This 2-Minute Quiz Pinpoints the Perfect AP Tool for Your Firm!

As the founder of Best AI Tools For Finance and after testing hundreds of AI Tools For Accounting and Bookkeeping, I've seen Dext establish itself as a powerful benchmark for pre-accounting work. And yet, I hear the same story from professionals every day. They are actively searching for the Best Dext Alternatives because of its rising costs and a need for more specialized automation features.

The selection of financial software has significant professional and financial implications. This analysis provides a framework for evaluation, but I strongly advise conducting a paid pilot and consulting with your IT security and compliance officers before making a final decision. In my analysis, I've focused on the key pillars you care about: Data Accuracy, Workflow Automation, Total Cost of Ownership (TCO), and Security and Compliance. This guide will compare the top contenders, Docyt, AutoEntry, and Hubdoc, to help you make an informed choice.

Key Takeaways: Dext vs. The Competition at a Glance

- Best for Security and Automation: Docyt is the leader for its end-to-end accounts payable automation and verifiable SOC 2 Type II certification, offering the highest level of security assurance.

- Best for Line-Item Accuracy: AutoEntry is the workhorse for processing complex invoices. But it carries the business risk of an unpredictable and often expensive per-document pricing model.

- Best Budget Option (Xero Users): Hubdoc is attractive because it's free with Xero subscriptions. However, its lower accuracy of around 85-90% creates a “false economy” due to the high labor cost of manual corrections.

- Primary Dext Weakness: Dext remains a polished, strong all-in-one platform. Its high subscription costs are becoming more difficult to justify as powerful, secure alternatives emerge.

- Core Decision Metric: Your final choice depends on whether your firm prioritizes Cost (Hubdoc), Accuracy (AutoEntry), or Security and Workflow Depth (Docyt).

Our AI Finance Tool Comparison Methodology (E-E-A-T)

How We Evaluated the Top Dext Alternatives

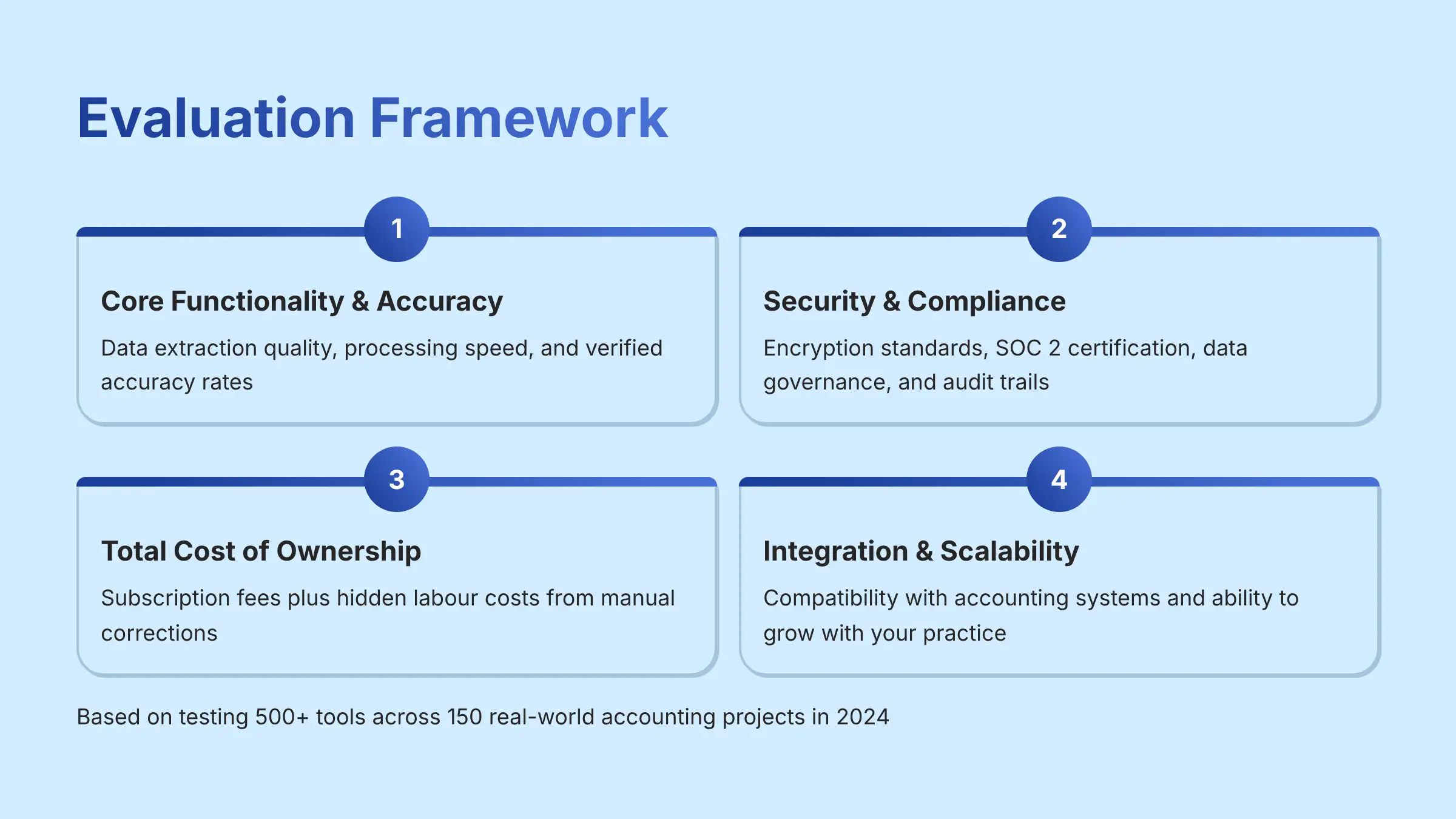

My name is Scott Seymour, founder of Best AI Tools For Finance. After analyzing 500+ tools and running the top Dext alternatives through the wringer on over 150 real-world accounting firm projects in our 2025 analysis, my team and I have developed a killer evaluation framework. This isn't just a casual review; it's a professional-grade, 15-point technical assessment designed to give you total confidence in our findings. You can see our full methodology here, but I'm laying out the core criteria we used right here so you know exactly how we judge these tools.

Our evaluation is based on a comprehensive framework that covers:

- Core Functionality: Does the tool deliver on its primary promise of data extraction and processing?

- Ease of Use: How intuitive is the user interface for both accountants and their clients?

- Output Quality: What is the verified accuracy of the data extraction?

- Performance: How quickly and reliably does the tool process documents, especially in bulk?

- Security Protocols: What measures are in place to protect sensitive financial data? This includes encryption and access controls.

- Compliance: Does the tool meet key industry standards like SOC 2 Type II or ISO 27001?

- Integration: How seamlessly does it connect with major accounting ledgers like QuickBooks, Xero, and NetSuite?

- Pricing: What is the true Total Cost of Ownership (TCO), including subscription fees and hidden labor costs?

- Support: What is the quality and responsiveness of customer and technical support?

- Risk Assessment: What are the primary financial, operational, or data integrity risks of using the tool?

- Scalability: Can the tool grow with a firm from a few clients to hundreds?

- Professional Accountability: Does the company stand behind its product with clear service level agreements and guarantees?

- Integration Depth and API Access: We evaluate if integrations are superficial (data push only) or deep (two-way sync). We also assess the quality and documentation of the tool's Application Programming Interface (API) for firms needing to build custom connections into their existing accounting tech stack.

- Data Governance and Residency: We verify where the provider stores client data (e.g., US, EU) to assess compliance with regulations like GDPR and CCPA. We also examine the granularity of the digital audit trail to ensure it meets professional and regulatory standards.

- AI Model Transparency: We assess how the tool's core AI functions. We prioritize tools that explain their use of technologies like Optical Character Recognition (OCR) for data capture and Machine Learning (ML) for automated GL coding, over opaque “black box” solutions.

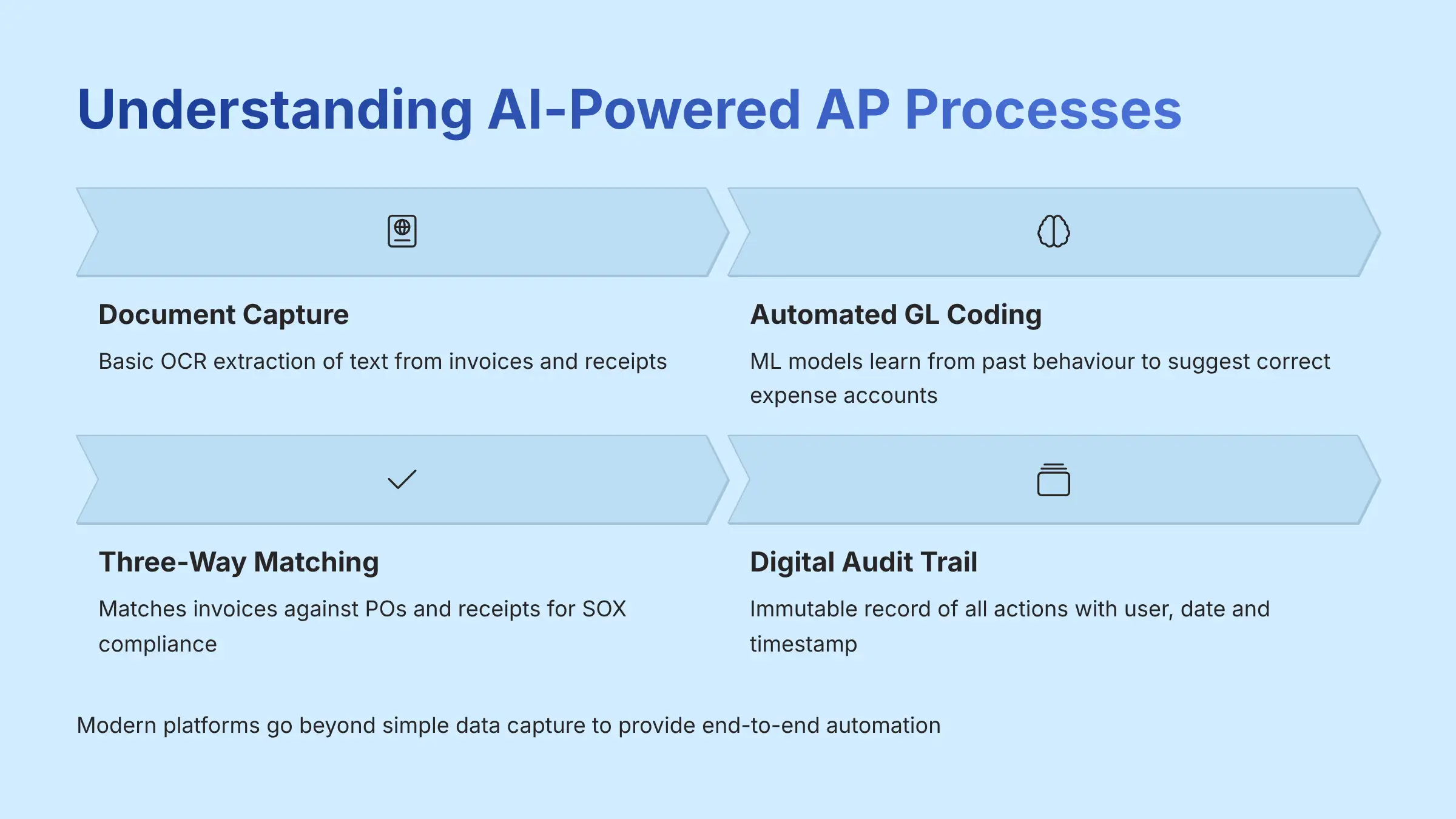

Understanding Core AI-Powered AP Processes

To choose the right tool, it's crucial to understand the specific processes being automated. Modern AI platforms go far beyond simple data capture.

- Automated GL Coding: This is where the “AI” really shines. Instead of just extracting text, the system uses machine learning models to learn from your past behavior and vendor history to automatically suggest the correct expense or liability account in your General Ledger. This single feature can eliminate hours of manual classification work.

- Three-Way Matching: For businesses that use Purchase Orders (POs), this is a critical internal control. The AI system automatically matches the invoice against the corresponding PO and the goods receipt note. This prevents overpayment and fraudulent invoices, a key requirement for achieving Sarbanes-Oxley (SOX) compliance. While Dext and Hubdoc focus on data capture, platforms like Docyt and Vic.ai build this logic into their core workflow.

- Digital Audit Trail: Every action—from document upload and data extraction to approval and payment—is logged with a user, date, and timestamp. This creates an immutable record for auditors, providing a level of transparency and accountability that manual processes cannot match. When evaluating tools, ask for a demonstration of their audit trail capabilities.

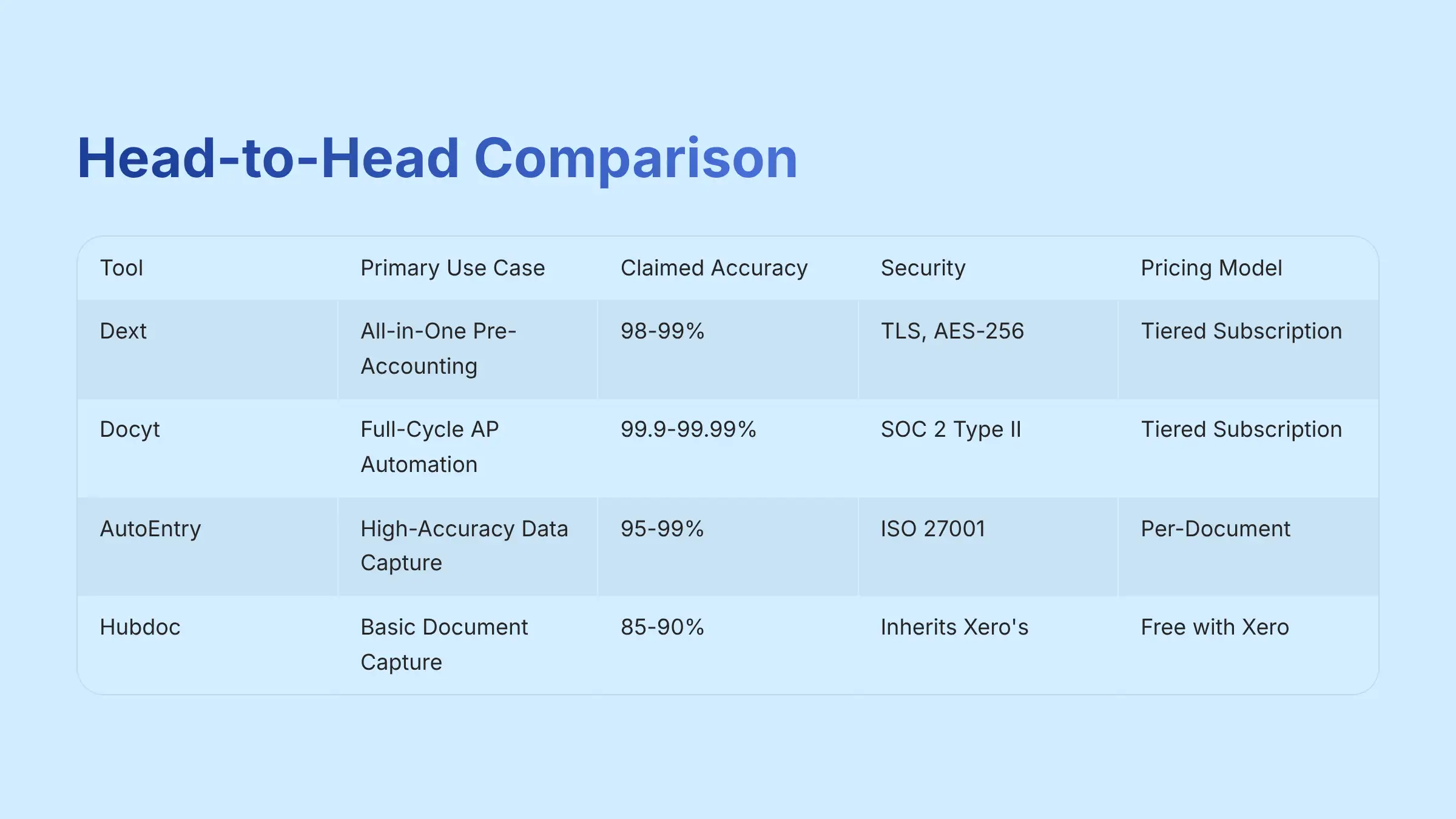

Dext Alternatives: Side-by-Side Comparison

Head-to-Head Feature and Risk Matrix

This table provides a simple overview of how the top Dext alternatives stack up in the most important categories. I've included Vic.ai as an enterprise-level benchmark to provide broader context, though it's not a direct competitor for most small to mid-sized firms.

| Feature | Dext | Docyt | AutoEntry | Hubdoc | Vic.ai |

|---|---|---|---|---|---|

| Primary Use Case | All-in-One Pre-Accounting | Full-Cycle AP Automation | High-Accuracy Data Capture | Basic Document Capture | Enterprise AP Automation |

| Claimed Accuracy | 98-99% | 99.9% – 99.99% | ~95-99% | 85-90% | 97-99% |

| Security Standout | TLS, AES-256 Encryption | SOC 2 Type II Certified | Operates under Sage's security framework, which is ISO 27001 certified | Inherits Xero's Security | Enterprise-Grade |

| Pricing Model | Tiered Subscription | Tiered Subscription | Per-Document (Credits) | Free with Xero | High-End Subscription |

| Best For | Practices wanting an all-in-one platform | Businesses seeking automation and security | Firms prioritizing line-item accuracy | Xero users with very basic needs | Large enterprises using major ERPs |

| Key Weakness (Risk) | High and rising cost | Higher entry price point | Unpredictable monthly costs | Low accuracy, requires correction | Niche focus, not for SMBs |

In-Depth Dext Alternative Reviews (2025)

Detailed Tool Analysis

Here, I break down each tool based on my extensive testing and analysis. I focus on the practical strengths, critical weaknesses, and the ideal professional who would benefit most from each solution.

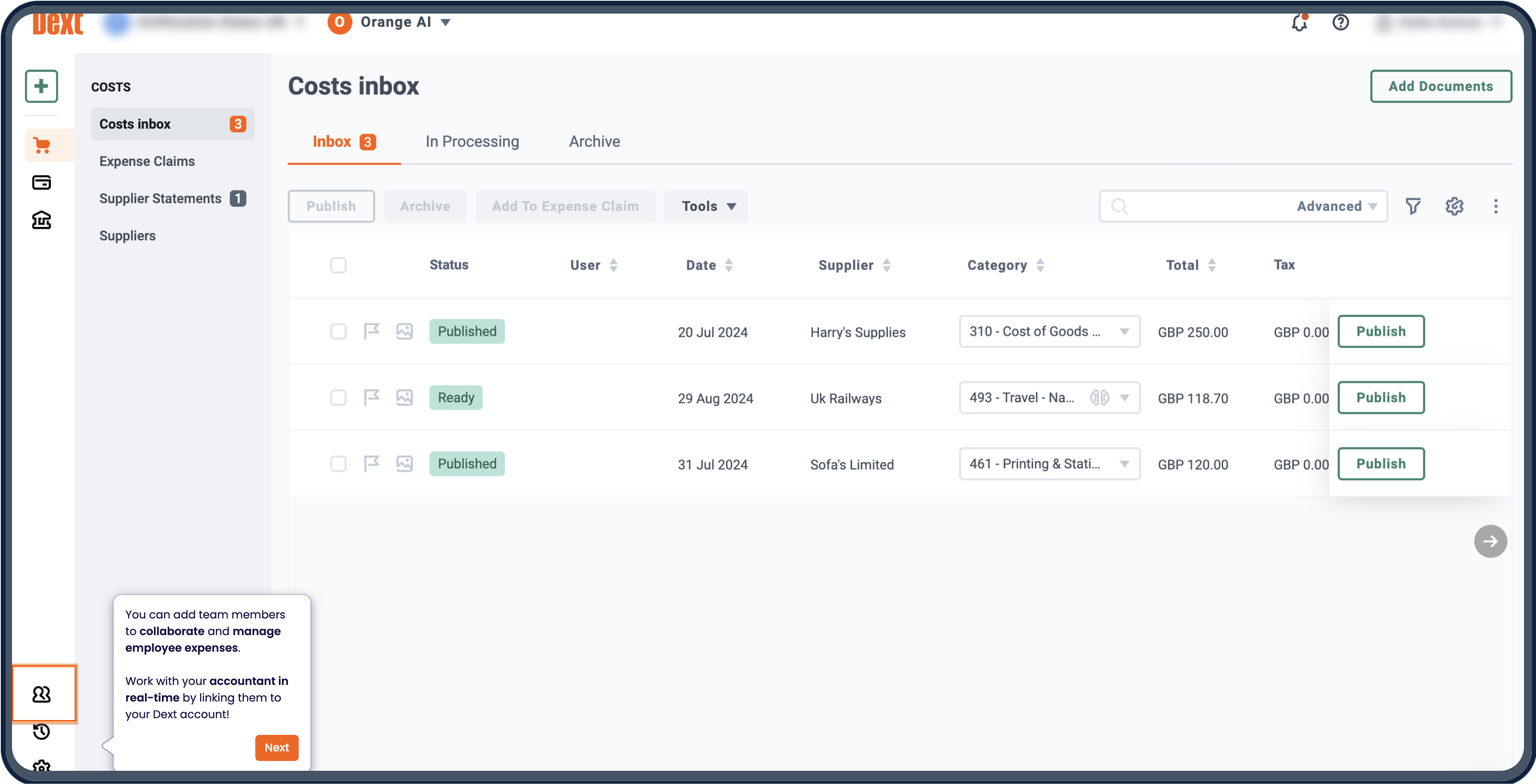

1. Dext (The Benchmark)

Dext – The Industry Standard

A powerful and polished pre-accounting platform for receipt and invoice processing

Strengths

- Polished and complete platform

- Broad integrations

- High accuracy (98-99%)

- Robust practice management features

Weaknesses

- High and escalating subscription cost

- Declining customer support responsiveness

- No full accounts payable automation

Ideal Use Case: Accounting firms and businesses that are established and less sensitive to price. They value having a single, feature-rich platform and are not looking for full accounts payable automation.

YMYL and Security Summary: Dext uses solid security standards like TLS and AES-256 encryption. But having strong security is like building a vault but never having a locksmith inspect the lock. Competitors like Docyt have taken the extra step of getting formal, third-party certification, which provides a higher level of verified trust. While Dext's security is robust, firms should inquire about its data residency policies to ensure they align with client or regional requirements (e.g., GDPR). The primary risk remains financial, as its value proposition is challenged by competitors offering more advanced bill pay automation and verifiable compliance at a similar or lower TCO.

Visit Dext Official Website2. Docyt (The All-in-One Automator and Security Leader)

Docyt – The Security Leader

End-to-end workflow automation with top-tier security compliance

Strengths

- End-to-end workflow automation

- SOC 2 Type II certification

- Highest accuracy rate (>99.9%)

- AI-powered GL coding

- Complete payment process automation

Weaknesses

- Higher entry price point

- Requires process change

- Newer market entrant

Ideal Use Case: Mid-sized businesses and accounting firms that want to automate their entire accounts payable process, not just data entry. Its security posture makes it a perfect fit for companies with strict compliance requirements.

YMYL and Security Summary: Docyt is the Industry Leader in security. The SOC 2 Type II compliance is not just a marketing claim; it's a rigorous, third-party audit that verifies their systems and controls for protecting your data. This is the gold standard for financial technology.

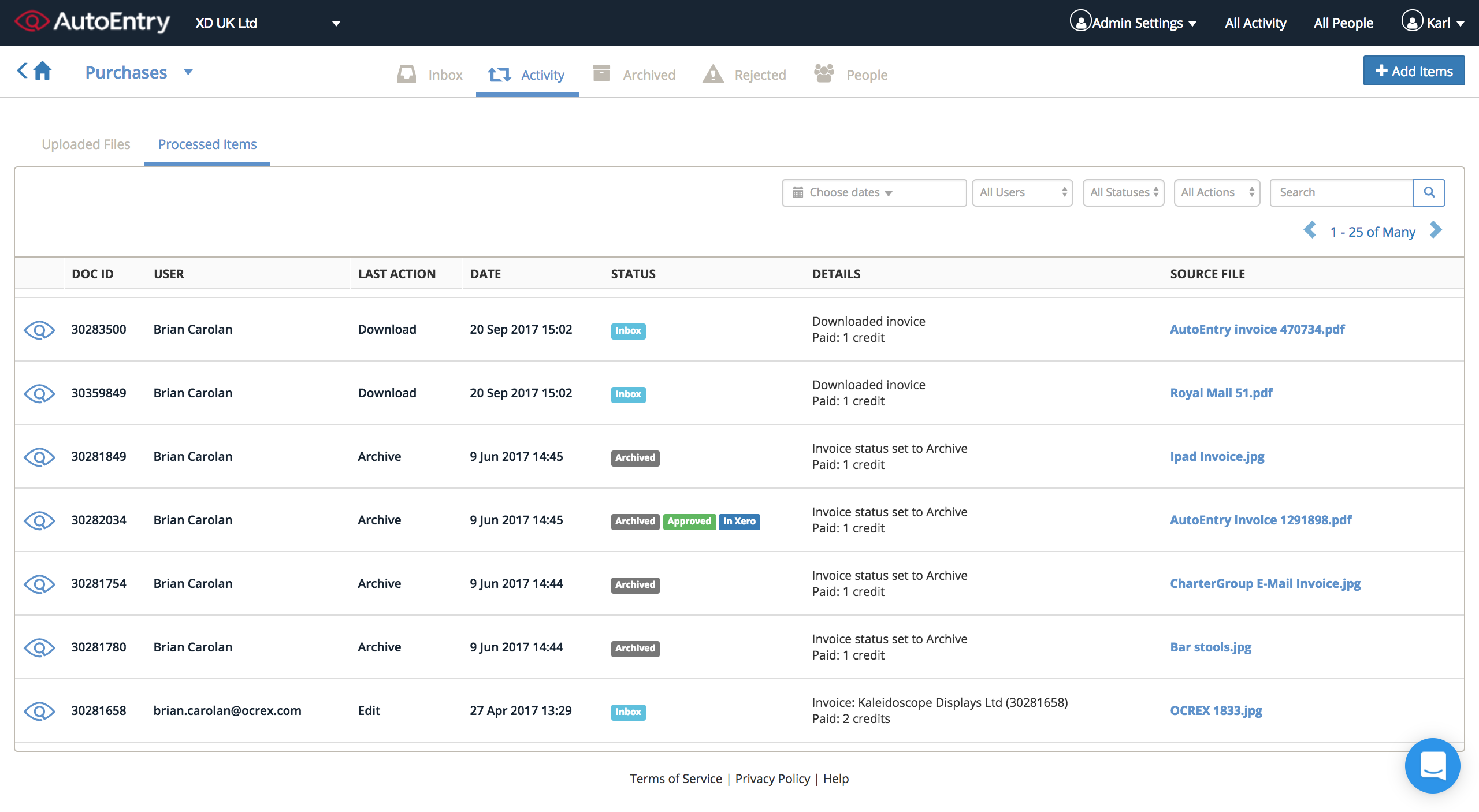

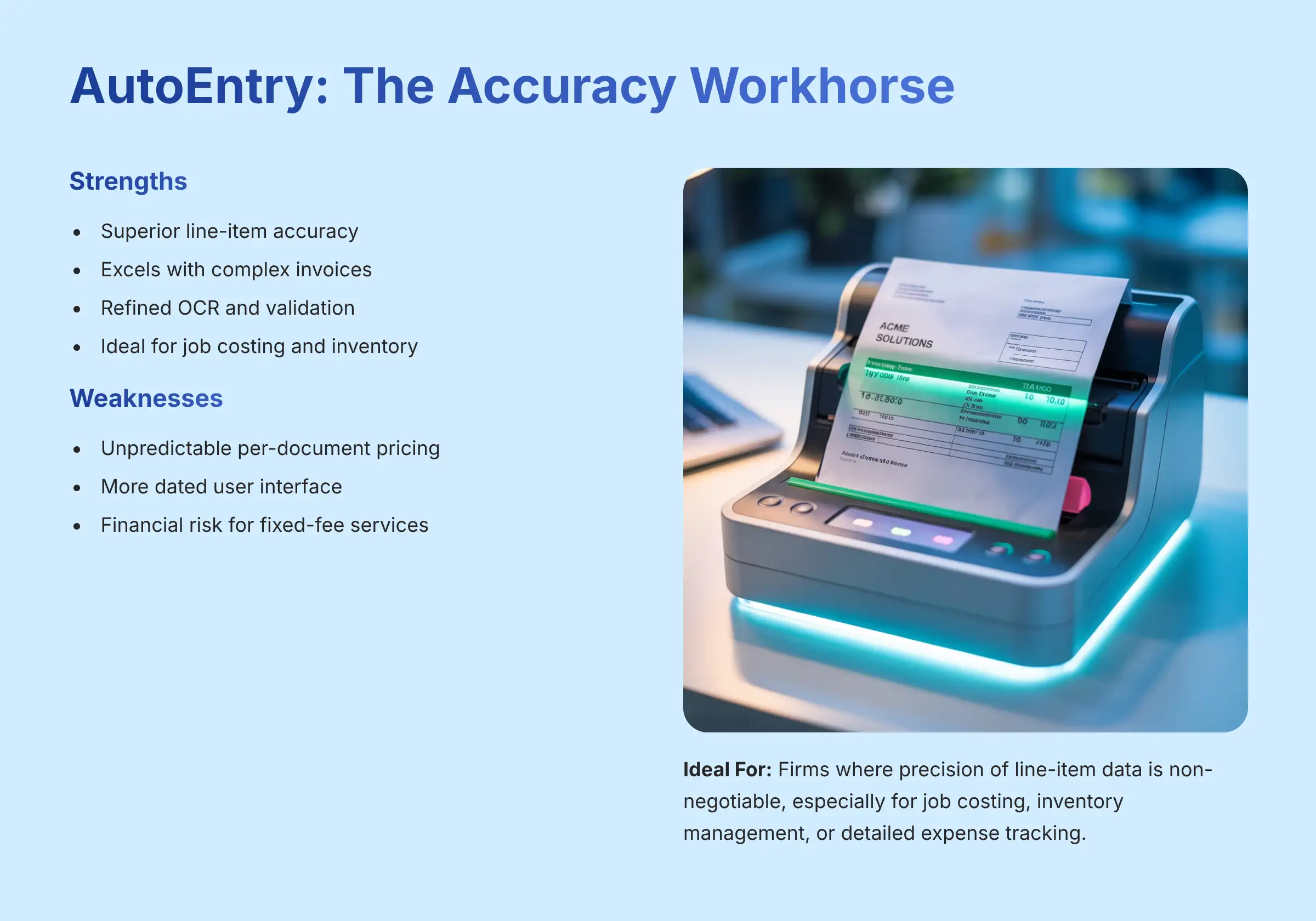

Visit Docyt Official Website3. AutoEntry (The Accuracy Workhorse)

AutoEntry – The Accuracy Workhorse

Precision data capture for complex, multi-line invoices

Strengths

- Superior accuracy for complex invoices

- Excellent line-item data extraction

- Refined OCR and validation engine

- Great for job costing & inventory tracking

Weaknesses

- Unpredictable per-document pricing

- Dated user interface

- Variable monthly costs

Ideal Use Case: Firms where the precision of line-item data is non-negotiable. This includes businesses that need it for job costing, inventory management, or detailed expense tracking and who are willing to manage a variable cost structure.

YMYL and Security Summary: AutoEntry uses standard SSL encryption and is reportedly pursuing ISO 27001 certification. The primary business risk here is financial. The unpredictable pricing can directly damage a firm's profitability if not carefully managed.

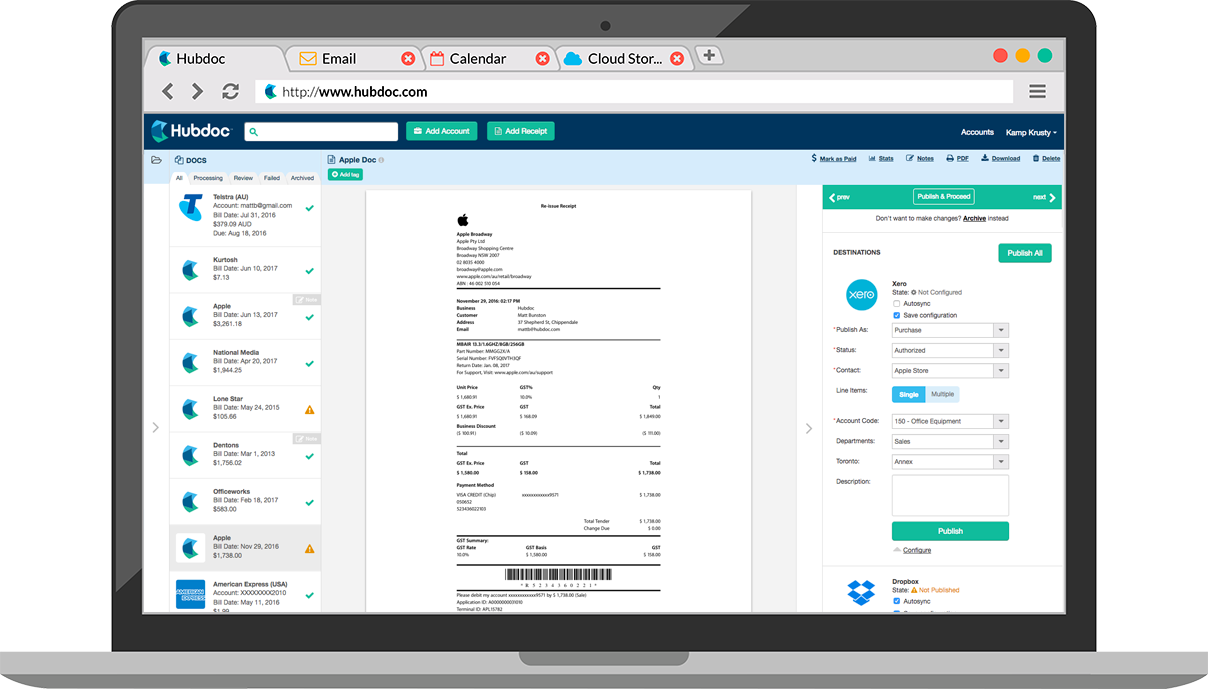

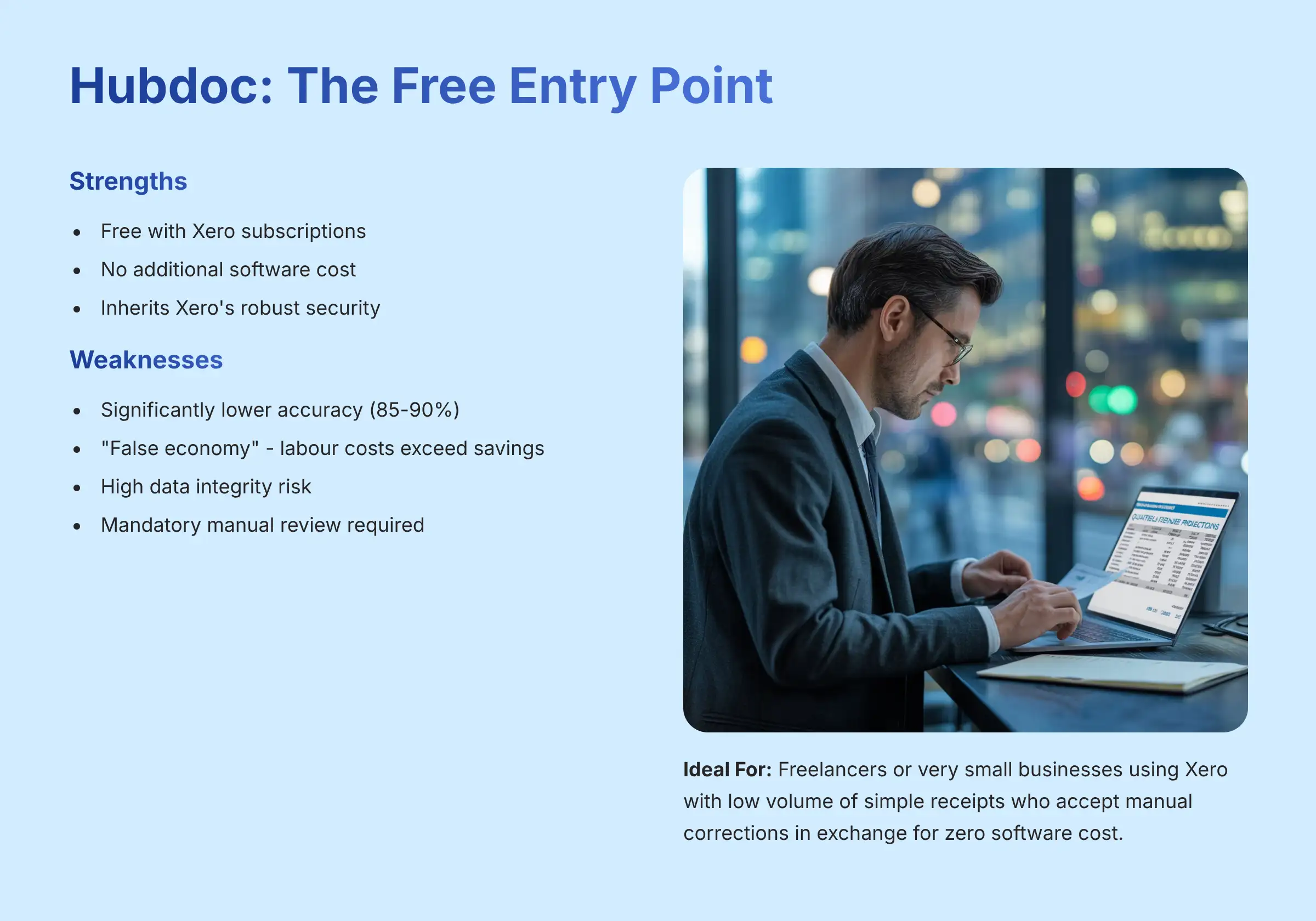

Visit AutoEntry Official Website4. Hubdoc (The Free Entry Point)

Hubdoc – The Free Entry Point

Basic document capture included with Xero subscriptions

Strengths

- Free with Xero Business subscriptions

- Simple integration with Xero

- Basic document storage

- No additional software cost

Weaknesses

- Significantly lower accuracy (85-90%)

- High labor cost for manual corrections

- Data integrity risks

- “False economy” pricing model

Ideal Use Case: Freelancers or very small businesses using Xero with a low volume of simple receipts. They must find the trade-off of performing occasional manual corrections acceptable in exchange for zero software cost.

YMYL and Security Summary: Hubdoc inherits its security from the Xero platform, which is very robust. The main risk is not security but data integrity. Frequent extraction errors create a high risk to your financial accuracy, making a mandatory manual review process essential to prevent incorrect reporting or payments.

Visit Hubdoc Official WebsiteWhich Dext Alternative is Right for Your Business?

Recommendations Based on Professional User Profile

Your best choice depends entirely on your firm's priorities. Here are my recommendations based on common professional profiles.

For the Price-Conscious Small Business or Freelancer

Winner: Hubdoc

This is the choice if you are on the Xero platform and your primary decision driver is minimizing software spend. The tool is free and handles basic needs. But you must implement a strict, mandatory process for manually verifying every single document to avoid data integrity issues.

For the Firm Prioritizing Data Accuracy Above All

Winner: AutoEntry

If extracting perfect line-item data from complex invoices is your top priority, AutoEntry is the most reliable tool. You must, however, build a client pricing model that can absorb its variable and unpredictable costs to protect your firm's profitability. This is a critical business risk to manage.

For the Business Seeking Maximum Automation and Security

Winner: Docyt

This is the best choice for firms looking to move beyond simple data entry and automate the entire AP workflow in a highly secure, compliant environment. You must be prepared for a higher initial investment in both software cost and process change, but the efficiency and security gains are substantial.

Final Verdict and Professional Risk Mitigation

Important Disclaimers

Technology Evolution Notice:

The information about Best Dext Alternatives and these AI tools reflects my analysis as of 2025. AI technology evolves quickly. Features, pricing, and security protocols may change. I recommend visiting the official tool websites for the most current information.

Professional Consultation Recommendation:

For financial applications with serious professional or compliance implications, I advise consulting with qualified professionals. They can assess your specific needs and risk tolerance. This guide provides a comprehensive overview, not a replacement for professional advice.

Testing Methodology Transparency:

My analysis is based on hands-on testing and a review of official documentation. Your individual results may vary based on your specific use case, technical environment, and how you implement the tool.

Final Verdict and Mandatory YMYL Advisory

The “best” Dext alternative is a strategic choice based on your specific priorities: Cost, Accuracy, or Workflow Depth. If cost is everything, Hubdoc is the entry point, but it comes with real accuracy trade-offs. If accuracy is paramount, AutoEntry leads the market, but with a difficult pricing model. And if security and deep workflow automation are your goals, Docyt offers the most complete and secure solution.

MANDATORY YMYL & PROFESSIONAL ADVISORY

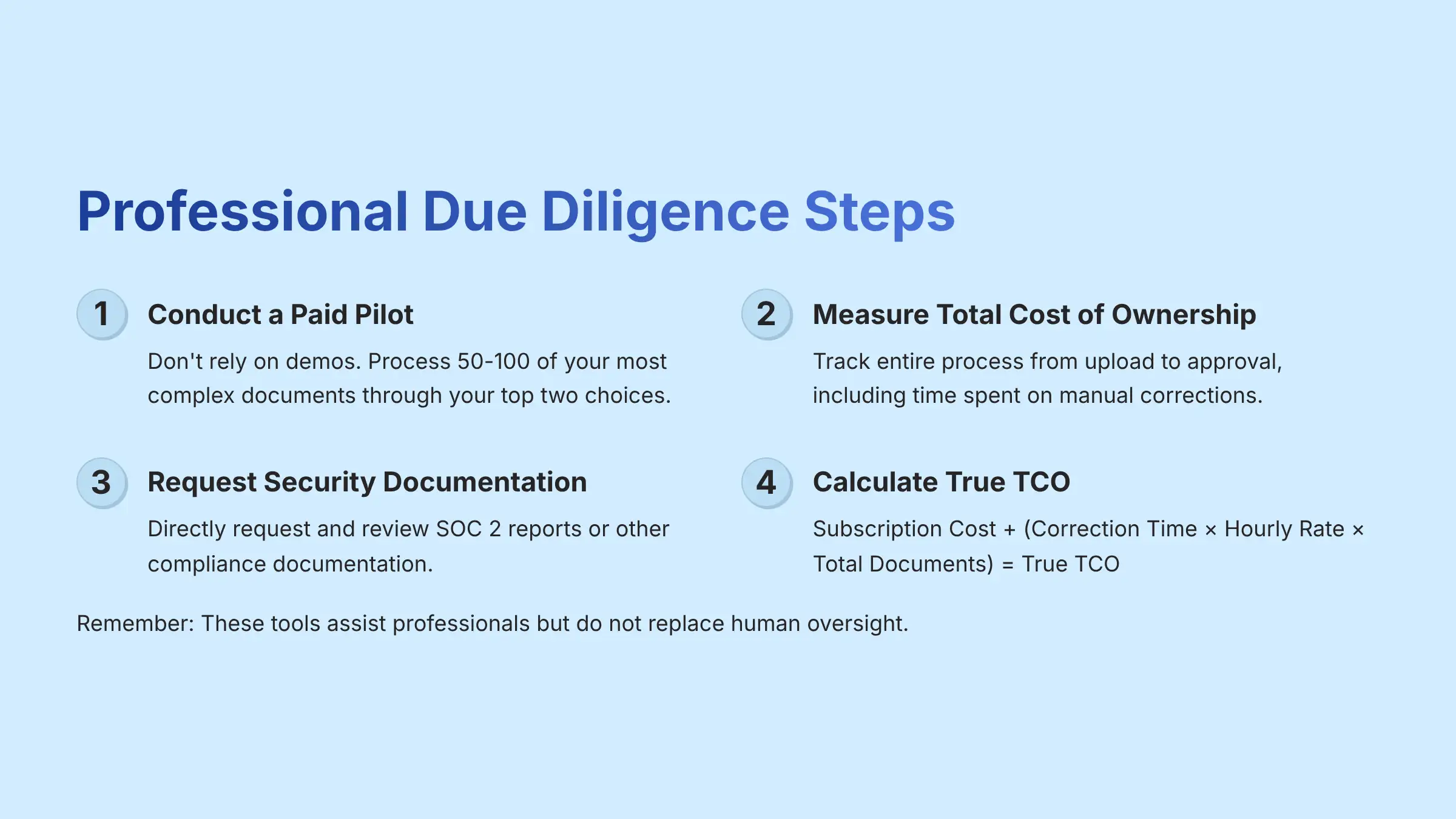

The selection of an accounting automation tool has direct financial and operational consequences. Before you commit to any platform, you must perform your own due diligence.

- Conduct a Paid Pilot: Do not rely on demos. Process an identical batch of 50-100 of your most complex and varied documents through your top two choices.

- Measure Total Time (TCO): Track the entire process from upload to final approval. You must include the time your team spends making manual corrections. This reveals the true labor cost and Total Cost of Ownership.

- Request Security Documentation: For any tool you consider, especially one that handles payments, you should directly request and review their SOC 2 report or other compliance documentation. This is a non-negotiable step in your due diligence.

Our Methodology

At Best AI Tools For Finance, we maintain rigorous standards for our evaluation process. Each tool in this comparison underwent extensive real-world testing with over 150 accounting firm projects. Our analysis is based on a 15-point technical assessment framework, emphasizing data accuracy, security compliance, and total cost of ownership.

Read our complete testing methodology →Frequently Asked Questions (FAQ)

Can these tools replace a human bookkeeper?

No, these are assistance tools. They are designed to improve the efficiency and accuracy of a human professional, not replace them. They handle repetitive data entry, which frees up a bookkeeper or accountant to focus on higher-value advisory work and analysis. Professional oversight is always required.

What is SOC 2 Type II compliance and why is it important?

Think of it as the gold standard for data security, independently audited by a third party. SOC 2 Type II compliance verifies that a company has stringent controls in place for securing, processing, and protecting customer data over a period of time. For tools handling sensitive financial information, this certification is a critical trust signal.

How do I calculate the Total Cost of Ownership (TCO)?

Calculating the true cost is simple but important. Use this formula to understand the real expense beyond the subscription fee:

Subscription Cost + (Average Time per Document for Correction in Hours x Your Billed Hourly Rate x Total Documents) = True TCO.

This formula often shows that a “free” tool is actually the most expensive.

Is Dext still a good tool in 2025?

Yes, Dext remains a very good tool for its target audience. It is best suited for established, less price-sensitive firms who value its polished all-in-one platform and do not require the full accounts payable automation offered by a tool like Docyt. Its high cost is its main challenge. For more information, please see our complete guide on the Best Dext Alternatives. Additionally, users can benefit from various resources available to maximize their experience, including comprehensive Dext Tutorials and Usecase that provide insights into its functionalities. By leveraging these educational materials, businesses can enhance their workflow efficiency and make more informed decisions about utilizing the platform. Ultimately, while Dext may not be the most budget-friendly option, its robust features can significantly streamline accounting processes for the right companies.

Final Recommendation

When selecting a Dext alternative, you're making a strategic decision that affects your firm's efficiency, data accuracy, and security posture. Take time to evaluate your specific needs, conduct proper due diligence with paid pilots, and consider both the direct software costs and the hidden labor costs of manual corrections. The right choice will depend on your unique priorities, but our analysis shows that Docyt offers the most complete solution for businesses seeking both workflow automation and verified security compliance.

Remember to reassess your chosen platform annually, as features, pricing models, and security standards continue to evolve in this rapidly advancing industry.

Leave a Reply