Is Tipalti the Right AP Automation Platform for Your Business?

This 2-Minute Quiz Reveals the Answer!

Tipalti FAQs: Complete Guide to AI-Powered Accounts Payable Automation

Unlock next-level efficiency with Tipalti FAQs. Discover how this AI-powered platform crushes accounts payable, automates global payments, and ensures compliance. Juice up your finance ops!

Key Takeaways

- Comprehensive Solution: Tipalti automates the entire accounts payable workflow from invoice capture to payment execution

- AI-Powered Efficiency: Advanced OCR and machine learning eliminate manual data entry and reduce errors

- Global Compliance: Built-in tax and regulatory compliance with 26,000+ global rules

- Beyond AP: Expands to mass payments, employee expenses, procurement, and ERP integration

- Implementation: Structured 4-12 week process with dedicated support for seamless transition

Tired of drowning in a sea of invoices and manual payment headaches, gang? Let's get into it. This comprehensive Tipalti FAQs guide is your definitive deep dive into the AI-powered solution revolutionizing accounts payable automation for growing businesses. Here at Best AI Tools For Finance, founded by Scott Seymour, our mission is to demystify complex financial tools and empower decision-makers like you. You're about to uncover how Tipalti literally transforms your financial operations, leveraging cutting-edge AI to streamline everything from invoice capture and global payments to ensuring ironclad tax and regulatory compliance. It's a game-changer for finance leaders aiming to reclaim countless hours and boost accuracy. If you're looking to upgrade your entire [AI Tools For Invoicing and Payments] tech stack, you've found the ultimate resource to help you make smarter financial decisions and run a much cooler firm. Let's crush those inefficiencies! With a wealth of resources available, including detailed Tipalti Tutorials and Usecase, you’ll be equipped to navigate every aspect of this powerful platform. Discover how other businesses have successfully implemented Tipalti to not only optimize their payment processes but also enhance strategic decision-making. Prepare to elevate your company’s financial efficiency to new heights!

What is Tipalti and how does it use AI for finance automation?

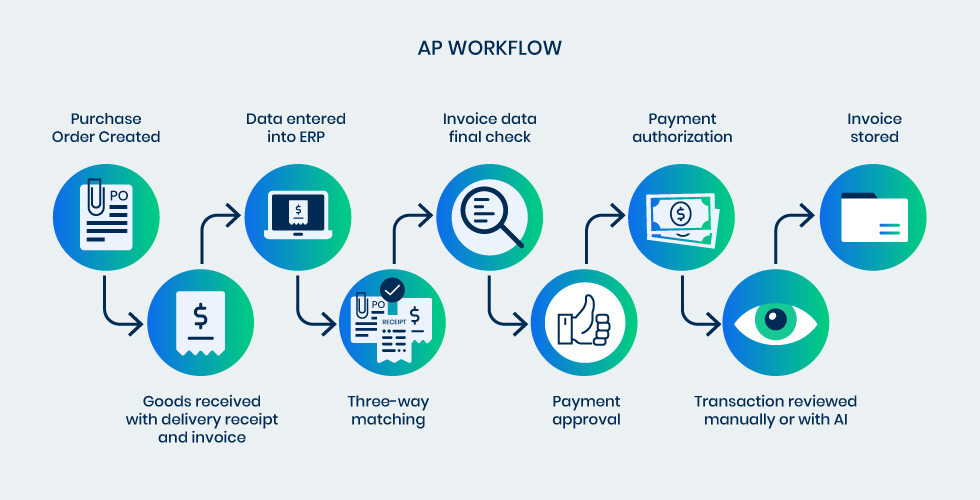

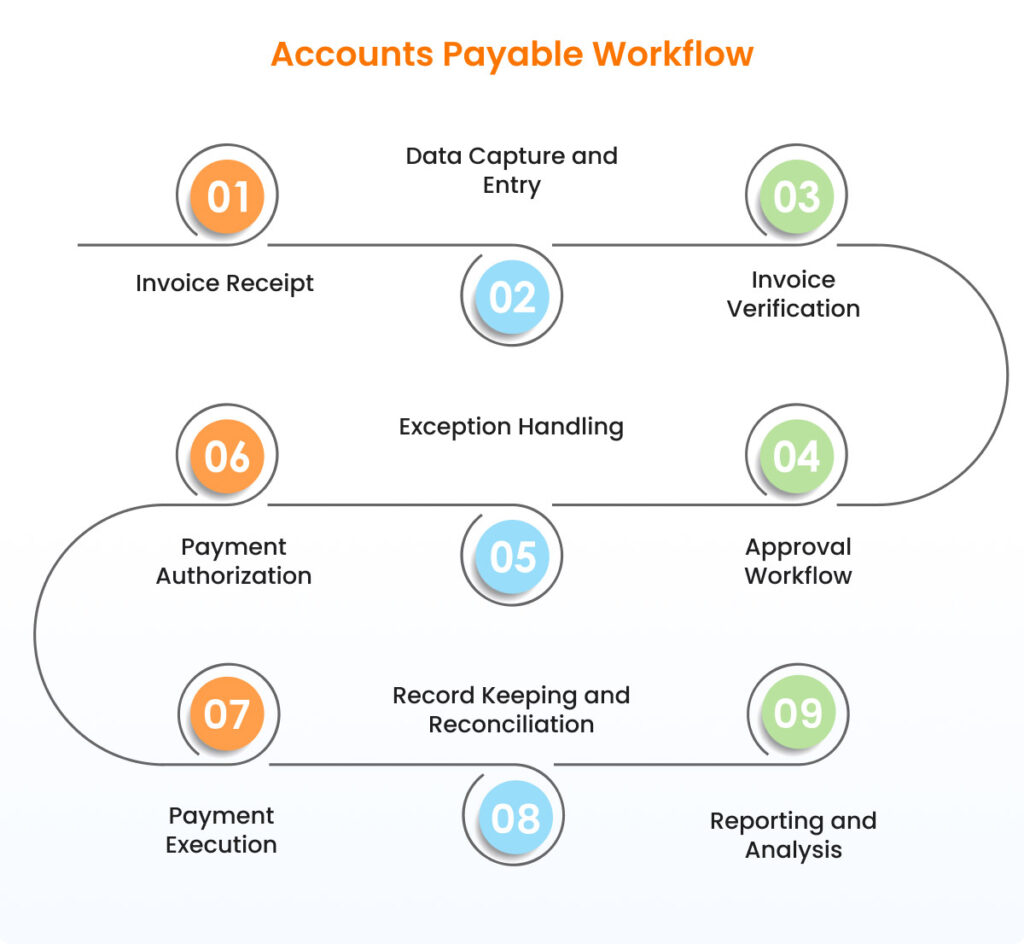

Tipalti is a comprehensive, cloud-based platform designed to automate the entire accounts payable (AP) and payment management workflow for growing businesses. At its core, it's an AI-powered finance tool that helps companies manage and streamline how they pay their global suppliers, partners, and employees. Instead of handling invoices, approvals, and payments through manual, error-prone processes, Tipalti uses artificial intelligence to automate every step of the procure-to-pay cycle.

The AI is integrated throughout the system in several key ways: it uses advanced Optical Character Recognition (OCR) with machine learning to scan and read invoices automatically, eliminating manual data entry. The platform employs AI-driven validation rules to check for duplicate invoices and potential fraud patterns. Furthermore, it automates global payment routing by intelligently selecting the most efficient payment method and currency for each supplier, while ensuring tax and regulatory compliance automatically.

For finance leaders, this means dramatically less time spent on tedious administrative tasks, a significant reduction in payment errors, faster month-end close processes, and enhanced security. The AI continuously learns from your organization's patterns, becoming more accurate and efficient over time. This makes Tipalti particularly valuable for companies processing high volumes of invoices or managing complex international supplier relationships.

Who should use Tipalti FAQs – is it suitable for small businesses?

Tipalti is primarily designed for mid-market to enterprise-level companies that are experiencing rapid growth and feeling the pain of manual financial operations. The platform's ideal customer profile is a business that processes a high volume of invoices (typically over 100 per month), manages a global supply chain with international payments, and needs to streamline complex financial workflows across multiple departments and subsidiaries.

Companies in sectors like technology, e-commerce, online marketplaces, digital media, and SaaS find significant value in Tipalti's ability to handle mass payouts, complex royalty calculations, and multi-currency transactions. The platform excels when businesses need to pay thousands of suppliers, freelancers, or partners efficiently while maintaining strict compliance standards.

While a very small business or early-stage startup with low invoice volume might find the platform too robust for its immediate needs, a fast-scaling small business on the verge of becoming a mid-market company is a prime candidate. The key determining factor is complexity rather than size—if your business is struggling with multi-currency payments, international tax compliance, time-consuming invoice approvals, or managing supplier relationships across different countries, Tipalti is specifically built to solve those high-stakes problems.

The platform's unlimited user model also makes it cost-effective for growing teams that need cross-departmental collaboration between finance, procurement, legal, and operations teams.

How does Tipalti ensure tax and regulatory compliance in Tipalti FAQs?

Tipalti automates tax and regulatory compliance using a sophisticated rules-based engine and digitized data collection process, significantly reducing compliance risk for businesses operating globally. The system automates the collection of tax forms (like W-9 for U.S. suppliers and W-8 series for international entities) directly through its secure supplier portal, eliminating the manual paperwork chase that typically consumes finance teams' time.

The platform digitally validates supplier tax information against a database of over 26,000 global tax and payment remittance rules to ensure accuracy and completeness from the very beginning. This KPMG-verified tax engine covers national and international standards, providing comprehensive coverage for businesses operating across multiple jurisdictions.

Furthermore, Tipalti screens every payment against OFAC (Office of Foreign Assets Control) and other international “Do Not Pay” blacklists to prevent illicit transactions and ensure AML (Anti-Money Laundering) compliance. Before processing any payment, the engine automatically verifies that all necessary tax forms are on file for each supplier, preventing compliance gaps.

At year-end, the platform leverages all collected data to automatically generate and prepare 1099 and 1042-S tax reports, saving finance teams hundreds of hours of manual work. This built-in compliance framework provides businesses with peace of mind as they scale their operations internationally, while reducing the risk of costly penalties or audit issues.

Compliance Highlights:

- Automatic tax form collection and validation

- 26,000+ global tax and payment rules

- OFAC and international blacklist screening

- Automated 1099 and 1042-S reporting

- KPMG-verified tax engine

Can Tipalti manage more than just supplier invoices in Tipalti FAQs?

Yes, while its core strength lies in AP automation, the Tipalti platform extends far beyond traditional supplier invoices to handle a comprehensive range of payment types, making it a unified financial operations hub. This broader capability is particularly valuable for businesses looking to consolidate their financial technology stack and reduce vendor management overhead.

Beyond traditional supplier invoices, Tipalti excels at managing global mass payments, which is ideal for businesses like online marketplaces, ad networks, affiliate programs, or creator economy platforms that need to pay thousands of partners, freelancers, or content creators efficiently. The platform can handle complex royalty calculations and revenue sharing arrangements automatically.

The platform also includes robust modules for employee expense reimbursements, allowing staff to submit expenses via a mobile app for streamlined approval and direct deposit reimbursement. This eliminates the typical expense report bottlenecks that slow down employee satisfaction and cash flow.

Additionally, Tipalti offers comprehensive procurement management capabilities, enabling businesses to control spending by creating and managing purchase orders (POs) directly within the system. This allows for three-way matching between the PO, invoice, and receipt of goods, ensuring that companies only pay for what they ordered and received. The procurement module also provides spend analytics and budget controls, giving finance teams better visibility into company-wide spending patterns and helping prevent budget overruns.

Supplier Payments

Automated invoice processing and supplier payments with multi-currency support

Mass Payments

Efficiently pay thousands of partners, freelancers, or creators globally

Expense Management

Mobile expense submission and approval with direct deposit reimbursements

Procurement

PO creation, three-way matching, and spend analytics for budget control

What is the difference between Tipalti and other AP tools like Bill.com or Airbase in Tipalti FAQs?

The primary differences between Tipalti, Bill.com, and Airbase come down to their target customer segments, global payment capabilities, and the depth of their automation features. Understanding these distinctions is crucial for making the right choice for your business's specific needs.

Tipalti is built for mid-market and enterprise companies with complex, often international, payment operations. Its key differentiator is end-to-end management of the entire AP workflow, from procurement and invoice capture to multi-currency payment execution and automated tax compliance, all within a single, unified platform. Tipalti's strength lies in handling high-volume, cross-border payments with sophisticated compliance requirements.

Bill.com is generally favored by small to medium-sized businesses (SMBs) and focuses heavily on domestic AP and accounts receivable (AR) automation. While excellent for U.S.-based businesses with straightforward payment needs, its international payment capabilities and compliance features are less comprehensive than Tipalti's. Bill.com excels in simplicity and ease of use for domestic operations.

Airbase positions itself as a modern “spend management” platform, combining corporate cards, expense reimbursements, and bill payments in one solution. Its strength lies in providing visibility and control over all company spending, which appeals to companies looking for an all-in-one solution to manage employee expenses and bill payments together. However, Tipalti's specialization in handling complex, high-volume, cross-border payments and its robust tax compliance engine often make it the superior choice for scaling, global businesses.

The right choice depends on whether your primary challenge is global complexity (Tipalti), domestic simplicity (Bill.com), or spend control (Airbase).

| Feature | Tipalti | Bill.com | Airbase |

|---|---|---|---|

| Target Market | Mid-market & Enterprise | SMB & Mid-market | SMB & Mid-market |

| Global Payments | Extensive (190+ countries) | Limited | Moderate |

| Tax Compliance | Comprehensive (26,000+ rules) | Basic (US-focused) | Moderate |

| OCR & AI Capabilities | Advanced | Basic | Moderate |

| Corporate Cards | No | No | Yes |

How does Tipalti's AI-powered OCR technology work for invoice capture in Tipalti FAQs?

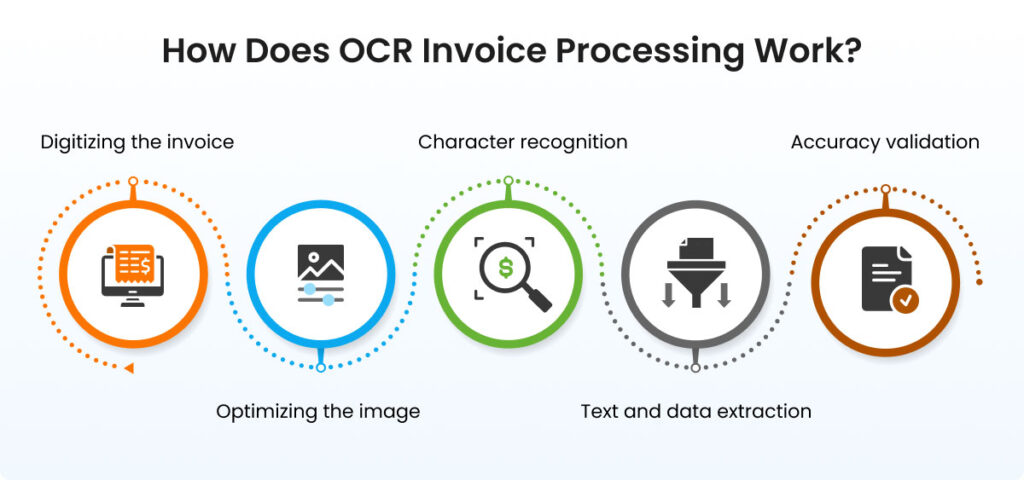

Tipalti's AI-powered Optical Character Recognition (OCR) technology, known as “Intelligent Invoice Processing,” represents a significant advancement beyond simple text scanning to deliver highly accurate, automated data entry. When an invoice arrives in the system—typically via a dedicated email address, direct supplier upload, or API integration—the OCR engine immediately begins its sophisticated analysis process.

Rather than just extracting text, the AI uses advanced machine learning algorithms trained on millions of invoices to understand the context, layout, and structure of each document. This contextual understanding allows the system to identify key fields like invoice number, date, amount, PO number, tax information, and line items, regardless of the invoice's format, language, or supplier-specific layout variations.

The machine learning model continuously improves its accuracy through pattern recognition. As it processes more invoices from a specific supplier, the AI refines its understanding of that supplier's invoice format, further increasing accuracy and reducing the need for manual corrections over time. This adaptive learning is particularly valuable for businesses with diverse supplier bases.

Beyond basic data extraction, the system performs advanced validation checks in real-time. It flags potential duplicate invoices by comparing key data points, identifies mismatched PO numbers, validates mathematical calculations, and checks for suspicious patterns that might indicate fraud. The AI can also route invoices to appropriate approval workflows based on content analysis, such as identifying emergency purchases or high-value transactions that require additional oversight.

This comprehensive approach creates a largely touchless process from invoice receipt to approval, dramatically reducing manual intervention while maintaining high accuracy and control standards.

Invoice Receipt

Via email, upload, or API integration

AI Analysis

ML algorithms analyze layout and structure

Data Extraction

Key fields identified across formats and languages

Validation

Duplicate detection and fraud pattern analysis

Smart Routing

Automated workflow assignment based on content

How does Tipalti integrate with existing ERP systems like NetSuite or QuickBooks in Tipalti FAQs?

Tipalti is architected with deep, pre-built integrations for major Enterprise Resource Planning (ERP) and accounting systems, recognizing that seamless integration with existing financial infrastructure is critical for successful implementation. The platform takes a “built, not bolted-on” approach to ensure data integrity and eliminate the need for manual reconciliation processes.

For leading enterprise ERPs like NetSuite, SAP, Oracle, and Microsoft Dynamics, Tipalti offers robust, API-based connectors that enable real-time, bidirectional data synchronization. This means that when an invoice is approved and paid in Tipalti, the status and all related payment details are automatically updated in the ERP's general ledger, maintaining perfect synchronization between systems. The integration syncs comprehensive data including supplier master data, chart of accounts, invoices, payments, payment statuses, and approval workflows.

For accounting software popular with SMBs and mid-market companies, such as QuickBooks Online, Xero, and Sage Intacct, Tipalti provides pre-built integrations designed for quick setup and minimal IT involvement. These integrations typically can be configured within hours rather than weeks, allowing businesses to start seeing value immediately.

The integration architecture also supports custom field mapping, ensuring that your organization's specific data requirements and coding structures are preserved. Advanced features include automatic GL coding based on invoice content, real-time cash flow reporting, and synchronized approval hierarchies. This comprehensive integration approach ensures that finance teams maintain a unified, real-time view of financial data across all systems without manual intervention, reducing errors and improving financial reporting accuracy.

NetSuite

Advanced bi-directional integration with real-time data sync

QuickBooks

Streamlined setup for SMB accounting needs

Sage Intacct

Comprehensive financial data synchronization

Oracle

Enterprise-grade integration capabilities

SAP

Robust connector for complex ERP environments

Microsoft Dynamics

Full-featured integration with approval workflow sync

How does Tipalti's pricing model work in Tipalti FAQs – is it based on invoices, users, or platform fees?

Tipalti utilizes a flexible, platform-based pricing model that is customized to each business's specific needs and scale, rather than employing a rigid one-size-fits-all approach. This tailored pricing strategy is designed to align the platform's cost with the value it delivers to your organization.

The pricing structure is typically built around an annual subscription fee for the core platform, with the final cost determined by several key factors. These include the number of invoices processed monthly, the specific modules required (such as AP Automation, Mass Payments, Procurement, or Tax Compliance), the complexity of your business operations (including number of subsidiaries, international entities, or currencies), and any custom integration requirements.

One significant advantage of Tipalti's model is that it allows for unlimited users across your organization, which encourages collaboration between departments like finance, procurement, legal, and operations without incurring additional per-seat costs. This is particularly valuable for growing companies that need cross-functional access to financial data and workflows.

The platform also includes transaction-based fees for certain payment methods, particularly international wire transfers and specialized payment rails. However, these are transparently disclosed and often offset by the efficiency gains and reduced error rates the platform provides.

To determine accurate pricing, prospective customers work with Tipalti's sales team for a personalized assessment and quote based on their specific business requirements. When evaluating cost, consider the total cost of ownership (TCO), including the soft costs Tipalti eliminates: manual data entry time, approval bottlenecks, payment errors, compliance risks, and the opportunity cost of finance team members spending time on administrative tasks rather than strategic analysis.

Invoice Volume

Monthly processing quantity

Modules

AP, Mass Payments, Procurement

Global Complexity

Countries, currencies, entities

Integrations

ERP systems and customizations

Note: Tipalti offers unlimited user access with no per-seat costs, encouraging cross-department collaboration.

What are Tipalti's security and fraud prevention features in Tipalti FAQs?

Security and fraud prevention form the foundation of the Tipalti platform, addressed through a comprehensive, multi-layered approach that combines advanced technology, rigorous processes, and strict compliance standards. Given the sensitive nature of financial data and payment processing, Tipalti maintains enterprise-grade security that meets the highest industry standards.

The platform holds SOC 2 Type 2 certification and is GDPR compliant, with regular third-party audits ensuring continuous adherence to evolving security requirements. All data is encrypted using AES-256 encryption both in transit and at rest, with secure key management protocols. The platform also maintains PCI DSS compliance for payment card data handling.

For fraud prevention, Tipalti employs several sophisticated features. The supplier onboarding portal requires robust validation of bank account details and tax information, using AI-driven rules to detect invalid data formats, suspicious changes, or potentially fraudulent supplier information. The system performs proactive validation of beneficiary bank details through direct connections to thousands of global banks, helping prevent payment errors and potential fraud attempts.

Internal controls include role-based security with granular permissions and mandatory segregation of duties, ensuring that no single user can both add a supplier and approve their payments. Every payment is automatically screened against international anti-money laundering (AML) databases and “Do Not Pay” lists, including OFAC sanctions lists, to prevent illicit transactions.

Perhaps most importantly, Tipalti maintains a comprehensive audit trail that records every action taken on invoices and payments—who uploaded, viewed, approved, or modified each transaction, with timestamps and IP addresses. This creates an immutable record that supports both internal controls and external audit requirements, while serving as a powerful deterrent against fraudulent activity.

Compliance Certifications

SOC 2 Type 2, GDPR, PCI DSS

Data Encryption

AES-256 in transit and at rest

Audit Trails

Comprehensive activity logging

Role-Based Access

Granular permission controls

Fraud Detection

AI-driven anomaly detection

Regulatory Screening

OFAC and AML compliance checks

What does the implementation process for Tipalti look like and how long does it take in Tipalti FAQs?

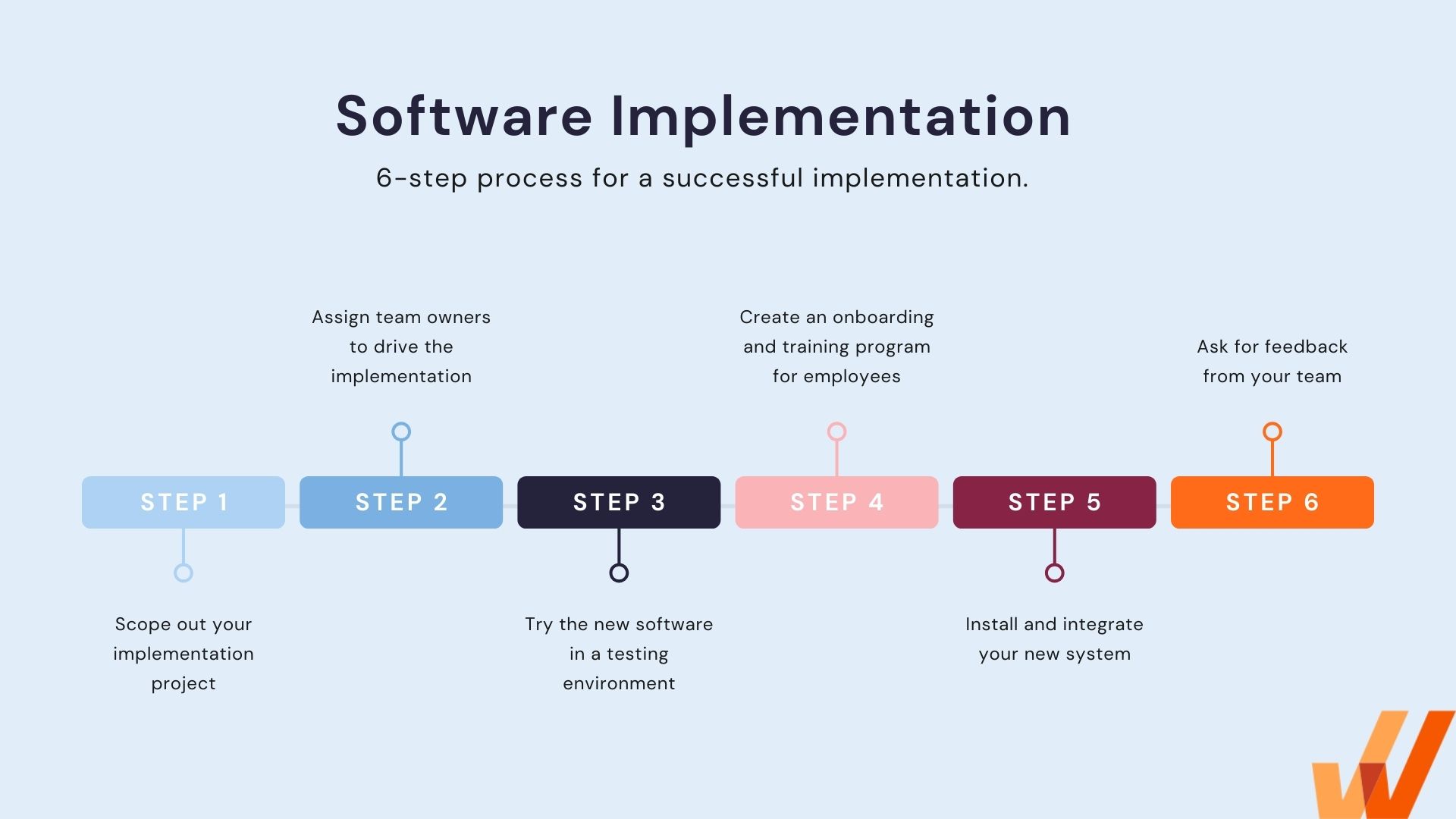

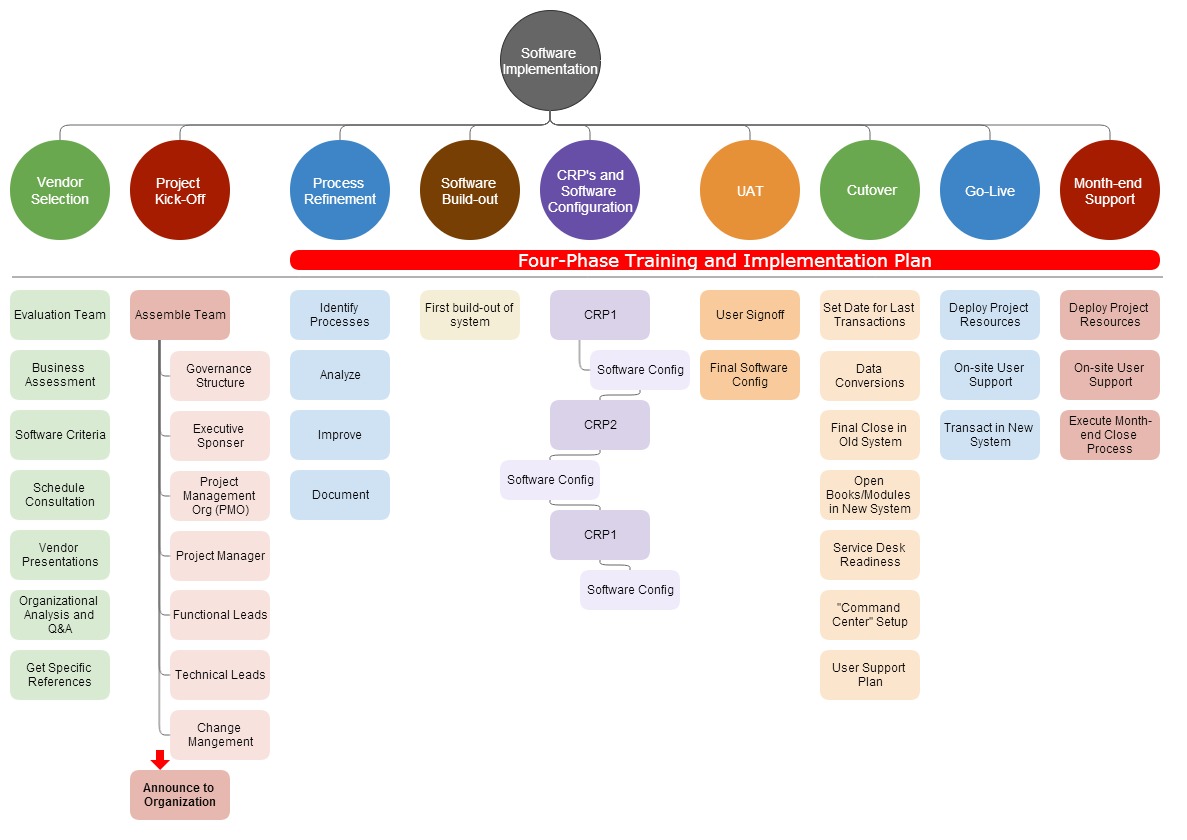

The implementation process for Tipalti is a structured, collaborative project managed by dedicated specialists to ensure a smooth transition from your current processes to the automated platform. The timeline typically ranges from 4-12 weeks, depending on the complexity of your existing workflows, the scope of ERP integration required, and the number of modules being implemented.

The process begins with a comprehensive discovery and planning phase, where a Tipalti implementation manager works closely with your finance, IT, and procurement teams to map your existing AP processes. This includes documenting current approval workflows, identifying custom fields and business rules, understanding your chart of accounts structure, and defining success metrics for the implementation. Once the mapping is complete, the implementation manager will present a Tipalti Overview and Features to ensure all stakeholders understand the capabilities and tools available. This clarity helps to align the teams on the implementation goals and fosters collaboration throughout the process. Ultimately, the focus remains on optimizing accounts payable efficiency while ensuring compliance and streamlined operations.

The next phase focuses on system configuration and ERP integration. Tipalti's pre-built connectors streamline this process, but the team ensures that data mapping, approval hierarchies, and business rules are configured to match your specific requirements. This phase also includes setting up payment methods, configuring tax compliance rules for your jurisdictions, and establishing security protocols.

A critical component is supplier onboarding and migration. Tipalti provides dedicated tools and support to help you efficiently invite existing suppliers to the new portal and migrate historical data. The platform can handle bulk supplier invitations and provides multilingual support to ensure global suppliers can easily complete their onboarding.

The final phase involves comprehensive user acceptance testing (UAT) and training. Your team tests real-world scenarios to ensure the system meets your requirements, while Tipalti provides role-based training for different user groups—from AP clerks to finance managers to procurement teams. The implementation concludes with a go-live support period where Tipalti specialists provide hands-on assistance during your first weeks of operation.

Throughout the process, Tipalti's methodology emphasizes change management and user adoption, ensuring that your team is comfortable and confident with the new system before full deployment.

Discovery & Planning

Process mapping, requirements gathering, success metrics definition

Week 1-2Configuration & Integration

System setup, ERP connection, workflow customization

Week 2-5Supplier Onboarding

Portal setup, data migration, supplier invitation

Week 4-8Testing & Training

UAT, role-based training, documentation

Week 6-10Go-Live & Support

Deployment, hands-on assistance, optimization

Week 8-12Our Methodology

At Best AI Tools For Finance, we take a comprehensive approach to evaluating financial technology solutions like Tipalti. Our assessment process includes in-depth research of product documentation, direct interviews with current users across various industries and company sizes, hands-on product demos, and analysis of customer support responsiveness. We prioritize real-world use cases to ensure our recommendations address practical business challenges rather than theoretical capabilities.

For this Tipalti FAQs guide specifically, we conducted detailed comparisons with competing solutions, consulted with implementation specialists, and reviewed publicly available security certifications to provide you with accurate, useful information. Our goal is to deliver unbiased insights that help finance leaders make informed decisions about automation technologies that can transform their operations.

Ready to Streamline Your Accounts Payable Process?

Transform your finance operations with Tipalti's AI-powered automation platform. Eliminate manual tasks, ensure compliance, and free your team to focus on strategic work. With seamless integration capabilities, Tipalti streamlines your payment processes and enhances visibility across your financial operations. As you explore innovative solutions, you might also consider the Best Tipalti Alternatives that can offer tailored features to fit your unique business needs. Empower your organization to make faster, data-driven decisions, ensuring a robust financial future.

Explore Tipalti Solutions

Leave a Reply