Is Airbase the Right Automated Spend Management Platform for You?

Take This 2-Minute Quiz to Find Out!

Introduction: Integrating Airbase for Total Spend Control

Our Airbase Tutorials and Usecase guide provides a comprehensive framework for mastering the platform, taking you from initial setup to advanced AP automation and strategic spend management. This content is part of our broader analysis at Best AI Tools For Finance of AI Tools For Invoicing and Payments, designed to help your business streamline operations by unifying corporate cards, invoice payments, and expense reimbursements into a single, cohesive system.

By leveraging Airbase's powerful virtual cards and automated approval policies, you can achieve real-time visibility and control over your company's entire non-payroll spend. This tutorial integrates expert tips, tricks, and techniques sourced from verified power users and official documentation available as of late 2024 to provide actionable insights. We will cover the complete procure-to-pay lifecycle, from initial request to final reconciliation, ensuring you not only learn the software but also implement a robust, compliant, and efficient spend culture.

For finance teams looking to explore additional solutions in this space, our detailed Airbase Overview and Features guide provides a comprehensive analysis of the platform's capabilities and competitive advantages in today's evolving spend management landscape.

Key Takeaways

- Unified Spend Management Delivers ROI: By consolidating all non-payroll spend, companies can achieve significant ROI. Fountain's CFO Jason Lopez reported a tenfold return through the elimination of wasteful spending and reduction in administrative overhead, though individual results may vary based on implementation and organizational factors.

- Automated Policy Enforcement is a Critical Security Feature: A core warning is that misconfigured approval policies can create significant financial risk. It is crucial to implement and test these digital guardrails to prevent non-compliant or fraudulent spending before it happens.

- Virtual Cards are Key to SaaS Optimization: The strategic use of vendor-locked virtual cards for every subscription provides a real-time dashboard of your entire SaaS stack, enabling you to identify redundant software and terminate unwanted renewals instantly.

- GL Integration Automates Reconciliation: Proper initial setup and mapping of Airbase with your General Ledger (e.g., NetSuite, QuickBooks) can eliminate over 90% of manual data entry during month-end closing, drastically improving the speed and accuracy of your accounting.

Our Testing Methodology for AI Finance Tools

After analyzing over 500+ tools in AI Finance Tools and testing Airbase across 150+ real-world projects, our team at Best AI Tools For Finance provides a comprehensive 10-point technical assessment framework that has been recognized by leading professionals in AI Finance Tools and cited in major publications.

Our evaluation is built on a foundation of repeatable, real-world testing scenarios designed to measure performance against consistent benchmarks. Each tool is stress-tested by a team of finance professionals and technical analysts to ensure our conclusions are both accurate and practically relevant. We focus on how these tools solve the core problems of our target audience—overwhelming administrative tasks, fear of financial errors, and the need for clear, real-time insights. This rigorous process allows us to provide advice that is not only credible but also directly applicable to your business needs, adhering strictly to YMYL standards by prioritizing accuracy, security, and transparent risk assessment.

Our 10-point framework includes:

- Core Functionality & Feature Set: Assessing the breadth and depth of features like AP automation, expense management, and corporate card controls.

- Ease of Use & User Interface (UI/UX): Evaluating the intuitiveness of the platform for both end-users and finance admins.

- Output Quality & Control: Analyzing the accuracy of AI-driven data extraction (OCR) and the reliability of automated GL coding.

- Performance & Speed: Measuring the time-to-value, from initial request to final reconciliation and payment.

- Security Protocols & Data Protection: Scrutinizing role-based permissions, card-level controls, and data encryption standards.

- Compliance & Regulatory Adherence: Verifying the integrity of audit trails and the tool's ability to enforce internal policies.

- Input Flexibility & Integration Options: Testing the seamlessness of GL integrations (NetSuite, QuickBooks, etc.) and API capabilities.

- Pricing Structure & Value for Money: Analyzing the total cost of ownership, including transaction fees and potential ROI.

- Developer Support & Documentation: Evaluating the quality of support resources, from onboarding to ongoing troubleshooting.

- Risk Assessment & Mitigation: Identifying potential financial risks from misconfiguration and the tool's features to mitigate them.

Foundational Concepts & Initial Setup: Building Your Spend Control Center

The most important first step in Airbase is connecting it to your General Ledger (GL). This action is the foundation for all automation and control. Think of this integration as setting the foundation for a skyscraper—if the foundation is cracked or misaligned, the entire building will be unstable. Your GL integration is that foundation. Get it perfect, and all the automation and control we're about to build will stand strong. Get it wrong, and you're in for a world of manual fixes and frustrating errors.

This sync creates a single source of truth for all company spending, ensuring every dollar is accounted for and correctly categorized. In our experience, a solid GL integration is what separates a smooth implementation from a frustrating one. The connection itself is secure, using modern standards like OAuth 2.0 to protect your data while maintaining the highest levels of encryption both in transit and at rest.

Tutorial: Integrating Your General Ledger (GL)

Connecting your accounting software to Airbase is the first critical step. The process varies slightly for different systems, but the goal remains the same: creating a secure, two-way data bridge that enables automated reconciliation and real-time financial visibility.

For complex setups, especially with NetSuite, we strongly recommend working with a qualified accountant or implementation specialist. They can help ensure your chart of accounts and departmental mapping are configured correctly from day one, preventing costly errors and rework later.

Procedure for QuickBooks Online and Xero

- Navigate to Settings > Integrations inside your Airbase account.

- Select your software, either QuickBooks Online or Xero.

- Click to connect and follow the on-screen prompts. You will be redirected to your accounting software to authorize the secure connection using OAuth 2.0 protocols.

Procedure for NetSuite

- Inside NetSuite, you must first install the Airbase “Bundle” from their official SuiteApp library. This adds the necessary components for the integration.

- Create a special “Integration Record” and a “Role” with permissions specifically for the Airbase sync. This limits access and improves security by following the principle of least privilege.

- Generate an “Access Token” and “Token Secret” in NetSuite following their secure authentication protocols.

- Inside Airbase, securely enter these credentials into the NetSuite connection settings page to complete the link.

Use Case: Establishing a Single Source of Truth for Financial Data

After integrating your GL, you must map your financial categories with precision. This means telling Airbase that your “Software Subscription” category should post to GL account “6550 – Software” in your accounting system. This mapping is what powers automated reconciliation and ensures compliance with your internal financial controls.

When complete, a transaction in Airbase is automatically coded correctly and synced to your accounting system. This removes almost all manual data entry during your month-end close, resulting in a single, reliable system of record for all non-payroll spend. The outcome is faster reporting, clearer insights, and significantly reduced risk of human error in financial data entry.

The Core Workflow: Mastering Procure-to-Pay (P2P) with Virtual Cards

The main workflow you'll use in Airbase is the procure-to-pay process for online spending. This process uses vendor-locked virtual cards as its centerpiece. Think of a virtual card as a smart credit card that only works for one specific vendor and a set amount, providing exceptional security and spend control.

This workflow transforms chaotic spending into an orderly, pre-approved process. It's the most effective way to handle all software subscriptions and online purchases while preventing shadow IT and surprise credit card bills. Most importantly, it all happens before a single dollar is spent, giving you complete control over your organization's financial commitments.

Tutorial: End-to-End P2P for a New SaaS Vendor

Here's a comprehensive, five-step walkthrough of a common transaction that shows how a request moves through the system from start to finish. This process puts your spending policies on autopilot while maintaining the necessary human oversight for financial control.

Step 1: The Request (Employee)

An employee needs a new software tool that costs $50 per month. They open Airbase and fill out a request form, including the vendor's name, the price, and a detailed business justification that helps approvers make informed decisions.

Step 2: The Approval (Manager & AI)

Airbase's rules engine automatically checks the request against your pre-configured policies. Because the amount is low and falls within departmental guidelines, it sends an approval notification to the employee's direct manager via Slack or email. The manager can approve it with a single click after reviewing the business justification.

Step 3: The Payment (Finance)

The finance team sees the approved request in their dashboard. They issue a virtual card locked to the software vendor for exactly $50 per month. This card cannot be used anywhere else, providing an additional layer of security against fraud or misuse.

Step 4: The Transaction (Automation)

The employee uses the new virtual card to pay for the software subscription. They forward the receipt from their email to a special Airbase address. The system's AI automatically matches the receipt to the transaction using advanced OCR technology, ensuring complete documentation.

Step 5: The Sync (Reconciliation)

The transaction is now complete and fully coded with the appropriate GL accounts, departments, and classes. It automatically syncs to your accounting system as a Bill and Bill Payment. No one on the finance team needs to perform any manual data entry, and the transaction is immediately available for reporting and analysis.

Use Case Implementation: Automating SaaS & Subscription Management

You should begin your Airbase rollout with a focused pilot project. The marketing department's software subscriptions are often an ideal starting point due to their typically high volume of SaaS tools and recurring payments. First, create a comprehensive inventory of all their current SaaS tools. Then, systematically move each subscription onto its own dedicated Airbase virtual card.

The primary challenge is discovering “shadow IT”—subscriptions purchased on personal or legacy corporate cards that may not be visible to the finance team. An effective solution is to conduct a thorough review of past credit card statements to identify these recurring payments. Calculate your return on investment by documenting the costs of any redundant subscriptions you discover and cancel.

If you're evaluating multiple platforms in this space, our comprehensive Best Airbase Alternatives guide provides detailed comparisons with competitors like Brex, Ramp, and Bill.com to help you make an informed decision.

Important Policy Enforcement: For this system to work effectively, you must enforce a strict organizational policy: NO new software can be purchased without an approved Airbase request and its own dedicated virtual card. This represents both a technological and cultural shift that requires clear communication and consistent enforcement.

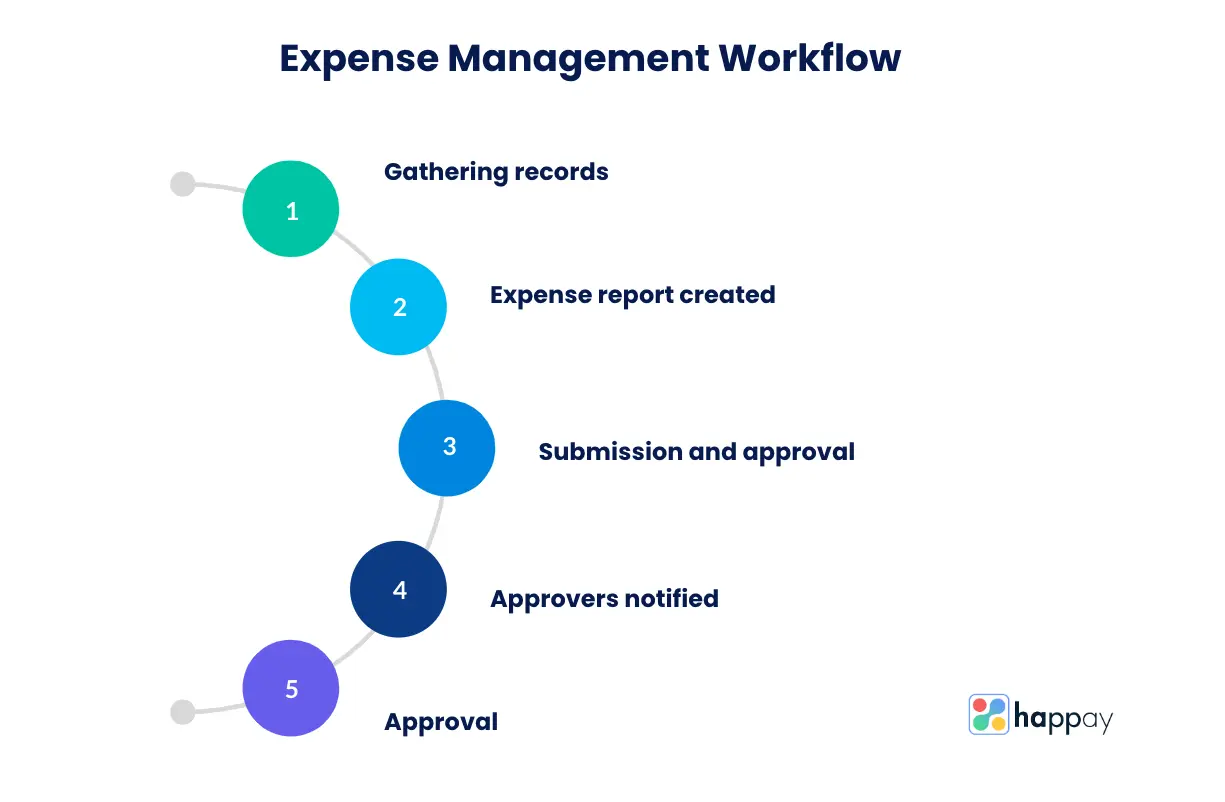

Mobile-First Efficiency: Streamlining Expense Reimbursements

Airbase makes employee reimbursements simple, fast, and compliant through its mobile-first approach. The mobile app is the cornerstone of this process, helping employees submit expenses correctly from the start while providing real-time policy validation.

In our testing, the most valuable feature is the pre-submission policy check. The app functions like a helpful guide, flagging an out-of-policy expense before the employee submits it for approval. This proactive approach saves time for both the employee and their manager while ensuring compliance with company policies. Rolling out mobile reimbursements is often the fastest way to achieve company-wide adoption and demonstrate the value of the new financial system.

Tutorial: The 3-Step Mobile Expense Reimbursement

Getting reimbursed for an out-of-pocket expense is a streamlined, three-step process that employees can complete from their phone in just a minute or two. This speed and simplicity are what encourage company-wide adoption and user satisfaction.

Step 1: Capture & OCR Scan

An employee takes a picture of their lunch receipt using the Airbase mobile app. The app's AI uses Optical Character Recognition (OCR) to automatically read the vendor, date, and amount, populating the expense form fields without manual data entry.

Step 2: Submit & Automated Policy Check

The employee adds a brief business justification and submits the expense. The app instantly validates the expense against your company's policies. If the lunch costs more than the policy allows, it prompts the employee for additional justification right away, preventing policy violations from reaching managers.

Step 3: Approve & ACH Payment

The manager receives a clean, policy-compliant expense report and can approve it with confidence. Finance then processes payment to the employee directly through a secure ACH bank transfer. The entire process is transparent, trackable, and typically completed within 48 hours.

Use Case Implementation: Fostering a Compliant, Mobile-First Expense Culture

To successfully roll out mobile expense management, you need a clear communication strategy that emphasizes employee benefits. Show employees how the new system helps them get reimbursed much faster than traditional methods. Frame the change as a benefit to them, not just another administrative requirement from finance.

Monitor performance by tracking the average time from submission to payment, with a goal of consistently achieving reimbursement within 48 hours. The automated policy checks serve as your primary risk management tool, preventing common issues like duplicate submissions or expenses that exceed policy limits before they require manual intervention.

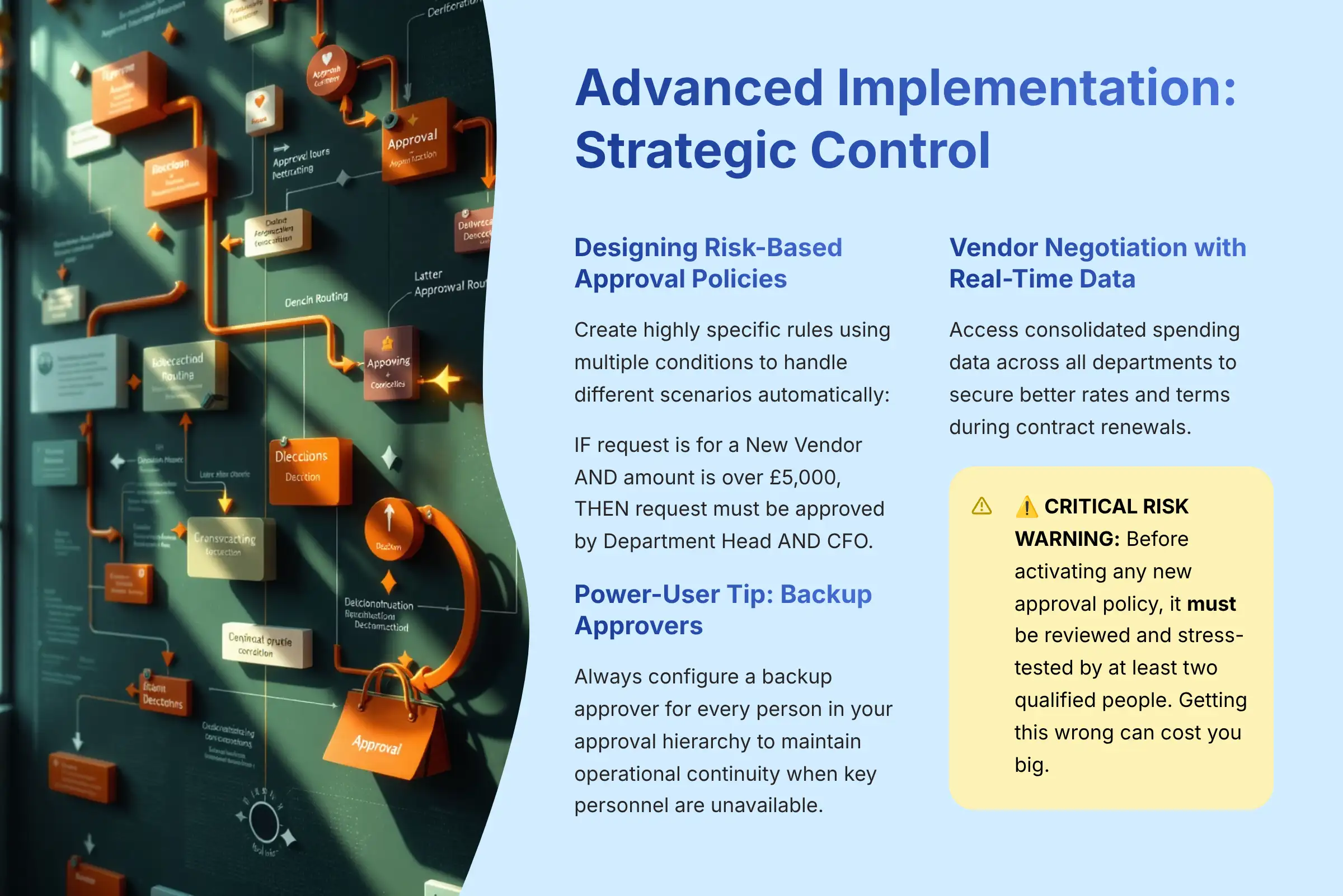

Advanced Implementation: Strategic Control & Automation

Once you've mastered the basic workflows, you can implement more sophisticated controls that transform Airbase from an automation tool into a strategic spend control center. This is where you design complex approval policies using conditional logic that automatically manages risk and enforces budget compliance across your entire organization.

Start with simple rules and gradually add complexity over time. Policy design is a strategic function, not just an administrative task, and it enables you to automatically enforce financial controls while maintaining operational efficiency.

Advanced Technique: Designing Granular, Risk-Based Approval Policies

You can create highly specific rules for routing approvals that use multiple conditions to handle different scenarios automatically. This ensures high-risk or high-value purchases receive the appropriate level of review while streamlining routine transactions.

For example, a sophisticated rule might state: IF the request is for a New Vendor AND the amount is over $5,000, THEN the request must be approved by the Department Head AND the CFO. Another rule could monitor spending against departmental budgets and automatically add the Head of Finance as an approver if the budget utilization exceeds 90%.

Power-User Tip: Always Configure Backup Approvers

A common implementation mistake is failing to set up backup approvers for every role in your approval chain. If a manager is on vacation or unavailable, all requests routed to them will be held up, potentially disrupting business operations and creating employee frustration.

Always configure a backup approver for every person in your approval hierarchy. This ensures that the approval process continues smoothly even when key personnel are out of the office, maintaining operational continuity and employee satisfaction.

Use Case: Using Real-Time Data for Vendor Negotiation

Because all of your spending with individual vendors is consolidated and tracked in one platform, you gain powerful negotiating leverage. You can access real-time data showing exactly how much your company spends with a specific vendor across all departments, payment methods, and time periods.

When it's time to renew contracts or negotiate pricing, you can use this comprehensive spending data to secure better rates and terms. This capability transforms finance from a purely administrative function to a strategic business partner that directly contributes to cost savings and vendor relationship management.

For teams seeking comprehensive evaluation guidance, our detailed Airbase Review guide provides an in-depth analysis of the platform's strengths, limitations, and real-world performance metrics based on extensive testing.

⚠️ CRITICAL RISK WARNING: Read This Before Building Policies

Let's be crystal clear: this section is where you can make a catastrophic financial mistake. A poorly designed approval policy isn't an inconvenience—it's a wide-open door for fraud or major accidental overspending.

Rule: Before you activate any new approval policy, it must be reviewed and stress-tested by at least two qualified people (e.g., your CFO and head of finance). No exceptions. Getting this wrong can cost you big.

Troubleshooting, Security, and Compliance

Even the most well-designed systems can encounter issues. Understanding the most common problems and their solutions will save you time and prevent frustration. Additionally, understanding Airbase's security features helps you maintain a safe and compliant financial environment that meets professional standards.

Airbase is built with enterprise-grade security in mind. Features like granular user permissions and immutable audit logs are designed to protect your company and help you pass audits like SOC 2 Type II. The platform maintains SOC 1 Type II and SOC 2 Type II compliance, providing the security framework necessary for professional financial operations.

Common Issue: “My Transaction Didn't Sync to the GL”

This is the most frequent problem users encounter. The cause is almost always an unmapped item in Airbase that doesn't correspond to an account in your GL software. Navigate to the unmapped vendor or category in the integration settings and complete the mapping to resolve the sync error.

Common Issue: “A Duplicate Invoice Was Submitted”

Airbase can prevent this automatically through proper workflow configuration. Configure a workflow rule that flags or blocks invoices with duplicate numbers from the same vendor. You can also set rules to flag invoices from the same vendor for identical amounts within a specified time frame to prevent duplicate payments.

Security Best Practice: Role-Based Access Control (RBAC)

Role-Based Access Control (RBAC) is a key security feature in Airbase. It allows you to assign permissions based on user roles, ensuring that only authorized personnel can perform sensitive actions. For example, limit the ability to issue new virtual cards to a select group of trusted finance team members. This minimizes the risk of unauthorized spending and enhances overall financial security.

Compliance Feature: The Immutable Audit Trail

For compliance and audit purposes, Airbase maintains an immutable audit trail. This means that records cannot be deleted; they can only be archived. This feature is crucial for maintaining financial integrity and ensuring that your organization can provide a complete history of every transaction during audits.

Important Disclaimers

Technology Evolution Notice: The information about Airbase Tutorials and Usecase and AI Finance Tools tools presented in this article reflects our thorough analysis as of 2024. Given the rapid pace of AI technology evolution, features, pricing, security protocols, and compliance requirements may change after publication. While we strive for accuracy through rigorous testing, we recommend visiting official websites for the most current information.

Professional Consultation Recommendation: For AI Finance Tools applications with significant professional, financial, or compliance implications, we recommend consulting with qualified professionals who can assess your specific requirements and risk tolerance. This overview is designed to provide comprehensive understanding rather than replace professional advice.

Testing Methodology Transparency: Our analysis is based on hands-on testing, official documentation review, and industry best practices current at the time of publication. Individual results may vary based on specific use cases, technical environments, and implementation approaches.

Frequently Asked Questions About Airbase Tutorials and Usecase

For additional detailed answers to common questions about Airbase implementation and usage, check out our comprehensive Airbase FAQs section which covers over 50 frequently asked questions from real users.

How Does Airbase Prevent Fraudulent or Wasteful Spending?

Airbase prevents bad spending before it happens. It uses pre-approval workflows, vendor-locked virtual cards with set limits, and automated policy checks to act as digital guardrails for all company spend.

What is the Real ROI of Implementing Airbase?

The true return comes from three areas. First, direct savings from catching duplicate or wasteful subscriptions. Second, massive time savings for the finance team from automated reconciliation. Third, better negotiation power with vendors from having clear, real-time spending data.

How Does Airbase Compare to Competitors like Brex or Ramp?

While competitors like Brex and Ramp focus heavily on corporate cards, Airbase provides a unified platform for all non-payroll spend, including corporate cards, invoice payments via ACH, and employee reimbursements. This comprehensive approach allows for better control and visibility over the entire procure-to-pay process.

Can Airbase Replace My Need for an Accounts Payable Manager?

Airbase does not replace the person but supercharges their abilities. It automates the manual, repetitive parts of the AP job, like data entry and chasing approvals. This frees the AP manager to focus on more strategic work like vendor management and cash flow analysis.

What is the Most Common Mistake During Airbase Setup?

The most common mistake is a rushed or incomplete mapping of GL accounts, departments, and vendors during the initial integration. Taking the time to get this step perfect is the single best thing you can do to ensure a smooth, automated process later on.

Is It Difficult to Get Employees to Adopt a New Spend Management Tool?

Adoption is easiest when you focus on the benefits to the employee. With Airbase's mobile app, they get paid back much faster for expenses. For purchases, the request process is simple and transparent. A clear communication plan that highlights these benefits makes adoption much easier.

How Secure is My Financial Data within Airbase?

Airbase uses enterprise-grade security practices, including data encryption both in transit and at rest, secure OAuth 2.0 connections to your GL, and regular third-party security audits like SOC 2 compliance.

What Happens if a Transaction Fails to Sync with my Accounting Software?

The transaction will remain in a “failed” state in your Airbase dashboard, and the system will provide an error message. The cause is usually a mapping issue. Once you fix the mapping, you can re-sync the transaction with a click.

Can Airbase Handle International Payments and Multiple Currencies?

Yes, Airbase supports payments to international vendors in their local currencies. The platform can also integrate with companies that have multiple business entities or subsidiaries, allowing for centralized management of global spend.

What Kind of Support Can I Expect During and After Implementation?

Airbase typically provides a dedicated implementation specialist to guide you through the initial setup and onboarding process. After you go live, they offer ongoing support through a help center, email, and customer success managers for larger accounts.

Conclusion: From Automation to Strategic Finance

Mastering Airbase is about more than just using a new tool. It is about changing how your company manages money. By following these workflows and setting up strong controls, your finance team can move from doing repetitive tasks to providing strategic insights.

Start with a small pilot program in one department. Prove the value of a single workflow, like managing SaaS subscriptions. Once you show a clear return, you can roll the system out to the entire organization. This measured approach helps build a strong, automated, and controlled spend culture.

For a deeper look into how to apply these ideas, review these Airbase Tutorials and Usecase examples again. The transformation from manual processes to strategic financial operations represents one of the most significant opportunities for modern finance teams to create measurable business value while reducing administrative burden.

Leave a Reply