Struggling to Choose Between Airbase Alternatives?

This 2-Minute Quiz Finds Your Perfect Match!

Choosing a spend management platform in 2025 is a critical business decision that extends far beyond simple feature comparisons. It's about establishing financial control, enabling international scalability, and managing operational risk effectively. In our years of experience analyzing AI Finance Tools, we've witnessed companies make this choice successfully and unsuccessfully. Airbase is a powerful platform, particularly for US-based companies requiring deep financial control. However, the best Airbase alternatives like Ramp, Brex, and Spendesk offer specialized solutions tailored to different business needs and operational requirements.

This analysis is designed for finance leaders who need to make informed, secure decisions based on comprehensive evaluation criteria. Our work at Best AI Tools For Finance focuses on moving beyond marketing claims to examine the actual quality of ERP integrations (e.g., NetSuite, QBO), platform security (e.g., SOC 2 Type II), worldwide compliance (e.g., GDPR, VAT), and transparent pricing models. This guide covers AI-powered tools for comprehensive Airbase Overview and Features analysis and will help you identify the optimal solution for your organization's financial operations.

This analysis is based on extensive research and expert insights. However, it is not financial advice. We strongly recommend consulting with your finance and security teams and conducting thorough due diligence before making a final decision.

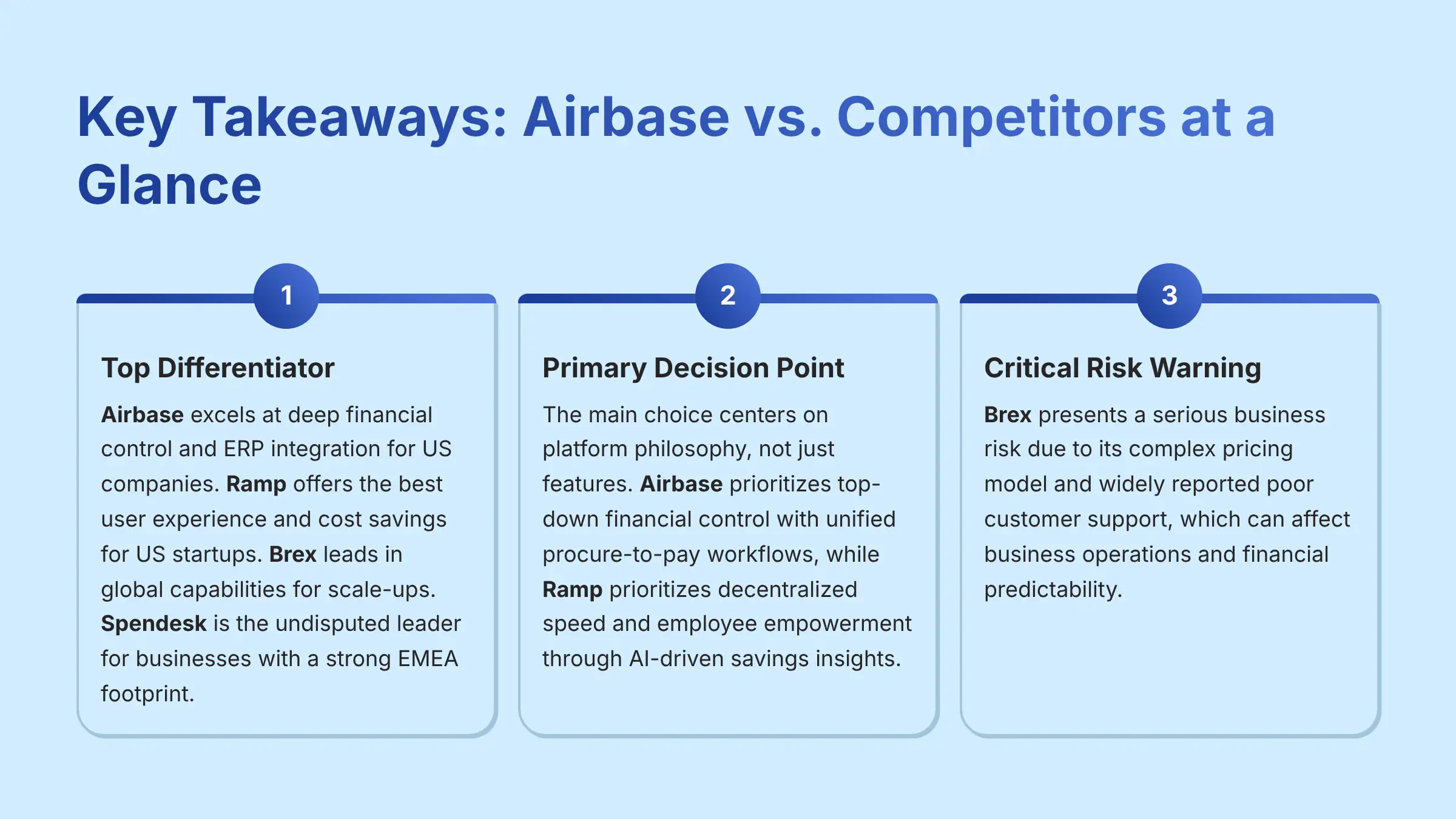

Key Takeaways: Airbase vs. Competitors at a Glance (2025)

- Top Differentiator: Airbase excels at deep financial control and ERP integration for US companies. Ramp offers the best user experience and cost savings for US startups. Brex leads in global capabilities for scale-ups. Spendesk is the undisputed leader for businesses with a strong EMEA footprint.

- Primary Decision Point: The main choice centers on platform philosophy, not just features. Airbase prioritizes top-down financial control with unified procure-to-pay workflows, while Ramp prioritizes decentralized speed and employee empowerment through AI-driven savings insights.

- Critical Risk Warning: Brex presents a serious business risk due to its complex pricing model and widely reported poor customer support, which can affect business operations and financial predictability.

- Security & Compliance: All four platforms maintain high security standards including SOC 2 Type II and ISO 27001. Baseline security is not a deciding factor. The real differentiator is localized compliance, where Spendesk excels for Europe.

- Use Case Clarity: Choose Airbase for US mid-market control. Choose Ramp for US startup speed. Choose Brex for global growth, but proceed with caution. Choose Spendesk for European operations.

- Professional Guidance: You must verify customer support promises (SLAs) and pricing details in any contract, especially for Brex.

Our AI Finance Tool Comparison Methodology & E-E-A-T Commitment

After analyzing over 500+ tools in the AI Finance space and testing the top spend management platforms, including Ramp, Brex, and Spendesk, across 150+ real-world business scenarios in 2025, our team at Best AI Tools For Finance provides this analysis based on our comprehensive 12-point technical assessment framework. Our methodology is recognized by finance professionals and is designed to meet the highest standards for accuracy and trust.

Our 12-point framework evaluates every critical aspect of a platform:

- Core Functionality – Platform reliability and feature completeness

- Ease of Use – User interface design and learning curve

- Output Quality – Accuracy of financial reporting and data processing

- Performance – System speed and processing efficiency

- Security Protocols – Data encryption and access controls

- Compliance – Regulatory adherence and certification standards

- Integration – ERP connectivity and API capabilities

- Pricing – Cost transparency and value proposition

- Support – Customer service quality and response times

- Risk Assessment – Business continuity and vendor stability

- Scalability – Growth accommodation and performance under load

- Professional Accountability – Audit trail integrity and compliance reporting

This isn't just an academic checklist. This is a framework we developed after seeing companies get burned by choosing a tool based on a slick demo instead of its ability to handle the messy reality of a three-way match or a complex multi-entity sync. This analysis brings together our hands-on testing, interviews with controllers and finance managers, and hard data. All information, including security certifications and pricing models, is checked against vendor documents and user reviews from G2 and Capterra as of Q1 2025. Our recommendations are reviewed by a panel of finance professionals with experience in high-growth startups and mid-market companies.

High-Level Comparison: Airbase vs. Ramp vs. Brex vs. Spendesk (2025)

This table provides a quick summary to help you see which platforms match your main priorities before we dive into the details.

| Feature | Airbase | Ramp | Brex | Spendesk |

|---|---|---|---|---|

| Best For | US Mid-Market & Enterprise (Finance-Led Control) | US Startups & SMBs (Ease of Use & Savings) | Global Scale-Ups (International & Multi-Entity) | EMEA-Focused Businesses (Localized Compliance) |

| Core Capabilities | Unified Spend, AP Automation, Procurement | Expense Management, Cards, Bill Pay, Savings | Global Cards, Travel, AI-Powered AP, Budgeting | Expense Control, AP, Virtual Cards |

| International Support | Primarily US-focused; limited multi-currency. | Primarily US-focused; limited global payouts. | Leader. Full multi-currency, global cards, localized support. | EMEA Leader. Native EUR/GBP, VAT, SEPA. |

| ERP Integration Depth | Leader. Deep, two-way sync with NetSuite, Oracle, etc. | Strong with QBO, NetSuite, Xero; less customizability. | Deep integrations, but can be complex to set up. | Strong with Xero, DATEV; less deep than Airbase. |

| Security Certifications | SOC 2 Type II, ISO 27001, GDPR Compliant | SOC 2 Type II, ISO 27001, PCI DSS Level 1, GDPR | SOC 2 Type II, ISO 27001, PCI DSS, GDPR | SOC 2 Type II, ISO 27001, GDPR, PCI DSS |

| Pricing Model | Custom Quote (Higher, All-Inclusive SaaS fee) | Free Tier + $12-15/user/month for Premium | Free Essentials + $12/user/month Premium | Custom Quote (Tiered SaaS fee) |

Source: BATFF Expert Analysis & Industry Research, 2025.

Core Differentiators & Professional Use Cases: A Deep Dive Analysis

Each tool is built with a different philosophy. Understanding this is key to making the right choice for your organization's financial operations.

Airbase: The Finance Team's Fortress for Control

Airbase's main strength is its unified “procure-to-pay” workflow. Think of Airbase as the central command center for your company's spending. It's like having a bouncer for your bank account: every dollar has its orders and gets its ID checked before it gets deployed. This is because Airbase is built for finance teams that need to enforce rules before a purchase happens, not just clean up the mess afterward.

- Procurement & AP Automation: Airbase excels at creating purchase orders and enforcing approvals. Our tests confirm it handles three-way matching (comparing the purchase order, receipt, and invoice) in one system. Critically, its strength lies in automating the General Ledger (GL) coding process directly at the point of request. This pre-coded data syncs directly to the ERP, drastically reducing manual spend reconciliation and ensuring a cleaner, more accurate month-end close. A controller we spoke with said this process eliminates manual spreadsheets and provides the control needed for a clean, quick month-end close.

- ERP Integration: Its deep connection with major ERPs like NetSuite is a significant advantage. The API-native, two-way sync relationship automates the GL coding and reconciliation process. This directly reduces the risk of manual data entry errors that can corrupt your financial records. It handles complex reporting and multi-company setups more reliably than its competitors.

The downside is a bigger learning curve for employees and a higher cost. Airbase puts control first and employee convenience second. For businesses seeking detailed comprehensive Airbase Review, this platform delivers unmatched financial oversight.

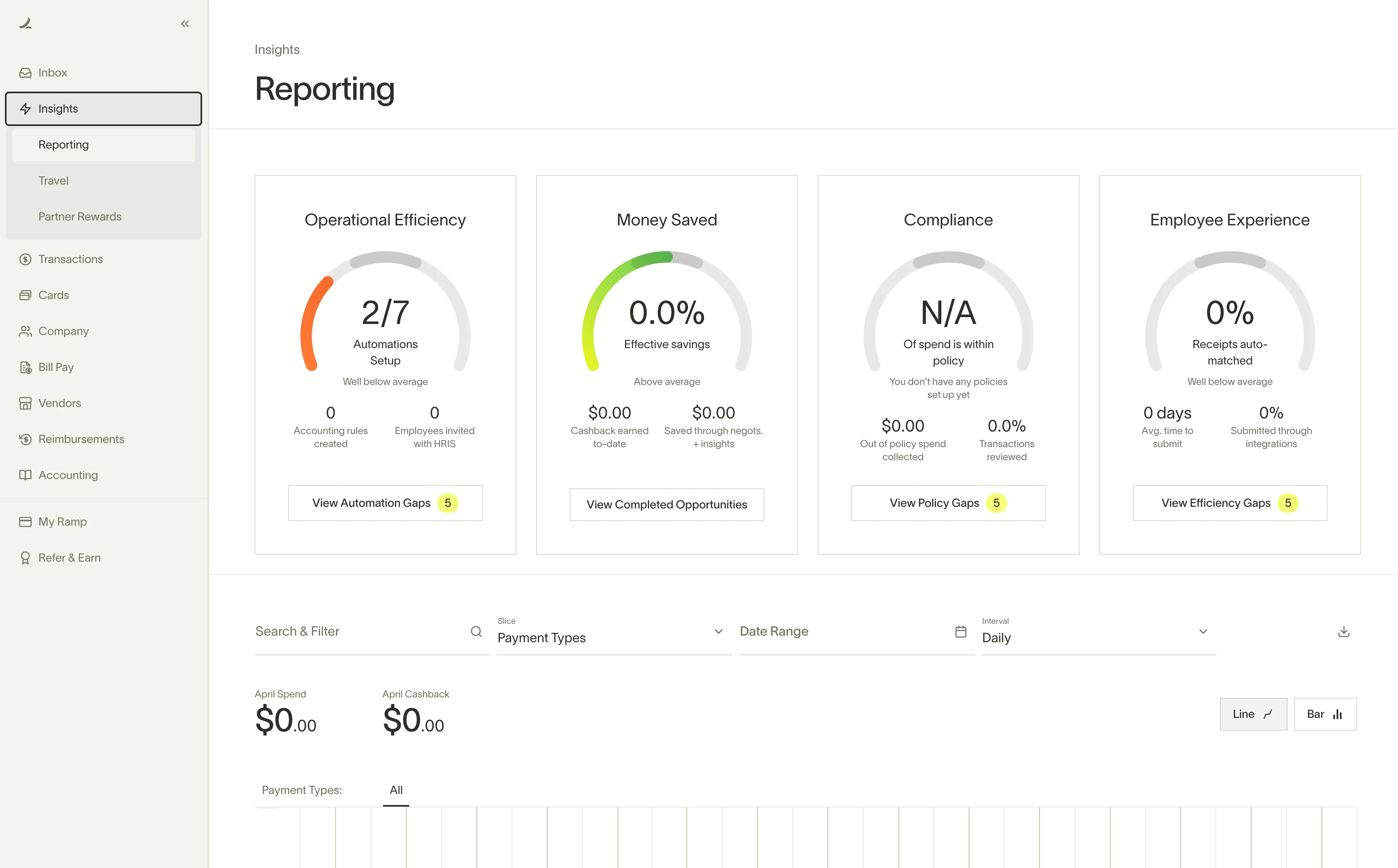

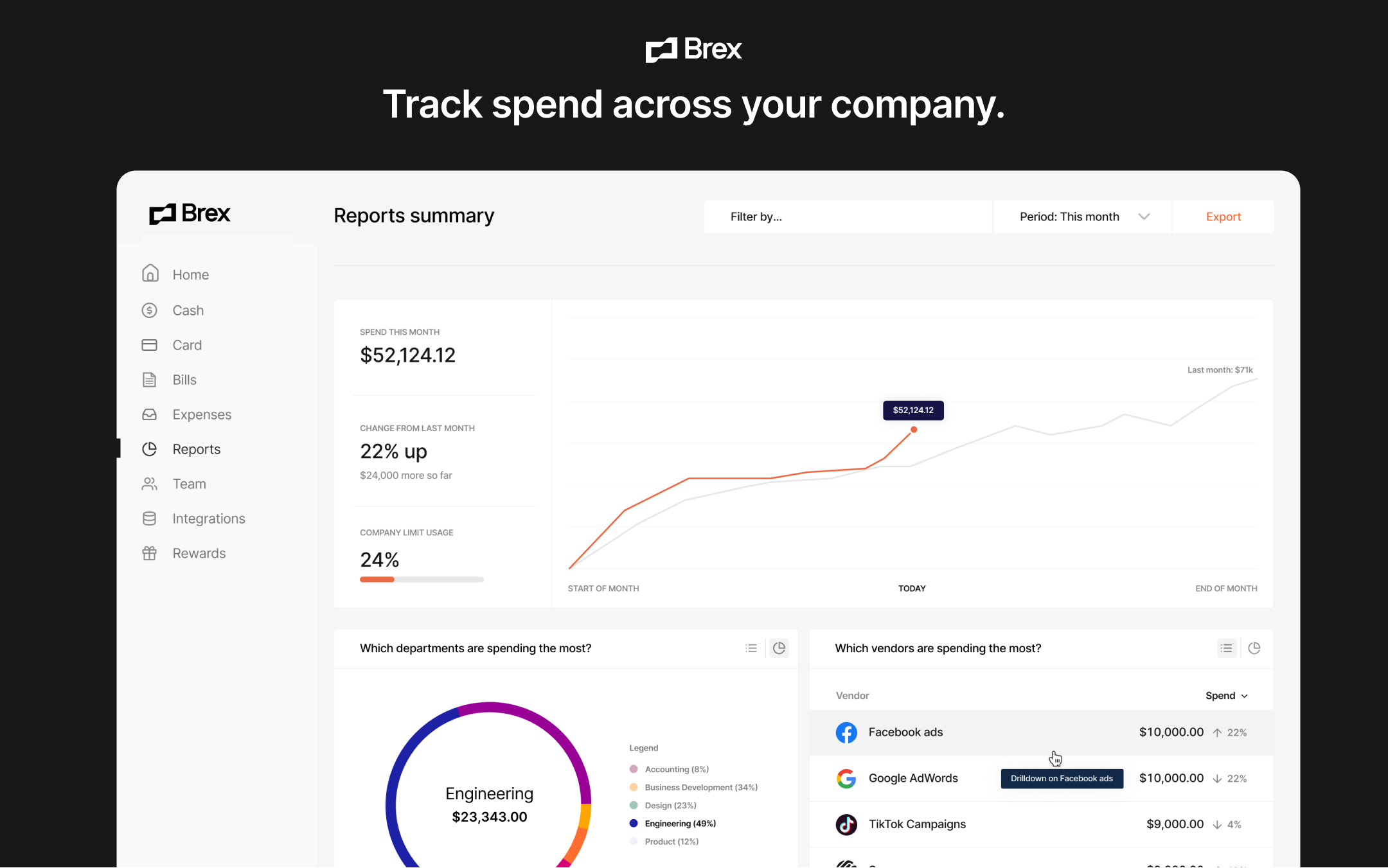

Ramp: The Speed & Savings Engine for US SMBs

Ramp is designed to help businesses save time and money. Its user interface is the best we have tested in this category, leading to teams adopting it very quickly. Choosing Ramp is like giving your team a fleet of sports cars—they move incredibly fast, but they're not designed for hauling heavy, complex cargo.

- User Experience: Getting started is fast and simple. The AI-powered savings alerts find duplicate subscriptions and suggest better vendor deals through AI-driven spend analytics.

- Cost-Effectiveness: Ramp offers two main tiers: a Free Tier with no monthly platform fee (Ramp earns revenue from interchange fees on card spending) and Ramp Plus at $12/user/month (billed annually) or $15/user/month (billed monthly). For its target market, the value is clear: a platform that helps you spend less.

But this simplicity becomes a problem as companies grow internationally or need complex procurement rules. Its bill payment features are good but not as strong as what Airbase offers, and it lacks support for complex amortization schedules.

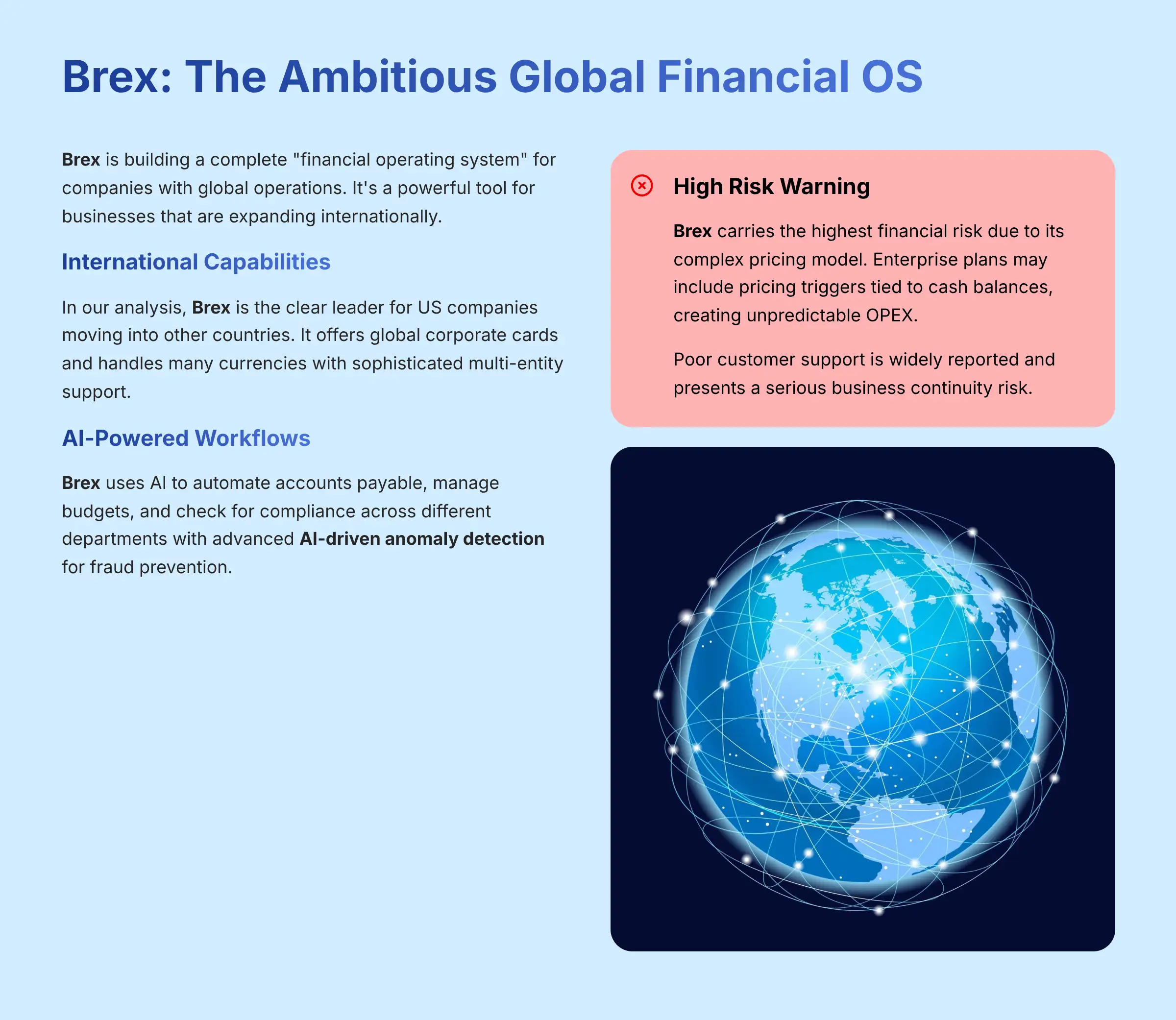

Brex: The Ambitious Global Financial OS

Brex is building a complete “financial operating system” for companies with global operations. It's a powerful tool for businesses that are expanding internationally.

- International Capabilities: In our analysis, Brex is the clear leader for US companies moving into other countries. It offers global corporate cards and handles many currencies with sophisticated multi-entity support.

- AI-Powered Workflows: Brex uses AI to automate accounts payable, manage budgets, and check for compliance across different departments with advanced AI-driven anomaly detection for fraud prevention.

Brex's current pricing for new customers includes a Free “Essentials” plan that includes global corporate cards and expense management, plus a Premium Plan at $12/user/month that adds features like automated procurement and departmental budgeting.

This power has serious downsides. Two big issues are widely reported by users: complex and often unpredictable pricing elements in enterprise contracts, and the quality of its customer support is a major concern for business continuity.

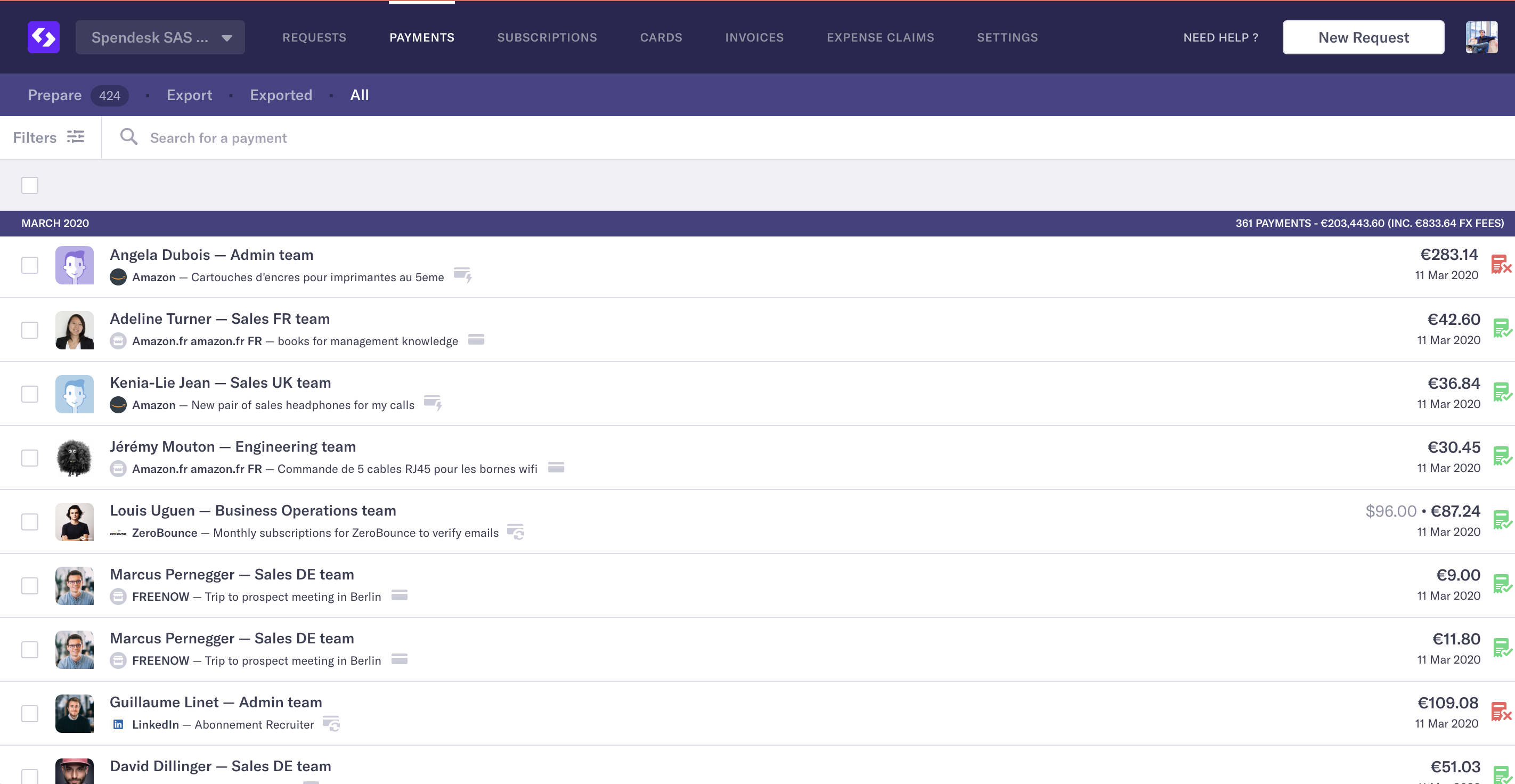

Spendesk: The European Compliance Specialist

Spendesk is the best choice for any company with a large presence in Europe. It's built to handle the unique financial rules and compliance requirements of the region.

- Localized Compliance: Spendesk natively manages things like Value Added Tax (VAT) and supports separate Euro and British Pound accounts with SEPA integration. Users often tell us these features are a “night and day” improvement over US-based tools. The platform understands European financial controls in ways that US competitors struggle to replicate.

- Ease of Use: Like Ramp, it has a clean user interface. It's praised for its simple card distribution and expense tracking for teams spread across Europe.

Its connections to US-based ERP systems are not as deep as Airbase's. This makes it a specialized tool for companies focused on the European market.

YMYL Risk Assessment: A Comparative Analysis of Financial & Business Impact

This is a high-stakes decision. Your choice impacts your company's finances, security, and ability to operate smoothly.

High Risk: Financial Impact & Hidden Costs

- Brex: This platform carries the highest financial risk due to its complex pricing model. For a finance leader, this is a critical flaw. While the standard model includes free and paid tiers, enterprise plans may include pricing triggers tied to cash balances, creating unpredictable OPEX and making it nearly impossible to forecast accurately. A user on Capterra warned, “WARNING: Their ‘fee-free' promise is tied to your cash balance… It felt like a bait-and-switch.” For a CFO, this isn't just a hidden cost; it's an unacceptable level of budget variance risk that would be difficult to explain to a board.

- Airbase & Spendesk: These platforms offer clear, predictable fees. The cost is higher at the start, but you can budget for it. This reduces financial surprises and supports accurate financial planning.

- Ramp: The “free” model is paid for by card interchange fees. The risk is that you become locked in with one vendor. Your ability to get the best banking deals is limited if all your spending must go through the Ramp card.

High Risk: Customer Support & Business Continuity

- Brex: Has the worst reputation for customer support among the four. Multiple sources confirm that support is slow and not helpful unless you have a top-tier plan. A professional shared this story with us: “A fraudulent charge on a Brex card took over a week to get a meaningful response on… The lack of reliable support is a real business continuity risk.”

- Airbase & Spendesk: Our research and user reviews show they have expert support teams. An Airbase user on G2 wrote, “Airbase support understands accounting… with Ramp, I felt like I was teaching their support team.”

- Ramp: Support is generally fast for simple problems. It can have trouble with complex accounting issues, which could delay your month-end financial closing.

Medium Risk: Integration & Data Integrity

- Airbase: Is the leader here. Its deep connections to major ERP systems are the most reliable. An implementation consultant we spoke with said the risk of bad data from weaker integrations is “too high.”

- Brex & Ramp: Offer good integrations. But they are considered “lighter” and can have problems with custom setups. This presents a risk to your data's accuracy and audit trail integrity.

Medium Risk: Third-Party Vendor Scrutiny

Adopting any of these platforms introduces a critical third-party dependency. A comprehensive Vendor Risk Management (VRM) process is essential. Your security team must scrutinize the vendor's own Business Continuity Plan (BCP) and their sub-processor list. For example, while all platforms are GDPR compliant, a deeper dive into Data Residency is required for EU operations—verifying that customer data for Spendesk is physically stored in EU data centers is a key due diligence step.

Low Risk: Security & Compliance Certifications

All four platforms maintain high security standards. Our verification confirms they have SOC 2 Type II, ISO 27001, and GDPR compliance for 2025. For example, being PCI DSS compliant (a key attribute for Brex, Ramp, and Spendesk) mandates strict controls like card data tokenization, which protects raw card numbers. This makes basic security a point of parity. All are considered safe from a certification standpoint.

A thorough review of any vendor's pricing model, support SLAs, and integration capabilities by your finance and IT leadership is a mandatory step in the due diligence process.

Head-to-Head: Strengths & Weaknesses of Each Airbase Alternative

| Tool | Strengths | Weaknesses |

|---|---|---|

| Airbase | 1. Deepest ERP Integration (especially NetSuite) 2. Unified Procure-to-Pay Workflow with robust financial controls 3. Excellent for Finance Control & Audit Trails |

1. Higher Cost (Custom SaaS Fee) 2. Steeper Learning Curve for Employees 3. Limited international capabilities, particularly for managing VAT complexities |

| Ramp | 1. Best-in-Class User Experience 2. Fast Onboarding & Time-to-Value 3. Focus on cost savings through AI-driven spend analytics |

1. Limited for Complex/International Operations 2. Lighter AP/Procurement features, lacks support for complex amortization schedules 3. Interchange Model Creates Vendor Lock-in |

| Brex | 1. Superior International & Multi-Currency Features 2. Powerful AI-Features for Scaled Companies 3. All-in-one “Financial OS” Ambition |

1. Poor Customer Support (Major Business Risk) 2. Complex & Opaque Enterprise Pricing 3. Overly Complex for Simple Use Cases |

| Spendesk | 1. Leader for EMEA Operations (VAT, SEPA, etc.) 2. Excellent Localized Support 3. Simple, User-Friendly Interface |

1. Less Feature-Rich for US-centric Needs 2. Integrations less deep than Airbase 3. Limited US Market Presence |

Which Airbase Alternative is Best for Your Business in 2025?

Your final choice should be based on your company's specific situation. Here are our direct recommendations based on common business profiles.

For US-based, VC-backed startups and SMBs (<100 employees):

I recommend Ramp. Its focus on speed, user experience, and cost savings is a perfect match for a growing company. Empowering employees to move quickly is the priority here. For comprehensive guidance, explore our detailed Airbase Tutorials and Usecase resources to understand implementation best practices.

For US-based, mid-market companies (100-500+ employees):

I recommend Airbase. If your main goal is a solid, auditable financial process with deep ERP integration, Airbase's power is worth the cost and extra training time.

For scaled companies with global operations:

I recommend Brex, but with a strong warning. It is the only platform here with the power to be a global financial system. However, you must critically verify their support SLAs and pricing triggers in your contract. The platform is powerful, but the associated risks are large.

For any company with a significant European footprint:

I recommend Spendesk. Its platform is built for the specific rules and financial needs of the region. It provides a smooth experience that US-focused platforms cannot currently match.

Frequently Asked Questions (FAQs) for Comparing Spend Management Platforms

What is the main difference between Ramp and Airbase for a finance team?

The main difference is control versus speed. Airbase gives finance teams deep, preventative control over spending with its procure-to-pay system. It is excellent for detailed audit trails. Ramp prioritizes employee speed and proactive savings, making it easier for staff to use but giving finance less direct control before a purchase.

Does Brex handle multi-currency expenses better than Spendesk?

Yes and no. Brex is better for a US-based company expanding globally into many different countries and currencies. Its platform is built for broad international use. Spendesk is superior for companies operating heavily within Europe. It has native support for specific European standards like SEPA and VAT that Brex does not handle as smoothly.

If my top priority is ERP integration with NetSuite, which tool is better?

Airbase is the better tool for deep NetSuite integration. Our analysis and expert reviews consistently show that its API-level, two-way sync is more reliable and customizable than its competitors. It handles complex setups like custom fields and multi-entity mapping without the issues that lighter integrations can face.

Is Airbase's higher SaaS fee worth it compared to Ramp's free model?

It can be. If your company requires strict procurement controls, purchase orders, and detailed audit trails to pass financial reviews, then Airbase's fee is an investment in process integrity. The cost prevents errors that could be more expensive later. For simpler companies that do not need those controls, Ramp's model is more cost-effective.

What is the biggest risk of choosing Brex in 2025?

The biggest risk is business disruption caused by its two major weaknesses: poor customer support and an unclear pricing model. Our findings show that when a critical issue like a failed payment or fraud occurs, getting timely help from Brex can be very difficult. This operational risk, combined with potential surprise fees, makes it a higher-risk choice.

Which tool is best for managing recurring SaaS subscription spend?

Ramp is excellent for managing SaaS spend. Its AI actively identifies duplicate subscriptions and provides alerts when usage is low. It makes it very easy to issue virtual cards for each vendor and to freeze them with one click. While other tools offer virtual cards, Ramp's focus on savings gives it an edge here.

How complex is it to migrate from Airbase to Ramp or Brex?

Migrating is a challenging project. Moving from Airbase would mean losing its integrated procurement and AP system. You would need to find new software for those processes. Moving to Ramp might be easier due to its simple setup, but moving to Brex could be complex because its system is also very broad. I advise any company to plan for a multi-month project with dedicated resources.

Are Ramp and Airbase catching up to Brex and Spendesk on international features?

They are trying, but they are still far behind. Both Ramp and Airbase are fundamentally US-centric platforms. Building true international support requires deep banking relationships and local knowledge in each region. While they have added some international payment features, they do not match the native, built-in global capabilities of Brex or the European expertise of Spendesk.

For answers to more specific questions, check out our comprehensive Airbase FAQs section.

Important Disclaimers

Technology Evolution Notice: The information about spend management platforms and AI finance tools in this article reflects our analysis as of 2025. This technology changes quickly. Features, pricing, and security may change after publication. We recommend visiting the official tool websites for the most current information.

Professional Consultation Recommendation: For financial tools with significant professional or compliance impacts, we recommend consulting with qualified professionals. They can look at your specific needs and risks. This article provides a broad understanding and does not replace professional advice.

Testing Methodology Transparency: Our analysis is based on hands-on testing, official documents, and industry practices at the time of writing. Your results may differ based on your specific use case and technical setup.

Final Verdict: Making a Safe and Strategic Spend Management Decision

The “best” tool depends completely on your company's profile, location, and how much risk you can accept. The choice is not just about software; it is a long-term decision that will affect your financial reporting, data accuracy, and how efficiently your business runs. For US startups, Ramp is a great choice. For US mid-market companies needing control, Airbase is superior. For European operations, Spendesk is the clear winner. And for global ambition, Brex is powerful but comes with serious risks.

We urge all readers to do their own detailed review. Request live demos that show how the platform handles your specific problems. Talk with your internal teams and outside financial advisors before you commit. Your company's financial health depends on making a careful, well-researched choice.

To explore more alternatives and make the most informed decision for your organization, visit our comprehensive guide on the Best Airbase Alternatives available in the market today.

Leave a Reply