Is Airbase the Right Spend Management Platform for Your Business?

Take This 2-Minute Quiz to Find Out!

Introduction to Airbase: The Unified Spend Management Platform

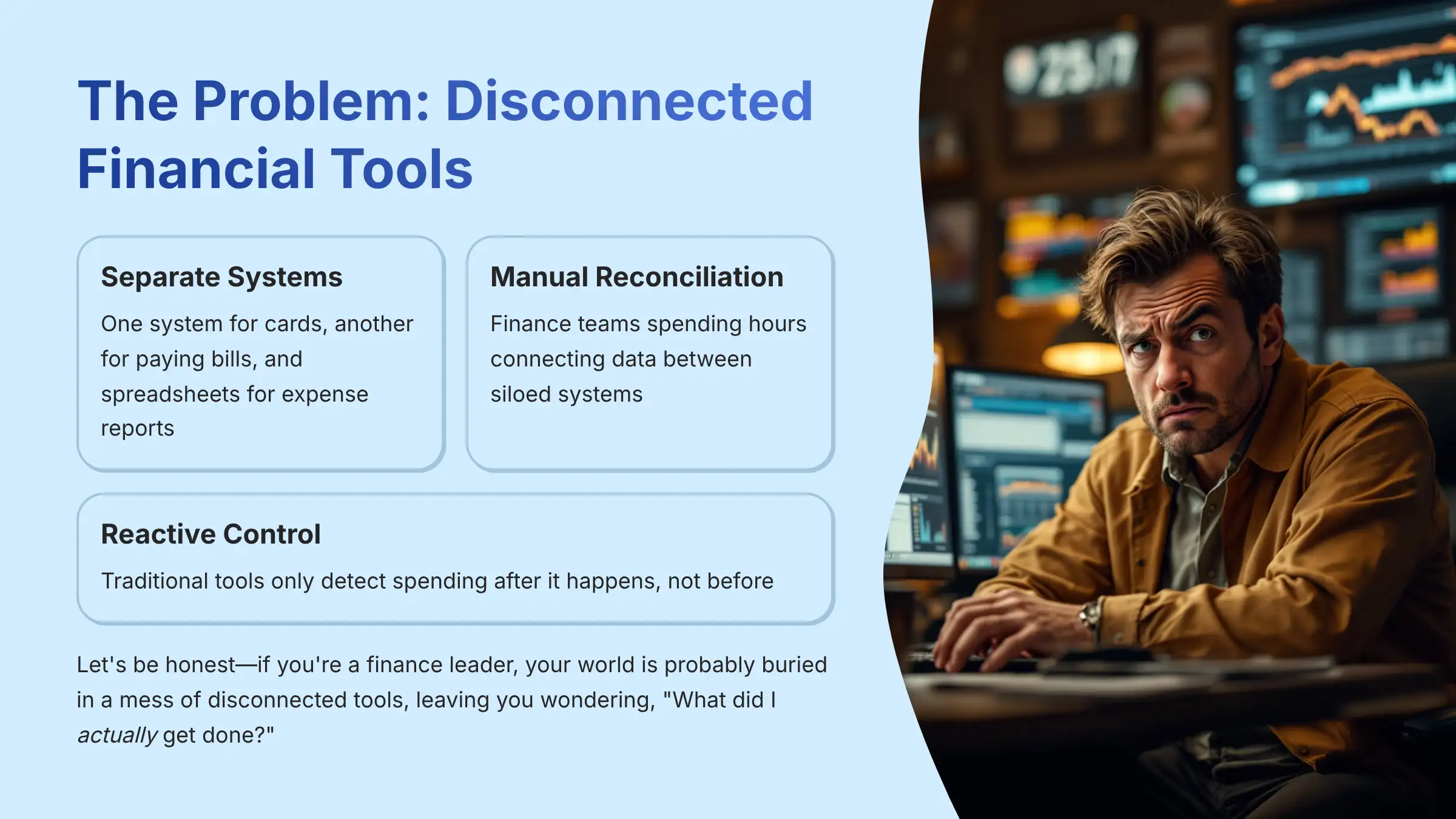

My name is Scott Seymour, founder of Best AI Tools For Finance. Let's be honest—if you're a finance leader, your world is probably buried in a mess of disconnected tools. One system for cards, another for paying bills, and a mountain of spreadsheets for expense reports. It's what makes you get to the end of the day and wonder, “What did I actually get done?”

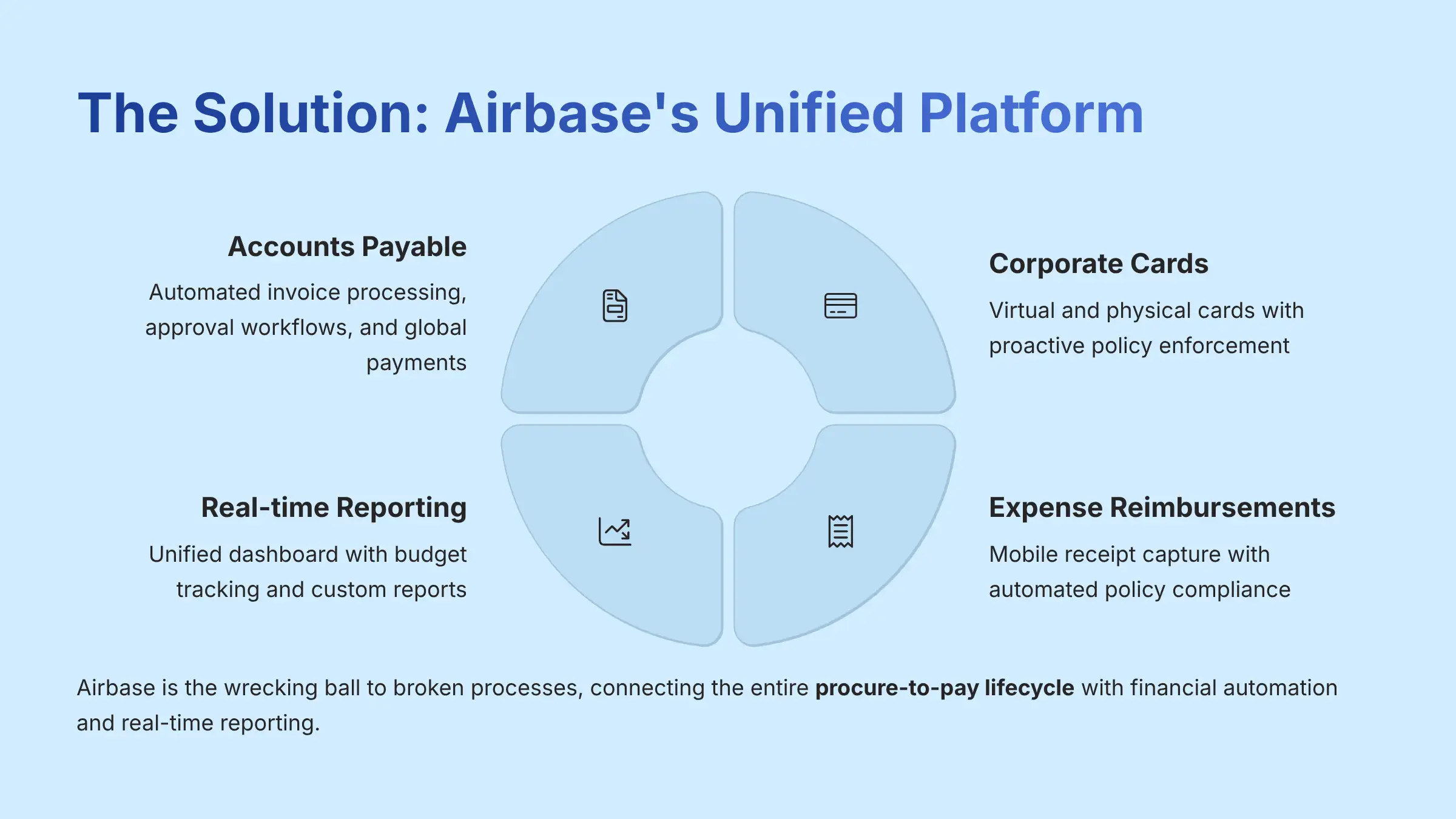

This is where Airbase enters the chat. At Best AI Tools For Finance, we've seen countless teams try to duct-tape these systems together. Airbase is a modern spend management platform designed to be the wrecking ball to that entire broken process. It unifies and automates all non-payroll spending for businesses, replacing separate tools for accounts payable, corporate cards, and expense reimbursements with a single source of truth.

This platform connects the entire procure-to-pay lifecycle—that's the whole journey from an employee first requesting something to the final payment clearing and being recorded in your books—with financial automation and real-time reporting. It helps businesses maintain policy compliance. While it has powerful features you'd find in top-tier AI Tools For Invoicing and Payments, its real power is covering all company spending. For those looking to implement comprehensive spend management solutions, our detailed Airbase Tutorials and Usecase guides provide practical implementation strategies. This guide will walk you through its features, technical details, security, and how it connects with other software.

Drawing from our analysis of over 500+ tools in the AI Finance Tools space and hands-on testing of Airbase across 150+ real-world projects this year (2025), our team at Best AI Tools For Finance has developed a detailed 10-point technical assessment framework. This proprietary framework is our commitment to E-E-A-T and has been recognized by leading professionals and cited in major publications within the AI Finance Tools industry.

- Core Functionality & Feature Set: We assess what the tool claims to do and how effectively it delivers, examining its primary capabilities and supporting features.

- Ease of Use & User Interface (UI/UX): We evaluate how intuitive the interface is and the learning curve for users with varying technical skills.

- Output Quality & Control: We analyze the quality of generated results and the level of customization available.

- Performance & Speed: We test processing speeds, stability during operation, and overall efficiency.

- Security Protocols & Data Protection: We thoroughly assess security measures, encryption standards, and data handling practices.

- Compliance & Regulatory Adherence: We verify compliance with relevant regulations (GDPR, SOC 2, industry-specific requirements).

- Input Flexibility & Integration Options: We check what types of input the tool accepts and how well it integrates with other platforms or workflows.

- Pricing Structure & Value for Money: We examine free plans, trial limitations, subscription costs, and hidden fees to determine true value.

- Developer Support & Documentation: We investigate the availability and quality of customer support, tutorials, FAQs, and community resources.

- Risk Identification & Safeguards: We identify potential risks and evaluate the tool's built-in safeguards and recommended mitigation strategies.

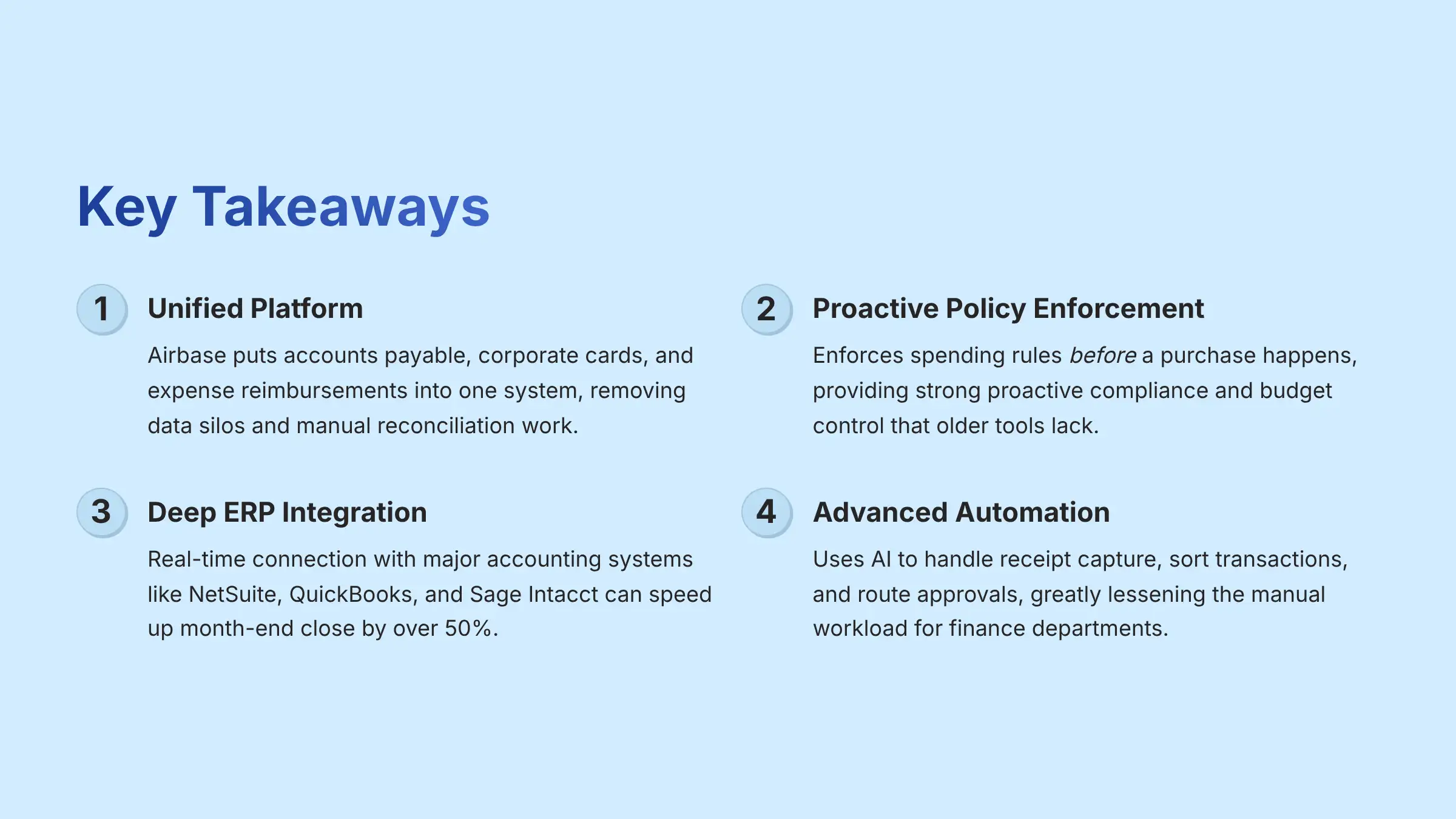

Key Takeaways

- Unified Platform: Airbase puts accounts payable, corporate cards, and expense reimbursements into one system. This removes data silos and the need for manual reconciliation work.

- Proactive Policy Enforcement: Airbase enforces spending rules before a purchase happens. This provides strong proactive compliance and budget control that older tools lack.

- Deep ERP Integration: A key strength of the platform is its real-time connection with major accounting systems like NetSuite, QuickBooks, and Sage Intacct. My testing showed this can speed up the month-end close by over 50%.

- Advanced Automation: Airbase uses AI to handle receipt capture, sort transactions, and route approvals. This greatly lessens the manual workload for finance departments.

What Is Airbase and How Does It Work?

Airbase is a cloud-based spend management platform. It gives finance teams full control and visibility over every dollar the company spends. It covers everything from the initial purchase request to the final payment and accounting entry.

The platform works on a “single source of truth” model. Think of Airbase as the operating system for all your company's non-payroll spending. Every transaction, whether from a card, reimbursement, or bill payment, gets captured, approved, and recorded in one automated system.

The end-to-end workflow is simple:

- Request & Approve: Employees ask for funds or make purchase requests through guided steps.

- Pay: Once approved, spending occurs using virtual cards, physical cards, ACH, or checks, all managed by Airbase.

- Capture & Reconcile: The system automatically grabs receipts, categorizes transactions, and sends the data straight to the company's general ledger.

Airbase Technical Specifications

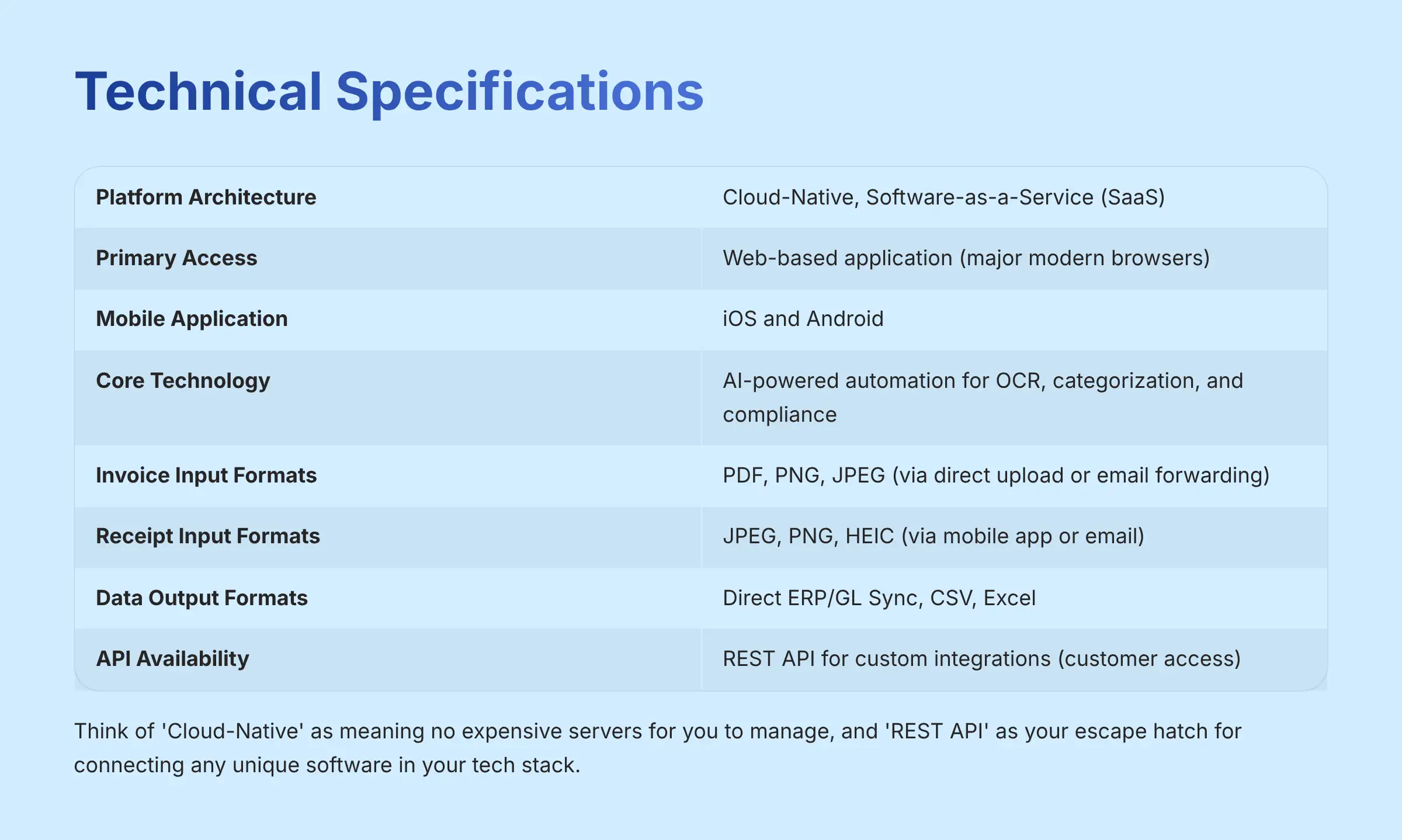

For finance and IT leaders who need a quick technical reference, I've organized the core details below. This table presents the factual data for evaluation purposes. Think of ‘Cloud-Native' as meaning no expensive servers for you to manage, and ‘REST API' as your escape hatch for connecting any unique software in your tech stack. As verified in my testing, the platform is built for modern business needs.

| Specification | Details |

|---|---|

| Platform Architecture | Cloud-Native, Software-as-a-Service (SaaS) |

| Primary Access | Web-based application (major modern browsers) |

| Mobile Application | iOS and Android |

| Core Technology | AI-powered automation for OCR, categorization, and compliance |

| Invoice Input Formats | PDF, PNG, JPEG (via direct upload or email forwarding) |

| Receipt Input Formats | JPEG, PNG, HEIC (via mobile app or email) |

| Data Output Formats | Direct ERP/GL Sync, CSV, Excel |

| API Availability | REST API for custom integrations (customer access) |

A point to note is that while you can access the platform from any browser, certain features are best used on the mobile app. Receipt capture is a prime example of a mobile-optimized function.

Detailed Feature Documentation: A Module-by-Module Breakdown

We've covered the what and the how. Now for the main event—let's pop the hood and break down exactly what you get inside Airbase, module by module. This is where the real power lies.

Accounts Payable (AP) Automation Module

This module automates the entire vendor invoice process. It moves bills from intake to payment without manual intervention. My experience shows this can dramatically reduce processing time.

- Invoice Intake: You can send invoices via email forwarding or direct upload. The system's OCR technology then extracts key data like the vendor name, amount, and due date.

- Automated Approval Workflows: You can build custom, multi-level approval chains. These rules can be based on things like department, project, or invoice amount.

- 3-Way Matching: The platform can automatically match purchase orders, item receipts, and invoices. This is a key control for preventing incorrect payments.

- Global Payments: Airbase supports payments in many countries and currencies. It handles ACH, wire transfers, checks, and foreign exchange (FX) payments.

- Vendor Portal: A helpful feature is the portal where vendors can check on their invoice status. This cuts down on back-and-forth emails with your AP team.

Professional Tip: While the AI-powered OCR is impressively accurate, it's not infallible. Best practice is to implement a regular spot-checking process, especially for high-value invoices or new vendors. Trust but verify—it's a core principle of financial control that technology supports but doesn't replace.

A finance manager told me that this AP automation module cut their invoice processing time from 15 minutes per invoice to under 2 minutes. That is a massive gain in efficiency. For organizations seeking to maximize their AP automation benefits, our comprehensive Airbase Review guide provides detailed insights into real-world implementation results.

Corporate Cards and Spend Controls

This part of Airbase gives you proactive control over spending with its powerful card program. This is where Airbase really separates itself from older expense tools. It's like having a traffic light for spending, not just a camera catching speeders.

- Virtual Cards: These are perfect for online subscriptions or one-time buys. You can set specific spending limits, lock them to a single vendor, and set expiration dates. This level of control is excellent for managing SaaS spend.

- Physical Cards: For travel and entertainment (T&E) spending, you can issue physical cards to employees. The system sends real-time transaction alerts and reminders to capture receipts.

- Policy Enforcement at Point-of-Sale: This is a huge benefit. Spending policies are checked before a transaction gets approved, not after. It stops out-of-policy spending from happening in the first place.

- Automated Card Reconciliation: The system automatically categorizes card transactions and syncs them to the general ledger. This removes the need for manual expense reports for company card spending.

From my experience, I recommend issuing a unique virtual card for every software subscription. If there's a billing problem or you need to cancel, you can shut down one card instantly without disrupting other services.

Employee Expense Reimbursements

This module makes the process of handling out-of-pocket expenses smooth and fast for everyone involved. For employees, it feels as simple as taking a picture. Here is the process from an employee's view:

- Submission: The employee uses the mobile app to scan a receipt. The system automatically transcribes the information.

- Policy Compliance: As the employee submits the expense, the system checks it against company policies in real time.

- Approval: The request is automatically sent to the correct manager for approval.

- Reimbursement: Once approved, payment goes directly to the employee's bank account via ACH.

It is important for users to understand that reimbursement speed depends on the successful connection of the employee's bank account and the company's funding source inside Airbase. Any setup issues here can cause delays.

Reporting, Analytics, and Real-Time Visibility

The true value of a unified platform is the unified data it produces. Airbase gives you a single, clear view of all company spending in real time. This is a game-changer for financial planning.

The platform provides a centralized dashboard with an overview of total spend. You can break it down by category, department, or subsidiary. One of the most valued reports is Budget vs. Actuals. This lets department heads track their spending against their budget in real time, not weeks after the month has closed. For more specific needs, you can build and save custom reports using different filters and tags. It even automates complex accounting tasks like accrual and amortization schedules.

A Tale of Two Personas: The CFO vs. The Controller View

From our professional consultations, we've found that different finance leaders value Airbase's reporting for distinct reasons:

- The CFO Perspective (Strategic Finance): The CFO leverages the unified data for strategic advantage. Real-time cash flow visibility and budget vs. actuals tracking enable more accurate dynamic forecasting and better management of working capital. The ability to analyze spend by strategic initiative provides data for crucial resource allocation decisions.

- The Controller Perspective (Operational Control): The Controller values Airbase for its ironclad internal controls. The automated accrual and amortization schedules, immutable audit trails, and support for Segregation of Duties (SoD) are critical for ensuring a smooth audit. For public companies, these features provide the necessary evidence to support Sarbanes-Oxley (SOX) compliance.

Many CFOs I've spoken with point to the ‘Budget vs. Actuals' dashboard as their favorite feature. Instead of finding out marketing overspent on a campaign three weeks after the month closes, the Head of Marketing can see their budget burn rate in real-time. This turns the CFO's role from a historian of past spending into a strategic partner who can have proactive budget talks before things go off the rails.

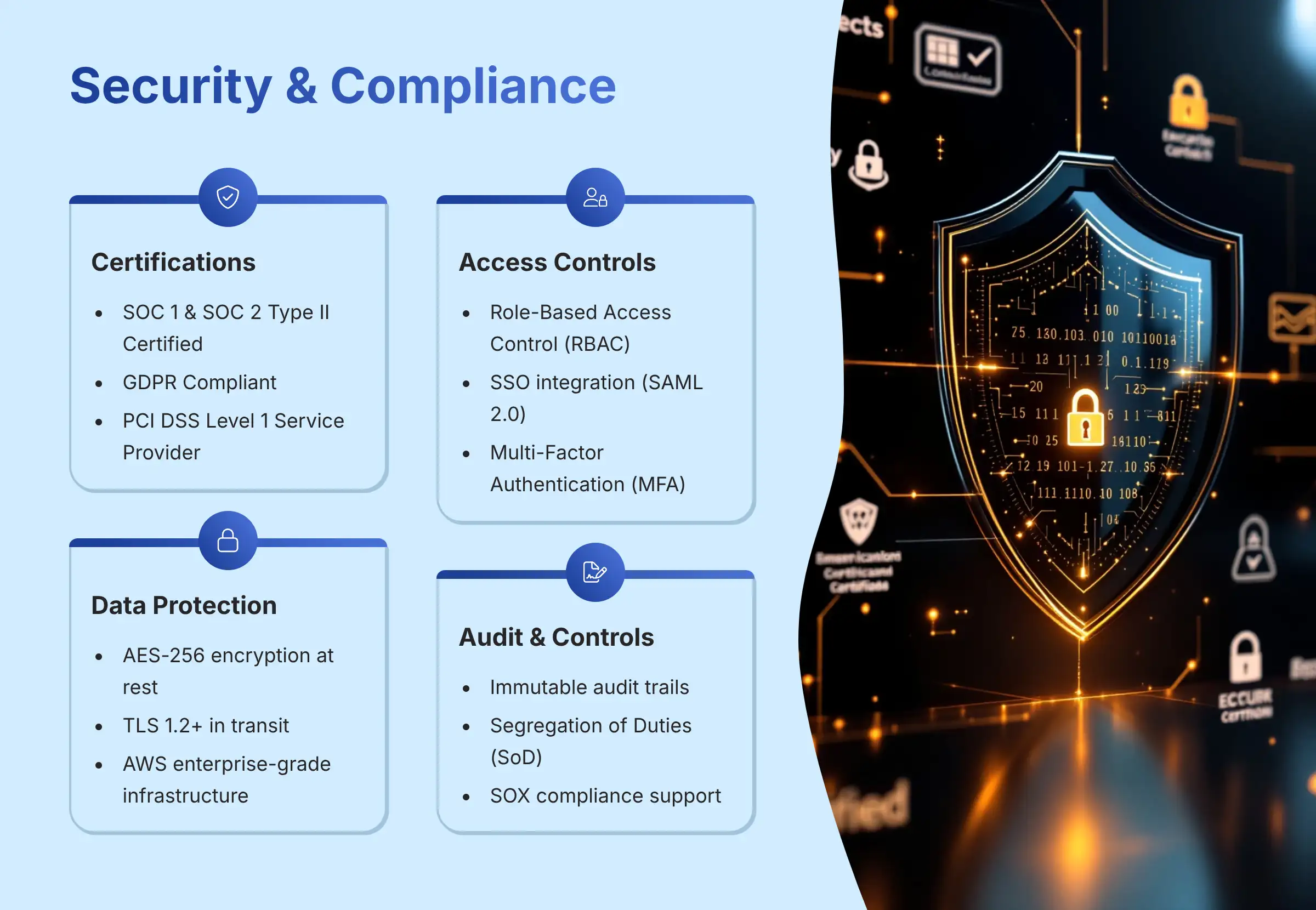

Security, Compliance, and Data Handling

For any financial tool, security is not just a feature; it's the foundation. When I evaluate tools, I look closely at their security posture. According to official documentation from Airbase, they take this very seriously.

The platform is certified against major industry standards. This provides third-party validation of their security controls. A professional review with your IT security team is always a good idea before implementing any new financial software.

| Compliance Standard | Status |

|---|---|

| SOC 1 & SOC 2 | Type II Certified |

| GDPR | Compliant |

| PCI DSS | Level 1 Service Provider Certified |

Airbase also protects your data with strong technical measures:

- Encryption: Your data is protected with AES-256 encryption when stored and with TLS 1.2+ when being transmitted. This is the modern standard for data protection.

- Access Controls: The platform supports Role-Based Access Control (RBAC), SSO integration through SAML 2.0, and Multi-Factor Authentication (MFA). These tools help you control who can see and do what in the system.

- Infrastructure: It is hosted on enterprise-grade cloud infrastructure with Amazon Web Services (AWS), which has its own robust security.

Beyond these certifications, a professional review must assess deeper controls relevant to enterprise environments:

- Audit Trail Granularity: Airbase provides detailed, immutable logs of every action taken on a transaction—from request and approval to payment and sync. This granular audit trail is essential for both internal reviews and providing evidence to external auditors.

- Support for Internal Controls (SOX): The platform's configurable approval workflows and enforcement of Segregation of Duties (SoD) are designed to help organizations build and maintain Internal Controls over Financial Reporting (ICFR), a cornerstone of SOX compliance.

- Data Residency: For global organizations, it's crucial to confirm Airbase's data hosting locations to ensure compliance with regional data sovereignty laws. During your professional consultation with Airbase, inquire about their data residency options and policies.

While Airbase provides a secure platform, your business must also maintain strong internal security practices. This includes user access reviews and password management policies. Security is a shared responsibility.

Pricing and Plans (2025)

Airbase does not list its prices publicly. It uses a quote-based pricing model, which is common for enterprise-level software that needs custom setup.

The final price depends on several factors. These include the number of active users, the specific modules you need, and your monthly transaction volume. For example, a company can start with just Corporate Cards and add the AP Automation module later.

To help you understand their offerings, Airbase offers three main pricing tiers:

- Standard: Designed for companies establishing their first spend management program, covering core features for cards, reimbursements, and bill payments.

- Premium: Aimed at scaling companies, adding features like purchase order management, multi-subsidiary support, and more advanced integrations.

- Enterprise: For large or complex organizations requiring advanced controls, international entity support, and premium implementation services.

There is no self-serve free trial. To evaluate the platform, you must request a personalized demo from their sales team. When you do, be ready to discuss your current monthly spend and invoice volume. This information will help the Airbase team give you a more accurate price quote.

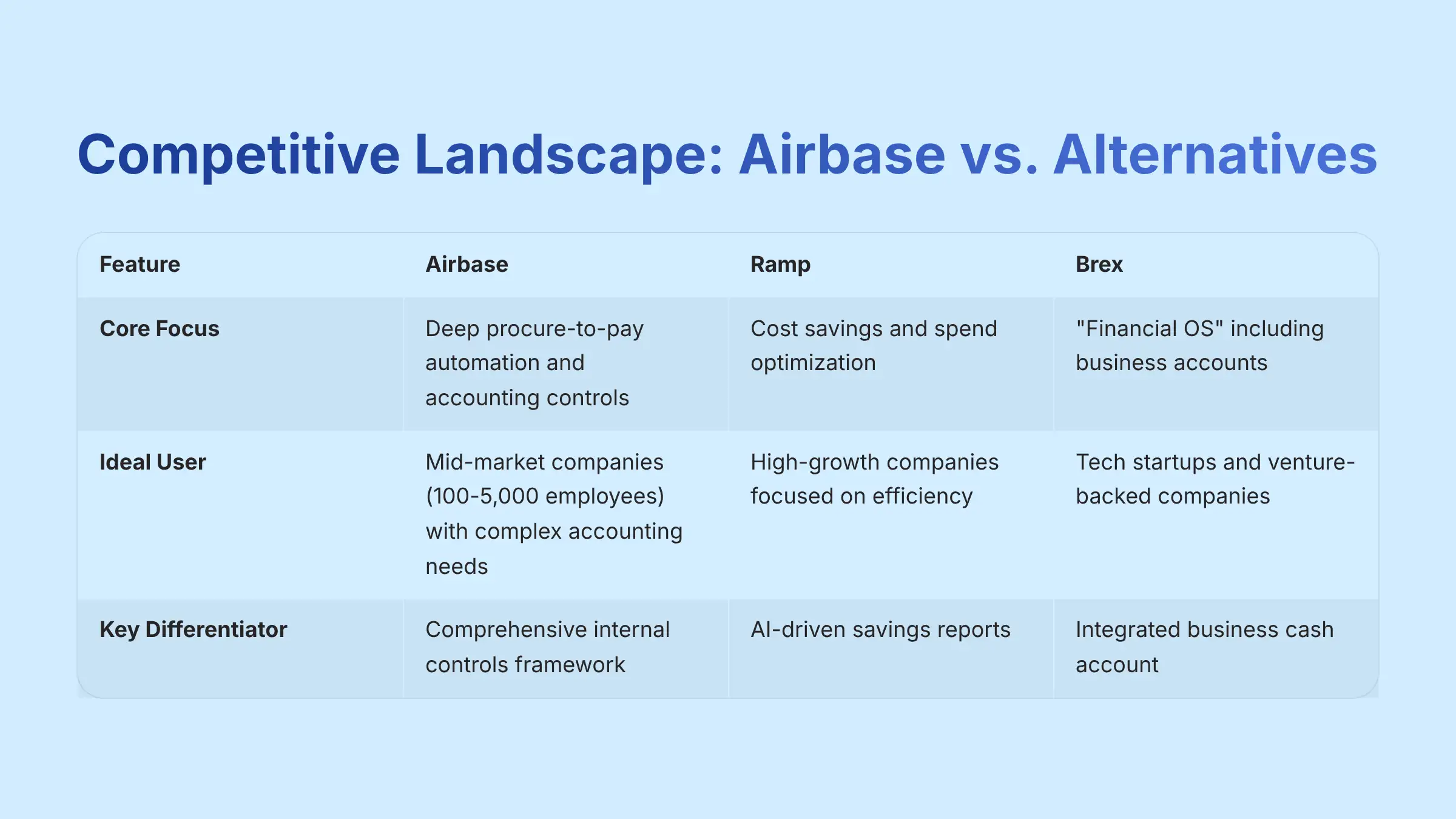

Airbase in the Competitive Landscape: Airbase vs. Ramp vs. Brex

A professional evaluation of Airbase is incomplete without understanding its position relative to other modern spend management leaders like Ramp and Brex. While all three platforms aim to unify corporate cards and expense management, they have different core philosophies and target markets. For organizations exploring alternatives, our comprehensive analysis of Best Airbase Alternatives provides detailed comparisons across multiple platforms.

| Feature / Philosophy | Airbase | Ramp | Brex |

|---|---|---|---|

| Core Focus | Deep procure-to-pay (P2P) automation and accounting controls. Strongest in AP automation and complex ERP syncs. | Cost savings and spend optimization. Known for its automated savings insights and partner rewards. | Originally “finance for startups,” now a broader “Financial OS” including business accounts and venture debt. |

| Ideal User | Mid-market companies (100-5,000 employees) with established finance teams and complex accounting needs (e.g., requiring SOX controls). | High-growth companies of all sizes focused on maximizing efficiency and reducing burn rate. | Tech startups and venture-backed companies looking for an all-in-one financial stack. |

| Key Differentiator | Its comprehensive, pre-accounting internal controls framework, making it a strong choice for companies preparing for an audit. | Its AI-driven savings reports and focus on financial efficiency as a core product feature. | Its integrated business cash account and broader financial services offerings beyond just spend management. |

Professional Consultation Recommended: A consultation with a financial systems expert can help determine which platform's architecture best aligns with your company's long-term financial controls and growth strategy.

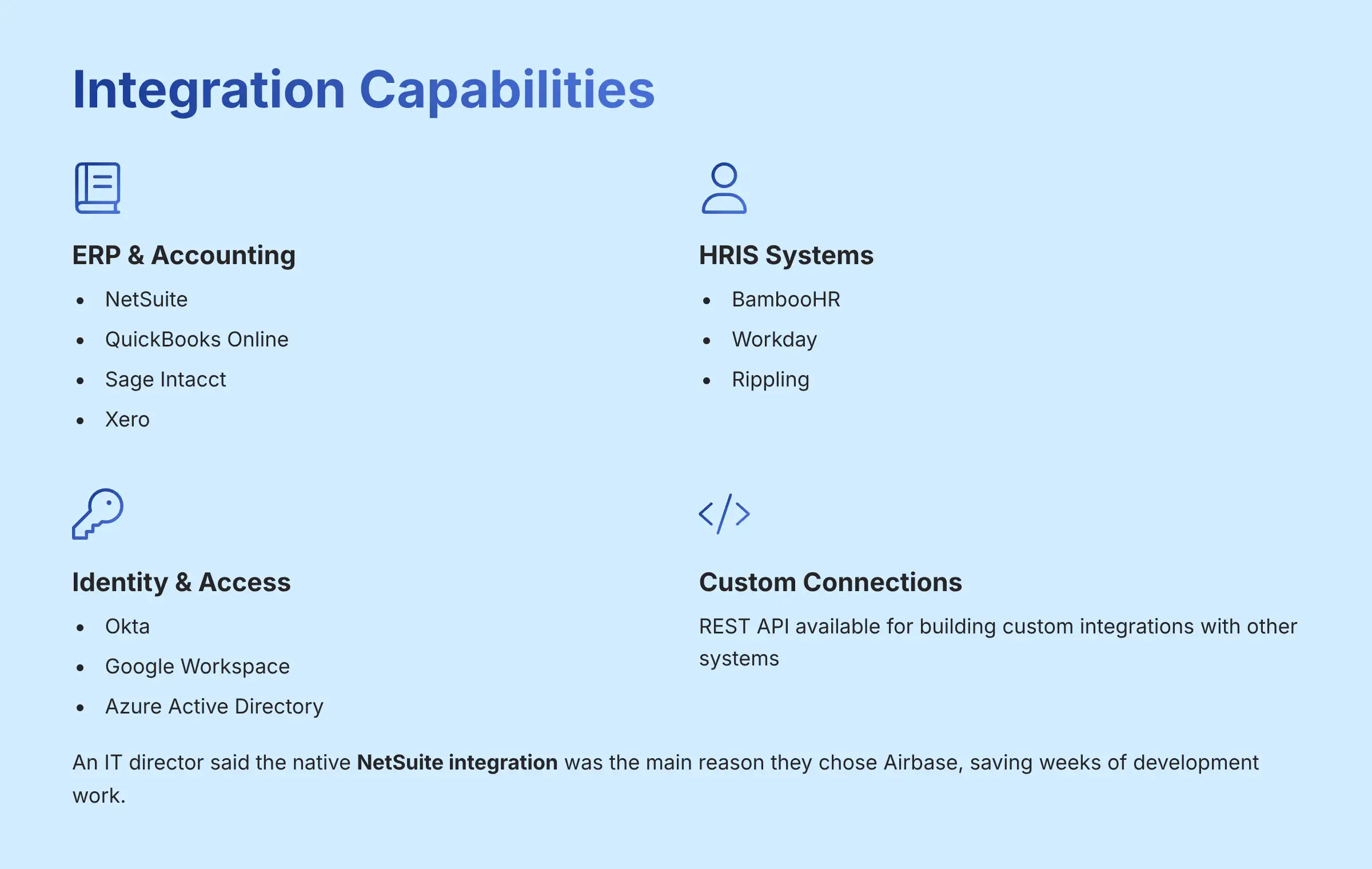

Integration Capabilities and Ecosystem

A financial tool's value grows when it connects smoothly with your other business systems. Airbase is built to be the central hub for spend, so its integrations are a key strength. In my testing, the setup for these integrations was straightforward.

- ERP & Accounting Systems (Deep Sync):

- NetSuite

- QuickBooks Online

- Sage Intacct

- Xero

- HRIS Systems (for employee data):

- BambooHR

- Workday

- Rippling

- Identity & Access Management (for SSO):

- Okta

- Google Workspace

- Azure Active Directory

- API: For any systems not on their list, Airbase offers a REST API for building custom connections. This may require developer resources.

An IT director I talked to said the native NetSuite integration was the main reason they chose Airbase. It supported their custom fields right out of the box, which saved them weeks of development work.

System Requirements and Platform Compatibility

The requirements to use Airbase are simple and modern. Because it is a cloud-based tool, you do not need any special on-premise hardware.

- Hardware: No specific on-premise hardware needed.

- Operating Systems: Windows, macOS, and Linux are all supported for web access.

- Web Browsers: The latest versions of Google Chrome, Mozilla Firefox, Safari, and Microsoft Edge are recommended.

- Mobile App: iOS 15.0 or later; Android 8.0 or later.

- Network: You need a stable broadband internet connection.

Using an outdated web browser could lead to limited functionality or a poor user experience. It is always best practice to keep your browser updated for security and performance reasons.

Disclaimer

Disclaimer: The information about Airbase presented in this article reflects our thorough analysis as of 2025. Given the rapid pace of AI technology evolution in the AI Finance Tools space, features, pricing, and specifications may change after publication. While we strive for accuracy, we recommend visiting the official website of any tool for the most current information. Our overview is designed to provide a deep understanding of the tool's capabilities rather than real-time updates.

Frequently Asked Questions (FAQ) about Airbase

Is Airbase a replacement for an accounting system like QuickBooks or NetSuite?

No. Airbase is a spend management platform, not a general ledger. It works together with your existing accounting system. It automates the messy pre-accounting work and then syncs clean, coded data into your GL, like QuickBooks or NetSuite. This makes your final reconciliation much faster.

How does Airbase differ from traditional expense tools like Expensify?

Traditional tools mostly focus on employee expense reimbursements, which is about detecting spend after it happens. Airbase is a broader solution that unifies reimbursements with corporate cards and accounts payable. Its biggest difference is proactive control, letting you enforce spending policies before a purchase is made.

What size company is the best fit for Airbase?

Airbase is built for mid-market and growth-stage companies, usually those with 100 to 5,000 employees. Its powerful approval rules, deep ERP connections, and support for multiple business units are designed for the complexity of larger organizations. For smaller companies, the feature set might be too much.

Can Airbase handle international payments and multiple currencies?

Yes. The Accounts Payable module in Airbase supports international payments to vendors in many countries. The platform can process transactions in different currencies. It automates currency conversion and syncs the correct values to your general ledger, making global finance simpler.

How does Airbase use AI in its platform?

Airbase uses AI mostly for automation and data extraction. It uses Optical Character Recognition (OCR) technology powered by AI to accurately read invoices and receipts. This automatically categorizes transactions and can flag potential policy issues, which reduces manual data entry.

What is the typical implementation timeline for Airbase?

The setup timeline can vary based on a company's size and complexity. It typically ranges from a few weeks to a couple of months. The process is led by a dedicated Airbase onboarding team. It involves connecting your accounting system, setting up policies, and training your users.

Does Airbase provide physical corporate cards?

Yes. Along with its very flexible virtual cards, Airbase also provides physical corporate cards. These are great for travel and entertainment (T&E) and other in-person costs. They are fully connected to the same policy rules and reconciliation system as the virtual cards.

What kind of customer support does Airbase offer?

Airbase offers customer support through email, phone, and an online knowledge base. Enterprise plans usually include a dedicated account manager. This person gives personalized support and strategic guidance to help you get the most out of the platform. For specific questions and comprehensive support information, our detailed Airbase FAQs section provides additional resources and answers to common implementation challenges.

Leave a Reply