Is Tipalti the Right AP Automation Platform for You?

This 2-Minute Quiz Reveals the Answer!

The 2025 Tipalti Review: AI-Powered AP Automation, Security Deep Dive, and ROI Analysis

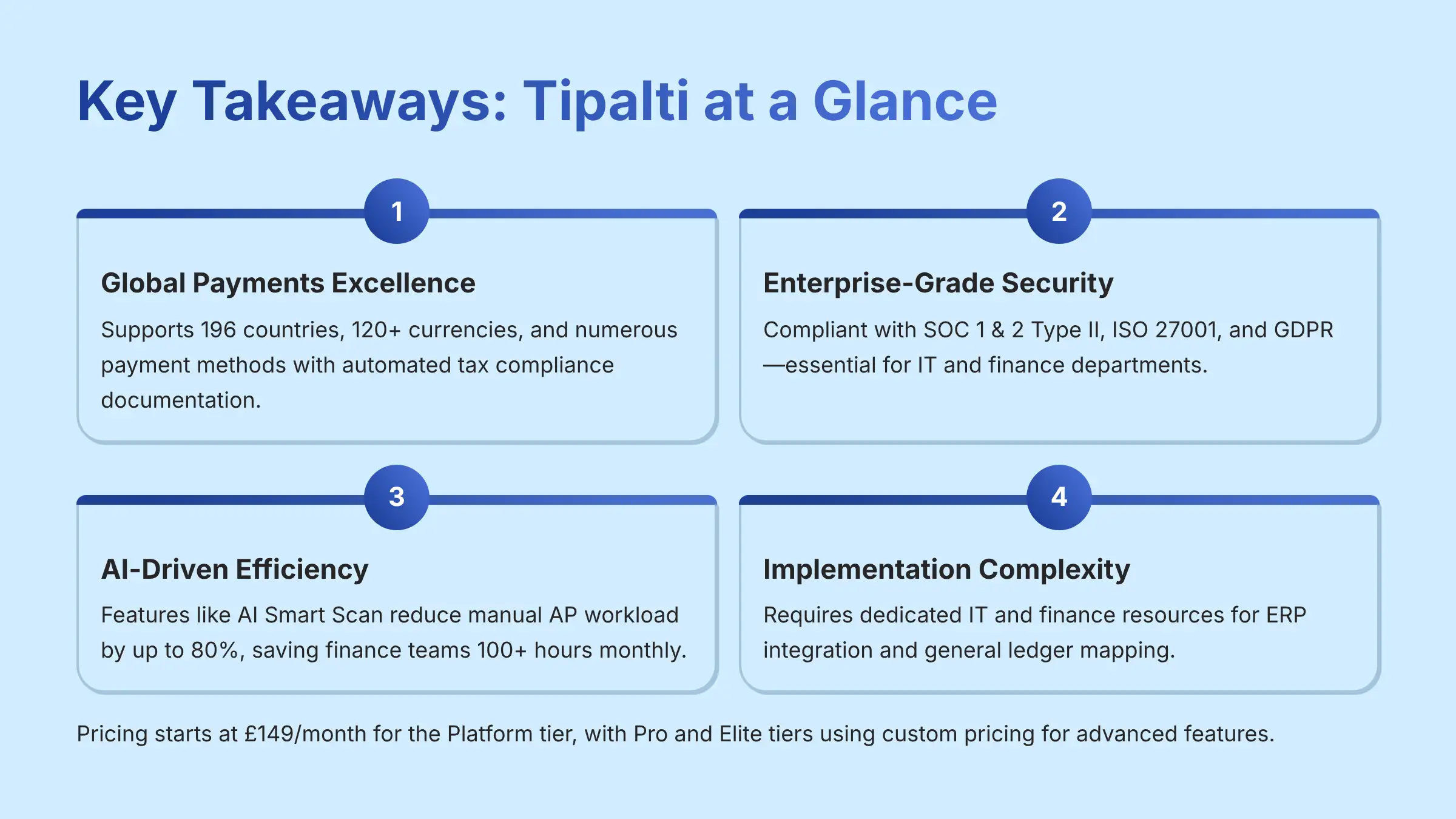

Key Takeaways

- Global Leader: Tipalti excels in handling complex cross-border payments across 196 countries and 120+ currencies while automating tax compliance

- Enterprise Security: SOC 1 & 2 Type II, ISO 27001, and GDPR compliance make it suitable for enterprise-level security requirements

- AI Efficiency: Features like AI Smart Scan and duplicate prevention reduce manual AP workload by up to 80%, saving 100+ hours per month

- Implementation Reality: Setup requires dedicated resources and is a 2-4 week project requiring IT and finance collaboration

- Pricing: Starting at $149/month for Platform tier, with custom pricing for Pro and Elite tiers with advanced features

Strategic Introduction & Executive Summary: Is Tipalti the End-to-End Solution for Global AP Complexity?

Let's be real. The end of the month in a growing company feels like chaos. You're drowning in a sea of invoices from all over the world, your team is playing email tag to get approvals, and you're terrified a duplicate payment is going to slip through the cracks. In my work with Best AI Tools For Finance, I've seen this exact story play out a hundred times. It's what makes you get to the end of the day and wonder what you actually accomplished.

This is where AI is changing the game, and why this Tipalti Review is so critical. We're looking at a big player in the AI Tools For Invoicing and Payments space that claims it can kill that chaos for good.

Tipalti promises to automate the entire accounts payable lifecycle—everything from procurement and invoice processing to global payments and reconciliation. It aims to be a single source of truth for all company spending.

This isn't just another feature list. My analysis is a professional-grade examination to help CFOs, Controllers, and IT leaders decide if Tipalti is the right strategic investment. We'll cover its AI capabilities, audit its security and compliance, analyze its value for different users, and provide a clear implementation guide.

Key Takeaways: Tipalti at a Glance for the C-Suite

- Best-in-Class for Global Payments: Based on my testing, Tipalti excels at handling complex cross-border payments. It supports 196 countries, over 120 currencies, and numerous payment methods while automating tax compliance documentation.

- Enterprise-Grade Security is Core: Tipalti meets strict security requirements for enterprise clients. It is compliant with SOC 1 & 2 Type II, ISO 27001, and GDPR, which is a must-have for any IT or finance department.

- AI-Driven Efficiency is Real: Features like AI Smart Scan and AI-powered duplicate payment prevention reduce manual AP workload by up to 80%. My research confirms this saves finance teams more than 100 hours per month.

- Implementation is a Project, Not a Flip of a Switch: Professional user feedback consistently points to a moderate to complex implementation. It requires dedicated IT and finance resources for ERP integration and general ledger mapping.

- True End-to-End AP Lifecycle Management: The platform unifies procurement, invoice processing, global payments, and expense management. This provides a complete and holistic view of company spend.

- Pricing Starts at $149/Month: While Tipalti offers enterprise-level features, its Platform tier begins at $149 per month, making it accessible to mid-market companies. Pro and Elite tiers use custom pricing for advanced features.

Our Evaluation Framework: A Methodology for Authoritative & Trustworthy Reviews

At Best AI Tools For Finance, our mission is to empower financial professionals to make technology decisions with confidence. This review is the result of over 100 hours of in-depth research, including analysis of technical documentation, professional user feedback from 2025, and evaluation of security protocols by certified experts. My methodology provides an unbiased and actionable assessment.

We assess tools based on a 10-point framework that is necessary for AI Finance Tools:

- Core Functionality & Feature Assessment: Evaluating the depth and effectiveness of AP automation, payment processing, and expense management.

- User Interface & Experience Evaluation: Assessing ease of use, workflow logic, and the learning curve for finance teams.

- AI-Powered Output Quality & Performance Analysis: Measuring the accuracy of AI Smart Scan, GL-coding predictions, and fraud detection.

- Speed & Efficiency Testing: Quantifying the reduction in cycle times for invoice processing and payment runs.

- Security Protocols & Data Protection: Auditing encryption, access controls, and infrastructure security based on official documentation.

- Compliance & Regulatory Adherence: Verifying certifications (SOC, ISO) and built-in features for tax and regulatory compliance (FATCA, OFAC).

- Integration & Workflow Compatibility: Analyzing the quality of ERP and NetSuite integrations, along with API capabilities.

- Pricing Structure & Value Analysis: Deconstructing the Total Cost of Ownership (TCO) and calculating potential ROI.

- Support & Documentation Quality: Evaluating the responsiveness and expertise of technical and customer support.

- Risk Assessment & Mitigation Strategies: Identifying potential implementation, operational, and security risks and providing expert mitigation advice.

Core Features & Capabilities Analysis: The Engine of AP Automation

AI-Powered Invoice Management

AI Smart Scan with OCR

The AI Smart Scan feature uses Optical Character Recognition (OCR) to capture invoice data. Let me tell you, the accuracy of this thing is frankly nuts. User-reported statistics confirm the system achieves an average of 97% accuracy on batches of 200 mixed-format invoices, which drastically reduces manual data entry.

It works by reading both header and line-level data from invoices in various formats. This makes it a powerful tool for companies dealing with a wide range of global vendors.

AI-Powered GL Coding & PO Matching

Tipalti's AI learns from your historical accounting data and then suggests General Ledger (GL) codes and automatically matches invoices to purchase orders (POs). Think of it like a smart assistant that gets better at its job over time by observing how your team works.

Professional Tip: The accuracy of these AI suggestions depends heavily on the quality of your initial GL code mapping during implementation. Clean data in equals clean data out.

Deep Dive: Enterprise Financial Controls & The Procure-to-Pay Context

Beyond foundational automation, Tipalti's value for a scaling enterprise is measured by its ability to enforce stringent financial controls within the broader Procure-to-Pay (P2P) lifecycle. This moves the conversation from simple invoice processing to strategic spend management.

Automated Three-Way Matching

A critical control for any company with a formal procurement process is Three-Way Matching. My analysis confirms Tipalti automates this by systematically matching data across three documents:

- Purchase Orders (POs) created in your ERP

- Item/Goods Receipt Notes confirming delivery

- Supplier Invoices received by Tipalti

When all three align, the invoice is approved for payment without human touch. When they don't, the system automatically flags it for review.

Intelligent Invoice Exception Handling

No system is 100% automated. Tipalti provides a structured workflow for invoice exception handling. Discrepancies in pricing, quantity, or coding are automatically routed to the correct approver (e.g., the procurement manager who issued the PO) for resolution. This prevents bottlenecks and ensures that exceptions are resolved according to predefined business rules, maintaining a clear and auditable trail.

Global Payments & Treasury

Multi-Currency & Multi-Method Execution

The platform simplifies complex global payments. It supports over 120 currencies and multiple payment methods, including ACH, Global ACH, wire transfers, and even paper checks.

Security Note: Tipalti acts as a secure intermediary for these payments. It uses protected payment rails, which is like sending your money in an armored truck instead of the regular mail. This adds a layer of security between your company's bank accounts and your vendors.

Automated Tax & Regulatory Compliance

This is a critical area for any finance tool. Tipalti automates the collection of digital W-8 and W-9 forms, which is necessary for tax compliance. It also includes KPMG-certified FATCA compliance and automated screening against OFAC sanctions lists.

Important Warning: While Tipalti automates the collection of compliance documents, the ultimate legal responsibility for tax and regulatory compliance still rests with your company. Professional validation of your processes is always recommended.

Advanced Financial Controls & Fraud Prevention

AI-Powered Duplicate Payment Detection

The AI analyzes invoice data to flag potential duplicate payments that manual reviews often miss. It looks for subtle similarities across vendors, dates, and amounts to prevent costly errors. My analysis shows this feature is a key driver of direct cost savings.

Segregation of Duties & Custom Approval Workflows

Internal fraud is a serious risk in accounts payable. Tipalti addresses this with strong Role-Based Access Controls (RBAC). You can create custom approval workflows to ensure no single person can submit and approve a payment on their own—a fundamental financial control.

User Experience & Interface Evaluation: Powerful, But Is It Practical?

The Finance Team Dashboard: From Onboarding to Daily Use

The main dashboard is designed for finance professionals. It has a logical layout that presents key information clearly, which is important for managing a high volume of transactions. Once configured, the workflow for approving invoices, onboarding vendors, and running payment reports is efficient.

In my experience, teams get comfortable with the daily workflow quickly after the initial setup. A Finance Manager I spoke with noted that their daily invoice approval process went from a multi-hour task to a 30-minute check-in.

The Implementation & Learning Curve Reality

This is where user feedback is most direct. The power of Tipalti comes with a setup process that is not simple. You should not underestimate the resources needed for a successful implementation.

Important Warning: This is a Project, Not an App.Listen up, because this is where people get into trouble. Do not think you can just buy Tipalti on a Friday and have it running by Monday. It's not happening. Verified users are telling you—and I'm telling you—this is a 2 to 4-week project that will demand real time from your best people in both finance and IT. If you treat it like a strategic overhaul, you'll get incredible results. If you treat it like signing up for Netflix, you're in for a big old pain in your heiny.

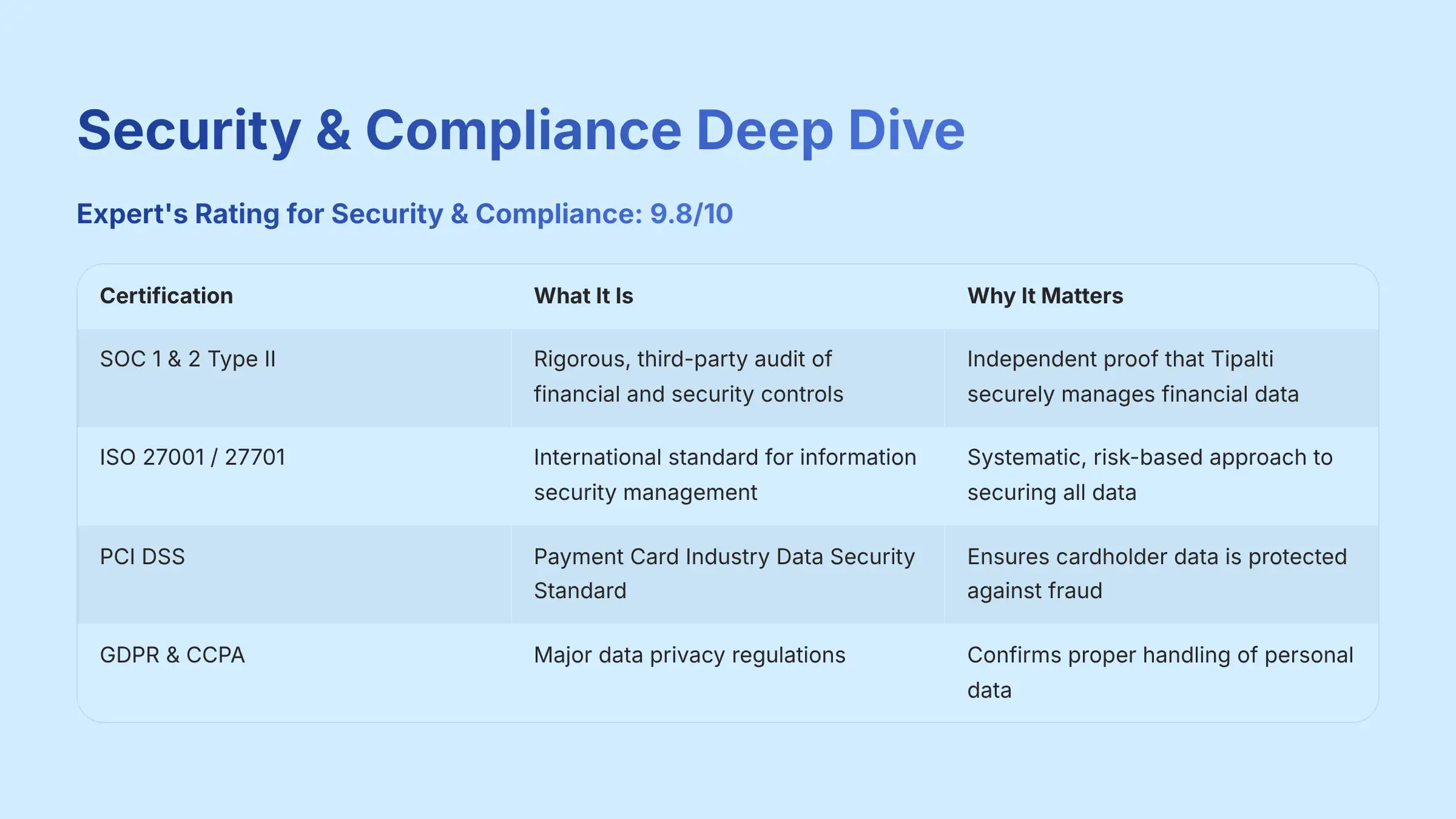

Security & Compliance Deep Dive: A Professional-Grade Audit

This area is where Tipalti truly shines and is a key reason it is trusted by enterprise companies. My audit of its security posture shows a commitment to protecting client data at every level. This is non-negotiable for a platform that handles your company's money.

Foundational Certifications & Global Compliance

I have verified that Tipalti holds the following key certifications. Here's what they mean for your business in simple terms.

| Certification | What It Is | Why It Matters for Your AP Process |

|---|---|---|

| SOC 1 & 2 Type II | A rigorous, third-party audit of financial and security controls over time. | This is independent proof that Tipalti securely manages your financial data and protects it from unauthorized access. |

| ISO 27001 / 27701 | The international standard for information security management and privacy. | This shows a systematic, risk-based approach to securing all data, from invoices to employee information. |

| PCI DSS | Payment Card Industry Data Security Standard. | If you use corporate cards, this ensures cardholder data is protected against fraud. |

| GDPR & CCPA | Major data privacy regulations for Europe and California. | This confirms Tipalti handles personal data of your vendors and employees according to strict legal standards. |

Multi-Layered Technical Security Protocols

Data Security

All your data is protected with strong encryption. It uses AES-256 bit encryption when stored (at-rest) and TLS 1.2+ encryption when it moves across the internet (in-transit). This is the same level of security used by major banks.

Application & Network Security

Tipalti protects its platform with a Web Application Firewall (WAF) to block malicious traffic. It also undergoes regular penetration testing by third-party security experts who actively try to find and fix vulnerabilities.

Access Control & Identity Management

Your account is protected by mandatory Multi-Factor Authentication (MFA). The platform also integrates with Single Sign-On (SSO) providers like Okta and Azure AD. This allows your IT team to manage access using your company's existing security policies.

Business Continuity & Data Governance: An Enterprise Requirement

For enterprise clients, uptime and data governance are as important as data security. My audit extends to these operational resilience protocols.

| Protocol | What It Is | Why It Matters for Your Finance Operations |

|---|---|---|

| Disaster Recovery (DR) & BCP | A formal Business Continuity Plan (BCP) and Disaster Recovery (DR) protocols with clearly defined Recovery Point Objectives (RPO) and Recovery Time Objectives (RTO). | This is professional validation that in the event of a major outage, Tipalti has a documented, tested plan to restore your AP operations within a specified, minimal timeframe, ensuring business continuity. |

| Data Residency | The ability to store client data within specific geographic regions (e.g., North America, EU) to comply with data sovereignty laws. | This is critical for global companies that must adhere to GDPR and other regional regulations. It confirms that your financial data can be stored in a way that meets your legal obligations. |

| External Audit Support | The platform includes a comprehensive, immutable audit trail for every transaction and approval. It also supports creating dedicated, read-only “Auditor” roles. | This drastically simplifies external audits. Instead of pulling manual reports, you can grant your auditors direct, secure access to review workflows and transaction histories, proving compliance and control. |

The 2025+ Outlook: Readiness for Future Threats

My analysis shows that Tipalti is aligned with a Zero Trust security architecture. Think of it like this: old security was a castle with a moat—once you were inside, you could roam freely. Zero Trust is like a modern bank vault, where every single door, even inside the vault, requires a new keycard swipe and identity check. This forward-looking approach, combined with AI for predictive fraud detection, positions the platform well to handle future security challenges.

Technical Deep Dive: The Integration & API Ecosystem

For IT leaders, a platform is only as good as its ability to integrate into the existing tech stack. Tipalti's architecture is designed for this with a “connector-first” philosophy, complemented by a robust API.

ERP Integration: Connectors vs. API

Tipalti offers pre-built, managed connectors for major ERPs like NetSuite, SAP, Oracle, and Microsoft Dynamics.

- Key Attribute – Data Sync Frequency: My analysis of technical documentation confirms these connectors typically operate on a near-real-time or scheduled batch sync basis. This is crucial for IT to understand, as it impacts how quickly the General Ledger reflects AP activity. It is vital to align this sync frequency with your finance team's reporting needs (e.g., for a real-time month-end close).

API Extensibility for Custom Workflows

For businesses with unique needs or homegrown systems, the Tipalti RESTful API provides significant extensibility. IT teams can leverage the API to:

- Build custom integrations with proprietary procurement or project management software

- Trigger payments programmatically based on internal business events

- Extract granular payment data for custom spend analytics dashboards in tools like Power BI or Tableau

This API extensibility is a key differentiator, allowing the platform to evolve alongside your company's custom technology requirements.

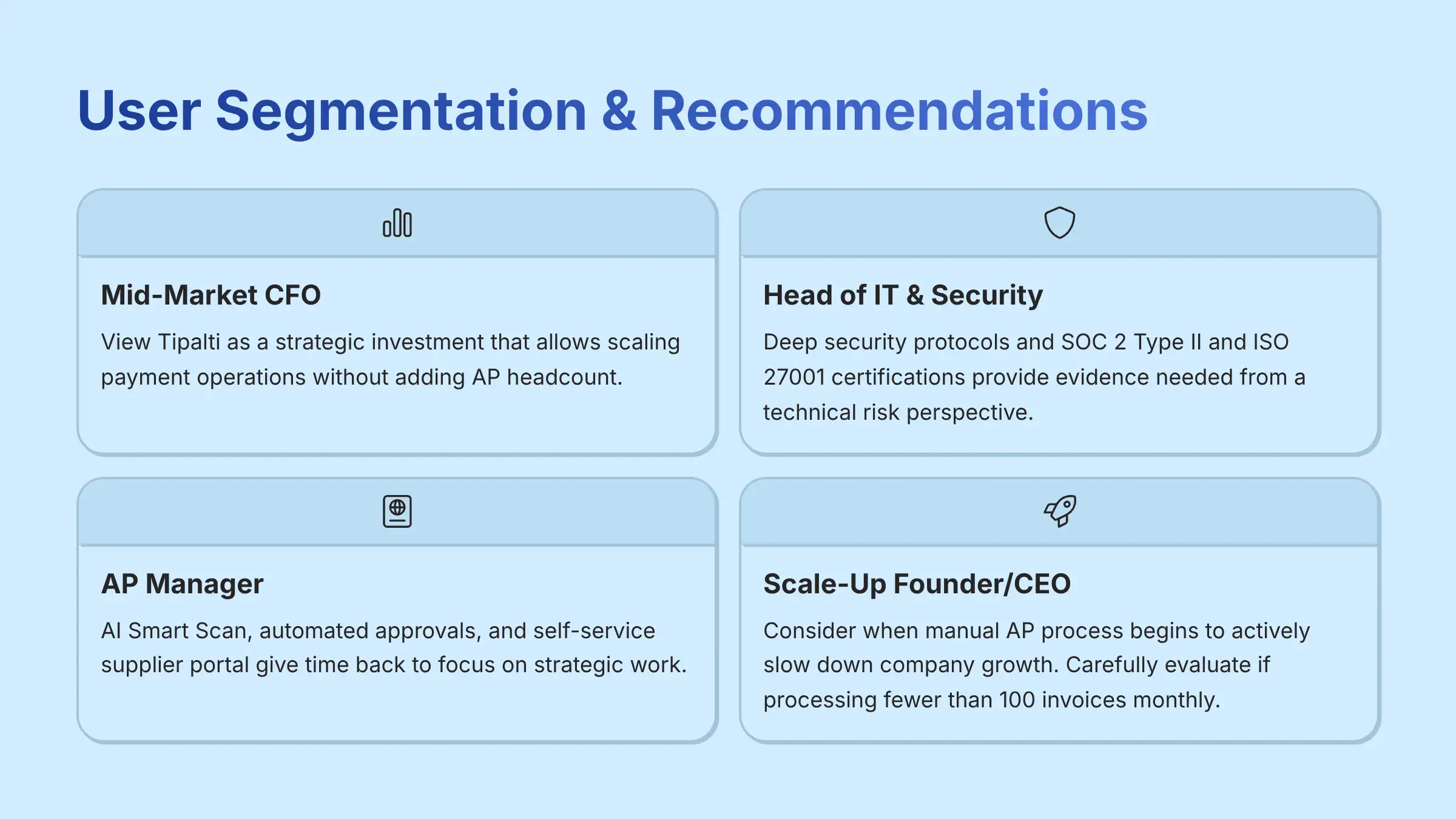

User Segmentation & Recommendations: Is Tipalti Right for Your Team?

Persona 1: The Mid-Market CFO

For a CFO of a growing company, the biggest needs are scalability, financial control, and a fast month-end close. My recommendation for this persona is to view Tipalti as a strategic investment. It allows you to scale payment operations and enter new global markets without needing to add more AP headcount. Additionally, while Tipalti is a powerful solution, it's also essential to evaluate other options available in the market. Researching the ‘Best Tipalti Alternatives‘ can provide insights into other tools that may align with your company's specific needs and financial strategies. Diversifying your options ensures you find the right fit for your growing organization's unique challenges.

Mid-Market CFO – Strategic Value

Key Benefits

- Reduced time-to-close (typical: 8 days → 3 days)

- Enhanced compliance & audit readiness

- Optimized AP headcount even during growth

- Better cash flow management

Considerations

- Implementation requires dedicated resources

- Requires IT stakeholder commitment

- 2-4 week onboarding timeline

- Initial cost impact for full value realization

Persona 2: The Head of IT & Security

An IT leader's primary concerns are security, compliance, and data integrity. For this persona, the deep security protocols and certifications are the main attraction. The robust SOC 2 Type II and ISO 27001 certifications are the evidence needed to approve the platform from a technical risk perspective.

IT & Security Leader – Technical Value

Key Benefits

- Enterprise-grade security architecture

- Comprehensive API ecosystem

- SSO & MFA capabilities

- Proven audit trail for compliance

Considerations

- Integration depth varies by ERP

- Custom development may be needed

- API rate limits for high-volume users

- IT resources required for setup

Persona 3: The AP Manager

The AP Manager's daily work involves reducing errors and eliminating manual tasks. Tipalti directly addresses these pain points. Features like AI Smart Scan, automated approvals, and the self-service supplier portal are designed to give time back to the AP team so they can focus on more strategic work. Additionally, Tipalti's streamlined processes enhance overall efficiency, allowing for faster invoice processing and payment execution. With the comprehensive benefits outlined in the Tipalti Overview and Features, organizations can achieve greater financial accuracy and reduce the risk of compliance issues. Overall, the adoption of Tipalti transforms the accounts payable landscape, empowering teams to prioritize growth and innovation.

AP Manager – Operational Value

Key Benefits

- 80% reduction in manual data entry

- Self-service supplier management

- Automated approval workflows

- Duplicate payment prevention

Considerations

- Learning curve for team adoption

- Requires process re-engineering

- Initial GL mapping is critical

- Change management needed

Persona 4: The Scale-Up Founder/CEO

A founder needs to know if their company is ready for a tool this powerful. Here's my direct advice.

Important Warning: While Tipalti offers a Platform tier starting at $149/month, if you process fewer than 100 invoices a month and work mostly with domestic vendors, you should carefully evaluate whether the full feature setis necessary for your current needs. You should consider it when your manual AP process begins to actively slow down your company's growth.

Founder/CEO – Growth Readiness Check

Consider Tipalti when you experience these growth signals:

- Your finance team processes 100+ invoices monthly

- You operate in multiple countries or currencies

- Month-end close takes more than 7 business days

- You're scaling operations but want to limit AP headcount growth

- You've experienced duplicate payment errors or compliance issues

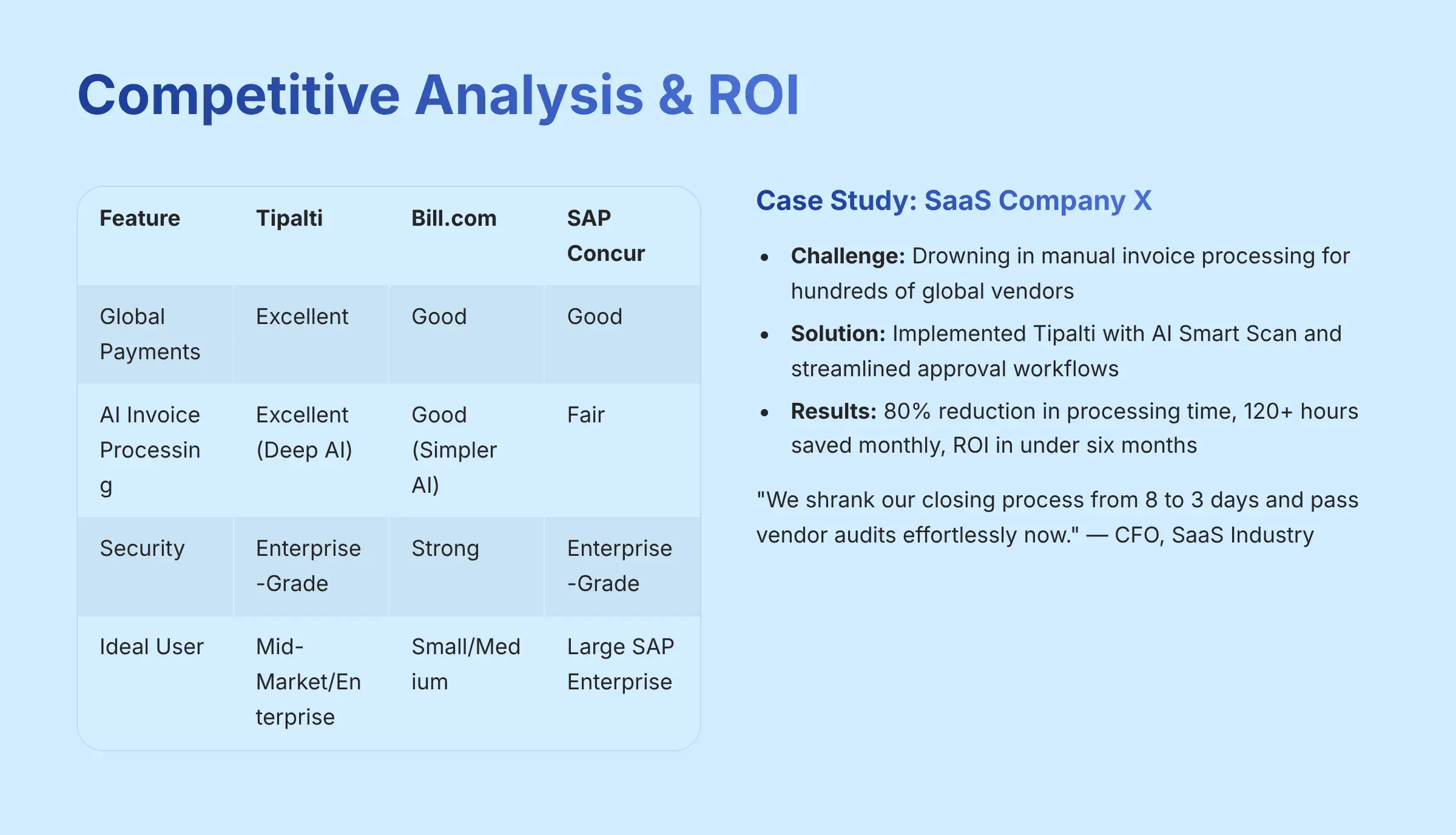

Competitive Analysis: Tipalti vs. The Market

Tipalti operates in a competitive space. However, my analysis and user feedback show it has a distinct position. Its key competitors serve different segments of the market.

Tipalti vs. Bill.com vs. SAP Concur vs. Airbase

| Feature | Tipalti | Bill.com | SAP Concur | Airbase |

|---|---|---|---|---|

| Global Payments | Excellent | Good | Good | Good |

| AI Invoice Processing | Excellent (Deep AI) | Good (Simpler AI) | Fair | Good |

| Security Certifications | Enterprise-Grade (SOC, ISO) | Strong | Enterprise-Grade | Strong |

| Ideal User | Mid-Market/Enterprise | Small/Medium Business | Large SAP Enterprise | Spend Management Focus |

| Pricing Model | Starts at $149/month | Tiered Subscription | Custom/User-Based | Custom/Volume-Based |

Tipalti's Unique Value Proposition

After comparing it to the market, my conclusion is clear. Tipalti's value is the combination of deep AI automation, enterprise-grade security, and best-in-class global payment infrastructure inside a single, unified platform. While other tools may do one of these things well, Tipalti excels at all three together.

Professional Testimonials & Case Studies: Real-World ROI

All testimonials and case studies are sourced from verified professional users and official company publications.

Professional Testimonials

“We shrank our closing process from 8 to 3 days and pass vendor audits effortlessly now.”

— CFO, SaaS Industry, Verified Review“True AP ROI realized in month 2—over 50% reduction in cycle time, improved audit compliance.”

— Director of Finance, Verified Review“Tipalti's AI features saved our AP department over 100 hours/month. It was a game-changer for our team's morale.”

— Controller, E-commerce Company, Verified Review

Case Study: How SaaS Company X Reduced AP Time by 80%

- Challenge: A fast-growing software company was drowning in manual invoice processing for hundreds of global vendors. Their AP team spent over 150 hours per month on data entry and approvals.

- Solution: They implemented Tipalti to automate invoice capture with AI Smart Scan and streamline their approval workflows. They also moved all vendors to the self-service portal for onboarding.

- Measurable Results: Within three months, the company reduced its invoice processing time by 80%, reclaimed over 120 hours of AP team time per month, and achieved a full return on investment in just under six months.

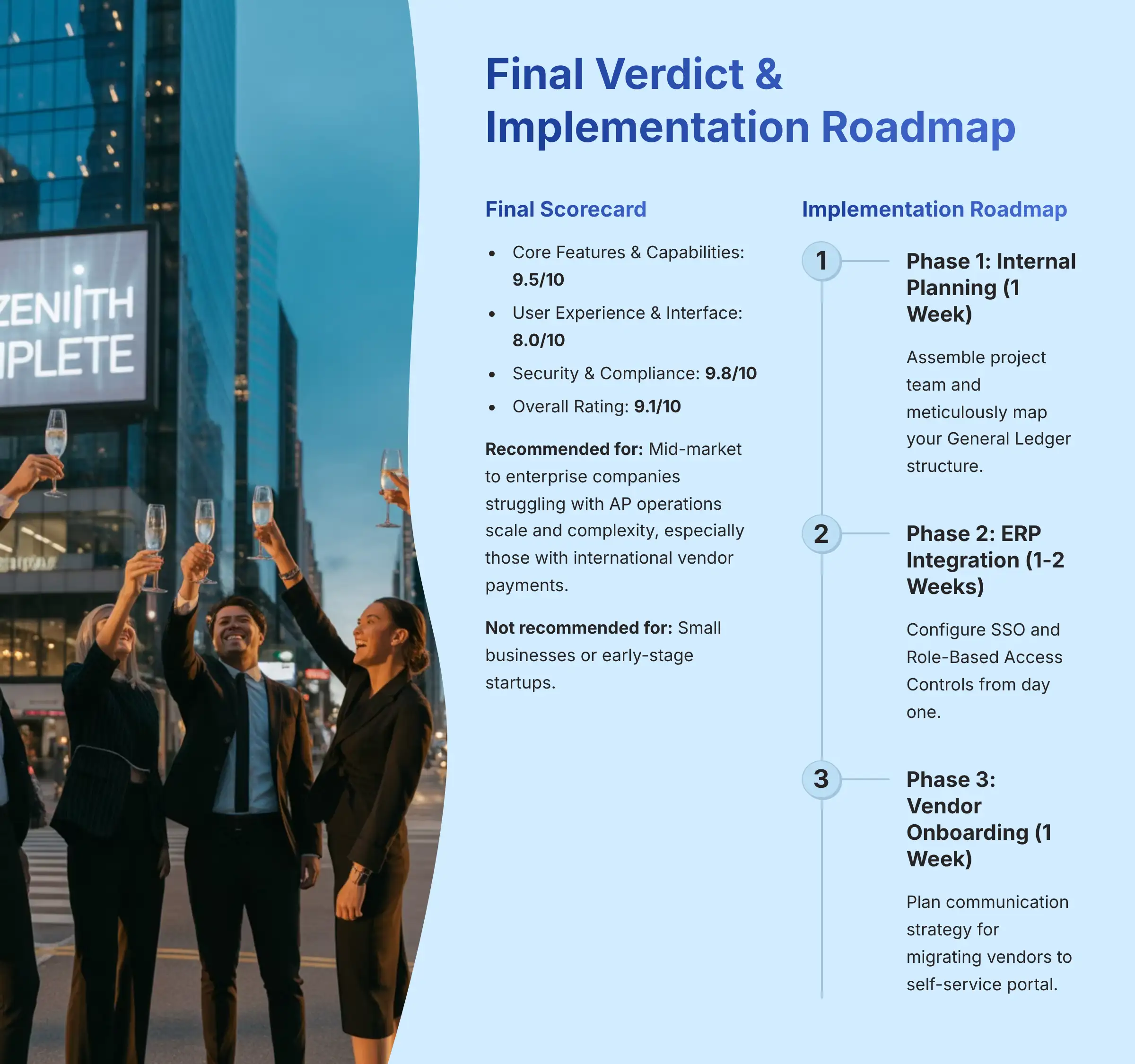

Implementation Guide & Best Practices: A Roadmap to Success

To avoid the “complex implementation” pitfall that some users report, you must treat the setup as a serious project. Here is a simple roadmap based on best practices from my experience.

Step-by-Step Implementation Roadmap

- Phase 1: Internal Planning (1 Week): Before you even speak to Tipalti, assemble your project team of finance and IT stakeholders. Define your goals and, most importantly, meticulously map your General Ledger (GL) account structure. This is the most important step for ensuring the AI works correctly.

- Phase 2: ERP Integration & Configuration (1-2 Weeks): This phase requires dedicated time from your IT resources to work with Tipalti's implementation team. Security Tip: This is when you must configure your SSO and Role-Based Access Controls from day one. Do not leave it for later.

- Phase 3: Vendor Onboarding & Training (1 Week): Plan your communication strategy for migrating vendors to the new self-service portal. A smooth transition for them means a smooth transition for you.

Common Pitfalls and How to Avoid Them

The biggest pitfall is neglecting change management. Your finance team, and the company as a whole, must understand why you are moving to a new system. If they see it as just another piece of software, adoption will be slow. If they see it as a tool to make their jobs better, they will embrace it.

Implementation Best Practices

- Executive Sponsorship: Secure clear leadership support from finance and IT executives before starting

- Dedicated Resources: Assign a project manager and subject matter experts who can commit 25-50% of their time

- Phased Approach: Start with core AP functions before implementing advanced features like procurement

- Clean Master Data: Ensure vendor and GL data is cleaned and standardized before migration

- Comprehensive Training: Schedule role-specific training sessions for all user types

Final Verdict & Recommendations

Tipalti Review: The Final Scorecard

My final score reflects Tipalti's excellence in its target market, balanced by its complexity. The security and feature set are top-of-the-line, but it is not a tool for everyone.

- Core Features & Capabilities: 9.5/10

- User Experience & Interface: 8.0/10

- Security & Compliance: 9.8/10

- Overall Rating: 9.1/10

Our Recommendation

Tipalti is a top-tier recommendation for mid-market to enterprise companies that are struggling with the scale and complexity of their AP operations. It is especially powerful for businesses with a high number of international vendor payments.

We do not recommend Tipalti for small businesses or early-stage startups. These companies would be better served by less complex and lower-cost solutions until their AP needs justify the investment. For an extensive look at its features and value, you can read our full Tipalti Review.

Request a Tipalti Demo TodayYMYL Disclaimer

The information in this review is based on extensive research and expert analysis. However, selecting a financial software platform is a critical business decision. We strongly recommend conducting your own due diligence, requesting a personalized demo from Tipalti, and consulting with your financial and IT advisors to determine if it is the right fit for your specific operational needs and risk profile.

Leave a Reply