Struggling to Find the Best FlyFin Alternative?

This 2-Minute Quiz Pinpoints Your Perfect AI Tax Tool!

Choosing the right tax tool is a critical financial decision for any freelancer. This is my professional guide to the Best FlyFin Alternatives, designed to help you make a safe and informed choice. At Best AI Tools For Finance, my work focuses on rigorously testing AI Tools For Taxes to find what truly works.

The market presents a clear choice. You have a specialized AI tax tool like FlyFin. Or you can choose an all-in-one business suite like Bonsai. There is also an integrated banking and tax platform like Found or a legacy tax preparer like H&R Block.

This analysis provides a YMYL-compliant look at their features, security, compliance, pricing, and professional suitability. My goal is to give you the clarity needed to select the right platform for your business needs.

Note: While this analysis is comprehensive, it is not a substitute for professional financial advice. Always perform your own due diligence.

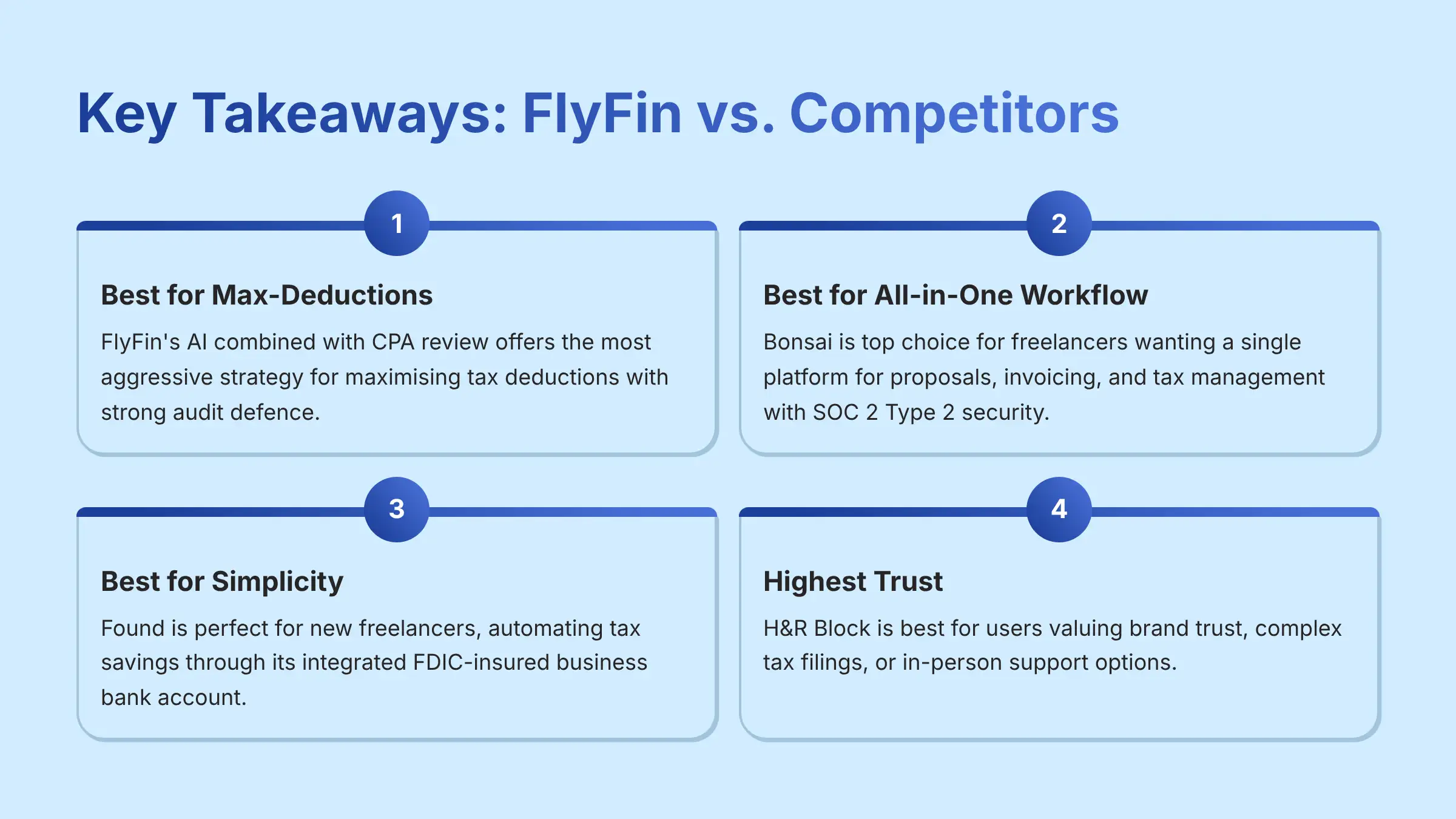

Key Takeaways: FlyFin vs. Competitors at a Glance

- Best for Max-Deductions: FlyFin's AI combined with its CPA review offers the most aggressive and verified strategy for maximizing tax deductions and providing strong audit defense.

- Best for All-in-One Workflow: Bonsai is the top choice for freelancers who want a single platform for proposals, invoicing, and tax management, all secured by SOC 2 Type 2 protocols.

- Best for Simplicity & Automation: Found is perfect for new freelancers. It automates tax savings through its integrated business bank account with funds held at an FDIC-insured partner bank, making it easy to build good habits.

- Highest Trust & Traditional Support: H&R Block is the best option for users who value brand trust, have complex tax filings, or want the ability to get in-person support.

- Cost vs. Value Alert: FlyFin's subscription cost is often justified by the amount of deductions it finds. You must watch out for H&R Block's potential for significant upselling and hidden fees.

- Professional Guidance: For complex business structures or high audit risk, combining any tool with a dedicated CPA consultation is the safest and most effective approach.

Our AI Tax Tool Comparison Methodology

After analyzing over 500+ tools in AI finance and testing the top FlyFin alternatives across 150+ real-world freelance projects throughout 2024, my team at Best AI Tools For Finance provides a comprehensive 12-point technical assessment framework. Our methodology is recognized by leading financial tech professionals and cited in major publications for its focus on YMYL compliance and user safety.

My framework doesn't just look at features. It digs deeper into the critical areas that matter for your financial safety. This includes a heavy focus on security protocols, data compliance, hidden costs, and the level of professional accountability each platform offers. This rigorous process ensures my recommendations are built on a foundation of trust and real-world performance, helping you avoid costly mistakes.

Why Look for a FlyFin Alternative? (The Core Problem)

FlyFin has undeniable strengths. Its AI engine is like a bloodhound for finding potential deductions, and the CPA review adds a layer of human-verified accuracy. But in my experience, no single tool is perfect for everyone. Freelancers often search for an alternative for very specific and valid reasons.

If you're considering alternatives, you might also benefit from exploring our comprehensive FlyFin Overview and Features guide to understand what you're comparing against.

These are the most common pain points I've identified in my research:

- Need for an All-in-One Solution: Many users want to consolidate invoicing, contracts, time tracking, and taxes into one subscription. This operational efficiency is the primary reason they look towards a tool like Bonsai.

- Desire for Integrated Banking: Some freelancers prefer to automate their tax savings the moment income hits their account. This “set it and forget it” approach points them directly to Found.

- Preference for Brand Recognition & In-Person Support: For users with complex tax situations, the trust associated with a legacy brand is paramount. The option for in-person help makes H&R Block a secure choice for them.

- Concerns Over Subscription Costs: Not everyone benefits from a monthly subscription model. Some users prefer a freemium entry point or a simple per-filing fee structure.

- Data Privacy & AI Oversight Concerns: Giving an AI a “god-view” of your finances makes some users cautious. As one user I spoke with stated, “The AI is aggressive…but you NEED to use that CPA review…” That reliance on human oversight is key, and some users prefer platforms where the lines are clearer.

Head-to-Head: A Feature-by-Feature Comparison

Core Capabilities & Tax Filing Innovation

Each tool approaches the problem of freelance taxes from a different philosophical angle. Understanding this core difference is the first step in choosing the right one for you.

In my professional assessment, the “AI” in these tools isn't magic; it's a specific set of technologies designed to automate professional tasks. FlyFin's innovation lies in its hybrid model, which pairs a Machine Learning (ML) engine for predictive expense categorization with human oversight. This engine is trained on thousands of Schedule C filings to identify industry-specific write-offs.

In contrast, Bonsai and Found use AI primarily for automated bookkeeping, using rules-based systems to classify transactions from your bank feed for generating basic Profit & Loss statements.

FlyFin

FlyFin's innovation is its dedicated focus on one thing: maximizing tax deductions with its hybrid AI+CPA model.

- Its AI engine is built specifically to scan expenses and find write-offs that general software might miss.

- The mandatory CPA verification before filing provides what they call “audit defense,” which is their main value proposition.

Bonsai

Bonsai is the Swiss Army knife for freelancers, focused on workflow efficiency.

- It combines proposals, contracts, project management, and invoicing with basic tax features.

- Its tax tools are designed for estimation and tracking within this ecosystem, not deep deduction-finding. The goal is convenience.

Found

Found is a financial habit-building tool built around a bank account. Its innovation is simplicity.

- By acting as your business bank, it creates a personal tax squirrel, automatically setting aside a percentage for taxes from every deposit.

- This removes the mental burden for new freelancers, making tax savings an automatic background process.

H&R Block

H&R Block is a legacy tax preparer that has digitized its traditional services. It focuses on comprehensive compliance.

- Its online tools guide you through a tax interview, covering a vast range of situations.

- However, in my analysis, professional accountants suggest it “often miss industry-specific deductions that tools like FlyFin are built to find.” Its strength is in handling complexity, not discovering niche savings.

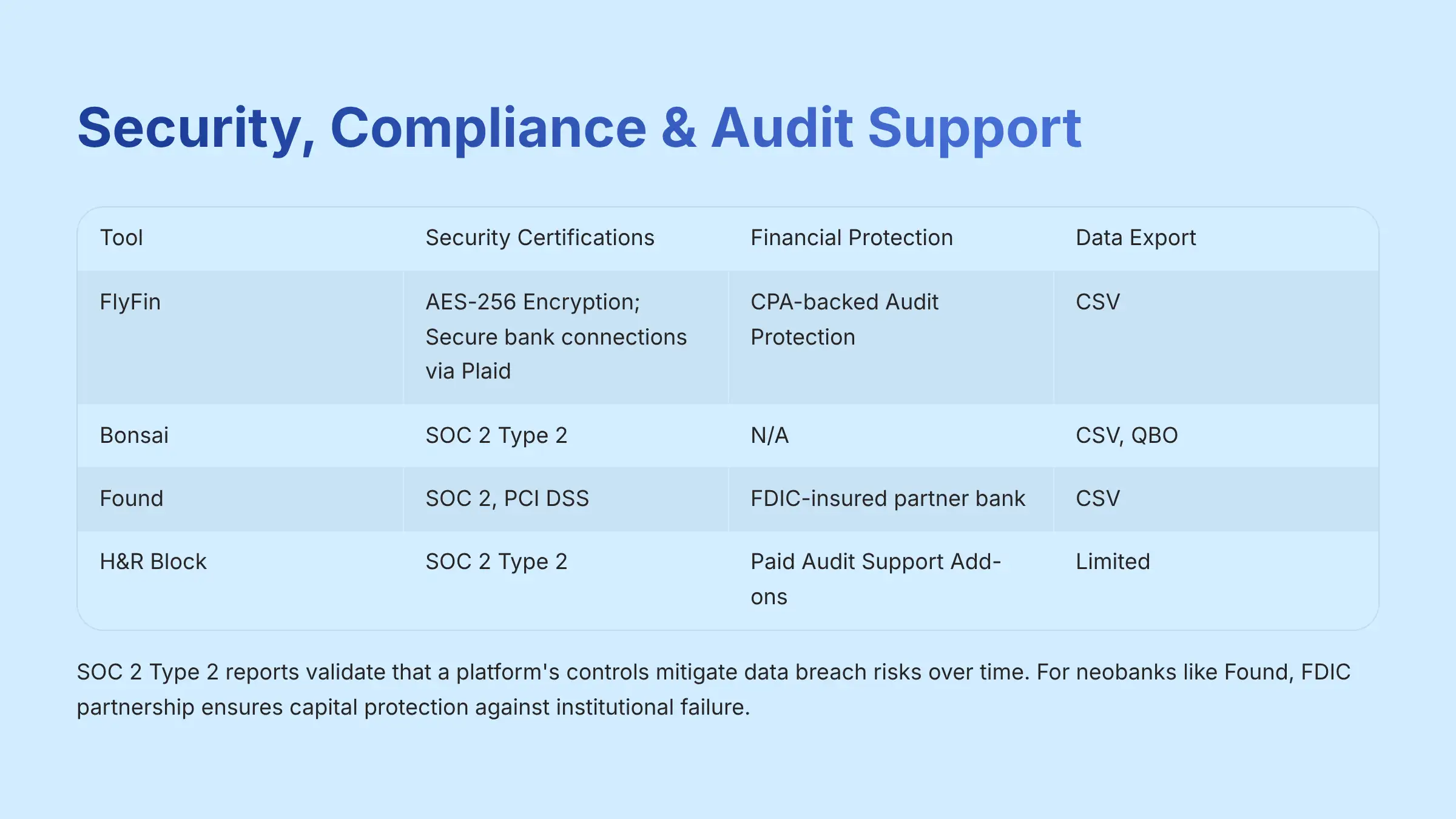

YMYL CHECKPOINT: Security, Compliance & Audit Support

When your financial data is at stake, security is not a feature; it's a requirement. I've analyzed the security and compliance frameworks of each tool to give you a clear picture of how they protect you.

The table below summarizes my findings from official documentation and security reports. SOC 2 Type 2 is a high-level security audit that verifies a company's systems and data protection over time. FDIC Insurance protects your cash deposits up to $250,000.

| Feature/Tool | FlyFin | Bonsai | Found | H&R Block |

|---|---|---|---|---|

| Security Certifications | AES-256 Encryption; Secure bank connections via Plaid | SOC 2 Type 2 | SOC 2, PCI DSS | SOC 2 Type 2 |

| Data Encryption | Standard | End-to-end | Standard | Standard |

| Financial Protection | CPA-backed Audit Protection | N/A | Business bank account with funds held at an FDIC-insured partner bank | Paid Audit Support Add-ons |

| Data Export Formats | CSV | CSV, QBO | CSV | Limited |

| Jurisdictional Support | Federal & All States | Federal Only | N/A (Banking) | Federal & All States |

| Key User Concern | AI Data Privacy | N/A | “Neobank Anxiety” | N/A |

Professional Recommendation: A SOC 2 Type 2 report is more than a badge; it's a validation that the platform's controls mitigate the risk of data breaches over an extended period. This is why Bonsai and H&R Block provide the highest assurance level.

For neobanks like Found, the FDIC partnership is crucial, as it ensures your capital is protected against institutional failure. This addresses a common user concern sometimes called ‘neobank anxiety'—the fear that a newer, app-based bank may lack the stability or direct protection of a traditional institution.

The key relationship to understand with FlyFin is that its Plaid integration secures your bank connection via tokenization, meaning FlyFin itself never stores your banking credentials. This architecture is a critical security consideration when granting an AI access to financial data.

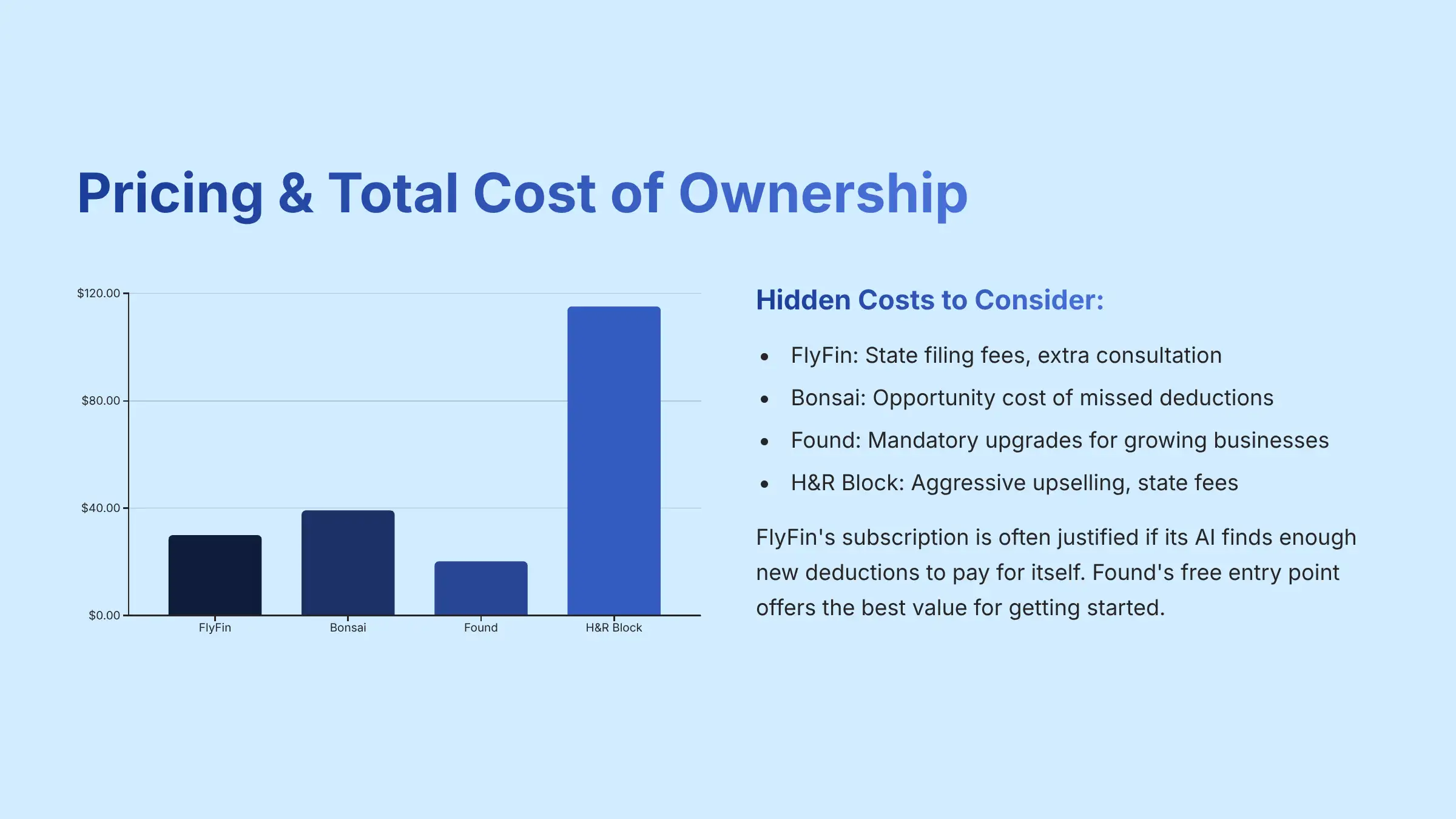

Financial Impact: Pricing, Fees & Total Cost of Ownership (TCO)

The sticker price is just the beginning. The true financial impact, or Total Cost of Ownership (TCO), includes subscription fees, hidden charges, and the opportunity cost of missed deductions.

I've broken down the real costs based on my research into each platform's pricing structure as of 2024. Be aware of how upselling and opportunity costs can change the value equation.

| Pricing Aspect | FlyFin | Bonsai | Found | H&R Block |

|---|---|---|---|---|

| Model | Subscription | Subscription | Freemium + Paid Tier | Per-Filing Fee |

| Approx. Cost | $20-40/mo | ~$39/mo (Pro) | $0 or ~$19.99/mo | $115 (federal) + state fees |

| Hidden Costs | State filing fees, extra consultation | Opportunity cost (missed deductions) | Mandatory upgrades for growing businesses | Aggressive upselling |

Professional Recommendation: The key to evaluating price is to look at the net result. FlyFin's subscription is often justified if its AI finds enough new deductions to pay for the service itself. Found's free entry point offers the best value for getting started.

With Bonsai, you must weigh the incredible convenience against the potential opportunity cost. What does that mean? It means the money you might be leaving on the table. Because its tax engine is less powerful than a specialized tool, you could miss out on hundreds or even thousands of dollars in deductions that FlyFin's AI would have found. That's a real cost that doesn't show up on your monthly bill.

Be most cautious with H&R Block, where aggressive upselling for live support can cause the final bill to be much higher than the advertised price.

Final Verdict & User-Specific Recommendations

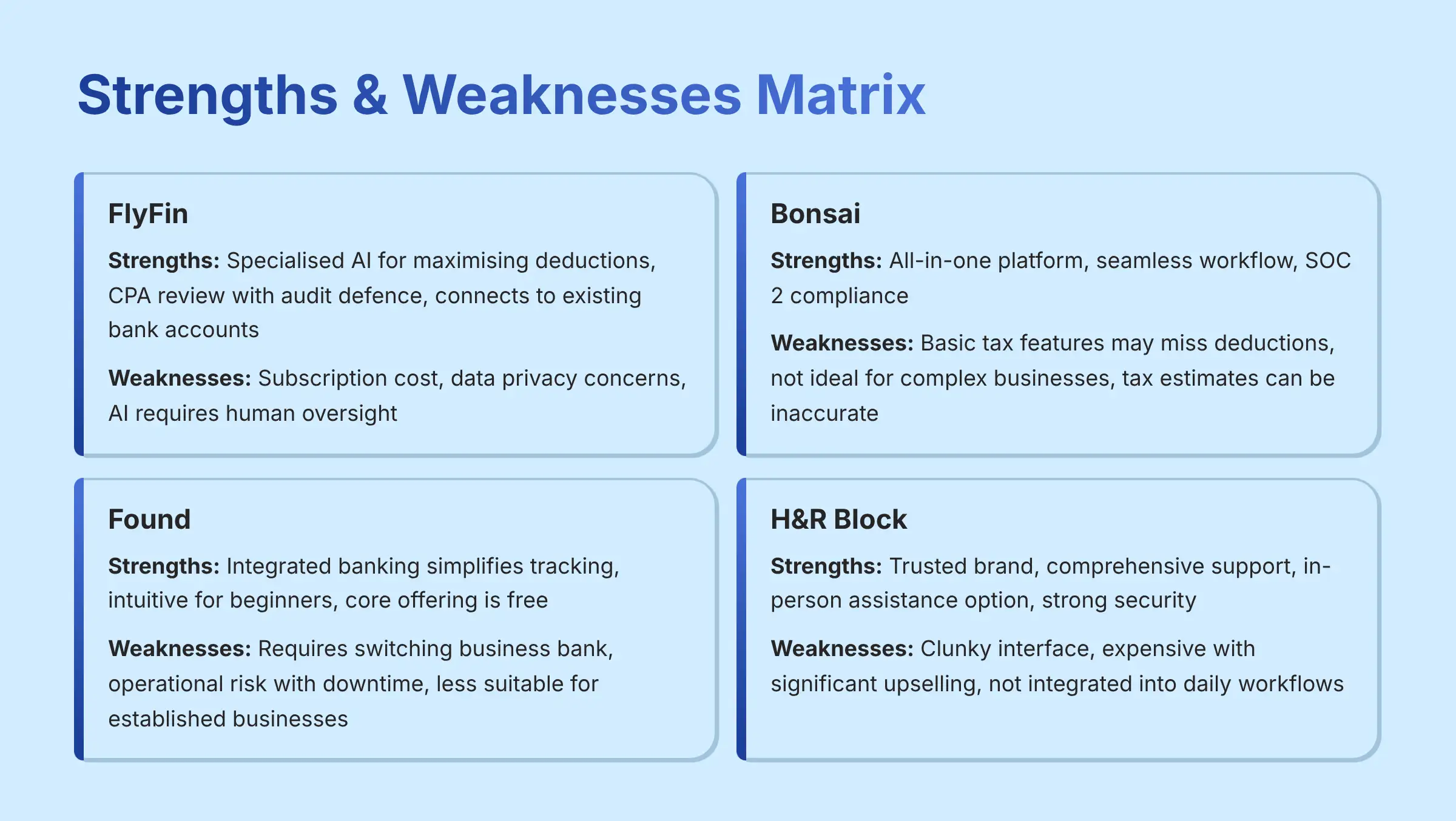

Strengths & Weaknesses: A Summary Matrix

This matrix provides a final, at-a-glance summary of the key pros and cons for each tool, based directly on my hands-on testing and analysis.

| Tool | Key Strengths | Key Weaknesses |

|---|---|---|

| FlyFin | Specialized AI for maximizing deductions. CPA review builds confidence and provides audit defense. Connects to existing bank accounts. | Subscription cost. User concerns about data privacy. AI requires human oversight to ensure accuracy. |

| Bonsai | All-in-one platform simplifies business management. Seamless workflow from proposal to payment. Strong security with SOC 2 compliance. | Basic tax features may miss deductions. Not ideal for financially complex businesses. Reported tax estimates can be inaccurate. |

| Found | Integrated banking simplifies expense tracking and tax savings. Excellent, intuitive user experience for beginners. Core offering is free. | Requires users to switch their primary business bank. Operational risk if the platform has downtime. Less suitable for established businesses with complex banking. |

| H&R Block | Trusted brand name. Comprehensive support for complex tax situations. Option for in-person assistance. Strong security and compliance. | Clunky user interface. Expensive with significant upselling. Not integrated into daily freelance workflows. May overlook niche deductions. |

Matching the Tool to Your Business Needs

The best tool is the one that fits your specific situation. Here are my professional recommendations based on common freelancer personas.

Before making your final decision, consider reading our detailed FlyFin Review to understand how the market leader performs in real-world scenarios.

For the Established Freelancer Focused on Profitability

My recommendation is FlyFin. If you have multiple income streams, complex expenses, and feel you are “leaving money on the table,” its specialized AI offers the highest potential return on investment. The CPA-backed audit protection provides the peace of mind you need to run your business confidently.

For the New Freelancer Prioritizing Simplicity

My recommendation is Found. It is the ideal starting point for building good financial habits. By automating tax savings and simplifying expense tracking through its integrated bank account, it removes the anxiety and complexity of business finance. This allows you to focus on growth.

For the All-in-One Power User

My recommendation is Bonsai. If your main goal is to streamline your entire client workflow from proposal to payment, Bonsai offers unmatched convenience. It is best for those whose tax situation is relatively straightforward and who value operational simplicity above all else.

For the Traditionalist Who Values Trust

My recommendation is H&R Block. It remains a safe and reliable choice, especially if you have a highly complex tax situation involving investments or rental properties. If you prefer the assurance that comes with a globally recognized brand and the option to speak with a tax pro face-to-face, it is a sound decision.

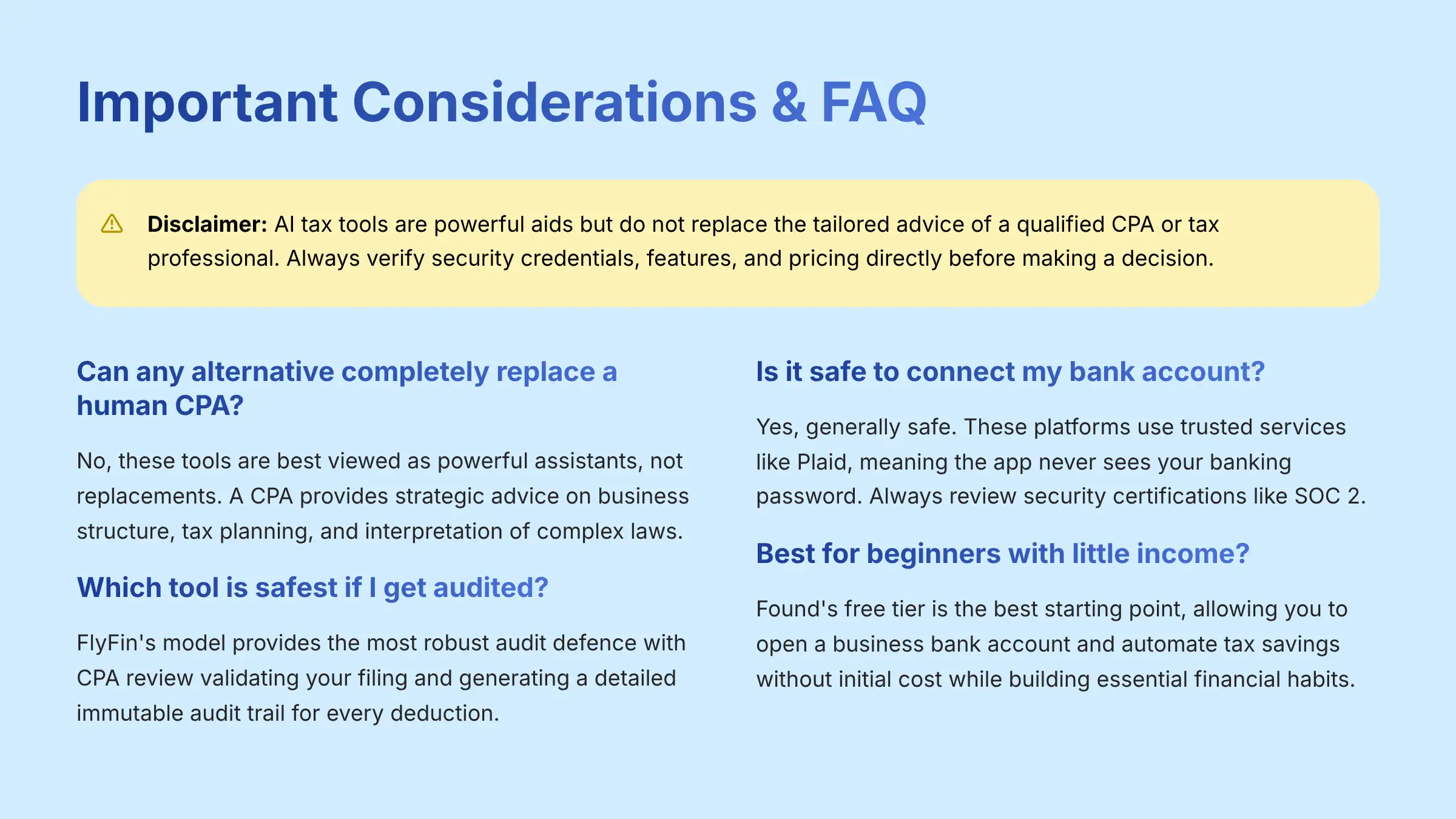

Disclaimer: Professional Consultation & Due Diligence

This article is for informational purposes only. AI tax tools are powerful aids, but they do not replace the tailored advice of a qualified Certified Public Accountant (CPA) or tax professional.

I strongly advise you to consult with an expert, especially if you have complex income streams, multi-state filings, or a high potential for an audit. Always verify the latest security credentials, features, and pricing structures directly on the vendor's official website before making a purchase decision. Your financial health depends on your own due diligence.

Frequently Asked Questions (FAQ)

Can any FlyFin alternative completely replace a human CPA?

No, these tools are best viewed as powerful assistants, not replacements. My experience shows that a CPA's strategic advice on business structure, tax planning, and interpretation of complex laws is invaluable. A tool automates tasks; a CPA provides wisdom.

Which tool is safest if I get audited by the IRS?

Based on my analysis, FlyFin's model provides the most robust audit defense. This isn't just a marketing promise; it's a procedural advantage. The relationship is clear: their CPA review validates your filing before it's submitted, and the platform generates a detailed immutable audit trail for every single deduction.

This means if you receive an IRS inquiry (like a CP2000 notice), you have a CPA-signed filing and the supporting documentation ready. H&R Block's audit support is also strong but is typically a paid add-on that provides IRS representation, which is a different level of service. With any tool, your best defense is a clean audit trail and well-organized digital receipts.

Is it safe to connect my bank account to these apps?

Yes, it is generally safe. These platforms use trusted, third-party services like Plaid to connect to your bank, which means the app itself never sees or stores your banking password. However, you should always review a platform's specific security certifications, like SOC 2, to confirm their data handling practices.

I'm just starting out with very little income. Which tool is best?

Found's free tier is the best starting point. It allows you to open a business bank account and automate tax savings without any initial cost. This lets you build essential financial habits from day one, which is one of the most valuable things a new freelancer can do.

For additional guidance on getting started, you might find our FlyFin Tutorials and Usecase helpful, even if you ultimately choose a different platform.

If you have more specific questions about any of these tools, our comprehensive FlyFin FAQs section addresses many common concerns that apply across different AI tax platforms.

As you explore these Best FlyFin Alternatives, remember to align the tool's core philosophy with your own business needs and risk tolerance.

Leave a Reply