Key Takeaways

- All-in-One Platform: Ramp consolidates corporate cards, expense management, bill pay, and accounting automation into a single, cohesive system, eliminating the need for multiple point solutions.

- AI-Powered Savings: The platform's core Ramp Intelligence engine proactively analyzes spending to identify savings opportunities and provides access to features like Price Intelligence to make sure you're not overpaying for software and services.

- Freemium Business Model: Ramp's core platform is free to use, with revenue generated from interchange fees. This includes unlimited 1.5% cashback on all card spending, directly aligning the platform's success with customer savings.

- Accelerated Financial Operations: By automating manual tasks, Ramp's marketing materials show it can help accelerate month-end financial closes by up to 8x, freeing up finance teams to focus on strategic initiatives.

- Enterprise-Grade Security: Ramp is built with robust security and compliance features, including SOC 2 Type 2 certification and adherence to PCI DSS and GDPR standards, making it a trusted choice for businesses handling sensitive financial data.

As an expert who has spent years analyzing financial technology, I've seen countless tools that solve one piece of a puzzle. Ramp, however, is a finance automation platform that addresses the entire spend lifecycle. It combines corporate cards, expense management, bill payments, and accounting into a single, AI-powered system. My work focuses on identifying solutions that genuinely save businesses time and money. Ramp is built to move finance departments from tedious, manual work to a position of strategic oversight.

This platform is a leading solution in the AI Tools For Accounting and Bookkeeping space. It uses artificial intelligence to give you real-time visibility into spending and automatically finds ways to save. This overview will take a deep look at Ramp's features, technical details, security, and pricing. I will show you how it works and what makes it a powerful option for modern finance teams.

What Is Ramp and How Does It Work?

Ramp is officially defined as a finance automation platform. Founded in 2019 by Eric Glyman and Karim Atiyeh, the company is headquartered in New York City and has become a major fintech player, processing billions in transaction volume. The platform's primary goal is to shift finance teams from reactive, manual work like chasing receipts to proactive, strategic activities like analyzing spend and finding savings.

Think of Ramp as the central nervous system for all non-payroll company spending. At its core is “Ramp Intelligence,” a technology layer that uses advanced models from OpenAI to understand context and automate complex tasks. Finance automation is the process of using technology to handle repetitive financial duties like data entry, transaction categorization, and reconciliation. This frees up your team for high-value analysis and strategy.

In enterprise finance, this entire process is known as the Procure-to-Pay (P2P) cycle. Ramp's innovation is unifying the disparate parts of this cycle—from purchase requisition to vendor payment and final automated reconciliation—into a single platform. The AI doesn't just categorize transactions; it learns your company's Chart of Accounts (CoA) to apply the correct General Ledger (GL) codes, a critical step for accurate financial reporting and a streamlined month-end close.

Ramp is designed to solve the entire spend management problem, not just one piece of it. And its true power is unlocked when you use its components together. The synergy between its corporate cards, expense management, and bill pay provides a complete, real-time picture of your company's finances.

Try Ramp FreeCore Features and Capabilities: A Technical Breakdown

Spend Management and Corporate Cards

In my analysis, Ramp's spend management is built around its powerful corporate card program. The system is designed to automate expense reporting from the moment a purchase is made. This eliminates the manual work that plagues most finance teams.

- Unlimited Corporate Cards: You can issue unlimited physical and virtual corporate cards to employees. In my experience, using virtual cards for specific vendors or one-time purchases is a best practice for enhancing security and budget control.

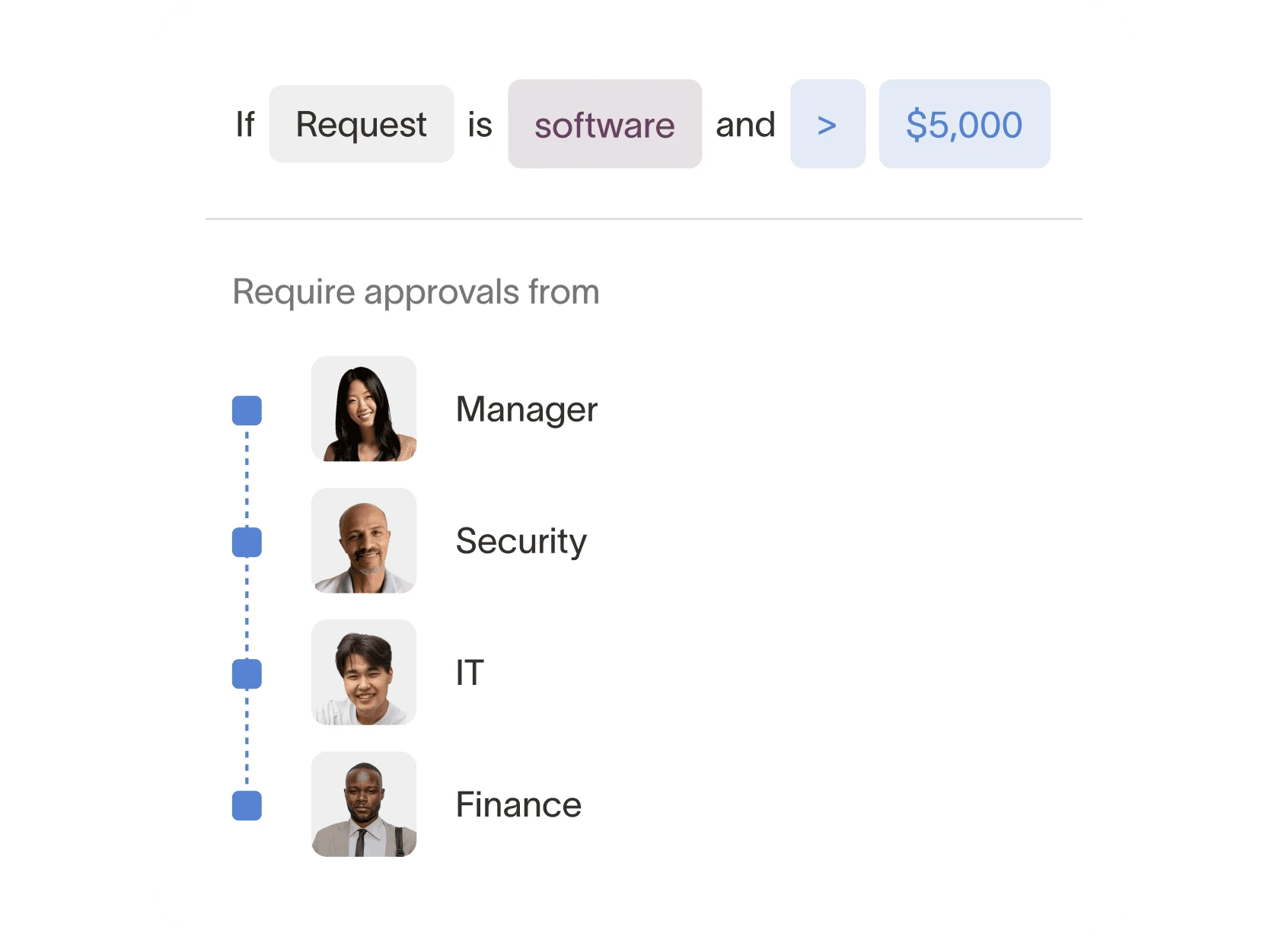

- Built-in Spending Controls: Administrators set spending policies directly on the cards. This includes setting limits, restricting merchant categories, and requiring receipts for purchases over a certain amount.

- Automated Expense Reporting: When an employee makes a purchase, Ramp automatically texts or emails them a request for the receipt. The system then uses AI-powered receipt matching and OCR to auto-categorize the expense and sync it to your accounting software.

- Real-Time Monitoring: All transactions appear on the dashboard in real-time, giving finance managers immediate visibility. The platform offers unlimited 1.5% cashback on all card spending, a key data point for calculating its value.

But here's the deal: these controls are only as smart as you make them. A sloppy policy setup will get you sloppy results. My professional advice is to treat the initial policy configuration as the most important part of the entire setup process—it's the foundation for everything else.

Accounts Payable Automation

Ramp extends its automation capabilities to accounts payable, streamlining how you pay bills. This system is designed to take an invoice from receipt to reconciliation with minimal human touch. My professional advice is to set up a dedicated email inbox for vendors that forwards directly to Ramp, which allows for full automation of invoice ingestion.

- AI-Assisted Bill Pay: The platform uses AI to process invoices sent to a dedicated email address. It extracts key data points like vendor name, invoice number, due date, and amount.

- Automated Invoice Processing: Ramp reports 98.5% line-item extraction accuracy with its Optical Character Recognition (OCR) engine. OCR is the technology that “reads” text from an image, like a PDF invoice, and converts it into digital data.

- Three-Way Matching: For businesses on its enterprise plan, Ramp supports three-way matching. This is a fraud-prevention process that makes sure a payment is valid by matching the invoice to its corresponding purchase order and item receipt.

- Global Payments: You can pay bills to vendors in over 195 countries. The system handles the currency conversion and payment routing automatically.

- Vendor Master File Integrity: The platform centralizes all vendor information, helping maintain a clean vendor master file. By automatically flagging potential duplicate invoices or vendors, it reduces the risk of erroneous payments and strengthens fraud prevention controls, a key responsibility for any AP Specialist.

It is important to know that advanced features like three-way matching are typically part of Ramp's paid enterprise plans.

AI-Powered Intelligence and Procurement Features

What truly sets Ramp apart in my view are its AI-driven intelligence features. This is the “brain” that turns financial data into actionable savings and risk-mitigation strategies. These features look beyond simple automation to provide predictive and analytical insights.

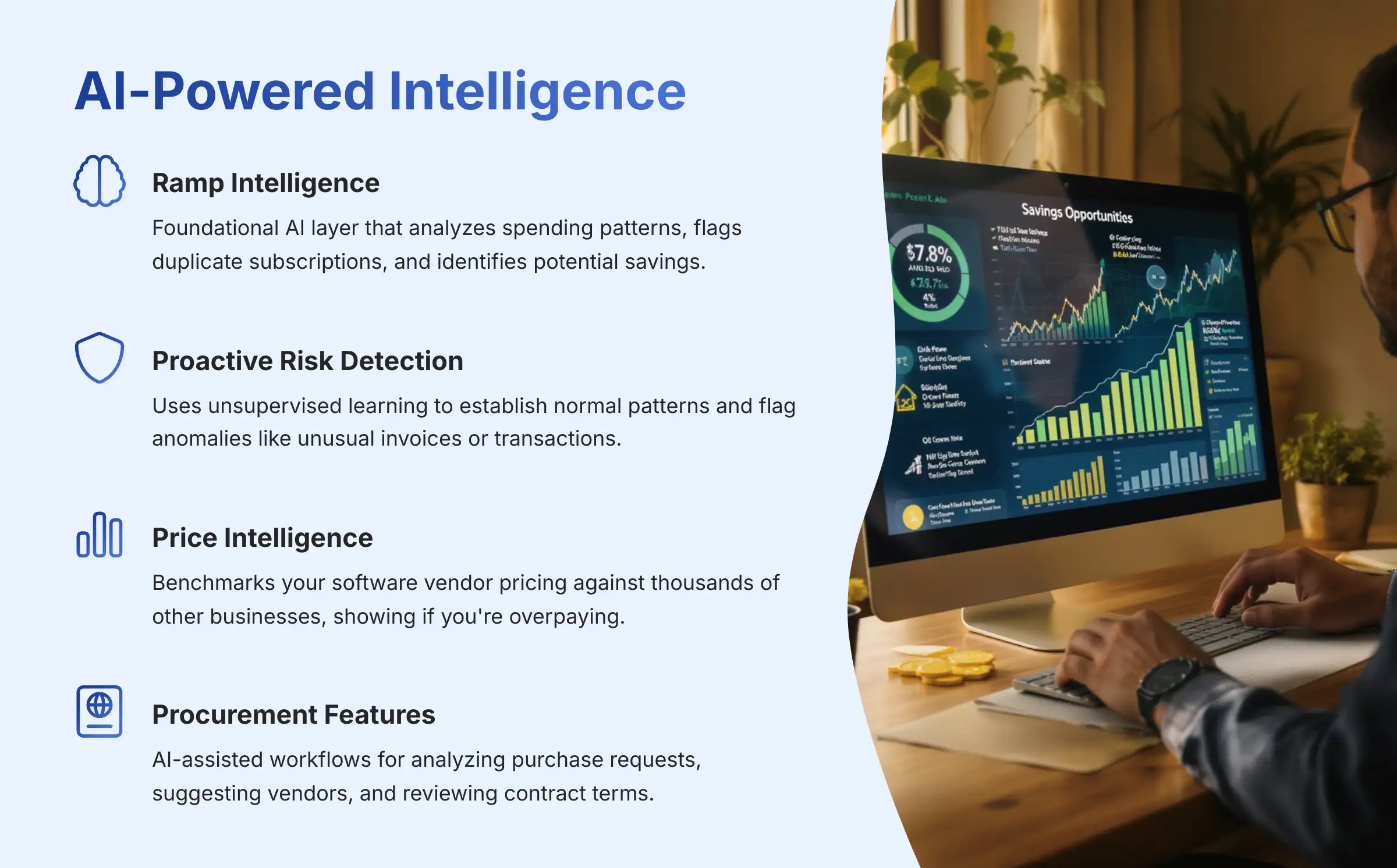

- Ramp Intelligence: This is the foundational AI layer that analyzes spending patterns, flags duplicate subscriptions, and identifies areas for potential savings across the entire platform.

- Proactive Risk Detection: Ramp's proactive risk detection capabilities are an integrated part of its core platform intelligence. It uses powerful AI methods called unsupervised learning. Think of it like a security guard who works at your company for a month. It doesn't need a list of rules; it just observes everything to figure out what “normal” looks like. The moment it sees something odd—like an invoice from a new vendor for a strange amount at 2 a.m.—it flags it for review.

- Price Intelligence: This tool gives you negotiating power. It benchmarks your software vendor pricing against the anonymized data of thousands of other businesses on Ramp, showing you if you are overpaying.

- Procurement Features: The advanced procurement features, including AI-assisted workflows and purchase order management, are part of the Procurement module, which is a core component of the Ramp Enterprise plan. This includes AI assistance for analyzing purchase requests, suggesting the best vendors, and reviewing contract terms for risks or opportunities.

A key warning is that the effectiveness of these AI models relies on the quality and completeness of your integrated data. For the best results, Ramp should be connected to both your accounting software and your HR information system (HRIS). Without both data sources, the predictive capabilities will be reduced.

Security and Compliance: A YMYL Deep Dive

For any finance tool, security is not just a feature; it is the foundation of trust. In my assessment of YMYL products, Ramp demonstrates a strong commitment to enterprise-grade security and compliance, giving you peace of mind that your company's financial backbone is protected. This is a topic where professional consultation with a security expert is always a good idea for any business.

Ramp's infrastructure is built to protect sensitive financial data. The company has undergone independent audits to verify its security controls. This is what you need to know:

- SOC 2 Type 2 Certification: This is a key certification for any modern software company. In practical terms, it means an independent auditor has verified that Ramp not only has strong security policies in place but that it also consistently follows them over time.

- PCI DSS Level 1 Compliance: This is the highest level of compliance for handling credit card data, the same standard required for major banks. It makes sure that all cardholder information is stored and transmitted securely.

- Data Protection Standards: Ramp adheres to both GDPR for protecting the data of European Union residents and CCPA for California residents. All sensitive data is protected with AES-256 bit encryption, both at rest and in transit.

- Access Controls: The platform integrates with Single Sign-On (SSO) providers like Okta and Azure AD. My advice for any business is to enforce SSO and two-factor authentication for all users to maximize security.

- Immutable Audit Trail: Beyond certifications, the platform provides a complete and unchangeable digital record for every transaction. For a Financial Controller, this immutable audit trail is critical for both internal controls and external audits, as it logs every purchase, approval, policy change, and sync to the GL.

While Ramp provides a secure platform, remember that ultimate security also depends on your own company's practices, like creating strong passwords and carefully managing user permissions.

Ramp Pricing and Plans (2025 Update)

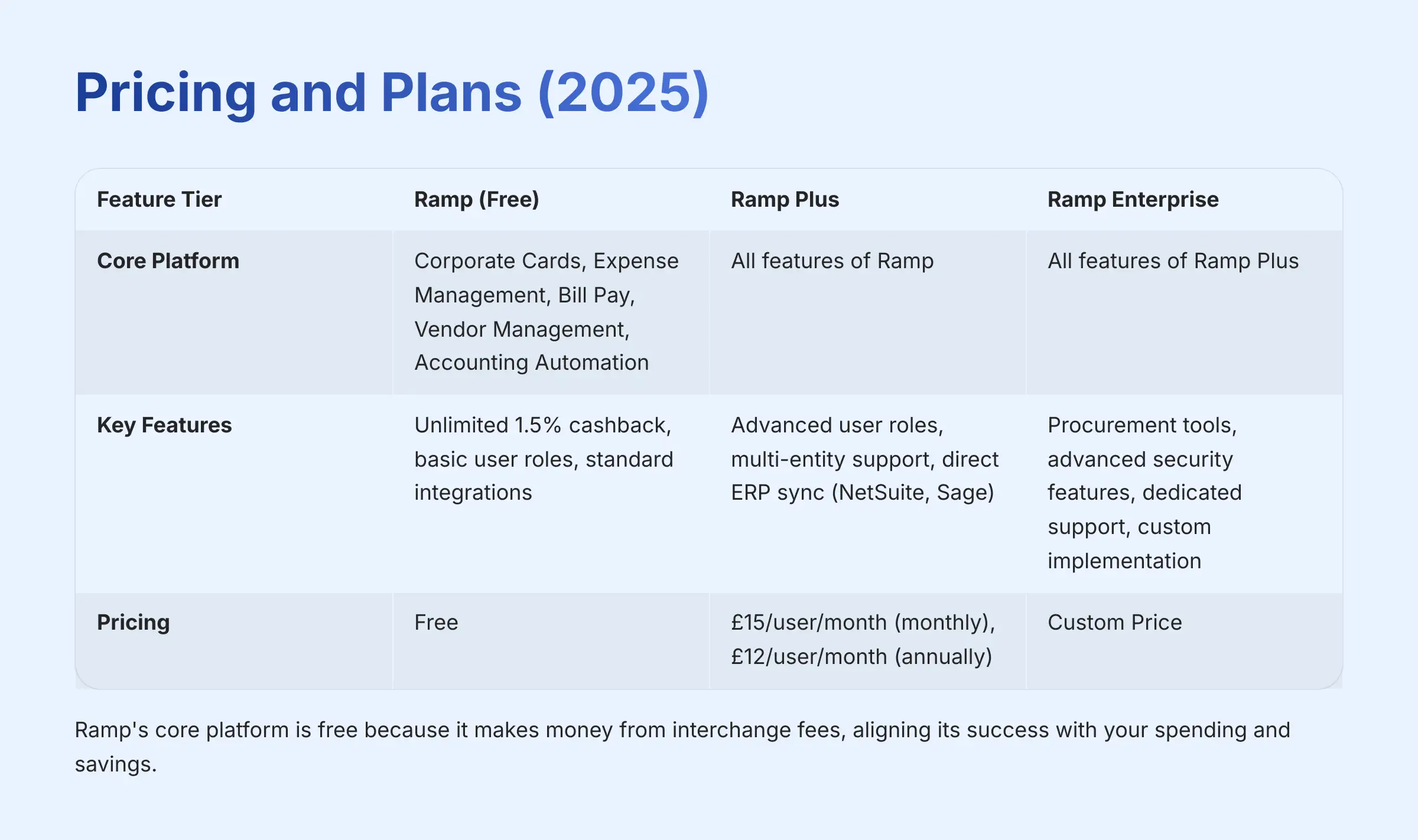

Ramp's pricing model is a key differentiator. The core platform is free to use because Ramp makes most of its money from interchange fees. An interchange fee is the small percentage that a merchant pays to card networks for processing a transaction. This model aligns Ramp's success with your spending and savings.

For businesses that require more advanced functionality, Ramp offers paid plans. In my professional opinion, most small-to-medium businesses will find the free “Ramp” plan incredibly powerful and sufficient. A business should only look at “Ramp Plus” when managing multiple legal entities or needing direct integration with an advanced ERP like NetSuite.

| Feature Tier | Ramp (Free) | Ramp Plus ($15/user/month monthly, $12/user/month annually) | Ramp Enterprise (Custom Price) |

|---|---|---|---|

| Core Platform | Corporate Cards, Expense Management, Bill Pay, Vendor Management, Accounting Automation | All features of Ramp | All features of Ramp Plus |

| Key Features | Unlimited 1.5% cashback, basic user roles, standard integrations | Advanced user roles, multi-entity support, direct ERP sync (NetSuite, Sage) | Procurement tools, advanced security features, dedicated support, custom implementation |

The price listed for Ramp Plus is per user, per month. The monthly billing price is $15 per user per month, while annual billing offers a discount at $12 per user per month. You should always inquire about potential discounts for annual billing. The Enterprise plan pricing is fully custom and requires a direct consultation with their sales team.

Get Started with RampUse Cases and Applications: Ramp in Action

Primary Use Cases for Finance Teams

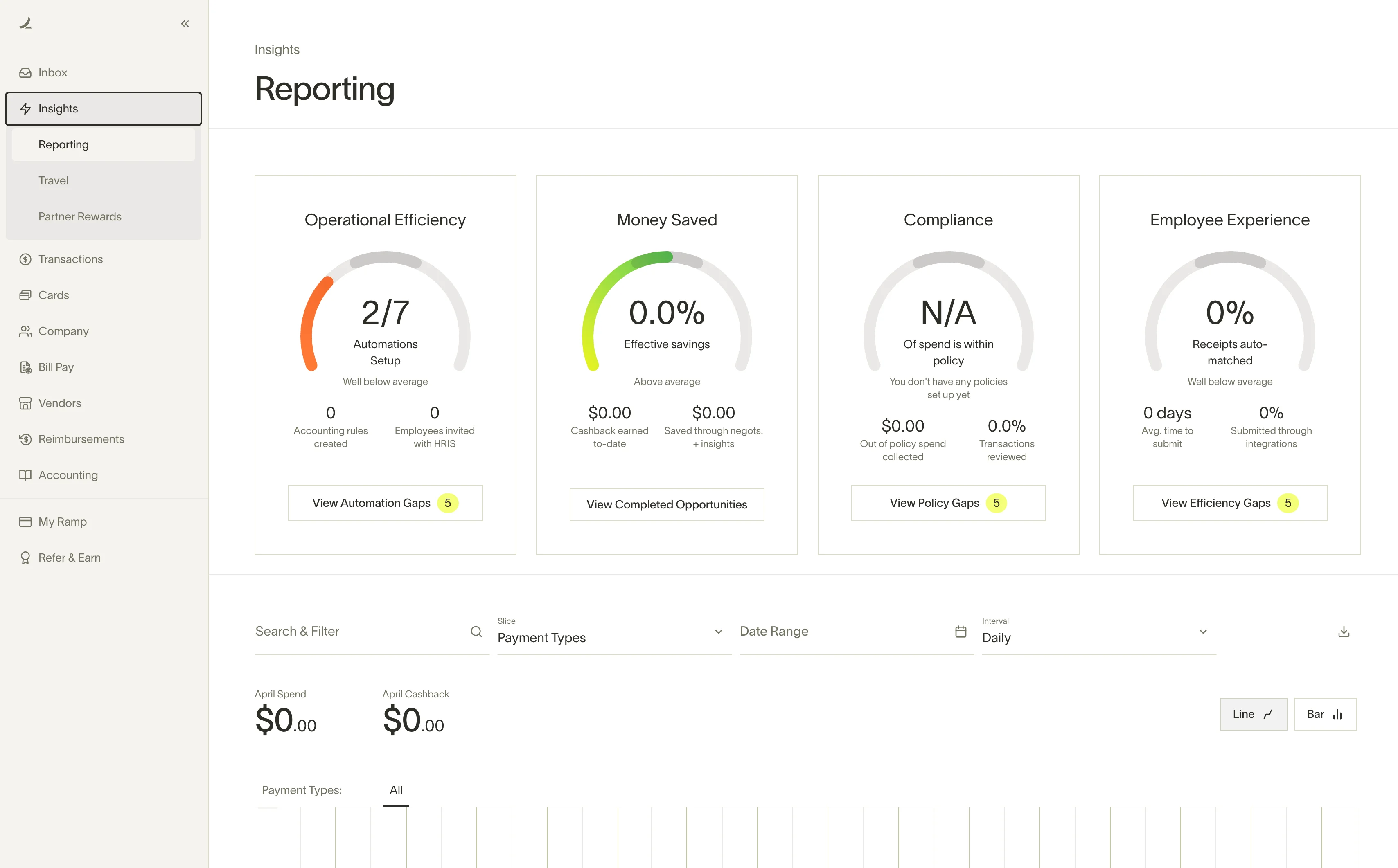

In practice, Ramp translates its features into tangible benefits that address the core jobs of a finance team. My analysis shows these are the primary applications where the platform delivers the most value.

- Automated Expense Management: This use case eliminates the need for manual expense reports. It is a huge time-saver for both employees and the finance team.

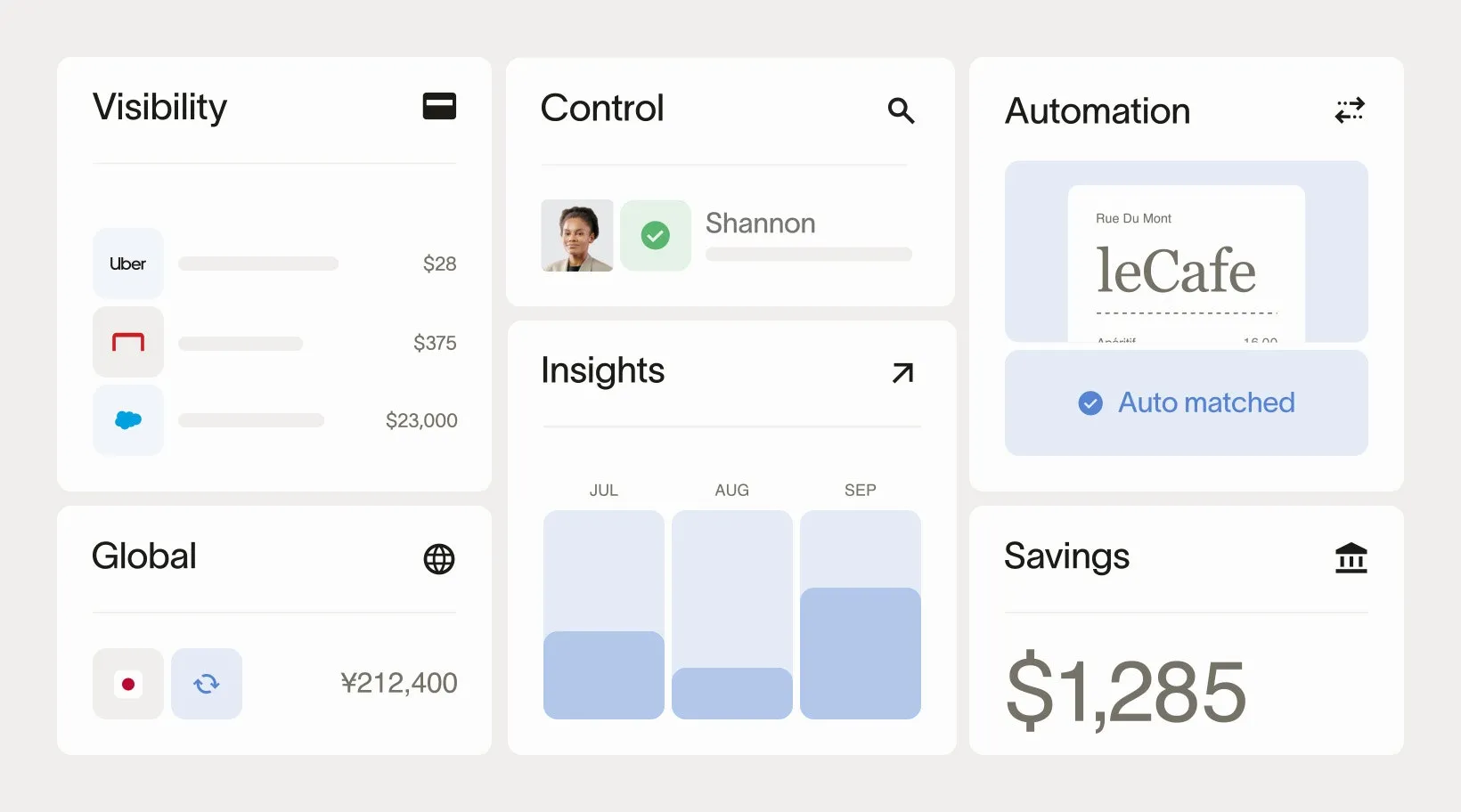

- Centralized Spend Control: Ramp provides a single dashboard to see all company spending in real-time. This helps prevent budget overruns and unauthorized purchases.

- Streamlined Accounts Payable: The platform automates the entire process of paying bills, from invoice capture to final payment and reconciliation in your accounting system.

- Strategic Procurement: With tools like Price Intelligence, finance teams can move from simply processing purchase orders to making data-driven decisions that save the company money.

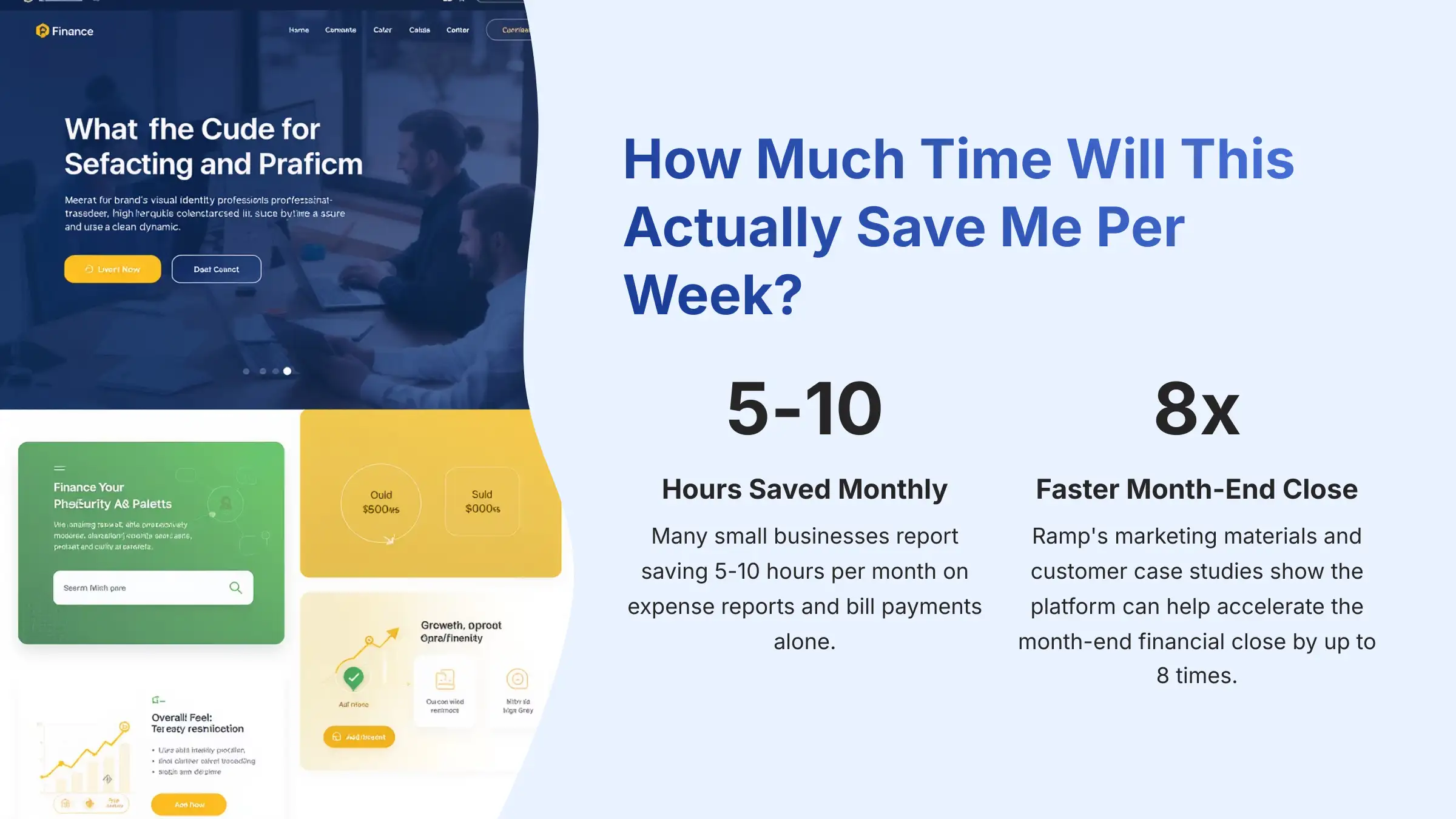

As evidence for these use cases, Ramp's marketing materials and customer case studies state that the platform can help accelerate the month-end financial close by up to 8x.

How Different Roles Benefit from Ramp

The platform is not just for finance leaders; it provides distinct benefits for individuals across the organization. Its design addresses the different pain points each role faces with company spending.

For employees, Ramp completely eliminates the need to file manual expense reports. After making a purchase, they simply take a picture of the receipt with the mobile app or forward an email, and Ramp handles the rest. This is a massive improvement in their daily work life.

For managers, the platform provides easy approval workflows and real-time visibility into their team's spending. They can approve or deny requests from their phone or laptop, giving them more control over their budgets without creating bottlenecks.

For Finance Leaders and CFOs, this is where the game changes. Instead of getting a month-old report, you get a live dashboard showing you that the marketing department has already spent 75% of its monthly SaaS budget by the 12th. You can see duplicate software subscriptions in real-time, not after you've paid the invoice twice. Ramp turns you from a financial historian into a strategic operator who can actually impact the bottom line before the month closes.

Ultimately, this transforms the finance department's role, enabling a modern FinOps (Financial Operations) approach where technology drives efficiency and financial data is leveraged as a strategic asset across the entire organization.

Integration and Ecosystem: Connecting Your Tech Stack

No financial tool exists in a vacuum. A platform's true power is often determined by how well it connects to a company's existing software ecosystem. In my experience, the deepest value from Ramp comes when you integrate it with both an accounting system like NetSuite and an HRIS like Gusto.

Ramp offers deep, bi-directional integrations. A bi-directional integration means that data not only flows from Ramp to your accounting software but also flows from your accounting software back to Ramp, keeping both systems perfectly in sync. For custom needs, Ramp also provides a RESTful API.

Here are some of its key integrations, grouped by category:

- Accounting/ERP: QuickBooks, Xero, NetSuite, Sage Intacct, SAP S/4HANA.

- HRIS: Workday, Gusto.

- Productivity: Slack, Microsoft Teams.

- Security/Identity: Okta, Azure AD.

Be aware that the most advanced integrations, such as direct sync with NetSuite or SAP, are typically reserved for the paid “Ramp Plus” or “Enterprise” plans. For specific implementation questions, consulting with a systems integration specialist is recommended.

Technical Specifications and Requirements

Here is a quick reference table with the essential technical details for any IT or finance team considering the platform. As a cloud-based service, the requirements are straightforward.

| Specification | Details |

|---|---|

| Supported Platforms | Web (Chrome, Safari, Firefox, Edge), Mobile (iOS, Android) |

| System Requirements | Standard computer with stable internet connection |

| Input Formats | Images (JPG, PNG), Documents (PDF) for receipts/invoices |

| Output Formats | Direct sync with ERPs; CSV for manual reports |

| Performance Metrics | Real-time transaction data; Ramp reports 98.5% OCR accuracy |

It is important to know about a specific technical limitation: Full functionality of advanced AI features like Ramp's forecasting capabilities requires integration with both an accounting provider and an HRIS provider to access the necessary data for modeling. Without both data sources, the model's accuracy will be reduced.

Getting Started with Ramp

Getting started with Ramp is designed to be a straightforward process. The platform even uses its own AI to ingest your existing financial policies from a PDF to speed up the configuration. My professional tip is to start with a small team as a pilot program before a company-wide rollout.

- Apply for an Account: The application is done online and requires you to provide official business information and link a corporate bank account for verification. This is a standard procedure for financial products.

- Configure Your Settings: Once approved, an administrator will configure spending policies, set up user roles and permissions, and connect Ramp to your accounting software.

- Deploy and Onboard: The fastest way to get started is by issuing virtual cards to employees for immediate use while physical cards are mailed. You can then onboard teams and show them how to submit receipts.

Disclaimer

The information about Ramp presented in this article reflects our thorough analysis as of 2025. Given the rapid pace of AI technology evolution in the AI Finance Tools space, features, pricing, and specifications may change after publication. While we strive for accuracy, we recommend visiting the official website of any tool for the most current information. Our overview is designed to provide a comprehensive understanding of the tool's capabilities, not to replace a formal financial or technical evaluation. For complex implementations, we always recommend consulting with a qualified financial advisor or systems integration specialist to ensure the tool aligns with your specific business and compliance needs. Additionally, potential users should consider the insights and feedback from existing clients to gain a well-rounded perspective on practical applications. Each Ramp Review provides valuable user experiences that can highlight both strengths and weaknesses of the tool in real-world scenarios. This firsthand information is crucial for making an informed decision tailored to your organizational requirements. Additionally, users may find valuable insights in the Ramp FAQs, which address common questions and provide detailed answers regarding the platform's features and functionality. Engaging with these FAQs can enhance your understanding and assist in making informed decisions. Remember to explore user reviews and testimonials as well for a well-rounded perspective on the tool's performance in real-world scenarios. Additionally, to further assist users in maximizing the potential of Ramp, we encourage exploring various resources, including the Ramp Tutorial. This tutorial provides step-by-step guidance on utilizing the platform effectively. By leveraging these resources, users can enhance their understanding and application of Ramp’s features in their financial operations.

Frequently Asked Questions about Ramp

No. Ramp automates bookkeeping and data entry tasks, but it does not replace the strategic advice, tax planning, and final review that a human accountant or CFO provides. It empowers them by giving them clean, real-time data to work with, allowing them to focus on higher-value advisory work.

This varies by company size, but many small businesses report saving 5-10 hours per month on expense reports and bill payments alone. Ramp's marketing materials and customer case studies show that the platform can help accelerate the month-end financial close by up to 8 times, which is a significant time saving for any finance team.

Yes. Ramp is designed to scale from startups to mid-market companies. With features in its paid tiers like multi-entity support, advanced user roles, and direct integrations with major ERPs like NetSuite and SAP, it can grow with your business's complexity.

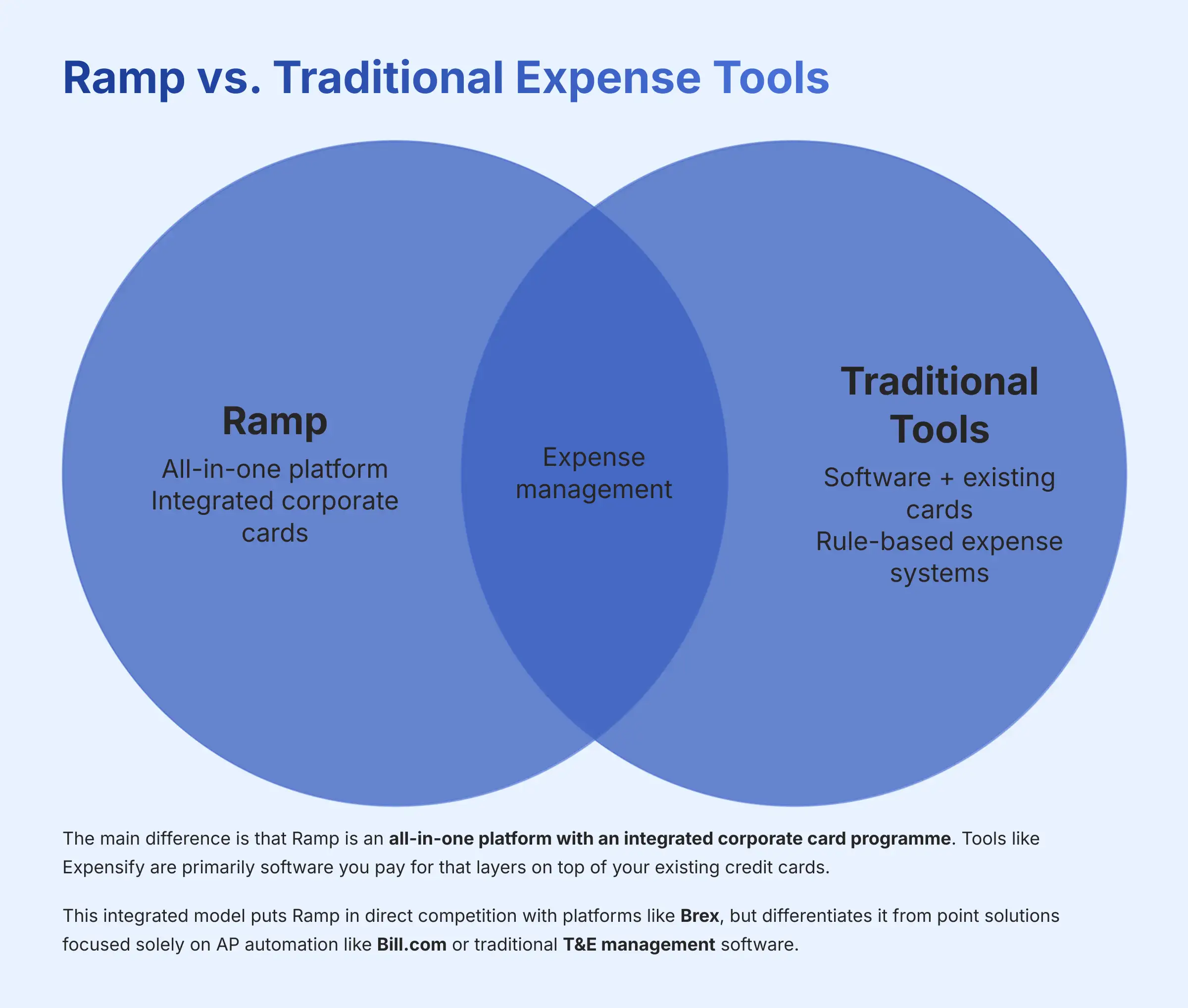

The main difference is that Ramp is an all-in-one platform with an integrated corporate card program. Tools like Expensify are primarily software you pay for that layers on top of your existing credit cards. Ramp's AI is also more context-aware, whereas many older tools rely on rigid, rule-based systems for approvals. This integrated model puts Ramp in direct competition with platforms like Brex, which also offer a unified card and software experience, but differentiates it from point solutions focused solely on AP automation like Bill.com or traditional T&E management software.

For a complete breakdown of features and current pricing, I recommend you review the information on the official product site for Ramp Overview and Features.

Leave a Reply