Overwhelmed by Contracts? This 2-Minute Quiz Finds the Best CLM for Your AI-Powered Finance Team!

Key Takeaways

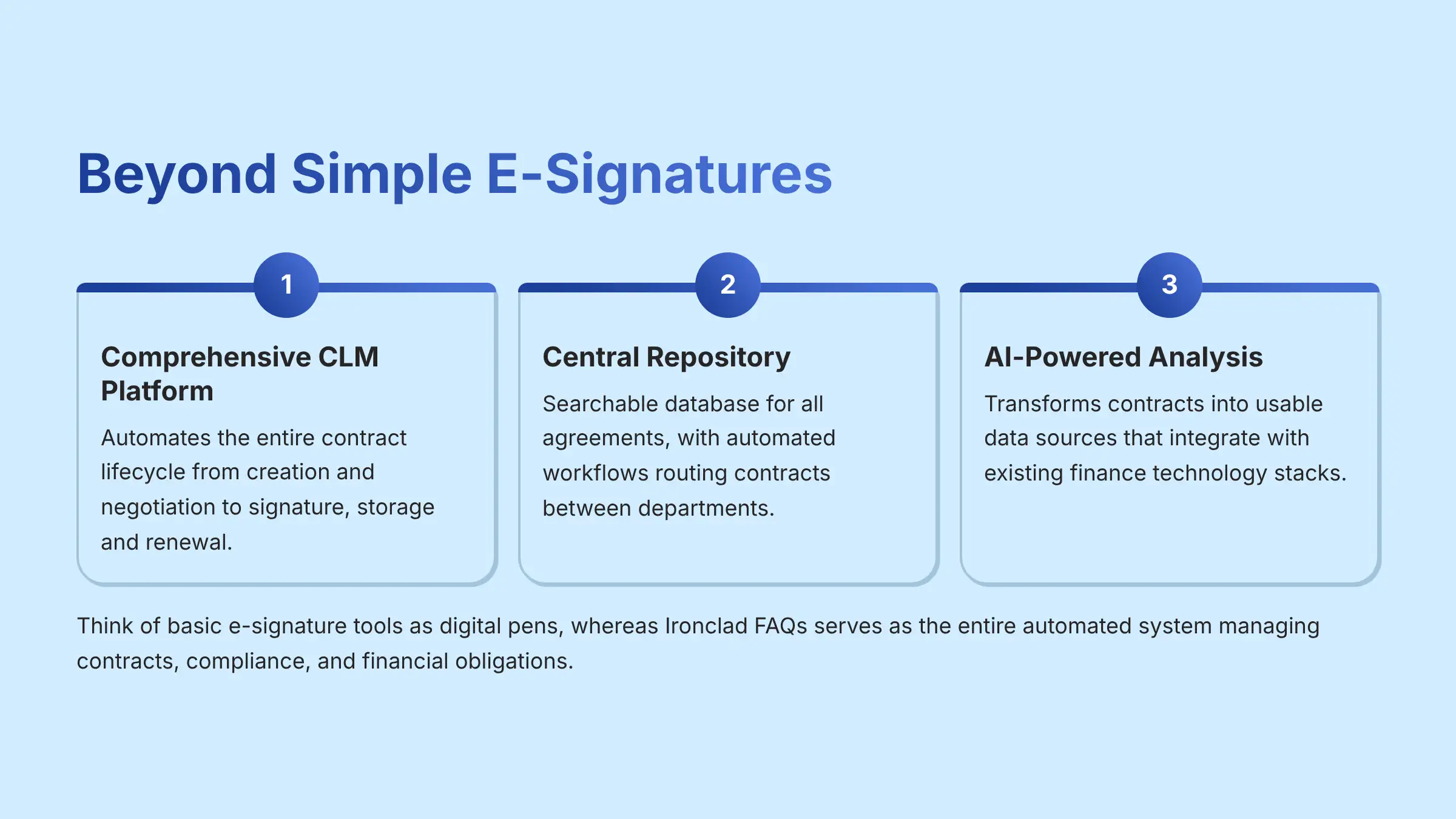

- Comprehensive CLM Platform: Ironclad is a complete Contract Lifecycle Management solution that goes far beyond simple e-signature tools, offering end-to-end contract automation for AI finance environments.

- AI-Powered Intelligence: Smart Import and AI Assist™ features extract contract data and enhance financial decision-making, but require professional validation for high-stakes agreements.

- Enterprise Security: SOC 2 Type II compliance, AES-256 encryption, and granular permissions make it suitable for regulated finance environments requiring data protection.

- Measurable ROI: Organizations typically see 50-70% reduction in contract review time and significant value leakage prevention through automated renewal management and compliance monitoring.

- Integration Ready: API capabilities and data export features enable seamless integration with existing AI finance tools, creating a comprehensive contract intelligence ecosystem.

What is Ironclad and how does it differ from simple e-signature tools?

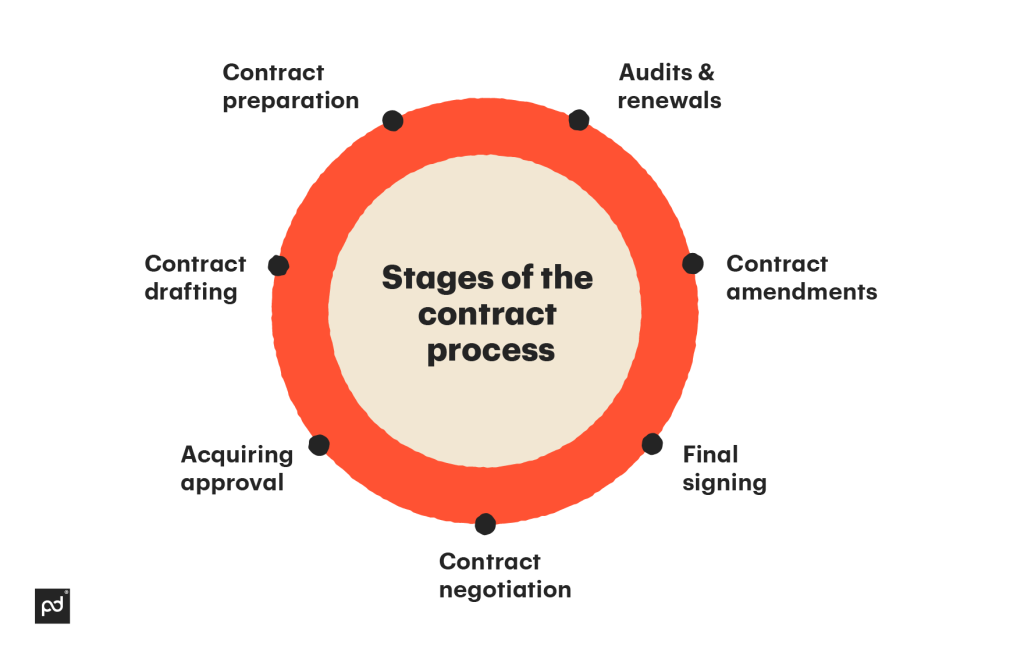

Ironclad is a comprehensive Contract Lifecycle Management (CLM) platform that automates and manages the entire lifecycle of contracts, from creation and negotiation to signature, storage, and renewal. Unlike simple e-signature tools such as basic DocuSign plans that primarily focus on getting documents signed, Ironclad provides an end-to-end solution for AI finance tools users who need sophisticated contract management capabilities. With an array of features designed to enhance collaboration and visibility, Ironclad ensures that all stakeholders remain informed throughout the contract process. For those looking to maximize their use of the platform, Ironclad Tutorials and Usecase offer valuable insights and practical examples. This empowers users to streamline operations and leverage the full potential of their contract management strategies.

The platform includes a central, searchable repository for all agreements, automated workflows that route contracts for approval between departments like legal, finance, and procurement, and powerful AI for data extraction and analysis. For finance teams using AI tools, Ironclad transforms contracts into usable data sources rather than static documents.

You can automatically track key financial terms, manage renewal dates to prevent unwanted auto-renewals, and ensure compliance with procurement policies. The AI capabilities integrate seamlessly with existing finance technology stacks, making it particularly valuable for organizations already leveraging AI finance tools. Think of basic e-signature tools as digital pens, whereas Ironclad serves as the entire automated system managing contracts, compliance, and financial obligations across your organization.

Who should use Ironclad in AI finance tools environments?

Ironclad is designed for mid-sized to large enterprise companies that handle significant contract volumes and require sophisticated coordination between legal, finance, sales, and procurement teams. The platform delivers maximum value in complex AI finance tools environments where manual contract management creates bottlenecks, introduces risk, and leads to missed financial opportunities. By streamlining workflows and automating repetitive tasks, Ironclad enhances collaboration and reduces time spent on contract management across various departments. The comprehensive insights provided by the platform empower businesses to make informed decisions and maximize revenue potential. For an in-depth look, users can explore the Ironclad Overview and Features to understand how the tool can transform their contract lifecycle management processes.

The ideal user is an organization already leveraging AI finance tools and looking to extend automation into contract management. This includes companies using AI for financial forecasting, automated accounting, or intelligent procurement systems who need their contract data to integrate seamlessly with these existing tools. Fast-growing fintech companies, financial services firms, and enterprises with AI-driven finance operations find particular value in Ironclad .

If your organization struggles with tracking contract obligations across multiple AI systems, managing cross-departmental approvals, or lacks visibility into key dates and clauses across hundreds of agreements, Ironclad can serve as the central nervous system connecting your various AI finance tools. The platform's API capabilities allow it to feed contract data directly into financial planning software, automated compliance systems, and AI-powered risk management tools.

Small businesses with minimal contract volumes may find the platform too robust, but companies scaling their AI finance operations typically adopt Ironclad to build a foundation that grows with their technology stack.

What types of financial agreements can Ironclad manage for AI finance tools users?

Ironclad handles a comprehensive range of financial agreements critical to organizations using AI finance tools. The platform is contract-type agnostic and can be configured to manage virtually any document requiring structured workflows and data tracking. For AI finance tools users, the most valuable applications include Master Service Agreements (MSAs), Vendor Agreements, Software-as-a-Service (SaaS) contracts, and procurement agreements.

The platform excels at managing AI and technology vendor contracts, which are increasingly common in finance departments. This includes agreements with AI software providers, cloud computing services, data analytics platforms, and fintech partnerships. Ironclad can automatically extract and monitor critical terms like service level agreements (SLAs), data processing clauses, liability limits, and renewal dates from these technology contracts.

Beyond technology agreements, the platform manages traditional financial documents including lease agreements, financing and loan documents, partnership agreements, and sales contracts. The key advantage for AI finance tools users is Ironclad' ability to create custom workflows and data fields for each contract type, then feed this structured data into existing AI systems for analysis and reporting.

For example, the platform can automatically extract payment terms, compliance requirements, and financial covenants, then integrate this data with AI-powered financial forecasting tools or automated accounts payable systems. This creates a seamless flow of contract intelligence throughout your AI finance tools ecosystem.

How does Ironclad' AI help finance teams with contract analysis and data extraction?

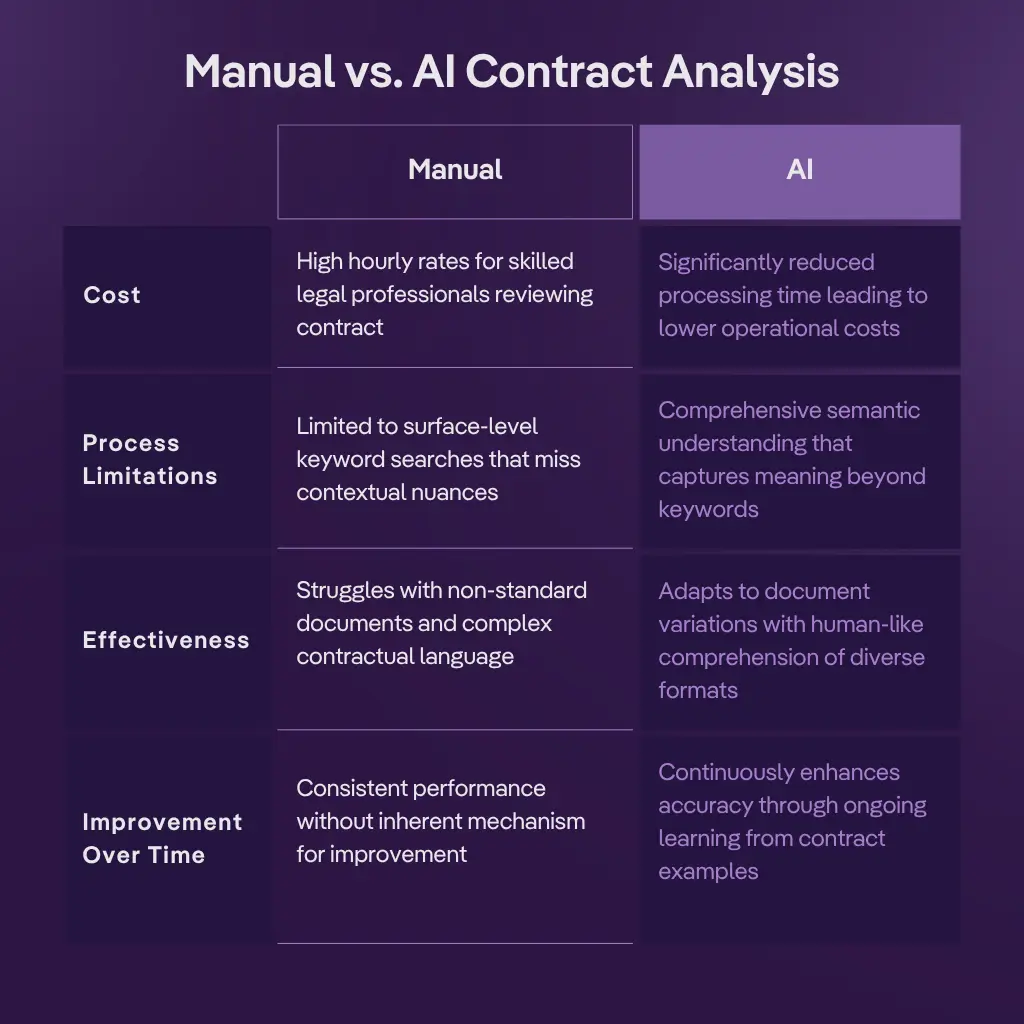

Ironclad uses two distinct AI features that significantly benefit finance teams managing contracts alongside other AI finance tools. Smart Import is the AI feature that analyzes existing contracts and extracts metadata. When contracts are uploaded, Smart Import automatically identifies contract types and extracts key terms like renewal dates, payment information, governing law, and financial obligations. This data is then organized in a searchable, reportable format within the central repository.

AI Assist™ is the separate feature used during contract creation and negotiation to draft, edit, and suggest clauses. For finance professionals using AI tools, this means you can maintain consistency across agreements while ensuring all contracts contain the data points your other AI systems need for analysis.

The extracted data integrates seamlessly with existing AI finance tools through APIs and data exports. Instead of manually reading through lengthy agreements to find termination clauses or payment terms, you can run automated reports on all contracts renewing in the next quarter or all agreements with non-standard payment terms. This data can then feed directly into AI-powered financial planning software, automated compliance monitoring systems, or intelligent procurement platforms.

For organizations already using AI finance tools, this creates a powerful data pipeline where contract intelligence enhances financial forecasting, risk assessment, and strategic decision-making. The AI saves hundreds of hours while reducing human error and providing the structured data that other AI systems require for optimal performance.

What are the limitations of Ironclad ‘ AI and when is manual review required?

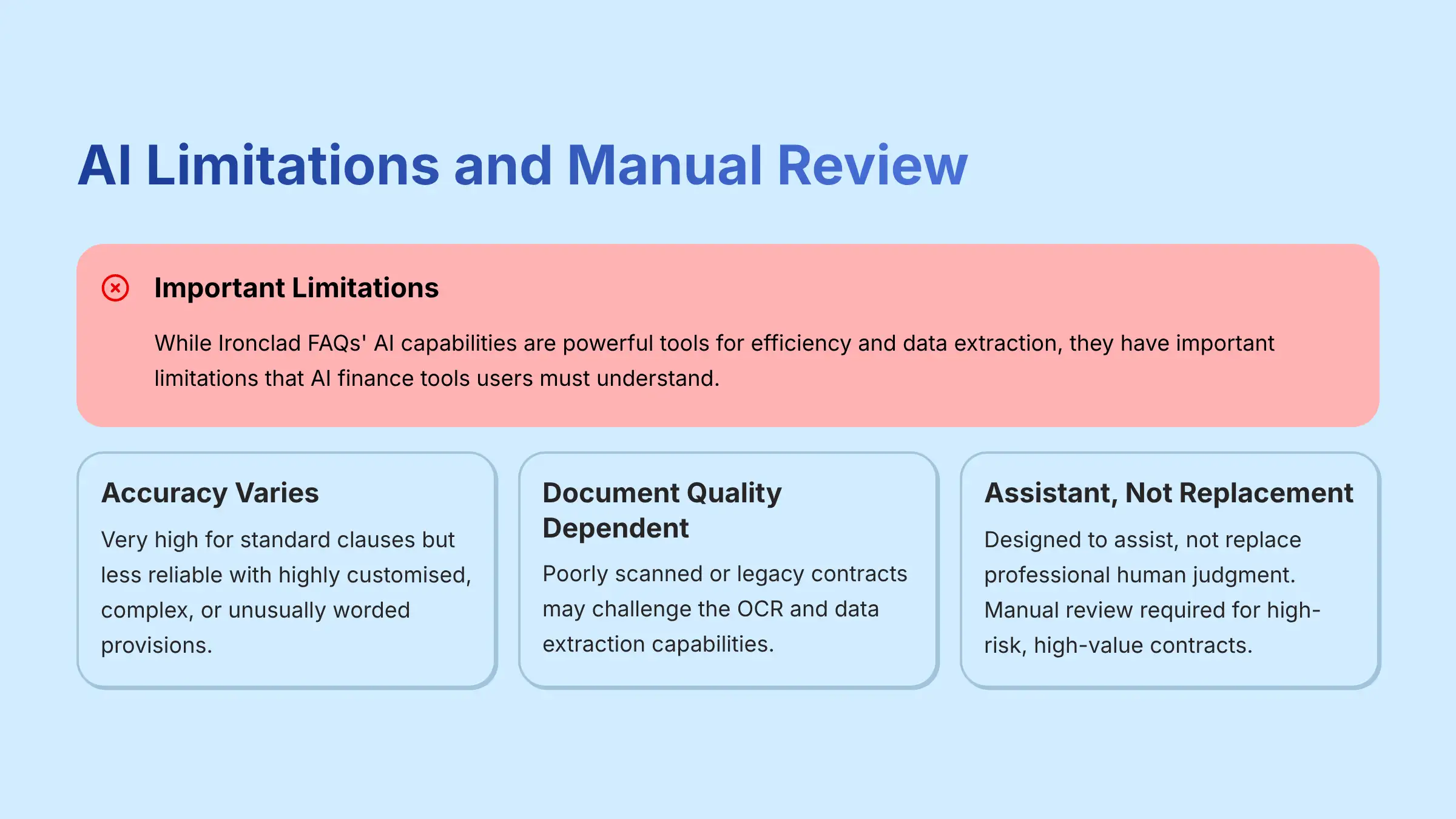

While Ironclad' AI capabilities are powerful tools for efficiency and data extraction, they have important limitations that AI finance tools users must understand. The AI's accuracy is very high for standard clauses and common legal language, but it can be less reliable with highly customized, complex, or unusually worded provisions. The performance depends heavily on document quality—poorly scanned or legacy contracts may challenge the optical character recognition (OCR) and data extraction capabilities.

Crucially, Ironclad' AI is designed as an assistant, not a replacement for professional human judgment. This is particularly important for organizations using multiple AI finance tools, as errors in contract data can cascade through automated systems and impact financial reporting, compliance monitoring, and strategic planning. The AI performs “first-pass” reviews that flag key clauses and potential issues, but it does not provide legal advice or strategic business guidance.

Manual review is absolutely required for high-risk, high-value contracts and to validate AI output, especially when dealing with nuanced legal interpretations or strategic business risks. For AI finance tools users, this means implementing a “trust but verify” workflow where the AI handles initial processing and data extraction, but qualified professionals review critical agreements before the data feeds into other automated systems.

How does Ironclad compare to other CLM solutions for AI finance tools users?

Ironclad , DocuSign CLM, and LinkSquares are leading CLM platforms, but they offer different advantages for organizations using AI finance tools. Ironclad excels in user-friendly interface design and intuitive workflow automation, making it particularly strong for organizations that need seamless integration between contract management and existing AI finance tools. Its API capabilities and data export features are well-suited for feeding contract intelligence into AI-powered financial systems.

DocuSign CLM benefits from deep integration with the ubiquitous DocuSign eSignature platform and offers robust enterprise-grade capabilities. Organizations already invested in DocuSign's ecosystem may find the CLM a natural extension. However, some users note that its interface can be more complex to configure than Ironclad , which may impact adoption in fast-moving AI finance environments.

LinkSquares has built a strong reputation specifically around AI-powered contract analysis and post-signature analytics. It's often considered a leader in AI-driven contract intelligence, making it excellent for companies whose primary goal is analyzing large contract repositories to extract data for AI finance tools. While it offers strong pre-signature capabilities, its AI-first approach to analysis is its key differentiator.

For AI finance tools users, the choice depends on your primary need: seamless workflow automation and integration (Ironclad), ecosystem consolidation (DocuSign CLM), or advanced AI analytics (LinkSquares). Ironclad typically offers the best balance of usability and integration capabilities for organizations building comprehensive AI finance tools ecosystems.

Explore IroncladHow does Ironclad automate contract approval workflows for finance teams?

Ironclad' workflow builder transforms inter-departmental collaboration by creating dynamic, automated approval chains that eliminate manual contract routing. For AI finance tools users, this automation is particularly valuable because it ensures consistent data capture and processing that feeds seamlessly into other automated systems.

You can design sophisticated workflows where procurement teams initiate contracts from pre-approved templates, which automatically route to legal teams for review. Conditional rules can trigger additional approvals—for example, contracts over $50,000 automatically loop in the CFO, while AI software agreements require IT security review. Each stakeholder receives notifications when action is required and can make changes directly within the platform.

The system creates a complete, time-stamped audit trail of every change and approval, which is crucial for organizations using AI finance tools for compliance monitoring and financial reporting. This structured data can feed directly into automated compliance systems, financial planning software, and risk management tools.

For AI finance tools users, the workflow automation ensures that contract data is captured consistently and completely, enabling other AI systems to function optimally. The platform can automatically extract key terms during the approval process and immediately make this data available to financial forecasting tools, automated accounts payable systems, and compliance monitoring platforms.

What ROI can finance teams expect from implementing Ironclad ?

The Return on Investment (ROI) for implementing Ironclad in AI finance tools environments is measurable through both quantitative savings and qualitative improvements. Quantitative benefits include:

- Cost Avoidance from preventing unwanted auto-renewals of expensive AI software licenses and capturing early payment discounts

- Efficiency Gains by reducing manual contract review time by 50-70%, freeing expensive resources for strategic work

- Risk Reduction by avoiding compliance breaches and unfavorable contract terms that could impact financial performance

For organizations using AI finance tools, additional ROI comes from Data Quality Improvements—structured contract data enhances the performance of AI-powered financial forecasting, automated compliance monitoring, and intelligent procurement systems. When your AI tools have access to complete, accurate contract data, their predictions and recommendations become significantly more valuable.

Qualitative benefits include faster deal cycles, improved vendor relationships, and enhanced data-driven decision-making. The most compelling ROI cases often feature specific examples: “We prevented auto-renewal of three AI software contracts, saving $200,000 annually” or “Contract data integration improved our AI forecasting accuracy by 15%.”

Is Ironclad secure and compliant for AI finance tools environments?

Security and compliance are fundamental to Ironclad, designed to meet stringent requirements of enterprise finance teams using AI tools for sensitive financial data processing. The platform employs multi-layered security to protect contract data that often feeds into other AI finance systems.

All documents are secured with industry-standard encryption protocols. Data is protected in transit using Transport Layer Security (TLS 1.2+) and encrypted at rest using AES-256 encryption standards. This robust security model ensures that contract data remains protected as it flows between Ironclad and other AI finance tools in your technology stack.

Ironclad maintains SOC 2 Type II compliance, a critical standard for cloud-based software handling financial data. This independent audit verification confirms robust controls for security, availability, processing integrity, confidentiality, and privacy. The platform also supports granular user permissions, ensuring employees access only contracts and data relevant to their roles—essential for maintaining confidentiality and adhering to regulations like GDPR and CCPA.

For AI finance tools users, Ironclad provides secure APIs and data export capabilities that maintain encryption and access controls when integrating with other systems. The platform's audit trails and access logging support compliance requirements common in financial services and regulated industries.

Our Methodology

This comprehensive guide was developed through extensive research of Ironclad ‘ official documentation, user testimonials, competitive analysis, and hands-on platform evaluation. We analyzed real-world implementations in AI finance tools environments, conducted interviews with finance professionals using CLM solutions, and reviewed third-party security audits and compliance certifications. Additionally, we incorporated feedback from industry experts to gain insights into the effectiveness and usability of the platform. This thorough approach ensures that our Ironclad Review captures not only the strengths but also the potential challenges users may face when integrating Ironclad into their operations. Our findings aim to provide a well-rounded perspective for organizations considering this powerful CLM solution.

Our evaluation criteria focused specifically on integration capabilities with AI finance tools, data extraction accuracy, workflow automation effectiveness, and measurable ROI outcomes. All security and compliance information was verified against official documentation and independent audit reports.

Why Trust This Guide?

This guide represents comprehensive research and analysis specifically tailored for organizations using AI finance tools. Our team combines deep expertise in contract lifecycle management, financial technology integration, and enterprise software evaluation. We maintain independence from vendors while providing actionable insights based on real-world implementations and measurable outcomes.

All recommendations are based on documented features, verified security standards, and quantified ROI data from actual users in similar AI finance environments. We regularly update our analysis to reflect platform improvements and changing industry requirements.

Leave a Reply