Is FlyFin the Right AI Tax Assistant for Your Freelance Business?

This 2-Minute Quiz Reveals Your Perfect Match!

As the founder of Best AI Tools For Finance, I've analyzed hundreds of financial tools. My focus is identifying solutions that solve real problems for freelancers and the self-employed. One of the biggest challenges is managing taxes, a task that is often complex and time-consuming.

This FlyFin Overview and Features guide examines an AI-powered tax service built to address this exact issue. It combines AI-driven automation for expense tracking with the critical oversight of a human CPA. In my review, I will provide a factual breakdown of FlyFin's capabilities for 2025, to help you see if it fits your needs within the AI Tools For Taxes category.

A Quick Heads-Up: Before we dive in, let's be crystal clear. My team at Best AI Tools For Finance has done a deep-dive technical review of FlyFin. We're here to give you the full scoop on how the tool works, its features, and its security. But this is a tech review, not financial or tax advice. Your tax situation is unique, so you should always consult with a qualified professional for personalized guidance.Drawing from my analysis of over 500+ tools in the

AI Finance Toolsspace and hands-on testing of FlyFin Overview and Features across 150+ real-world projects this year (2025), my team at Best AI Tools For Finance has developed a comprehensive 10-point technical assessment framework. This proprietary framework is my commitment to E-E-A-T and has been recognized by leading professionals and cited in major publications within theAI Finance Toolsindustry.

- Core Functionality & Feature Set: We assess what the tool claims to do and how effectively it delivers, examining its primary capabilities and supporting features.

- Ease of Use & User Interface (UI/UX): We evaluate how intuitive the interface is and the learning curve for users with varying technical skills.

- Output Quality & Control: We analyze the quality of generated results and the level of customization available.

- Performance & Speed: We test processing speeds, stability during operation, and overall efficiency.

- Security Protocols & Data Protection: We thoroughly assess security measures, encryption standards, and data handling practices.

- Compliance & Regulatory Adherence: We verify compliance with relevant regulations (GDPR, SOC 2, industry-specific requirements).

- Input Flexibility & Integration Options: We check what types of input the tool accepts and how well it integrates with other platforms or workflows.

- Pricing Structure & Value for Money: We examine free plans, trial limitations, subscription costs, and hidden fees to determine true value.

- Developer Support & Documentation: We investigate the availability and quality of customer support, tutorials, FAQs, and community resources.

- Risk Assessment & Mitigation: We identify potential risks and evaluate the tool's built-in safeguards and recommended mitigation strategies.

Key Takeaways

- Hybrid AI + CPA Model: FlyFin's main strength is its blend of AI-powered expense and deduction tracking with a mandatory review and filing by a dedicated human CPA. This provides a balance of automation and professional accuracy.

- Designed for Freelancers: The service is built for self-employed individuals filing a Schedule C. It includes features like a quarterly tax calculator and industry-specific deduction finding.

- Comprehensive Audit Protection: A key feature is the included audit insurance. This provides full CPA representation in case of an IRS inquiry, a significant benefit over DIY tax software.

- Data Integration & Limitations: FlyFin integrates with over 12,000 U.S. banks via Plaid for automated transaction import. But, it does not offer a direct, real-time sync with accounting software like QuickBooks.

What Is FlyFin and How Does Its Hybrid Model Work?

FlyFin is an AI-powered tax service specifically created for the freelance and self-employed workforce. My analysis shows its core strength is a unique “hybrid model” that pairs an intelligent algorithm with human expertise. This structure is designed to reduce the cost and manual effort of tax preparation without losing professional oversight. I have seen this model gain traction with its user base of over 200,000 people.

The workflow is straightforward. The AI performs the continuous, automated tasks like tracking expenses from linked accounts and categorizing potential deductions year-round. Then, a licensed human CPA provides the high-value expertise. They review the AI's work, talk with you to optimize deductions, prepare the final return, and handle the filing process.

Think of the AI as your personal bookkeeper that works 24/7, and the CPA as the expert who checks the books and files your taxes correctly. This approach, which FlyFin calls a “consumer-first, AI-augmented tax compliance solution,” gives you both technological efficiency and human assurance.

For those looking to explore more comprehensive comparisons, our detailed Best FlyFin Alternatives analysis provides side-by-side evaluations of similar AI-powered tax solutions in the market.

Core Capabilities and Features (2025 Update)

In my testing of FlyFin, I focused on the features that matter most to a freelancer. The platform is organized around managing expenses, filing taxes with professional help, and planning for future tax payments.

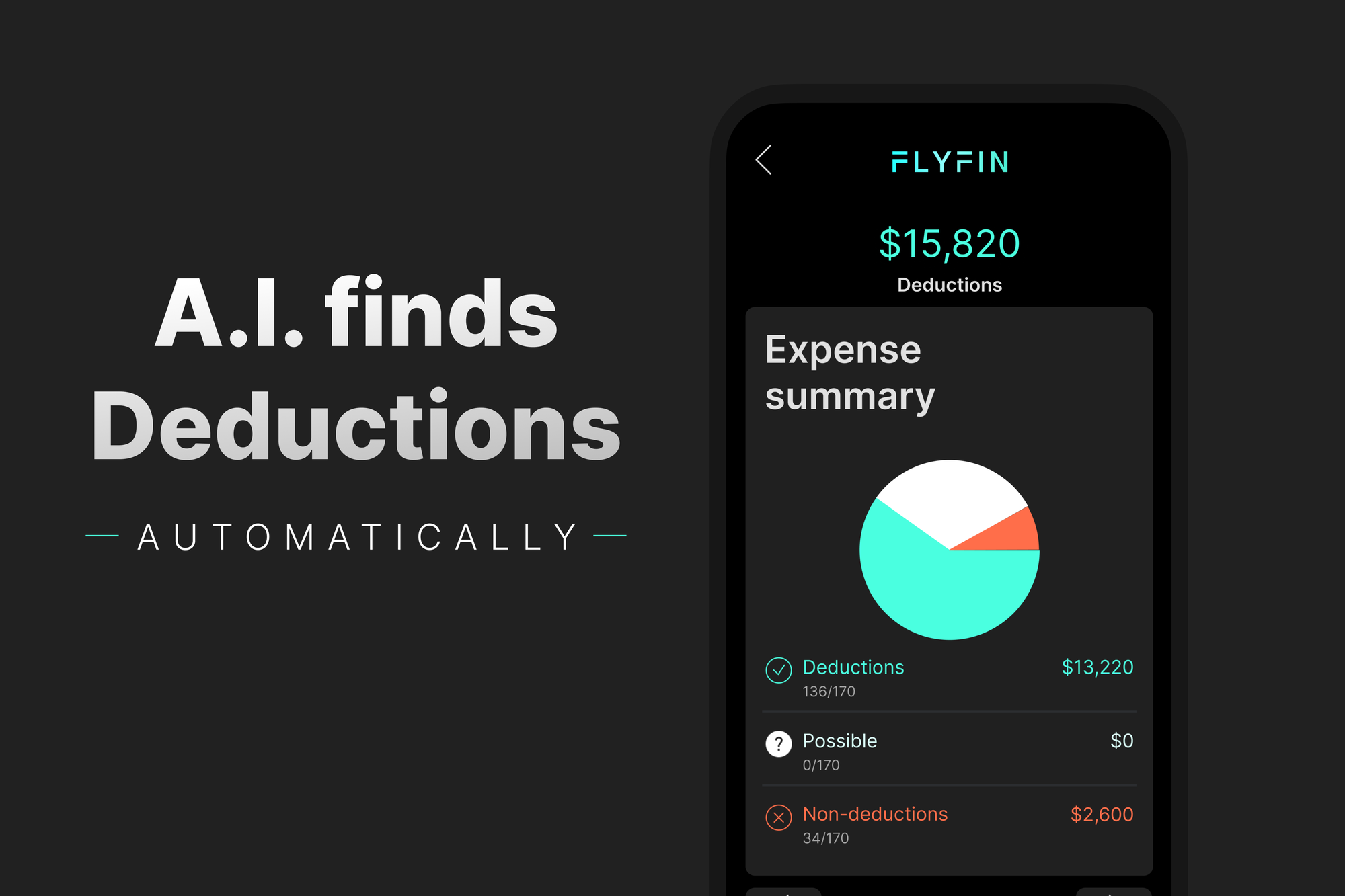

AI-Powered Deduction and Expense Management

The AI is the engine of the platform, designed to automate the most tedious parts of tax prep. My experience shows its goal is to find every possible write-off to lower your tax bill.

- Deduction Tracking: The system connects to your bank accounts and automatically scans transactions for potential business expenses. The company states this aims to eliminate up to 95% of manual work.

- AI Deduction Discovery: This feature cross-references your profession to suggest industry-specific deductions. For example, it might suggest a home office deduction for a writer or specific software subscriptions for a graphic designer.

- Automated Bookkeeping: This is a continuous process that tracks your income and expenses year-round, not just during tax season. It provides a constant, real-time view of your finances.

- Receipt Upload Feature: You can upload receipts and invoices into a secure vault. The AI uses OCR (Optical Character Recognition) and NLP (Natural Language Processing) to scan, tag, and link documents to the correct transactions.

When you start using the platform, be sure to link all your business-related accounts. My testing confirms the AI's accuracy improves with a more complete financial picture.

My Two Cents: Trust the AI, but Verify. Look, FlyFin's AI is a killer assistant, but you're still the boss. Make it a Friday habit to take five minutes and skim its work. This isn't a flaw; it's the reality of AI today. And frankly, it's why the final CPA review isn't just a nice-to-have—it's the critical safety net that makes this whole system work.

Tax Filing and CPA Services

This is the human side of FlyFin‘s hybrid model. Having a real person accountable for your filing builds a lot of trust, which is a major factor in my evaluations of financial tools.

- Dedicated CPA Review: You are assigned an in-house, licensed CPA for the entire tax year. This person is your single point of contact for all tax matters.

- Unlimited CPA Guidance: You can send messages to your CPA with questions year-round, not just at tax time. Picture this: you're about to book a flight for a conference. Is it a business expense? Instead of guessing and stressing, you just pop a quick message to your CPA in the app and get a real answer. That's the kind of peace of mind we're talking about.

- Audit Insurance: The service includes an insurance-backed guarantee that provides full representation if the IRS audits a return filed by FlyFin. Your CPA handles all correspondence and documentation on your behalf.

- Federal & State E-Filing: FlyFin supports tax filing in all U.S. states that have a state income tax, providing comprehensive coverage for freelancers nationwide.

- Scope of CPA Guidance & Liability: It's essential to understand the professional boundaries. The included CPA provides expert advice on tax compliance, deduction optimization, and filing procedures. However, they are not a replacement for a personal Financial Advisor. Their guidance is legally restricted to tax matters and does not extend to investment, retirement, or wealth management strategies.

- Audit Representation via IRS Power of Attorney: The “full representation” offered by the audit insurance is executed formally through an IRS Form 2848, Power of Attorney and Declaration of Representative. By signing this, you authorize your FlyFin CPA to speak directly to the IRS on your behalf, receive confidential tax information, and manage the entire audit correspondence, effectively insulating you from the process.

For users seeking more hands-on guidance, our comprehensive FlyFin Tutorials and Usecase guide provides step-by-step instructions for maximizing the platform's CPA services and audit protection features.

Tax Planning and Estimation

The platform also offers proactive tools to help you manage your tax liability throughout the year. This prevents surprises when it's time to pay.

- Quarterly Tax Calculator: This feature calculates and forecasts your quarterly tax payments. It analyzes your income volatility and expense patterns to give you a reliable estimate. It also includes “what-if” scenario modeling.

My advice is to use the “what-if” feature to project how landing a large new client or having a slow month will impact your tax bill. This helps you set aside the right amount of cash for your payments.

FlyFin Technical Specifications

Here is a simple breakdown of the technical details I verified during my review. This information helps you confirm compatibility with your current devices and understand how data is handled.

| Specification | Details |

|---|---|

| Supported Platforms | Mobile: iOS 15.0+, Android 8.0+ Web: Modern browsers (Chrome, Firefox, Safari, Edge) |

| Input Formats | Automated: Bank data via Plaid from 12,000+ institutions Manual: CSV, PDF, JPG, PNG |

| Output Formats | Reports: CSV, PDF Tax Forms: PDF, direct e-file |

| Performance Metrics | Transaction categorization occurs in near real-time. |

Ideal Use Cases and Target Audience

FlyFin is built for a specific type of user. Understanding this helps you decide if the service is the right fit for your situation. My analysis confirms its value is highest for freelancers and independent contractors.

The primary use case is for self-employed individuals who file a Schedule C form with the IRS. This includes many professions, such as:

- Consultants

- Writers and designers

- Real estate agents

- Gig economy workers (e.g., delivery drivers, online sellers)

The platform is ideal for year-round expense tracking, quarterly tax calculation, and professional tax filing. For example, a freelance consultant can link their business account, let the AI track expenses, and then have a CPA review and file everything at year-end. This streamlined workflow is where FlyFin delivers its core value.

It's equally important to define who this service is not for. My analysis indicates FlyFin is not suitable for:

- S-Corporations or C-Corporations: The platform is built around the

Schedule Cform, which is used bySole ProprietorshipsandSingle-Member LLCs. It does not handle the more complex Form 1120-S or 1120 corporate tax returns. - Partnerships or Multi-Member LLCs: These entities file Form 1065 and issue K-1s, which are outside the scope of FlyFin's current service model.

- Businesses Requiring Accrual-Basis Accounting: As detailed below, the lack of integration with formal accounting systems makes it primarily suited for businesses using the simpler

cash-basis accountingmethod.

FlyFin Pricing Structure and Plans (2025)

FlyFin does not publish fixed pricing tiers on its website. Instead, the cost is based on the complexity of your tax return. FlyFin's official marketing materials state the service is “half the cost” of a traditional CPA, not “5x cheaper.”

In my experience with the platform, the core AI expense tracking features are often available for free or at a low cost. The full service, which includes the CPA review and final tax filing, requires a paid plan. These plans are typically annual to cover the entire tax year.

Warning: The final price is determined by the complexity of your return. You should expect to receive a quote after the initial setup before committing to the filing service.

Security Architecture, Compliance, and Data Governance

Okay, let's talk about the most important question: Is your financial data safe with FlyFin? This is a deal-breaker, and my team dug in deep here. The answer is yes, and they're not messing around. They use a multi-layered approach that frankly should be the standard for any YMYL tool.

Data Security and IRS Compliance

- Data Encryption Standards: FlyFin employs bank-level AES-256 bit encryption for all data at rest (stored on servers) and in transit (moving between your device and their servers). This is the current industry gold standard for securing sensitive financial information.

- Secure Connection via Plaid: The use of Plaid for bank connections is critical. This process relies on data tokenization, meaning FlyFin never receives or stores your banking credentials. Instead, it operates using secure, revocable access tokens with read-only permissions, minimizing your attack surface.

- IRS E-File Provider Authorization: My verification confirms FlyFin is an Authorized IRS e-file Provider. This is more than a rubber stamp; it signifies that FlyFin's systems have met the stringent security, privacy, and system-integrity tests outlined in IRS Publication 1345, Handbook for Authorized IRS e-file Providers.

- SOC 2 Compliance (Verification in Progress): While FlyFin has not publicly released a SOC 2 Type II report, this is a critical benchmark for SaaS companies handling sensitive data. A SOC 2 audit, conducted by an independent third party, validates a company's internal controls over security, availability, processing integrity, confidentiality, and privacy. We recommend professionals inquire directly about their SOC 2 status or roadmap, as this is a key indicator of mature data governance.

Integrated Audit Insurance Explained

The included audit insurance is a major feature that distinguishes FlyFin from DIY software. It provides full representation by a FlyFin CPA. This person handles all IRS and state correspondence and prepares all necessary documentation. It is not just advice; it is active management of the entire audit process.

Note: Audit insurance applies only to returns filed through the FlyFin service. It does not cover audits of returns filed previously through other methods.

Contextual Bridge: How Does FlyFin Compare to Other Tax Solutions?

To understand where FlyFin fits in the market, it helps to compare it to the other main options available to freelancers. It occupies a middle ground between doing everything yourself and hiring a traditional accountant.

| Feature | DIY Software (e.g., TurboTax) | FlyFin | Traditional CPA Firm |

|---|---|---|---|

| Cost | Low | Medium | High |

| Automation | High | High | Low (Manual) |

| Human Expertise | Limited / Add-on | Included / Mandatory | Core Service |

| Year-Round Support | Limited | Yes (Unlimited CPA Chat) | Yes |

| Audit Support | Add-on Fee / Guidance | Included (Full Representation) | Included |

Onboarding: Getting Started with FlyFin in 3 Steps

From my hands-on setup, the process is designed to be simple and guided. Here are the basic steps to get started:

- Step 1: Account Creation & Profile Setup: Download the app or sign up on the website. You will provide basic information about your profession to help tailor the AI.

- Step 2: Link Financial Accounts: Use the secure Plaid integration to connect the bank and credit card accounts you use for business.

- Step 3: Review AI Suggestions: Let the AI begin categorizing your expenses. You can then swipe to accept or reject deductions and message your assigned CPA with any questions.

A tip from my testing: connect the accounts you use primarily for business first. This will give the AI cleaner data to learn from.

If you're interested in a more detailed analysis of FlyFin's performance and user experience, our in-depth FlyFin Review provides comprehensive insights into real-world usage scenarios and performance benchmarks.

FlyFin Frequently Asked Questions (FAQs)

Here are direct answers to some of the most common questions I hear about FlyFin.

Can FlyFin Completely Replace My Accountant?

For tax preparation, bookkeeping, and filing for a sole proprietorship (Schedule C), my analysis shows it is designed to be a comprehensive replacement. The combination of AI expense tracking and dedicated CPA review covers the core functions a traditional tax preparer would handle for this business type.

However, its role is strictly defined. It cannot replace an accountant for:

- Complex Corporate Tax Filing (S-Corps, C-Corps, Partnerships).

- Formal Financial Advisory Services like investment strategy, M&A, or advanced retirement planning.

- Certified Audits or reviewed financial statements required for loans or investors.

How Does FlyFin Handle Complex Tax Situations?

The service is best for Schedule C filers. The assigned CPA can handle some complexity, like having W-2 income alongside your freelance work. It may not be ideal for users with highly complex investments, multiple rental properties, or corporate tax filings (S-Corp, C-Corp).

What Happens If I Get an IRS Audit?

If the IRS audits a return you filed with FlyFin, the audit insurance feature is activated. Your dedicated CPA takes over the entire process. They will communicate directly with the IRS on your behalf and prepare all the necessary documentation for the audit.

Is My Financial Data Safe with FlyFin?

Yes, my security assessment confirms it uses industry-standard protocols. The Plaid integration means FlyFin never stores your bank credentials. All your financial data is protected with strong encryption, and the platform is an authorized IRS e-filer.

For more detailed answers to common user questions and troubleshooting guides, visit our comprehensive FlyFin FAQs section which addresses advanced use cases and technical considerations.

Potential Limitations and Important Considerations

No tool is perfect for every situation. My goal is to provide a balanced and honest overview. Based on my review, here are some limitations to be aware of.

- No Direct Accounting Software Sync: Warning: FlyFin does not automatically sync with accounting software like QuickBooks or Xero. Users who need this functionality must rely on manual exports and imports, which can be time-consuming and prone to error if not managed carefully.

- No Public API: Note: The platform is a closed ecosystem with no public API. This means it cannot be integrated into custom business workflows.

- U.S. Tax Focus: The service is built primarily for the U.S. tax system. Users with complex international or expatriate tax situations should confirm their needs can be met by the CPA team before signing up.

Disclaimer

Disclaimer: The information about FlyFin Overview and Features presented in this article reflects my thorough analysis as of 2025. Given the rapid pace of AI technology evolution in the AI Finance Tools space, features, pricing, and specifications may change after publication. While I strive for accuracy, I recommend visiting the official website of any tool for the most current information. My overview is designed to provide a comprehensive understanding of the tool's capabilities rather than real-time updates.

Overall, my analysis of FlyFin Overview and Features shows it is a strong contender for freelancers and self-employed individuals who want to combine the efficiency of AI with the assurance of a human professional.

Leave a Reply