Is Koinly the Right Crypto Tax Tool for You?

Take This Quick Quiz to Find Out!

Key Takeaways

- AI-Powered Simplicity: Koinly automates complex crypto tax calculations using artificial intelligence, eliminating manual tracking and reducing errors

- Comprehensive Coverage: Supports DeFi transactions, NFT trades, staking rewards, and over 350+ exchanges with professional tax report generation

- Security First: Uses read-only API connections and never requests private keys, ensuring your crypto assets remain completely secure

- Free Testing: Generous free plan allows complete testing with up to 200,000 transactions before purchase, ensuring accuracy

- Global Compliance: Generates country-specific tax reports for 20+ countries with direct integration into popular tax software

What is Koinly and how does it work for crypto tax reporting?

Koinly is a specialized AI-powered crypto tax software designed to simplify the complex process of calculating and reporting cryptocurrency taxes for individuals and businesses. This innovative platform leverages artificial intelligence to automate the tedious work of tracking crypto activity across various exchanges, wallets, and blockchain platforms, making it an essential tool in the AI Finance Tools ecosystem.

The Koinly system operates through streamlined steps. First, you securely connect your crypto accounts—including major exchanges like Binance, Coinbase, or Kraken, as well as DeFi wallets like MetaMask—using read-only API keys or public wallet addresses. Koinly then automatically imports your complete transaction history, including trades, deposits, withdrawals, staking rewards, and DeFi interactions.

Second, Koinly's AI engine processes this data by reconciling transactions, matching transfers between your own wallets, and calculating capital gains and losses for every trade. The platform supports various cost basis methods required by different tax jurisdictions, including FIFO (First In, First Out), LIFO (Last In, First Out), and HIFO (Highest In, First Out).

Finally, Koinly generates compliant tax reports specific to your country's requirements. For US users, this includes IRS Form 8949 and Schedule D, while international users receive reports like the UK's Capital Gains Summary or Canada's Schedule 3. These professionally formatted reports are ready for filing with your tax return or sharing with your accountant, eliminating hours of manual calculation work.

Trusted by hundreds of thousands of crypto investors and tax professionals worldwide

Is Koinly FAQs safe and legitimate for handling sensitive financial data?

Yes, Koinly is a legitimate and widely trusted platform used by hundreds of thousands of crypto investors, tax professionals, and accountants worldwide. The software prioritizes security and data privacy through multiple layers of protection, making it a reliable choice among AI Finance Tools for crypto tax management. Additionally, Koinly offers a user-friendly interface that simplifies the tax reporting process, allowing users to efficiently track their crypto transactions and generate necessary reports. Many users praise the platform in their Koinly Review, highlighting its seamless integration with various exchanges and wallets, which enhances the overall user experience. With robust customer support and regular updates, Koinly continues to evolve, ensuring compliance with changing tax regulations.

The platform's most critical security feature is its connection methodology. When syncing with exchanges, Koinly uses read-only API keys, which means the platform can view your transaction history but cannot access your funds, execute trades, or access sensitive personal information. For blockchain wallets, you simply provide public wallet addresses—information that's already publicly available on the blockchain—which grants no access to your actual assets. Importantly, Koinly will never request your private keys, seed phrases, or exchange login credentials.

From a data protection standpoint, Koinly employs enterprise-grade encryption for all user data and maintains compliance with international privacy regulations including GDPR. The platform offers two-factor authentication (2FA) for enhanced account security and maintains transparent privacy policies outlining data usage practices.

The company has established credibility through partnerships with major accounting firms and tax professionals who recommend the platform to their clients. Additionally, Koinly has processed billions of dollars worth of crypto transactions without security incidents, demonstrating its reliability in handling sensitive financial data. However, users should always maintain good security practices on their own exchange accounts and never share private keys with any third-party service.

GDPR compliant with enterprise-grade encryption and read-only API connections

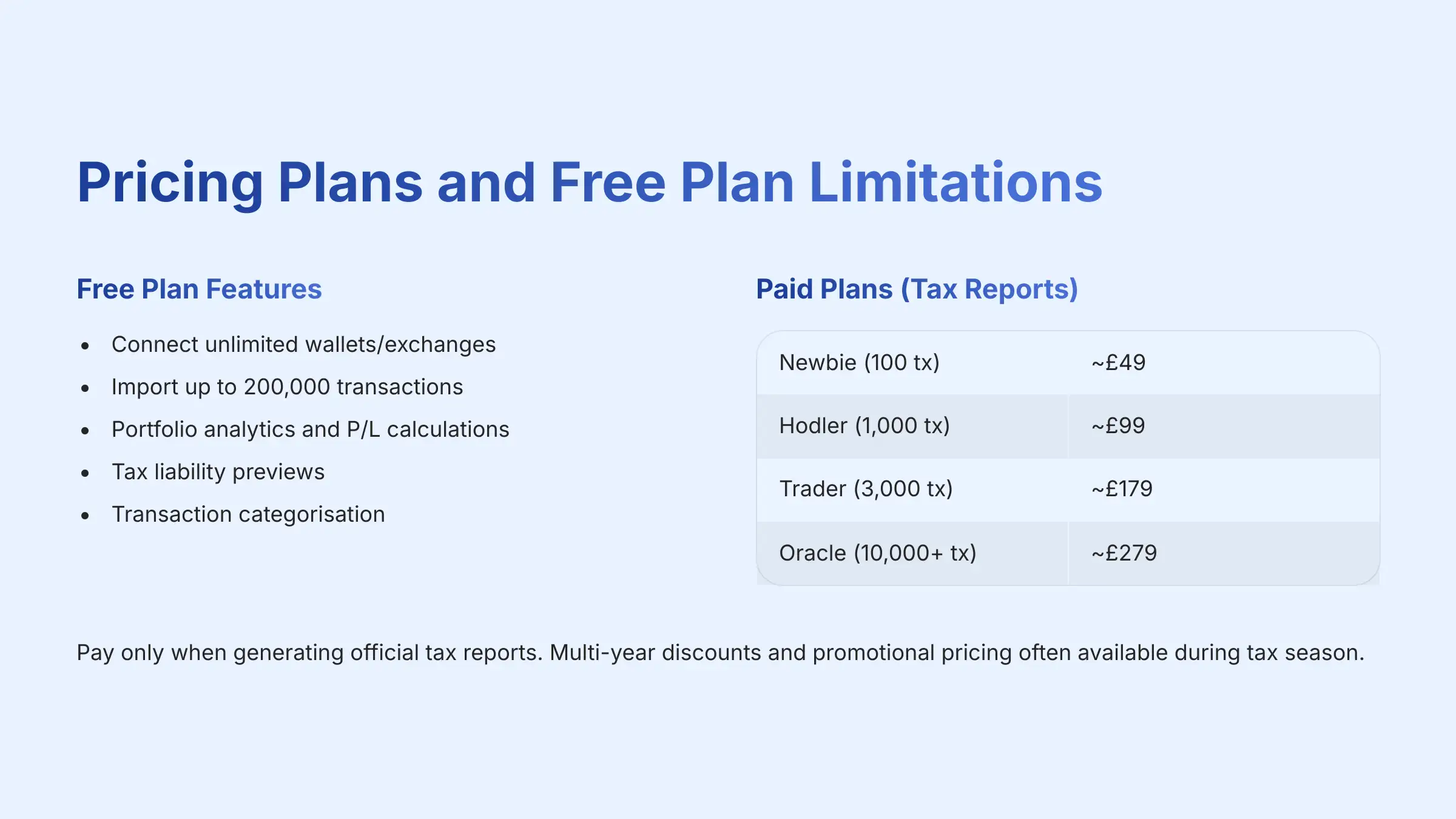

What are the Koinly FAQs pricing plans and free plan limitations?

Koinly operates on a transparent freemium model that allows extensive testing before purchase, making it accessible for users evaluating AI Finance Tools for crypto tax management. The pricing structure is based solely on transaction volume rather than features, ensuring fair and predictable costs.

The free plan is exceptionally robust for portfolio tracking and evaluation purposes. Users can connect unlimited wallets and exchanges, import up to 200,000 transactions, and access comprehensive portfolio analytics including real-time profit/loss calculations, tax liability previews, and transaction categorization. This generous free tier allows users to spend an entire tax year monitoring their portfolio, identifying data issues, and ensuring accuracy before committing to a purchase.

The cost structure only applies when generating official tax reports for filing. Paid plans are tiered based on transaction count:

- Newbie Plan: Up to 100 transactions (~$49)

- Hodler Plan: Up to 1,000 transactions (~$99)

- Trader Plan: Up to 3,000 transactions (~$179)

- Oracle Plan: Up to 10,000+ transactions (~$279)

Pricing ranges from approximately $49 for basic plans to $179 for high-volume traders, with the exact cost depending on your total transaction count for the tax year.

This model is particularly user-friendly because you can fully test Koinly's accuracy with your actual data, resolve any issues, and verify tax calculations before paying. The platform clearly displays your transaction count on the dashboard, making it easy to select the appropriate plan. Additionally, Koinly offers multi-year discounts and often provides promotional pricing during tax season, making it cost-effective compared to hiring tax professionals for complex crypto portfolios.

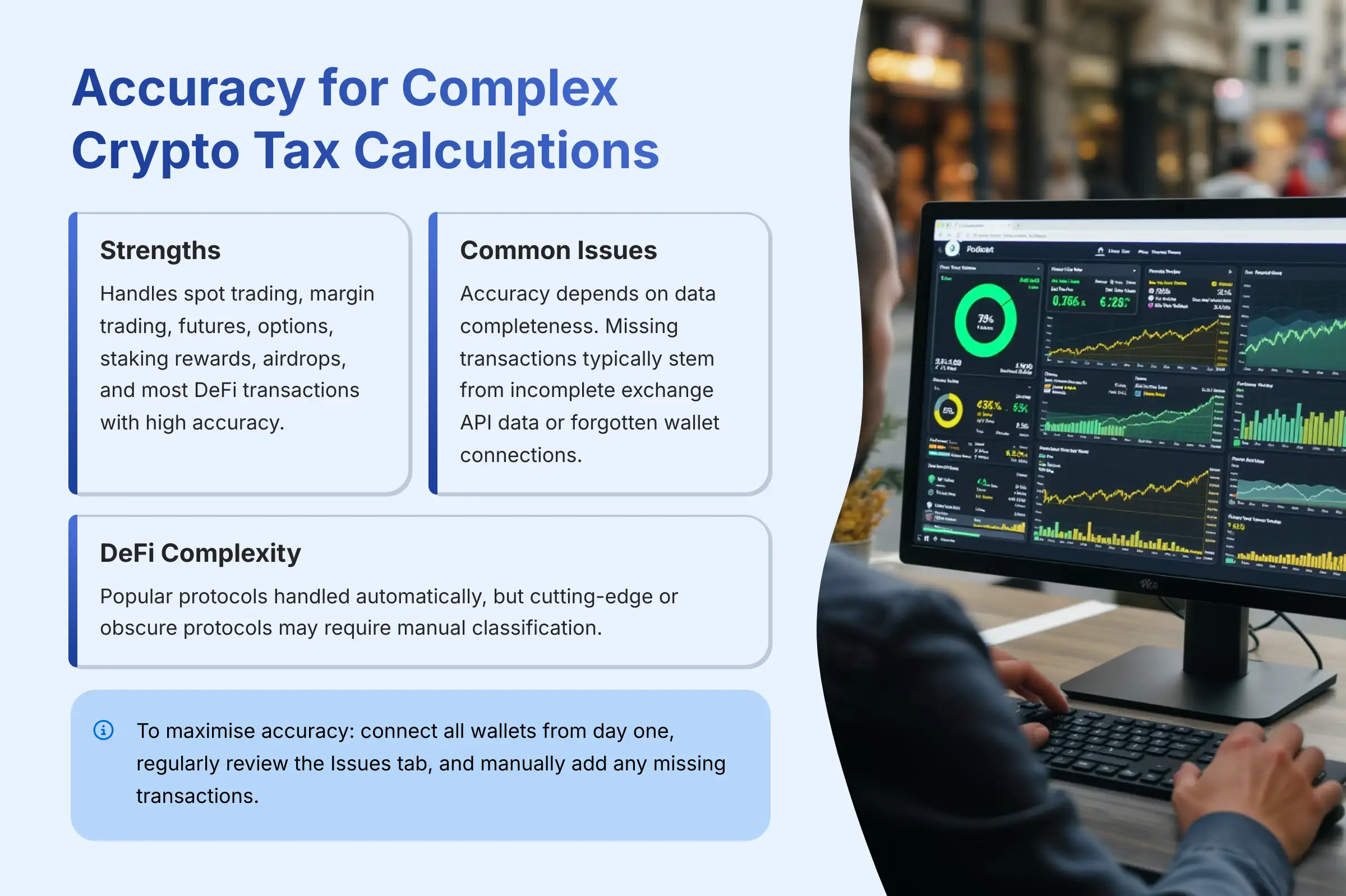

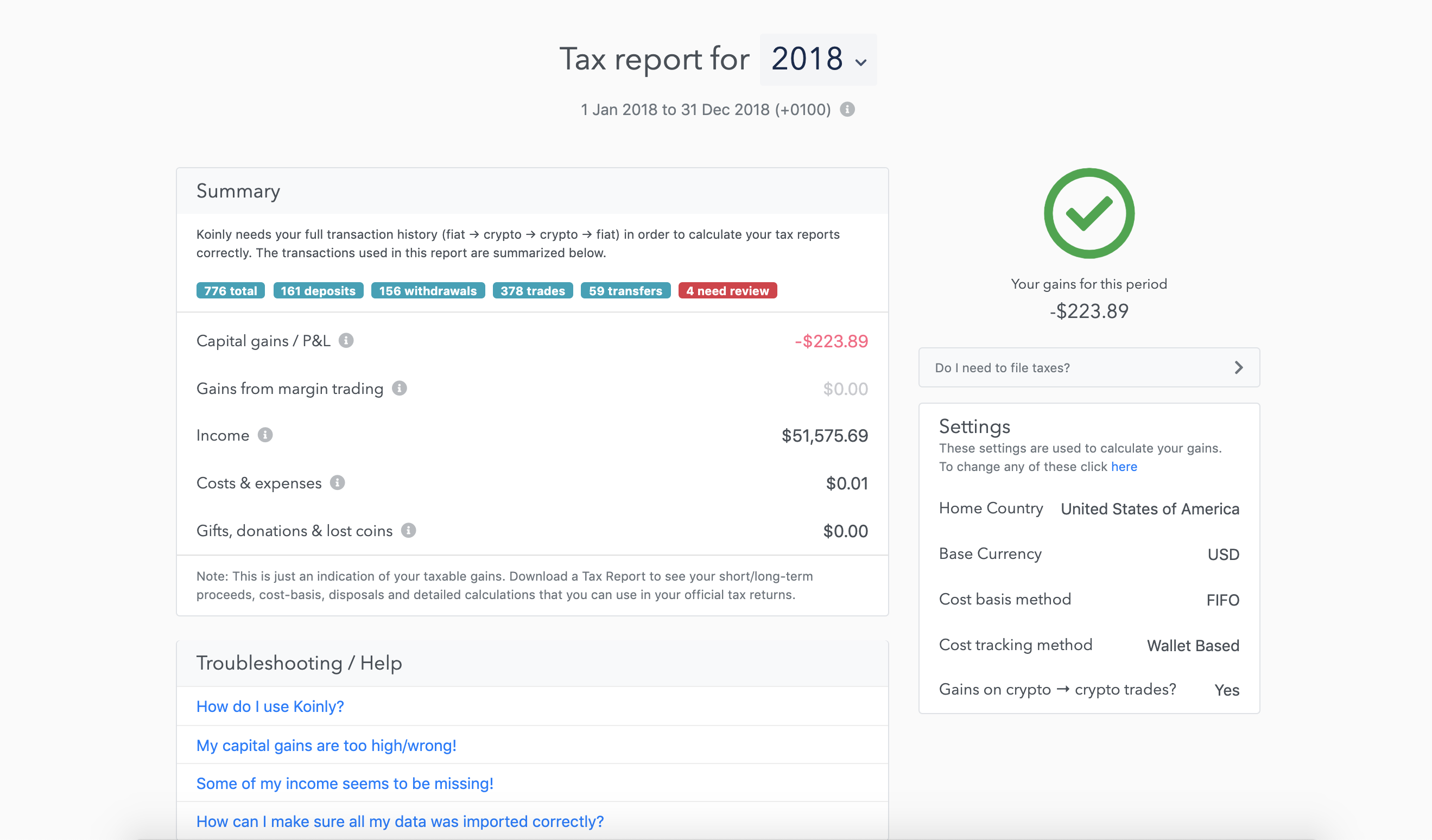

How accurate is Koinly FAQs for complex crypto tax calculations?

Koinly delivers high accuracy for crypto tax calculations, but its precision fundamentally depends on the completeness and quality of data provided. As one of the leading AI Finance Tools for crypto taxation, Koinly's sophisticated algorithms can handle complex scenarios, but users must understand both its capabilities and limitations. To maximize the benefits of Koinly, users are encouraged to explore the extensive resources available, including Koinly Tutorials and Usecase, which provide valuable insights into effectively navigating the platform. By familiarizing themselves with these tutorials, users can better understand how to input data accurately and leverage all of Koinly's features. This knowledge not only enhances the accuracy of tax calculations but also empowers users to make informed decisions in their crypto investments.

The platform excels at standard crypto activities including:

- Spot trading across all major exchanges

- Margin trading and futures contracts

- Options trading and derivatives

- Staking rewards and validator income

- Airdrops and hard fork distributions

- Most DeFi transactions and yield farming

Koinly's AI engine automatically categorizes transactions, matches transfers between wallets, and applies appropriate tax treatments based on your jurisdiction's rules. The software handles complex cost basis calculations, wash sale rules (where applicable), and can process transactions across multiple blockchains simultaneously.

Common accuracy issues typically stem from incomplete data rather than calculation errors. Missing transactions occur when exchange APIs don't provide complete historical data, users forget to connect old wallets, or manual transactions aren't properly recorded. Koinly addresses this through its comprehensive “Issues” dashboard, which flags problems like negative balances, unmatched transfers, or transactions requiring review.

For complex DeFi activities like liquidity mining, yield farming, or interactions with newer protocols, some manual review may be necessary. While Koinly automatically handles popular DeFi protocols on major chains, cutting-edge or obscure protocols might require manual classification. The platform provides flexible labeling options and detailed transaction editing capabilities to ensure accurate tax treatment.

To maximize accuracy, users should connect all wallets and exchanges from day one, regularly review the Issues tab, and manually add any missing transactions. Cross-referencing with exchange CSV exports can help identify gaps in automated data collection.

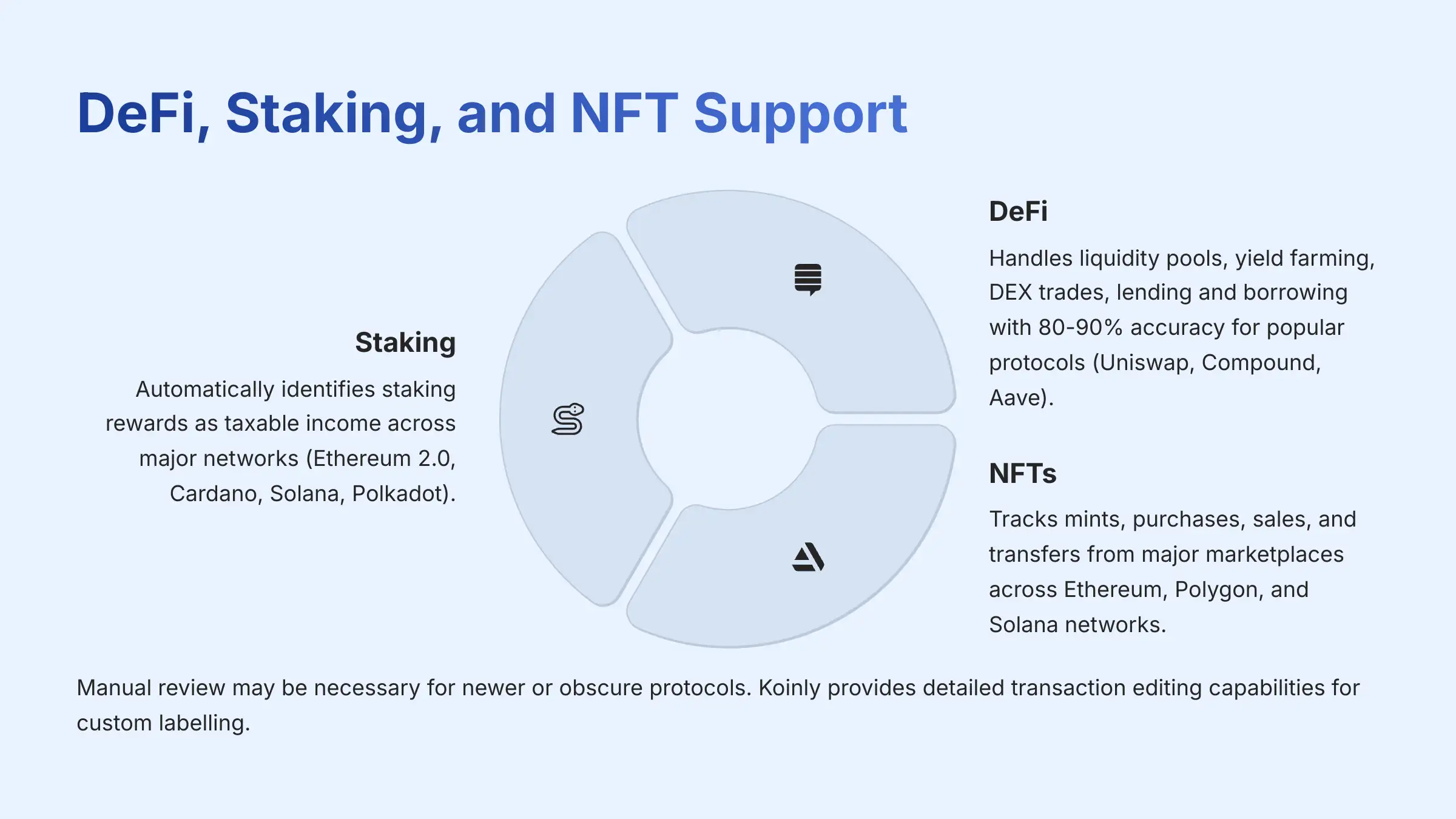

Can Koinly FAQs handle DeFi transactions, staking, and NFT trades?

Koinly offers comprehensive support for DeFi (Decentralized Finance) transactions, staking activities, and NFT trades, positioning it as one of the most capable AI Finance Tools for modern crypto tax reporting. However, the complexity of these activities often requires some user oversight to ensure proper classification. In addition to its robust DeFi support, Koinly provides a user-friendly interface that simplifies the process of tracking and managing crypto investments. The platform integrates seamlessly with various exchanges and wallets, making tax reporting more straightforward for users. For a deeper understanding of its capabilities, a detailed Koinly Overview and Features can be explored to maximize the benefits of this powerful tool.

Staking and Validator Rewards

For staking activities, Koinly automatically identifies most staking rewards and properly categorizes them as taxable income, which is the correct treatment in most jurisdictions. The platform supports staking across major networks including:

- Ethereum 2.0 staking rewards

- Cardano (ADA) delegation rewards

- Solana (SOL) staking yields

- Polkadot (DOT) nomination rewards

- Cosmos ecosystem staking

- Tezos baking rewards

The platform automatically calculates the fair market value of rewards at the time of receipt, ensuring accurate income reporting.

DeFi Protocol Support

DeFi transactions present more complexity due to their varied nature. Koinly handles liquidity pool activities by recognizing “add liquidity” and “remove liquidity” transactions, ensuring they're not mistakenly treated as taxable trades. The platform correctly identifies:

- Yield farming rewards from protocols like Compound and Aave

- DEX trades on Uniswap, SushiSwap, and PancakeSwap

- Lending and borrowing activities

- Liquidity mining incentives

- Flash loan transactions

- Cross-chain bridge transfers

For popular protocols like Uniswap, Compound, Aave, and SushiSwap, Koinly's AI typically achieves 80-90% accuracy in automatic classification.

NFT Transaction Handling

NFT support includes comprehensive tracking of mints, purchases, sales, and transfers. Koinly recognizes NFT transactions from major marketplaces like OpenSea, Foundation, and SuperRare across Ethereum, Polygon, and Solana networks. The platform correctly calculates capital gains by tracking acquisition costs (including gas fees) and sale proceeds.

For newer or more obscure DeFi protocols, manual review may be necessary. Koinly provides detailed transaction editing capabilities, allowing users to apply custom labels, adjust transaction types, and modify cost basis calculations. The key is ongoing maintenance—reviewing and properly categorizing complex transactions as they occur rather than waiting until tax season.

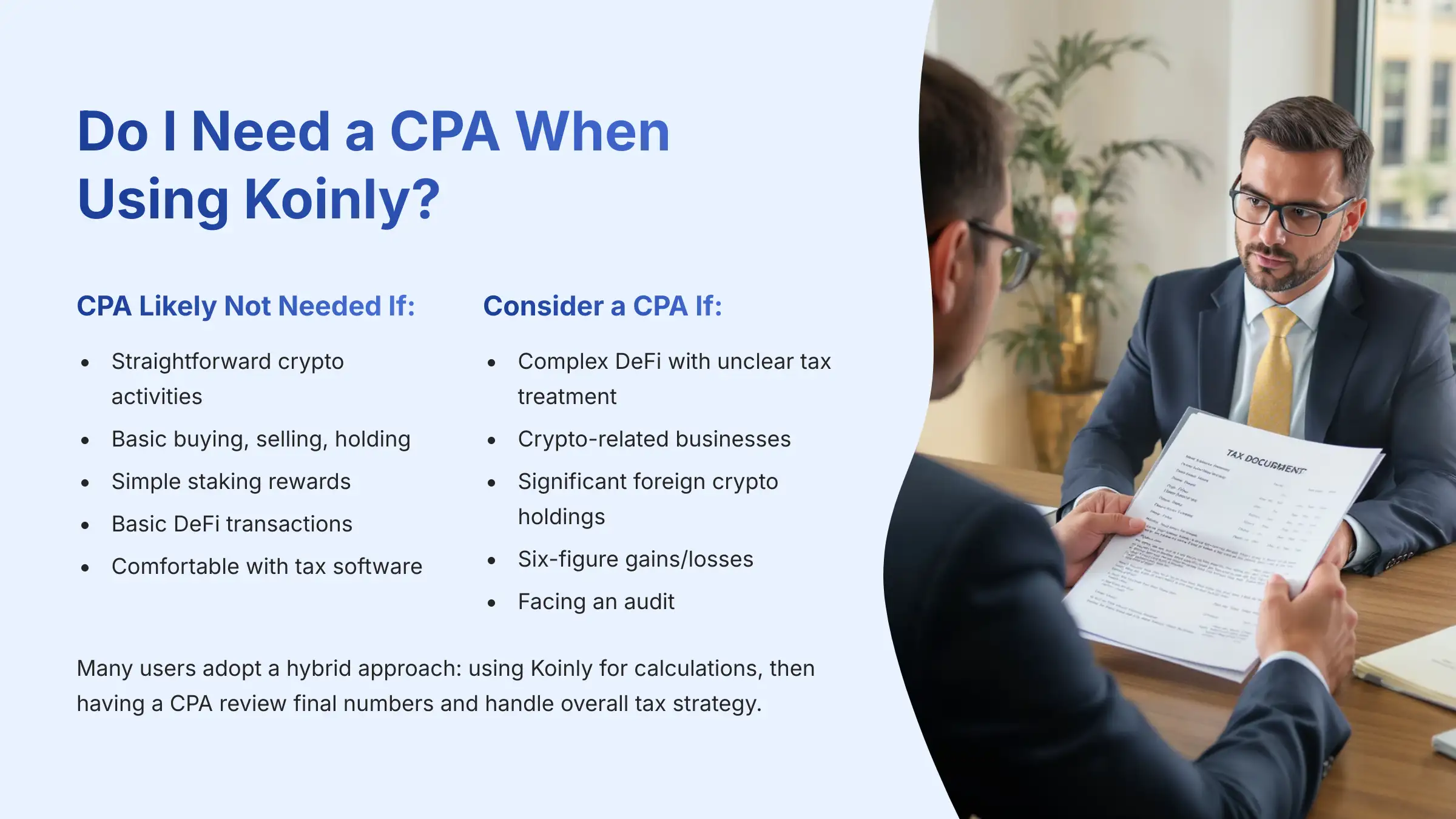

Do I need a CPA when using Koinly FAQs for crypto tax filing?

Whether you need a Certified Public Accountant (CPA) when using Koinly depends on your overall financial complexity and comfort level with tax preparation. Koinly generates IRS-compliant tax documents that are sufficient for most crypto tax situations, but professional guidance may be valuable in certain scenarios.

Koinly produces official tax forms including Form 8949 (Sales and Other Dispositions of Capital Assets) and Schedule D (Capital Gains and Losses) for US taxpayers, with equivalent documents for other countries. These reports are professionally formatted and contain all necessary information for tax filing, meeting the same standards required by tax authorities.

When You DON'T Need a CPA

You likely don't need a CPA if your situation involves:

- Straightforward crypto activities like buying, selling, and holding cryptocurrencies

- Basic staking rewards that Koinly automatically categorizes

- Simple DeFi transactions that the platform handles automatically

- Standard trading activities across major exchanges

- Total crypto gains/losses under $10,000 annually

The platform's reports integrate seamlessly with popular tax software like TurboTax or H&R Block, making self-filing straightforward.

When You SHOULD Consider a CPA

Consider consulting a CPA if you have:

- High-volume complex DeFi activities with unclear tax treatment

- Crypto-related business operations or mining activities

- Significant foreign crypto holdings requiring additional reporting

- Six-figure gains and losses requiring professional review

- Audit concerns or questions about specific transaction classifications

- Multiple income sources beyond cryptocurrency

Many users find a hybrid approach most cost-effective: using Koinly to organize and calculate crypto taxes, then having a CPA review the final numbers and handle overall tax strategy. This approach leverages Koinly's efficiency while ensuring professional oversight, typically reducing CPA fees significantly compared to having them manually process raw transaction data. The key is that Koinly transforms hours of expensive manual accounting work into a quick professional review.

How do I file taxes using Koinly FAQs reports?

Filing taxes with Koinly reports is straightforward, with multiple options designed to integrate seamlessly into existing tax preparation workflows. As one of the most user-friendly AI Finance Tools for crypto taxation, Koinly provides flexible filing methods to accommodate different preferences and situations.

Direct Tax Software Integration

The most popular method is direct integration with major tax software platforms. Koinly offers specific export formats for:

- TurboTax (TXF format)

- H&R Block (CSV import)

- FreeTaxUSA (direct integration)

- TaxAct (compatible formats)

- Other leading tax preparation services

Simply download the appropriately formatted file from Koinly and import it directly into your tax software. This automatically populates all capital gains and income information in the correct fields, eliminating manual data entry and reducing errors.

Paper Filing Options

For those filing paper returns, Koinly generates PDF versions of all required forms including Form 8949 and Schedule D. These professionally formatted documents can be printed and included with your mailed tax return. The forms contain all necessary transaction details organized exactly as the IRS requires.

Professional Tax Preparer Collaboration

Professional tax preparers can access your Koinly data through the platform's accountant invitation feature. This allows you to grant read-only access to your CPA or tax professional, enabling them to review your transaction history, verify calculations, and download reports in their preferred format. This streamlines collaboration and ensures your tax professional has complete information.

International Tax Reporting

For international users, Koinly generates country-specific reports meeting local tax authority requirements. The platform supports tax reporting for over 20 countries, including specialized formats for:

- UK's HMRC (Capital Gains Summary)

- Canada's CRA (Schedule 3)

- Australia's ATO (CGT forms)

- Germany's tax authorities

- France's tax requirements

Before filing, always review Koinly's final tax summary to understand your total gains, losses, and income. The platform provides detailed breakdowns by transaction type, helping you understand the components of your tax liability and ensuring accuracy before submission.

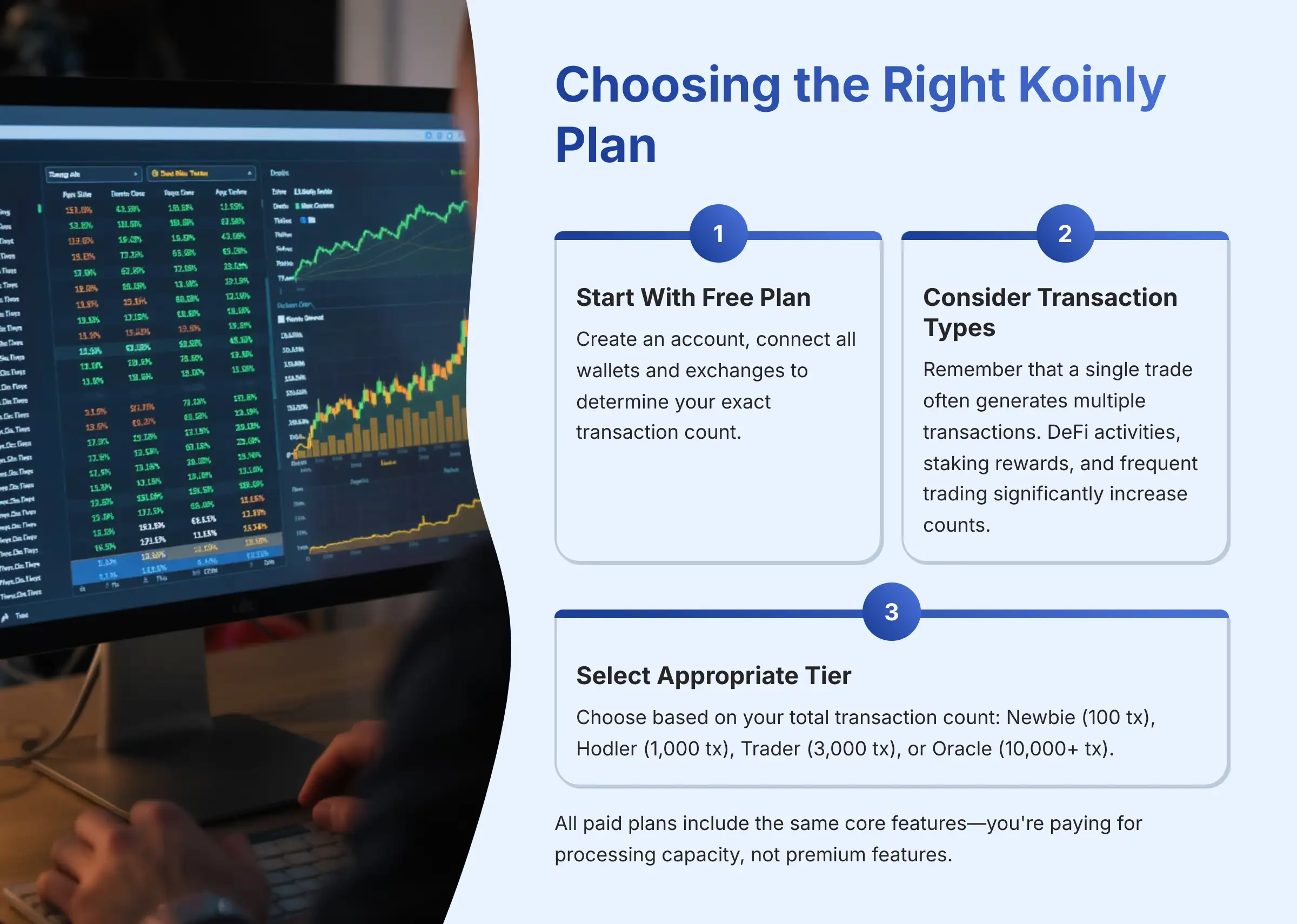

Which Koinly FAQs plan should I choose based on my trading activity?

Selecting the right Koinly plan is straightforward since pricing is based entirely on your transaction volume rather than feature limitations. This transparent structure makes Koinly one of the most predictable AI Finance Tools for crypto tax planning, allowing you to determine exact costs before purchasing.

Start with the Free Plan

The optimal approach is to start with Koinly's free plan to determine your exact transaction count. Create an account, connect all your wallets and exchanges, and let the platform import your complete transaction history. Koinly will display your total transaction count for each tax year on the main dashboard, providing the precise information needed to select the appropriate paid plan.

Plan Tiers and Pricing

Plan tiers typically include:

- Newbie: Up to 100 transactions (~$49)

- Hodler: Up to 1,000 transactions (~$99)

- Trader: Up to 3,000 transactions (~$179)

- Oracle: 10,000+ transactions (~$279)

These prices may vary based on promotions and specific features included in each tier.

Important Transaction Count Considerations

Important considerations when evaluating transaction counts:

- A single trade often generates multiple transactions (buy order, fee transaction, possible transfer)

- Your transaction count is typically higher than your trade count

- DeFi activities significantly increase transaction volumes

- Staking rewards create frequent small transactions

- Each individual staking reward, liquidity pool interaction, or token swap counts as a separate transaction

Free Plan Benefits

The free plan's 200,000 transaction limit for portfolio tracking means most users can spend the entire year monitoring their data accuracy before purchasing a plan. This allows you to:

- Identify and resolve any data issues

- Ensure complete transaction coverage

- Test platform accuracy with your specific situation

- Purchase the correct tier based on complete information

All paid plans include the same core features—professional tax reports, unlimited customer support, and access to all advanced tools. You're paying for processing capacity, not premium features, making the decision purely based on your activity level rather than trying to evaluate feature trade-offs.

Can Koinly FAQs track NFT transactions and calculate accurate tax implications?

Koinly provides comprehensive NFT (Non-Fungible Token) tracking and tax calculation capabilities, making it one of the few AI Finance Tools that properly handles the unique tax implications of digital collectibles and art transactions. The platform supports NFT activities across major blockchains and marketplaces with both automated detection and manual classification options.

NFT Purchase and Sale Tracking

For NFT purchases and sales, Koinly automatically tracks acquisition costs including the purchase price and associated gas fees, which become part of your cost basis. When you sell an NFT, the platform calculates capital gains or losses by subtracting your total cost basis from the sale proceeds. This includes properly accounting for:

- Initial purchase price or mint cost

- Gas fees for minting and transactions

- Marketplace fees and commissions

- Creator royalties on secondary sales

- Transaction costs that affect net proceeds

NFT Minting Tax Treatment

NFT minting presents unique tax scenarios that Koinly handles appropriately. When you mint an NFT, the gas fees paid become your cost basis in the newly created asset. If you later sell the minted NFT, Koinly calculates your gain based on this cost basis. For creators who mint NFTs as part of their business, the platform can categorize minting activities as business expenses or inventory, depending on your tax situation.

Supported NFT Marketplaces and Networks

The platform automatically recognizes NFT transactions from major marketplaces including:

- OpenSea (Ethereum, Polygon, Solana)

- Foundation (Ethereum)

- SuperRare (Ethereum)

- Magic Eden (Solana)

- LooksRare (Ethereum)

- Rarible (Ethereum, Polygon)

- X2Y2 (Ethereum)

Koinly supports NFT tracking across multiple networks including Ethereum, Polygon, Solana, and additional Layer 2 solutions. The platform's AI identifies these transactions and applies appropriate tax treatments, distinguishing NFTs from regular cryptocurrency transactions.

Special NFT Tax Considerations

Airdropped or gifted NFTs require careful handling, and Koinly allows you to set appropriate cost basis values—either fair market value at receipt (creating taxable income) or zero basis, depending on your jurisdiction's treatment of gifts and airdrops.

For less common NFT activities or newer marketplaces, manual classification may be necessary. Koinly provides detailed editing capabilities allowing you to:

- Mark specific tokens as NFTs

- Adjust cost basis calculations

- Properly categorize complex transactions like NFT fractionalization

- Handle NFT lending and borrowing activities

- Process batch minting operations

The platform also handles advanced NFT scenarios like fractional ownership, NFT-backed loans, and cross-chain NFT transfers, ensuring comprehensive tax coverage for all types of digital asset activities.

Our Methodology

This comprehensive guide to Koinly cryptocurrency tax software is based on extensive research and testing of the platform's capabilities. Our analysis includes hands-on experience with the software, review of official documentation, consultation with tax professionals, and evaluation of user feedback from the crypto community.

We evaluated Koinly's features across multiple criteria including accuracy, ease of use, security measures, customer support, and integration capabilities. All pricing information and feature descriptions are current as of 2025 and verified through official sources.

Why Trust This Guide?

This guide combines expert analysis with practical experience to provide accurate, actionable information about crypto tax reporting. We maintain strict editorial standards and regularly update our content to reflect the latest developments in cryptocurrency taxation and software capabilities.

Our team has extensive experience in both cryptocurrency investing and tax preparation, ensuring that our recommendations are based on real-world usage rather than theoretical analysis. We prioritize transparency and accuracy in all our evaluations.

Comprehensive analysis based on extensive testing and professional tax expertise

Leave a Reply