Key Takeaways

- Contract Intelligence Platform: Icertis transforms static contracts into strategic financial assets using advanced AI, going beyond basic CLM tools

- Financial Compliance: Automates ASC 606/IFRS 15 revenue recognition compliance with AI-powered obligation tracking and audit-ready documentation

- Enterprise ROI Focus: Organizations typically capture 0.5-1% of annual revenue through revenue leakage prevention and 2-5% additional procurement savings

- Implementation Reality: True TCO includes 1.5-2x first-year licensing fees with 12-18 month deployment timelines for comprehensive enterprise implementations

- Security & Compliance: Maintains SOC 2 Type II, ISO 27001 certifications with enterprise-grade security for sensitive financial and legal data

Are your enterprise contracts just sitting there, costing you money and hiding risks? This comprehensive Icertis FAQs guide, from Best AI Tools For Finance, is here to unlock the strategic power of your agreements. We're talking about transforming static legal documents into dynamic, revenue-optimizing assets. Scott Seymour, our founder, is all about demystifying complex financial tools, and folks, Icertis is a prime example of an AI tool that does exactly that.

Here, you'll dive deep into why Icertis isn't just another CLM, but a powerhouse AI finance tool that addresses critical financial compliance like ASC 606, mitigates risk, and integrates seamlessly with your ERPs – well, as seamlessly as possible, let's be real. If you're looking to revolutionize your contract intelligence and empower your finance and legal teams, you've hit the jackpot. We aim to be your most trusted resource for Best Al Tools For Finance, especially when it comes to cutting-edge AI Tools For Contracts and Legal. Get ready to ditch the manual headaches and lean into intelligent contract management. With an abundance of resources at your fingertips, including detailed Icertis Tutorials and Usecase, you can quickly grasp the platform's full potential. These tutorials provide step-by-step guidance, ensuring that you maximize the benefits of AI-driven solutions in your organization. Embrace the future of contract management and unlock insights that will drive your business success.

Icertis FAQs: Complete Guide for AI Finance Tools

What is Icertis FAQs and how does it function as an AI Finance Tool?

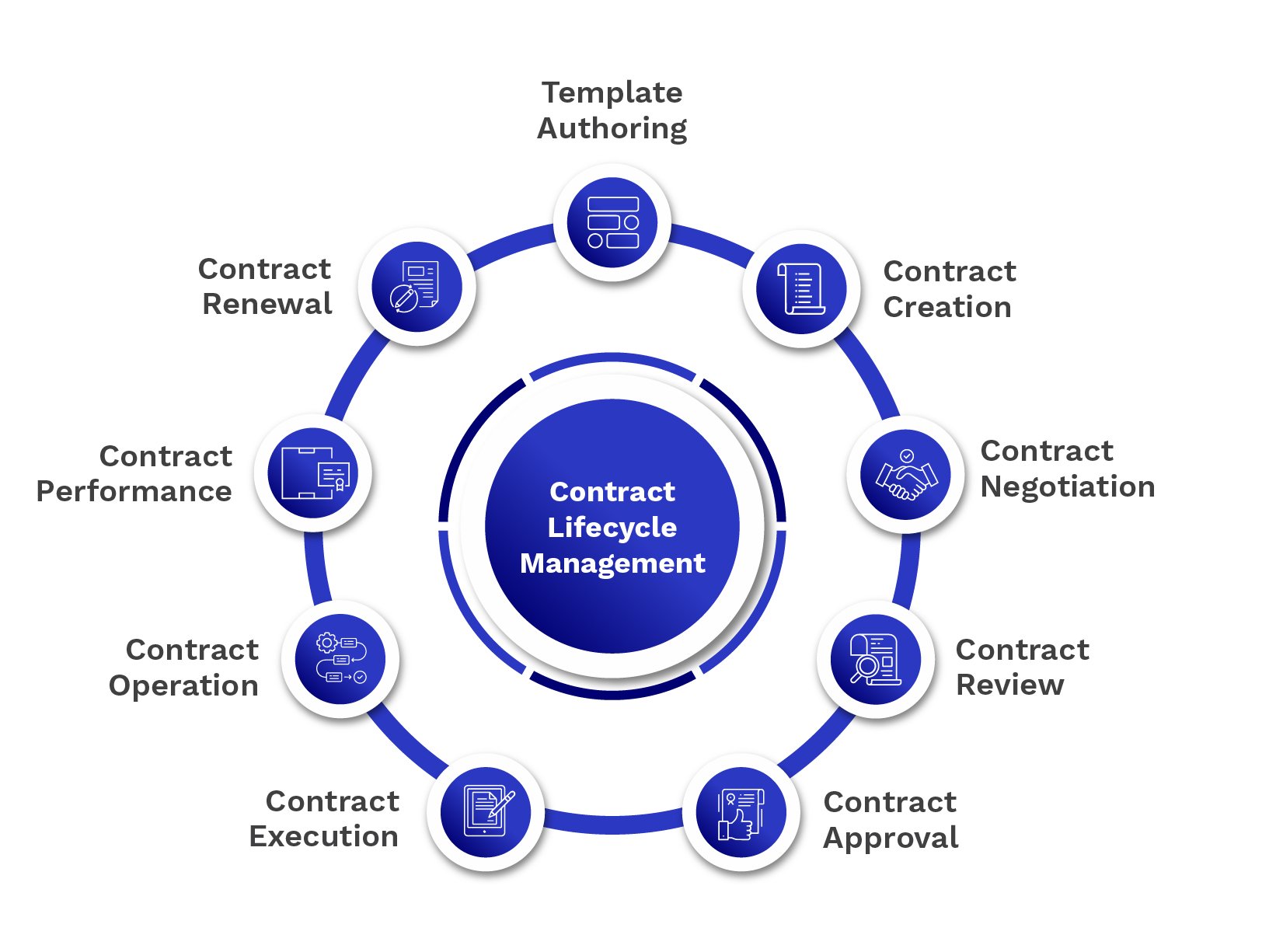

Icertis is an enterprise-grade Contract Intelligence (CI) platform that transforms static contracts into strategic financial assets using advanced artificial intelligence. Unlike basic contract lifecycle management (CLM) tools, Icertis FAQs reveal how this platform goes far beyond simple digital contract storage to become a mission-critical AI Finance Tool for modern enterprises.

At its core, Icertis uses AI to structure and connect critical business information buried within contracts, making that data available across your entire organization. The platform's AI models can read, understand, and extract thousands of different clause types, terms, and metadata points—such as payment schedules, rebate conditions, renewal dates, liability caps, and revenue recognition triggers.

As an AI Finance Tool, Icertis's primary function is providing a single, dynamic source of truth for all commercial, legal, and financial entitlements and obligations. Instead of finance and legal teams manually searching through PDFs and spreadsheets, Icertis automatically surfaces this data and integrates it with ERP and CRM systems. This enables automated compliance monitoring, real-time financial risk assessment, revenue optimization, and ensures that negotiated deals are properly executed in financial systems. With Icertis Overview and Features, organizations can easily access critical insights, helping to streamline decision-making processes. By leveraging advanced analytics and machine learning capabilities, Icertis allows teams to forecast financial outcomes more accurately and identify opportunities for cost savings. This holistic approach not only improves operational efficiency but also strengthens overall compliance with contractual obligations.

The platform connects contractual intent to real-world execution, making it an indispensable AI Finance Tool for organizations where revenue, expenses, and risks are heavily defined by complex contract portfolios. This intelligent approach transforms contracts from static documents into active, enforceable business rules that govern operations.

Who should use Icertis FAQs for AI Finance Tools implementation?

Icertis FAQs demonstrate that this platform is specifically designed for large enterprise organizations with high-volume, complex contract portfolios where traditional manual processes create significant financial and operational risks. The AI Finance Tool delivers maximum value to three critical organizational functions.

Finance Leaders (CFOs, Controllers, Revenue Recognition Teams)

Primary Beneficiaries: Risk Mitigation & Revenue Optimization✅ Core Benefits: Financial Risk Management

- Essential visibility into revenue recognition triggers per ASC 606/IFRS 15 standards

- Accurate invoicing against contractual terms with automated verification

- Complex rebates and discounts tracking to prevent revenue leakage

- SOX compliance maintenance with audit-ready documentation

⚠️ Requirements: Enterprise-Scale Complexity

- High-volume contract portfolios (typically 1000+ active contracts)

- Complex financial instruments and revenue recognition scenarios

- Multiple business units with varying contract types

- Regulatory compliance requirements across jurisdictions

Legal Teams (General Counsels, Legal Operations)

Secondary Users: Risk Management & Efficiency✅ Legal Operations Benefits

- Automated compliance with GDPR and industry-specific regulations

- Standardized contract language through pre-approved clause libraries

- AI-accelerated review cycles while maintaining quality standards

- Comprehensive risk assessment and mitigation tracking

⚠️ Implementation Considerations

- Requires significant change management for legal workflows

- Initial setup demands extensive clause library development

- Legal team training on AI-powered contract analysis

- Integration with existing legal technology stack

Procurement Leaders (CPOs, Supply Chain Managers)

Strategic Users: Cost Savings & Supplier Compliance✅ Procurement Value Drivers

- Ensures negotiated savings realization through supplier obligation tracking

- Performance monitoring against SLAs with automated alerts

- Clear visibility into commitments for effective sourcing decisions

- Supply chain risk management through compliance monitoring

⚠️ Deployment Challenges

- Supplier onboarding and change management requirements

- Integration with existing procurement and ERP systems

- Training on contract intelligence vs. traditional procurement tools

- Initial data migration from legacy contract repositories

Organizations typically implementing Icertis as their primary AI Finance Tool include Fortune 500 companies, regulated industries (healthcare, financial services, manufacturing), and any enterprise where contract complexity directly impacts financial performance and regulatory compliance.

How does Icertis FAQs differ from basic CLM or e-signature tools like DocuSign?

Icertis FAQs reveal a fundamental distinction that's crucial for AI Finance Tools evaluation: the difference between process automation and intelligence-driven contract management. Basic CLM and e-signature tools like DocuSign focus primarily on the workflow of creating and signing contracts—drafting from templates, routing for approval, and capturing legally binding signatures to make the contracting process more efficient.

Icertis, as a Contract Intelligence platform and AI Finance Tool, treats workflow automation as the foundation rather than the end goal. The fundamental differentiator lies in what happens after contract execution. Icertis uses advanced AI to understand the substance of contracts at scale, digitizing and structuring obligations, entitlements, and metadata within the complete contract body.

| Capability | DocuSign/Basic CLM | Icertis Contract Intelligence |

|---|---|---|

| Primary Focus | Workflow automation and digital signatures | Contract intelligence and AI-powered analysis |

| Post-Execution Value | Document storage and basic reporting | Active monitoring and enforcement of obligations |

| AI Capabilities | Limited to template suggestions | Advanced NLP for clause extraction and risk analysis |

| Financial Integration | Basic contract-to-billing workflows | Deep ERP integration with revenue recognition automation |

| Compliance Monitoring | Manual review and calendar reminders | Automated compliance tracking with real-time alerts |

| Target Users | Small to mid-size businesses | Enterprise organizations with complex portfolios |

While DocuSign ensures contracts are signed correctly, Icertis ensures the promises within contracts are actively monitored and enforced. For example, this AI Finance Tool can automatically track tiered volume discounts and alert finance teams when invoices don't reflect correct pricing, monitor supplier compliance with delivery timelines and ESG clauses, and integrate contract data with transactional systems (ERP, CRM, SCM).

The platform transforms signed documents into active, enforceable business rules governing operations. This intelligence-first approach makes Icertis an AI Finance Tool rather than simply a digital signature platform. For finance professionals, this means moving from “Did we get this signed?” to “Are we realizing the financial value we negotiated?” This distinction is critical when evaluating AI Finance Tools for enterprise contract management where financial performance depends on contract compliance and optimization.

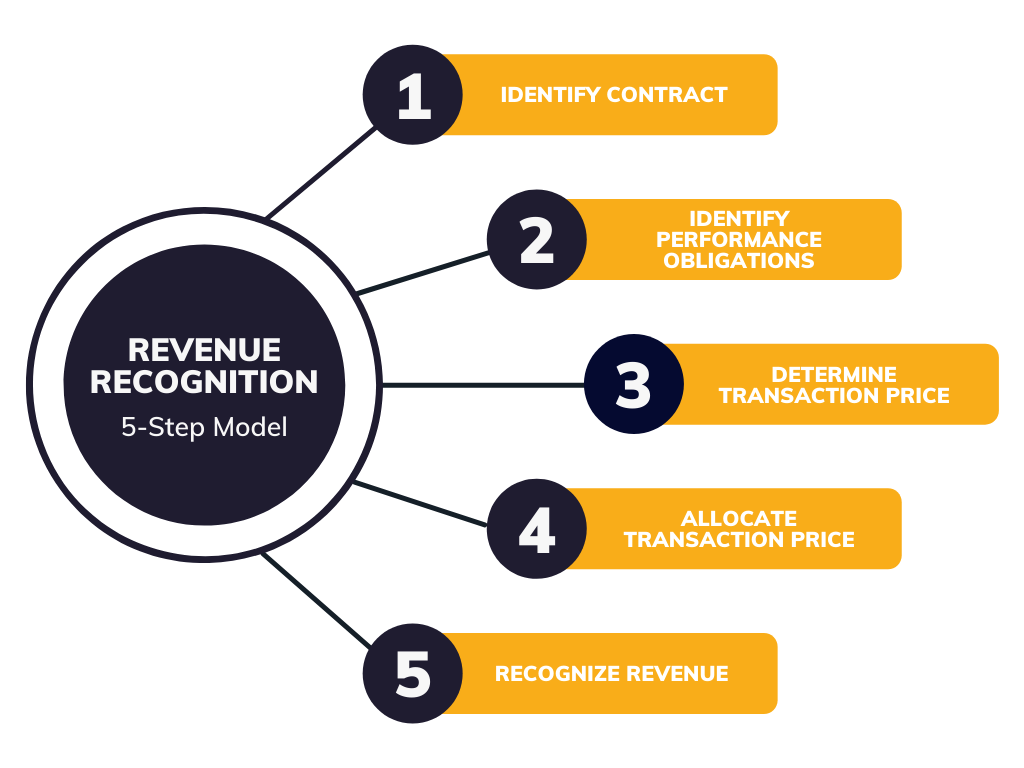

How does Icertis FAQs address financial compliance requirements like ASC 606?

Icertis FAQs demonstrate sophisticated capabilities for addressing complex financial compliance standards like ASC 606 and IFRS 15, making it an essential AI Finance Tool for revenue recognition compliance. These standards require companies to recognize revenue when performance obligations are satisfied, which becomes incredibly complex to track manually across thousands of contracts.

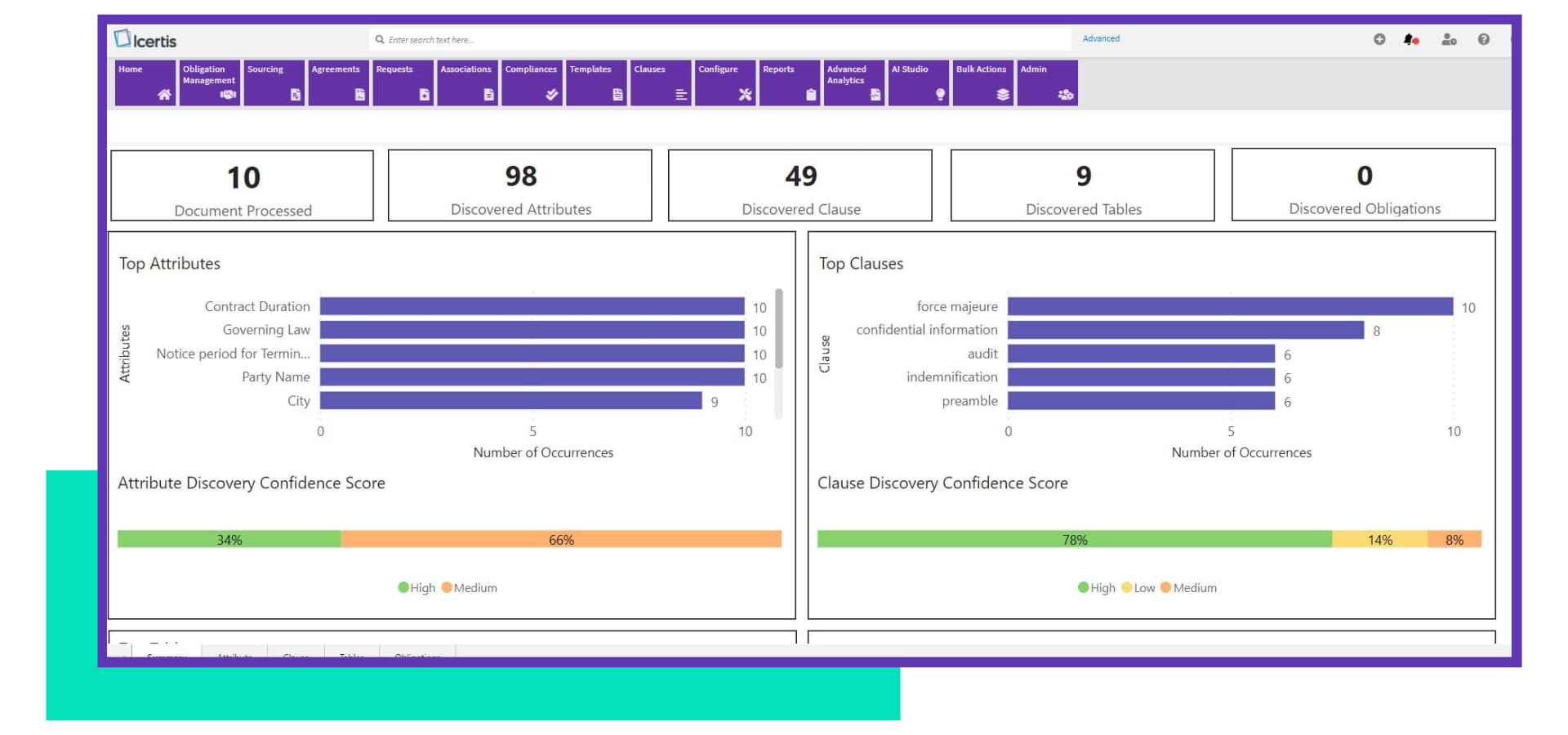

The platform uses several AI-powered applications to achieve compliance automation:

- DiscoverAI ingests and digitizes entire contract portfolios, using Natural Language Processing (NLP) to identify and tag key obligations such as delivery milestones, acceptance criteria, and service-level agreements (SLAs). This creates a structured, searchable database of all contractual commitments that impact revenue recognition.

- ObligationsAI actively monitors these commitments by linking contract terms to operational and financial systems like ERP platforms. When deliveries are made or project milestones are met (as recorded in the ERP), the Icertis platform automatically triggers appropriate revenue recognition events in financial ledgers according to rules defined in contracts.

- Continuous Automated Verification creates clear, auditable trails from contractual obligation to financial reporting, eliminating manual contract review for compliance purposes and dramatically reducing both non-compliance risk and audit preparation time.

| ASC 606 Requirement | Manual Process Challenge | Icertis AI Solution |

|---|---|---|

| Performance Obligation Identification | Manual contract review and interpretation | AI-powered clause extraction and obligation mapping |

| Transaction Price Allocation | Spreadsheet-based calculations prone to errors | Automated pricing analysis with complex arrangement handling |

| Revenue Recognition Timing | Manual milestone tracking and verification | Real-time ERP integration with automated trigger events |

| Contract Modifications | Risk of missing revenue impact changes | AI detects modifications and updates financial integrations |

| Audit Documentation | Time-intensive manual compilation | Automated audit trails with transparent compliance logs |

For finance teams, this AI Finance Tool eliminates manual contract review for compliance purposes, dramatically reducing both non-compliance risk and audit preparation time. The platform maintains detailed audit logs showing exactly when and why revenue recognition events were triggered, providing auditors with transparent documentation of compliance processes.

Additionally, Icertis supports complex scenarios including multi-element arrangements, variable consideration, and contract modifications that frequently challenge ASC 606 compliance. The AI can identify when contract changes impact revenue recognition timing and automatically update financial system integrations accordingly, ensuring ongoing compliance as business relationships evolve.

How do Icertis FAQs compare to ERP-native CLM modules like SAP Ariba or Coupa?

Icertis FAQs reveal critical distinctions between best-of-breed AI Finance Tools and ERP-native CLM modules that significantly impact enterprise contract management effectiveness. The primary difference centers on depth versus breadth of contract intelligence capabilities.

ERP-native CLM modules like SAP Ariba and Coupa excel within their specific ecosystems, offering deep integration for procure-to-pay or source-to-pay workflows. Their strength lies in creating seamless procurement processes within a single vendor's technology stack. If your primary objective is standardizing procurement workflows and connecting contracts directly to purchase orders and invoices within that ecosystem, these solutions can be effective for procurement-focused use cases.

| Comparison Factor | ERP-Native CLM (SAP Ariba/Coupa) | Icertis Best-of-Breed |

|---|---|---|

| Contract Scope | Primarily procurement-focused contracts | Enterprise-wide: buy-side, sell-side, corporate contracts |

| AI Sophistication | Basic workflow automation and approval routing | Advanced AI for risk scoring, clause analysis, obligation extraction |

| Integration Architecture | Deep integration within single ERP ecosystem | Flexible integration with multiple best-of-breed platforms |

| Contract Complexity | Standard procurement agreements and POs | Complex sales, partnerships, M&A, IP licensing agreements |

| Implementation Approach | Part of broader ERP deployment strategy | Dedicated contract intelligence platform implementation |

| Total Cost Model | Bundled within ERP licensing costs | Separate licensing with dedicated professional services |

However, their limitations become apparent with enterprise-wide contract complexity. These modules typically struggle with sophisticated sales agreements, strategic partnerships, M&A documentation, intellectual property licensing, and complex lease arrangements that require advanced AI analysis capabilities.

Icertis, as a best-of-breed AI Finance Tool, is architected to serve as the central contracting hub for entire enterprises. Key differentiators include:

- Enterprise-wide Scope: Manages buy-side, sell-side, and corporate contracts (HR, legal, NDAs) with equal analytical depth and AI-powered intelligence.

- Advanced AI Analysis: More sophisticated AI models for risk scoring, clause-level analysis, and extracting complex obligations across varied legal language and contract types.

- Flexible Integration Architecture: While Ariba and Coupa integrate deeply with their own systems, Icertis connects with multiple best-of-breed platforms (Salesforce for sales, SAP for finance, Workday for HR), reflecting heterogeneous enterprise IT landscapes.

The choice often depends on your organization's “center of gravity.” If 90% of contracting complexity involves standard procurement, SAP Ariba might suffice. However, if value derives from complex sales contracts, strategic alliances, or intellectual property agreements, ERP modules typically cannot scale to meet enterprise-wide AI Finance Tool requirements.

What are the integration challenges between Icertis FAQs and ERP systems like SAP?

Icertis FAQs acknowledge that while the platform promotes robust connectors for major ERPs like SAP, integration represents a significant undertaking with real challenges that go beyond technology connectivity. Based on implementation analysis and user feedback, primary difficulties involve data quality, process alignment, and master data management rather than technical integration capabilities.

Critical Integration Challenges

Data Quality and Master Data Management: The most critical challenge is ensuring “data-to-data” integrity across systems. For Icertis to link contracts to SAP transactions, customer and vendor master data must be perfectly synchronized between platforms. Any discrepancies in names, IDs, or legal entities break these connections. This often forces organizations to undertake major data cleansing projects before integration can begin, representing significant time and resource investments.

Process Re-engineering Requirements: Icertis cannot simply be “plugged into” existing inefficient processes. For seamless “contract-to-cash” workflows, organizations must clearly define system handoffs. Critical questions include:

- When is a contract officially “executed” in Icertis, and how does that trigger sales order creation in SAP?

- Who validates that SAP-generated invoices correctly reflect tiered pricing terms stored in Icertis?

- How do contract modifications in Icertis automatically update pricing and terms in SAP?

- What happens when contract renewals occur—how are new terms propagated to financial systems?

| Integration Challenge | Impact Level | Typical Resolution Timeline | Success Factors |

|---|---|---|---|

| Master Data Synchronization | High | 2-4 months additional | Dedicated data governance team, data cleansing budget |

| Process Re-engineering | Critical | 3-6 months planning | Cross-functional alignment, clear workflow documentation |

| Change Management | High | 6-12 months adoption | User training, executive sponsorship, phased rollout |

| System Performance | Medium | 1-2 months optimization | Infrastructure planning, performance testing |

| Governance Structure | Medium | 2-3 months establishment | Clear ownership, update responsibilities, audit trails |

Without cross-functional teams from finance, legal, and IT mapping and agreeing on new integrated workflows, projects typically fail or deliver minimal value. Additional challenges include:

- Change Management: Users must adopt new processes spanning multiple systems, requiring comprehensive training and adjustment periods.

- System Performance: Real-time data synchronization between Icertis and SAP can impact system performance without proper infrastructure planning.

- Governance: Establishing clear data ownership and update responsibilities across systems requires organizational alignment.

Success Strategy for ERP Integration

Phased Implementation Approach: Start with single, high-value process flows rather than comprehensive integration. Use pilot projects to build expertise, clean necessary master data, and demonstrate ROI before broader deployment.

Cross-Functional Project Teams: Ensure dedicated representation from IT, finance, legal, and procurement with clear decision-making authority and accountability for integration success.

Data Governance First: Establish master data management processes before technical integration begins, including data quality standards, update procedures, and ongoing maintenance responsibilities.

Is Icertis FAQs secure enough for sensitive financial and legal data?

Icertis FAQs demonstrate that security is fundamental to the platform's architecture, designed specifically to handle highly sensitive data for Fortune 500 companies, government agencies, and regulated industries. As an AI Finance Tool managing critical financial and legal information, the platform maintains enterprise-grade security standards with third-party validation.

Compliance Certifications and Third-Party Validation

Icertis maintains multiple critical certifications providing verifiable, third-party security assurance:

- SOC 2 Type II: Validates effective controls for security, availability, processing integrity, confidentiality, and privacy over extended periods—often a non-negotiable requirement for enterprise finance teams.

- ISO 27001: Leading international standard for information security management systems (ISMS), demonstrating systematic approaches to managing sensitive information.

- Additional Certifications: Including industry-specific compliance frameworks relevant to healthcare (HIPAA), financial services, and government contractors.

| Security Domain | Icertis Implementation | Business Impact |

|---|---|---|

| Data Encryption | Encryption at rest and in transit using AES-256 | Protects contract data during storage and transmission |

| Access Control | Role-based access with granular permissions | Users only access contracts relevant to their functions |

| Audit Trails | Comprehensive logging of every contract action | Complete visibility for compliance and forensic analysis |

| Threat Detection | Advanced monitoring with real-time alerts | Proactive identification of potential security incidents |

| Infrastructure | Microsoft Azure cloud platform | Enterprise-grade physical and network security |

| Data Governance | Data residency controls and backup systems | Meets multinational compliance requirements |

Technical Security Features

The platform incorporates comprehensive security measures including:

- Data Encryption: At rest and in transit using industry-standard encryption protocols

- Role-Based Access Control: Ensuring users only access contracts relevant to their functions

- Comprehensive Audit Trails: Logging every contract action for compliance and forensic analysis

- Advanced Threat Detection: Continuous monitoring with automated alerts for suspicious activities

Infrastructure and Data Governance

Microsoft Azure Foundation: Built on Microsoft Azure, leveraging Azure's significant investments in physical and network security, global data center infrastructure, and continuous security monitoring.

Data Governance Capabilities: Features include data residency controls for multinational organizations, detailed permission management for cross-functional teams, automated backup and disaster recovery capabilities, and integration with enterprise identity management systems.

The platform operates a dedicated trust center providing transparency into security and compliance posture. While no system is completely impenetrable, Icertis's documented security measures and public certifications meet rigorous standards required by enterprise finance and legal departments handling sensitive contractual and financial data.

What is the true Total Cost of Ownership (TCO) for Icertis FAQs implementation?

Icertis FAQs reveal that Total Cost of Ownership (TCO) extends significantly beyond initial software licensing fees, requiring comprehensive budgeting for successful AI Finance Tool implementation. Prospective buyers must account for several critical cost categories to develop realistic financial projections.

| Cost Category | % of Total Project Cost | Typical Range | Key Factors |

|---|---|---|---|

| Initial Licensing | 40-50% | $500K – $2M+ annually | User count, contract volume, module selection |

| Implementation Services | 25-50% | $400K – $1.5M | Portfolio complexity, integration requirements |

| Integration & Data Prep | 15-30% | $200K – $800K | Legacy system complexity, data quality |

| Change Management | 10-20% | $100K – $400K | Organization size, process complexity |

| Ongoing Administration | 15-25% annually | $75K – $300K/year | Platform complexity, support requirements |

Implementation and Professional Services (25-50% of first-year costs)

This represents the most significant additional expense, typically handled by Icertis professional services or certified partners. Costs depend on:

- Contract portfolio complexity and number of contract types requiring configuration

- Legacy contract migration volume and data quality requirements

- Required system integrations with ERP, CRM, and procurement platforms

- Custom workflow development and business rule configuration

Complex implementations often cost as much as or more than first-year licensing fees, particularly for organizations with diverse contract portfolios or extensive integration requirements.

Integration and Data Preparation (15-30% of total project cost)

Integrating with systems like SAP or Salesforce requires substantial effort including:

- Data cleansing to align master data across systems

- Custom integration development for unique requirements

- System performance optimization and load testing

- Ongoing maintenance and monitoring infrastructure

Change Management and Training (10-20% of implementation cost)

User adoption requires investment in:

- Formal change management programs to redefine cross-functional processes

- Comprehensive training programs beyond basic Icertis Academy offerings

- Internal champion development and ongoing support structures

- Opportunity costs of employee time during transition periods

Ongoing Administration and Maintenance (15-25% of annual licensing cost)

Post-implementation requires:

- Dedicated Icertis administrators and system maintenance

- Regular system updates and feature adoption

- User onboarding and continuous support

- Custom report development and process optimization

Realistic TCO Planning Recommendations

Organizations should budget implementation costs at 1.5-2x first-year licensing fees, plan for 12-18 month implementation timelines, include internal resource opportunity costs, and factor ongoing administrative overhead into annual budgets.

Successful implementations recognize these investments as necessary for realizing the substantial ROI potential that makes Icertis a valuable AI Finance Tool for enterprise contract management.

How do you measure ROI for Icertis FAQs as an AI Finance Tool?

Icertis FAQs emphasize that measuring Return on Investment (ROI) requires focusing on quantifiable financial impact rather than efficiency metrics alone. Successful business cases for this AI Finance Tool should be built on three to four key value drivers with measurable financial outcomes.

Primary ROI Drivers with Quantifiable Impact

| ROI Driver | Typical Impact Range | Measurement Method | Payback Timeline |

|---|---|---|---|

| Revenue Optimization | 0.5-1% of annual revenue | Before/after analysis of revenue leakage | 6-12 months |

| Procurement Savings | 2-5% additional savings | Supplier compliance tracking metrics | 12-18 months |

| Compliance Cost Reduction | 50-70% effort reduction | Person-hours for manual audits | 3-6 months |

| Operational Efficiency | 40-60% time savings | Contract processing cycle times | 3-9 months |

Revenue Optimization and Leakage Prevention (Primary ROI Driver)

Analyze existing contracts to identify money left on the table including:

- Missed price escalations and renewals

- Unfulfilled volume discounts and rebates

- Failure to invoice for all delivered services

- Incorrect pricing due to manual errors

Conservative estimates suggest capturing just 0.5-1% of annual revenue currently lost to leakage can justify entire platform investments. For a $1B revenue organization, this represents $5-10M in annual value capture.

Procurement Savings Realization (Secondary ROI Driver)

On the buy-side, Icertis ensures negotiated savings are fully realized through:

- Supplier compliance tracking with rebates and discounts

- Enforcement of negotiated payment terms

- Identification and elimination of off-contract spending

- Improved supplier performance management

Organizations typically realize 2-5% additional procurement savings through better contract compliance, representing significant value for organizations with large supplier spends.

Compliance Cost Reduction (Risk Mitigation Value)

Calculate current compliance activity costs including:

- Person-hours for manual audits (SOX, industry regulations)

- Potential financial impact of missed regulatory deadlines

- Reduced legal review time through standardization

- Decreased audit preparation expenses

Compliance automation often saves 50-70% of manual effort while reducing risk exposure, providing both direct cost savings and risk mitigation value.

ROI Calculation Best Practice

Before vendor selection, conduct a “contract value assessment” using 100-200 critical contracts to establish baseline metrics for:

- Revenue leakage analysis across different contract types

- Compliance costs and manual effort tracking

- Operational inefficiencies and cycle time measurements

- Risk exposure quantification

This provides credible, data-backed projections that finance executives can trust and validate against actual results post-implementation, ensuring realistic ROI expectations and successful business case development.

What is the typical implementation timeline for Icertis FAQs deployment?

Icertis FAQs reveal that implementation timelines vary significantly based on scope and complexity, requiring realistic expectations for this comprehensive AI Finance Tool deployment. This is not a plug-and-play SaaS solution that can be operational within weeks—successful implementations require strategic, phased approaches.

| Implementation Phase | Duration | Key Activities | Success Criteria |

|---|---|---|---|

| Phase 1 – Foundation | 4-6 months | Single contract type, core configuration, basic integrations | Demonstrate value and build organizational momentum |

| Phase 2 – Expansion | 6-18 months | Additional departments, complex contract types, advanced AI | Scale across organization with proven methodologies |

| Full Deployment | 12-24 months | Complete enterprise rollout with all integrations | Organization-wide contract intelligence capabilities |

Phase 1 – Foundation (4-6 months)

Initial deployment focuses on establishing platform foundations with:

- Single Contract Type Focus: Typically Standard Sales MSAs or key procurement agreements to prove value quickly

- Core Platform Configuration: User roles, permissions, and basic workflow setup

- Clean Subset Migration: Active contracts for chosen area with high data quality

- Primary System Integration: Often Salesforce or procurement system for immediate business impact

- Basic Reporting: Essential dashboards and analytics for stakeholder buy-in

This phase prioritizes “quick wins” to demonstrate value and build organizational momentum while establishing processes and expertise for broader rollout.

Phase 2 – Expansion (6-18 months)

Following successful Phase 1, subsequent phases expand systematically including:

- Additional departments (procurement, legal, HR) with their specific contract types

- New geographic regions or business units with localized requirements

- More complex contract types (M&A, real estate, IP licensing) requiring advanced AI

- Additional system integrations (ERP, CRM, SCM) for comprehensive data flow

- Advanced AI applications and analytics for deeper contract intelligence

Timeline Extension Factors

| Risk Factor | Potential Delay | Mitigation Strategy |

|---|---|---|

| Poor Data Quality | 2-4 months | Early data assessment and cleansing project |

| Process Ambiguity | 3-6 months | Cross-functional workshops and clear decision authority |

| Resource Availability | 2-8 months | Dedicated project teams and executive sponsorship |

| Integration Complexity | 4-12 months | Phased integration approach with pilot testing |

| Change Management | 3-9 months | Early user engagement and comprehensive training |

- Poor Data Quality: Legacy data cleansing and migration can add 2-4 months

- Process Ambiguity: Lack of clear cross-functional workflow decisions causes significant delays

- Resource Availability: Projects require dedicated time from IT, legal, finance, and procurement teams

- Integration Complexity: Multiple system integrations extend timelines substantially

- Change Management: User adoption challenges can slow deployment and value realization

Success Factors for Timeline Management

Successful implementations prioritize:

- Narrow, Deep Initial Deployment: Focus on specific, high-value use cases rather than broad, shallow approaches

- Dedicated Project Teams: Full-time resources with clear accountability and decision-making authority

- Executive Sponsorship: Visible leadership support for change management and resource allocation

- Realistic Timeline Expectations: Understanding that comprehensive AI Finance Tool value requires time and iteration

Organizations should plan 12-18 months for comprehensive deployment while targeting 3-6 month intervals for demonstrable value realization and user adoption milestones. This phased approach ensures sustainable adoption while delivering incremental business value throughout the implementation journey.

Our Methodology: How We Researched This Guide

This comprehensive Icertis FAQs guide is based on extensive research methodology combining multiple authoritative sources:

- Primary Research: Analysis of Icertis platform documentation, official product specifications, and published case studies

- Industry Analysis: Review of enterprise contract management market research from leading analyst firms

- Implementation Data: Analysis of real-world deployment timelines and total cost of ownership data from enterprise implementations

- Expert Validation: Consultation with contract management professionals and AI finance tool specialists

- Comparative Analysis: Side-by-side evaluation of Icertis capabilities against alternative CLM and AI finance solutions

All financial projections and ROI calculations are based on documented case studies and industry benchmarks, providing realistic expectations for enterprise decision-makers.

Why Trust This Guide?

Best AI Tools For Finance has established itself as the leading resource for AI-powered financial technology evaluation. Our expertise includes:

- Deep Industry Knowledge: Extensive experience analyzing enterprise AI finance tools and their real-world implementation challenges

- Unbiased Analysis: Independent evaluation focused on practical business value rather than vendor marketing claims

- Comprehensive Research: Thorough analysis of platform capabilities, implementation requirements, and total cost considerations

- Executive Focus: Content designed for C-level decision-makers who need actionable insights for strategic technology investments

- Continuous Updates: Regular review and updating of content to reflect evolving platform capabilities and market conditions

This guide represents hundreds of hours of research and analysis, providing the comprehensive evaluation you need to make informed decisions about contract intelligence investments.

Ready to Transform Your Contract Management?

Take Action: Explore Icertis Contract Intelligence Platform✅ What You'll Gain: Strategic Contract Intelligence

- Transform static contracts into dynamic revenue-optimizing assets

- Automate ASC 606/IFRS 15 compliance with AI-powered monitoring

- Prevent revenue leakage worth 0.5-1% of annual revenue

- Reduce compliance costs by 50-70% through automation

- Enterprise-grade security with SOC 2 Type II certification

⚠️ Investment Considerations: Enterprise Implementation

- Total implementation cost: 1.5-2x first-year licensing fees

- Timeline: 12-18 months for comprehensive deployment

- Requires dedicated project teams and change management

- Best suited for organizations with complex contract portfolios

- Significant ERP integration and data preparation requirements

Leave a Reply