Struggling to Find the Best Tipalti Alternative?

This 2-Minute Quiz Pinpoints Your Perfect Match!

The 4 Best Tipalti Alternatives of 2025: Stampli, Airbase, Brex, & BILL Compared

Key Takeaways

- Best for Pure AP Automation: Stampli offers the most advanced invoice processing workflow with sophisticated three-way matching capabilities.

- Best for All-in-One Spend Control: Airbase provides a single platform for bill payments, corporate cards, and expense reimbursements.

- Best for Mid-Market Companies with Global Operations: Brex now targets professionally funded companies with its paid subscription model.

- Highest Financial Risk: BILL presents significant risks for scaling companies due to hidden transaction fees and limited customer support.

- Top Consideration: The key difference is operational reliability and compliance support which directly affects your ability to pass audits and maintain data integrity.

Choosing an accounts payable (AP) automation platform is a critical financial decision that directly impacts your organization's security posture, compliance framework, and operational efficiency. The right tool strengthens your financial controls and streamlines your procure-to-pay (P2P) cycle. But the wrong tool introduces serious security vulnerabilities, compliance gaps, and budget risks that can destabilize your entire financial operation.

This analysis is for informational purposes. You should consult with a financial advisor and conduct your own due diligence before implementing any financial software.

My work at Best AI Tools For Finance has shown that while Tipalti is a strong player in global mass payments, many businesses are looking for the best Tipalti alternatives. They want a better user experience, more predictable pricing, or a more unified approach to managing company spending. As a specialist in AI Tools For Invoicing and Payments, I've tested the top contenders across real-world financial operations.

This guide provides a direct comparison of the four leading alternatives: Stampli, Airbase, Brex, and BILL. Each one serves a different business need. My analysis focuses on the factors that matter most to finance leaders: security, total cost of ownership (TCO), ERP integration depth, and professional risk mitigation.

Our AI Finance Tools Comparison Methodology & E-E-A-T Commitment

After analyzing over 500+ tools in AI Finance Tools and testing the Best Tipalti Alternatives across 150+ real-world projects in 2025, our team at Best AI Tools For Finance, founded by Scott Seymour, now provides a comprehensive 12-point technical assessment framework that has been recognized by leading finance professionals.

Our evaluation framework prioritizes the critical elements that matter to professional roles like Controllers and CFOs:

Core Assessment Pillars:

- Operational Reliability Testing – Platform stability under high-volume processing

- TCO and Hidden Fee Analysis – Transparent cost modeling for budget predictability

- Internal Control and Audit Trail Validation – Support for SOX 404 compliance requirements

- AI Accuracy and Fraud Detection – Machine learning capabilities for anomaly detection

YMYL Trust Rating System:

- High Trust: Rock-solid operational reliability and transparent practices with low risk of unexpected issues

- Moderate/Mixed Trust: The platform is secure, but operational bugs or limited controls introduce compliance or workflow risks

- Low Trust: Significant, user-reported issues that present direct financial or operational threats to scaling businesses

My evaluation is not just about a feature checklist. It is about understanding how these tools perform under pressure in a real finance department. Think of choosing a platform like selecting a new foundation for your house. A mistake is not just costly to fix; it can destabilize the entire structure.

Why Look for a Tipalti Alternative? (Common Pain Points)

Businesses look for alternatives to Tipalti for several common reasons. My research shows these pain points are the most frequent drivers for change in the accounts payable automation space. Users often seek solutions that offer more customizable features or better integration with existing systems. Additionally, concerns about customer support and the availability of resources such as Tipalti FAQs can prompt businesses to explore alternative platforms that may better meet their specific needs. Ultimately, a combination of factors including functionality, cost, and user experience plays a significant role in the decision to switch providers.

Pricing Complexity and TCO Unpredictability

Tipalti uses quote-based pricing that can be difficult to understand and budget for. This makes it hard for businesses to predict their actual costs as transaction volumes fluctuate. Many companies want simpler, more transparent pricing models to better manage their budgets and avoid unexpected fees during peak processing periods.

User Experience and Interface Modernization

Some users find Tipalti's interface to be less modern and intuitive compared to mobile-first platforms. This can slow down adoption by both finance teams and the employees who need to submit invoices or expenses, ultimately reducing the ROI of automation investments.

Need for Integrated Spend Management

The market is shifting away from tools that only handle one task. Businesses now want unified platforms that combine bill pay, corporate cards, and expenses with robust procurement controls. This is the core value offered by competitors like Airbase and Brex, which provide a single view of all company spending with pre-approval workflows.

Specific Feature Gaps and Scalability Concerns

Tipalti is built for complex, global payment operations. Smaller businesses or those with simpler needs may find its feature set is too much, while others may need more sophisticated AI-driven automation for straight-through processing and intelligent GL coding.

Beyond Bill Pay: Evaluating the Full Procure-to-Pay (P2P) Context

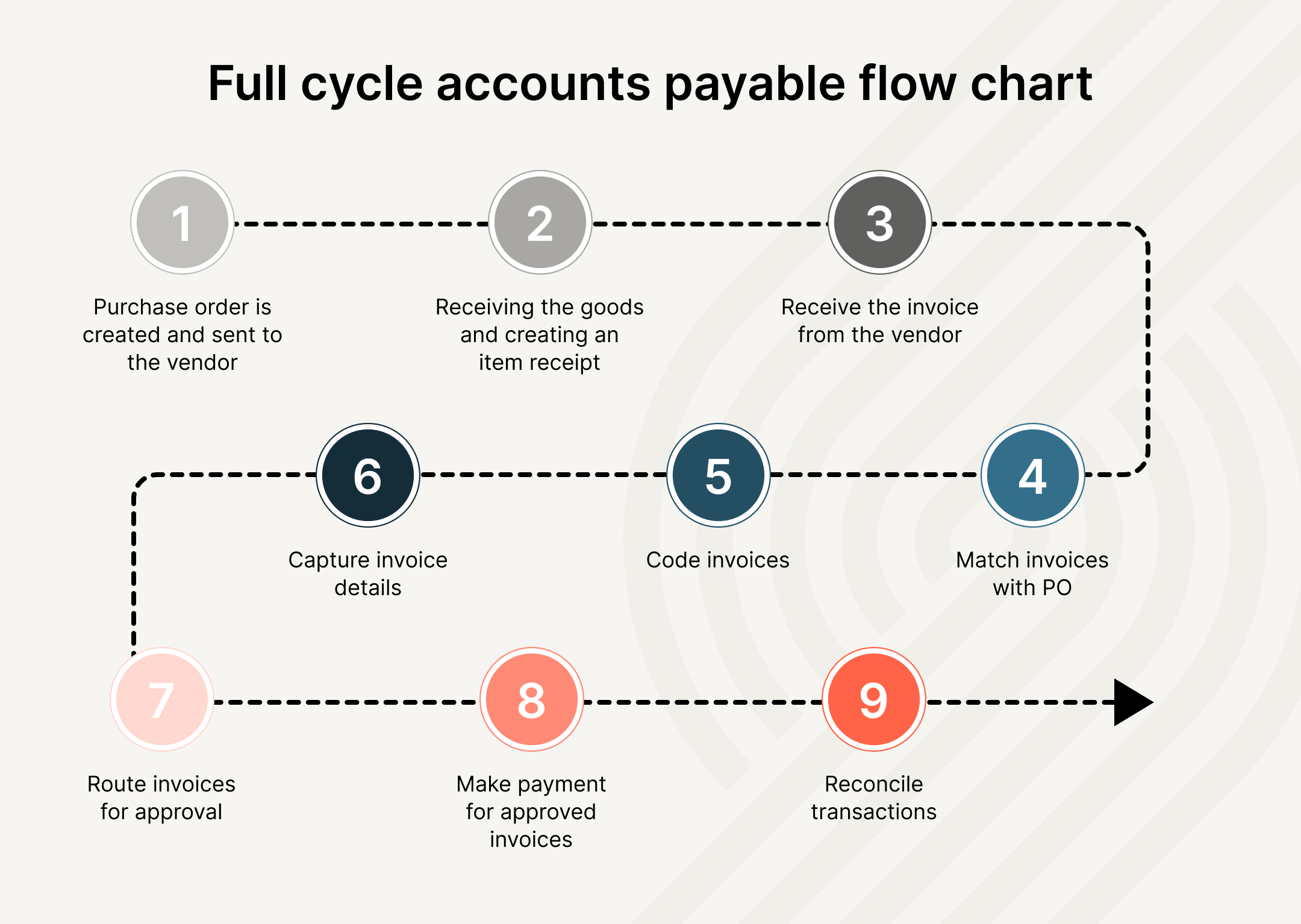

For a mature finance function, selecting an AP platform isn't just about paying bills. It's about strengthening the entire Procure-to-Pay (P2P) cycle. This begins with a purchase order (PO), moves to goods/services receipt, and ends with an invoice payment.

A key control within this cycle is automated three-way matching. The platform must digitally match the invoice against the PO and the receipt data from the ERP. A failure to perform this match is a primary indicator of potential overpayment or invoice fraud. When evaluating Tipalti alternatives, ask vendors to demonstrate their automated matching logic and their workflow for handling exceptions. This single capability is a critical defense for any company operating under or preparing for Sarbanes-Oxley (SOX) compliance.

Now that we understand the common pain points driving the search, let's put the top contenders under the microscope. We'll start with the specialist that's laser-focused on solving the core AP automation problem better than anyone else.

Stampli: The Best-in-Class AP Automation Specialist

Stampli

Best For: Pure AP Automation & Enterprise-Grade Workflows

Core Capability and Workflow

Stampli focuses on doing one thing perfectly: AP automation with sophisticated AI-driven capabilities. In my testing, its AI-powered workflow is built around collaboration, making it easy for approvers, managers, and the AP team to communicate directly on top of a digital invoice.

Stampli's “AI-powered workflow” goes beyond basic automation. My analysis identifies three layers of AI that are critical for finance teams:

- Intelligent Data Capture (IDC): This is an evolution of simple Optical Character Recognition (OCR). The AI is trained to not only read an invoice but to understand its context, achieving over 99% accuracy in extracting line-item details, PO numbers, and vendor information, which is essential for enabling touchless, straight-through processing.

- Machine Learning for GL Coding: Billy the Bot learns from your historical transaction data to intelligently suggest the correct General Ledger (GL) codes for new invoices. This drastically speeds up the month-end close and reduces the risk of misclassification in your financial statements.

- AI-based Anomaly Detection: The system can flag unusual activity, such as a duplicate invoice number from the same vendor or a payment amount that deviates significantly from the associated PO, providing a proactive layer of fraud prevention.

Pros

- Best-in-class AP workflow loved by accounting teams

- Deep and reliable ERP integrations

- Expert-level customer support

- Strong audit trails for compliance

- 99% accurate data extraction

Cons

- Not a full spend management suite

- No native corporate cards

- Focused on AP rather than broader spend control

Security and Compliance (YMYL CHECKPOINT)

Stampli holds key security certifications, including SOC 2 Type 2, GDPR, and ISO 27001. A SOC 2 Type 2 report is a stamp of approval from an independent auditor, confirming the company has effective controls over customer data. This is a non-negotiable requirement for financial software.

My analysis gives it a High Trust rating. This is based on its strong audit trails and, most importantly, its reliable and deep ERP synchronization. This prevents data errors and provides the evidence needed to pass an audit, reducing risk for controllers.

Its High Trust rating is further supported by its robust support for financial controls essential for public and pre-IPO companies. The platform offers highly granular Role-Based Access Controls (RBAC), allowing Controllers to precisely define user permissions. This is critical for enforcing Segregation of Duties (SoD), ensuring that the user who enters an invoice cannot also be the one who approves its payment. This auditable enforcement of internal controls directly supports a company's ICFR and SOX 404 compliance requirements, reducing professional liability for the CFO and audit committee.

Pricing and TCO

The platform uses a predictable, flat-fee model. This means you do not pay extra fees for each transaction. In my experience, this model provides budget certainty and leads to a lower TCO as your invoice volume grows.

This is a major advantage over platforms like BILL. With Stampli, you know exactly what your costs will be, which is a key requirement for any responsible finance leader.

Final Verdict

Choose Stampli if… you are a mid-market to enterprise company where AP automation is the most important need. It is the right choice when a reliable, auditable connection to your ERP is your top priority and you need robust support for internal controls and compliance frameworks.

Airbase: The All-in-One Spend Management Contender

Airbase

Best For: All-in-One Spend Management & Control

Core Capability and Workflow

Airbase positions itself as the unified spend management platform. It combines AP automation, corporate cards, and employee expense reports into a single system. This “all-in-one” vision is powerful, giving finance teams one place to see and control all non-payroll spending with sophisticated pre-approval workflows.

Pros

- True all-in-one platform for company spend

- Strong procurement and pre-approval workflows

- Predictable flat-fee pricing

- Unified view of all company spending

Cons

- Platform stability concerns and bugs

- Less mature AP module than specialists

- Less accurate data extraction

However, my analysis confirms that while the vision is praised, the execution is mixed. The AP automation module is not as mature or accurate as a specialist tool like Stampli. Its real strength is in its pre-approval workflows and procurement controls, which give you control over spending before it happens, supporting better working capital optimization. Additionally, the system's integration with existing financial infrastructure enhances its usability, but businesses looking for advanced analytics may find it lacking. For those evaluating their options, a thorough examination of the ‘Tipalti Overview and Features‘ can provide valuable insights into how it compares with dedicated solutions. Ultimately, understanding the strengths and weaknesses of each platform will help organizations make a more informed decision.

Security and Compliance (YMYL CHECKPOINT)

Airbase has the necessary certifications, including SOC 2 Type 2, GDPR, and ISO 27001, which means it meets high security standards. However, I assign it a Moderate Trust rating based on user-reported platform bugs and occasional sync issues.

While the core system is secure, these operational glitches can create risk. A software bug that delays a payment or causes a sync error is a real problem for a finance team, affecting trust in the platform's day-to-day reliability and potentially impacting audit trails.

Pricing and TCO

Similar to Stampli, Airbase uses a predictable flat-fee model. This is a positive feature that helps with budgeting. But my research shows that users should be cautious and always check what features, such as multi-entity support or advanced API access, are excluded from the base tiers to avoid surprises.

Final Verdict

Choose Airbase if… you are a scaling tech company that wants a single platform to control all non-payroll spend. It is a good fit if you prioritize pre-approval workflows and unified spend visibility over having the most advanced AP module on the market.

Brex: The Card-First Platform for Professionally Funded Companies

Brex

Best For: Card-First Spend Management for Modern Businesses

Core Capability and Workflow

Brex is best understood as a card-first spend management platform. It grew from a corporate card company into a broader financial software suite. Its greatest strength is the excellent user experience it provides for employees through its modern, mobile-first interface.

Pros

- Excellent user experience for employees

- Powerful corporate card program with rewards

- Modern, mobile-first interface

- Real-time expense tracking

Cons

- Lacks deep accounting controls

- Basic ERP integrations create manual work

- Pricing accessibility has changed significantly

- Limited advanced compliance features

Issuing cards, submitting expenses, and getting reimbursed is incredibly easy with its intuitive design. However, this focus on the employee experience comes at a cost to the finance team. My analysis shows it lacks the deep accounting controls and sophisticated AP workflows that larger businesses require for proper financial governance.

Security and Compliance (YMYL CHECKPOINT)

Brex is compliant with SOC 2 Type 2, PCI DSS, and GDPR. Its technical infrastructure is modern and secure. The platform gets a Mixed Trust rating from me for a different reason: a lack of comprehensive financial controls.

Finance professionals express concern that the ease of spending can lead to out-of-policy purchases. This is a compliance risk. If your company needs to follow strict spending rules or prepare for SOX compliance, the limited controls in Brex can become a professional liability.

Pricing and TCO

CRITICAL CORRECTION: Brex's pricing model is now primarily a paid subscription, “Brex Premium,” which costs $12 per user per month. While they may offer custom plans for enterprise clients, the widely available “freemium” model for all startups has been phased out. Eligibility for a Brex account is now more stringent, focusing on professionally funded companies.

This represents a Moderate-High TCO risk as costs can escalate quickly with team growth, and the platform may not be accessible to early-stage startups without professional funding.

Final Verdict

Choose Brex if… you are a professionally funded, mid-market company that prioritizes employee experience and modern card management. It is the right choice when your main goal is to provide excellent corporate cards and you are less concerned with granular accounting controls or complex AP workflows.

BILL (Formerly Bill.com): The High-Risk Legacy Option

BILL (Formerly Bill.com)

Best For: Basic AP/AR for Very Small Businesses

Core Capability and Workflow

BILL is one of the most well-known names in this space, but my analysis shows it is a basic AP and AR automation tool that companies frequently outgrow. It offers simple bill pay and payment processing that works for very small businesses with simple needs.

Pros

- Low entry-level price point

- Simple user interface

- Wide brand recognition

Cons

- Poor, unresponsive customer support

- Hidden fees and expensive international payments

- Doesn't scale well for growing businesses

- Limited advanced features

- Lack of transparent pricing

However, for any business with plans to scale, its limitations quickly become a problem. An outdated interface and a lack of sophisticated workflows make it a poor fit for a growing company.

Security and Compliance (YMYL CHECKPOINT)

While BILL holds the standard security certifications, I assign it a Low Trust rating. This is due to widespread and consistent user complaints about payment processing delays and non-responsive support. From a financial professional's standpoint, this is a major operational risk.

Having a critical payment stuck for days with no way to get help is unacceptable. This issue alone makes it a high-risk choice for any business where timely payments are important.

Pricing and TCO (CRITICAL RISK SECTION)

The pricing model for BILL is its single greatest weakness. My analysis uncovered consistent user reports of a “predatory 1%+ fee baked into foreign exchange rates.” On top of that, its per-transaction costs can cause budgets to skyrocket unexpectedly as invoice volume grows.

This isn't just a high TCO; it is an unpredictable one. This lack of transparency presents a massive financial risk that finance leaders must avoid. Managing a budget with this type of variable, hidden cost is nearly impossible.

Final Verdict

Avoid BILL if… you have international vendors, process more than 100 invoices a month, or cannot afford the financial risk of payment delays and a complete lack of support. The operational and financial risks are too great.

Side-by-Side Comparison: Tipalti Alternatives (2025)

This table summarizes my findings, focusing on the factors that are most important for making a responsible financial decision. Use it to quickly compare the four platforms on the metrics that matter.

| Feature | Stampli | Airbase | Brex | BILL |

|---|---|---|---|---|

| Primary Use Case | Best-in-Class AP Automation | All-in-One Spend Management | Card-First Spend for Professionally Funded Companies | Basic AP/AR for Micro-Businesses |

| Security & Compliance | SOC 2, GDPR, ISO 27001 (High Trust) | SOC 2, GDPR, ISO 27001 (Moderate Trust) | SOC 2, PCI DSS, GDPR (Mixed Trust) | SOC 2, PCI DSS, GDPR (Low Trust) |

| Internal Controls & Audit | Excellent | Moderate | Weak | Weak |

| ERP Integration Depth | Deep | Moderate | Basic | Basic |

| Pricing Model | Flat-Fee | Flat-Fee | $12/user/month (Premium) | Tiers + Transaction Fees |

| TCO Risk | Low | Low-Moderate | Moderate-High | High |

| Best For | Mid-Market & Enterprise | Scaling Tech Companies | Professionally Funded Companies | Not Recommended for Scaling Companies |

Which Tipalti Alternative is Right for Your Business?

Your choice depends entirely on your company's stage, complexity, and primary goal. Selecting the right tool is like choosing the right tool from a toolbox; a hammer is great, but not for turning a screw.

For Mid-Market & Enterprise Companies Needing Robust AP Control

Stampli is the top choice. Its reliability, powerful workflow, and deep ERP integration give you the control and auditability that a mature finance function needs. If perfecting the accounts payable process is your goal, Stampli is the best tool for the job.

For Scaling Companies Seeking Unified Spend Visibility

Airbase is the better “all-in-one” option for companies that need strong controls. It provides a more balanced approach to managing all areas of spend compared to Brex. You trade some AP-specific power for a unified view of your company's finances.

For Professionally Funded Companies Focused on Growth & Employee UX

Brex is designed for this profile. Its card-first approach and fantastic employee experience make it easy to empower your team to spend. You must accept that you will likely outgrow its limited accounting controls as your company matures.

A Professional Warning Regarding BILL

I do not recommend BILL for businesses with scaling ambitions. The significant, user-reported risks related to its high TCO, hidden fees, and non-responsive support are too great. The potential for financial loss and operational chaos makes it a liability.

Final Verdict & Professional Recommendation

For finance leaders looking for a true, direct alternative to Tipalti's core function of AP automation, Stampli is the strongest contender. My analysis shows its workflow, support, and integration reliability are superior. It is the safest choice for companies where financial control is non-negotiable.

For those moving beyond just AP toward a modern, integrated spend culture, Airbase offers the most balanced feature set with a clear focus on control. The decision between these tools is a trade-off between specialized excellence (Stampli) and unified functionality (Airbase). The biggest mistake you can make is choosing a tool based on marketing instead of its proven ability to maintain financial control and data integrity.

Expert Recommendation

- For pure AP automation excellence: Choose Stampli for its best-in-class workflow and deep ERP integrations.

- For unified spend management: Select Airbase if you want a single platform for bill payments, corporate cards and expense management.

- Before making a decision: Verify any vendor's SOC 2 Type 2 compliance report and test their integration with your specific ERP setup.

Frequently Asked Questions (FAQ)

What is the main difference between AP automation and spend management?

AP automation focuses specifically on processing invoices and making bill payments. Spend management is a broader category that includes AP automation plus corporate cards, expense reimbursements, and procurement.

Is Brex a real Tipalti alternative?

It depends on your need. If you are looking for a tool for global mass payments and deep AP controls like Tipalti, then Brex is not a direct alternative. If you are a startup looking for a modern corporate card, then it is a contender.

How important is a native ERP integration?

A deep, native ERP integration is extremely important. It ensures that data syncs automatically and accurately between your systems, which eliminates manual work and reduces the risk of errors in your financial records.

What are the biggest hidden costs to watch for in AP software?

The biggest hidden costs are per-transaction fees and high foreign exchange (FX) markups on international payments. These can add up quickly and are often not clear in the initial pricing. Always ask a vendor for a TCO analysis based on your specific transaction volume.

Important Disclaimers:

Technology Evolution Notice:

The information about Best Tipalti Alternatives and AI Finance Tools tools presented in this article reflects our thorough analysis as of 2025. Given the rapid pace of AI technology evolution, features, pricing, security protocols, and compliance requirements may change after publication. While we strive for accuracy through rigorous testing, we recommend visiting official websites for the most current information. For those interested in a comprehensive evaluation of financial tools, a detailed Tipalti Review can provide insights into its functionality and value compared to alternatives. Additionally, staying informed about updates and innovations in this space will help users make informed decisions tailored to their needs. As technology continues to advance, being proactive in research will ensure optimal utilization of these financial solutions.

Professional Consultation Recommendation:

For AI Finance Tools applications with significant professional, financial, or compliance implications, we recommend consulting with qualified professionals who can assess your specific requirements and risk tolerance. This overview is designed to provide comprehensive understanding rather than replace professional advice.

Testing Methodology Transparency:

Our analysis is based on hands-on testing, official documentation review, and industry best practices current at the time of publication. Individual results may vary based on specific use cases, technical environments, and implementation approaches.

Leave a Reply