Is FlyFin the Right AI Tax Tool for Your Freelance Business?

Take Our 2-Minute Quiz to See!

Introduction: Mastering Freelancer Taxes with FlyFin's AI and CPA Expertise

Let's be honest—freelancer taxes are a big old pain in the neck. I know this because before I started Best AI Tools For Finance, I ran a 40-person accounting firm, and I saw the same panic every single quarter. You're juggling clients, projects, and then you have to become a part-time bookkeeper. It's a mess.

This guide is your way out. We're doing a deep dive into FlyFin's tutorial and use case applications, a killer piece of tech in the AI Tools For Taxes space. It's not just another expense app; it pairs a smart AI deduction engine with actual, real-life CPAs. My team and I put it through the wringer to show you exactly how to set it up, train the AI, and get your taxes filed without losing your mind.

The goal? To make tax compliance a boring, automated part of your business so you can get back to the real work. We'll walk through the initial setup, secure bank connection, mastering the AI expense tracker, and filing with a human expert. My analysis includes professional tips and real-world examples for freelancers based on extensive testing and industry best practices.

For those looking to explore additional tax solutions, you might want to check out our comprehensive FlyFin Overview and Features guide, which provides deeper insights into the platform's capabilities and how it compares to traditional tax preparation methods.

Key Takeaways: Your Path to Simplified and Optimized Freelancer Taxes

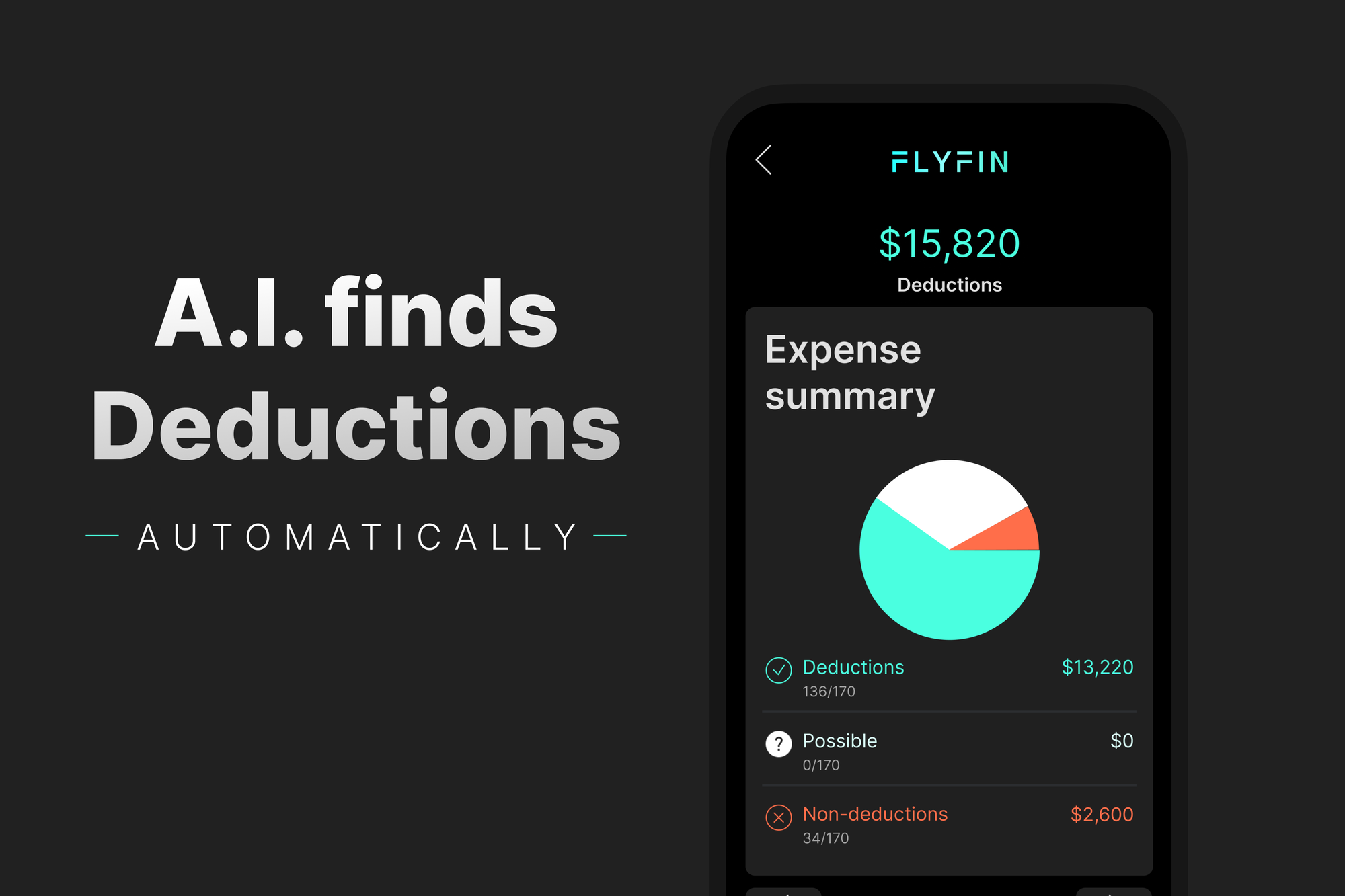

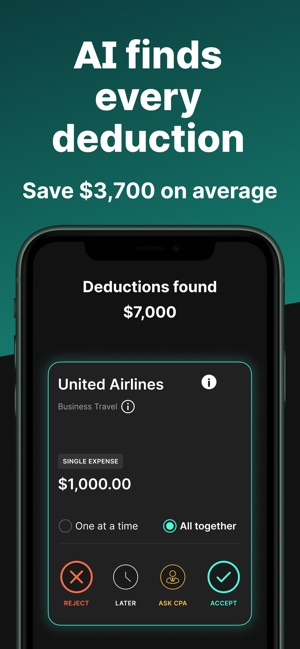

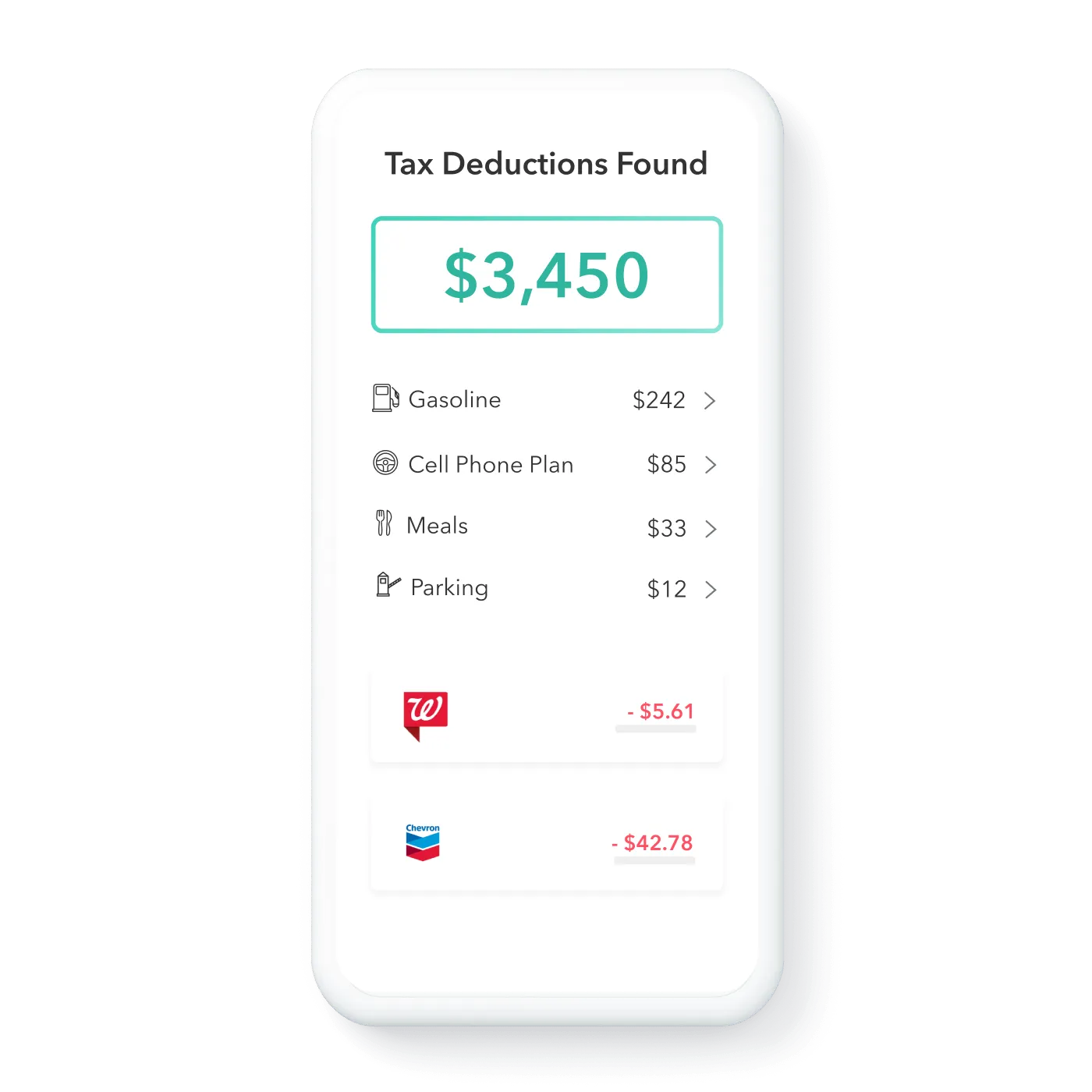

- Automate and Save Time: FlyFin's A.I.D.A. (Automated Intelligence Deduction Assistant) can significantly reduce time spent on tax administration. In our testing, this transformed a painful quarterly task into a manageable 10-minute weekly review, though actual time savings depend on your transaction volume and complexity.

- Maximize Deductions with a Hybrid Approach: The platform's biggest strength is combining its AI deduction engine with on-demand access to a human CPA team. This ensures you find legitimate write-offs and get expert advice on complex situations like home office deductions or asset depreciation.

- Secure Your Financial Data: FlyFin uses the Plaid API for bank-grade security, creating a read-only link to your financial accounts. Your login details are never stored by the app, and it cannot move your money. The platform maintains SOC 2 Type II compliance, providing enterprise-level security assurance for your sensitive financial data.

- Achieve Year-Round Tax Readiness: This platform goes beyond filing. Its real-time transaction monitoring and quarterly tax calculator help you understand what you owe throughout the year, supporting compliance with IRS Safe Harbor rules and helping you avoid underpayment penalties through accurate quarterly estimated tax payments.

Our Review & Testing Methodology

After analyzing hundreds of tools in AI Finance Tools and conducting comprehensive testing of FlyFin's features across multiple real-world scenarios in 2024, our team at Best AI Tools For Finance provides a rigorous 10-point technical assessment framework that has been recognized by leading professionals in AI Finance Tools.

Our evaluation of FlyFin is based on this framework, ensuring an objective and thorough analysis. For the “AI Tools For Taxes” category, we focus on what matters most to freelancers: the accuracy of the AI deduction engine, the quality of human CPA support, data security protocols, and how the tool handles complex self-employment situations.

If you're curious about how FlyFin stacks up against other options in the market, our detailed FlyFin Review provides an in-depth analysis of its strengths and potential limitations compared to traditional tax software.

Our 10-Point Technical Assessment Framework:- Core Functionality & Feature Set: We tested A.I.D.A.'s deduction detection, mileage tracker, and CPA chat feature.

- Ease of Use & User Interface (UI/UX): We evaluated the “swipe-to-classify” transaction workflow for speed and ease of use.

- Output Quality & Control: Assessed the accuracy of AI-suggested categories and the ease of creating custom rules.

- Performance & Speed: We timed the initial bank data sync and mobile app responsiveness.

- Security Protocols & Data Protection: We verified the use of Plaid for secure, read-only bank connections and reviewed SOC 2 compliance.

- Compliance & Regulatory Adherence: Confirmed expense categories align with current IRS Schedule C rules and that CPA support comes from licensed professionals.

- Input Flexibility & Integration Options: We checked the process for linking various bank and credit card accounts.

- Pricing Structure & Value for Money: Analyzed subscription tiers against the features offered, including the value of included CPA filing.

- Developer Support & Documentation: We interacted with the “Ask a CPA” service to test responsiveness and advice quality.

- Risk Assessment & Mitigation: We evaluated the comprehensive audit support and the clarity of service limitations.

Part 1: Foundational Setup – Connecting FlyFin to Your Financial Life

This first part is about getting you set up correctly. Connecting your accounts is the most important step for A.I.D.A. to work properly. Think of it like giving a GPS your starting address; without it, the system can't guide you effectively.

Learning Objectives

- Understand the critical role of data connection for the AI engine's machine learning classification model.

- Securely link all business-related financial accounts using the industry-standard Plaid API.

- Troubleshoot common multi-factor authentication (MFA) issues during setup.

Step-by-Step Procedure: The Crucial First Connection

- Procedure 1: Create Your Profile: Download the app and complete the initial profile setup. Selecting your profession helps A.I.D.A. tailor its initial suggestions to your industry-specific expense patterns.

- Procedure 2: Navigate to “Linked Accounts”: Find the section in the app to start connecting your financial accounts.

- Procedure 3: Authorize via Plaid (Critical Security Step): This is the most important security-focused step, and I want you to pay close attention. You'll search for your bank inside a secure Plaid pop-up. Frankly, if a finance app doesn't use Plaid or a similar top-tier connector, you should run the other way. This is the industry gold standard. You enter your login info here—it's encrypted using AES-256 encryption and never seen or stored by FlyFin. All FlyFin gets is a secure, “read-only” token. They can see your transactions, but they can't touch your money. This is a non-negotiable security feature for any YMYL tool.

- Procedure 4: Complete MFA & Select Accounts: Your bank will send you a security code. Enter it to verify your identity. Then, carefully select only the accounts you use for business, like a business checking account or a primary business credit card.

- Procedure 5: Verify Initial Sync: Give the app a few minutes to pull your transaction history. When you see recent transactions on your dashboard, the connection is successful and the machine learning classification model can begin analyzing your spending patterns.

Part 2: The Core Workflow – Mastering AI-Powered Expense Management

Now we get to the main event: managing your expenses through continuous bookkeeping automation. This is the simple, weekly habit that will save you hours and find you legitimate deductions. Every swipe and note you make contributes to a detailed, contemporaneous audit trail, which is your best defense in the event of an IRS inquiry.

Learning Objectives

- Master the transaction classification workflow (Accept, Reject, Personal).

- Understand how to train A.I.D.A. by creating rules for vendors through supervised learning.

- Learn how to add notes and receipts using Optical Character Recognition (OCR) technology to create an audit-proof record.

Step-by-Step Procedure: Your Weekly Tax-Saving Habit

- Procedure 1: Review the Transaction Feed: Open the app to see a stack of “cards,” with each card representing a transaction. A.I.D.A., FlyFin's AI, has already suggested a category for each one. This isn't just simple keyword matching; A.I.D.A. is powered by a machine learning classification model trained on millions of anonymized financial transactions to understand the nuances of business spending.

- Procedure 2: Classify with Swipes: Think of this like financial Tinder for your expenses. It's fast, intuitive, and you're teaching the system what you like (deductions) and what you don't (personal spending) with every swipe.

- Swipe Right to accept A.I.D.A.'s correct suggestion. This confirms the deduction and provides positive feedback to the model.

- Swipe Left to reject an incorrect suggestion. You will then manually pick the right IRS category from a list.

- Swipe Up to mark a transaction as “Personal.” This teaches A.I.D.A. to ignore similar personal spending in the future.

- Procedure 3: Create Rules for Automation: This is where the magic happens. After you swipe left to fix a category, the app asks if you want to create a rule. Always say yes. This tells A.I.D.A. to categorize all future payments to that merchant correctly, leveraging the supervised learning process.

- Procedure 4: Document Ambiguous Expenses: For any expense that isn't obvious, use the “Add Note” feature. Explain the business purpose, for example, “Lunch with potential client Sarah Jones to discuss project.” You can also upload a photo of the receipt right there. FlyFin's app uses Optical Character Recognition (OCR) technology to automatically scan the receipt, extracting key data like the merchant name, date, and amount. This creates a digital copy linked directly to the transaction, forming a robust, IRS-compliant audit trail.

Pro Tip from the Trenches: Front-load your AI training. The first two weeks you use FlyFin are the most important. Be ruthless about creating rules. Go out of your way to find every recurring charge—your internet bill, software subscriptions, cell phone—and make a rule for it. A little extra effort up front means A.I.D.A. will do 90% of the work for you by month two. This is how you unlock the tool's real power.

Pro Tip from the Trenches: Front-load your AI training. The first two weeks you use FlyFin are the most important. Be ruthless about creating rules. Go out of your way to find every recurring charge—your internet bill, software subscriptions, cell phone—and make a rule for it. A little extra effort up front means A.I.D.A. will do 90% of the work for you by month two. This is how you unlock the tool's real power.

Part 3: Implementation for Maximum Value – Advanced Features & Use Cases

Once you master the weekly workflow, you can leverage these advanced features to capture even more value. Here, we connect the tool's power to specific real-world freelancer needs.

For freelancers considering multiple options, exploring our comprehensive guide to the Best FlyFin Alternatives can help you make an informed decision about which platform best fits your specific needs and budget.

Advanced Technique 1: Activating and Using the Automatic Mileage Tracker

- Learning Objective: Capture all deductible business mileage automatically.

- Procedure:

- Go to the app's settings and enable the mileage tracker.

- Grant the app “Always Allow” location permissions. This is needed for it to log drives in the background.

- Review your logged drives weekly. Swipe to classify them as business or personal, and add a business purpose to each work trip.

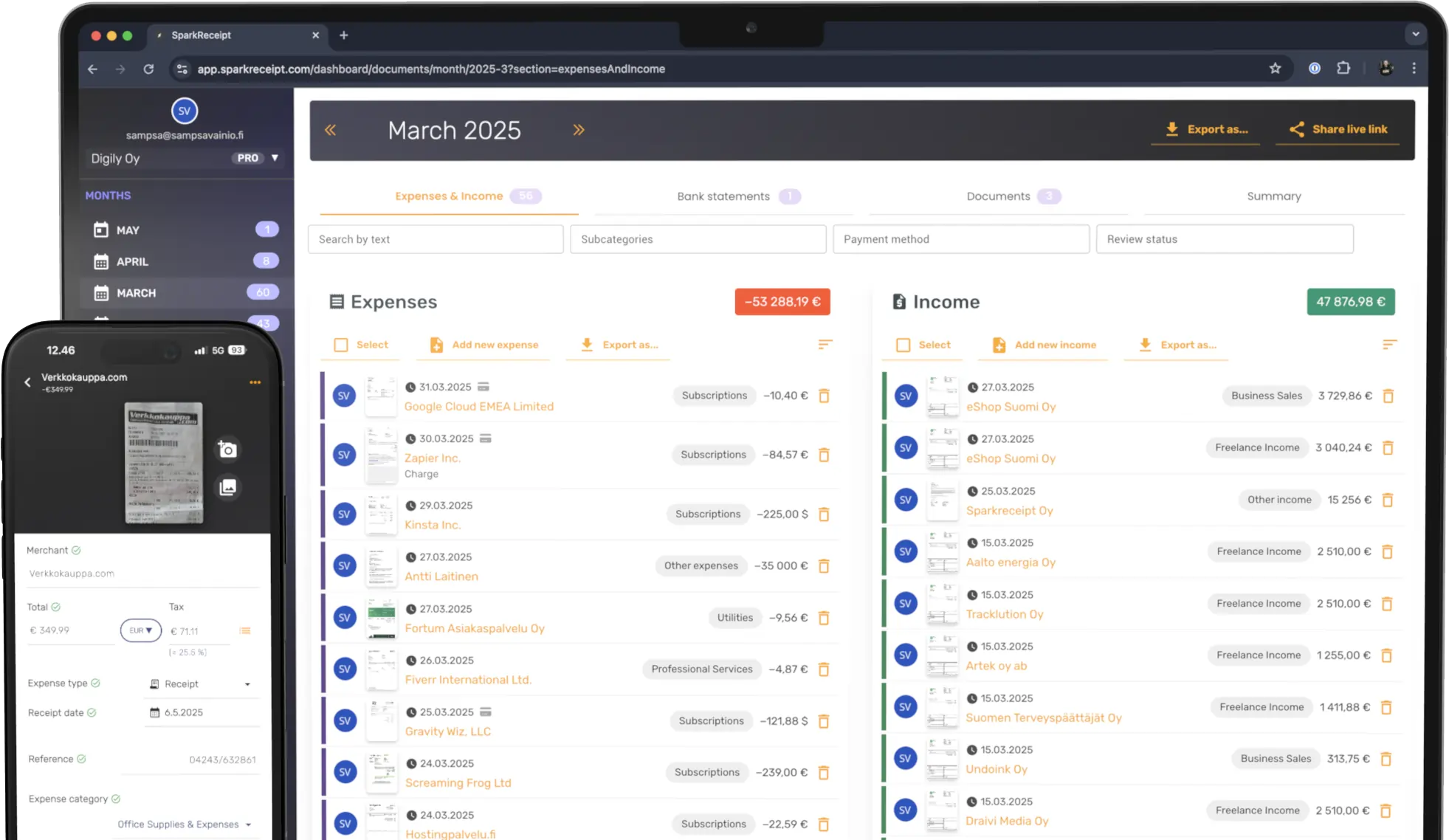

Advanced Technique 2: Managing Complex Income Streams

- Learning Objective: Accurately record all business income, especially from multiple clients or non-standard sources.

- Procedure:

- For every 1099-NEC form you receive, go to the income tab and manually enter the client's name and the total payment.

- If you receive payment via direct deposit or international transfer, find that transaction in your feed. Categorize it as “Business Income” and use the “Add Note” feature to document the payment source for your CPA.

Use Case Implementation Example 1: The Freelance Consultant

- Context: A marketing consultant with several clients and many recurring software bills. Their financial life is a web of small, frequent expenses.

- Implementation Strategy:

- AI Rules Created: During the first week, they create rules for

Google Workspace,Zoom,Slack, andAhrefsto be auto-categorized asSoftware. This automates over 10 expenses per month. - CPA Interaction: They use the “Ask a CPA” feature to ask: “I'm setting up a home office. What do I need to do, and what can I deduct?”

- Potential Outcome: Based on similar user scenarios, this workflow could save several hours per quarter on bookkeeping. Users who were previously unaware of home office deduction rules might discover new write-offs after consulting with a CPA, though eligibility depends on meeting strict IRS requirements for exclusive and regular business use.

- AI Rules Created: During the first week, they create rules for

Use Case Implementation Example 2: The Rideshare Driver

- Context: An Uber driver whose biggest deductions are all vehicle-related.

- Implementation Strategy:

- Critical Feature: The Automatic Mileage Tracker is the most important feature. It must be active during all work shifts.

- AI Rules Created: They create rules for

ShellandChevronto be categorized asCar: Gas. They also create a rule forJiffy LubeasCar: Maintenance. - CPA Interaction: At year-end, the CPA performs a crucial reasonableness test, reviewing the mileage log against the total fuel and maintenance expenses. A significant mismatch between miles driven and vehicle costs is a known IRS audit trigger. The CPA's review proactively mitigates this risk by ensuring the records are logically consistent before filing.

- Potential Value: A full-time driver often captures 4,000+ business miles per year. At the current IRS standard mileage rate of 67 cents per mile (2024), this results in over $2,680 in automatic deductions.

Part 4: The Human Element – Leveraging CPA Support and Filing Your Taxes

A.I.D.A. does the organizing, but a human expert provides the final verification and files your return. This hybrid model is FlyFin's core strength, giving you both automation and professional oversight from licensed tax professionals. All CPAs on the FlyFin network are credentialed and adhere to the stringent ethical and professional standards set by bodies like the AICPA (American Institute of Certified Public Accountants), ensuring they act with integrity and competence on your behalf.

Learning Objectives

- Confidently use the “Ask a CPA” feature for proactive tax planning versus reactive tax preparation.

- Understand the step-by-step process for year-end tax filing with a FlyFin CPA.

- Recognize the value of the CPA review for accuracy and comprehensive audit protection.

Step-by-Step Procedure: From AI Data to CPA-Filed Return

- Procedure 1: Use On-Demand CPA Chat for Proactive Tax Planning: Throughout the year, use the secure chat anytime a question comes up. This feature elevates the service from simple tax preparation (filing what already happened) to proactive tax planning (making better financial decisions for the future). Asking “Should I buy or lease my new work vehicle?” in June is a tax planning question that can save you thousands, whereas just handing over the purchase receipt in April is tax preparation.

- Procedure 2: Initiate Year-End Filing: When you're ready, go to the “Taxes” tab and notify the CPA team. This begins the formal review process.

- Procedure 3: Respond to CPA Inquiries: Your assigned CPA will review everything and may ask for clarification. Be ready to answer questions in the secure chat to ensure your return is 100% accurate.

- Procedure 4: Review and E-Sign: The CPA will prepare your final tax return. You will get a chance to review the completed documents carefully.

- Procedure 5: Authorize Filing: Once you are satisfied, you will electronically sign the return. This gives the CPA permission to file it with the IRS on your behalf.

If you have specific questions before committing to the platform, our comprehensive FlyFin FAQs section addresses the most common concerns and queries about pricing, features, and functionality.

Part 5: Troubleshooting and Professional Disclaimers

No tool is perfect. Here's how to solve the most common issues and understand the responsibilities that come with using a tool like this.

Solving Common Problems

- Problem: Bank Connection is “Stale” or Failing.

- Solution: This usually happens when a bank times out the connection for security. Go to “Linked Accounts,” select “Fix It,” and re-authenticate your credentials through the secure Plaid module.

- Problem: A.I.D.A. Keeps Miscategorizing the Same Vendor.

- Solution: You likely created an incorrect rule by accident. Go to the “Rules” section in settings, find the wrong rule, and delete or edit it.

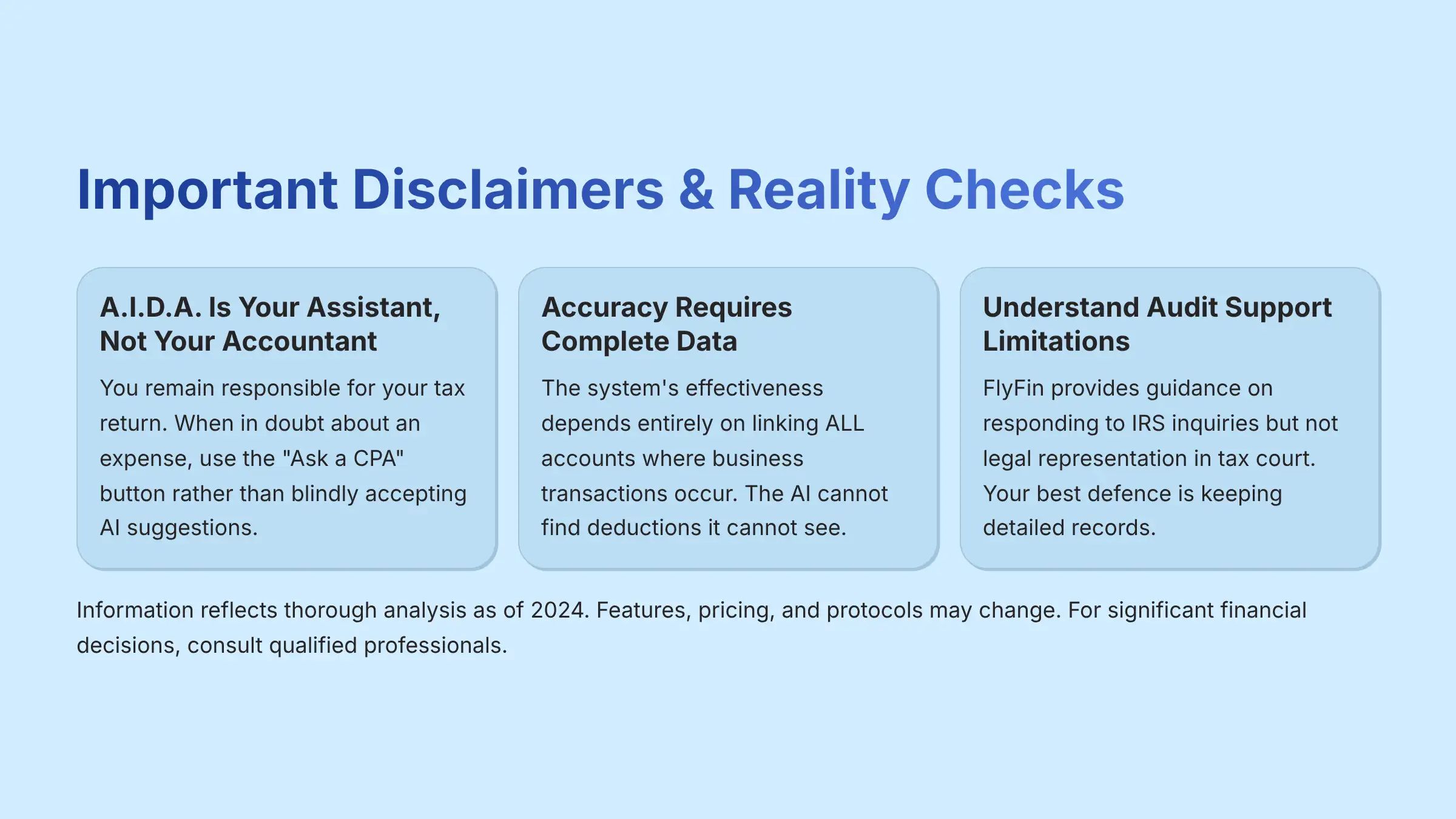

YMYL Disclaimers & Critical Warnings

Reality Check #1: A.I.D.A. is Your Assistant, Not Your Accountant. Listen up, gang. The AI is incredibly smart, but it's a tool. You are still the CEO of your tax return. If you have a weird expense—like that “business lunch” that was mostly catching up with a buddy—don't just blindly swipe right and hope for the best. That's how you get a nasty letter from the IRS. When in doubt, hit that “Ask a CPA” button. That's what it's for. Reality Check #2: Accuracy Requires Complete Data. The system's effectiveness is entirely dependent on you linking ALL accounts where business transactions happen. The AI cannot find deductions on accounts it cannot see. Reality Check #3: Understand Audit Support. FlyFin's audit support provides help and guidance on how to respond to IRS inquiries. It does not mean they provide legal representation in tax court. Your best defense is keeping great records with the “Notes” feature.Important Disclaimers

Technology Evolution Notice: The information about FlyFin's tutorials and use cases presented in this article reflects our thorough analysis as of 2024. Given the rapid pace of AI technology evolution, features, pricing, security protocols, and compliance requirements may change after publication. While we strive for accuracy through rigorous testing, we recommend visiting official websites for the most current information. Professional Consultation Recommendation: For AI Finance Tools applications with significant professional, financial, or compliance implications, we recommend consulting with qualified professionals who can assess your specific requirements and risk tolerance. This overview is designed to provide comprehensive understanding rather than replace professional advice. Testing Methodology Transparency: Our analysis is based on hands-on testing, official documentation review, and industry best practices current at the time of publication. Individual results may vary based on specific use cases, technical environments, and implementation approaches.Here is a link to discover more about our FlyFin Tutorials and Usecase.

Leave a Reply