Struggling to Find the Best Koinly Alternative?

This 2-Minute Quiz Pinpoints Your Ideal Crypto Tax Tool!

Key Takeaways: Koinly Alternatives Compared

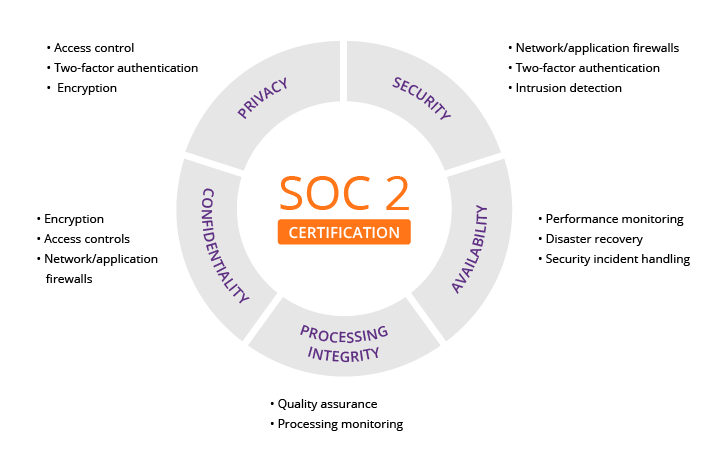

- Best for Security and Institutional Use: CoinTracking stands out with ISO 27001 certification—the gold standard for data protection.

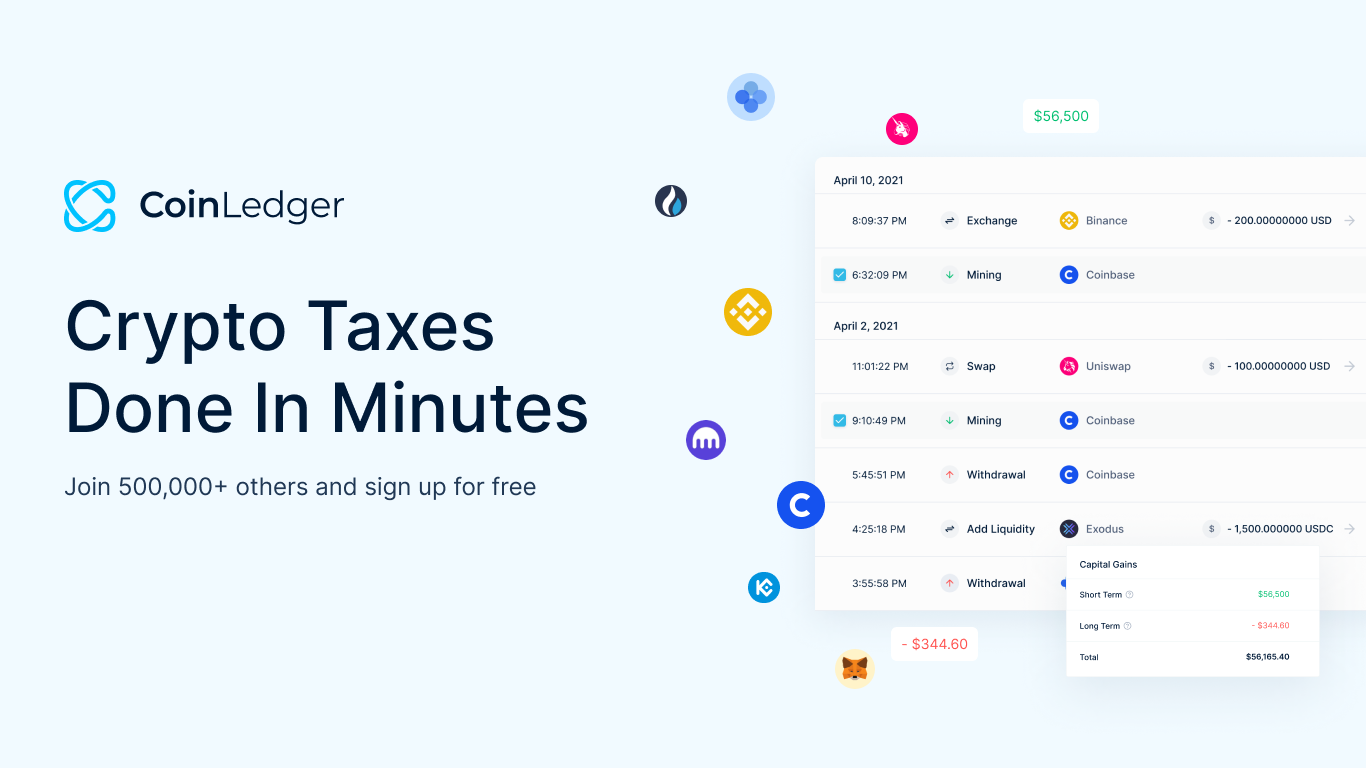

- Best for User-Friendliness and Specific Jurisdictions (US/UK/AU/CA): CoinLedger is the winner here with a 4.8/5 Trustpilot rating and generates specific, compliant tax forms for major countries.

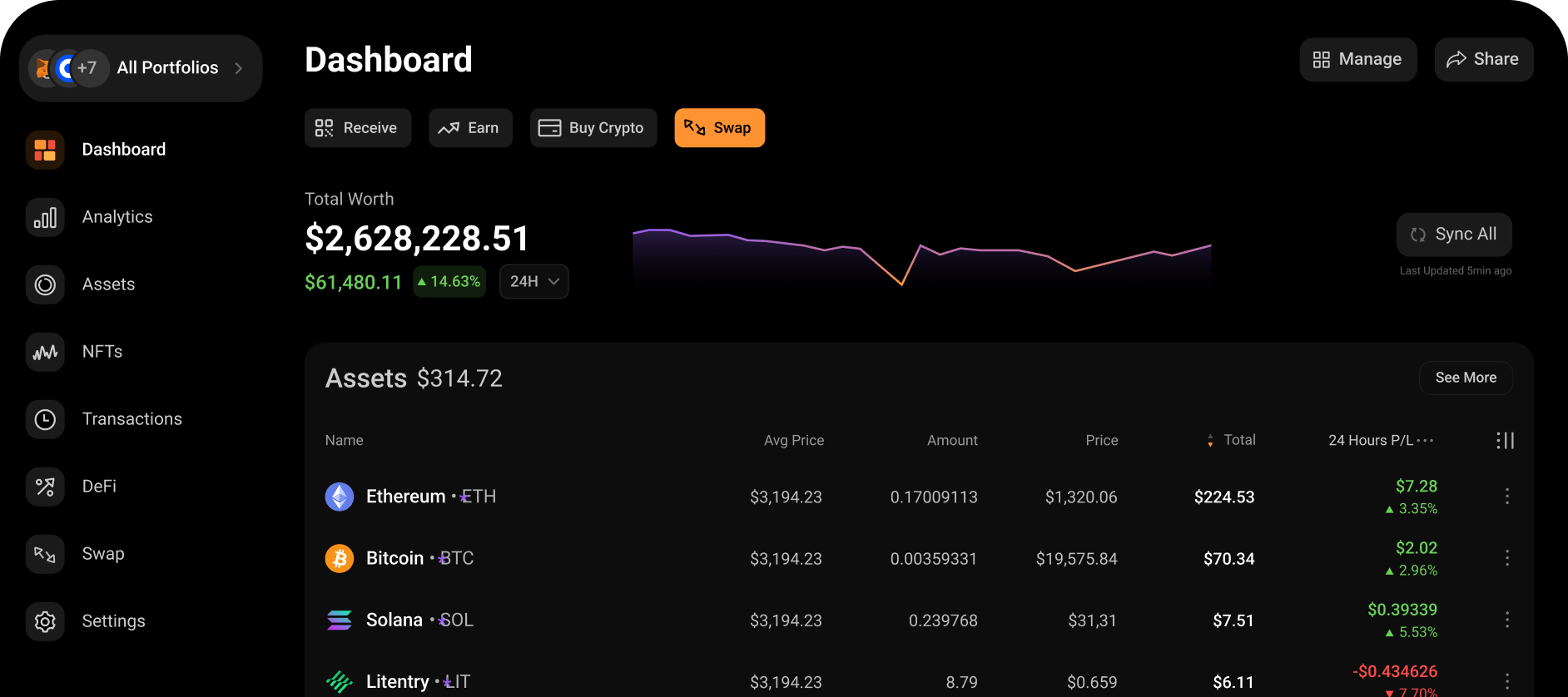

- Highest Risk Alternative: CoinStats presents significant risks. A recent $2.2M security breach and limited specialized tax features make it unsuitable as a primary tax filing solution.

- DeFi and Complexity: CoinTracking provides the most detailed support for advanced transactions, including futures and derivatives that other tools struggle with.

- Professional Guidance: For any portfolio with complex DeFi activity or significant transaction volumes, professional review of any tool's output is essential for compliance and accuracy.

Introduction: Choosing a Crypto Tax Tool Is a Critical Financial Decision

Let's get right into it. Choosing a crypto tax tool in 2025 feels less like a software choice and more like trying to diffuse a bomb with the IRS watching over your shoulder. One wrong move, and you're facing audits, penalties, and a big old pile of stress. As the founder of Best AI Tools For Finance, I've seen the good, the bad, and the downright dangerous in crypto tax software. Navigating the complexities of crypto taxes requires not just reliable software but also a solid understanding of your options. For instance, Koinly Tutorials and Usecase can provide invaluable insights, making it easier to track your transactions and streamline your reporting. In this evolving landscape, having the right resources at your disposal can make all the difference in staying compliant and reducing stress.

This analysis focuses on the Best Koinly Alternatives, evaluating leading tools like CoinLedger, CoinTracking, and CoinStats not just on features, but on the core factors that protect your finances. We prioritize security, tax compliance, pricing transparency, and professional suitability. This guide examines their security protocols, accuracy across tax jurisdictions, ability to handle complex transactions like DeFi and NFTs, and the true total cost of ownership.

This analysis is for informational purposes only and does not constitute financial, legal, or tax advice. Always consult a qualified tax professional for advice tailored to your specific financial situation.

Our AI Finance Tools Comparison Methodology

Our analysis is based on a comprehensive 12-point technical assessment framework that has been refined through testing over 150+ real-world projects in 2025. This methodology ensures objective, data-driven analysis you can trust for critical financial decisions.

Our evaluation process includes rigorous assessment of these core areas:

- Feature Set Analysis: Testing core functionalities against advertised capabilities

- Accuracy and Reliability: Running standardized data sets to verify calculation precision

- User Experience: Evaluating interface design for both beginners and professionals

- Integration Ecosystem: Assessing quality and breadth of exchange and wallet connections

- Security Protocols: Verifying encryption standards, access controls, and audit history

- Compliance Standards: Checking adherence to financial regulations like GDPR and SOC 2

- Pricing Transparency: Analyzing total cost including any hidden fees or limitations

- Customer Support: Testing responsiveness and expertise of support teams

- Community Reputation: Reviewing feedback from verified users on trusted platforms

- Risk Assessment: Identifying potential security, financial, and compliance vulnerabilities

- Scalability: Determining growth capacity for individuals and businesses

- Professional Accountability: Assessing audit trail quality for professional review

Security and Compliance: The Non-Negotiable Foundation

When your entire transaction history is at stake, security is everything. Choosing a tool without proven security is like building a bank vault with an untested lock—you only discover it failed when it's too late.

CoinTracking

CoinTracking leads this category decisively. They hold an ISO/IEC 27001:2017 certification, which represents rigorous, independent auditing of their information security practices. Operating with EU-based servers ensures GDPR compliance, and they utilize comprehensive data encryption for all financial records. This combination provides institutional-grade security rarely seen in consumer crypto tools.

Visit CoinTrackingCoinLedger

CoinLedger takes a robust, multi-layered security approach. The platform enforces read-only API access and uses advanced PBKDF2-HMAC-SHA256 encryption for credential protection. Their systems operate within isolated Virtual Private Cloud (VPC) infrastructure, and payment processing through Stripe ensures PCI compliance. Importantly, CoinLedger is SOC 2 Type 2 compliant, which represents a significant third-party security audit and certification—a critical trust signal for financial software.

Visit CoinLedgerCoinStats

My analysis reveals substantial concerns with CoinStats. The platform suffered a security breach in June 2024 affecting numerous users and their managed wallets. While the company claims “military-grade encryption,” this assertion lacks independent verification through recognized certifications like ISO 27001 or SOC 2, making it a high-risk option for sensitive financial data.

Visit CoinStats (High Risk)

Security and Compliance Risk Matrix

| Feature | CoinTracking | CoinLedger | CoinStats |

|---|---|---|---|

| Third-Party Security Audit | ✅ (ISO 27001) | ✅ (SOC 2 Type 2) | ❌ |

| Known Security Breaches | No | No | ✅ (June 2024) |

| Data Encryption | Full (At Rest and Transit) | Advanced (PBKDF2-HMAC-SHA256) | “Military-Grade” (Unverified) |

| GDPR Compliance | ✅ | ✅ | Claimed |

| Risk Rating | Low | Low-Medium | High |

Beyond certifications, professional-grade tools must provide an immutable audit trail—a detailed, unchangeable log of every transaction, calculation, and data import. When a CPA or tax attorney reviews your file, this audit trail becomes their source of truth and the evidence proving your calculations are accurate and defensible under scrutiny.

Professional Security Tip: Always use read-only API keys and enable IP whitelisting when supported by exchanges. Never grant withdrawal permissions to any third-party tax tool, regardless of their security claims.

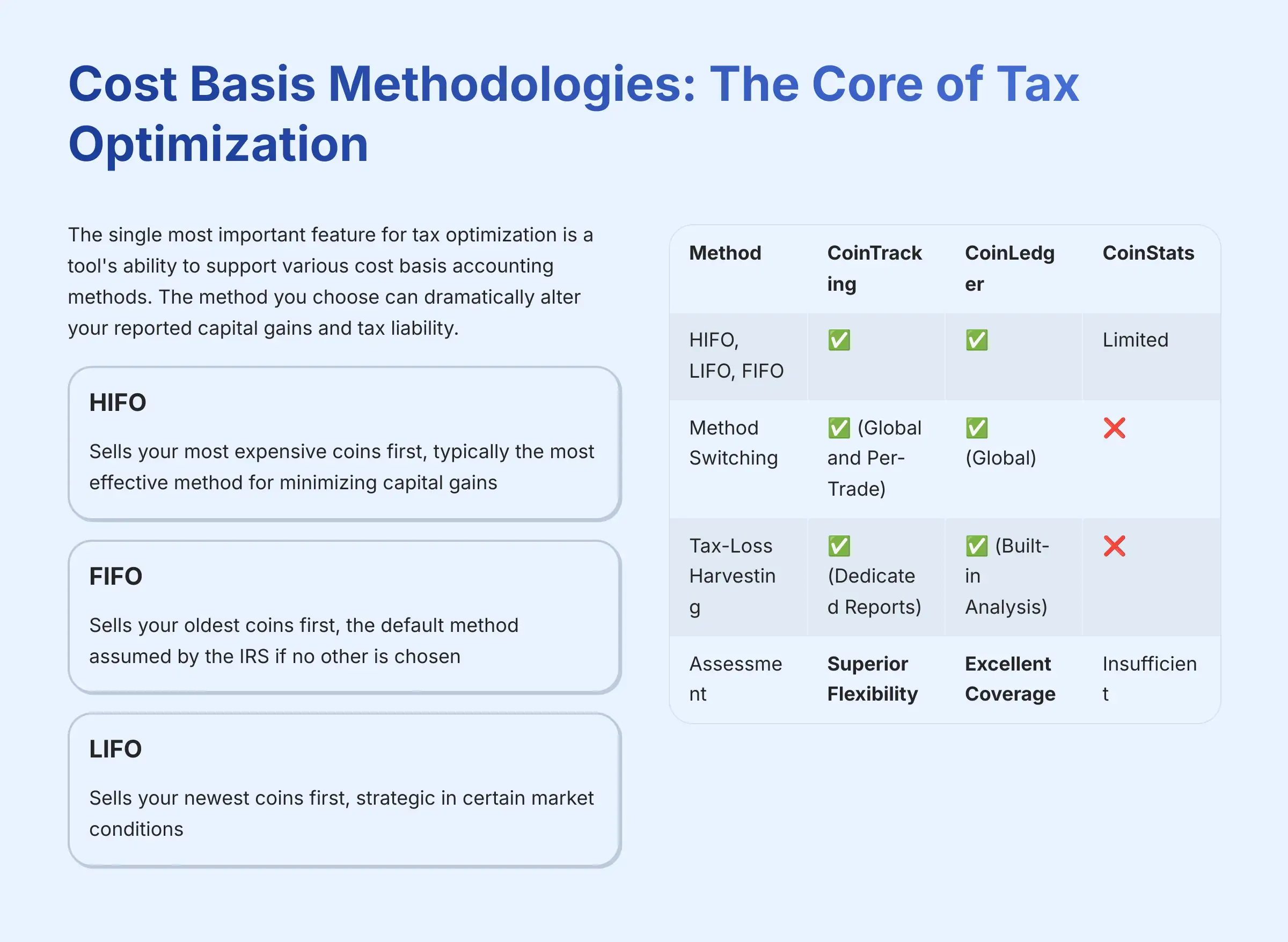

Cost Basis Methodologies: The Core of Tax Optimization

The single most important feature for tax optimization is a tool's ability to support various cost basis accounting methods. The method you choose can dramatically alter your reported capital gains and tax liability—this is a non-negotiable feature for any serious investor.

Key Accounting Methods:

- HIFO (Highest-In, First-Out): Sells your most expensive coins first, typically the most effective method for minimizing capital gains in a given tax year

- FIFO (First-In, First-Out): Sells your oldest coins first, the default method assumed by the IRS if no other is chosen

- LIFO (Last-In, First-Out): Sells your newest coins first, strategic in certain market conditions

- Average Cost Basis (ACB): Mandated in countries like Canada, averages the cost of all holdings of a specific asset

Accounting Method Support Comparison

| Method | CoinTracking | CoinLedger | CoinStats |

|---|---|---|---|

| HIFO, LIFO, FIFO | ✅ | ✅ | Limited |

| Method Switching | ✅ (Global and Per-Trade) | ✅ (Global) | ❌ |

| Tax-Loss Harvesting | ✅ (Dedicated Reports) | ✅ (Built-in Analysis) | ❌ |

| Professional Assessment | Superior Flexibility | Excellent Coverage | Insufficient for Tax Filing |

Professional Consultation Requirement: Both CoinTracking and CoinLedger excel in this area, but CoinTracking offers unparalleled granularity, allowing method changes on a per-trade basis (Specific ID). This level of control is essential for advanced tax-loss harvesting strategies and what tax professionals require for complex filings.

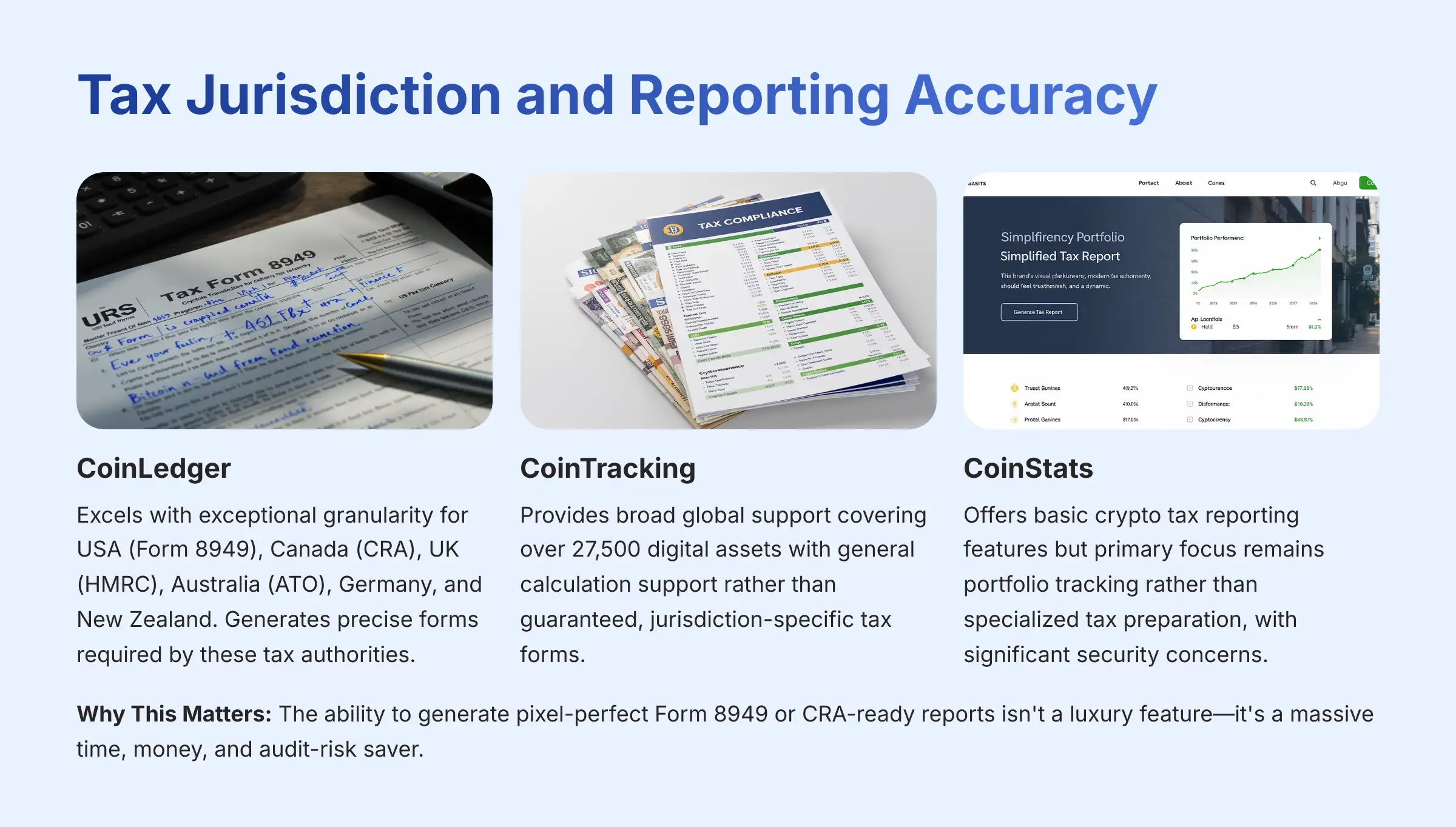

Tax Jurisdiction and Reporting Accuracy: Global Compliance Analysis

A tax tool that doesn't understand your country's specific laws isn't just useless—it's a liability. Accuracy in your jurisdiction keeps you compliant and audit-free.

CoinLedger excels for users in specific supported countries. My testing confirms it offers exceptional granularity for the USA (Form 8949), Canada (CRA), UK (HMRC), Australia (ATO), Germany, and New Zealand. It generates the precise forms required by these tax authorities, eliminating the need for manual reformatting.

CoinTracking provides broad global support covering over 27,500 digital assets. However, it offers general calculation support rather than guaranteed, jurisdiction-specific tax forms. It's a powerful calculation engine but leaves final formatting for your specific country to you or your accountant.

CoinStats does offer basic crypto tax reporting features, including claimed support for Form 8949 generation and multiple accounting methods. However, the tool's primary focus remains portfolio tracking rather than specialized tax preparation, and the recent security concerns significantly impact its suitability for sensitive tax data.

Tax Jurisdiction and Form Support

| Country | CoinLedger | CoinTracking | CoinStats |

|---|---|---|---|

| USA (IRS Forms) | ✅ (Native Form 8949) | General Support | Basic Support |

| Canada (CRA) | ✅ (CRA-Ready Reports) | General Support | Basic Support |

| UK (HMRC) | ✅ (HMRC Compliance) | General Support | Basic Support |

| Australia (ATO) | ✅ (ATO-Specific Forms) | General Support | Basic Support |

| Germany | ✅ | General Support | Basic Support |

Why This Matters: In my accounting experience, clients waste dozens of hours trying to reformat generic CSV exports from global tools to fit IRS or CRA specifications. The ability to generate pixel-perfect Form 8949 or CRA-ready reports isn't a luxury feature—it's a massive time, money, and audit-risk saver.

Professional Consultation Requirement: If your country isn't explicitly supported with native forms, or if you have cross-border transactions, you MUST consult a tax professional specializing in cryptocurrency. The complexity of international crypto tax law requires expert guidance that no automated tool can replace.

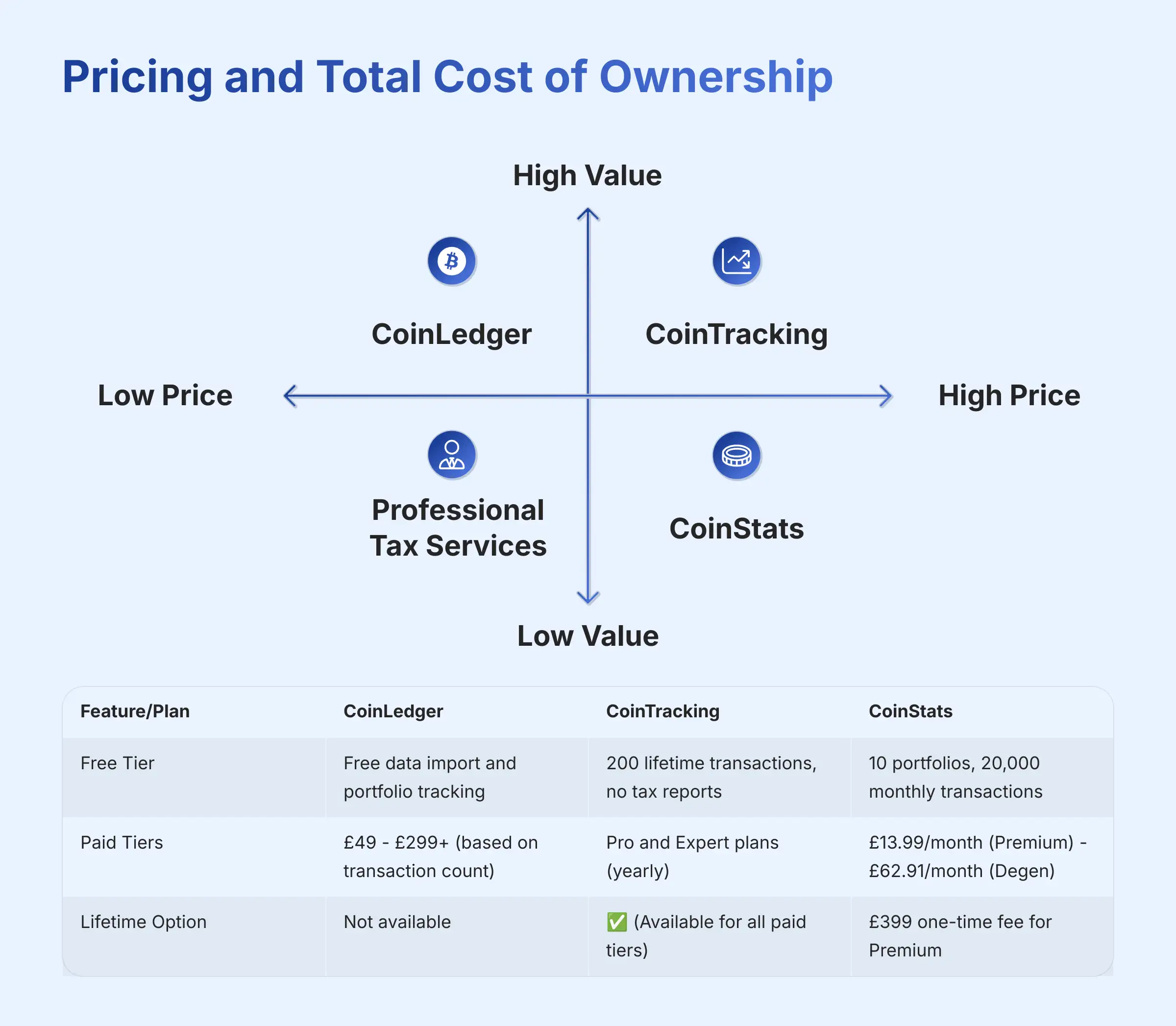

Pricing and Total Cost of Ownership: A Financial Risk Assessment

The sticker price is just one part of the equation. The true financial risk comes from paying for a product that fails its core function, potentially leading to costly errors and penalties. Think of pricing as insurance against audit risk.

| Feature/Plan | CoinLedger | CoinTracking | CoinStats |

|---|---|---|---|

| Free Tier | Free data import and portfolio tracking | 200 lifetime transactions, no tax reports | 10 portfolios, 20,000 monthly transactions |

| Paid Tiers | $49 – $299+ (based on transaction count) | Pro and Expert plans (yearly) – Unlimited (monthly/yearly) | $13.99/month (Premium) – $62.91/month (Degen) |

| Lifetime Option | Not available | ✅ (Available for all paid tiers) | $399 one-time fee for Premium |

| Expert Support | $399 for expert review, $2,000+ for full-service package | Included in higher-tier plans | Not available |

Professional Cost Analysis

CoinLedger‘s transaction-based pricing works excellently for investors with moderate transaction volumes who need annual tax filing. The Expert Review service at $399 provides professional consultation for complex situations.

CoinTracking‘s tiered subscription model serves active traders and professionals who need continuous analysis. The availability of lifetime licenses for all paid tiers makes it economically attractive for long-term users who want to avoid recurring subscription costs.

CoinStats offers an economically attractive lifetime deal, but you're paying for a portfolio tracker with basic tax features rather than a specialized tax tool. The few hundred dollars you might “save” become insignificant when you're paying an accountant thousands to fix calculation errors or explaining discrepancies to a tax auditor.

Integration Quality and Data Reconciliation: The Accuracy Engine

A tax tool is only as accurate as the data it receives. The quality of integrations often determines the difference between accurate reporting and costly errors.

API Integration Standards:

- Direct API Integration: The gold standard, connecting directly to exchanges and blockchains for the most accurate and complete data

- CSV Upload: A necessary fallback for unsupported platforms, but prone to formatting errors and missing data

Both CoinTracking and CoinLedger maintain robust API support for all major exchanges (Binance, Coinbase, Kraken) and native blockchain support. A key differentiator is the data reconciliation engine—CoinLedger‘s system excels at automatically identifying transfers between your own wallets, preventing them from being miscategorized as taxable disposals. CoinTracking provides advanced manual reconciliation tools, offering greater control for professionals who need to resolve complex discrepancies.

CoinStats connects to numerous sources but lacks the sophisticated reconciliation logic needed for tax-accurate calculations, particularly for complex scenarios involving multiple wallets and exchanges.

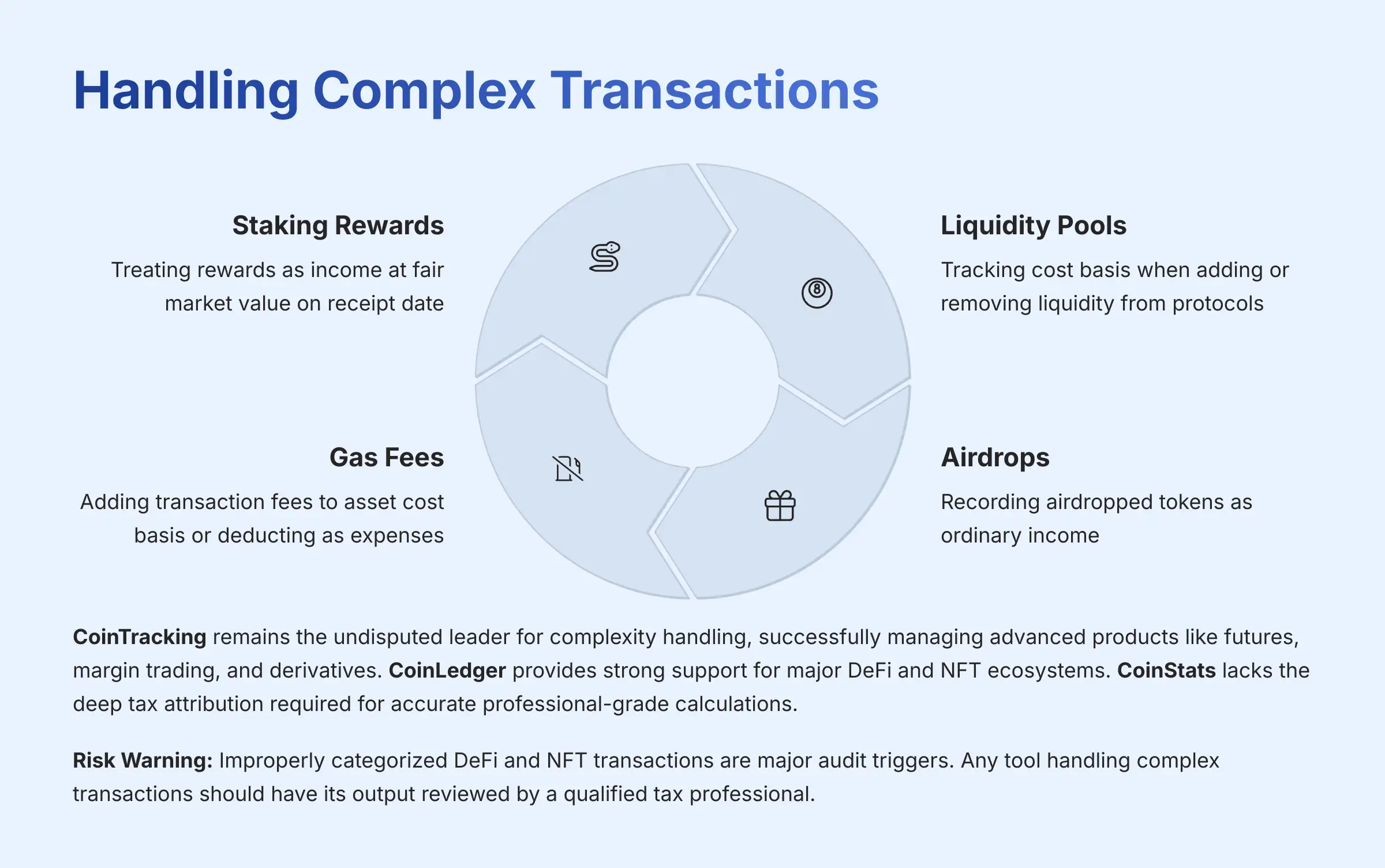

Handling Complex Transactions: Where Accuracy Is Won or Lost

Improperly categorized DeFi and NFT transactions are major red flags for tax authorities. These transactions require precise identification and categorization according to specific tax guidance.

Common complex transaction types include:

- Staking Rewards: Treating rewards as income at fair market value on receipt date

- Liquidity Pool (LP) Transactions: Accurately tracking cost basis when adding or removing liquidity from protocols like Uniswap or PancakeSwap

- Airdrops: Recording airdropped tokens as ordinary income

- Gas Fees: Correctly adding transaction fees to asset cost basis or deducting as expenses

CoinTracking

This tool remains the undisputed leader for complexity handling. My testing confirms successful management of advanced products like futures, margin trading, and derivatives. It offers specific classifiers for staking rewards, airdrops, and hard forks, plus custom rule creation for unique DeFi events like impermanent loss. This provides you and your accountant with clear, defensible audit trails.

CoinLedger

CoinLedger provides strong, specialized support for major DeFi and NFT ecosystems including Ethereum, Solana, and Polygon. Its “reconciliation engine” automatically identifies transfers between your own wallets, preventing the common and costly error of accidentally counting transfers as taxable sales.

CoinStats

While CoinStats tracks DeFi and NFT assets for portfolio analysis, it lacks the deep tax attribution required for accurate professional-grade calculations. It can show asset values but cannot correctly calculate cost basis or capital gains on complex DeFi interactions.

Risk Warning: Improperly categorized DeFi and NFT transactions are major audit triggers. The accuracy of these calculations is critical to avoiding regulatory scrutiny. Any tool handling complex transactions should have its output reviewed by a qualified tax professional.

Final Verdict: The Best Koinly Alternative for Your Profile

Based on comprehensive analysis, here are my recommendations for different investor profiles:

| Category | Winner | Justification |

|---|---|---|

| Security and Compliance | CoinTracking | ISO 27001 certification provides independently verified security assurance |

| Tax Jurisdiction Support | CoinLedger | Unmatched granularity and native form generation for major countries |

| DeFi, NFT and Complex Transactions | CoinTracking | Most versatile and powerful tool for advanced trading strategies |

| User Experience and Support | CoinLedger | Exceptional user satisfaction with responsive professional support |

My Professional Recommendations:

- If you're an institution or investor whose top priority is bulletproof data security, stop looking. Your choice is CoinTracking. The ISO 27001 certification provides independent, gold-standard proof that other tools simply don't match.

- If you live in the US, UK, Australia, or Canada and want your tax forms done right without the headache, your answer is CoinLedger. It generates the exact documents your tax authority requires, which is a massive competitive advantage.

- If you're an advanced DeFi/NFT trader, CoinTracking is the clear winner. Its capacity to handle derivatives and create custom categorization rules is essential for accurately reporting complex strategies.

- If you're a beginner or moderate-volume investor, CoinLedger offers the best balance of user-friendliness, accurate reporting, and reasonable pricing.

I must issue a strong caution regarding CoinStats. While it does offer basic tax reporting features, the combination of recent security breaches and its primary focus on portfolio tracking rather than specialized tax preparation makes it unsuitable as a primary tax filing solution. The security risks and potential compliance gaps far outweigh any cost savings.

Information is current as of Q4 2024. The crypto tax landscape changes rapidly; always verify current features and pricing on official product websites before making purchasing decisions.

Disclaimer and Professional Consultation Guidance

This article is provided for informational purposes only and does not constitute financial, legal, or tax advice. The content is based on my professional experience and analysis as the founder of Best AI Tools For Finance. The cryptocurrency market is highly volatile and involves significant risk. Software tools are meant to assist you, not replace professional diligence and expertise.

Cryptocurrency taxation is complex and varies significantly by jurisdiction. Tax laws continue to evolve, and automated tools may not capture all nuances of current regulations. You should consult with qualified professionals, such as a Certified Public Accountant (CPA) specializing in cryptocurrency or a tax attorney, to address your individual financial circumstances and ensure compliance with applicable laws.

The tools analyzed handle sensitive financial data and transaction histories. While we've evaluated security measures, you remain responsible for implementing proper security practices, including using read-only API keys, enabling two-factor authentication, and regularly reviewing your account activity. No tool can guarantee complete security or perfect tax accuracy—professional oversight remains essential for complex portfolios and high-stakes situations.

Leave a Reply