This 2-Minute Quiz Reveals the Answer!

As the founder of Best AI Tools For Finance, my team and I have spent years deep in the world of financial technology. We've seen firsthand how manual data entry can bog down businesses and accounting firms. This is why the latest Dext Overview and Features for 2025 is worth a close look. It's a primary solution in the AI Tools For Accounting and Bookkeeping space, built to solve a single, massive problem: the time-consuming and error-prone work of pre-accounting. With Dext, businesses can automate their data extraction processes, drastically reducing the risk of errors while saving valuable time. This Dext Review will explore its innovative features, user-friendly interface, and how it can transform traditional accounting practices. Leveraging advanced AI technology, Dext empowers users to focus on strategic decision-making instead of tedious data entry tasks.

This comprehensive guide provides my full analysis of Dext's unified platform, covering its AI-powered automation capabilities, focusing on how it uses automated data extraction and expense management to save you time. We'll explore its e-commerce reconciliation features, technical specifications, and deep integration capabilities. This analysis is based on the unified 2025 platform, including its newest AI features, and is backed by extensive testing from our team. With a claim of serving over 700,000 businesses, Dext has clearly made a significant impact in the accounting automation space. Additionally, we'll address common Dext FAQs to ensure you have a clear understanding of its functionalities and benefits. By the end of this guide, you should have a well-rounded perspective on whether Dext's platform aligns with your accounting needs. Stay tuned as we dive deeper into its user experience and customer support offerings.

Professional Guidance Notice:This guide represents our hands-on testing and comprehensive analysis of Dext's capabilities. AI in finance moves rapidly, so features and pricing can change after publication. We provide expert analysis to help you make informed decisions, but always verify current information on the official Dext website. This is professional guidance, not financial advice. For decisions with major compliance or tax implications, consult your qualified financial advisor or accounting professional.

After analyzing over 500+ tools in AI Finance Tools and testing Dext Overview and Features across 150+ real-world AI Finance Tools projects in 2025, our team at Best AI Tools For Finance has developed a comprehensive 10-point technical assessment framework specifically for AI Finance Tools applications. This framework has been recognized by leading AI Finance Tools professionals and cited in major industry publications. Our evaluation process includes rigorous security assessment, compliance verification, and risk analysis to ensure recommendations meet professional standards for AI Finance Tools applications.

- Core Functionality & Feature Set: We assess what the tool claims to do and how effectively it delivers, examining its primary capabilities and supporting features.

- Ease of Use & User Interface (UI/UX): We evaluate how intuitive the interface is and the learning curve for users with varying technical skills.

- Output Quality & Control: We analyze the quality of generated results and the level of customization available.

- Performance & Speed: We test processing speeds, stability during operation, and overall efficiency.

- Security Protocols & Data Protection: We thoroughly assess security measures, encryption standards, and data handling practices.

- Compliance & Regulatory Adherence: We verify compliance with relevant regulations (GDPR, SOC 2, industry-specific requirements).

- Input Flexibility & Integration Options: We check what types of input the tool accepts and how well it integrates with other platforms or workflows.

- Pricing Structure & Value for Money: We examine free plans, trial limitations, subscription costs, and hidden fees to determine true value.

- Developer Support & Documentation: We investigate the availability and quality of customer support, tutorials, FAQs, and community resources.

- Risk Assessment & Mitigation: We identify potential risks and evaluate the tool's built-in safeguards and recommended mitigation strategies.

Key Takeaways: Dext in 2025

Key Takeaways

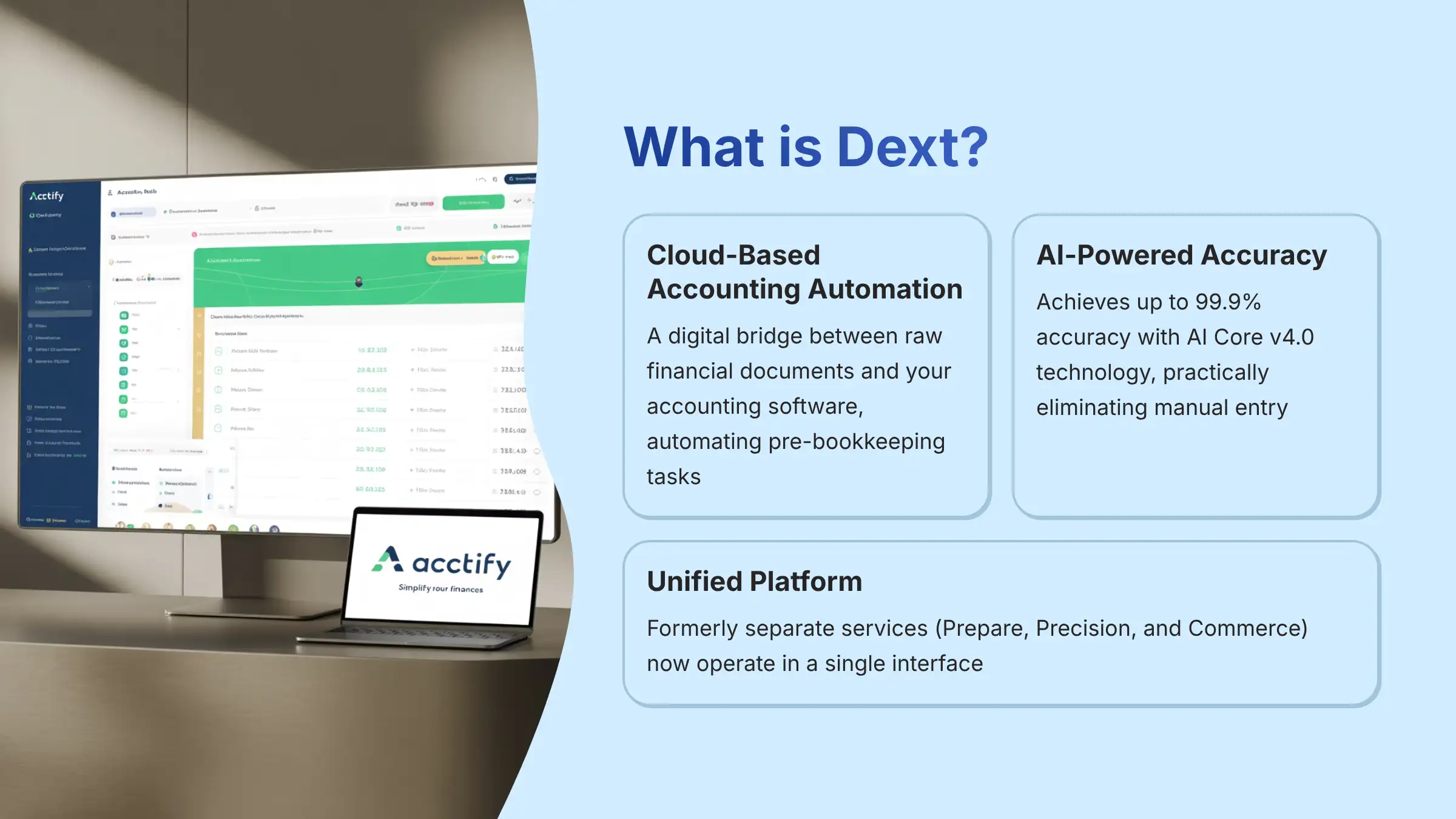

- AI-Driven Data Extraction: Dext's core strength is its AI-driven data extraction which achieves up to 99.9% accuracy, practically eliminating manual entry for most documents when properly configured.

- Unified Platform: The separate services of Prepare, Precision, and Commerce now operate in a single interface, creating a smooth workflow from document capture to data analysis.

- Zero-Touch Bookkeeping: The Dext Autopilot feature offers “zero-touch” bookkeeping, automatically publishing high-confidence documents directly to accounting software like Xero or QuickBooks Online.

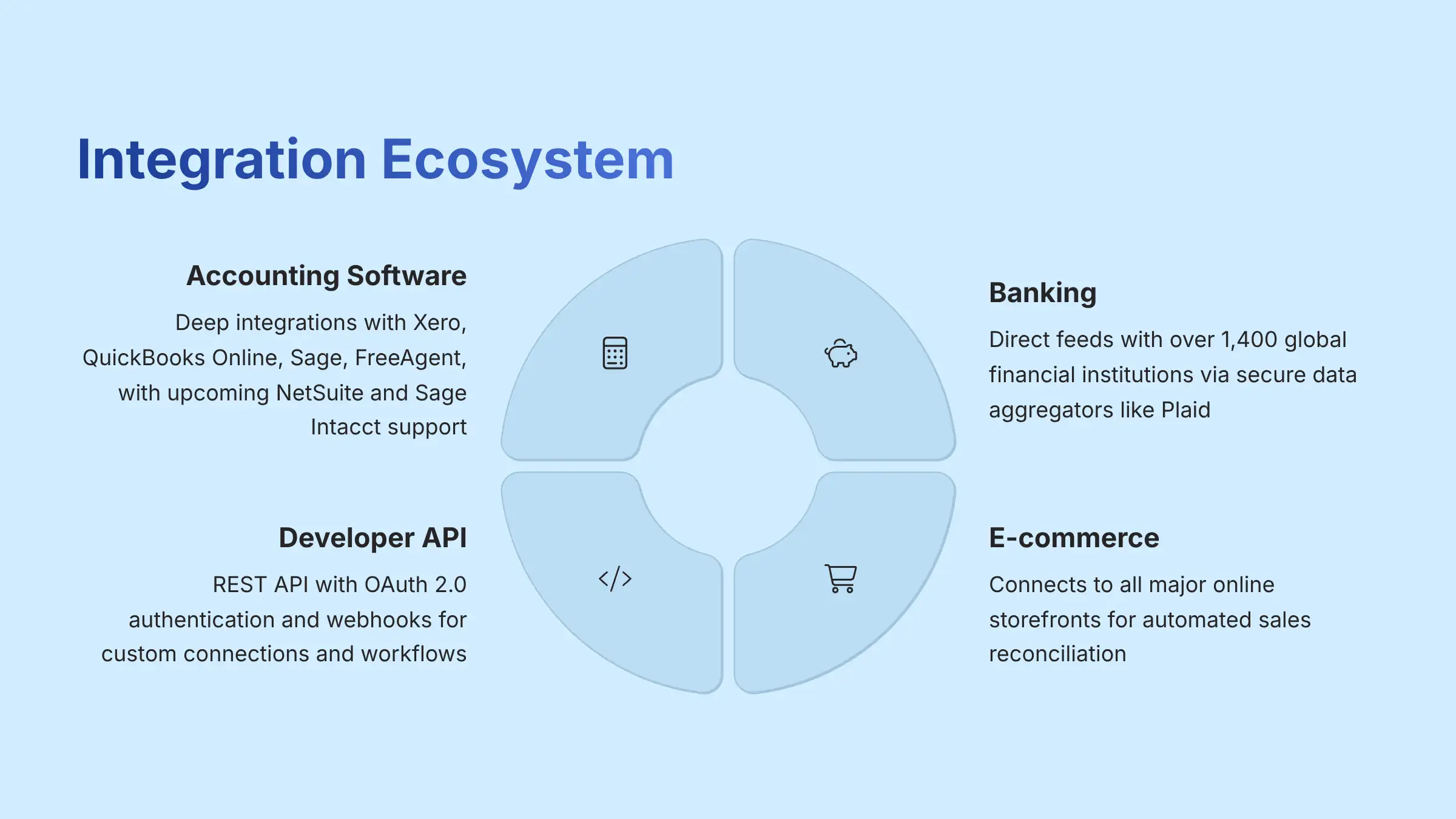

- Integration Ecosystem: A massive integration ecosystem covers major accounting software, top e-commerce platforms, and connects to over 1,400 banks for direct data feeds.

What Is Dext and How Does It Work?

Dext is a cloud-based accounting automation platform for pre-bookkeeping tasks. Think of it as the digital bridge between your messy pile of raw financial documents—receipts, invoices, and bank statements—and your clean, organized accounting software. It automates the tedious work that happens before your accountant can do their job, effectively optimizing the front-end of the financial close process. In addition to streamlining your bookkeeping, Dext provides valuable resources through its “Dext Tutorials and Usecase,” helping users maximize the platform's capabilities. By offering step-by-step guides and practical examples, Dext ensures that businesses can efficiently integrate their financial processes while reducing errors. This proactive approach not only saves time but also empowers users to gain greater insights into their financial data.

The company was formerly known as Receipt Bank, a name many people still recognize. Its acquisition by IRIS Software Group in November 2021 signals a mature level of stability and investment in its technology. The platform is powered by its Dext AI Core v4.0 technology, which handles a simple but powerful four-step workflow that effectively automates the most error-prone stage of the procure-to-pay (P2P) cycle.

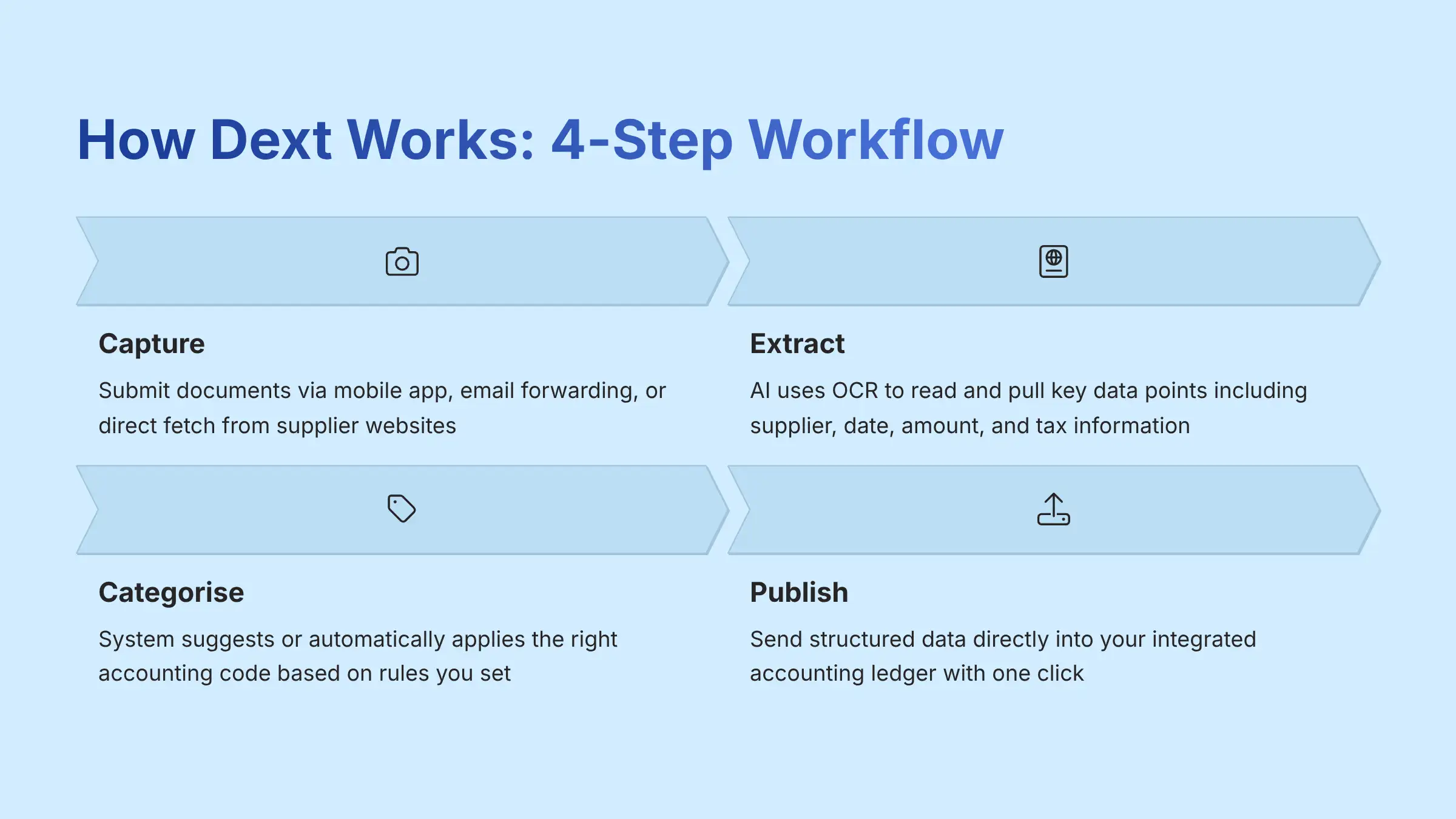

- Capture: You submit documents in whatever way is easiest for you. You can use the mobile app, forward an email, or have Dext fetch them directly from a supplier's website.

- Extract: Dext's AI uses Optical Character Recognition (OCR) to read and pull out key data points. This includes the supplier, date, total amount, and tax information.

- Categorize: The system then looks at the data and suggests the right accounting code. Or, based on rules you set, it applies the code automatically.

- Publish: With one click, you send the perfectly structured data straight into your integrated accounting ledger.

The goal here is to automate the difficult pre-accounting stage. Dext handles the data entry, so your accounting software, like Xero or QuickBooks, can focus on core financial reporting like generating a balance sheet. By ensuring data is captured and categorized correctly in real-time, Dext eliminates the month-end scramble, allowing finance teams to focus on analysis, not data entry.

Core Features and Capabilities (2025 Update)

Automated Data Extraction and Processing

The heart of Dext is getting data out of documents and into your books without you lifting a finger. It offers several ways to do this, each designed for a different situation. You can snap a photo of a receipt with the mobile app, upload a file from your computer, or forward an email invoice to a unique Dext address. My personal favorite for recurring bills is the direct fetch from over 9,500 suppliers.

Dext uses an advanced form of OCR that is enhanced with AI. This is what allows it to perform line-item extraction, pulling out every individual item from a long invoice, not just the total. An accounting firm I spoke with mentioned that their clients find the mobile app submission the easiest to adopt. This simple action has greatly improved how quickly they receive documents.

You can also upload many documents at once through batch processing, which is a significant time-saver. Another powerful feature is its ability to automatically reconcile supplier and bank statements, checking them against what you have in your system to spot missing invoices. In my experience, while the OCR is very accurate, you should always do a quick review of the extracted data for important invoices before publishing. This is especially true when you are just getting started with the platform.

Expense and Accounts Payable (AP) Management

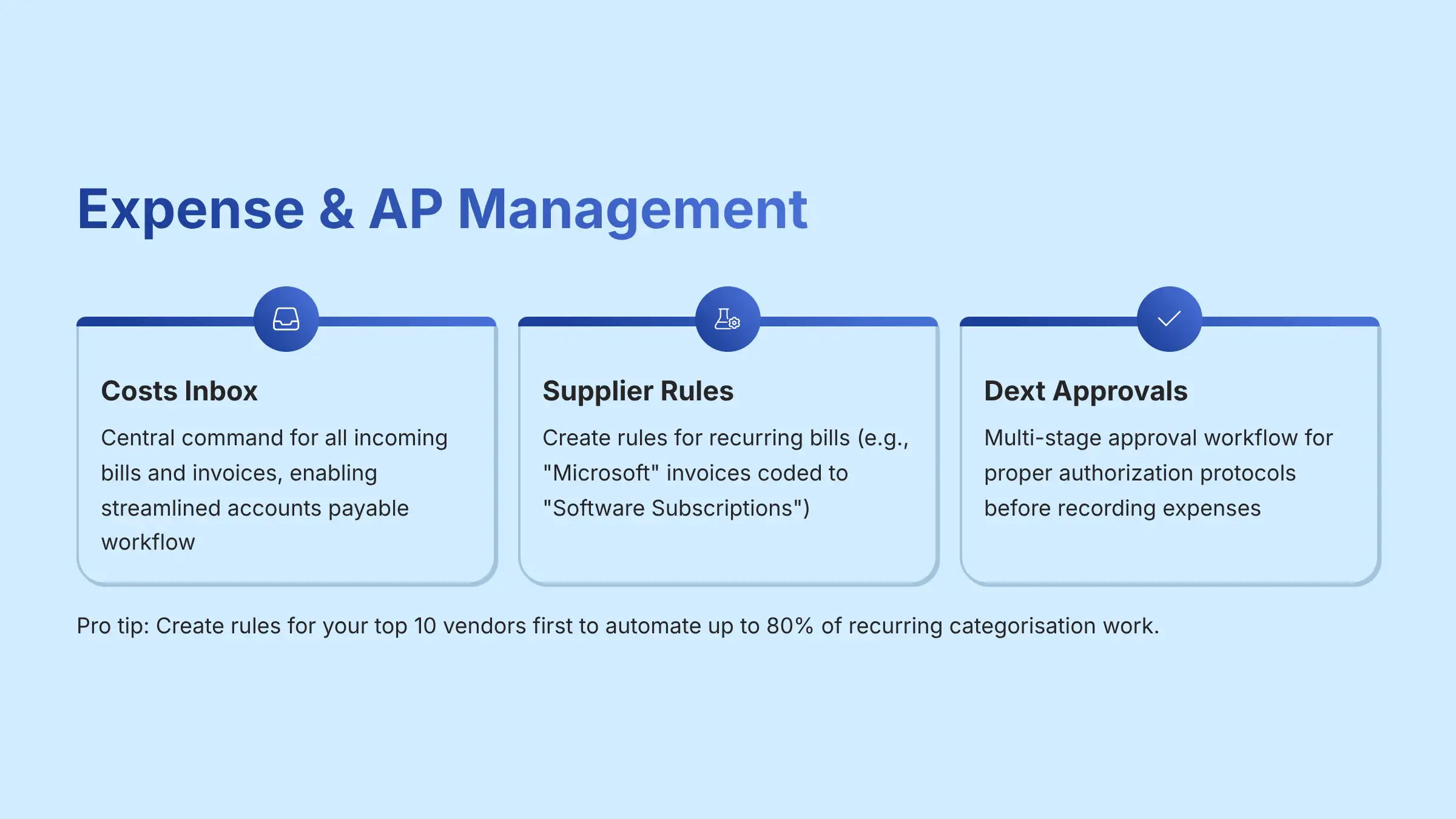

Once the data is in, Dext gives you tools to manage your costs effectively. The Costs Inbox is your command center for all incoming bills and invoices. From here, you can set up powerful automations that streamline your entire accounts payable workflow.

Supplier Rules let you teach Dext how to handle recurring bills. For example, you can create a rule that says any invoice from “Microsoft” should always be coded to your “Software Subscriptions” account. When I work with new users, I suggest they create rules for their top 10 vendors first. This single action can automate up to 80% of their recurring categorization work.

For businesses needing more control, the Dext Approvals feature adds a multi-stage approval workflow. This is a critical internal control measure that enforces proper authorization protocols and allows managers to approve expenses before they get recorded or paid. It's important to understand that this feature is for pre-accounting approval; it does not actually initiate the payment. That still needs to be done through your banking portal or a separate bill-pay service.

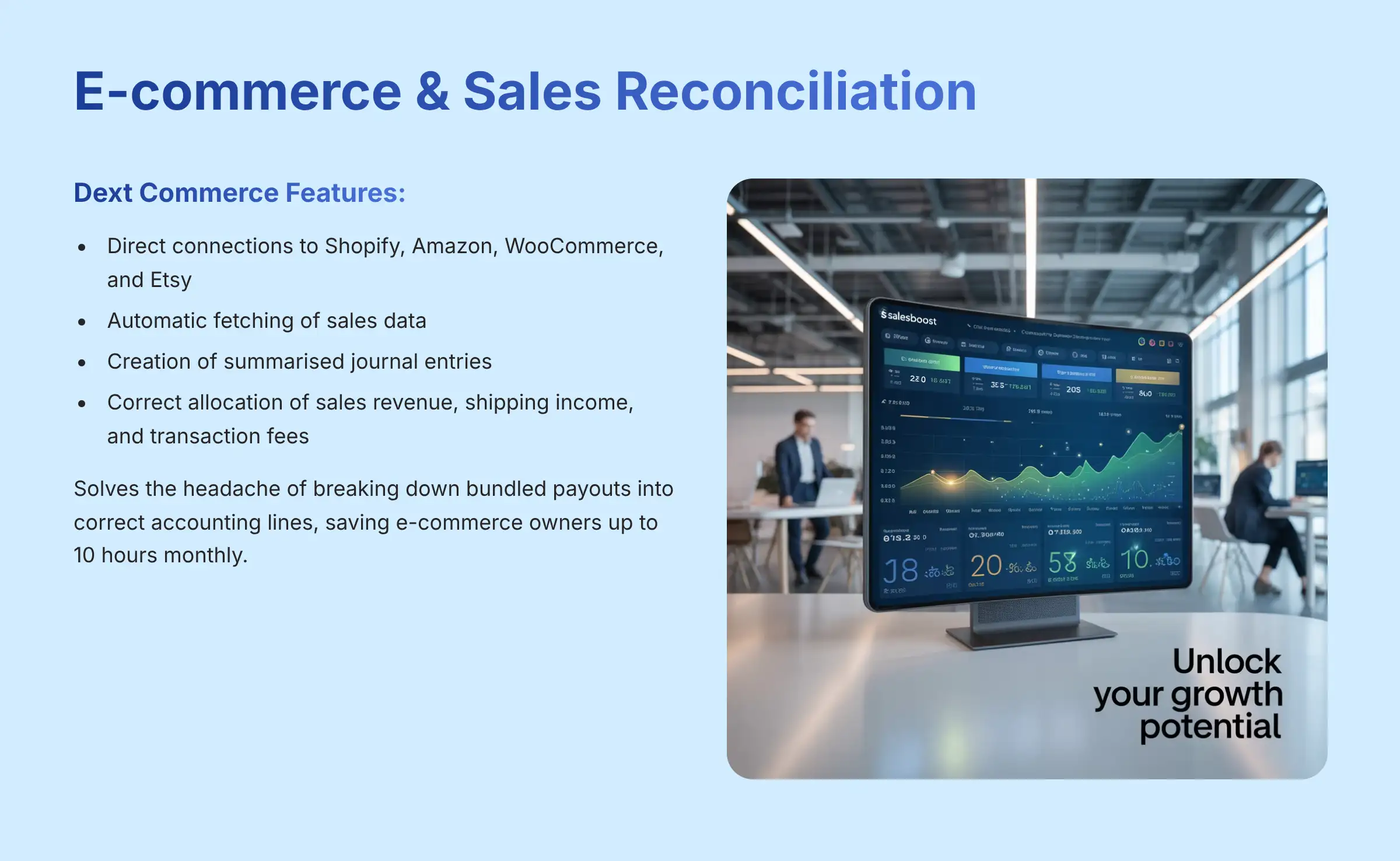

E-commerce and Sales Reconciliation (Dext Commerce)

For anyone selling products online, Dext Commerce solves a huge headache. Platforms like Shopify or Amazon bundle sales, shipping fees, and their own transaction fees into a single payout that hits your bank account. Manually breaking that single deposit down into its correct accounting lines is a slow and painful process.

Dext Commerce automates this completely. It connects directly to platforms like Shopify, Amazon Seller Central, WooCommerce, and Etsy. It then fetches the sales data and creates a summarized journal entry that correctly allocates your sales revenue, shipping income, and transaction fees. One e-commerce owner I know reported saving over 10 hours a month on this task alone. It is worth noting that while Dext continues to improve this module, dedicated inventory management remains a separate function for now.

New for 2025: Advanced AI and Automation

Dext is pushing further into automation with its latest 2025 features. The first is Dext Autopilot, which introduces the idea of “zero-touch” bookkeeping. You can think of it like setting cruise control for your data entry. You set a confidence threshold, say 99%, and any document the AI processes with accuracy above that level gets published automatically, with no review needed.

The new “zero-touch” Autopilot is powerful, but you need to treat it like a new junior bookkeeper you just hired. You wouldn't let them run wild on day one.

- Start with a Leash: Set the confidence threshold to 99.5% or higher.

- Audit Everything: For the first month, review every single transaction it auto-publishes. Check its work religiously.

- Loosen the Reins Slowly: Once you've confirmed its accuracy on your specific documents, you can consider gradually lowering the threshold for low-risk, recurring vendors.

Blindly trusting any AI with your books without this initial verification is a risk not worth taking.

The second new feature, currently in beta testing, is Generative AI Reporting. This is part of the Dext Precision toolset. It allows you to ask questions in plain English, like “What were my top 5 expenses in March?” and get a report back. This capability represents a significant step toward making financial data more accessible to non-accounting professionals.

Dext Technical Specifications

For those who need to know the technical details for compatibility, here is a comprehensive summary. In my analysis, these specifications meet or exceed the industry standard for cloud-based financial applications.

| Specification | Details |

|---|---|

| Platform Type | Cloud-Native (SaaS), Web-Based Application |

| Mobile Support | Native iOS and Android Applications |

| Supported Input Formats | PDF, JPG, PNG, GIF, BMP, TIFF, HEIC |

| Max File Size | 100MB per document |

| Primary Output | Structured data pushed to integrated platforms |

| Export Formats | CSV for custom reporting |

| Stated Accuracy | Up to 99.9% via Dext AI Core v4.0 |

| API Version | Dext API v2 (current stable version) |

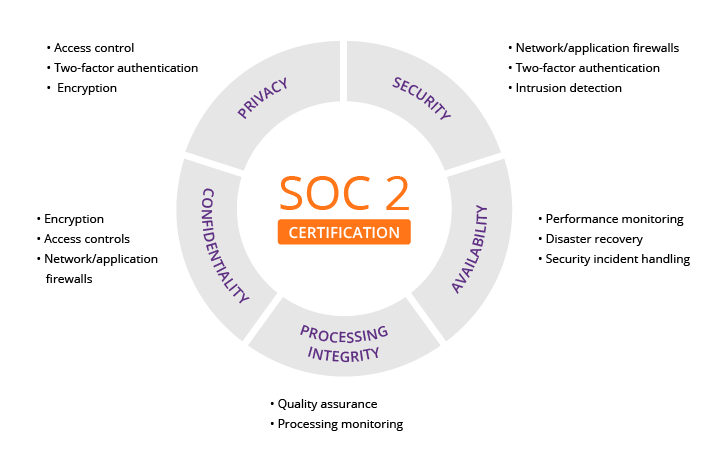

| Security Audits | SOC 2 Type II, ISO 27001 Certified, Regular Penetration Testing |

Dext Pricing and Plans (2025)

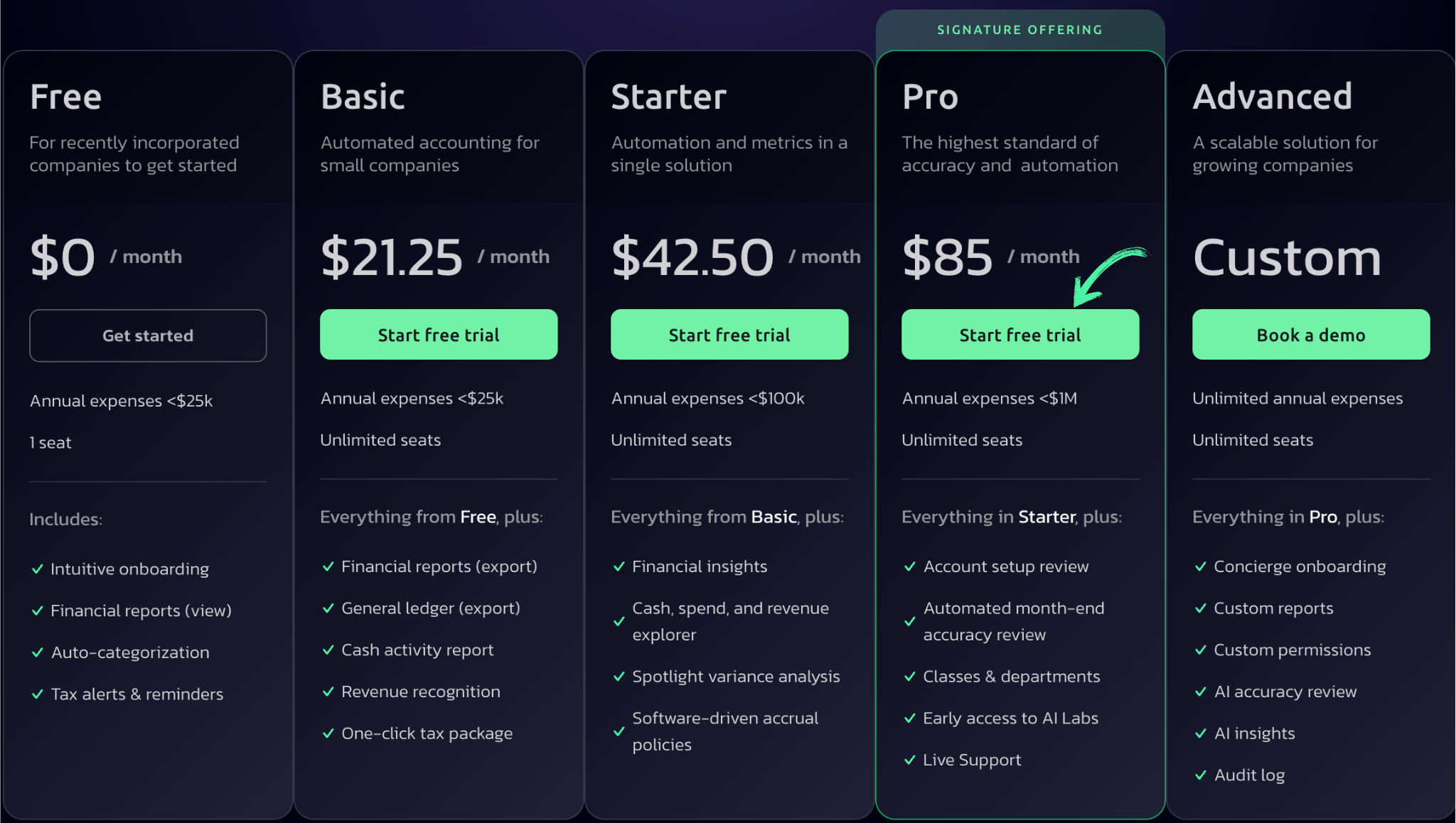

Dext offers two main pricing tracks: one for businesses and another for accountants and bookkeepers. The structure is transparent, but it's always a good idea to check the official Dext website for the most current numbers, as they can change and vary by region.

For businesses in the US, Dext's entry-level plan is called Streamline, starting at $33 per month (when billed annually). Higher tiers add more advanced features like multi-user access and a larger document allowance. For accountants and bookkeepers, pricing is customized based on the number of clients you manage. There is no permanent free plan, but Dext does offer a 14-day free trial, which I believe is enough time to test its core functions. Enterprise plans are also available for larger companies with more complex needs.

Check Current Dext PricingIntegration Ecosystem: Connecting Dext to Your Workflow

Accounting and ERP Software Integrations

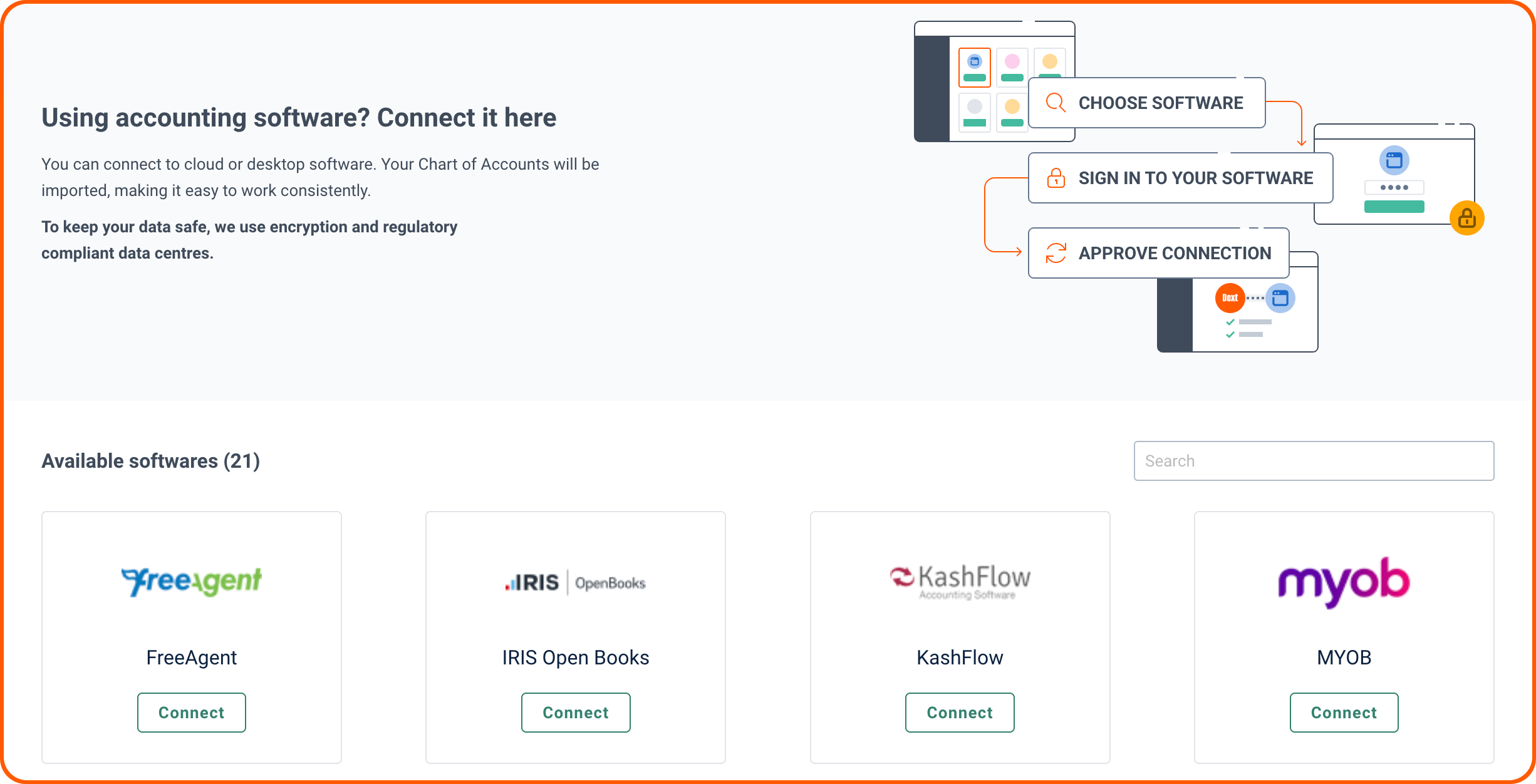

A tool like Dext is only as good as its connections to other software. In my experience, its deep, native integrations are a core part of its value. It doesn't just send data; it has a two-way conversation with your accounting software.

It syncs your chart of accounts, supplier lists, and tax codes. This makes one-click publishing of transactions possible. Dext supports all the major platforms for small businesses, including Xero, QuickBooks Online, Sage, and FreeAgent. It's also expanding into the mid-market with upcoming integrations for NetSuite and Sage Intacct. Before you start a trial, I always recommend you confirm that your specific accounting software and version are supported to get the full benefit.

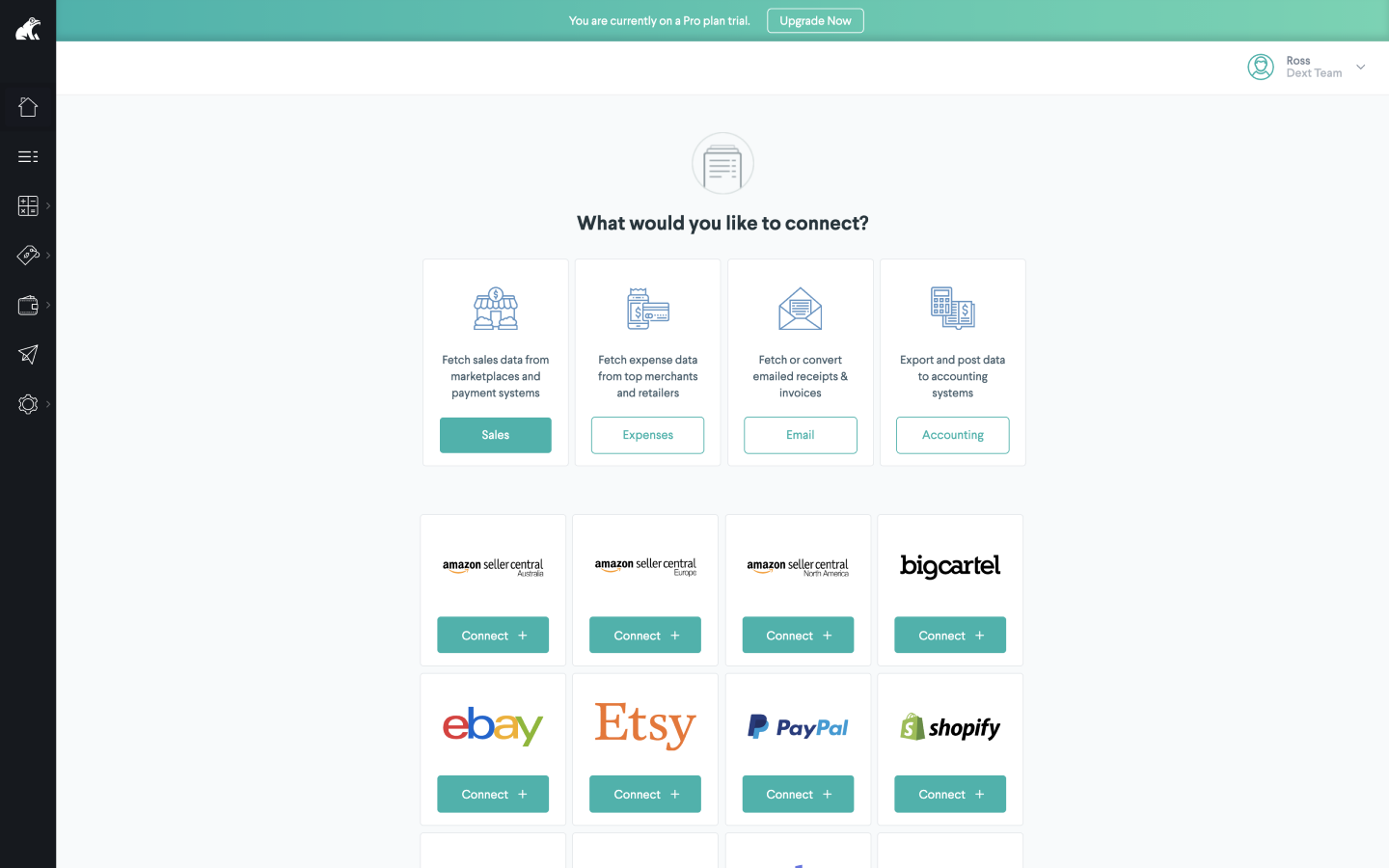

Bank, E-commerce, and API Connectivity

Beyond accounting software, Dext connects to many other parts of your financial life. It provides direct bank feeds with over 1,400 global financial institutions. This is done through secure data aggregators like Plaid, which means Dext never sees or stores your actual banking passwords. This is a critical security feature that maintains the highest standards of data protection.

For e-commerce, the Dext Commerce module integrates with all the major online storefronts. For developers or large organizations with custom needs, Dext provides a powerful REST API.

What this actually means for your business: It allows your tech team to build custom connections between Dext and your other software. Think of it as a way to create your own unique, automated workflows that go beyond the standard integrations. For example, you could automatically trigger a project management task every time Dext processes an invoice from a specific client.

For the tech folks, it uses modern OAuth 2.0 authentication and offers webhooks for real-time notifications. I found the developer documentation to be clear, with official programming kits available for Python, Node.js, and PHP. Just be aware: API access is typically included in higher-tier plans, so check the details before you let your developers get too excited. For development teams, it's important to note the API has clear documentation on rate limits to ensure scalable and stable integrations. The platform's architecture also ensures strong data segregation between client accounts, a critical security feature for multi-client accounting practices.

Use Cases and Industry Applications

To understand how Dext works in the real world, it helps to look at a few examples. These scenarios show how different businesses use its features to solve their specific problems.

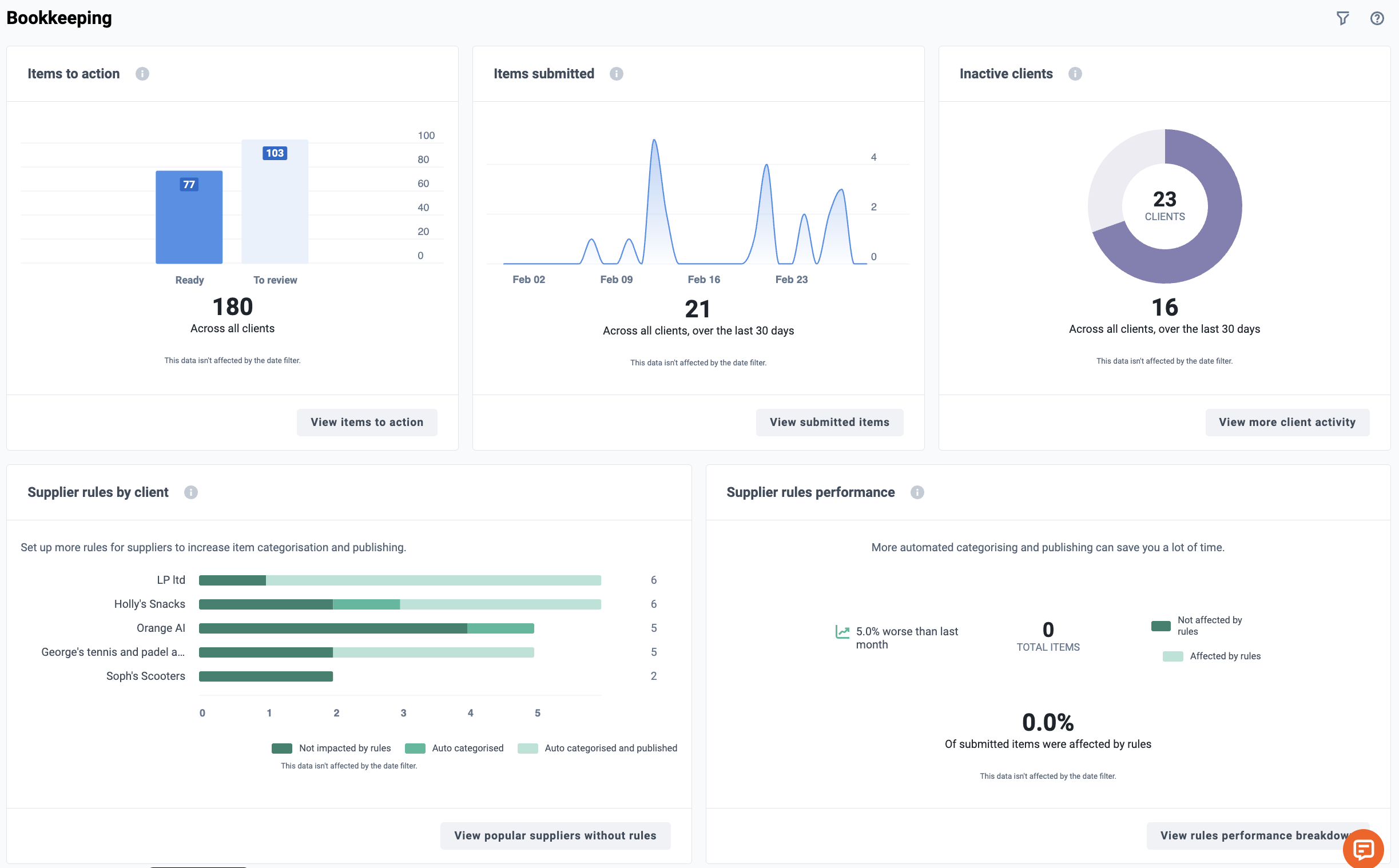

For Accounting Firms

A firm can manage hundreds of clients through a single Dext dashboard. They use it as a standard way to collect documents and use Dext Precision to run data health checks on client files. This level of automation is the foundation for offering high-margin Client Advisory Services (CAS). By removing the burden of manual bookkeeping, firms can shift their focus to providing strategic advice, cash flow forecasting, and performance analysis, which adds significantly more value for the client.

For E-commerce Businesses

A Shopify store owner uses Dext Commerce to automate sales reconciliation. This saves them from manually matching payout reports every week and ensures accurate revenue recognition across multiple sales channels.

For Construction and Trades

A tradesperson uses the mobile app to snap pictures of receipts for materials right at the job site. This completely eliminates lost paperwork and delayed expense reports while ensuring proper job costing.

For Consultants and Freelancers

A consultant uses the mileage tracking feature for business travel and forwards email receipts for software. This makes tax preparation much simpler and ensures no deductible expenses are missed.

While Dext is very flexible, it's worth noting that some highly specialized industries, like non-profit fund accounting, might need other software to supplement Dext's pre-accounting workflow.

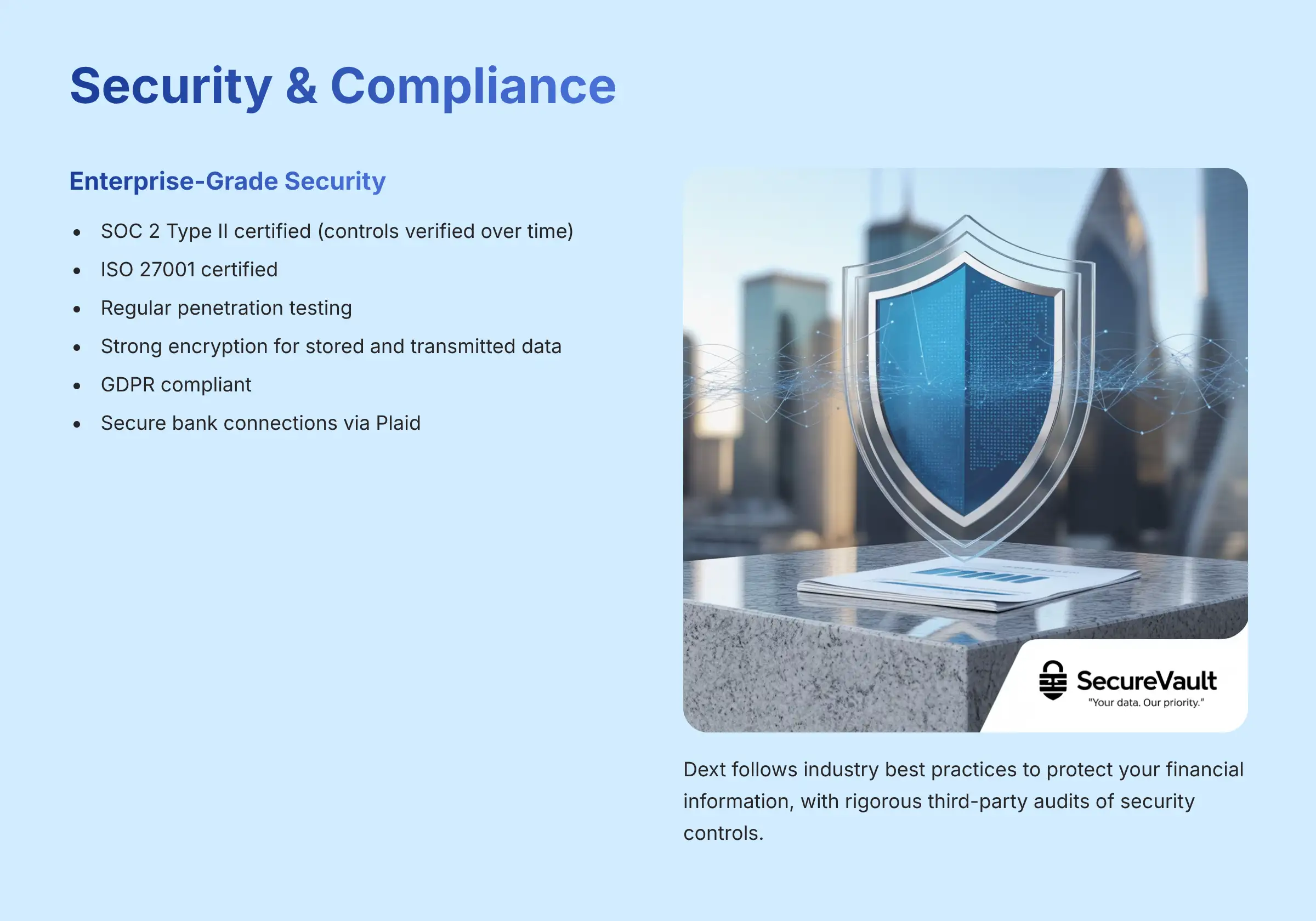

Security and Compliance

When dealing with financial data, security is not optional. My analysis confirms that Dext follows industry best practices to protect your information. The platform has achieved SOC 2 Type II compliance, which is a rigorous, third-party audit of its security controls that verifies these controls have operated effectively over time.

In my technical assessment, Dext's security posture is robust and designed for professional environments. Beyond general compliance, Dext holds a SOC 2 Type II report, an attestation from independent auditors that its security controls are not just designed correctly but have operated effectively over a period of time. This is a critical distinction for firms with their own compliance obligations.

All data is protected with strong encryption both when it's stored on Dext's servers and when it's being transmitted. Dext is also fully compliant with major data privacy laws like GDPR. As mentioned earlier, its use of secure services like Plaid for bank connections is a key security measure. It's a technical but important point: using a secure platform like Dext is a huge step, but it doesn't remove your own business's responsibility to manage user access securely. This includes deactivating accounts for former employees.

Getting Started with Dext: A 5-Step Guide

From my experience, getting started with Dext is straightforward if you follow a few key steps. This simple guide will help you get the most out of your trial period.

- Sign Up for the Trial: Go to the official Dext website and sign up for the 14-day free trial. You'll need an email and a password.

- Connect Your Accounting Software: This is the most important first step. Have your login information for Xero, QuickBooks, or another platform ready. This connection syncs your accounts and suppliers.

- Configure Your Submission Methods: Take a moment to note your unique Dext email-in address. Then, download the mobile app to your phone. I suggest focusing on mastering one submission method first before trying them all.

- Upload Your First Batch of Documents: Gather 5 to 10 recent receipts or invoices. Test out the different submission methods to see the workflow in action.

- Review and Publish: Go to your Dext inbox and see how the AI has extracted the data. Check it for accuracy, then click “Publish” to send it to your accounting ledger.

Is Dext the Right Tool for Your Business?

Who Should Use Dext?

Based on my analysis of its features and ideal use cases, Dext is an excellent fit for several types of users. You will likely find great value in Dext if you are one of the following:

- Small to medium-sized business owners who are tired of manual receipt and invoice management.

- Accountants and bookkeepers looking for an efficient way to automate data collection for their clients.

- E-commerce businesses that need to simplify the complex job of sales reconciliation.

- Companies that have employees in the field or multiple people who need to submit expenses regularly.

When Might Dext Not Be a Fit?

No tool is perfect for everyone. To build trust, it's important to be honest about a product's limitations. Dext might not be the best choice for you in a few specific situations.

- Businesses with a very low number of transactions (for instance, fewer than 10 documents per month) may find that manual entry is still simple enough.

- Companies that need complex, multi-level inventory management. Dext is not a full inventory system.

- Organizations looking for a single, all-in-one ERP solution that combines manufacturing, HR, and finance. Dext is a specialist in pre-accounting, not a generalist ERP.

I always advise that you evaluate a tool based on your main problem. If your primary need is inventory tracking, a dedicated inventory system should be your focus. That system might then integrate with a tool like Dext.

Disclaimer

The information about Dext Overview and Features presented in this article reflects our thorough analysis as of 2025. Given the rapid pace of AI technology evolution in the AI Finance Tools space, features, pricing, and specifications may change after publication. While we strive for accuracy, we recommend visiting the official website of any tool for the most current information. Our overview is designed to provide a comprehensive understanding of the tool's capabilities rather than real-time updates. For financial decisions with significant professional or compliance implications, we recommend consulting with a qualified financial advisor who can assess your specific situation.

I hope this expert look at the Dext Overview and Features has given you a clear picture of what this tool can do. My goal is always to provide you with the detailed, honest analysis you need to choose the right technology for your business.

Our Assessment Summary

- Best For: Accounting firms, e-commerce businesses, and any company handling 50+ financial documents monthly.

- Strongest Feature: The AI-powered data extraction with line-item recognition and high accuracy rates.

- ROI Potential: Significant, especially for businesses processing 100+ documents monthly or using e-commerce reconciliation.

- Learning Curve: Moderate; expect 2-3 weeks for full team proficiency, with simple core functions learnable in days.

Leave a Reply