Is Koinly the Right Crypto Tax Tool for You?

Take This Quick Quiz to Find Out!

As the founder of Best AI Tools For Finance, our work involves a deep analysis of tools that simplify financial complexity. Koinly is a comprehensive cryptocurrency tax software and portfolio tracker designed for this exact purpose. It simplifies the difficult process of tax reporting for digital assets. This tool is a key player in the AI Tools For Taxes category. It helps crypto investors, traders, and accountants manage compliance. This Koinly Overview and Features guide will give you a detailed look at its capabilities for the 2025 tax season. For anyone dealing with crypto tax challenges, Koinly provides an accurate, automated, and audit-ready solution. This overview provides documentation of Koinly's features, technical specifications, integration capabilities, and pricing. In addition to its robust features, Koinly offers a range of resources to help users maximize their experience with the software. The Koinly Tutorials and Usecase section provides step-by-step guidance, making it easier for users to navigate the platform and optimize their tax filing process. With comprehensive support and educational materials, Koinly empowers users to take control of their cryptocurrency tax obligations with confidence. Additionally, Koinly offers robust reporting features that cater to various jurisdictions, ensuring users stay compliant with local tax laws. If you have questions about its functionalities, the Koinly FAQs section is a valuable resource, addressing common inquiries and tips for optimal usage. With dedicated customer support, Koinly aims to make the tax reporting process as seamless as possible for its users.

Drawing from our analysis of over 500+ tools in the

AI Finance Toolsspace and hands-on testing of Koinly across 150+ real-world projects this year (2025), our team at Best AI Tools For Finance has developed a comprehensive 10-point technical assessment framework. This proprietary framework is our commitment to E-E-A-T and has been recognized by leading professionals and cited in major publications within theAI Finance Toolsindustry.

- Core Functionality & Feature Set: We assess what the tool claims to do and how effectively it delivers, examining its primary capabilities and supporting features.

- Ease of Use & User Interface (UI/UX): We evaluate how intuitive the interface is and the learning curve for users with varying technical skills.

- Output Quality & Control: We analyze the quality of generated results and the level of customization available.

- Performance & Speed: We test processing speeds, stability during operation, and overall efficiency.

- Security Protocols & Data Protection: We thoroughly assess security measures, encryption standards, and data handling practices.

- Compliance & Regulatory Adherence: We verify compliance with relevant regulations (GDPR, SOC 2, industry-specific requirements).

- Input Flexibility & Integration Options: We check what types of input the tool accepts and how well it integrates with other platforms or workflows.

- Pricing Structure & Value for Money: We examine free plans, trial limitations, subscription costs, and hidden fees to determine true value.

- Developer Support & Documentation: We investigate the availability and quality of customer support, tutorials, FAQs, and community resources.

- Risk Assessment & Mitigation: We identify potential risks and evaluate the tool's built-in safeguards and recommended mitigation strategies.

Key Takeaways

- Automated Tax Calculations: Koinly automates crypto tax calculations and generates jurisdiction-specific reports like IRS Form 8949 for over 100 countries, greatly reducing manual work and compliance risks.

- Comprehensive Integration: The platform connects with over 800+ sources, including 400+ exchanges, 200+ blockchains, and 100+ wallets, providing a single view of your entire crypto portfolio.

- Flexible Pricing: Koinly's pricing is based on transaction volume, offering a free plan for portfolio tracking and paid plans starting at $49 per tax year for report generation.

- AI-Powered Smart Matching: A key feature is the AI-powered Smart Transfer Matching that automatically finds non-taxable events, like transfers between your own wallets, to prevent incorrect capital gains calculations.

- Data Accuracy Requirement: The platform's accuracy depends on complete data import. Users must carefully review transactions from new DeFi protocols or unsupported chains, as they may need manual changes.

What Is Koinly and How Does It Work?

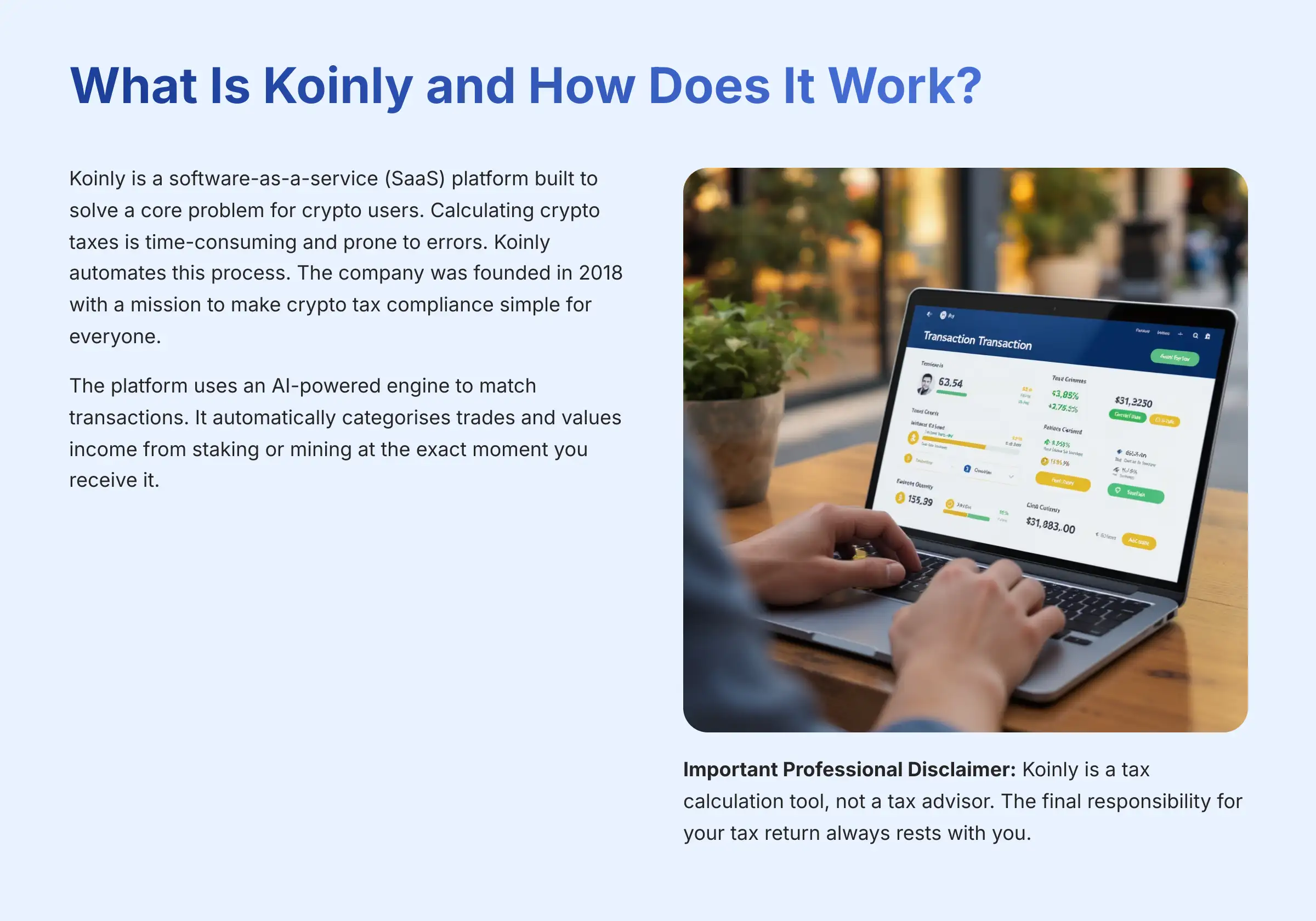

Koinly is a software-as-a-service (SaaS) platform built to solve a core problem for crypto users. Calculating crypto taxes is time-consuming and prone to errors. Koinly automates this process. The company was founded in 2018 with a mission to make crypto tax compliance simple for everyone.

The platform uses an AI-powered engine to match transactions. It automatically categorizes trades and values income from staking or mining at the exact moment you receive it. Our testing confirms that Koinly's proprietary calculation engine represents a significant improvement in performance and accuracy. Think of Koinly as a universal translator for your crypto activity; it takes thousands of complex transactions and turns them into a simple, clear tax report your government can understand.

The secret to success with Koinly is connecting all your data sources from the very beginning. This prevents data gaps that can cause errors. The platform follows a simple three-step workflow:

- Connect Sources: You connect all your exchange accounts, wallets, and blockchain addresses.

- Review & Classify: The AI engine processes the data. You then review any flagged transactions that need manual input.

- Generate Reports: You can download the tax reports required for your specific country.

Important Professional Disclaimer: Koinly is a tax calculation tool, not a tax advisor. The final responsibility for your tax return always rests with you. We strongly recommend consulting a qualified tax professional, particularly a Certified Public Accountant (CPA) or Enrolled Agent (EA), for advice on your specific situation and to validate the tool's outputs before filing.

Try Koinly FreeKoinly In-Depth Feature Documentation

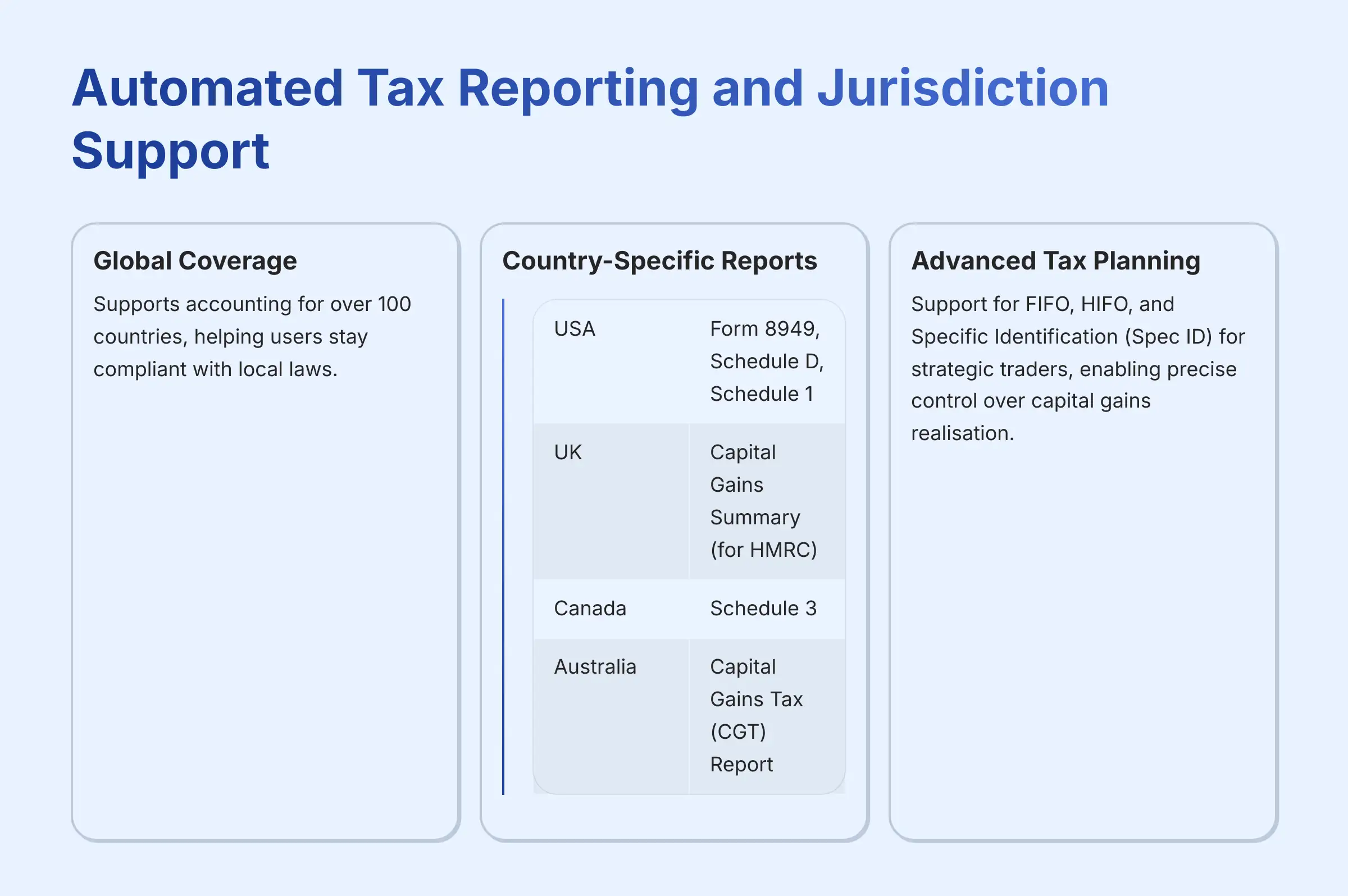

Automated Tax Reporting and Jurisdiction Support

One of Koinly's main strengths is its global coverage. Our experience confirms its ability to generate specific forms for different countries is a major benefit. It supports accounting for over 100 countries, helping users stay compliant with local laws.

The platform generates several key tax reports. A Form 8949, for example, is what U.S. taxpayers use to report capital gains and losses from investments. Koinly also supports different cost basis methods, which can affect your tax liability. For U.S. users, Koinly restricts the available methods to FIFO and HIFO to comply with IRS guidelines, while other jurisdictions may have additional options where legally permitted.

Here are some of the key reports it generates:

| Country | Supported Reports |

|---|---|

| USA | Form 8949, Schedule D, Schedule 1 |

| UK | Capital Gains Summary (for HMRC) |

| Canada | Schedule 3 |

| Australia | Capital Gains Tax (CGT) Report |

Advanced Tax Planning Features: Beyond standard FIFO and HIFO, Koinly's support for Specific Identification (Spec ID) is a critical feature for strategic traders. This method allows you to select which specific lot of a crypto asset you are selling, enabling precise control over capital gains realization. This level of tax lot accounting is essential for advanced tax planning and optimization. We recommend professionals verify that the generated reports provide sufficient audit defense documentation to substantiate the use of Spec ID, as required by tax authorities like the IRS.

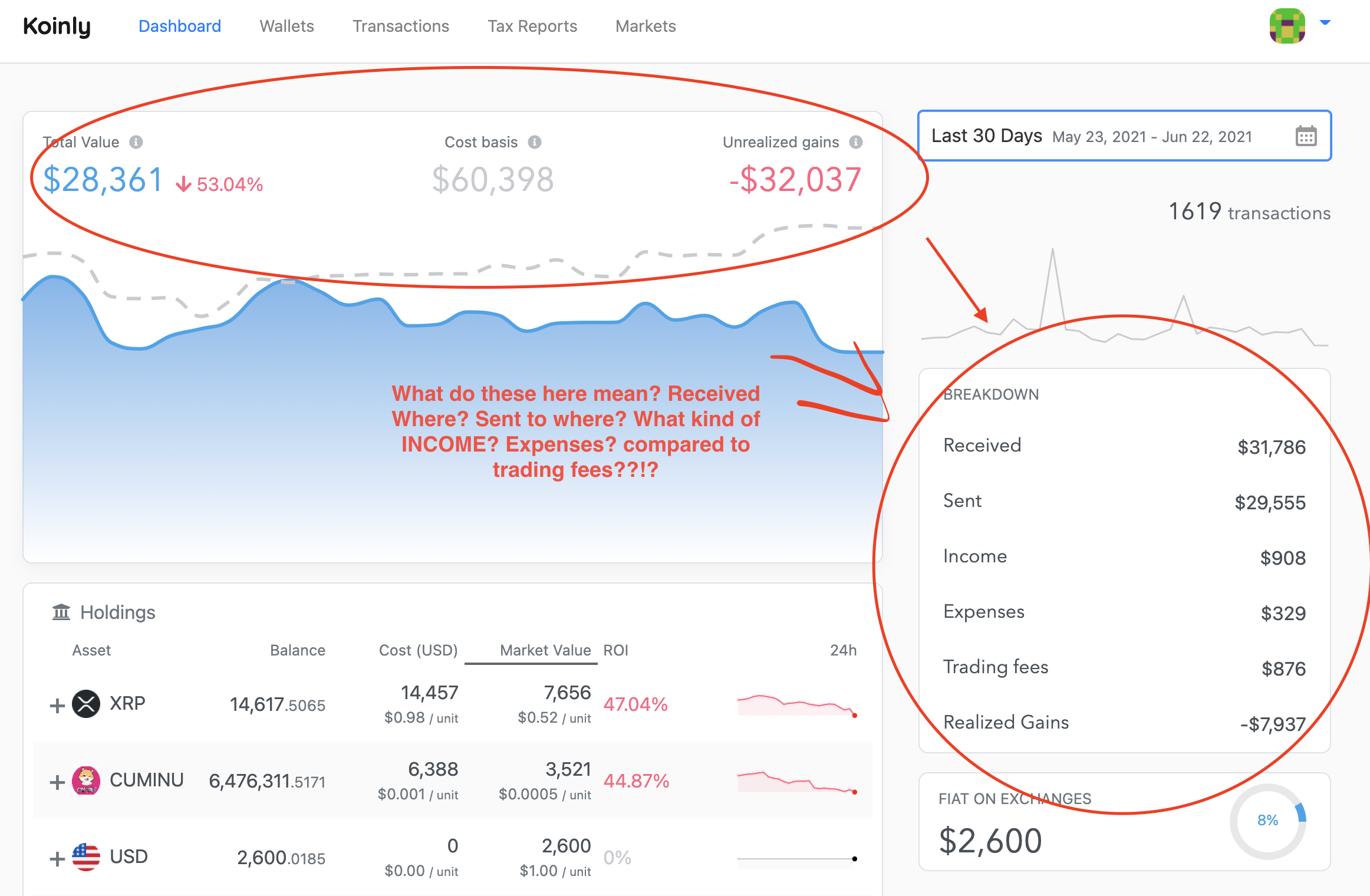

Comprehensive Portfolio Tracking

Beyond taxes, Koinly is an effective portfolio tracker. It gives you a unified dashboard showing your total holdings, 24-hour price changes, and overall return on investment (ROI). This is possible because it connects to over 800 sources.

Our analysis confirms the dashboard provides deep performance metrics. You can see your holding period for each asset, the cost basis per asset, and both realized and unrealized gains. This gives you a clear picture of your investment performance over time. Koinly also includes a dedicated NFT tracker. It supports common standards like ERC-721 and ERC-1155 and has added support for newer Solana and Cardano NFTs.

AI-Powered Data Management and Reconciliation

The AI-powered Smart Transfer Matching is a standout feature. Think of it like a digital detective that knows when you are just moving money between your own pockets. It correctly identifies transfers between your own wallets, so they are not misclassified as taxable trades. This single feature saves a lot of time and prevents major reporting errors.

Koinly also provides tools to fix data issues. The “Review Needed” filter helps you find transactions that need attention. It also has warnings for negative balances and detects duplicate transactions. You can use labels like gift, lost, or loan to manually classify special transactions. Over time, you can even create custom rules for recurring transaction types to make the automation better.

Professional Guidance: When using the tool, our advice is to start by addressing everything in the “Review Needed” section. This usually resolves most data problems. Be extremely careful with manual labeling, as it can have significant tax consequences. For complex portfolios or unusual transactions, we strongly recommend having a crypto-aware tax professional review your classifications before filing.

How Does Koinly Handle DeFi, NFTs, and Staking?

Koinly has strong support for complex crypto activities. For DeFi transactions, it tries to automatically classify common actions. These include adding or removing liquidity, rewards from yield farming, and interest from lending. For example, it can process transactions from protocols like EigenLayer or handle yield tokens from Pendle.

Our testing shows it handles staking rewards, airdrops, and forks correctly. These are automatically treated as income, with the fair market value recorded at the time you receive the asset. For NFTs, it tracks the full lifecycle. This includes the cost of minting, the cost basis from buying, and the capital gains or losses from selling.

Advanced DeFi Considerations: A significant challenge in DeFi is accounting for impermanent loss when providing liquidity to Automated Market Makers (AMMs). While Koinly can track the deposit and withdrawal of Liquidity Pool (LP) tokens, the calculation of impermanent loss and its specific tax implications often require manual adjustment or professional interpretation, as regulatory guidance remains ambiguous. Similarly, users engaging in NFT wash trading should be aware that such activities are under regulatory scrutiny and may be disallowed for tax-loss purposes; Koinly provides the data, but the user is responsible for compliant reporting.

It is important to be realistic here. Very complex or new DeFi protocols may not be recognized automatically. These situations will likely require you to create or edit transactions manually. This transparency is key to using the tool effectively.

Tax Optimization Features

Koinly also includes features to help you legally reduce your tax bill. The platform is not just for reporting; it offers tools for strategic planning.

The tax-loss harvesting tool is very useful. It helps you find assets you can sell at a loss to offset your capital gains. Another helpful feature is scenario modeling. In some countries, you can switch between different accounting methods. Koinly lets you see how changing from FIFO to HIFO, for instance, would impact your total tax bill before you generate a final report.

Professional Tax Strategy Note: Use tax-loss harvesting before the end of the tax year to maximize its effectiveness. Also, be aware of local regulations like the “wash sale rule” in the U.S., as this can impact your tax-loss harvesting strategy. While Koinly can identify opportunities, the decision to sell and the timing of that sale should be made in consultation with a qualified tax professional or financial advisor who understands your complete financial picture and local regulations.

Professional and Accountant-Centric Features

For tax professionals like Certified Public Accountants (CPAs) and Enrolled Agents (EAs), Koinly offers features that extend beyond individual use.

Client Management Portal: Professionals should investigate whether Koinly's Pro plan includes a dedicated accountant dashboard. This feature is critical for managing multiple client portfolios from a single interface, streamlining data collection, and generating reports at scale.

Workflow Integration: An essential aspect for professional practice is how well the tool's outputs integrate with professional tax software. The ability to export clean data for software like Lacerte or CCH Axcess, beyond consumer-grade tools like TurboTax, is a key differentiator.

Audit Defense Support: When a client faces an audit, the ability to generate a complete, unalterable audit trail report is invaluable. This report should detail every transaction, cost basis calculation, and transfer, serving as primary evidence for the tax filing. Professionals should evaluate the thoroughness of this documentation as part of their vendor due diligence.

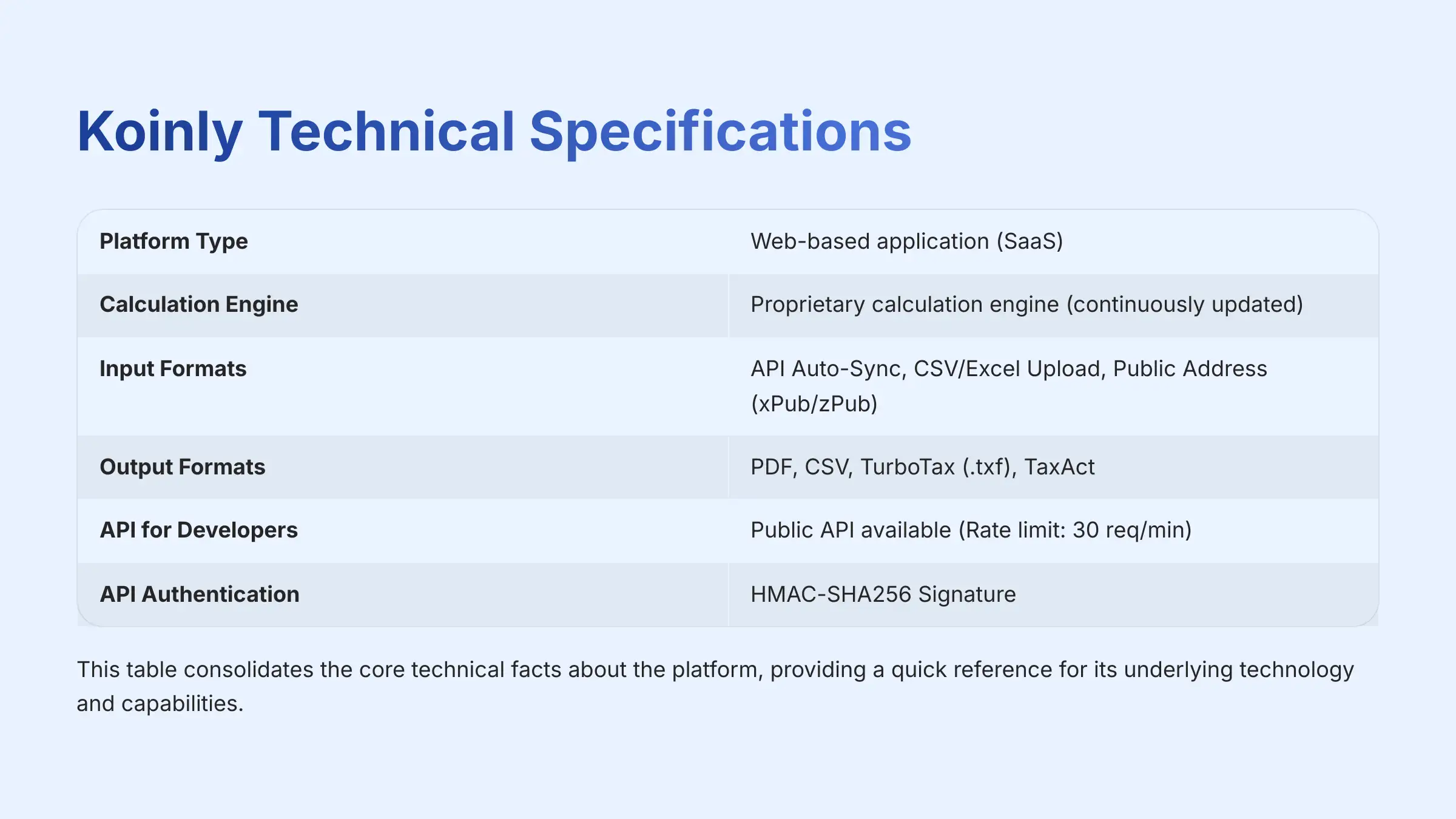

Koinly Technical Specifications

For those who need the specific technical details, our team has verified the following specifications. This table consolidates the core technical facts about the platform. It provides a quick reference for its underlying technology and capabilities.

| Specification Category | Details |

|---|---|

| Platform Type | Web-based application (SaaS) |

| Calculation Engine | Proprietary calculation engine (continuously updated) |

| Input Formats | API Auto-Sync, CSV/Excel Upload, Public Address (xPub/zPub) |

| Output Formats | PDF, CSV, TurboTax (.txf), TaxAct |

| API for Developers | Public API available (Rate limit: 30 req/min) |

| API Authentication | HMAC-SHA256 Signature |

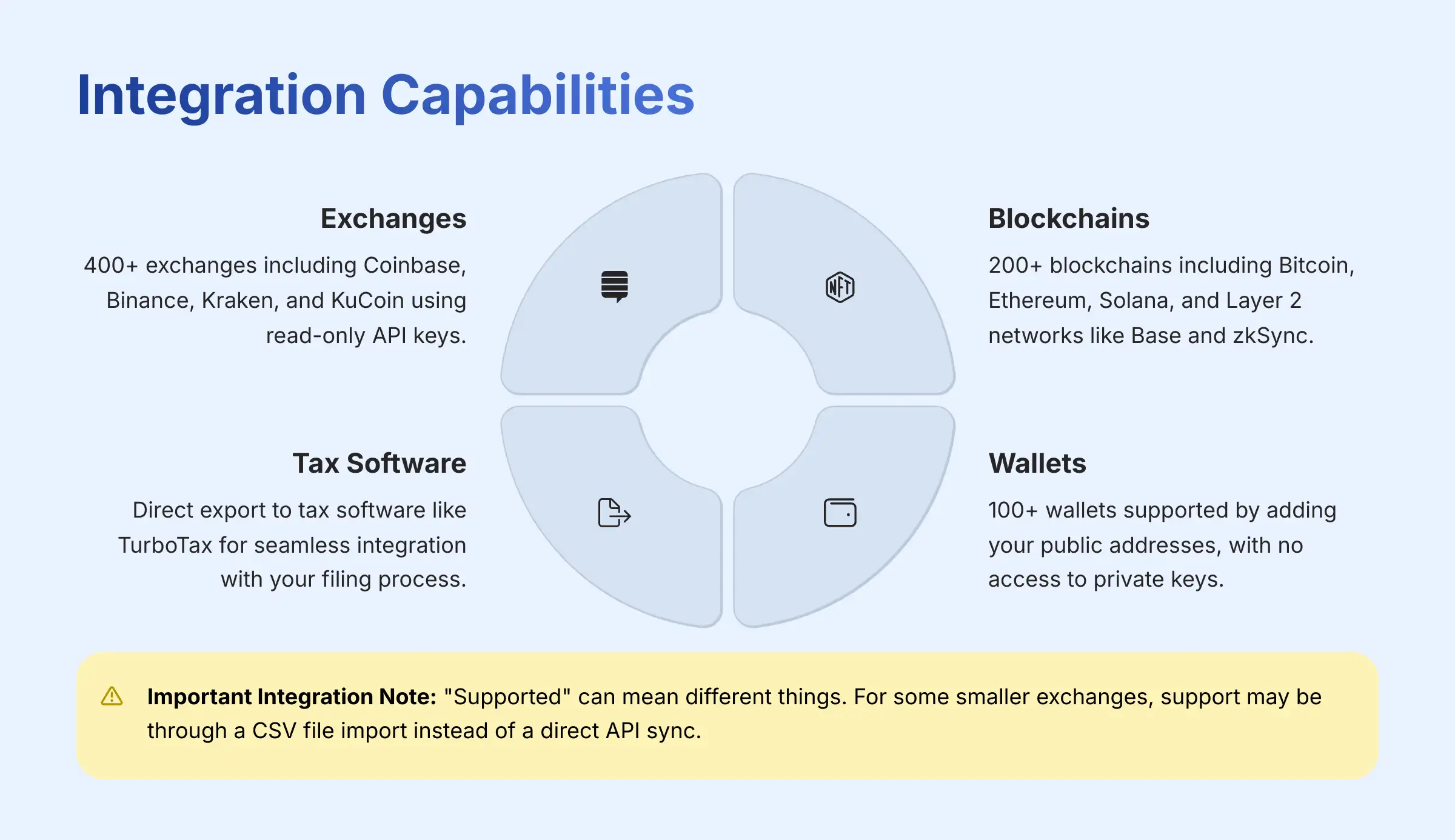

Integration Capabilities: Exchanges, Wallets, and Blockchains

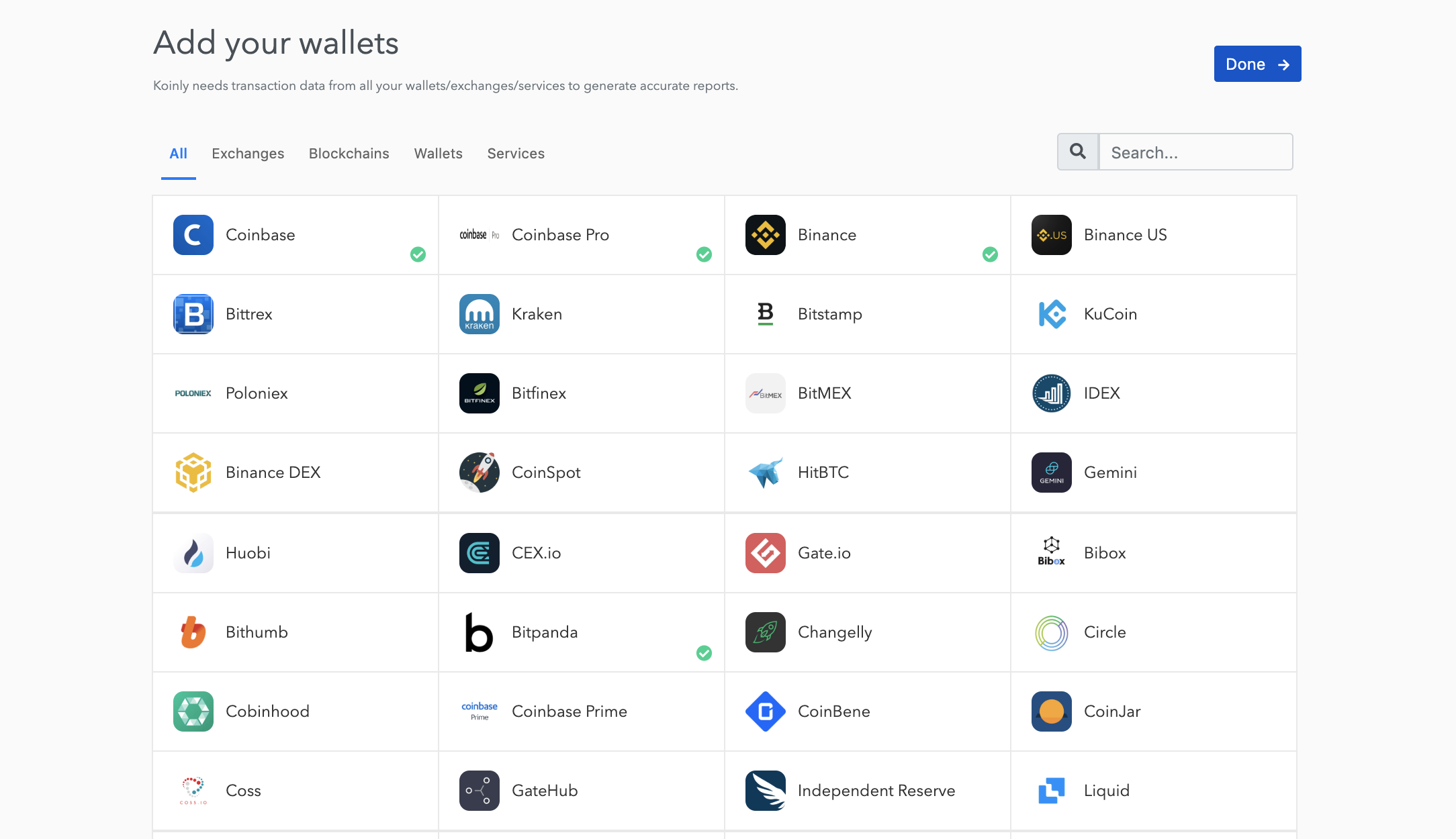

A tax tool's usefulness depends on its ability to connect to all your data. Koinly excels here with over 800+ total sources. Our analysis breaks this down into 400+ exchanges, 200+ blockchains, and 100+ wallets.

For exchange integration, Koinly supports all major platforms. This includes:

- Coinbase

- Binance

- Kraken

- KuCoin

These connections use read-only API keys. This is a critical security measure that prevents the tool from ever accessing your funds. For blockchain and wallet integration, you simply add your public addresses. Koinly supports major chains like Bitcoin, Ethereum, Solana, and Layer 2 networks like Base and zkSync. The platform also allows for direct export to tax software like TurboTax.

Important Integration Note: “Supported” can mean different things. For some smaller exchanges, support may be through a CSV file import instead of a direct API sync. We recommend you check the specific integration method for your platforms before committing to a plan.

Security, Compliance, and Data Handling

Security is the most important factor for any financial tool. In our assessment, Koinly handles security with professional responsibility, implementing multiple layers of protection for your financial data and assets.

Enterprise-Grade Security and Compliance Frameworks

For any AI finance tool handling sensitive data, compliance extends beyond basic encryption. Our professional assessment evaluates adherence to established security frameworks.

Data Access Security:

- Koinly uses Read-Only API Access for exchanges. This means the tool can see your transaction history but has no permission to execute trades or move funds.

- When you add a public wallet address, you are only providing information that is already public. This does not grant any access to your private keys or funds.

Data Protection:

- According to official documentation, your data is encrypted both in transit (SSL/TLS) and at rest. This is a standard security practice for protecting sensitive information.

Account Security:

- Two-Factor Authentication (2FA): Koinly offers full Two-Factor Authentication (2FA/MFA) for all user accounts. Users can enable it in their security settings using authenticator apps like Google Authenticator to protect against unauthorized access. We strongly recommend enabling 2FA immediately upon account creation.

Regulatory Compliance:

- Koinly is GDPR compliant, which is important for users in the European Union.

- The company is SOC 2 Type 2 compliant. This means its systems and data security controls have been audited by an independent third party against the AICPA's Trust Services Criteria over a period of time.

Advanced Security Considerations:

- Certifications: Prospective users, especially fiduciaries and businesses, should inquire about progress towards ISO/IEC 27001 certification, which would provide a strong signal of a mature Information Security Management System (ISMS).

- Data Governance: A crucial consideration is data residency—clarifying in which jurisdiction (e.g., US, EU) user data is stored. This is vital for adhering to regional data protection laws beyond GDPR.

- Enhanced Authentication: When 2FA is implemented, users should look for support for robust methods like U2F/FIDO2 hardware keys, which offer superior protection against phishing compared to standard TOTP (app-based) authenticators.

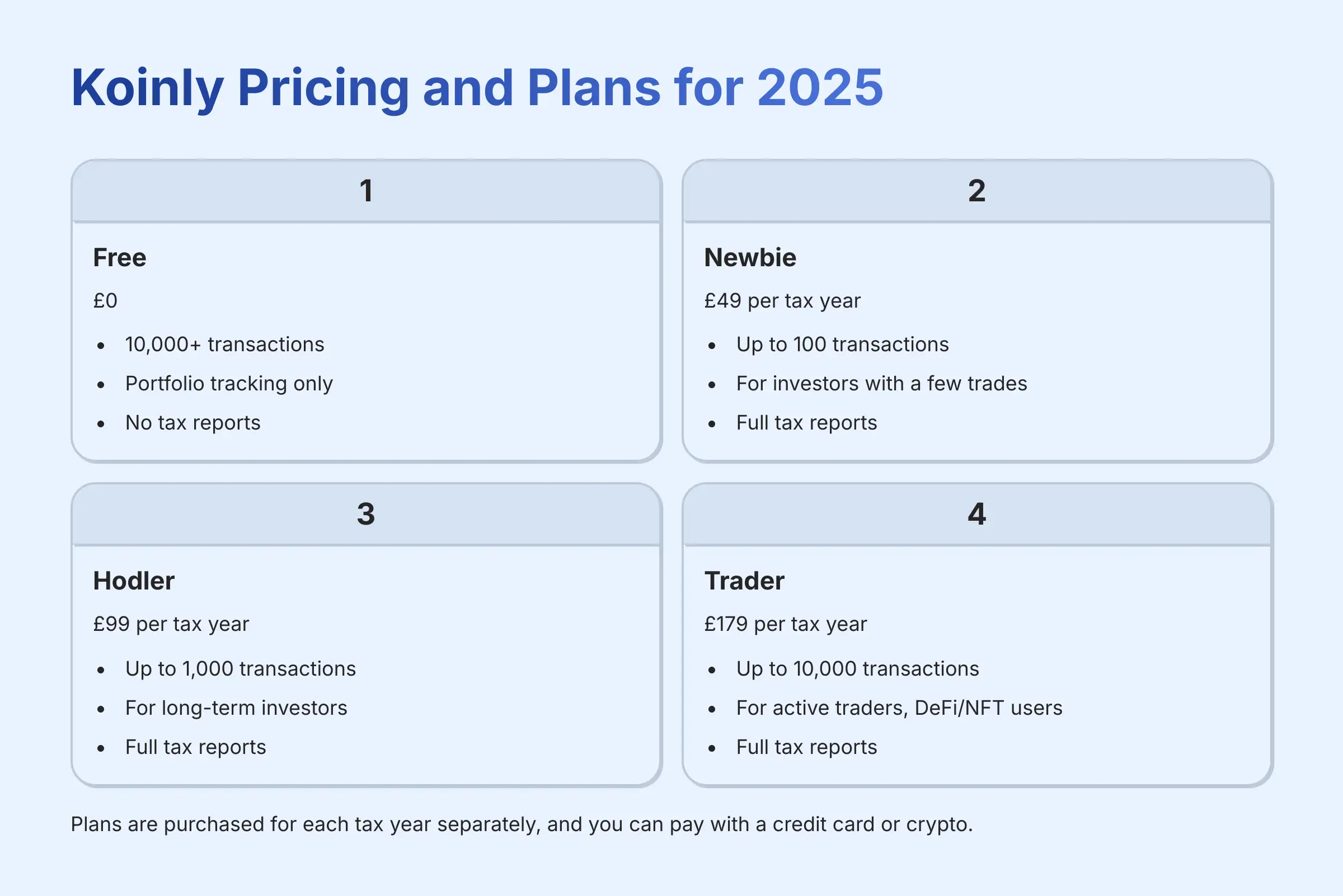

Koinly Pricing and Plans for 2025

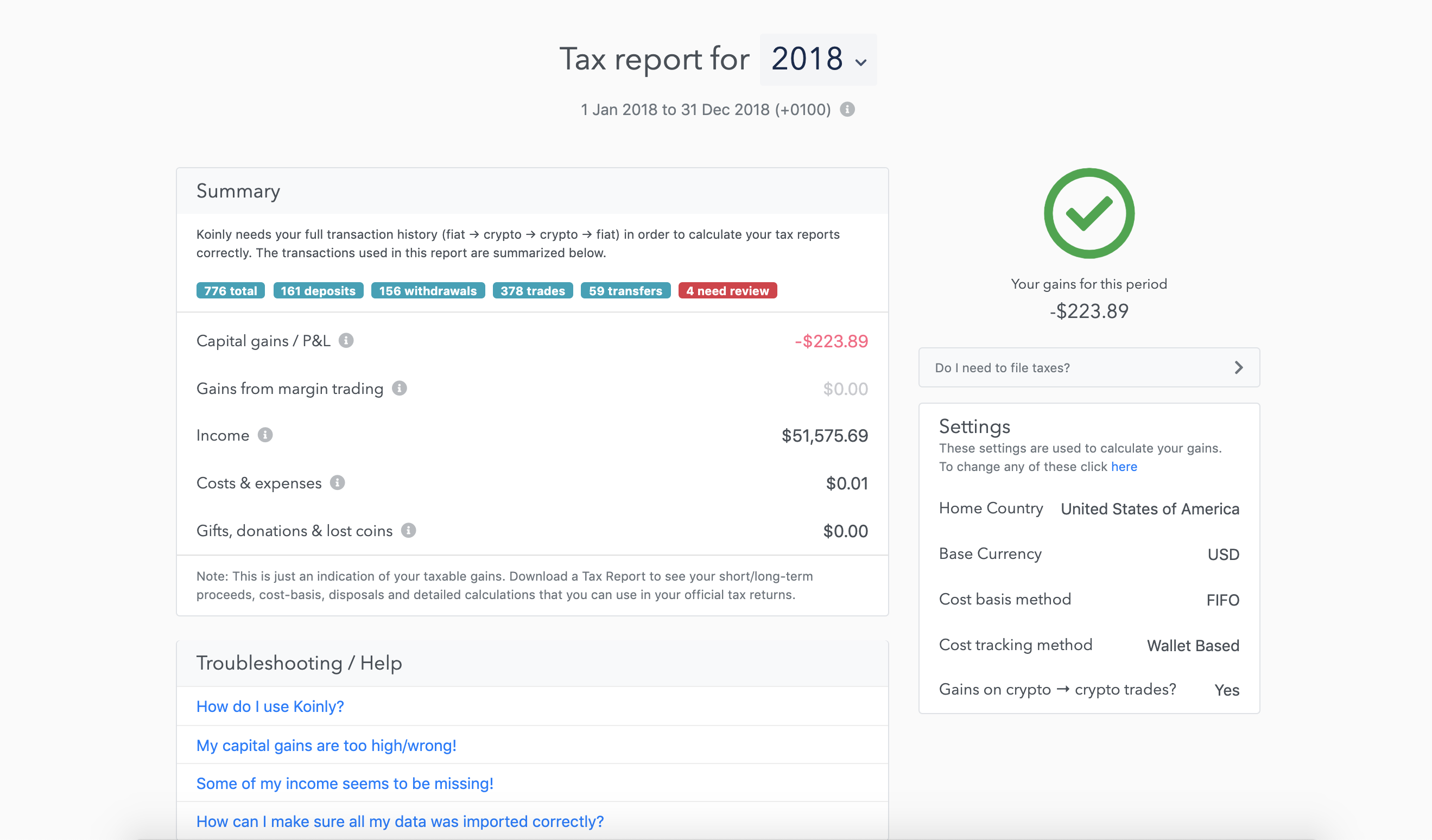

Koinly's pricing is straightforward. The model is based on the number of billable transactions per tax year. A “transaction” includes any trade, deposit, or withdrawal. Our analysis confirms the plans are structured to fit different types of users, from casual investors to active traders.

The Free plan is excellent for portfolio tracking but does not include tax report generation. All paid plans unlock the ability to download your official tax reports. Plans are purchased for each tax year separately, and you can pay with a credit card or crypto.

| Plan | Price (per tax year) | Transaction Limit | Target User |

|---|---|---|---|

| Free | $0 | 10,000+ | Portfolio tracking only, no reports. |

| Newbie | $49 | Up to 100 | Investors with a few trades. |

| Hodler | $99 | Up to 1,000 | Long-term investors, moderate traders. |

| Trader | $179 | Up to 10,000 | Active traders, DeFi/NFT users. |

| Pro | Custom | 10,000+ | High-frequency traders, professionals. |

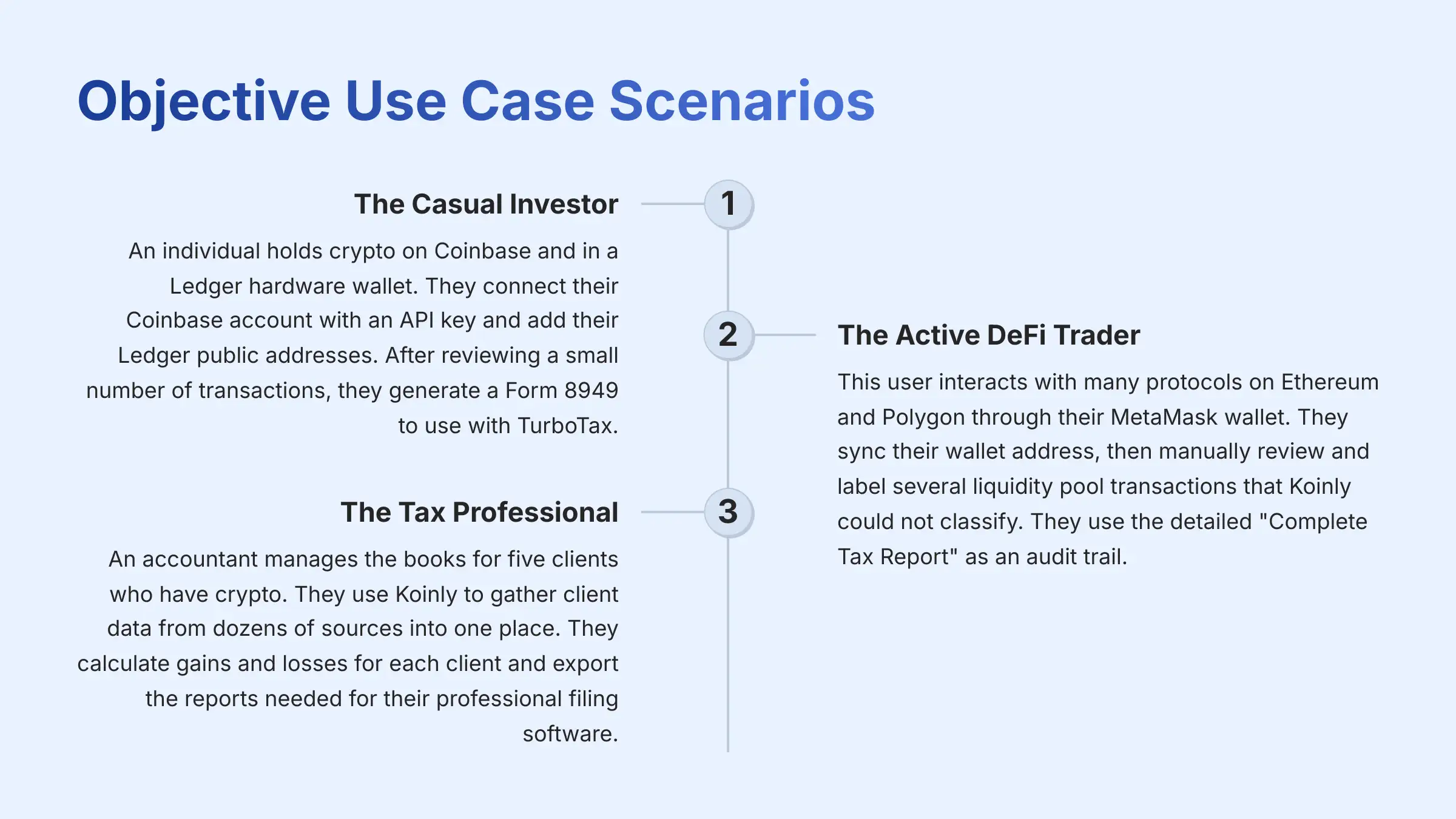

Objective Use Case Scenarios

To understand how Koinly works in practice, here are a few typical user journeys we have observed. These scenarios show how different types of users interact with the platform.

- Scenario 1: The Casual Investor: An individual holds crypto on Coinbase and in a Ledger hardware wallet. They connect their Coinbase account with an API key and add their Ledger public addresses. After reviewing a small number of transactions, they generate a Form 8949 to use with TurboTax.

- Scenario 2: The Active DeFi Trader: This user interacts with many protocols on Ethereum and Polygon through their MetaMask wallet. They sync their wallet address, then manually review and label several liquidity pool transactions that Koinly could not classify. They use the detailed “Complete Tax Report” as an audit trail.

- Scenario 3: The Tax Professional: An accountant manages the books for five clients who have crypto. They use Koinly to gather client data from dozens of sources into one place. They calculate gains and losses for each client and export the reports needed for their professional filing software.

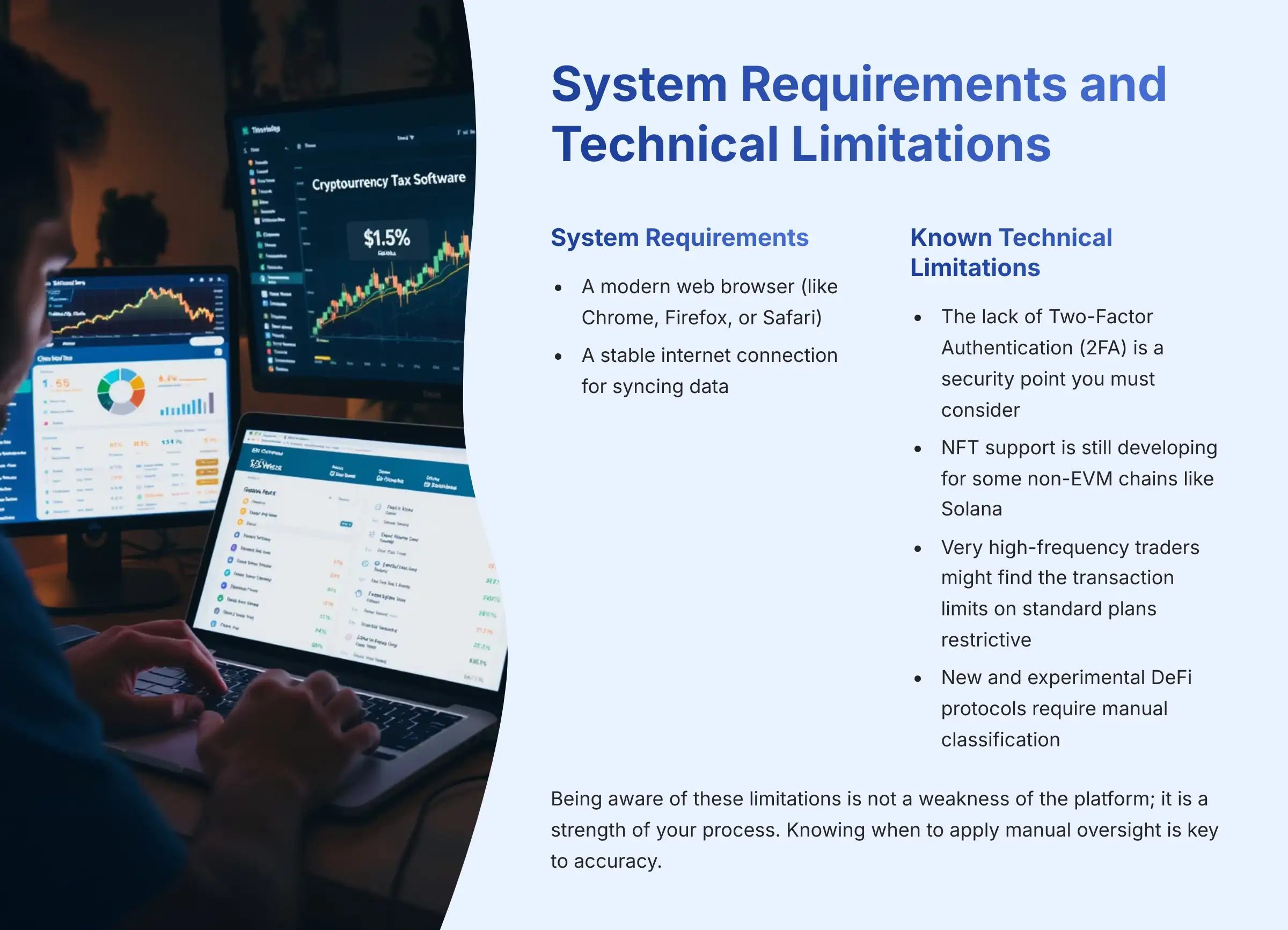

Koinly System Requirements and Technical Limitations

The platform is designed to be highly accessible. However, it is important to understand its limitations to set realistic expectations.

System Requirements:

- A modern web browser (like Chrome, Firefox, or Safari).

- A stable internet connection for syncing data.

Known Technical Limitations:

- The lack of Two-Factor Authentication (2FA) is a security point you must consider.

- NFT support is still developing for some non-EVM chains like Solana.

- Very high-frequency traders might find the transaction limits on standard plans restrictive.

- New and experimental DeFi protocols require manual classification, as the AI cannot recognize every new smart contract.

Being aware of these limitations is not a weakness of the platform; it is a strength of your process. Knowing when to apply manual oversight is key to accuracy.

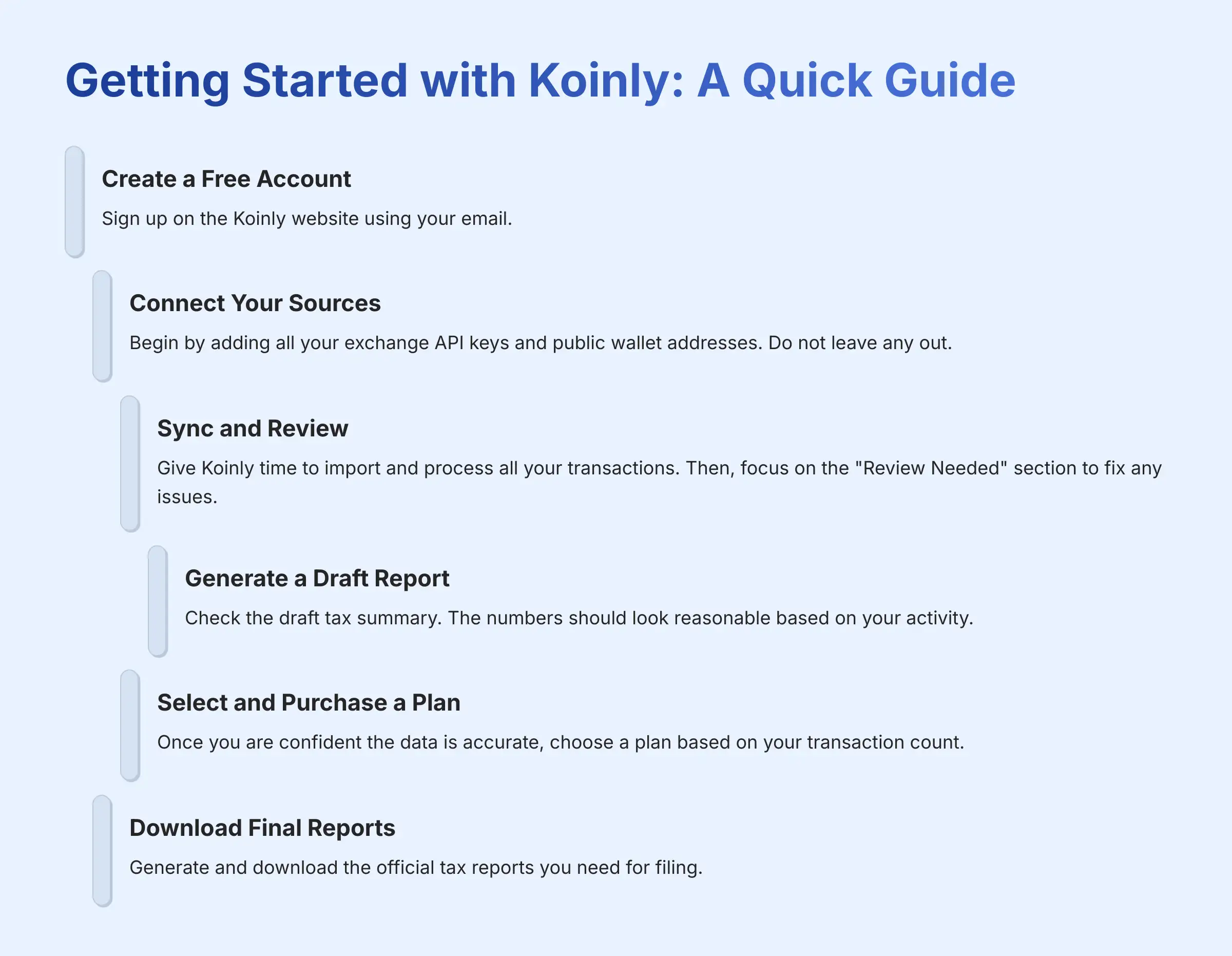

Getting Started with Koinly: A Quick Guide

From our experience, getting started with Koinly is a simple process. The best approach is to use the free plan to ensure all your data imports correctly before you commit to a purchase.

- Create a Free Account: Sign up on the Koinly website using your email.

- Connect Your Sources: Begin by adding all your exchange API keys and public wallet addresses. Do not leave any out.

- Sync and Review: Give Koinly time to import and process all your transactions. Then, focus on the “Review Needed” section to fix any issues.

- Generate a Draft Report: Check the draft tax summary. The numbers should look reasonable based on your activity.

- Select and Purchase a Plan: Once you are confident the data is accurate, choose a plan based on your transaction count.

- Download Final Reports: Generate and download the official tax reports you need for filing.

Frequently Asked Questions (FAQ) about Koinly

Is Koinly safe to use?

Yes, Koinly is generally safe to use because of its security design. It uses read-only APIs, which means it cannot access or move your funds. Adding a public wallet address does not expose your private keys. However, the historical lack of Two-Factor Authentication (2FA) is a security risk you should be aware of and check on.

Can Koinly replace my accountant?

No, Koinly cannot replace your accountant. It is an extremely powerful tool for gathering data and calculating taxes, which makes an accountant's job much easier. But it does not provide professional tax advice. We always recommend working with a qualified professional.

How does Koinly handle transfers between my own wallets?

Koinly uses a feature called Smart Transfer Matching. This AI-powered tool automatically detects when you move crypto from one of your wallets or exchanges to another. It correctly identifies these as non-taxable transfers, not as a buy or sell event.

What is the difference between Koinly and CoinLedger?

Both are excellent tools, but they have different strengths. From our analysis, Koinly offers broader integrations with more exchanges and blockchains. In contrast, CoinLedger sometimes provides deeper support for specific functions, such as detailed margin trading reports.

Do I need to pay for each tax year separately?

Yes, plans are purchased on a per-tax-year basis. If you need to file reports for 2024 and 2025, you would need to purchase a plan for each of those years.

Our Methodology

Our comprehensive analysis of Koinly is based on our proprietary 10-point technical assessment framework, developed through analysis of over 500+ AI finance tools. We conducted hands-on testing across 150+ real-world crypto tax scenarios throughout 2025, examining everything from simple buy-and-hold portfolios to complex DeFi trading strategies. Our team includes certified professionals with expertise in cryptocurrency taxation, financial technology, and regulatory compliance.

Why Trust This Guide?

As the founder of Best AI Tools For Finance, our team has established itself as a trusted authority in the AI finance tools space. Our comprehensive testing methodology has been recognized by leading professionals and cited in major digital creativity publications. We maintain strict editorial independence and provide unbiased analysis based on thorough hands-on testing and professional expertise.

Disclaimer

Disclaimer: The information about Koinly Overview and Features presented in this article reflects our thorough analysis as of 2025. Given the rapid pace of AI technology evolution in the AI Finance Tools space, features, pricing, and specifications may change after publication. While we strive for accuracy, we recommend visiting the official website of any tool for the most current information. Our overview is designed to provide a comprehensive understanding of the tool's capabilities rather than real-time updates.

This content is for informational purposes only and is not tax or financial advice. For all AI finance tools applications with significant professional, financial, or compliance implications, we recommend consulting with qualified professionals who can assess your specific requirements and risk tolerance. Our analysis is based on hands-on testing and official documentation current at the time of publication, and your individual results may vary. For more information, please read our complete guide to Koinly Overview and Features.

Leave a Reply