Is FlyFin the Best AI Tax Software for Your Freelance Business?

This 2-Minute Quiz Reveals the Answer!

Key Takeaways

- AI-Powered Tax Solution: FlyFin combines advanced AI technology with CPA expertise for comprehensive tax preparation specifically designed for freelancers and independent contractors

- Automated Deduction Tracking: The platform automatically scans bank and credit card transactions to identify potential business deductions using swipe-based categorization

- Schedule C Focus: Ideal for sole proprietorships and single-member LLCs but not suitable for S-Corps, C-Corps, or partnerships requiring separate business tax returns

- Bank-Level Security: Uses encrypted connections through trusted services like Plaid with 256-bit encryption and comprehensive audit protection included

- Cost-Effective Value: Often pays for itself through identified deductions that users typically miss, with potential tax savings of thousands of dollars annually

What is FlyFin FAQs and how does its AI technology work for tax preparation?

FlyFin is an AI-powered tax service specifically designed for freelancers, self-employed individuals, and independent contractors in the United States. The platform combines advanced artificial intelligence with access to qualified Certified Public Accountants (CPAs) to streamline the entire tax process from expense tracking to final filing.

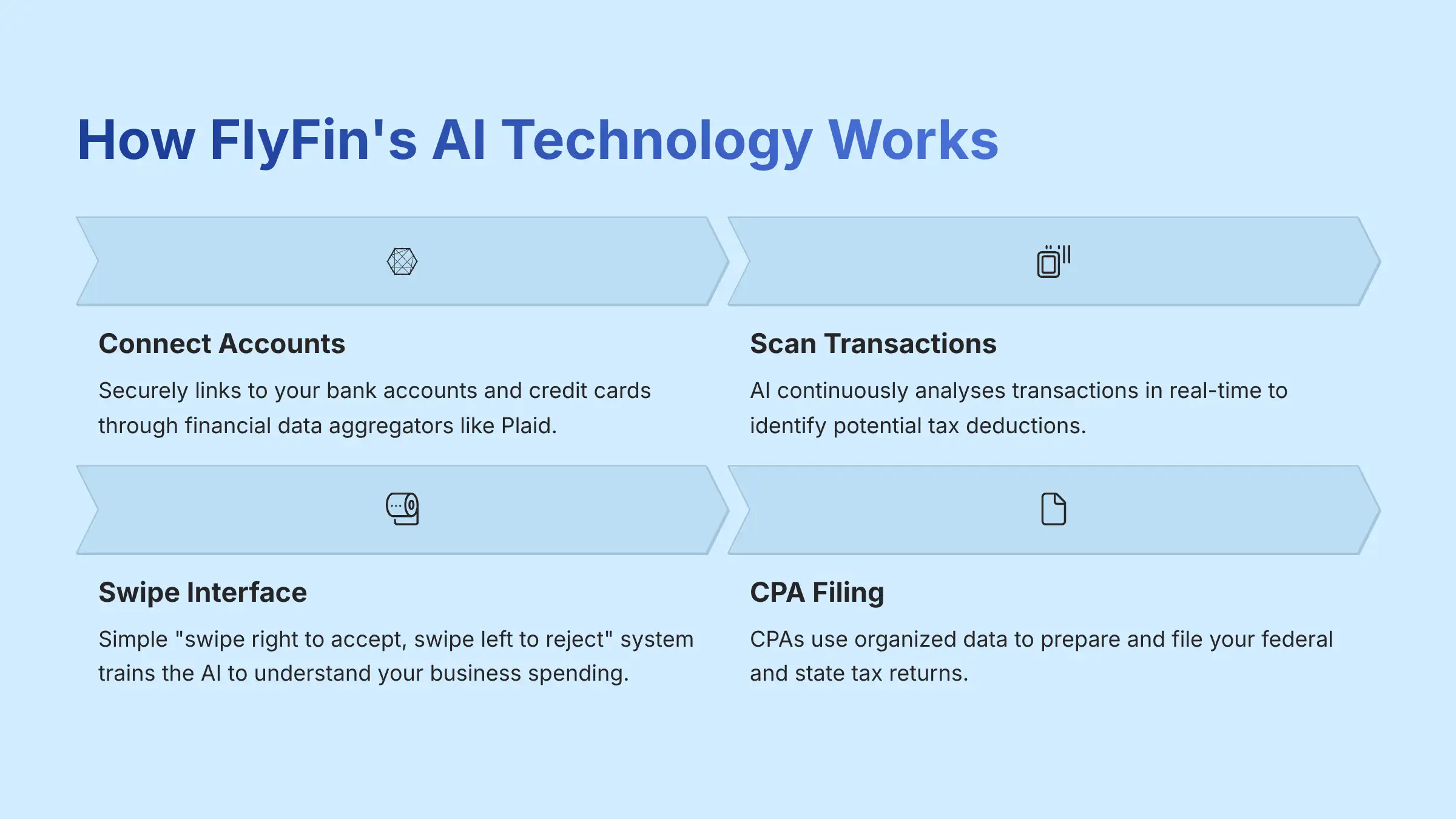

The core technology works by connecting to your bank accounts and credit cards through secure financial data aggregators like Plaid. FlyFin's AI engine continuously scans all your transactions in real-time, analyzing merchant names, transaction amounts, dates, and spending patterns to identify potential tax deductions.

For those seeking more comprehensive insights into how FlyFin operates, our detailed FlyFin Overview and Features guide provides in-depth analysis of the platform's capabilities and functionality.

The system maintains a comprehensive database of business expenses specific to freelancers and gig workers. When the AI identifies a potential deduction, it presents the transaction through a mobile app interface using a simple “swipe right to accept, swipe left to reject” system. This gamified approach helps train the AI to understand your specific business spending habits, becoming increasingly accurate over time. The AI learns from your decisions, reducing false positives and ensuring legitimate business expenses are captured.

Once your expenses are categorized throughout the year, FlyFin's team of CPAs uses this organized data to prepare and file your federal and state tax returns. This hybrid approach combines AI efficiency for data management with human expertise for compliance and accuracy, ensuring you maximize deductions while maintaining IRS compliance standards.

Who should use FlyFin FAQs – is it suitable for independent contractors and small businesses?

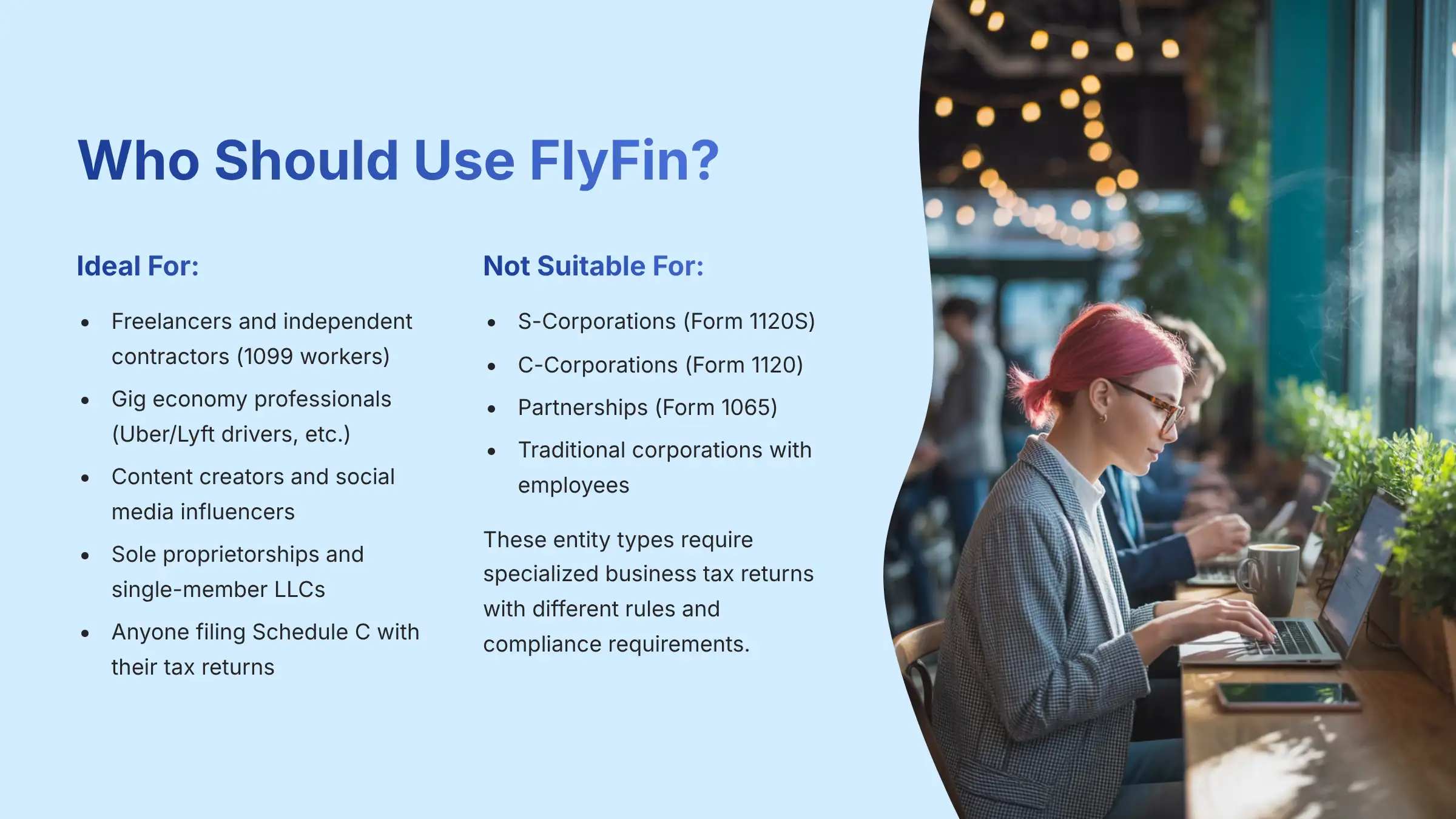

FlyFin is ideally suited for freelancers, independent contractors (1099 workers), creators, and gig economy professionals. This includes freelance writers, graphic designers, consultants, Uber/Lyft drivers, real estate agents, photographers, and content creators who need to track business expenses and file Schedule C with their tax returns.

The platform excels for sole proprietorships and single-member LLCs who file individual tax returns with Schedule C business income. FlyFin's AI is particularly effective at managing the mixed personal and business expenses that are common for freelancers, such as using personal credit cards for business purchases or working from home.

However, FlyFin has important limitations for more complex business structures. The service is not designed for S-Corporations (Form 1120S), C-Corporations (Form 1120), or partnerships (Form 1065). These entity types require specialized business tax returns with different rules and compliance requirements that fall outside FlyFin's current service scope.

For small businesses operating as traditional corporations or partnerships, you'll need accounting software like QuickBooks or a traditional CPA firm. The key determining factor is your business structure and filing requirements, not your business size. A solo freelancer earning $100,000 through Schedule C is a perfect fit, while a small S-Corp with one employee would need different tax software.

Before committing to FlyFin, use their consultation process to confirm your business structure and tax situation align with their specialized service model.

How does FlyFin FAQs compare to QuickBooks Self-Employed and Keeper Tax?

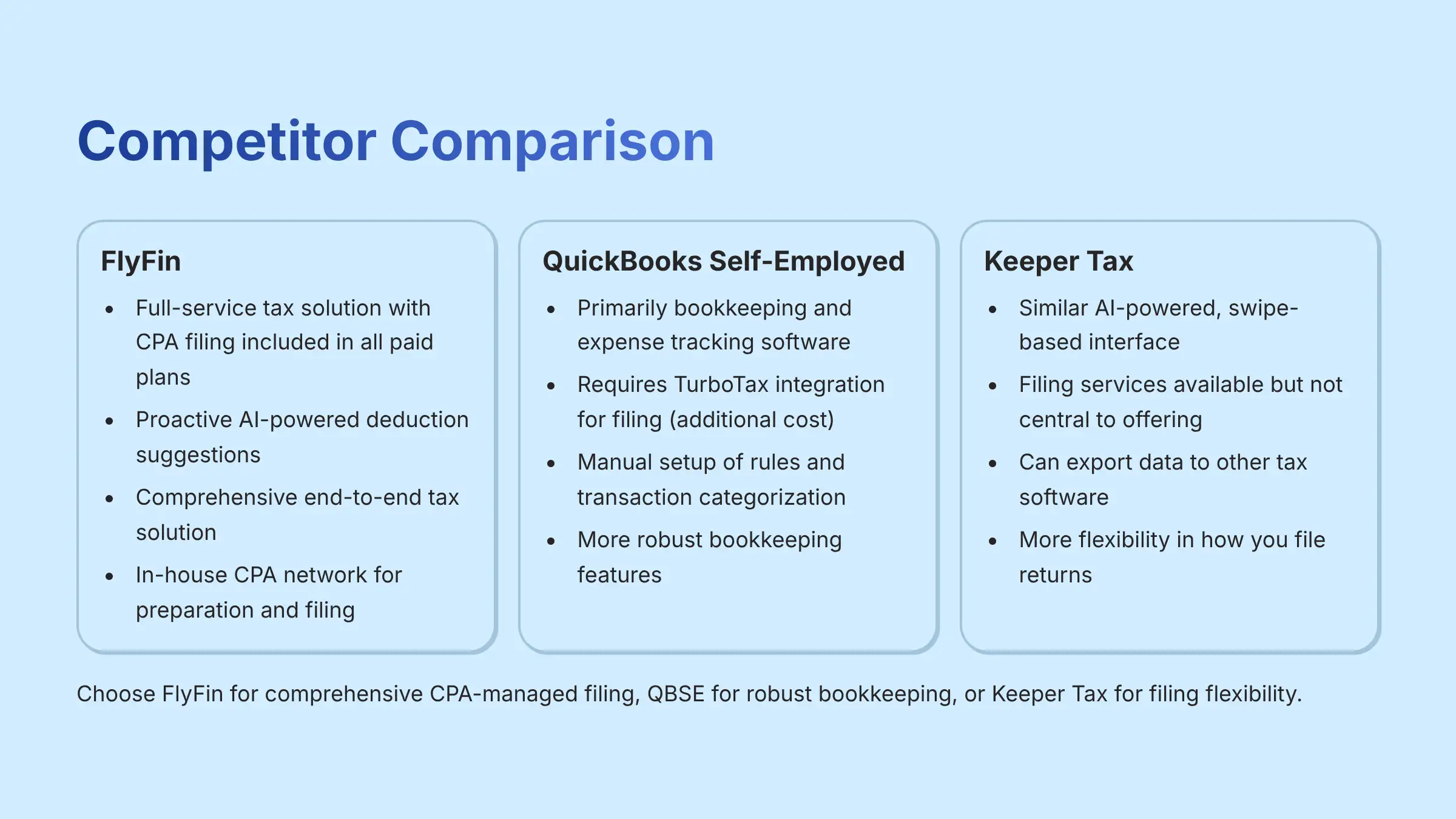

FlyFin, QuickBooks Self-Employed (QBSE), and Keeper Tax all target the freelancer market but differ significantly in their service models and value propositions.

FlyFin vs. QuickBooks Self-Employed:

FlyFin operates as a full-service tax solution where CPA filing is central to all paid plans. QBSE primarily functions as bookkeeping and expense tracking software that integrates with TurboTax for filing, often requiring additional costs for human support. FlyFin's AI proactively suggests deductions for your approval, while QBSE requires more manual setup of rules and transaction categorization. For freelancers who want a hands-off approach with guaranteed CPA oversight, FlyFin provides more comprehensive service.

FlyFin vs. Keeper Tax:

Both services use AI-powered, swipe-based interfaces for expense categorization, making them direct competitors with similar user experiences. The primary difference lies in the filing process and CPA integration. FlyFin emphasizes its network of in-house CPAs as a core feature for preparing and filing returns. Keeper Tax also offers filing services but positions itself more as a powerful deduction tracker that can export data to other tax software or external accountants.

To explore more options beyond FlyFin, check out our comprehensive analysis of the Best FlyFin Alternatives comparison which breaks down various AI-powered tax solutions for freelancers.

Key Decision Factors:

Choose FlyFin if you want comprehensive CPA-managed filing included in your subscription. Choose QBSE if you need robust bookkeeping features beyond tax preparation. Choose Keeper Tax if you prefer flexibility in how you file your returns. All three services are legitimate options, but FlyFin provides the most complete end-to-end tax solution for freelancers who value professional oversight.

Is FlyFin FAQs safe and secure for linking bank accounts and financial data?

Yes, FlyFin employs bank-level security protocols and encryption standards to protect your financial information. Security is paramount for any financial application, and FlyFin addresses these concerns through multiple layers of protection and industry-standard practices.

When you connect your financial accounts, FlyFin uses trusted third-party data aggregators like Plaid, the same technology powering major financial applications including Venmo, Chime, Robinhood, and many traditional banks' own mobile apps. This means FlyFin never sees or stores your actual banking credentials (username and password). Instead, the connection is established through secure, encrypted tokens provided by Plaid.

All data transmission between your bank, Plaid, and FlyFin is protected with 256-bit encryption, which is the same security level used by major banks and financial institutions worldwide. This encryption standard is considered virtually unbreakable with current technology. Additionally, FlyFin's systems undergo regular security audits and comply with financial data protection regulations.

Important Security Considerations:

While FlyFin uses industry-standard security measures, no system is 100% immune to cyber threats. However, the risk profile is comparable to other major fintech applications you likely already use. The use of established, reputable financial data integrators like Plaid significantly reduces risk compared to smaller, unknown services.

Best Practices:

Enable two-factor authentication on your FlyFin account, use strong unique passwords, and regularly monitor your connected accounts for any unauthorized activity. These practices, combined with FlyFin's security infrastructure, provide robust protection for your financial data.

How does FlyFin FAQs AI find and categorize tax deductions automatically?

FlyFin's AI operates as an intelligent financial assistant that continuously analyzes your spending to identify potential tax savings throughout the year. The system begins working immediately after you connect your bank and credit card accounts, scanning every transaction for business expense opportunities.

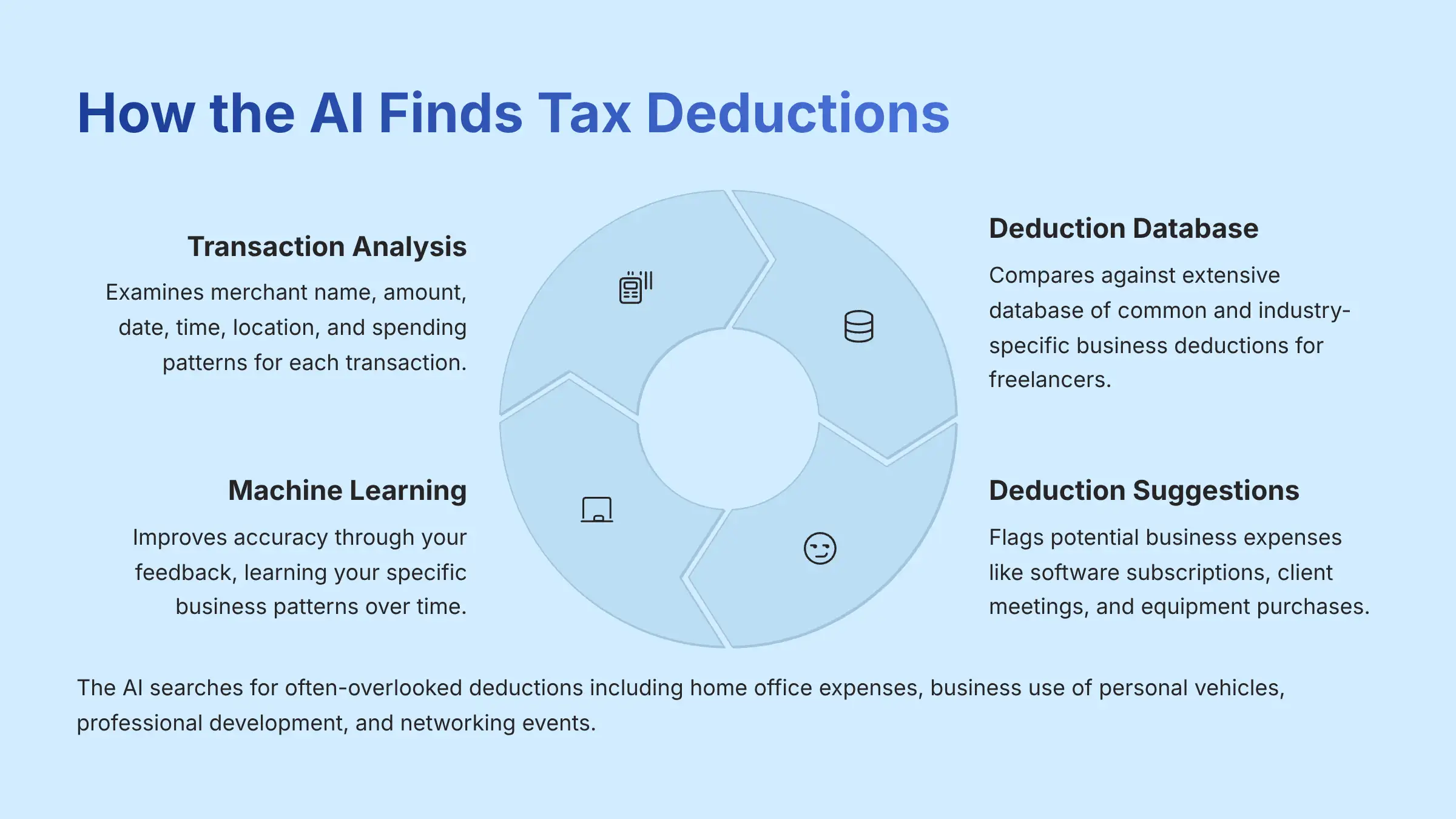

AI Analysis Process:

The AI examines multiple data points for each transaction: merchant name, transaction amount, date, time, location, and spending patterns. It compares this information against an extensive database of common and industry-specific business deductions for freelancers. For example, when it detects a charge from “Adobe Creative Cloud,” it flags this as a probable business expense under “Software and Subscriptions.” A transaction from “Starbucks” at 10 AM on a Tuesday might be flagged as potential client meeting expense.

Machine Learning Enhancement:

The system's accuracy improves through your feedback. Each time you swipe right to accept or left to reject a suggestion, the AI learns your specific business patterns. Over time, it understands that your weekly coffee shop visits are client meetings, while weekend purchases at the same location are personal. This personalized learning reduces false positives and ensures legitimate deductions aren't missed.

Comprehensive Coverage:

The AI searches for often-overlooked deductions including partial home office expenses, business use of personal vehicles, professional development courses, industry publications, networking events, and equipment purchases. It can identify both obvious business expenses and subtle ones that freelancers commonly miss.

For hands-on guidance on maximizing FlyFin's deduction-finding capabilities, explore our comprehensive FlyFin Tutorials and Usecase guide with practical implementation strategies.

Expert Tip:

Actively train the AI during your first 30-60 days by carefully reviewing each suggestion. This initial investment in accuracy pays dividends throughout the year by reducing manual review time and maximizing legitimate deductions.

What audit protection does FlyFin FAQs provide if I'm selected for IRS review?

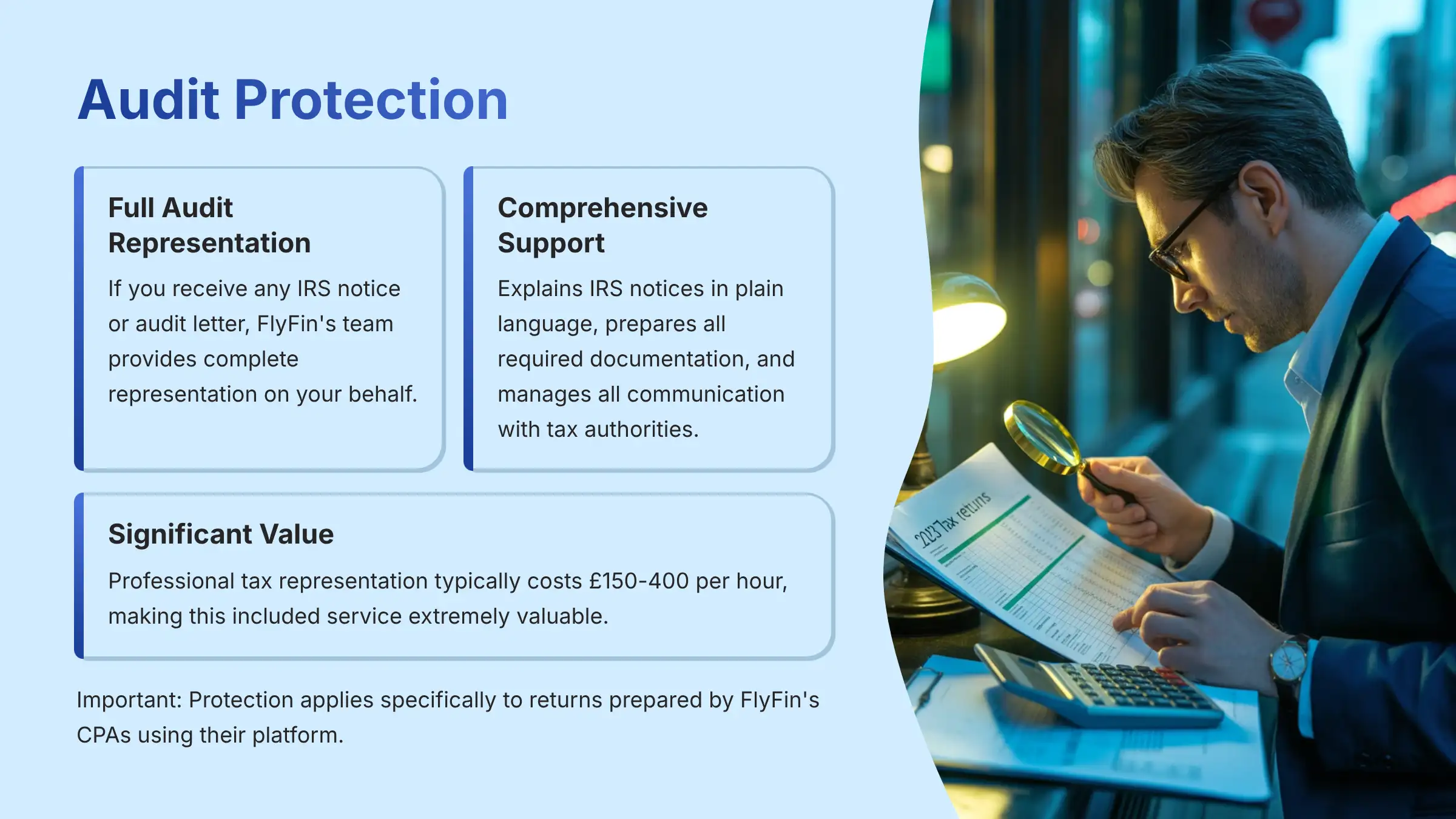

FlyFin includes comprehensive audit protection called “Audit-Proof” coverage with their tax filing plans, which is particularly valuable for freelancers who statistically face higher audit rates due to Schedule C filings and business expense deductions.

Full Audit Representation:

If you receive any IRS notice or audit letter related to a tax return prepared by FlyFin's CPAs, their team provides complete representation on your behalf. This includes explaining the IRS notice in plain language, preparing all required documentation and written responses, and managing all communication with tax authorities. You won't need to speak directly with the IRS or navigate complex tax procedures alone.

Scope of Protection:

The audit protection covers tax returns that FlyFin's CPAs have prepared and filed for you. This includes defending the deductions identified by their AI system and approved by you throughout the year. Their CPAs will provide documentation supporting each claimed deduction and handle any questions about expense categorization or business legitimacy.

Peace of Mind Value:

For freelancers, audit protection provides significant psychological and financial benefits. Professional tax representation typically costs $200-500 per hour, making this included service extremely valuable. The protection ensures that if FlyFin's AI or CPAs make an error, or if you're randomly selected for audit, you have qualified professionals managing the entire process.

Important Limitation:

Audit protection applies specifically to returns prepared by FlyFin's CPAs using their platform. It doesn't cover issues arising from incomplete information you provided or intentional misrepresentation of expenses. Maintaining accurate records and honest expense categorization ensures full protection coverage.

Can FlyFin FAQs handle complex tax situations like S-Corp elections or rental income?

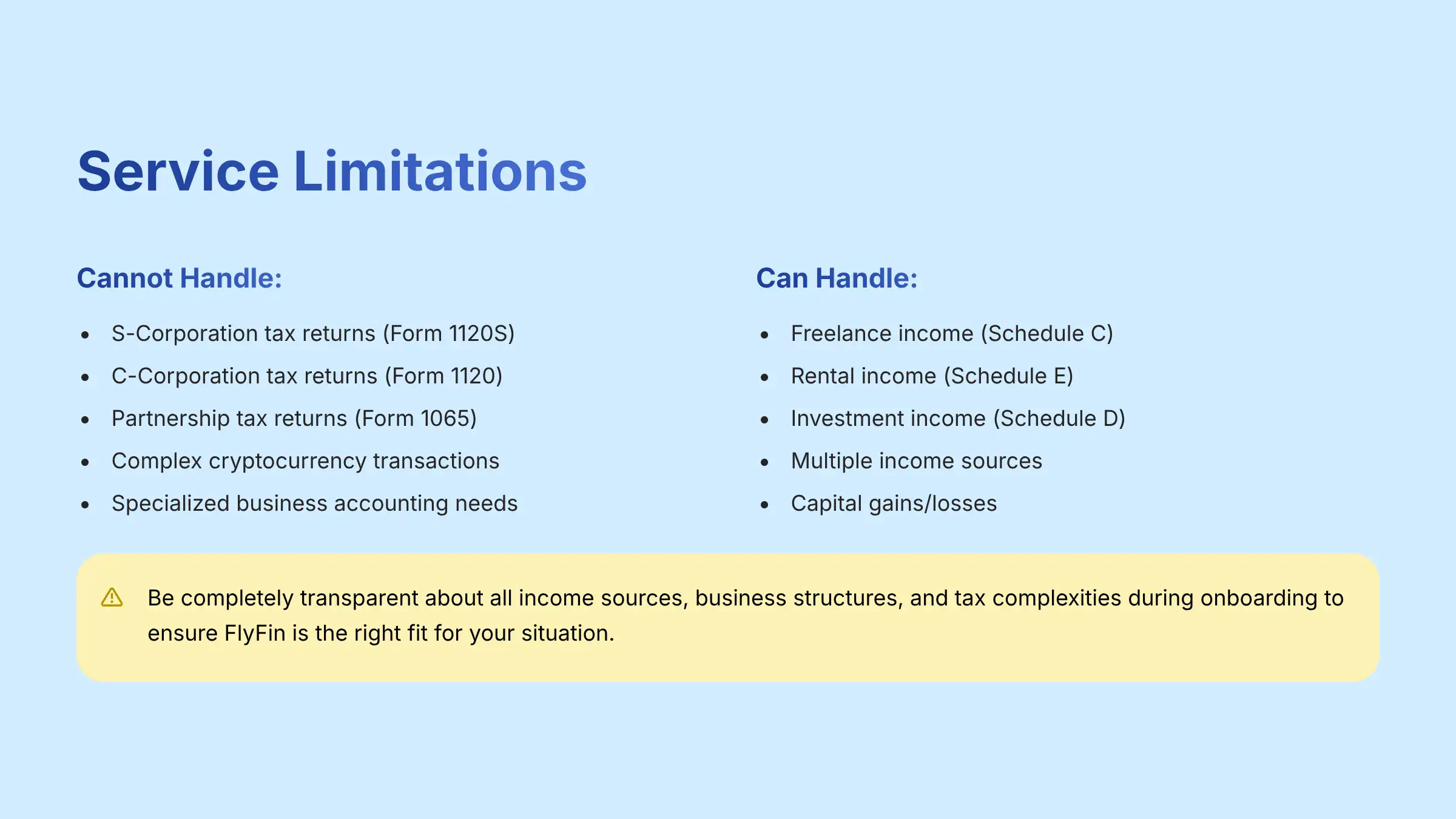

FlyFin's capabilities have specific boundaries that are crucial to understand before committing to their service. The platform excels within its specialty area but has important limitations for complex business structures and certain income types.

Business Structure Limitations:

FlyFin is not equipped to handle S-Corporation (Form 1120S), C-Corporation (Form 1120), or partnership (Form 1065) tax returns. These business entities require specialized business tax filings with different rules, deadlines, and compliance requirements that fall outside FlyFin's service model. If your business operates under these structures, you'll need traditional accounting software or a CPA firm specializing in business returns.

Individual Return Complexities:

However, FlyFin can often handle various complexities on personal tax returns (Form 1040), including rental income (Schedule E), investment income and capital gains/losses (Schedule D), and multiple income sources. The platform can manage situations where you have both freelance income (Schedule C) and rental properties, W-2 employment, or investment activities.

Cryptocurrency and Advanced Investments:

For cryptocurrency transactions, stock trading, or complex investment scenarios, FlyFin's capabilities may be limited. These situations often require specialized tax software or CPAs with specific expertise in these areas.

Best Practice for Complex Situations:

During FlyFin's onboarding process, be completely transparent about all income sources, business structures, and tax complexities. Their CPAs can assess whether your situation fits their service model. If your needs exceed their capabilities, it's better to discover this upfront rather than mid-tax season.

Strategic Recommendation:

Think of FlyFin as a world-class specialist for Schedule C filers rather than a generalist tax service. If you have freelance income as your primary tax complexity, FlyFin is likely perfect. If you have multiple business entities or complex investment portfolios, consider specialized business accounting solutions.

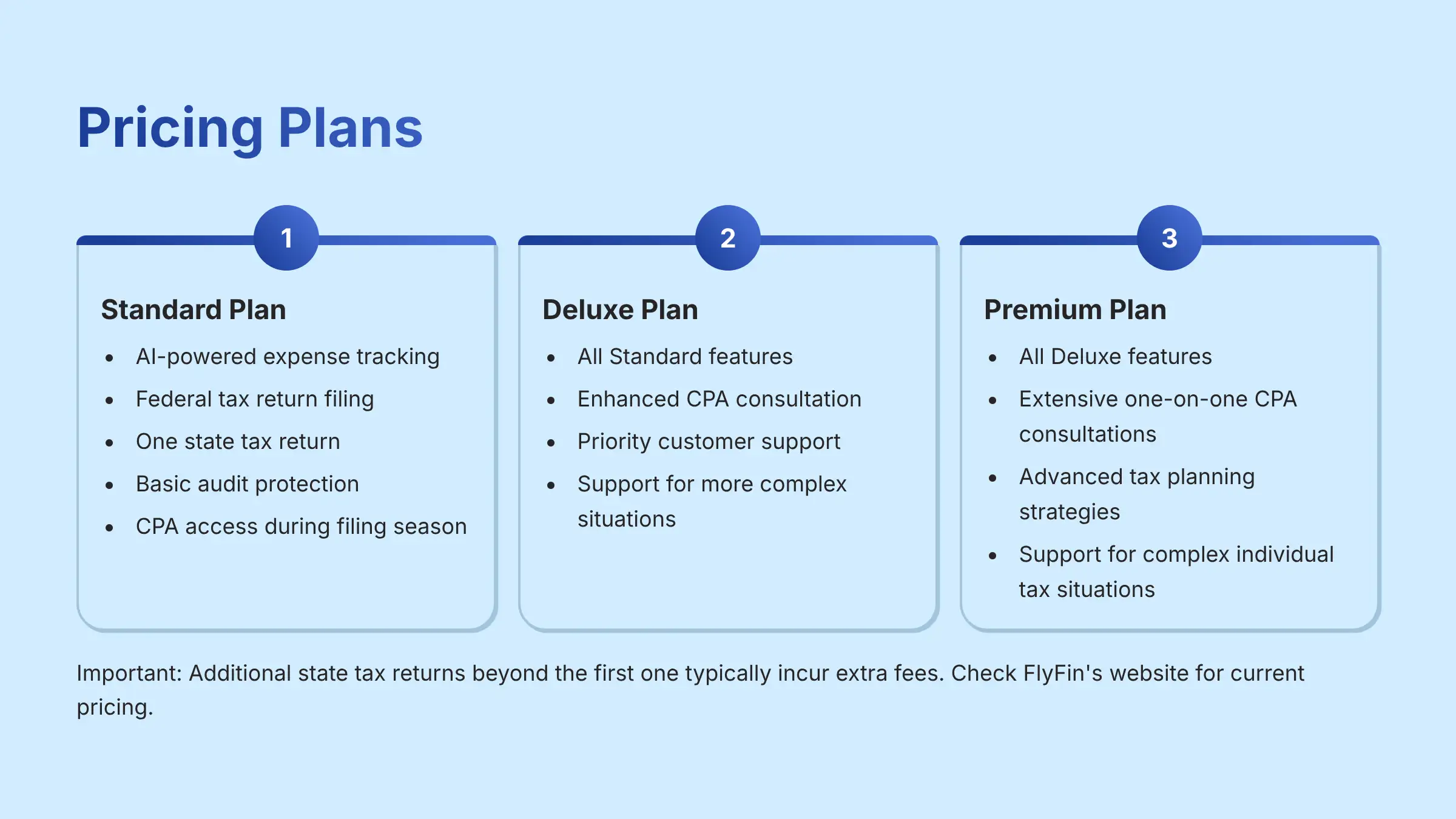

What are FlyFin FAQs pricing plans and what's included in each tier?

FlyFin structures its pricing around three distinct paid annual subscription tiers for its full-service tax solution: Standard, Deluxe, and Premium. While the expense tracking functionality is available for free, comprehensive CPA tax preparation and filing requires a paid subscription.

Standard Plan:

The Standard plan includes AI-powered expense tracking throughout the year, full-service tax preparation and filing of your federal return and one (1) state tax return by qualified CPAs, basic audit protection, and access to the CPA team for tax questions during filing season. This plan is suitable for straightforward freelancer tax situations with standard deductions and single-state filing requirements.

Deluxe Plan:

The Deluxe tier includes everything in the Standard plan plus enhanced CPA consultation access, priority customer support, and additional features for more complex freelancer tax situations. This plan typically accommodates freelancers with multiple income streams or more sophisticated business expense categories.

Premium Plan:

The Premium plan provides the most comprehensive service, including all lower-tier features plus extensive one-on-one CPA consultations, advanced tax planning strategies, and support for complex individual tax situations that still fall within FlyFin's service scope.

Important Pricing Considerations:

Pricing is subject to change and often includes promotional rates during tax season. Additional state tax returns beyond the first one typically incur extra fees. Users with income in multiple states should verify costs for additional state filings before subscribing.

Value Assessment:

When evaluating cost, consider that traditional CPA services often charge $300-800 for freelancer tax preparation, making FlyFin's annual subscription competitive when it includes year-round expense tracking, AI deduction finding, and professional tax preparation.

Recommendation:

Check FlyFin's official website for current pricing and promotional offers, as rates and included features can vary seasonally.

Is FlyFin FAQs worth the cost compared to DIY tax preparation software?

The value proposition of FlyFin depends on how you weigh subscription costs against time savings, accuracy improvements, and peace of mind. For most active freelancers, the service typically pays for itself through three key benefits.

Money Saved Through Enhanced Deductions:

The average freelancer misses $3,000-5,000 in legitimate tax deductions annually by failing to track small expenses or not understanding complex deduction rules. FlyFin's AI continuously scans for write-offs that DIY filers commonly overlook: partial home office expenses, business use of personal phone/internet, professional development, networking meals, and equipment depreciation. If the AI identifies just $1,000 in additional deductions, the tax savings (typically $250-370 depending on your tax bracket) can offset much of the subscription cost.

Time Savings Through Automation:

Consider the hours spent manually categorizing expenses, gathering receipts, and inputting data into tax software. FlyFin automates this entire process year-round. The AI handles transaction categorization, receipt matching, and expense organization. For busy freelancers, recovering 15-30 hours during tax season is often worth more than the subscription fee, especially when that time can be spent on billable client work.

Risk Mitigation and Professional Oversight:

DIY tax software places full responsibility for accuracy and compliance on you. FlyFin provides professional CPA review, audit protection, and expert guidance. This professional oversight reduces the risk of costly errors, missed deadlines, or audit complications. For freelancers who feel anxious about tax compliance or have been audited before, this peace of mind has significant value.

For an in-depth analysis of FlyFin's performance and value, read our comprehensive FlyFin Review with AI CPA oversight analysis that examines real user experiences and cost-benefit breakdowns.

Best Fit Assessment:

FlyFin provides the most value for freelancers with numerous small business expenses, multiple income sources, or those who prefer professional oversight. If you have very simple tax situations with minimal business expenses, basic DIY software might be sufficient.

How do I get started with FlyFin FAQs and set up the AI expense tracking?

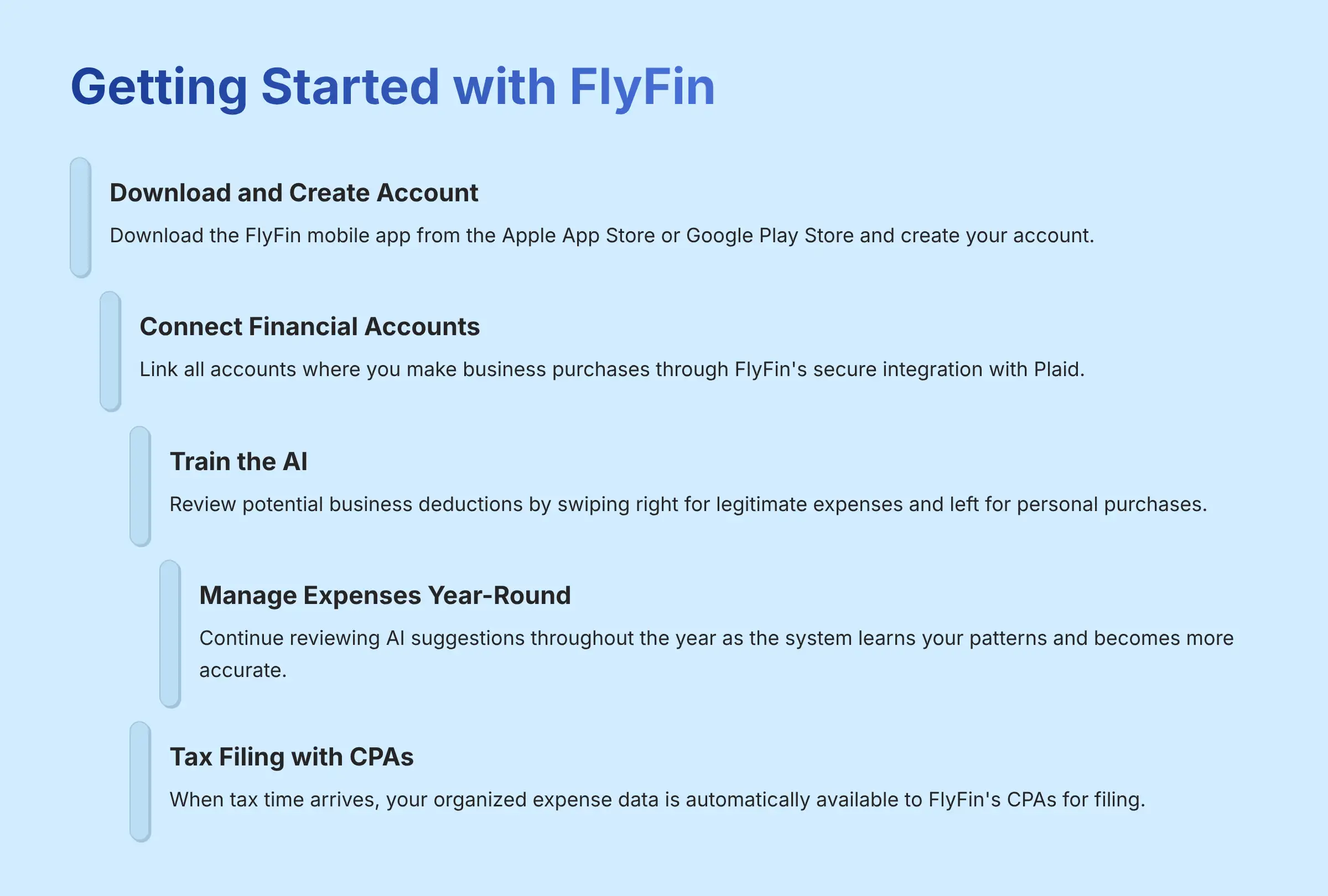

Getting started with FlyFin is designed as a streamlined, mobile-first process that can be completed in under 30 minutes. The setup focuses on connecting your financial accounts and training the AI to recognize your business spending patterns.

Step 1: Download and Account Creation

Download the FlyFin mobile app from the Apple App Store or Google Play Store. Create your account with basic information and select the subscription plan that matches your tax complexity. Many users start with a free trial to test the expense tracking features before committing to full tax filing services.

Step 2: Secure Account Linking

Connect your financial accounts through FlyFin's secure integration with Plaid. Link all accounts where you make business purchases: business bank accounts, personal credit cards used for business expenses, and any other relevant financial accounts. This connection is encrypted and doesn't require sharing your actual banking passwords with FlyFin.

Step 3: Initial AI Training

Once connected, the AI immediately begins analyzing your transaction history and current purchases. Within minutes, you'll receive push notifications with potential business deductions to review. Your job is to swipe right for legitimate business expenses and left for personal purchases. This initial training period is crucial for AI accuracy.

Step 4: Ongoing Expense Management

Continue reviewing AI suggestions throughout the year as you make purchases. The system learns your patterns and becomes more accurate over time. Take photos of receipts for cash purchases and add them manually to maintain complete records.

Step 5: Tax Season Preparation

When tax time arrives, your organized expense data is automatically available to FlyFin's CPAs. Schedule consultations through the app to discuss your tax situation and ensure all deductions are properly documented.

Pro Tip:

Spend extra time during the first month actively training the AI by carefully reviewing each suggestion. This initial investment in accuracy pays dividends throughout the year by reducing manual review time and maximizing legitimate deductions.

How to Choose the Right AI Tax Software for Your Freelance Business

When selecting AI-powered tax software like FlyFin, consider these essential factors:

- Business Structure Compatibility: Ensure the software supports your specific entity type (Schedule C, LLC, S-Corp, etc.)

- Deduction Discovery Capability: Look for AI systems that can identify industry-specific deductions for your freelance niche

- Professional Support Level: Evaluate whether you need CPA oversight or can handle DIY filing with guidance

- Security Standards: Verify the platform uses bank-level encryption and trusted financial data aggregators

- Integration Features: Check compatibility with your existing accounting tools and bank accounts

- Audit Protection: Consider whether comprehensive audit defense is included or available as an add-on

FlyFin excels in most of these areas for freelancers and Schedule C filers, making it a strong choice for independent contractors who prioritize automated deduction finding with professional tax preparation oversight.

For additional questions and detailed information not covered in this guide, be sure to visit our comprehensive FlyFin FAQs section for more specific answers to common user concerns and advanced usage scenarios.

Leave a Reply