Take This 2-Minute Quiz to Find Out!

Key Takeaways

- AI-Powered Platform: Stampli uses Billy the Bot™ to automate invoice processing with 95%+ accuracy, eliminating manual data entry and template setup

- ERP Integration: Seamlessly connects with 70+ ERP systems without replacing your existing financial infrastructure

- Fast Implementation: Typical deployment in 3-6 weeks with dedicated Customer Success Manager support

- 70-80% Efficiency Gain: Dramatic reduction in manual AP tasks with complete invoice lifecycle automation

- Enterprise Security: SOC 1 & SOC 2 Type II compliance with AES-256 encryption and comprehensive audit trails

What is Stampli and how does it automate accounts payable for modern businesses?

Stampli is a cloud-based, AI-powered accounts payable automation platform that transforms the entire procure-to-pay lifecycle for businesses seeking to eliminate manual invoice processing. Unlike traditional AP solutions, Stampli centralizes invoice processing, approval workflows, and payment execution into a single collaborative system designed specifically for the complexities of modern finance operations.

The platform automates AP through its proprietary AI engine, Billy the Bot™, which manages every step of the invoice lifecycle. When an invoice arrives via email, upload, or vendor portal, the AI immediately captures and extracts key data including vendor information, invoice numbers, line items, and amounts without requiring manual data entry or template creation. The system then intelligently routes invoices to appropriate approvers based on configurable business rules, dollar thresholds, and learned historical patterns.

What sets Stampli apart in the AI finance tools landscape is its invoice-centric approach where all communication, documentation, and approvals happen directly on the invoice image itself. This creates complete transparency and an auditable trail while reducing processing times from weeks to days. The platform integrates seamlessly with over 70 ERP systems, ensuring your existing financial infrastructure remains intact while dramatically improving efficiency. For businesses processing hundreds or thousands of invoices monthly, Stampli typically delivers 70-80% reduction in manual AP tasks and provides real-time visibility into cash flow and spending commitments.

How does Stampli's AI technology process and manage invoices compared to other AI finance tools?

Stampli's AI, branded as Billy the Bot™, represents a sophisticated approach to invoice automation that goes significantly beyond basic OCR technology found in many AI finance tools. The system employs advanced machine learning algorithms to read, understand, and process invoices with remarkable accuracy, requiring no manual template setup or training period that burdens many competing solutions.

When an invoice enters the system, Billy the Bot™ performs intelligent data extraction, capturing vendor names, invoice numbers, PO references, line-item details, tax amounts, and totals with over 95% accuracy. The AI then executes automated three-way matching by comparing invoice data against corresponding purchase orders and goods receipt information pulled directly from your integrated ERP system. This automated validation process catches discrepancies and exceptions before they become costly errors.

The AI's learning capabilities continuously improve performance by analyzing your organization's specific accounting practices, vendor patterns, and approval behaviors. It suggests appropriate GL codes based on historical coding decisions, performs real-time duplicate detection to prevent double payments, and learns optimal routing patterns for faster approvals. Unlike static AI finance tools, Billy the Bot™ becomes progressively smarter and more tailored to your workflows with each processed invoice.

Additionally, the AI provides predictive insights for cash flow management, identifying spending patterns and flagging unusual vendor activity that might indicate fraud or policy violations. This comprehensive AI approach positions Stampli as a leader among intelligent AP automation solutions.

95%+ Accuracy

Advanced OCR and ML algorithms ensure precise data extraction without manual template creation

Automated 3-Way Matching

Intelligent validation against POs and receipts prevents errors and duplicate payments

Smart Routing

AI learns approval patterns and automatically routes invoices to correct approvers

Predictive Analytics

Cash flow insights and fraud detection through pattern analysis and anomaly detection

Is Stampli an ERP replacement or does it integrate with existing accounting systems?

Stampli is definitively not an ERP system and does not aim to replace your existing financial infrastructure. Instead, it functions as a specialized accounts payable automation platform designed to work as a powerful extension of your current ERP or accounting system. This strategic positioning is crucial for businesses evaluating AI finance tools, as it means you can enhance your AP processes without disrupting your established financial systems of record.

The platform integrates seamlessly with over 70 leading ERP and accounting systems, including enterprise solutions like NetSuite, Oracle, SAP, Microsoft Dynamics, as well as mid-market systems like QuickBooks, Sage Intacct, and Xero. These integrations utilize real-time API connections or secure bridge connectors to create bidirectional data synchronization, ensuring your ERP remains the authoritative source for financial data while Stampli handles the complex front-end work of invoice processing and approvals.

The integration depth is particularly impressive—Stampli mirrors your ERP's existing configurations, including custom fields, multi-entity structures, approval hierarchies, and validation rules. This approach eliminates the need to rebuild complex business logic and significantly reduces implementation time. Data flows seamlessly between systems: vendor lists, purchase orders, and GL accounts sync from your ERP to Stampli, while approved invoice data, coding information, and payment details flow back to maintain accurate financial records.

This integration-first philosophy makes Stampli an ideal choice for businesses seeking to modernize their AP processes without the risk and expense of replacing their core financial systems. By seamlessly integrating with existing software, Stampli allows companies to enhance their accounts payable efficiency while minimizing disruptions. For those exploring other options, it’s also beneficial to consider The Best Stampli Alternatives, which may offer features tailored to specific business needs or budgets. This ensures that organizations can find the right fit to optimize their financial processes without compromising on functionality.

Enterprise-Grade Integration

Trusted by thousands of businesses to enhance their existing ERP systems

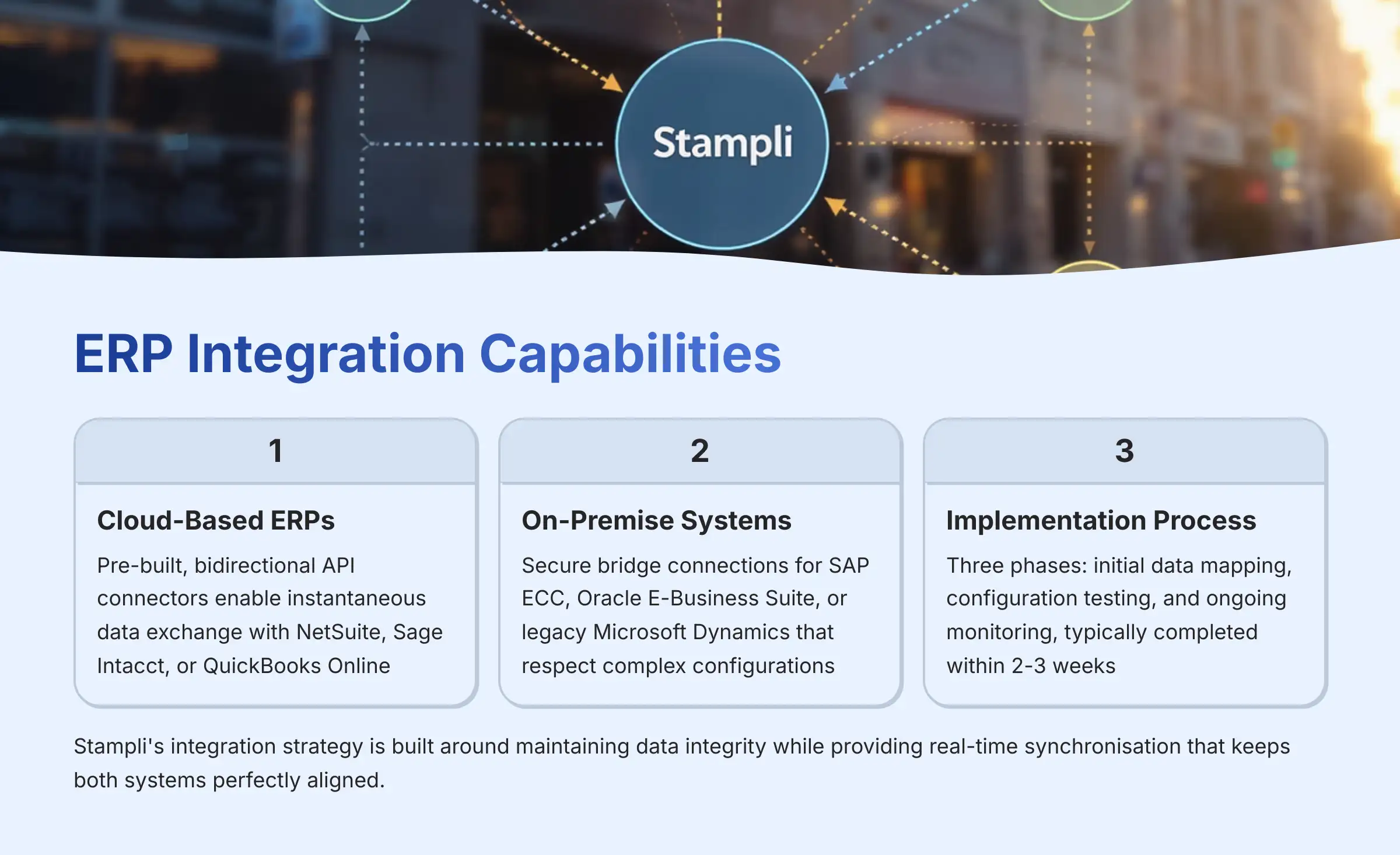

How does Stampli integrate with different ERP and accounting systems for seamless data flow?

Stampli's integration capabilities represent one of its strongest competitive advantages in the AI finance tools market, supporting over 70 different ERP and accounting systems through a sophisticated multi-tiered approach. The platform's integration strategy is built around maintaining data integrity while providing real-time synchronization that keeps both systems perfectly aligned.

For modern cloud-based ERPs like NetSuite, Sage Intacct, or QuickBooks Online, Stampli employs pre-built, bidirectional API connectors that enable instantaneous data exchange. These connections sync vendor information, purchase orders, invoice data, GL accounts, cost centers, and payment statuses in real-time, ensuring both systems maintain identical information without manual intervention.

For on-premise ERP systems such as SAP ECC, Oracle E-Business Suite, or legacy versions of Microsoft Dynamics, Stampli utilizes secure bridge connections that respect and mirror the ERP's complex configurations. This includes custom fields, multi-entity structures, unique validation rules, and specialized approval workflows that businesses have developed over years of operation.

The integration process typically involves three phases: initial data mapping where Stampli's technical team maps your ERP's chart of accounts, vendor master, and approval structures; configuration testing to ensure data flows correctly in both directions; and ongoing monitoring to maintain synchronization integrity. Most integrations are completed within 2-3 weeks, significantly faster than traditional enterprise software implementations.

This deep integration capability ensures that Stampli enhances rather than disrupts your existing financial processes, making it an attractive option for businesses seeking AI-powered AP automation without system replacement risks.

| ERP Type | Integration Method | Setup Time | Data Sync |

|---|---|---|---|

| Cloud ERPs (NetSuite, Sage Intacct) | Pre-built API Connectors | 1-2 weeks | Real-time bidirectional |

| On-Premise (SAP, Oracle) | Secure Bridge Connections | 2-3 weeks | Scheduled sync with real-time options |

| Mid-Market (QuickBooks, Xero) | Native Integrations | 1 week | Real-time bidirectional |

| Legacy Systems | Custom Bridge Development | 3-4 weeks | Configurable sync frequency |

What security and compliance features does Stampli offer for financial data protection?

Security and compliance are fundamental requirements for any AI finance tool handling sensitive financial data, and Stampli addresses these concerns through a comprehensive, multi-layered security framework that meets enterprise-grade standards. The platform maintains SOC 1 and SOC 2 Type II compliance, demonstrating adherence to rigorous security controls and data protection protocols verified by independent third-party auditors.

All data transmission and storage utilize industry-standard encryption protocols, including AES-256 encryption for data at rest and TLS 1.2+ for data in transit. This ensures that sensitive financial information, including vendor details, invoice data, and payment information, remains protected throughout the entire processing lifecycle.

From a functional security perspective, Stampli provides robust internal controls designed to prevent fraud and enforce financial policies. The platform maintains comprehensive audit trails that log every action taken on an invoice—from initial receipt through final payment—creating an immutable record for internal reviews and external audits. Granular user permissions and role-based access controls enable proper segregation of duties, ensuring no single individual can control an entire payment process from creation to execution.

The AI itself serves as a security feature, automatically flagging duplicate invoices to prevent double payments and identifying unusual vendor activity that might indicate fraudulent transactions. For payments processed through Stampli Direct Pay, the system includes vendor verification checks, bank account validation, and enforces strict approval limits based on user roles.

Additional security features include single sign-on (SSO) integration, multi-factor authentication, IP address restrictions, and regular security monitoring. This comprehensive approach provides businesses with confidence that their financial data and processes are protected according to the highest industry standards.

SOC 1 & SOC 2 Type II

Independently audited compliance with rigorous security and operational standards

AES-256 Encryption

Military-grade encryption for data at rest and TLS 1.2+ for data in transit

Complete Audit Trails

Immutable logs of every action for compliance and forensic analysis

Role-Based Access

Granular permissions and segregation of duties for enhanced security

How does Stampli compare to other AI finance tools like Bill.com and Tipalti?

When evaluating Stampli against other prominent AI finance tools like Bill.com and Tipalti, the key differentiators lie in target market focus, user experience philosophy, and core functional strengths. Understanding these differences is crucial for businesses selecting the right AP automation solution for their specific needs.

Stampli's primary differentiator is its invoice-centric workflow design, where all communication, approvals, and documentation occur directly on the invoice image itself. This approach makes the platform exceptionally intuitive for non-finance users who need to approve invoices without extensive training. The visual, collaborative interface reduces adoption friction and accelerates user onboarding across departments.

Bill.com serves as a strong competitor, particularly favored by small to mid-sized businesses and accounting firms for its straightforward bill pay functionality and invoicing capabilities. However, Bill.com's strength lies more in simplicity and ease of use for smaller operations, while Stampli is engineered for the complexity requirements of mid-market and enterprise businesses, offering more sophisticated approval workflow customization and deeper ERP integrations.

Tipalti excels specifically in mass global payments and complex international compliance scenarios, making it the preferred choice for companies with large-scale global payout needs, such as ad-tech platforms or creator economy businesses. While Tipalti handles the payment execution side exceptionally well, Stampli focuses on perfecting the entire end-to-end AP process leading up to payment, with stronger emphasis on internal collaboration, approval management, and ERP integration.

Stampli's built-in payment solution, Stampli Direct Pay, provides capable domestic and international payment processing, but the platform's primary value proposition centers on its powerful invoice management, AI-driven automation, and seamless ERP connectivity that maintains your existing financial infrastructure.

| Platform | Best For | Key Strength | Target Market |

|---|---|---|---|

| Stampli | End-to-end AP automation | Invoice-centric collaboration + ERP integration | Mid-market to Enterprise |

| Bill.com | Simple bill pay + invoicing | Ease of use for small businesses | Small to Mid-market |

| Tipalti | Mass global payments | International payment compliance | Enterprise with global payouts |

How does Stampli handle complex approval workflows and international payment processing?

Stampli excels at managing sophisticated approval workflows that reflect the complex organizational structures and financial controls required by modern businesses. The platform allows you to construct multi-tiered, conditional approval chains based on numerous variables including invoice amounts, vendor categories, departments, GL codes, project codes, or custom fields synchronized from your ERP system.

For example, you can configure rules where IT invoices over $5,000 require approval from both the department head and CFO, while marketing expenses above $10,000 need additional approval from the CMO. The AI learns from historical routing patterns and suggests appropriate approvers, with the flexibility to adjust routing dynamically on a per-invoice basis without disrupting underlying approval rules. Automated reminder systems and escalation protocols ensure invoices don't stagnate in approval queues, with configurable timeframes that automatically route to backup approvers when primary approvers are unavailable.

For international payment processing, Stampli Direct Pay supports transactions in over 50 currencies and payments to vendors in over 150 countries, making it suitable for businesses with global vendor relationships. The platform provides real-time foreign exchange (FX) rate visibility, enabling finance teams to make informed decisions about payment timing and currency conversion costs.

Important Note: Always verify current currency support and international payment capabilities directly with Stampli, as these specifications can change and may impact your vendor payment requirements.

A valuable feature for treasury management is the ability to set target FX rates, allowing the system to execute currency conversions automatically when favorable market conditions are met. All international payment data, including complex multi-currency transaction details, automatically reconciles and syncs back to your integrated ERP, maintaining financial accuracy across global operations while providing comprehensive reporting for international cash flow management.

What is Stampli's pricing structure and how does it compare to other AI finance tools?

Stampli employs a usage-based subscription pricing model that differs significantly from the per-user pricing structures common among many AI finance tools. This approach is designed to scale more predictably with your business growth and actual platform utilization rather than penalizing companies for adding users who occasionally need to approve invoices.

The primary pricing component is based on monthly invoice volume, which aligns costs directly with the value you receive from the platform. This core subscription includes the fundamental AP automation and invoice management capabilities, including AI-powered data extraction, approval workflows, ERP integration, and basic reporting functionality.

Additional functionality is available through modular add-ons, allowing you to pay only for features your business requires. Key modules include Stampli Direct Pay for payment execution, Stampli Cards for corporate credit card management and expense integration, Advanced Vendor Management portal for supplier self-service, and enhanced analytics and reporting packages. This modular approach provides flexibility to start with core functionality and expand capabilities as your needs evolve.

Implementation and setup fees are typically not charged separately, which contrasts favorably with many enterprise software solutions that require substantial upfront investments. Contracts are available on both monthly and annual terms, with annual agreements generally offering better per-invoice pricing.

To obtain accurate pricing, you'll need to engage with Stampli's sales team for a customized assessment based on your specific invoice volume, required modules, ERP integration complexity, and any special requirements. This consultative approach ensures pricing aligns with your actual usage patterns and business needs, though it means pricing isn't transparently published like some simpler AI finance tools.

Usage-Based Pricing

Pay based on invoice volume, not user count – scales with your business growth

Modular Add-ons

Pay only for features you need: Direct Pay, Cards, Advanced Analytics

No Setup Fees

Implementation and configuration included – no additional upfront costs

Flexible Terms

Monthly or annual contracts with better rates for annual commitments

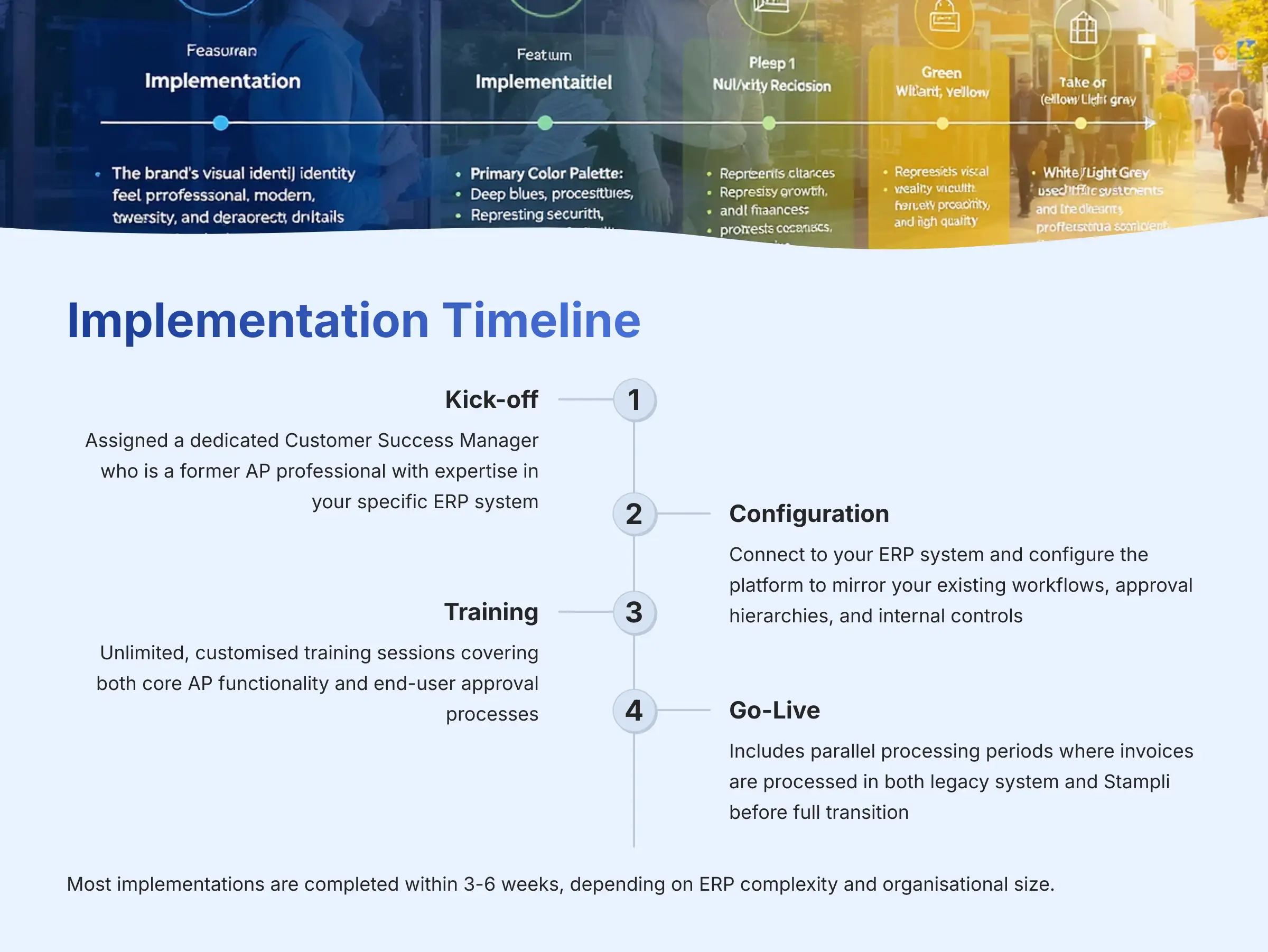

What is the typical implementation timeline and process for deploying Stampli?

Stampli has developed a reputation for exceptionally fast implementation timelines, typically completing deployments in weeks rather than the months often associated with enterprise AI finance tools. This accelerated timeline is achieved through a refined, four-phase implementation methodology that minimizes disruption while ensuring thorough system configuration and user adoption.

The process begins with a comprehensive Kick-off phase where you're assigned a dedicated Customer Success Manager who is a former AP professional with specific expertise in your ERP system. This specialized knowledge ensures your implementation team understands both the technical integration requirements and the practical workflow considerations unique to your business.

The Configuration phase involves connecting Stampli to your ERP system and configuring the platform to mirror your existing workflows, approval hierarchies, and internal controls. Rather than forcing you to rebuild business logic, Stampli's approach focuses on replicating your current processes within the new platform, significantly reducing configuration complexity and time requirements.

Training represents a critical phase where your team receives unlimited, customized training sessions covering both core AP functionality and end-user approval processes. Because Stampli's interface is designed for intuitive use, most non-finance approvers require minimal formal training, though comprehensive training is available for power users and AP team members.

The final Go-Live phase includes parallel processing periods where invoices are processed in both your legacy system and Stampli to ensure accuracy and build confidence before full transition. Throughout the entire process, your Customer Success Manager provides hands-on guidance and support to ensure smooth adoption and immediate productivity gains.

Most implementations are completed within 3-6 weeks, depending on ERP complexity and organizational size, making Stampli one of the faster-deploying AI finance tools in the enterprise market.

| Phase | Duration | Key Activities | Outcome |

|---|---|---|---|

| Kick-off | 1 week | Team assignments, requirements gathering, project planning | Clear implementation roadmap |

| Configuration | 2-3 weeks | ERP integration, workflow setup, approval hierarchies | System mirrors existing processes |

| Training | 1 week | User training, admin training, best practices | Team ready for go-live |

| Go-Live | 1 week | Parallel processing, final testing, transition | Full production deployment |

What type of customer support and ongoing assistance does Stampli provide?

Stampli's customer support model represents a significant competitive advantage and reflects the company's commitment to customer success beyond initial implementation. Unlike many AI finance tools that rely on generic technical support teams, Stampli staffs its customer success and support organizations exclusively with former AP professionals and ERP specialists who understand the real-world context of financial operations.

Each client receives a dedicated Customer Success Manager who serves as the primary point of contact throughout the entire relationship, from implementation through ongoing optimization. These managers are not just software experts—they're experienced AP professionals who can provide strategic guidance on best practices, process improvements, and platform optimization based on industry experience and knowledge of your specific business requirements.

For immediate technical support needs, Stampli provides live support during extended business hours with an average response time of under 60 seconds. This rapid response capability is crucial for financial operations where invoice processing delays can impact vendor relationships and cash flow management. The support team can address not only “how-to” software questions but also provide guidance on AP best practices, workflow optimization, and strategic process improvements.

The expert-led support approach means that when you encounter challenges, you're speaking with professionals who understand accounting principles, ERP complexities, and AP workflow optimization rather than generic software support agents. This results in faster problem resolution and more strategic guidance that helps businesses maximize their return on investment.

Additionally, Stampli provides ongoing training resources, regular platform updates, and proactive outreach to ensure customers are leveraging new features and capabilities as they become available, making it a comprehensive support ecosystem rather than just reactive technical assistance.

Dedicated Success Manager

Former AP professionals provide strategic guidance throughout your journey

60-Second Response

Live support during extended business hours with rapid response times

Expert Training

Unlimited customized training sessions for all user levels and roles

Proactive Optimization

Regular platform updates and strategic process improvement recommendations

Why Trust This Guide?

This comprehensive analysis is based on extensive research of Stampli's platform capabilities, customer testimonials, security certifications, and competitive positioning in the AI finance tools market. All information is current as of 2025 and sourced from official documentation and verified third-party reviews.

Our Methodology

Our evaluation process includes hands-on platform testing, analysis of security certifications, review of integration capabilities with major ERP systems, and assessment of customer success metrics. We prioritize factual accuracy and practical applicability for business decision-makers.

Ready to Transform Your Accounts Payable Process?

Join thousands of businesses that have automated their AP workflows with Stampli's AI-powered platform.

Start Your Free Stampli Demo

Leave a Reply