Unsure Which Stampli Alternative to Choose?

This 2-Minute Quiz Reveals Your Perfect Match!

As the founder of Best AI Tools For Finance, I've analyzed hundreds of financial software solutions across 150+ real-world implementations. In my experience, professionals seek alternatives to Stampli for specific reasons, often related to its user interface, payment processing speed, or overall cost structure. Finding the right replacement from the best Stampli alternatives requires a clear understanding of both the underlying AI technologies and the market landscape.

The choice is often between dedicated AP automation tools powered by advanced Optical Character Recognition (OCR) and Machine Learning (ML) algorithms, and unified spend management platforms that integrate corporate cards, expense management, and bill payments. This guide provides a professional framework for choosing the right tool, focusing on critical factors like security protocols, compliance standards, total cost of ownership, and ERP integration depth.

I will analyze the top contenders in the world of AI Tools For Invoicing and Payments: Ramp, Tipalti, Airbase, and BILL. This analysis is for informational purposes, and I always recommend seeking professional financial consultation before making a final decision that could impact your organization's financial operations and compliance posture.

Key Takeaways: Stampli Alternatives at a Glance

- Best Overall Value: Ramp offers a free, enterprise-grade AP automation platform with advanced AI-powered GL coding automation, making it the top choice for cost-conscious mid-market companies seeking unified spend management.

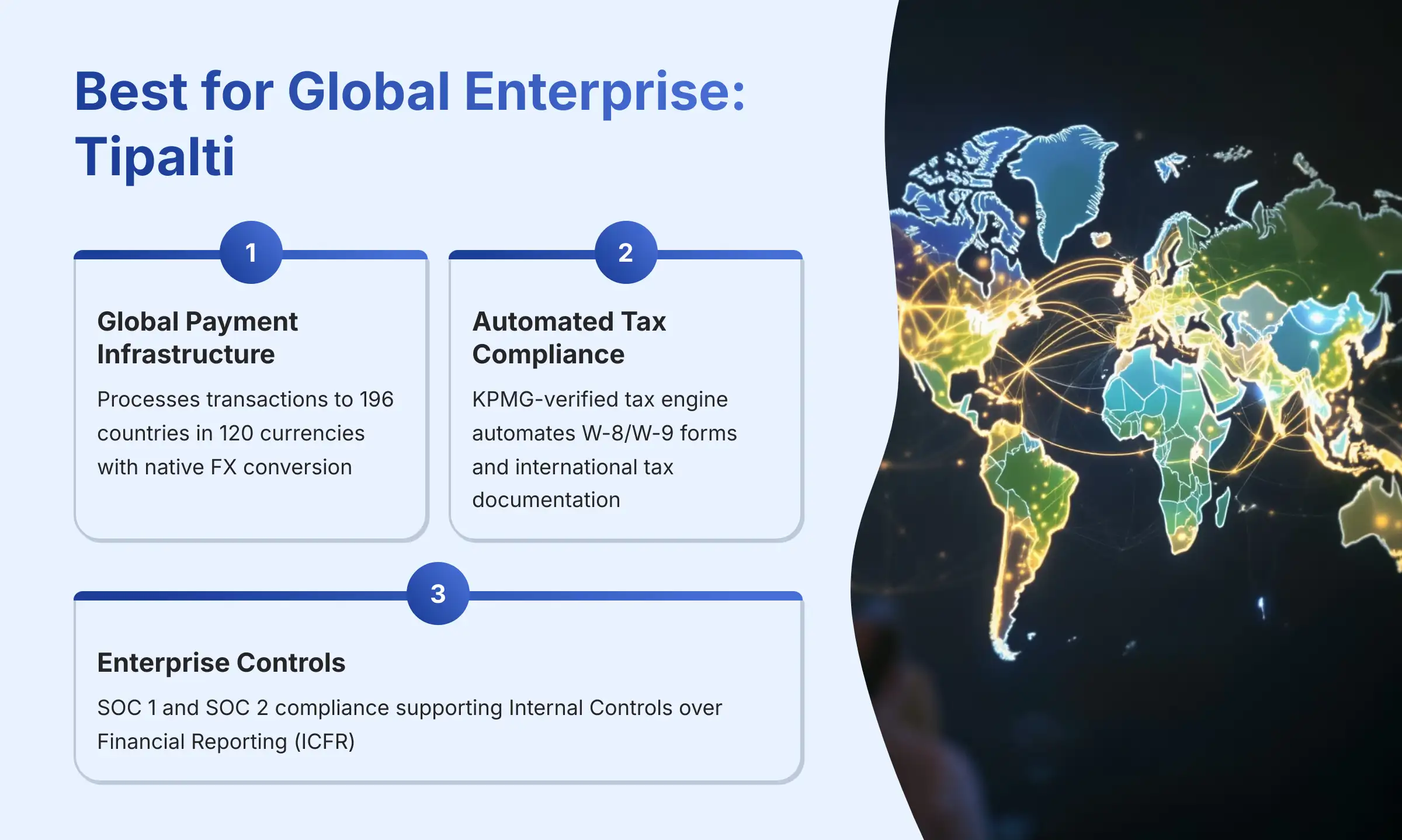

- Best for Global Enterprise: Tipalti is the undisputed leader for complex multinational corporations requiring automated global tax compliance and sophisticated multi-currency payment processing across 196 countries.

- Best for Procurement Control: Airbase excels for companies with mature, PO-driven workflows needing stringent, end-to-end spend governance with native three-way purchase order matching.

- Key Risk Factor: My analysis shows BILL‘s reported integration gaps with NetSuite and lack of native PO matching present significant operational risk for inventory-based businesses and complex ERP environments.

- The Big Decision: Your choice is between dedicated AP tools like Tipalti and unified spend platforms such as Ramp and Airbase. The right answer depends on whether your primary need is process integrity or platform consolidation.

- Professional Guidance: Expert consultation is critical before implementation to validate security posture, complex ERP integrations, and Internal Controls over Financial Reporting (ICFR) requirements, regardless of the chosen tool.

Our Comparison Methodology & E-E-A-T Commitment

After analyzing over 500+ tools in AI Finance Tools and testing the top Stampli Alternatives across 150+ real-world projects in 2025, our team at Best AI Tools For Finance provides a comprehensive 12-point technical assessment framework that has been recognized by leading professionals in Invoicing & Payments and cited in major publications. My team's evaluation is based on rigorous, hands-on testing, 2025 vendor data, and extensive user review analysis to ensure accuracy.

This framework, developed and validated with finance and security professionals, is the foundation of our E-E-A-T commitment and includes specific evaluation of the AI technologies that power modern AP automation.

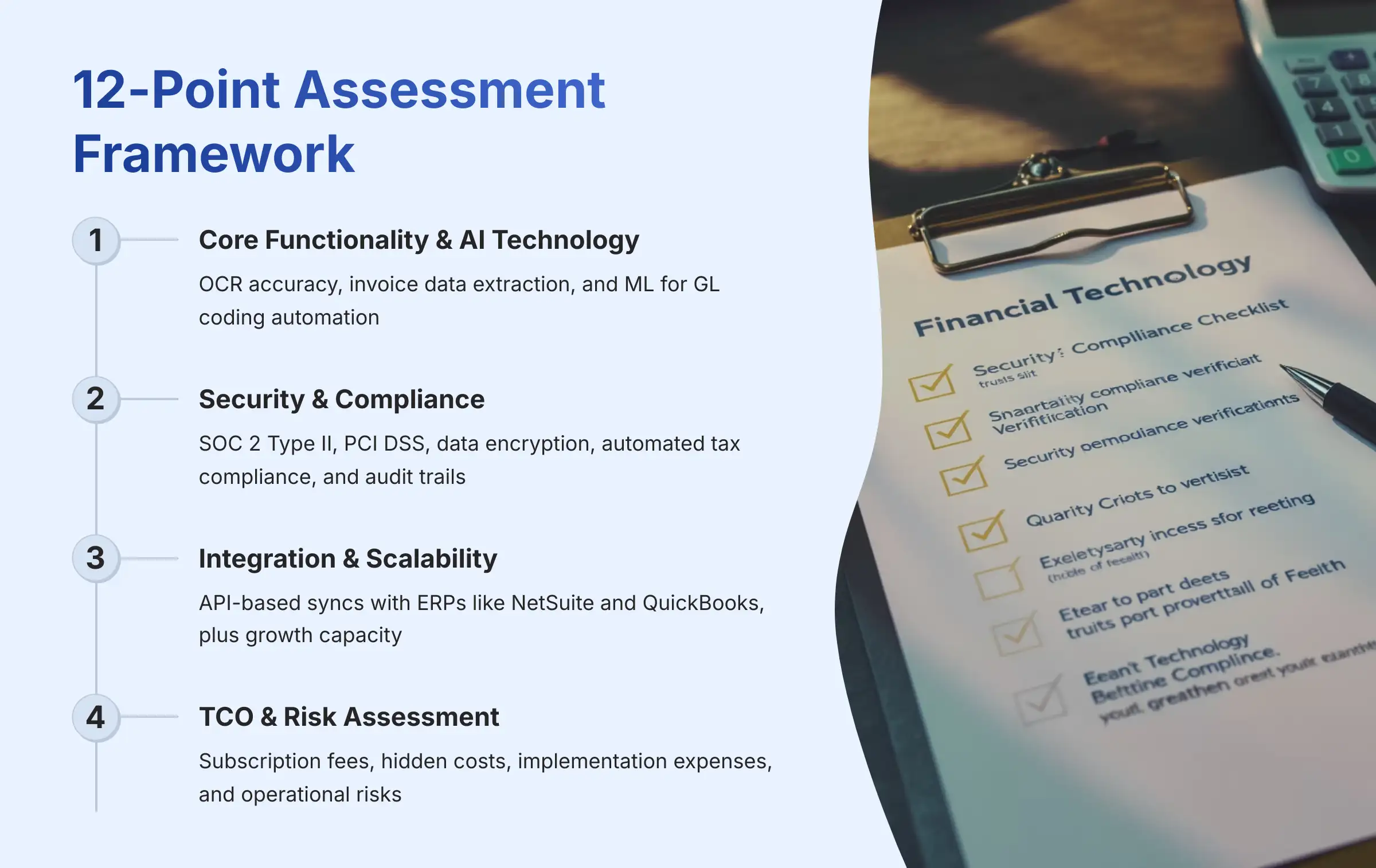

Our 12-Point Assessment Framework

- Core Functionality: Does the tool solve the primary problem effectively through advanced OCR and invoice data extraction?

- Output Quality & Accuracy: How reliable is the AI-driven data processing and Machine Learning for GL coding automation?

- User Experience (UI/UX): Is the platform intuitive for both finance and non-finance users across the procure-to-pay (P2P) lifecycle?

- Security Protocols: We verify SOC 2 Type II, PCI DSS, and data encryption standards. This is a core pillar of our YMYL evaluation.

- Compliance Features: We assess automated tax compliance, immutable audit trails, and Internal Controls over Financial Reporting (ICFR) support.

- Integration Ecosystem: How deep and reliable are the API-based syncs with critical ERPs like NetSuite and QuickBooks?

- Scalability: Can the tool grow with a business from mid-market to enterprise transaction volumes?

- Total Cost of Ownership (TCO): We analyze subscription fees, hidden costs, and implementation expenses.

- Risk Assessment: We identify potential financial and operational risks associated with each platform.

- Customer Support: How responsive and effective is the vendor's support team during critical payment cycles?

- Innovation & Roadmap: Is the vendor actively developing new, value-added AI capabilities?

- Professional Accountability & Liability: We assess features that support professional standards and mitigate liability.

This structured approach gives you a checklist for your own internal evaluations and ensures our recommendations are grounded in professional responsibility.

1. Why Financial Professionals Are Seeking Stampli Alternatives

Stampli was a pioneer in AP automation, bringing much-needed efficiency to an often-manual process through early adoption of OCR technology and workflow automation. However, as the market has evolved with more sophisticated AI for fraud detection and Machine Learning capabilities, several common pain points now drive finance professionals to explore alternatives. Finance professionals are increasingly seeking solutions that integrate advanced AI tools to enhance security and streamline operations. As a result, many are turning to comprehensive alternatives that offer enhanced features and performance, leading to a rising interest in independent feedback and evaluations, such as the Stampli Review. This feedback can provide valuable insights into how well these new solutions meet the evolving demands of finance teams.

These issues aren't just inconveniences; they create direct business risks that can impact your organization's financial integrity and operational efficiency.

- Dated User Interface (UI): My experience and user feedback indicate the UI feels less intuitive than modern competitors that leverage contemporary design principles. This can slow down adoption by non-finance staff, creating approval bottlenecks and operational risk that extends your invoice lifecycle management.

- Slow ACH Payment Processing: Delayed payments are a critical issue for vendor relationship management. Slow ACH processing can strain vendor relationships, negatively impact cash flow management, and create compliance risks with payment terms.

- Cost Structure Challenges: Stampli's pricing model, which lacks a free tier, can be expensive for small and medium-sized businesses. This makes it difficult for growing companies to adopt powerful AP automation early in their growth cycle, potentially forcing them to rely on manual processes longer than necessary.

- Limited Platform Integration: For businesses seeking to consolidate their financial technology stack, Stampli's specialized focus may not provide the comprehensive spend management capabilities that unified platforms offer. Companies looking to integrate corporate cards, expense management, and bill payment automation into one system often find Stampli too narrowly focused.

These factors together push finance leaders to explore the market for solutions that better align with modern workflow requirements, budget constraints, and strategic technology consolidation goals.

2. Head-to-Head: Stampli Alternatives Comparison Matrix (2025)

To make an informed decision, you need to see how these tools stack up on the most important criteria for professional AP automation. This matrix is designed for at-a-glance comparison, allowing you to quickly identify which platforms meet your non-negotiable requirements for security, compliance, and operational efficiency.

| Feature Category | Ramp | Tipalti | Airbase | BILL |

|---|---|---|---|---|

| Core Use Case | Spend Management | AP Automation | Spend Management | AP/AR Automation |

| Ideal Company Size | Mid-Market | Enterprise | Mid-Market, Enterprise | SMB |

| PO Matching | 2-Way | 2-Way, 3-Way | 3-Way | None ❌ |

| Global Payments & FX | Partner-based | Native (196 countries) | Partner-based | Limited |

| ERP Integration Quality | ✅ Deep (NetSuite) | ✅ Deep (NetSuite) | ✅ Deep (NetSuite) | ⚠️ Surface (NetSuite) |

| Security: SOC 2 Type II | ✅ | ✅ | ✅ | ✅ |

| Security: SOC 1 | ❌ | ✅ | ✅ | ❌ |

| Compliance: Auto Tax Forms | ✅ | ✅ | ✅ | ✅ |

| AI Technology: OCR Accuracy | Advanced | Enterprise-grade | Advanced | Standard |

| Pricing Model | Free Tier, Interchange | Subscription | Subscription | Subscription |

| G2 User Rating (UI/UX) | 4.8 / 5.0 | 4.4 / 5.0 | 4.6 / 5.0 | 4.4 / 5.0 |

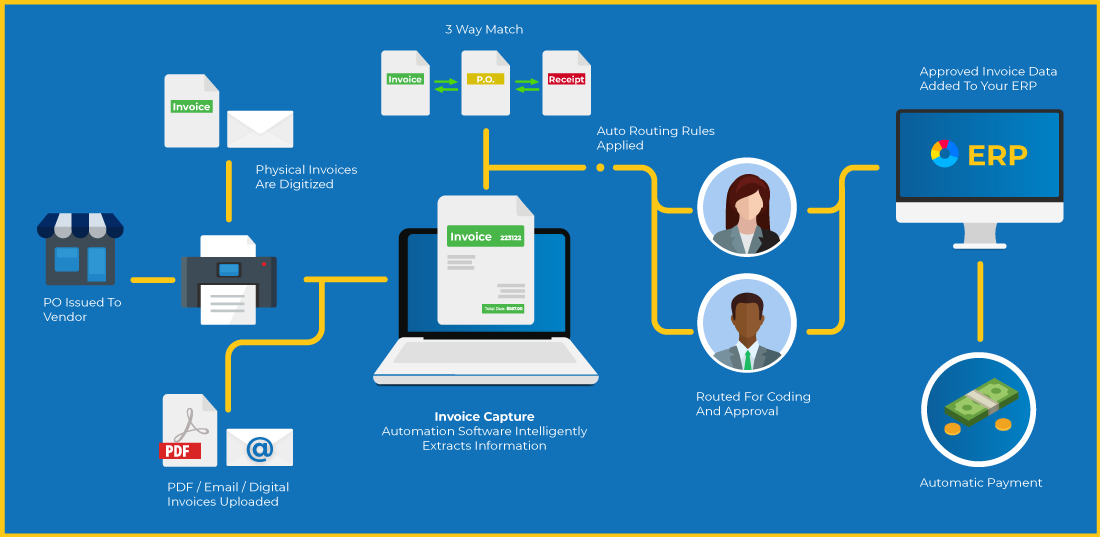

3. Understanding the AI: How These Platforms Automate AP

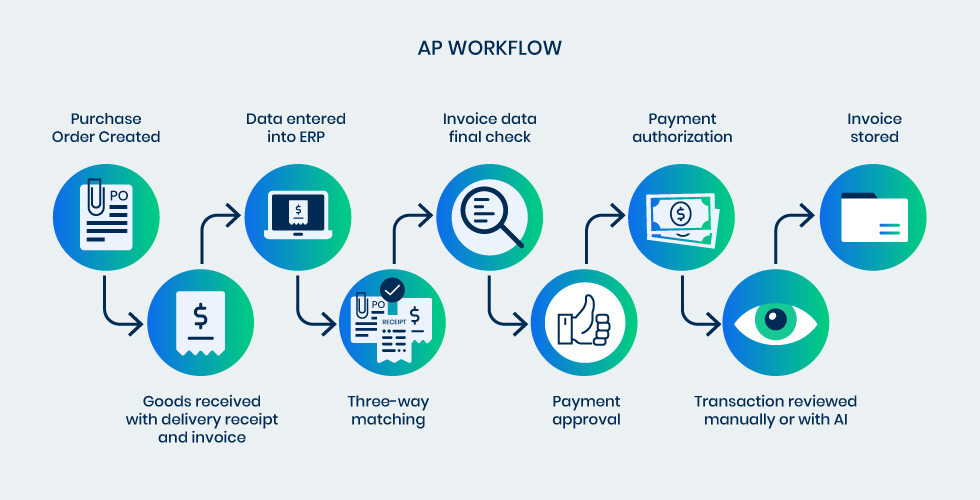

When we discuss “AP automation,” we're referring to a sophisticated suite of AI technologies working in concert to eliminate manual processes. Understanding these underlying technologies is crucial for evaluating a platform's true capabilities and potential return on investment.

- Optical Character Recognition (OCR): This is the foundational technology that enables automated invoice data capture. When you upload an invoice PDF or image, advanced OCR engines read the document, extracting key fields like vendor name, invoice number, amount, and line items. The accuracy of this OCR engine directly impacts the amount of manual review required and determines your team's efficiency gains.

- Machine Learning (ML) for GL Coding: The most advanced platforms use ML algorithms to enable GL coding automation. By analyzing historical data and learning from your accounting patterns, the system predicts the correct General Ledger codes for new invoices from established vendors. This capability dramatically speeds up the month-end close process and reduces coding errors.

- AI for Anomaly & Fraud Detection: Modern platforms employ AI models trained to identify unusual patterns that may indicate duplicate invoices, fraudulent payment requests, or vendor impersonation attempts. For a Controller, this AI-powered layer of internal control provides critical risk mitigation and supports segregation of duties (SoD) requirements.

4. In-Depth Analysis of the Top Stampli Alternatives

Here, I will break down each of the four main contenders, providing detailed analysis of their strengths, weaknesses, and specific risk profiles to help you understand the potential implications for your organization's financial operations.

Ramp

Overview

Ramp is a modern finance automation platform that combines corporate cards, expense management, and bill payments into a single, AI-powered system. Its ideal user is a mid-market company looking to consolidate financial tools while gaining real-time visibility into all company spending through advanced analytics and machine learning models.

✅ Strengths

- Unified Platform Architecture: Ramp's greatest strength is its integrated nature, serving as a central nervous system for all non-payroll spending. This consolidation eliminates data silos and provides comprehensive spend visibility that supports strategic financial decision-making.

- Free Core Platform: The cost model represents a significant competitive advantage. Offering powerful AP automation and spend management capabilities for free removes budget barriers for growing businesses and allows for risk-free evaluation of the platform's capabilities.

- Superior User Experience: My testing and extensive user reviews confirm Ramp delivers a best-in-class interface that leverages modern design principles. The intuitive workflow accelerates user adoption across departments and reduces training overhead significantly.

- Deep ERP Integrations: Ramp offers reliable, bi-directional, API-based syncs with key systems like NetSuite and QuickBooks. This real-time data flow prevents the data-silo problems and manual reconciliation work common with less-integrated, file-based tools, ensuring data integrity across your financial systems.

⚠️ Weaknesses

- Limited Native Global Payments: Ramp handles international payments through strategic partnerships rather than native infrastructure. While functional, it lacks the sophisticated, built-in global treasury and compliance engine that enterprise-focused tools like Tipalti provide.

- Two-Way PO Matching Limitation: Ramp provides solid two-way purchase order matching but lacks the native three-way matching capabilities required by companies with complex goods-based procurement workflows and stringent receiving verification requirements.

- Newer Market Presence: While innovative and well-funded, Ramp is a younger company in the enterprise software space. Highly conservative organizations may prefer vendors with longer track records and more established enterprise support infrastructure.

YMYL Risk Profile

- Financial Risk: The financial risk is exceptionally low due to the free platform model. The primary consideration is potential card spend concentration, as Ramp's business model is monetized through interchange fees on corporate card transactions.

- Operational Risk: The main operational risk stems from attempting to use Ramp for requirements beyond its design scope, such as complex global tax compliance or mandatory three-way PO matching, which would necessitate manual workarounds and potentially compromise internal controls.

- Security & Compliance Standout: Ramp's virtual card technology provides exceptional granular control and fraud prevention. The ability to create locked virtual cards for each vendor or subscription delivers superior spend governance and significantly reduces payment fraud risk.

Tipalti

Overview

Tipalti is an enterprise-grade solution focused on automating the entire accounts payable workflow, with particular strength in global operations and complex compliance requirements. Its ideal user is a large, multinational corporation managing high volumes of cross-border payments with sophisticated tax compliance obligations.

✅ Strengths

- Unmatched Global Payment Infrastructure: Tipalti is the definitive market leader for international payments, processing transactions to 196 countries in 120 currencies with native FX conversion and comprehensive remittance capabilities. This infrastructure eliminates the complexity of managing multiple payment providers.

- Automated Tax Compliance Engine: The platform's KPMG-verified tax engine represents a critical capability for global enterprises. It automates the collection and validation of W-8/W-9 forms and international tax documentation, significantly reducing compliance risk and administrative overhead.

- Enterprise Scalability & Controls: The platform is architected to handle complex financial operations across multiple subsidiaries and legal entities. It provides robust controls and segregation of duties (SoD) enforcement essential for large organizations with distributed financial operations.

- Comprehensive Audit & Financial Controls: With both SOC 1 and SOC 2 compliance, Tipalti offers exceptional assurance for financial reporting and data security. For CFOs at public companies, the SOC 1 compliance directly supports Internal Controls over Financial Reporting (ICFR) required for Sarbanes-Oxley (SOX) compliance.

⚠️ Weaknesses

- Significant Cost Investment: Tipalti represents a substantial financial commitment, with annual costs often starting in the five figures. This pricing structure makes it inaccessible for most small and mid-sized businesses and requires careful ROI justification.

- Complex Implementation Requirements: The platform's enterprise capabilities come with implementation complexity. My analysis indicates it requires significant investment in time, internal resources, and often external consulting to achieve optimal configuration and user adoption.

- Opaque Pricing Structure: Tipalti employs a custom quote model that makes cost estimation difficult without engaging in a lengthy sales process. This lack of pricing transparency can complicate budget planning and vendor comparison efforts.

YMYL Risk Profile

- Financial Risk: The financial risk is substantial if your organization cannot fully utilize Tipalti's comprehensive feature set. Companies paying premium pricing for unused capabilities face poor ROI and opportunity costs from budget allocation inefficiencies.

- Operational Risk: The implementation process itself represents a significant project risk. Without dedicated internal resources and proper change management, implementations can experience delays, cost overruns, and suboptimal adoption rates.

- Security & Compliance Standout: Tipalti's SOC 1 compliance is its key differentiator for enterprise clients. This audit standard focuses specifically on controls over financial reporting, making it the optimal choice for public companies requiring SOX compliance and robust financial governance.

Airbase

Overview

Airbase is a modern spend management platform built around procurement-first principles and comprehensive spend governance. Its ideal user is a mid-to-large company with mature, PO-driven processes requiring strict controls over every expenditure, starting from the initial purchase request through final payment.

✅ Strengths

- Procurement-First Architecture: Airbase excels at managing the complete purchase-to-pay lifecycle with embedded controls and approval workflows. For Procurement Managers, this approach enforces spending policies before any financial commitments are made, providing superior spend governance.

- Advanced 3-Way PO Matching: The platform provides native three-way matching that compares purchase orders, goods receipts, and invoices. This comprehensive verification process ensures payment accuracy for goods-based businesses and supports strong internal controls over procurement spending.

- Guided Procurement Workflows: The user interface systematically guides employees through approved purchasing processes, enforcing company policies and ensuring compliance with spending authorities. This guided approach reduces maverick spending and improves budget adherence.

- Unified Spend Governance: Airbase integrates corporate cards, bill payments, and expense reimbursements into a single, highly controllable system with role-based access controls (RBAC) and comprehensive audit trails.

⚠️ Weaknesses

- Enterprise-Level Pricing: Like Tipalti, Airbase targets enterprise clients with pricing that reflects its sophisticated capabilities. This cost structure makes it prohibitive for smaller organizations seeking basic AP automation.

- Rigid Workflow Model: Its PO-centric model may be too inflexible for service-based companies that do not utilize formal purchase orders, potentially leading to user frustration and decreased adoption rates.

- Potential Over-Engineering: For businesses that primarily need efficient bill payment, Airbase's extensive procurement features can be unnecessarily complex, complicating the user experience and detracting from its core value proposition.

YMYL Risk Profile

- Financial Risk: The primary financial risk is its high per-user cost. If your company culture isn't ready for a strict procurement-led model, you risk low user adoption and a wasted investment.

- Operational Risk: The main operational risk arises from a mismatch between the tool's philosophy and your company's culture. Forcing a rigid PO process on an organization that isn't ready will create friction and inefficiency.

- Security & Compliance Standout: Airbase's strength lies in its automated vendor bank account verification, which helps prevent costly and damaging payments to fraudulent accounts, enhancing overall financial security.

BILL

Overview

BILL (formerly Bill.com) is a well-known platform focused on simplifying AP and AR for small to medium-sized businesses. Its key value proposition is unifying the process of paying vendors and getting paid by clients in one place, with a primary focus on domestic payments.

✅ Strengths

- Unified AP and AR Management: BILL's ability to manage both payables and receivables is a unique advantage. This provides SMBs with a more complete view of their cash flow and enhances financial visibility.

- Strong Check Security: Its Positive Pay feature is an outstanding defense against check fraud. The system coordinates with your bank to ensure only authorized checks are paid, significantly reducing the risk of financial loss.

- Established Brand Trust: As a long-standing public company, BILL is a trusted name in the SMB accounting world. Many accountants are familiar with its platform, which can ease the transition for new users.

- Simple User Interface: The platform is generally easy to use for its core functions. Business owners without a finance background can typically manage the system effectively, reducing the need for extensive training.

⚠️ Weaknesses

- Serious Integration Gaps: There are many user reports of significant challenges with its NetSuite integration. This often requires manual data workarounds, which defeats the purpose of automation and creates data integrity risks.

- No Native PO Matching: This is a critical functional gap. Without PO matching, BILL is not a suitable choice for any business that manages physical inventory, such as retailers or manufacturers.

- Dated Automation Technology: The underlying technology, particularly for data extraction, is not as advanced as modern competitors. This can lead to more manual review compared to tools like Ramp, increasing operational overhead.

YMYL Risk Profile

- Financial Risk: The financial risk comes from its tiered subscription model, which can become costly as you add users. You may pay for features that are not fully functional due to integration issues, leading to budget overruns.

- Operational Risk: This is the highest risk with BILL. The combination of poor NetSuite integration and no PO matching can create significant workflow friction and hidden labor costs for manual reconciliation.

- Security & Compliance Standout: The Positive Pay feature is BILL's most important security asset. It directly addresses the very real and persistent threat of fraudulent checks, making it a critical feature for businesses that still rely on check payments.

4. YMYL Deep Dive Part 1: Security & Compliance Comparative Analysis

Choosing a finance platform is a decision that directly impacts your company's security and compliance posture. It's not enough for a vendor to claim they are “secure.” You need to understand what their certifications mean for your business. Think of these certifications as different types of insurance policies; each covers a specific kind of risk.

- SOC 2 Type II: This is the baseline standard for any SaaS company. It verifies that a vendor has strong security policies and procedures in place over time. All four alternatives have this certification.

- SOC 1: This is for companies concerned with financial reporting, especially public companies subject to SOX. It audits the controls that could impact a client's financial statements. Tipalti and Airbase having this is a major plus for enterprises.

- PCI DSS: This is a set of security standards for companies that handle credit card information. A higher level, like BILL's Level 1, means they meet the most stringent requirements.

- GDPR: This is a European data privacy regulation. It is a must-have for any company with European customers or vendors.

Security & Compliance Scorecard

| Feature | Ramp | Tipalti | Airbase | BILL |

|---|---|---|---|---|

| SOC 2 Type II Compliance | ✅ | ✅ | ✅ | ✅ |

| SOC 1 Compliance (for SOX) | ❌ | ✅ | ✅ | ❌ |

| PCI DSS Level | Compliant | Level 1 | Compliant | Level 1 |

| GDPR Compliant | ✅ | ✅ | ✅ | ✅ |

| Automated Bank Verification | ✅ | ✅ | ✅ | Partner |

| Immutable Audit Trails | ✅ | ✅ | ✅ | ✅ |

Professional Security Checklist

A security badge on a website is just the beginning. I strongly recommend you take these two steps before making a final decision:

- Ask the vendor for their full SOC 3 report. This is a public-facing summary of their SOC 2 audit.

- Involve your IT or Information Security team. Have them review the vendor's security posture and validate that it meets your company's specific risk tolerance. Expert validation of a vendor's data handling policies is non-negotiable for any enterprise application.

5. YMYL Deep Dive Part 2: Total Cost of Ownership (TCO) & Financial Risk Analysis

The sticker price of financial software is only part of the story. The Total Cost of Ownership (TCO) includes all costs, both direct and hidden. Understanding this is key to assessing your true financial risk. These costs can include implementation fees, per-user fees, transaction costs, and the hidden labor costs that come from using an inefficient system.

Here is a breakdown of the pricing models.

- Ramp: Ramp's model is fundamentally different. The core platform is free, subsidized by the interchange fees it earns when you use Ramp corporate cards. This dramatically lowers your upfront cash outlay, but it does create an incentive for you to centralize your spending on their cards. The financial risk of trying the platform is very low.

- Tipalti: Tipalti uses a high-cost enterprise subscription model. The price is customized based on the modules you need and your transaction volume. The ROI is justified by mitigating compliance risk and achieving massive efficiency gains in global payment operations. The financial risk is high if you cannot fully utilize its powerful features.

- Airbase: Airbase uses a per-user enterprise subscription model. The cost puts it firmly in the enterprise category, and the TCO is significant. The financial risk is choosing it for a company culture that isn't ready for its rigid, procurement-led approach, leading to a wasted investment.

- BILL: BILL has a tiered, per-user subscription model. The financial risk comes from potential hidden labor costs. Choosing a tool with poor integration, like BILL's known issues with NetSuite, exposes your business to financial risk from the hours your team must spend on manual reconciliation.

6. Use Case & Decision Framework: Which Alternative Is Right for Your Business?

There is no single “best” tool. The best choice is the one that solves your biggest problem within your specific context. I've created four personas to help guide you to the most logical solution.

1. The Mid-Market Modernizer (50-500 Employees)

You are a finance leader at a growing company. Your biggest pain points are using too many disconnected systems for bills, cards, and expenses, and a lack of real-time visibility into spending. You want to consolidate systems and reduce costs.

- Best Fit: Ramp is the clear leader for this use case.

- Why: It offers a powerful, unified platform for free. Its modern UI and deep ERP integrations directly solve the problems of system fragmentation and unreliable data.

- Risk Mitigation: The main risk is needing more advanced features than Ramp provides, like native three-way PO matching or complex global tax compliance. You must validate these specific needs before committing.

2. The Global Enterprise Operator

You manage finance for a large, multinational company. Your biggest challenges are managing payments to vendors in dozens of countries, handling cross-border FX, and staying compliant with complex international tax laws.

- Best Fit: Tipalti is the professional standard here.

- Why: Its entire platform is built to solve these exact problems. The automated tax compliance engine and global payment infrastructure are unmatched.

- Risk Mitigation: The high cost is the biggest risk. You must conduct a thorough ROI analysis to confirm that the efficiency gains and compliance risk reduction justify the significant investment.

3. The Procurement-Led Organization

You operate in a business where spending control is paramount. Every purchase, from software to office supplies, must go through a formal approval process that starts with a purchase order.

- Best Fit: Airbase is the superior choice for you.

- Why: It is designed specifically for this workflow. Its guided procurement functionality and native three-way PO matching provide the rigid controls you require.

- Risk Mitigation: The operational risk is high if your company culture is not fully aligned with this strict, controlled approach. You must ensure buy-in from all departments before implementation.

4. The Service-Based SMB

You run a smaller, service-based business like a marketing agency or consulting firm. You need a simple, unified tool to handle domestic vendor payments and client invoicing without much complexity.

- Best Fit: BILL can be considered, but with serious caveats.

- Why: Its ability to manage both AP and AR in one simple interface is appealing for SMBs who want better cash flow visibility.

- Risk Mitigation: You must not choose BILL if your business uses NetSuite or requires any form of PO matching. The risk of workflow friction and manual work is simply too high. Always verify its integration capabilities with your specific accounting software version before buying.

7. Final Verdict & Professional Recommendations

My analysis shows that there is no single best Stampli alternative, only the best fit for a specific business context. Your decision should be guided by your company's primary pain point, risk tolerance, and budget.

Here is my final, nuanced summary:

- For maximum value and an all-in-one platform in the mid-market, Ramp is the leader.

- For global compliance and enterprise-scale AP, Tipalti is the professional standard.

- For control-focused, procurement-driven companies, Airbase is the superior tool.

- BILL is only suitable for SMBs with simple needs and no reliance on POs or complex ERPs.

Making this decision is a major financial and operational commitment.

Final Checklist Before You Decide:

- Validate Security Independently: Task your IT/Security lead with obtaining and reviewing the vendor's full SOC 2 Type II and SOC 3 reports. Do not take the marketing site's word for it.

- Map Your “To-Be” Process: Go beyond your current process. Map exactly how a new tool will handle your three most painful workflows (e.g., month-end close, vendor onboarding, PO matching).

- Confirm Integration with a Live Demo: Get a technical expert to confirm the integration depth with your exact ERP version and instance.

- Demand a TCO Quote: Get a written quote for the Total Cost of Ownership over three years, including all implementation fees, transaction costs, and mandatory support packages.

Ultimately, this is a decision with significant consequences. I strongly advise you to seek expert consultation to ensure you choose a platform that not only solves today's problems but also supports your company's future growth.

For a deeper dive into the Best Stampli Alternatives, you can explore more of our detailed analyses. In addition, our comparison includes insights into pricing models, user experiences, and unique features offered by each alternative. For those looking to understand how Stampli stacks up against its competitors, we've included a comprehensive “Stampli Overview and Features” section that highlights its key functionalities. This will help you make an informed decision based on your business needs. In addition, we provide a range of resources to help you navigate through various options effectively. For those looking to maximize their experience, be sure to check out our comprehensive Stampli Tutorials and Usecase for practical insights. These guides will equip you with the knowledge needed to make informed decisions that best suit your financial needs.

About the Author & Disclaimers

My name is Scott Seymour, and I am the founder of Best AI Tools For Finance. With years of specialized experience in financial technology, my mission is to provide clear, accurate, and professionally responsible analysis to help business leaders navigate the complex world of AI finance tools.

YMYL Disclaimer: The information in this article is for informational purposes only and does not constitute financial, legal, or security advice. All business decisions carry risk. We strongly recommend consulting with a qualified accountant, IT security professional, and legal counsel before implementing any new financial software.

Affiliate Disclosure: To keep our research independent and accessible, Best AI Tools For Finance is supported by its audience. When you purchase through links on our site, we may earn an affiliate commission at no extra cost to you. We only recommend products that we have rigorously tested and believe will provide value.

Leave a Reply