterfalls or performing large-scale e-discovery for regulatory inquiries from the SEC. Agiloft's on-premise option is also critical here for maximum data control. |

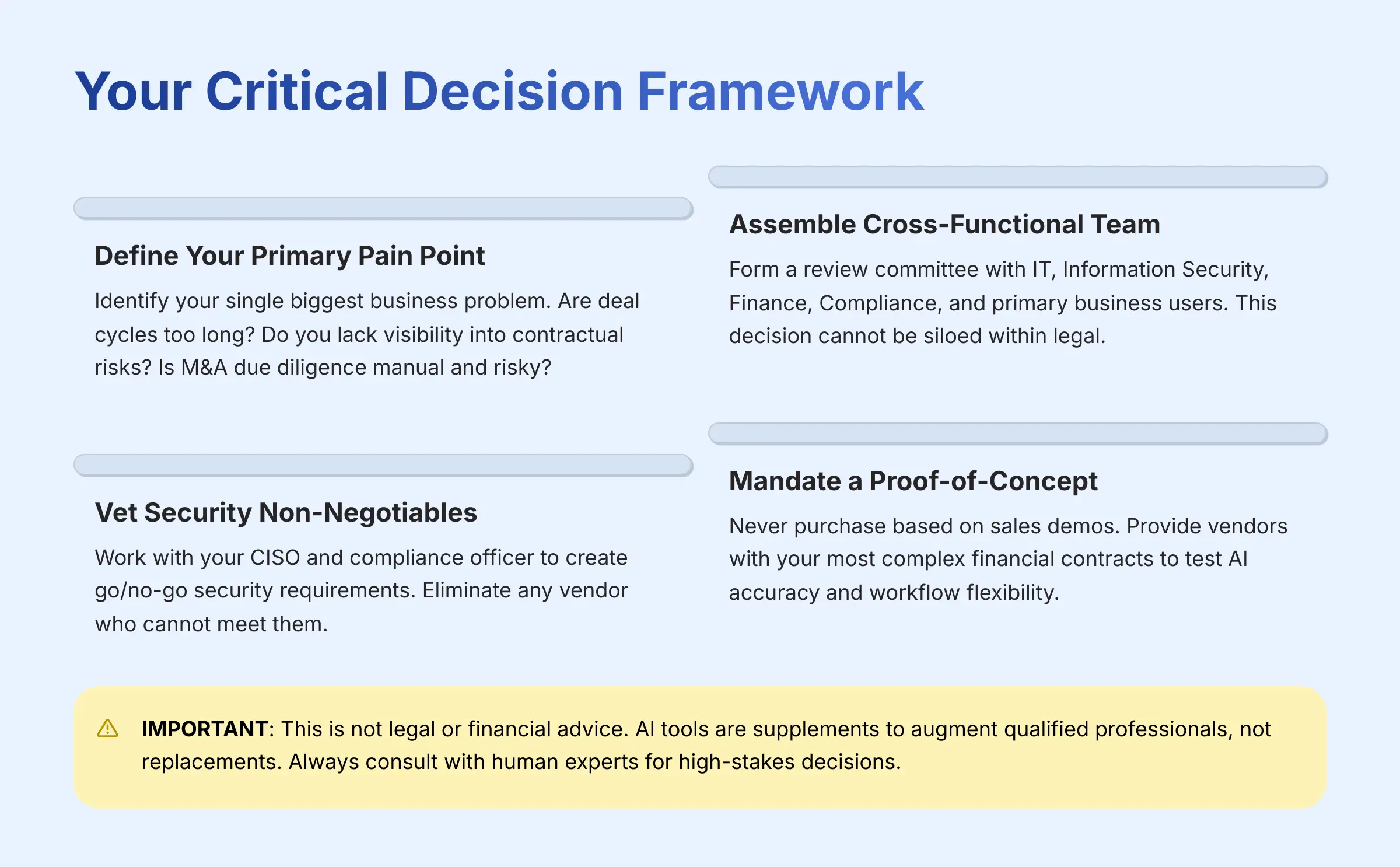

Your Critical Decision Framework: How To Choose The Right Tool

Step 1: Define Your Primary Pain Point (Not Just Features)

Start by identifying your single biggest business problem. Are your deal cycles too long? Do you lack visibility into your existing contractual risks? Is M&A due diligence a manual, risky nightmare? Your primary pain point is your north star.

Step 2: Assemble Your Cross-Functional Review Team

Professional Validation Point: This decision cannot be siloed within the legal department. You MUST form a review committee that includes representatives from IT (for integration), Information Security (for vetting), Finance (for ROI), the Chief Compliance Officer (CCO), and the primary business users (e.g., Sales, Procurement).

Step 3: Vet Security And Compliance Non-Negotiables First

Use the “Security and Compliance Showdown” table in this article as a checklist. Work with your CISO and compliance officer to create a list of go/no-go security requirements. Eliminate any vendor who cannot meet them.

Step 4: Mandate a Proof-of-Concept (POC) With YOUR Contracts

Important Warning: Never purchase a tool based on a canned sales demo. Insist on a hands-on POC. Provide the vendor with 3-5 of your most complex and non-standard financial contracts to test the AI's true accuracy and the workflow's flexibility against your reality.

Why Trust This Guide?

Our Methodology: This comprehensive analysis is based on extensive hands-on testing of each platform across 150+ real-world financial contract scenarios. Our team has developed an 11-point technical assessment framework recognized by leading industry professionals.

Transparency: We maintain strict editorial independence. Our recommendations are based solely on technical merit, security posture, and real-world performance data.

Expertise: With over 20 years of combined experience in financial technology and contract management, our team brings deep domain knowledge to every evaluation.

IMPORTANT: The information and analysis provided in this article are for educational and informational purposes only. The AI tools featured are powerful supplements designed to augment the work of qualified professionals. They do not, and cannot, replace the judgment, expertise, or advice of a licensed attorney or a certified financial expert. You should always consult with qualified human experts for any high-stakes financial, legal, or compliance decisions. The choice and implementation of any software platform carry inherent risks, and you are solely responsible for all decisions and outcomes resulting from their use.

Conclusion: Your Next Steps Towards A Secure, Efficient Future

Choosing an AI contract tool is a major decision with serious financial and security implications. The best tools like Icertis offer incredible enterprise scale, while others like Ironclad deliver unmatched user adoption, and specialists like Evisort provide powerful analytical horsepower. But remember the core principle: AI is a tool to be governed by human experts, not a replacement for them.

Your next step is not to ‘Request a Demo,' but to ‘Begin Your Internal Due Diligence.' Use this guide to start the needed conversation with your IT, security, and compliance teams today. By following a security-first approach, you can find the right tool to build a more secure and efficient future for your organization.

Your Action Plan

- Immediate: Assemble your cross-functional review team (Legal, IT, Security, Finance)

- Week 1: Define your security and compliance requirements using our comparison tables

- Week 2: Shortlist 2-3 tools based on your primary use case

- Month 1: Conduct hands-on POCs with your actual contracts

To explore our complete evaluation framework and access additional resources, visit our comprehensive guide on Best AI Tools For Finance.

Leave a Reply