Struggling with Manual Finance Tasks?

This 2-Minute Quiz Reveals Your Ideal AI Automation Tool!

Key Takeaways

- AI-Powered Platform: Airbase uses advanced machine learning and OCR technology to automate invoice processing, GL coding, and expense management, reducing manual data entry by up to 90%.

- Not a Bank Replacement: Airbase works as an intelligent layer on top of your existing banking infrastructure, providing enhanced control and visibility without replacing your business bank account.

- Enterprise Security: SOC 1 and SOC 2 Type 2 certified with end-to-end encryption, GDPR compliance, and enterprise-grade security standards for handling sensitive financial data.

- Proven ROI: Most mid-market companies achieve positive ROI within 6-12 months through 75-85% reduction in AP processing time and 3-5 days faster month-end close.

What is Airbase and how does it use AI for finance automation?

Airbase is a comprehensive AI-powered spend management platform that consolidates all aspects of a company's non-payroll spending into a single, unified system. Unlike traditional finance tools that require multiple disconnected solutions, Airbase combines corporate cards (both physical and virtual), accounts payable automation, and employee expense reimbursements into one intelligent platform designed specifically for modern finance teams.

The AI component is central to Airbase's value proposition for finance professionals. The platform leverages advanced machine learning algorithms and optical character recognition (OCR) to automate traditionally manual financial processes. When invoices and receipts are submitted, Airbase's AI automatically scans and extracts critical data including vendor information, dates, amounts, and line items, eliminating the need for manual data entry. The system's machine learning capabilities continuously improve by analyzing historical transaction patterns and user-defined rules to automatically suggest appropriate general ledger (GL) codes and expense categories.

This AI-driven automation significantly accelerates month-end close processes, reduces human error rates, and provides finance teams with real-time visibility into company-wide spending patterns. For businesses seeking to modernize their financial operations, Airbase's AI transforms reactive expense management into proactive spend control, making it an essential tool in the AI finance tools ecosystem.

What specific finance and accounting tasks can Airbase automate with AI?

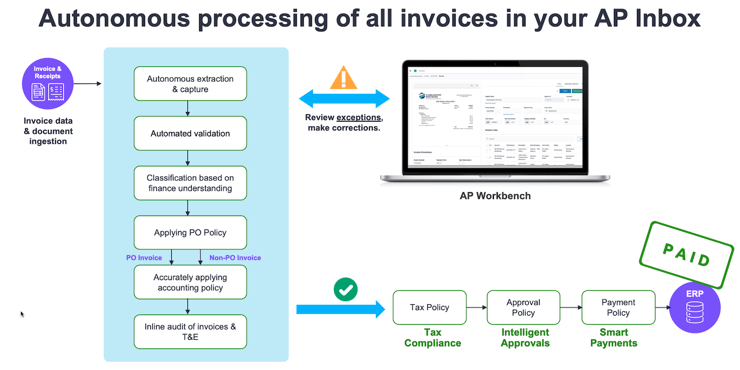

Airbase's AI automation capabilities span the entire financial transaction lifecycle, from initial purchase requests to final reconciliation in your accounting system. The platform excels at eliminating manual, time-consuming tasks that traditionally burden finance teams.

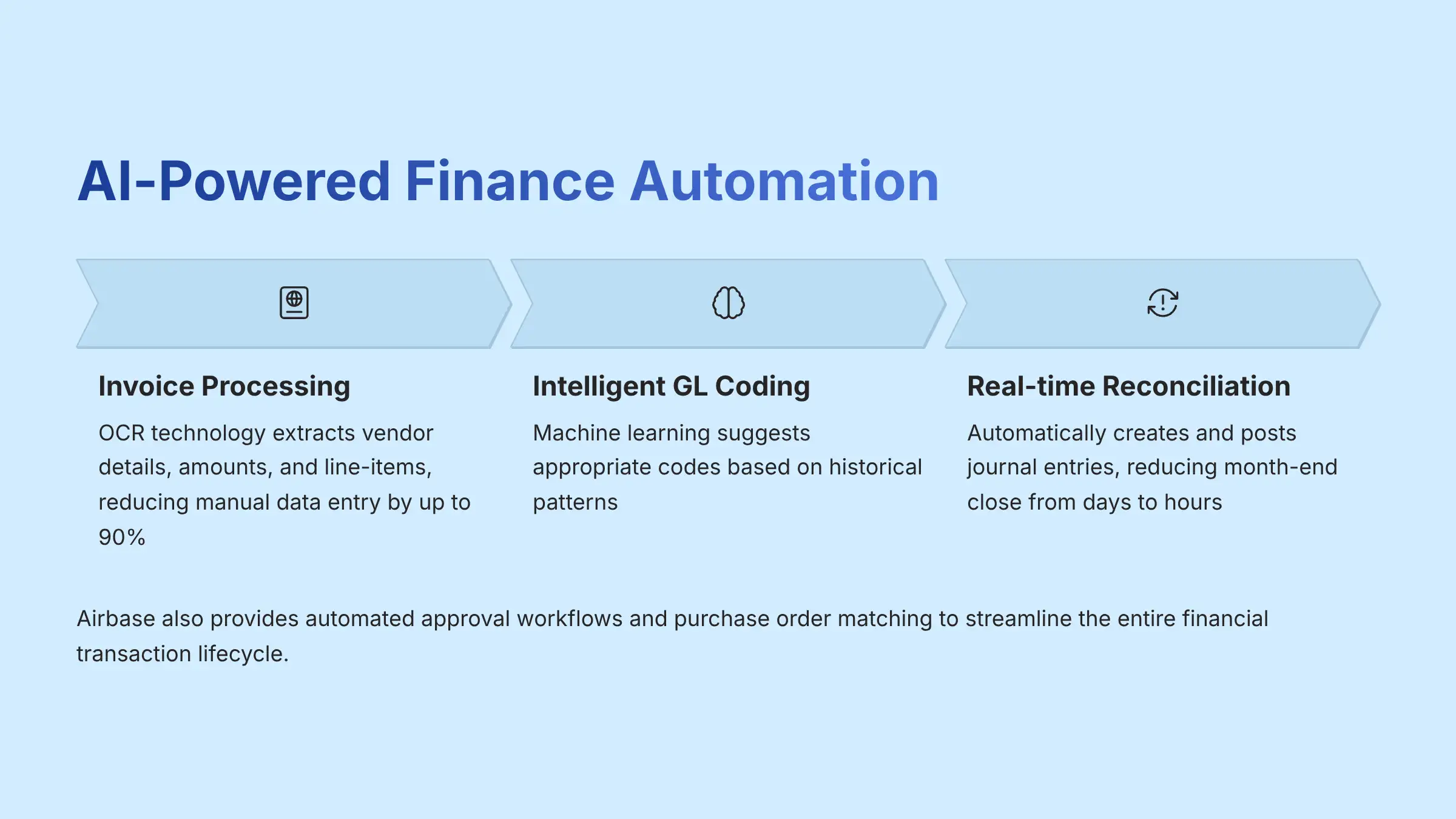

Invoice Processing & Data Extraction: Airbase uses advanced OCR technology to automatically read and process invoices submitted via email or direct upload. The AI extracts vendor details, invoice numbers, amounts, due dates, and line-item information with high accuracy, reducing manual data entry by up to 90%.

Intelligent GL Coding: The platform's machine learning algorithms analyze your company's historical coding patterns and accounting policies to automatically suggest appropriate general ledger codes, cost centers, and dimensions. This AI-powered suggestion engine becomes more accurate over time, learning from finance team corrections and approvals.

Automated Approval Workflows: Airbase creates sophisticated, rule-based approval chains that automatically route purchase requests, invoices, and expense reports to the correct approvers based on amount thresholds, departments, vendors, or custom criteria.

Purchase Order Matching: The system performs automated two-way and three-way matching, comparing invoices against purchase orders and receipts to identify discrepancies before payment processing.

Real-time Reconciliation: Through deep integrations with major accounting systems like NetSuite, QuickBooks, and Sage Intacct, Airbase automatically creates and posts journal entries, ensuring continuous reconciliation and dramatically reducing month-end close time from days to hours.

If you're looking to explore comprehensive solutions for AI-powered financial automation, be sure to check out our detailed Airbase Overview and Features guide that covers all the platform's automation capabilities in depth.

Is Airbase a bank or does it replace my business bank account?

Airbase is not a bank and does not replace your primary business banking relationship. Instead, it functions as an intelligent financial technology layer that sits on top of your existing banking infrastructure to provide enhanced control, automation, and visibility over your company's spending.

Your primary business bank account (whether at Chase, Bank of America, or any other financial institution) remains the central repository for your company's cash and core banking services. Airbase connects to this existing account through secure banking partnerships to fund its operations. The corporate cards provided by Airbase are charge cards issued through partnerships with FDIC-insured banking institutions, ensuring your funds are protected under federal banking regulations.

When Airbase processes payments on your behalf—whether for card transactions, bill payments, or employee reimbursements—it draws funds from your connected business bank account according to the terms of your service agreement. This architecture allows you to maintain your established banking relationships, credit lines, and treasury management practices while benefiting from Airbase's advanced AI-powered spend management capabilities.

This approach is particularly valuable for finance teams because it preserves existing banking relationships and compliance frameworks while adding a sophisticated layer of spend control, automation, and real-time financial visibility that traditional business banking typically cannot provide.

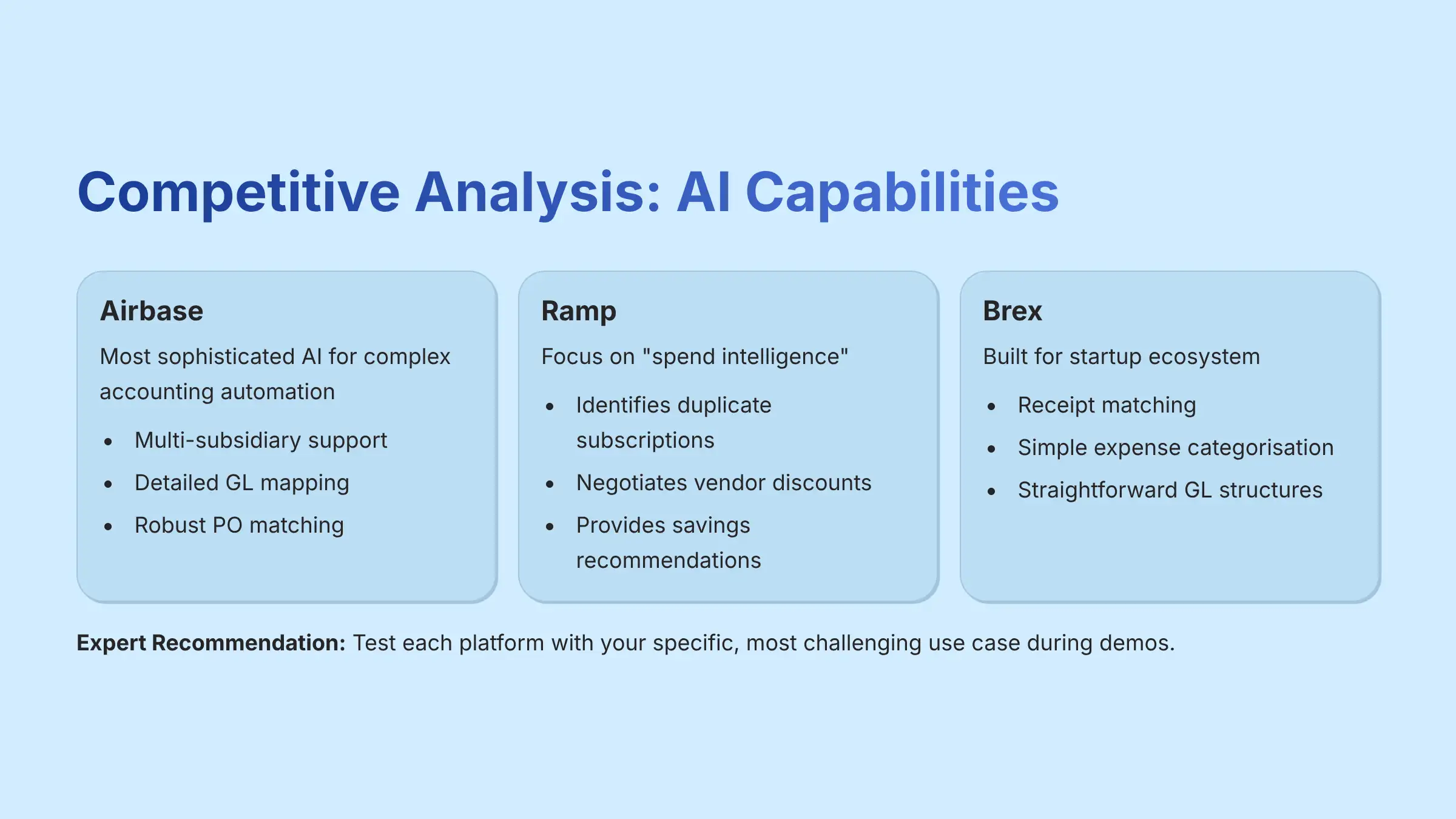

Airbase vs Ramp vs Brex: Which platform offers superior AI for accounting automation?

Choosing between Airbase, Ramp, and Brex depends heavily on your company's specific accounting complexity, size, and primary use cases. Each platform has developed AI strengths in different areas of financial management.

Airbase is widely recognized for having the most sophisticated AI for complex accounting automation, particularly for mid-market companies with intricate financial structures. Its AI excels in multi-subsidiary support, detailed general ledger mapping with custom fields and dimensions, and robust purchase order matching capabilities. Companies using complex ERPs like NetSuite or Sage Intacct often find Airbase's AI-powered synchronization to be more granular and customizable than competitors.

Ramp focuses its AI development on “spend intelligence” and proactive cost optimization. While it offers solid accounting automation, Ramp's AI differentiator lies in analyzing transaction patterns to identify duplicate subscriptions, negotiate vendor discounts, and provide automated savings recommendations. Their AI is particularly strong for companies prioritizing cost reduction over complex accounting workflows.

Brex initially built its AI for the startup ecosystem and excels at receipt matching and expense categorization for simpler organizational structures. With Brex Empower, they've expanded to serve larger companies, but their accounting AI is generally most effective for businesses with straightforward GL structures.

Expert Recommendation: The most effective evaluation method is testing each platform with your specific, most challenging use case. During demos, provide a complex, multi-line invoice requiring department splits and ask each vendor to demonstrate their AI's processing accuracy, error correction capabilities, and final journal entry output in your specific ERP system.

For more detailed comparisons and alternatives to help with your decision-making process, explore our comprehensive Best Airbase Alternatives guide that provides side-by-side analysis of all major spend management platforms.

How secure is Airbase and what are its data protection policies?

Security is fundamental to Airbase's platform architecture, given the sensitive financial data it processes. The company maintains enterprise-grade security standards that meet or exceed industry requirements for financial technology platforms.

Compliance Certifications: Airbase holds SOC 1 and SOC 2 Type 2 certifications, which represent rigorous third-party audits of their security controls, data handling procedures, and operational integrity over extended periods. These certifications are specifically designed for service organizations that handle sensitive customer data and are considered the gold standard for financial technology platforms.

Data Encryption & Infrastructure: All data is protected with end-to-end encryption using TLS 1.2 or higher for data in transit and AES-256 encryption for data at rest. The platform operates on Amazon Web Services (AWS) infrastructure, leveraging enterprise-grade cloud security with multiple layers of protection including network firewalls, intrusion detection, and continuous monitoring.

Privacy Compliance: Airbase adheres to major data privacy regulations including GDPR for European operations and CCPA for California-based users. This includes strict policies governing data access, processing transparency, and user rights regarding their personal information.

Access Controls: The platform enforces multi-factor authentication (2FA) and provides granular role-based permissions, ensuring employees only access data and functionality necessary for their specific responsibilities.

Due Diligence Recommendation: For enhanced security validation, request Airbase's security questionnaire through platforms like Consensus or Whistic, and consider asking for executive summaries of their latest SOC 2 reports under NDA for the most comprehensive security assessment.

How does Airbase handle multi-currency transactions for global operations?

Airbase is designed to support companies with global operations through comprehensive multi-currency capabilities across all platform functions. This makes it particularly valuable for businesses with international subsidiaries, remote employees, or global vendor relationships.

Bill Payments & Vendor Management: Airbase enables payments to vendors in their local currencies, supporting over 130 currencies worldwide. The platform manages currency conversion using competitive exchange rates and provides transparent reporting on conversion fees and final settlement amounts in your home currency. This eliminates the complexity and cost of maintaining multiple banking relationships for international payments.

Employee Expense Management: Employees can submit expenses in over 150 different currencies through the mobile app or web platform. Airbase uses real-time exchange rates to calculate precise reimbursement amounts in the employee's preferred currency and can process payments to local bank accounts globally, reducing friction for international team members.

Multi-Entity Support: For companies with formal global subsidiaries operating as separate legal entities, Airbase provides sophisticated multi-entity management. The platform can connect to multiple ERP instances (such as separate NetSuite subsidiaries) and maintain entity-specific configurations for payment accounts, accounting codes, approval workflows, and tax treatments.

Compliance & Reporting: Each transaction maintains detailed audit trails including original currency amounts, exchange rates used, and final converted amounts. This ensures compliance with local accounting standards and simplifies financial reporting across multiple jurisdictions.

This global capability makes Airbase particularly attractive for growing companies that need to scale their financial operations internationally without managing multiple disparate systems.

For practical implementation guidance and real-world use cases for global operations, explore our comprehensive Airbase Tutorials and Use Cases guide which includes detailed workflows for multi-currency operations.

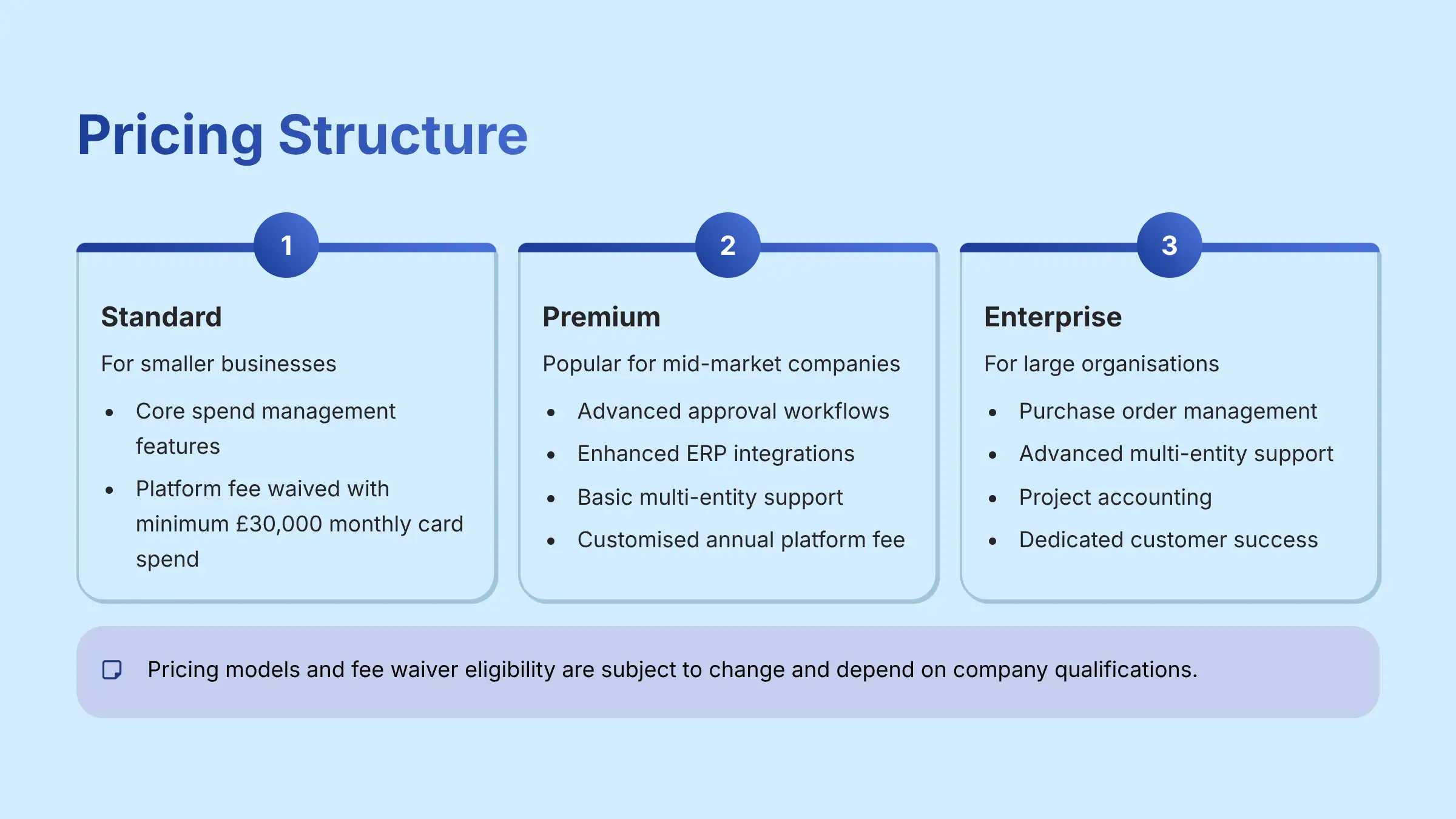

What are Airbase's pricing plans and fee structure?

Airbase operates on a hybrid pricing model that accommodates different company sizes and spending patterns, making it accessible to both growing businesses and established enterprises. Understanding the complete fee structure is crucial for accurate ROI calculations.

Pricing Tiers:

- Standard: Designed for smaller businesses, includes core spend management features with accounts payable, expense reimbursements, and corporate cards. Importantly, the platform fee is waived for companies that qualify and commit to a minimum of $30,000 in monthly card spend.

- Premium: The most popular tier for mid-market companies, featuring advanced approval workflows, enhanced ERP integrations, and basic multi-entity support with a customized annual platform fee.

- Enterprise: Comprehensive solution for large organizations including purchase order management, advanced multi-entity support, project accounting, and dedicated customer success management.

Fee Structure Considerations: Unlike competitors that rely solely on interchange fees, Airbase's model provides transparency and predictability. For qualifying businesses, the fee-waived Standard plan makes Airbase cost-competitive with interchange-only models. Premium and Enterprise customers pay annual platform fees but often benefit from cashback programs that can offset subscription costs.

Additional Costs: International payment fees, implementation services, and premium support options may incur additional charges. It's essential to request a comprehensive cost breakdown including all potential fees during the sales process.

Risk Disclaimer: Pricing models and fee waiver eligibility are subject to change and depend on company qualifications including creditworthiness, transaction volume, and underwriting by partner banks. Always verify current pricing and terms directly with Airbase sales representatives.

What ROI and time savings can companies expect from implementing Airbase?

Airbase delivers measurable return on investment through both quantifiable efficiency gains and direct cost savings, making it a compelling choice for companies seeking to modernize their financial operations with AI-powered automation.

Efficiency & Time Savings: Customer case studies consistently demonstrate that finance teams reduce accounts payable processing time by 75-85% after implementing Airbase. The AI-powered automation eliminates manual data entry, automates approval routing, and provides real-time reconciliation, enabling companies to close their books 3-5 days faster each month. This time savings allows finance professionals to focus on strategic analysis, forecasting, and business partnership rather than administrative tasks.

Direct Cost Savings: Real-time spend visibility and automated controls significantly reduce out-of-policy spending and fraud. Virtual cards with vendor-specific limits and spending controls prevent unauthorized transactions before they occur. Many customers report 10-15% reductions in overall spending through better visibility and control mechanisms.

Revenue Generation: Airbase's corporate card program offers competitive cashback rewards that can generate substantial revenue to offset platform fees. Companies with significant card spend often find that cashback earnings alone justify the platform investment.

Typical ROI Timeline: Most mid-market companies achieve positive ROI within 6-12 months, with larger organizations often seeing returns within the first quarter due to greater transaction volumes and more complex manual processes being automated.

Quantifiable Benefits: Beyond time savings, companies report improved vendor relationships through faster payments, reduced late fees, better cash flow management through enhanced visibility, and improved compliance through automated audit trails and approval documentation.

To see detailed case studies and real-world ROI examples from similar companies, check out our in-depth Airbase Review Guide which includes specific metrics and implementation outcomes from various industries.

What happens if we need to migrate away from Airbase?

Data portability and avoiding vendor lock-in are legitimate concerns when selecting any financial technology platform. Airbase addresses these concerns through comprehensive data export capabilities and transparent offboarding processes.

Data Export Capabilities: Airbase ensures that all your financial data remains accessible and exportable. The platform provides complete transaction histories for card spending, bill payments, and expense reimbursements in standard formats including CSV and Excel. Exported data includes vendor details, general ledger coding, associated receipts and invoices, approval histories, and audit trails with timestamps and user information.

Historical Data Retention: All transaction data, supporting documentation, and approval workflows are maintained with complete historical integrity. This includes original receipts, invoice images, and approval chains that may be required for auditing or compliance purposes even after migration.

Migration Support: While Airbase naturally prefers to retain customers, they provide reasonable support during offboarding processes. The specific level of migration assistance may depend on your contract terms and the circumstances of departure.

Timeline Considerations: Most data exports can be completed within standard notice periods, though complex multi-entity configurations may require additional time for complete data extraction and formatting.

Best Practices: During contract negotiation, explicitly confirm data export capabilities, any associated fees, required notice periods, and the specific formats available. Request sample export files to ensure compatibility with your intended destination system. A well-defined offboarding plan provides peace of mind and negotiating leverage.

Risk Disclaimer: Data export capabilities and migration support may vary based on contract terms, data complexity, and the specific systems involved in migration. Always verify current data portability policies and procedures directly with Airbase before making implementation decisions.

For comprehensive answers to additional questions about Airbase implementation, features, and best practices, explore our complete Airbase FAQs section which addresses common concerns and provides detailed guidance for finance teams evaluating the platform.

Leave a Reply