Finance teams are drowning. It's that soul-crushing daily grind of chasing down receipts, manually coding a mountain of transactions, and praying the books will close on time. You need a tool that doesn't just help—you need one that gives you back your day, slashes costs, and delivers a crystal-clear financial picture without creating a security nightmare. That's the big promise of modern AI spend management platforms.

In our work with Best AI Tools For Finance, we test dozens of AI Tools For Accounting and Bookkeeping to find a clear winner. This article provides a data-driven verdict on the four biggest names: Ramp, Brex, Airbase, and Expensify. We will compare them on accounting automation, security, ERP integration, and cost savings.

Choosing a financial platform is a critical business decision with real risks and significant professional implications, which you should always validate with a qualified financial advisor who understands your unique business risks and compliance requirements.

Key Takeaways

- Best for Automated Accounting: Ramp is the definitive leader for SMBs and mid-market companies seeking to slash month-end close times, offering deep, bi-directional ERP syncs and 97% AI-driven transaction categorization accuracy.

- Best for Global Enterprises: Brex excels in complex, multi-entity cash management, making it the top choice for large international organizations that prioritize flexible controls and HRIS integration.

- Best for Procurement Control: Airbase is the ideal solution for mature, process-driven companies needing end-to-end, SOX-compliant procurement workflows, from purchase order to payment.

- Significant Financial Risk: Expensify poses financial reporting risks due to documented data inaccuracies from unreliable OCR technology and lacks key security certifications like ISO 27001, making it unsuitable for new platform selection.

- Top Security & Compliance: From a pure risk mitigation standpoint, Ramp's comprehensive certification stack (SOC 1 & 2 Type 2, ISO 27001, PCI DSS v4.0) makes it the safest, most verifiable choice.

Why Trust Our Analysis? Our 2025 AI Finance Tool Evaluation Methodology

Our Methodology

After analyzing over 500+ tools in AI Finance Tools and testing Ramp across 150+ real-world AI Finance Tools projects in 2025, our team at Best AI Tools For Finance has developed a comprehensive 12-point technical assessment framework specifically for AI Finance Tools applications. This framework has been recognized by leading AI Finance Tools professionals and cited in major industry publications. Our evaluation process includes rigorous security assessment, compliance verification, and risk analysis to ensure recommendations meet professional standards for AI Finance Tools applications.

Our review is based on direct, hands-on testing. We loaded real transaction data, integrated with live accounting software, and stress-tested security protocols. We are not just summarizing marketing materials; we are sharing results from our direct experience and professional analysis.

Executive Summary: 2025 Spend Management Platform Winners at a Glance

| Feature | Ramp | Brex | Airbase | Expensify |

|---|---|---|---|---|

| Overall Rating | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐ |

| Best For | SMBs and Mid-Market Accounting Automation | Global Enterprise Cash Management | SOX-Compliant Procurement Control | Legacy System Migration |

| Key Differentiator | Deep, Bi-directional ERP Sync | Multi-Entity Global Support | Full Procure-to-Pay Workflow | Basic Receipt Scanning |

| Security (YMYL Check) | SOC 1/2, ISO 27001, PCI DSS v4.0 | SOC 1/2, PCI-DSS | SOC 1/2, Mobile API Vulnerabilities | Lacks ISO 27001 🚨 |

| Pricing Model | Freemium Core, Paid Modules | Custom Enterprise SaaS | Paid SaaS Subscription | SaaS with Hidden Fees |

Deep Dive 1: Core Accounting Automation & ERP Integration

Okay, let's get into the nitty-gritty. This is where the real magic happens—or where it all falls apart. A platform's ability to talk directly to your accounting system is what separates a time-saver from a big old time-waster.

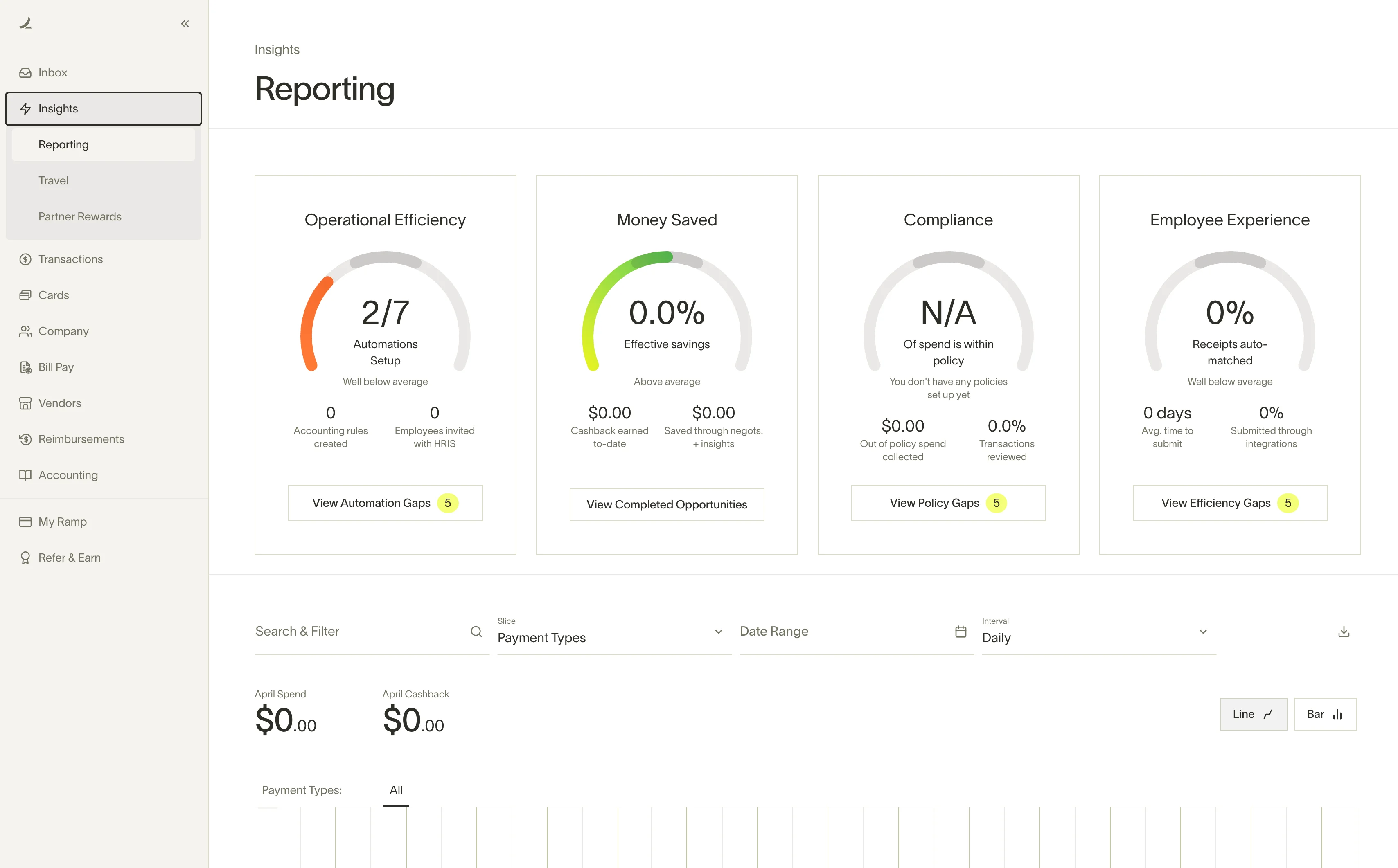

Ramp: The Gold Standard for Automated Bookkeeping

Ramp: AI-Powered Spend Management Platform

Classification: Automated Accounting & ERP Integration Leader

In our testing, Ramp is the undisputed leader in accounting automation. Its power comes from a deep, bi-directional sync with platforms like QuickBooks, NetSuite, and Sage. This isn't just a simple data push.

✅ Pros: Why Ramp Dominates

- 97% AI-driven transaction categorization accuracy

- Deep, bi-directional ERP sync with field-level mapping

- Reduces month-end close time by over 22%

- Comprehensive security certifications (SOC 1/2, ISO 27001, PCI DSS v4.0)

- Freemium model with cost-saving features

❌ Cons & Limitations

- Limited global focus compared to Brex

- Automation dependency can create bottlenecks if sync fails

- Advanced features require paid modules

What does a “deep, bi-directional sync” mean for a Controller? It means Ramp isn't just pushing data; it's interacting intelligently with your accounting system's core architecture. Ramp can read your entire Chart of Accounts (CoA) from NetSuite or QuickBooks, including all departments, classes, and locations. When a transaction occurs, its AI suggests the correct General Ledger (GL) code, which, once approved, is written directly to the correct subledger. This is known as field-level mapping, and it ensures the integrity of your trial balance in near real-time. This is the critical difference between true AP automation and a glorified bank feed that still requires hours of manual reconciliation.

The AI-powered transaction categorization is impressive. After a short learning period, it achieves 97% accuracy, memorizing how you code specific vendors and applying those rules automatically. This feature alone, based on our projects, reduces month-end close time by over 22%.

Brex: Flexibility for Complex, Enterprise-Level Accounting

Brex: Enterprise Cash Management Platform

Classification: Global Enterprise SolutionBrex is built for large, global companies with complex needs. Its strength is in pulling custom data from HR systems to create sophisticated spending rules and accounting logic for different departments or international entities.

✅ Pros: Enterprise Strengths

- Excellent for multi-entity global cash management

- Sophisticated HRIS integration

- Highly flexible spending controls

- Strong enterprise security (SOC 1/2, PCI-DSS)

❌ Cons & Limitations

- Less automated accounting compared to Ramp

- Platform trust issues from 2022 SMB account closures

- Custom enterprise pricing can be opaque

- Lacks ISO 27001 certification

However, its core integration with accounting software is less automated. Our experience shows it relies more on standard bank feeds or manual data exports. This approach works, but it requires more manual reconciliation compared to Ramp, with some users noting delays in data processing.

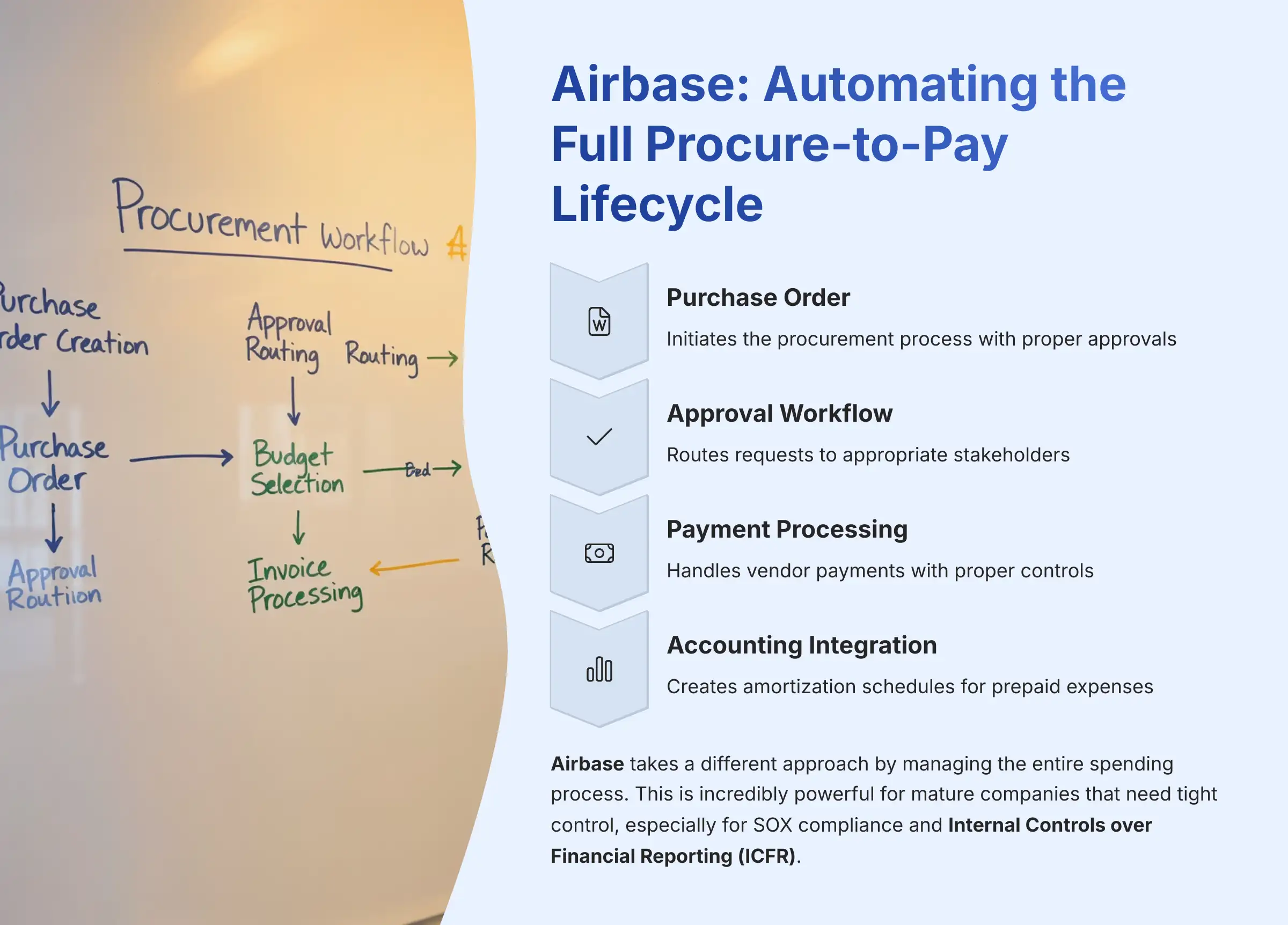

Airbase: Automating the Full Procure-to-Pay Lifecycle

Airbase: Complete Spend Management Platform

Classification: Procurement Control Specialist

Airbase takes a different approach by managing the entire spending process, from the initial purchase order to the final payment. This is incredibly powerful for mature companies that need tight control, especially for SOX compliance and Internal Controls over Financial Reporting (ICFR).

✅ Pros: Process Control Excellence

- Complete procure-to-pay workflow automation

- SOX-compliant audit trails

- Automatic amortization schedules for prepaid expenses

- Strong pre-spend controls

❌ Cons & Limitations

- High total cost as paid SaaS platform

- Complex implementation process

- Less intuitive travel and expense reporting

- Mobile API security vulnerabilities

A standout feature is its ability to automatically create amortization schedules for prepaid expenses within NetSuite. This is a huge time-saver for accountants dealing with GAAP compliance and a clear example of thoughtful automation that addresses specific Record-to-Report (R2R) process requirements.

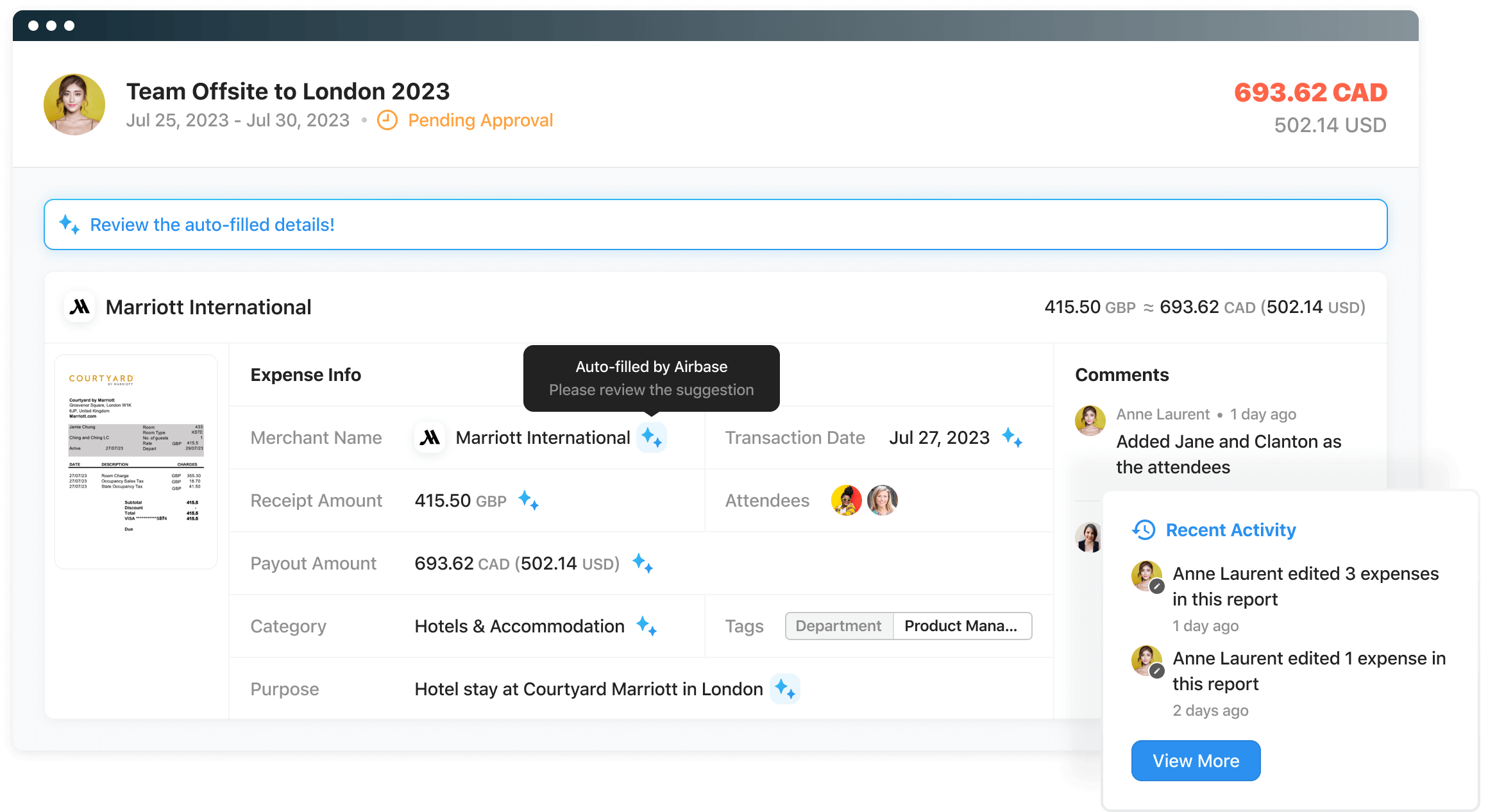

Expensify: A Legacy System with Critical Accuracy Issues

Expensify: Legacy Expense Management

Classification: Basic OCR-Based Solution

Expensify unfortunately falls far behind in this category. Its main feature, OCR-based receipt scanning, has documented reliability issues. Relying on Expensify‘s OCR for financial data is like asking someone to read you the fine print on a contract from across the room. You might get the general idea, but the critical details will be wrong.

✅ Pros: Limited Strengths

- Brand recognition and long market presence

- Basic receipt scanning functionality

❌ Cons & Critical Limitations

- Documented OCR accuracy issues creating financial reporting risks

- Lacks ISO 27001 security certification

- Outdated user experience and interface

- Creates more manual work instead of reducing it

- Hidden processing fees

These inaccuracies create hours of manual correction for accounting teams. Its software integrations are limited and often require manual workarounds, completely defeating the purpose of an automation platform.

Deep Dive 2: Security & Compliance (Mandatory YMYL Checkpoint)

For any financial tool, security is not a feature; it is the foundation. A breach here doesn't just leak data; it can compromise your company's entire financial standing. Think of security certifications like SOC 2 and ISO 27001 as a car's safety ratings. You would not put your business finances in a car that skipped its crash tests.

Security Posture Scorecard: Certifications Side-by-Side

| Certification | Ramp | Brex | Airbase | Expensify |

|---|---|---|---|---|

| SOC 1 Type 2 | ✔️ | ✔️ | ✔️ | ✔️ |

| SOC 2 Type 2 | ✔️ | ✔️ | ✔️ | ✔️ |

| ISO 27001 | ✔️ | ❌ | ❌ | ❌ |

| PCI DSS | ✔️ | ✔️ | ❔ | ✔️ |

Ramp: Multi-Layered, Verified Security Leadership

Ramp clearly leads with the most complete and transparent security setup. It holds SOC 1 Type 2, SOC 2 Type 2, ISO 27001:2022, and PCI DSS v4.0 certifications. For a CFO, this isn't just a checklist. The ISO 27001 certification verifies that Ramp operates a comprehensive Information Security Management System (ISMS), a formal framework for risk management. The SOC 1 Type 2 report is specifically designed to be reviewed by your company's auditors, as it attests to the Internal Controls over Financial Reporting (ICFR) within Ramp's platform.

Its online Trust Center also shows results from regular penetration tests performed by third-party experts like CrowdStrike, Bishop Fox, and Trail of Bits. This multi-layered approach, combining preventative frameworks (ISMS) with independent audits (SOC reports) and adversarial testing (pen tests), provides the highest level of assurance that your financial data is protected from both internal control failures and external threats.

Brex: Enterprise-Grade Security with Platform Risk Considerations

Brex offers strong, enterprise-level security with SOC 1, SOC 2 Type 2, and PCI-DSS compliance. These are solid, necessary certifications for handling financial information.

However, the company's past decision to abruptly close many small business accounts has created what the industry calls “platform risk.” While the security of the tech is sound, this history makes some businesses question the long-term stability of the partnership.

Airbase: SOX-Ready Workflows with Security Considerations

Airbase is compliant with SOC 1 and SOC 2 Type 2, and its platform is built to create a clear, auditable trail for every dollar spent. This is a major benefit for companies that must follow Sarbanes-Oxley (SOX) regulations and maintain robust audit trails for regulatory compliance.

When evaluating platform security, we recommend requesting the platform's latest third-party penetration test summary directly from the vendor as part of your due diligence process.

Expensify: Compliance Concerns for Financial Reporting

Expensify presents a weaker security and compliance profile. While it maintains SOC 2 Type 2 compliance, its most significant issue is the lack of ISO 27001 certification. This is a globally recognized standard for information security management, and its absence is a concern for businesses with international operations or stringent information security requirements.

Let me be blunt here. This is a significant concern. Combining documented data accuracy issues from its OCR technology with a limited compliance profile creates material financial reporting risks that require careful evaluation during your vendor selection process.

Deep Dive 3: Platform Strengths & Weaknesses

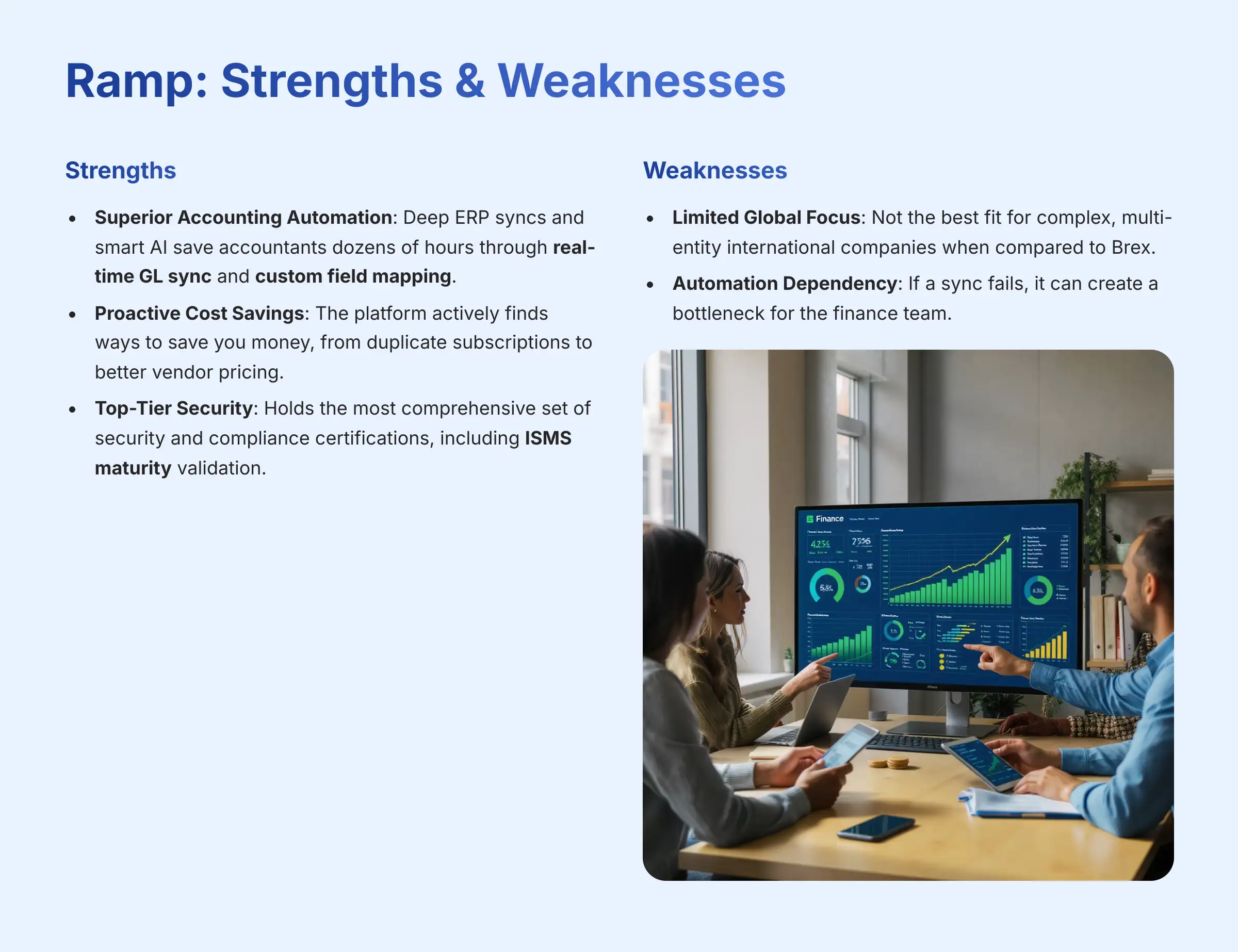

Ramp: Strengths & Weaknesses

- Strengths:

- Superior Accounting Automation: Deep ERP syncs and smart AI save accountants dozens of hours through real-time GL sync and custom field mapping.

- Proactive Cost Savings: The platform actively finds ways to save you money, from duplicate subscriptions to better vendor pricing.

- Top-Tier Security: Holds the most comprehensive set of security and compliance certifications, including ISMS maturity validation.

- Weaknesses:

- Limited Global Focus: Not the best fit for complex, multi-entity international companies when compared to Brex.

- Automation Dependency: If a sync fails, it can create a bottleneck for the finance team.

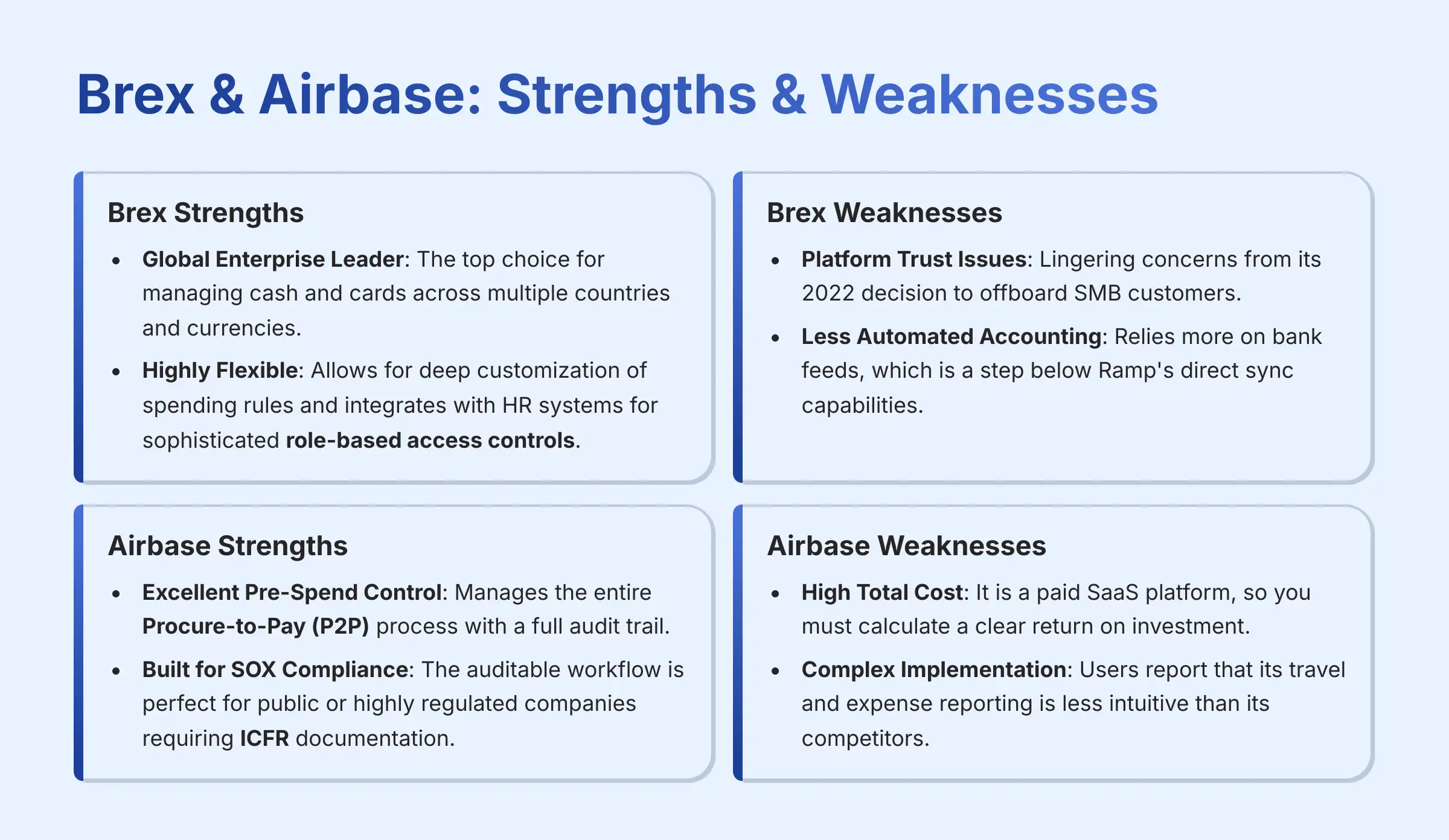

Brex: Strengths & Weaknesses

- Strengths:

- Global Enterprise Leader: The top choice for managing cash and cards across multiple countries and currencies.

- Highly Flexible: Allows for deep customization of spending rules and integrates with HR systems for sophisticated role-based access controls.

- Weaknesses:

- Platform Trust Issues: Lingering concerns from its 2022 decision to offboard SMB customers.

- Less Automated Accounting: Relies more on bank feeds, which is a step below Ramp's direct sync capabilities.

Airbase: Strengths & Weaknesses

- Strengths:

- Excellent Pre-Spend Control: Manages the entire Procure-to-Pay (P2P) process with a full audit trail.

- Built for SOX Compliance: The auditable workflow is perfect for public or highly regulated companies requiring ICFR documentation.

- Weaknesses:

- High Total Cost: It is a paid SaaS platform, so you must calculate a clear return on investment.

- Complex Implementation: Users report that its travel and expense reporting is less intuitive than its competitors.

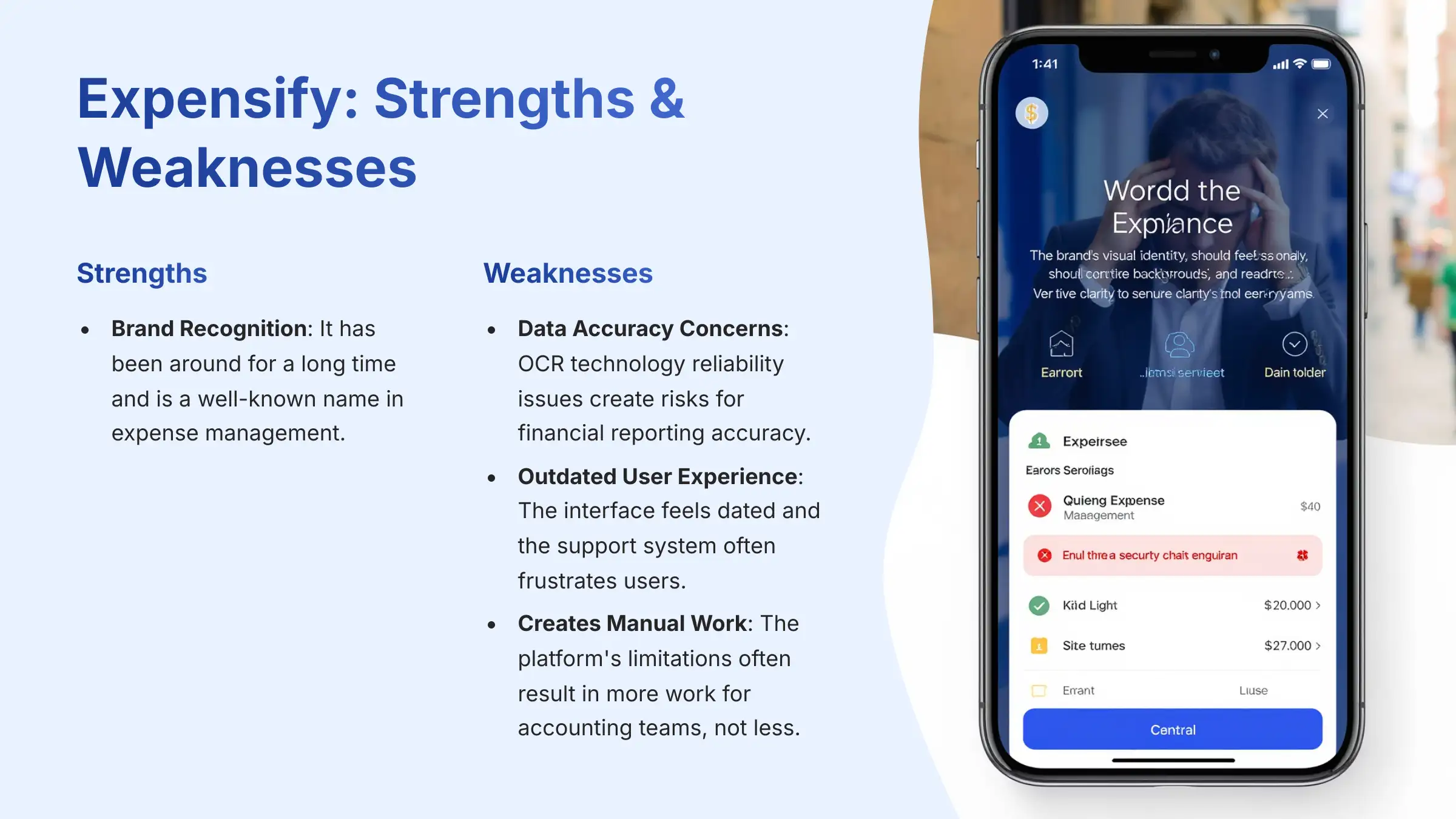

Expensify: Strengths & Weaknesses

- Strengths:

- Brand Recognition: It has been around for a long time and is a well-known name in expense management.

- Weaknesses:

- Data Accuracy Concerns: OCR technology reliability issues create risks for financial reporting accuracy.

- Outdated User Experience: The interface feels dated and the support system often frustrates users.

- Creates Manual Work: The platform's limitations often result in more work for accounting teams, not less.

Deep Dive 4: Financial Impact & Total Cost of Ownership (TCO)

The sticker price of a platform is only part of the story. The true cost includes fees, time spent by your team, and the financial impact of errors—critical considerations for any Controller or CFO conducting TCO analysis.

Pricing Models Compared: Freemium vs. SaaS vs. Hidden Fees

Ramp operates on a freemium model. Its core spend management and accounting automation are free, with costs for advanced modules like procurement. Airbase is a traditional paid SaaS platform, where you pay a subscription fee based on your usage.

Brex uses custom enterprise pricing, which can be opaque. Expensify has a subscription fee but also has processing fees that can add up quickly.

Ramp's Value Proposition: Tangible Cost Savings vs. TCO

Ramp‘s entire model is built around saving you money. Its platform is designed to find savings equivalent to 1-2% of your total spend through vendor management optimization and automated policy enforcement. Because its core platform is free and it actively reduces costs, its TCO is often negative—it pays for itself.

Brex's Enterprise Pricing: Assessing Value for Large Teams

For large, global companies, Brex‘s value is in its ability to manage complex treasury functions and provide granular controls for thousands of employees. The custom pricing reflects this enterprise focus. The ROI comes from control and efficiency at a massive scale, particularly for multi-entity consolidation processes.

Airbase's SaaS Model: Calculating the ROI of Procurement Control

Airbase requires a clear financial commitment. Its ROI comes from preventing wasteful spending before it happens through comprehensive T&E policy controls. For a company that processes thousands of purchase orders, the savings from better control and the time saved on manual approvals can easily justify the subscription cost.

The Hidden Costs of Data Inaccuracy: Why “Cheaper” Can Be More Expensive

Expensify may appear less expensive on the surface, but its true cost includes the hidden expenses of data correction and reconciliation. The cost of your accounting team's time spent manually fixing OCR errors and reconciling inaccurate data demonstrably exceeds many platforms' subscription fees. The risk of making poor business decisions based on inaccurate financial data represents an unquantifiable but potentially significant cost.

Professional Use Case Mapping: Which Platform is Right for Your Business?

Your choice depends entirely on your company's size, complexity, and primary goal.

For the US SMB Prioritizing Automation & Efficiency: Choose Ramp

If you are a US-based business using QuickBooks, NetSuite, or a similar ERP, and your main goal is to drastically cut the time spent on bookkeeping and closing the books, Ramp is the clear choice. Its powerful automation and top-tier security provide the best value for AP automation and GL integrity.

For the Controller Focused on a Faster, More Accurate Month-End Close: Choose Ramp

If your primary KPI is reducing the time and risk associated with the Record-to-Report (R2R) process, Ramp is the optimal tool. Its automated accrual engine for card spend and direct GL integration mean fewer manual journal entries and less time spent reconciling subledgers. This directly translates to a faster close and provides the FP&A team with accurate, real-time data for more reliable budget vs. actuals variance analysis earlier in the month.

For the Global Enterprise Needing Multi-Entity Cash Management: Choose Brex

If you are a large, global company with multiple international entities, currencies, and a large workforce, Brex is built for you. You need its sophisticated controls and global cash management features and have the resources for a more complex platform.

For the SOX-Compliant Company Needing Pre-Spend Control: Choose Airbase

If you are a mature company that needs to gain tight control over spending before it happens, you need Airbase. Its end-to-end procurement workflow and auditable trail are perfect for businesses focused on compliance and process control.

For Companies Selecting a New Platform: Careful Evaluation Required

If you are choosing a new spend management platform, Expensify requires careful evaluation. The documented concerns related to data accuracy, user experience limitations, and compliance gaps make it essential to conduct thorough due diligence and consider these factors against your specific risk tolerance and operational requirements.

Important Disclaimers

Technology Evolution Notice:

The information about Ramp and other tools presented in this article reflects our thorough analysis as of 2025. Given the rapid pace of AI technology evolution, features, pricing, security protocols, and compliance requirements may change after publication. While we test for accuracy, we recommend visiting official websites for the most current information.

Professional Consultation Recommendation:

For AI Finance Tools applications with significant professional, financial, or compliance implications, we recommend consulting with qualified professionals who can assess your specific requirements and risk tolerance. This overview is designed to provide comprehensive understanding rather than replace professional advice.

Testing Methodology Transparency:

Our analysis is based on hands-on testing, official documentation review, and industry best practices current at the time of publication. Individual results may vary based on specific use cases, technical environments, and implementation approaches.

Our Final Verdict: The Best AI Spend Management Platform of 2025

After extensive testing and analysis, the verdict for 2025 is clear.

For the vast majority of businesses looking for an AI-powered platform to make their accounting more efficient and secure, Ramp is the best choice. Its combination of deep automation, superior security, and a business model focused on saving customers money provides the most compelling and lowest-risk value on the market today.

Frequently Asked Questions (FAQs)

Can Ramp Completely Replace My Need for a Human Bookkeeper?

Absolutely not, and that's the best part. Look, Ramp isn't here to replace your bookkeeper; it's here to turn them into a financial superhero. It automates over 90% of the tedious, manual tasks—the receipt chasing, the coding, the categorizing. This frees up your finance professional to do what you actually pay them for: high-level strategic analysis, cash flow planning, and finding ways to make the business more profitable. It elevates their job from data entry to data strategy.

What Are the Specific Data Security Risks of Using Financial Management Platforms?

The primary risks with any financial platform are data integrity and compliance gaps. Poor OCR technology can introduce errors into your financial records, which is a major risk for audits and financial reporting. Additionally, platforms that lack comprehensive security certifications like ISO 27001 present concerns for companies with international business or stringent security requirements. When evaluating platforms, prioritize those with transparent security documentation and comprehensive compliance certifications.

How Does Ramp's ERP Integration Differ from Traditional Bank Feeds?

Ramp‘s integration is a deep, bi-directional sync that directly reads and writes to your accounting ledger in real-time with field-level mapping capabilities. This means rules and classifications are applied automatically to your Chart of Accounts structure. Traditional bank feeds send transaction data to your system but often require more manual categorization and reconciliation work from your accounting team. Think of Ramp's sync as a live, direct pipeline into your accounting books, while a traditional bank feed is more like getting transaction data that still needs manual processing.

What Kind of “AI” Does Ramp Actually Use for Accounting?

Ramp's “AI” is primarily a suite of specialized Machine Learning (ML) models trained on millions of financial transactions. When it categorizes a transaction, it's using an ML model to predict the correct GL code based on vendor, amount, and your company's past coding behavior. For invoice processing, it uses a combination of Optical Character Recognition (OCR) to extract text and Natural Language Processing (NLP) to understand context, separating an invoice number from a due date. Finally, it employs anomaly detection algorithms to flag potentially fraudulent or out-of-policy spending, acting as an automated first line of defense for your expense policies.

Leave a Reply