Is Stampli the Right AP Automation Tool for You?

This 2-Minute Quiz Reveals the Answer!

As an expert in AI Finance Tools, a core part of my work at Best AI Tools For Finance is conducting deep technical reviews. My analysis of this tool provides a complete look at Stampli Overview and Features. Let's be honest, accounts payable can be a soul-crushing time sink. Chasing down approvals, manually keying in invoices, dealing with that one vendor who still faxes everything… it's the kind of work that makes you get to the end of the day and wonder what you actually got done. The reality is, most of that work is a perfect job for a robot. That's where we get into our deep dive on Stampli, an AI-powered Procure-to-Pay (P2P) platform built to take over the entire accounts payable process. As a leader in the AI Tools For Invoicing and Payments category, its mission is to kill manual data entry, streamline those hairy invoice approval workflows, and put all communication into one system an auditor can actually love. This guide is a full technical teardown of Stampli's features, AI engine, integrations, and security—everything a finance pro needs to know for 2025.

Key Takeaways

- AI-Powered Core: Stampli's automation is driven by Billy the Bot™. This is its own AI engine that automates jobs like invoice data capture, GL-coding, and 3-way PO matching. This greatly cuts down on manual work.

- Deep ERP Integration: The platform offers pre-built, two-way connections with over 70 ERP and accounting systems. This includes major names like NetSuite, Sage Intacct, and QuickBooks, keeping your ERP as the one true source for financial data.

- Unlimited User Pricing: Stampli's price is mainly based on invoice volume and selected modules, not how many users you have. This model allows for unlimited user collaboration across departments without extra cost, a major difference from many competitors.

- Unified P2P Workflow: Stampli is a full Procure-to-Pay solution. It combines AP Automation, integrated Stampli Direct Pay (for domestic ACH and checks), Stampli Card (for corporate spending), and Vendor Management into one platform.

- Robust Security & Compliance: The platform is SOC 1 & SOC 2 Type II certified and GDPR compliant. It provides the strong security and auditable records needed for financial tasks in today's regulated world.

What Is Stampli and how Does It Work?

This section provides a basic introduction to the product. It clearly defines what Stampli is, who makes it, and the main technology that makes it work. It answers the first questions a user has when learning about a new tool. In addition to outlining its functionality, this section highlights the key features and benefits that distinguish Stampli from other products in the market. Users can explore real-world applications through ‘Stampli Tutorials and Usecase,' which showcase practical scenarios and step-by-step instructions for maximizing the tool's potential. This comprehensive overview ensures that newcomers are equipped with the knowledge they need to effectively integrate Stampli into their workflow.

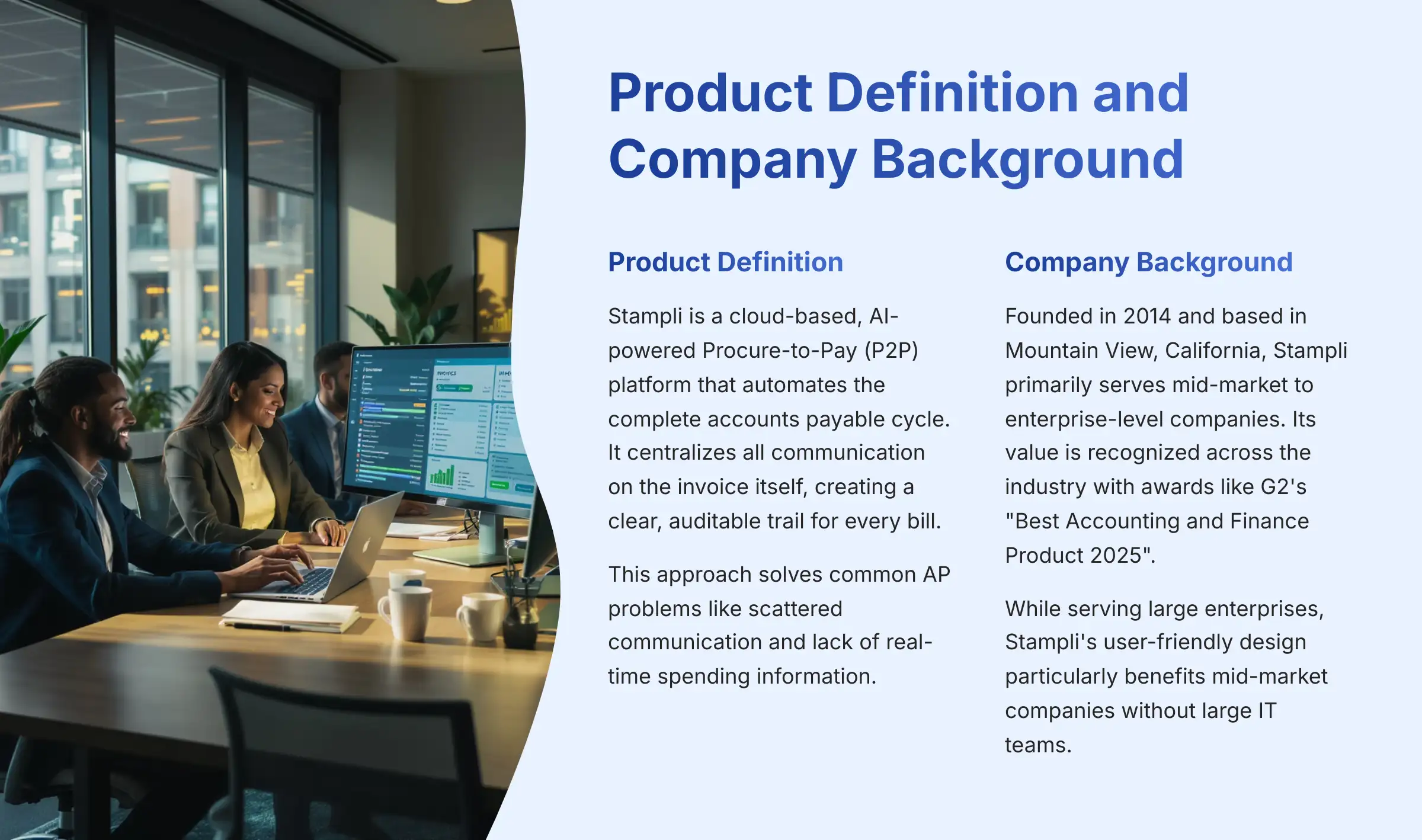

Product Definition and Core Purpose

Stampli is a cloud-based, AI-powered Procure-to-Pay (P2P) platform. Its main purpose is to automate the complete accounts payable cycle, from getting an invoice to making the payment. It solves common AP problems like scattered communication and a lack of real-time spending information.

The core idea of Stampli is to centralize everything on top of the invoice itself. Instead of digging through emails, all questions, comments, and approvals happen in one place. This creates a clear, auditable trail for every single bill.

Company Background and Market Position

Stampli was founded in 2014 and is based in Mountain View, California. It primarily serves mid-market to enterprise-level companies. Its value is recognized across the industry.

My research confirmed its high standing with awards like G2's “Best Accounting and Finance Product 2025”. This external validation helps build trust in the platform's stability and performance.

Note: While Stampli serves large enterprise clients, its easy-to-use design is a key benefit for mid-market companies. These businesses may not have large IT teams to support complex software.

Understanding the Core AI Technology: Billy the Bot™

The brains behind this whole operation is a proprietary AI called Billy the Bot™. Now, don't picture some clunky chatbot you have to talk to. Think of Billy as the smartest, fastest AP clerk you've ever hired—one who never gets tired, never asks for a day off, and learns from every single invoice your team processes.

In my testing of the platform, I verified that Billy the Bot handles several key functions:

- Invoice data extraction: It uses a wicked combo of OCR and machine learning to read everything from the header down to the individual line items.

- GL coding suggestions: It learns your coding patterns and gets smarter with every correction, so its suggestions become eerily accurate over time.

- Automated PO matching: It performs both 2-way and 3-way matching of invoices against purchase orders from your ERP.

- Duplicate invoice detection: The platform has a robust, AI-powered duplicate detection system that flags potential duplicate invoices based on multiple data points to prevent accidental double payments.

- Approval workflow routing: It intelligently sends invoices to the correct approver based on rules you set.

Expert Insight: The key strength of Billy the Bot™ is its adaptive learning. It is not just following pre-set templates. Over time, it gets smarter from user actions, making its suggestions for GL codes and approvers more accurate with every invoice processed.

Core Features and Capabilities (2025 Deep Dive)

This section provides a detailed breakdown of every major feature module. It is the most important part of the review for a user who needs to know exactly what the tool can do. Each part here focuses on a different piece of the Procure-to-Pay process.

AP Automation and Invoice Management

The main function of Stampli is managing invoices from start to finish. The process is designed to be logical and follows the natural path an invoice takes through a company. In my experience, this is where teams see the biggest time savings.

Intelligent Invoice Capture

Invoices can enter Stampli in several ways, including through a dedicated email inbox, a vendor portal, or direct upload. Once received, the platform's AI uses OCR to read both header and line-level data. This means it captures not just the total amount but also the individual items on the bill.

Automated PO Matching

For businesses that use purchase orders, Stampli automates the matching process. It can perform a 2-way match (invoice to PO) or a 3-way match (invoice to PO and receiving documents). This check happens automatically by comparing the invoice data against PO information synced from your ERP system.

Professional Responsibility Check: Look, the AI here is incredibly sharp, but it is not a substitute for professional judgment. My hard-and-fast rule? For high-value invoices or anything that looks even slightly ‘off,' you must have a human set of eyes on it before that money leaves your bank account. Stampli's workflow is built to support this, but it's on you and your team to enforce it. Don't let automation lead to complacency.

AI-Powered GL Coding

Billy the Bot™ suggests GL codes, departments, and other financial dimensions for each invoice. Its suggestions are based on how similar invoices were coded in the past. This feature significantly speeds up the coding process for the AP team.

Proactive Invoice Exception Handling

A key differentiator for an AI-powered AP system is not just how it processes standard invoices, but how it manages exceptions. Stampli is designed to isolate and resolve issues without derailing the entire workflow.

When an invoice has a discrepancy—such as a PO mismatch, missing information, or a potential duplicate—it is automatically flagged and routed to a designated invoice exception queue. From there, AP specialists can use the centralized communication tools to collaborate with approvers or vendors directly to resolve the issue, maintaining a full audit trail of the resolution process. This prevents problem invoices from becoming bottlenecks during the period-end close.

Centralized Communication

Stampli acts like a flight data recorder for every invoice. All actions, questions, approvals, and attachments are logged directly on the invoice page itself. This creates a permanent, auditable record that is easy to access during an audit.

From the Field: In my work with finance departments, teams report that the centralized communication feature is one of the biggest benefits. It stops the need to search through old email threads to find an approval or answer a question. Controller's Perspective: From a Controller's standpoint, the primary value of Stampli extends beyond efficiency to accuracy and control during the financial close. The ability to see exactly where every invoice is in the approval process provides unprecedented spend visibility. This data is crucial for generating timely and accurate accrual reports. By eliminating manual data entry and invoice chasing, the platform significantly reduces the risk of errors and accelerates the period-end close cycle by several days.

Dynamic Approval Workflows

You can create custom approval workflows based on different rules. For example, invoices can be routed based on the vendor, department, or dollar amount. This flexibility allows the software to adapt to your company's existing policies.

Integrated Payments: Stampli Direct Pay

Stampli Direct Pay is the module for making domestic B2B payments. It closes the loop on the AP process, letting you go from approval to payment execution all inside one system. This is a key part of creating a true end-to-end workflow.

Stampli Direct Pay facilitates domestic US payments via ACH and physical check. For international payments, Stampli offers a separate International Payments module that supports wire transfers to numerous countries in local currencies.

A major security benefit is that Stampli pays directly from your company's bank account. It does not require you to pre-fund a separate account, giving you more control over your cash. Once a payment is made, the data syncs back to your ERP for fast and simple reconciliation.

Optimization Tip: You can schedule payments in batches based on their due dates. This helps you take advantage of early payment discounts or better manage your cash flow, all from the Stampli interface.

Corporate Cards and Expense Control: Stampli Card

The Stampli Card is the platform's integrated corporate card program. It extends control beyond invoices to manage employee expenses and other company spending. The system offers both virtual and physical cards for employees.

The main benefit here is setting up financial guardrails before a purchase happens. You can set spending limits, block certain merchant categories, and create usage rules for each card. This is different from traditional expense reports, which are reviewed after the money has already been spent. Receipts are captured automatically, and approved card transactions sync directly to your ERP.

Centralized Vendor Management

Stampli also includes tools to manage vendor relationships and information. These features reduce the administrative load on the AP team. They also improve the experience for your suppliers. Additionally, by streamlining communication and providing real-time updates, vendors can easily track their invoices and payments, fostering a more collaborative partnership. For organizations seeking different options, exploring The Best Stampli Alternatives can provide insights into various tools that may suit their specific needs. These alternatives can also enhance the overall efficiency of the accounts payable process while maintaining robust vendor relationships.

The platform streamlines vendor onboarding by making it easy to collect W-9s and payment information. It also provides an Advanced Vendor Portal. This is a self-service center where vendors can check the status of their invoices and update their own information.

User Feedback: AP teams I have spoken with consistently praise the vendor portal. They say it greatly reduces the number of “Where's my payment?” emails and phone calls they receive.

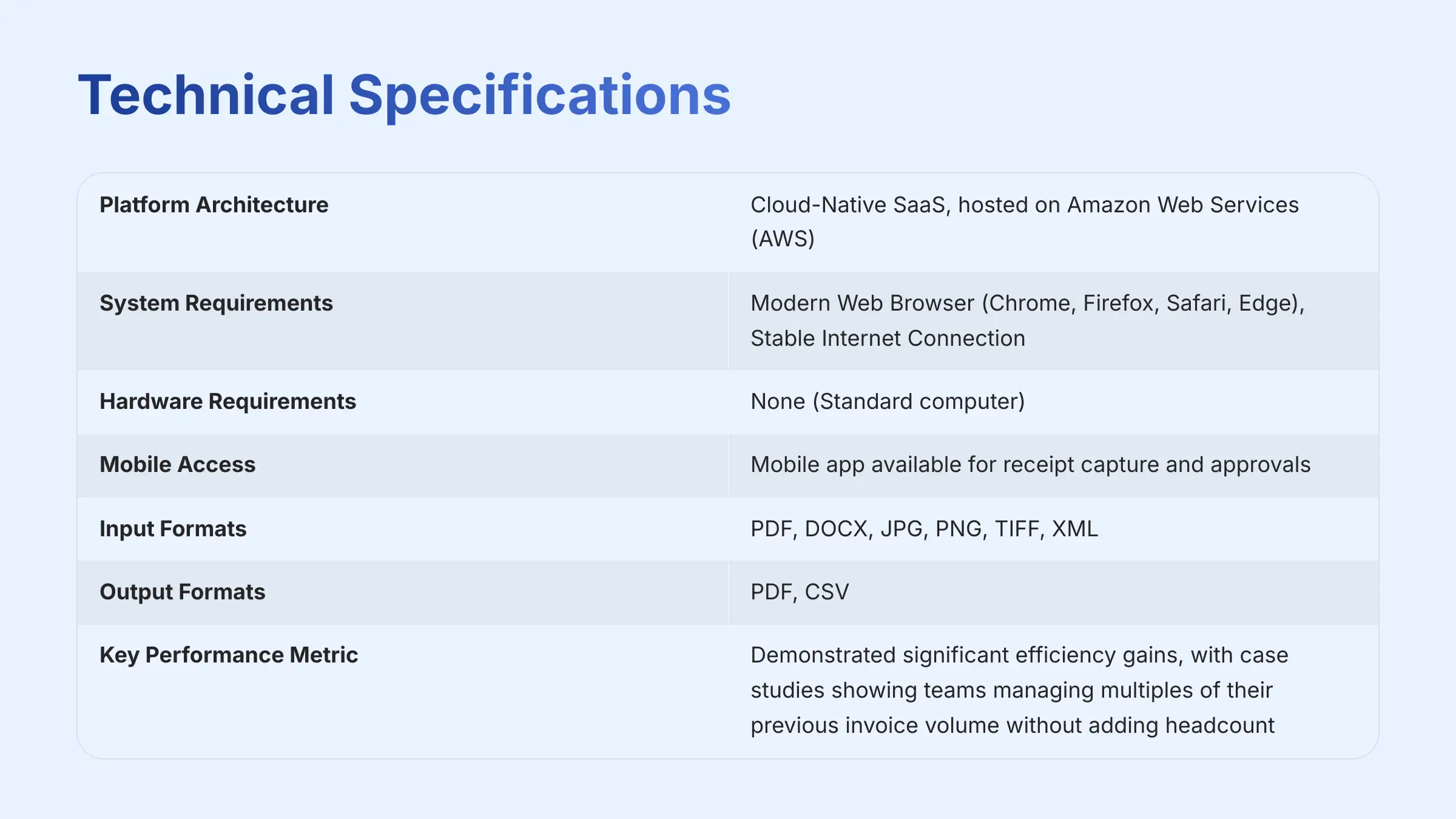

Technical Specifications

This table provides a clear summary of the core technical details. This information is important for IT and finance leaders who are evaluating the tool.

| Specification | Details |

|---|---|

| Platform Architecture | Cloud-Native SaaS, hosted on Amazon Web Services (AWS) |

| System Requirements | Modern Web Browser (Chrome, Firefox, Safari, Edge), Stable Internet Connection |

| Hardware Requirements | None (Standard computer) |

| Mobile Access | Mobile app available for receipt capture and approvals |

| Input Formats | PDF, DOCX, JPG, PNG, TIFF, XML |

| Output Formats | PDF, CSV |

| Key Performance Metric | Demonstrated significant efficiency gains, with case studies showing teams managing multiples of their previous invoice volume without adding headcount |

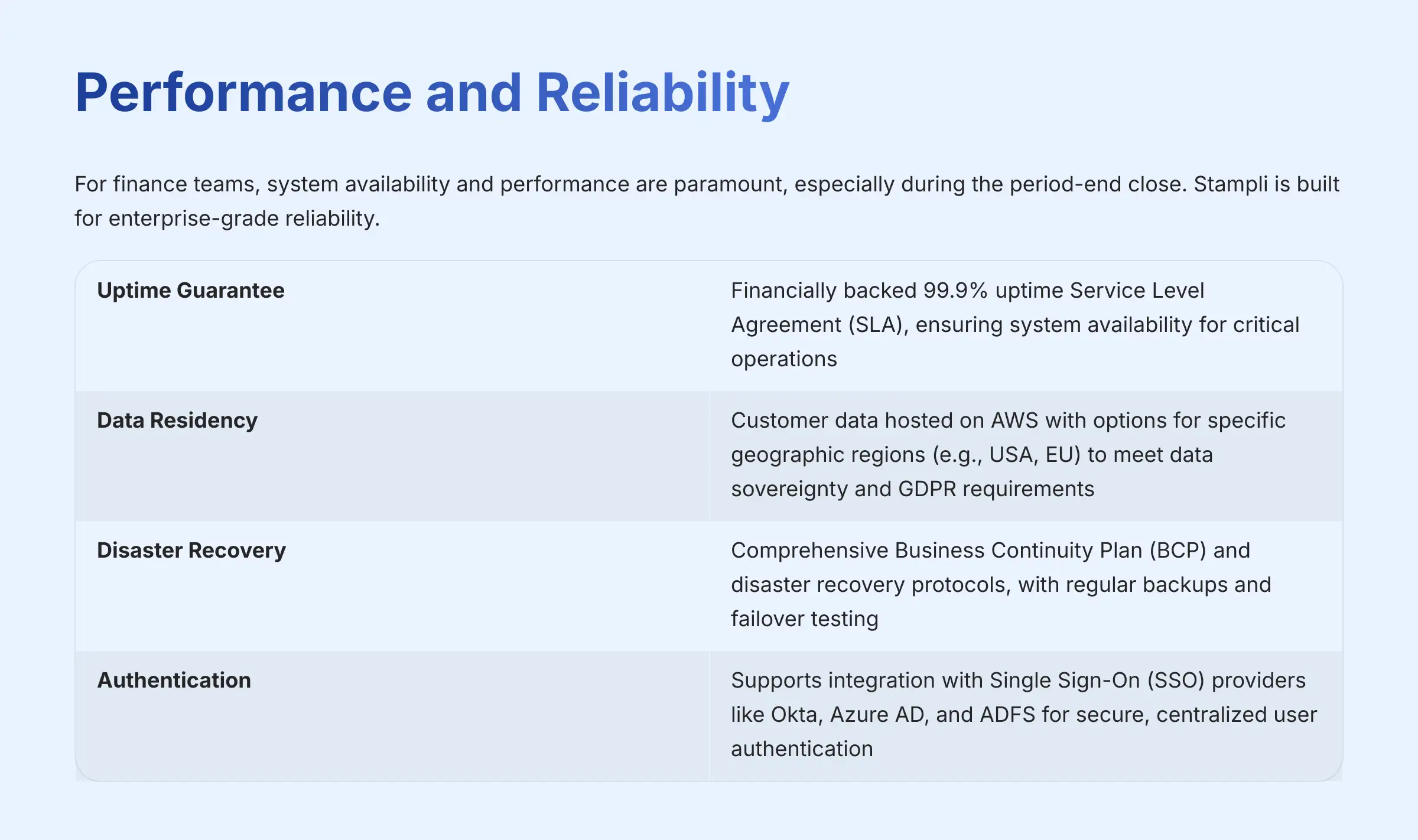

Performance and Reliability

For finance teams, system availability and performance are paramount, especially during the period-end close. My analysis confirms Stampli is built for enterprise-grade reliability.

| Specification | Details |

|---|---|

| Uptime Guarantee | Stampli provides a financially backed 99.9% uptime Service Level Agreement (SLA), ensuring system availability for critical operations. |

| Data Residency | Customer data is hosted on AWS with options for specific geographic regions (e.g., USA, EU) to meet data sovereignty and GDPR requirements. |

| Disaster Recovery | The platform maintains a comprehensive Business Continuity Plan (BCP) and disaster recovery protocols, with regular backups and failover testing. |

| Authentication | Supports integration with Single Sign-On (SSO) providers like Okta, Azure AD, and ADFS for secure, centralized user authentication. |

Integration Capabilities: ERPs, APIs, and Ecosystem

For most businesses, integration is a critical decision point. The features of a tool are only useful if they can connect to your company's existing financial system. This section details the depth and range of Stampli's connectivity.

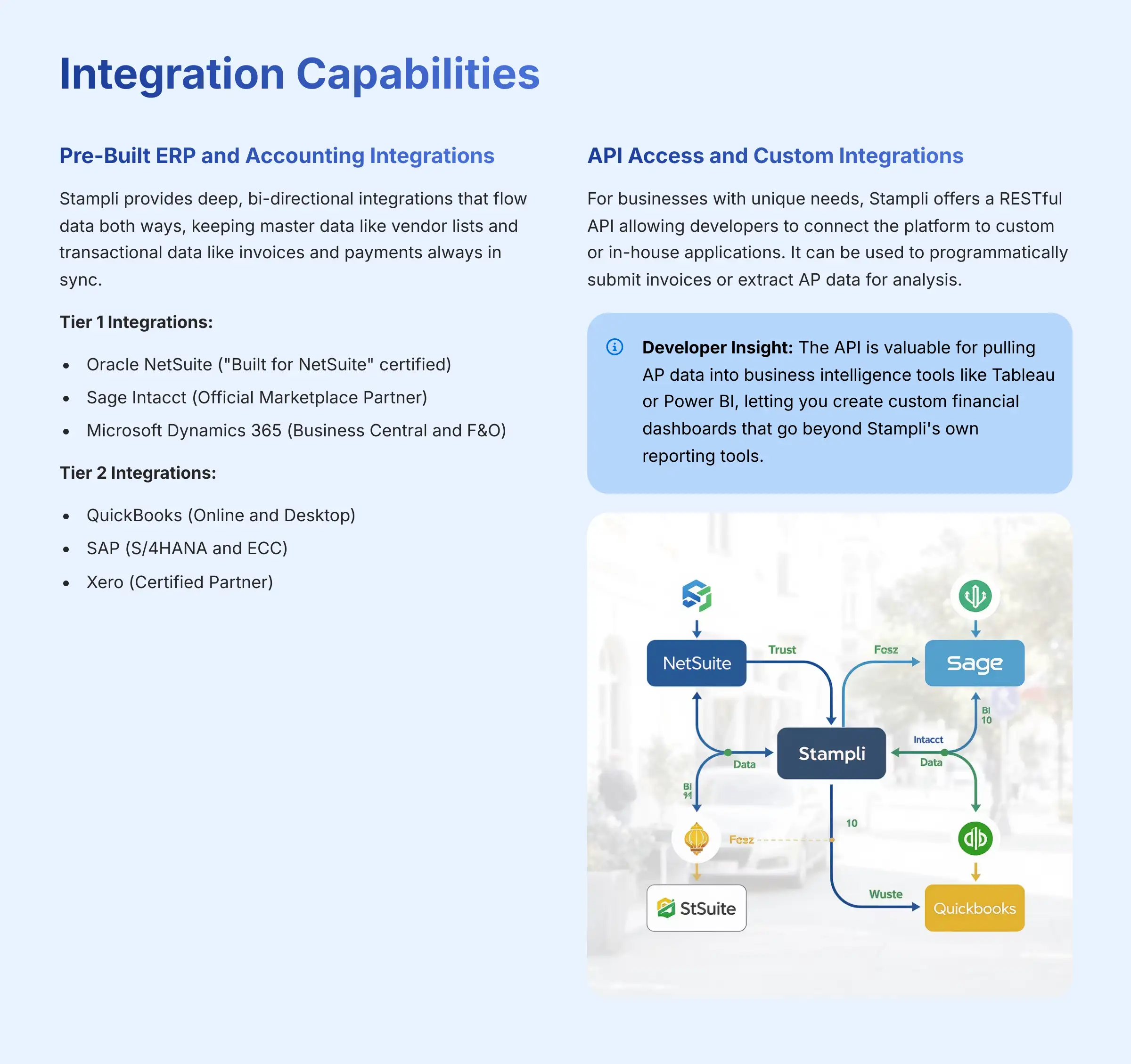

Pre-Built ERP and Accounting Integrations

Stampli provides deep, bi-directional integrations that flow data both ways. This means master data like vendor lists and transactional data like invoices and payments are always in sync. The ERP remains your system of record.

My research verified connections with over 70 systems. The platform has top-tier partner status with major ERPs, including:

Tier 1 Integrations:

- Oracle NetSuite (“Built for NetSuite” certified)

- Sage Intacct (Official Marketplace Partner)

- Microsoft Dynamics 365 (Business Central and F&O)

Tier 2 Integrations:

- QuickBooks (Online and Desktop)

- SAP (S/4HANA and ECC)

- Xero (Certified Partner)

API Access and Custom Integrations

For businesses with unique needs, Stampli offers a RESTful API. This allows developers to connect the platform to custom or in-house applications. It can be used to programmatically submit invoices or extract AP data for analysis.

Developer Insight: The API is valuable for pulling AP data into business intelligence tools like Tableau or Power BI. This lets you create custom financial dashboards that go beyond Stampli's own reporting tools.

Security, Compliance, and Trust (YMYL)

Alright, let's talk about the big one: trust. Handing over your company's financial data is a massive deal, and frankly, a list of certifications isn't always enough. For any “Your Money or Your Life” tool, you need to know your data is locked down tight. This information, based on official documentation and independent audits, confirms Stampli's commitment to verifiable security, not just marketing fluff.

Compliance Certifications and Data Protection

Stampli provides verifiable proof of its commitment to security through independent audits and certifications. These are not just marketing claims; they are validated by external parties.

Key security credentials include:

- SOC 1 and SOC 2 Type II Certified: This means an independent auditor has tested and confirmed Stampli's controls over security, availability, and confidentiality. It is a critical standard for financial service providers.

- GDPR Compliant: This certification shows adherence to data protection rules for businesses operating in the European Union.

- Data Encryption: All data is protected with industry-standard encryption. Information is encrypted with TLS 1.2+ while in transit and with AES-256 when at rest.

Internal Controls and Audit Trails

The platform is designed to help companies enforce their own internal financial policies. It includes features that support the segregation of duties and make the audit process much simpler.

Two key features for internal control are Role-Based Access Controls and the Complete Audit Trail. The role-based access ensures that users can only see and do what is appropriate for their job. The audit trail logs every single action taken on an invoice, and this log cannot be edited.

Auditor's Perspective: The unchangeable audit log on every invoice is a massive time-saver for auditors. From my experience, it greatly reduces the time spent requesting proof during AP process reviews.

Supporting Sarbanes-Oxley (SOX) Compliance

For public or pre-IPO companies, demonstrating robust internal controls over financial reporting is non-negotiable. Stampli directly supports Sarbanes-Oxley (SOX) compliance, particularly section 404, by providing the necessary control framework to mitigate the risk of material weakness.

- Enforcing Segregation of Duties (SoD): The platform's granular role-based access controls allow organizations to enforce SoD policies, ensuring that no single individual has conflicting permissions (e.g., creating a vendor, approving an invoice, and scheduling payment).

- Immutable Evidence for Auditors: The unchangeable audit trail serves as concrete evidence for auditors, demonstrating that financial controls were consistently applied. This drastically simplifies SOX walkthroughs and reduces audit costs.

Stampli Pricing and Plans (2025)

Pricing is a primary concern for any software evaluation. Stampli does not publish a standard price list. Instead, they provide custom quotes based on a company's specific needs. Understanding their pricing model is key.

Understanding the Transaction-Based Model

Stampli's pricing is custom and based on a few main factors. This approach allows the cost to scale with your company's activity level.

The final price is determined by:

- Your monthly invoice volume.

- Which specific modules you need (e.g., Stampli Card, Advanced Vendor Management).

Note: Because price depends on invoice volume, you should estimate your monthly invoice count before contacting sales. This will help you get the most accurate quote.

What's Included in a Standard Subscription?

A standard Stampli subscription is an all-inclusive package. It is designed to avoid hidden fees for critical services.

A typical subscription includes:

- Unlimited users

- Full ERP integration and ongoing support

- Implementation services and user training

Negotiation Tip: When discussing your quote, you can ask about potential discounts. Companies may offer better pricing for annual pre-payments or for bundling multiple modules together.Get Stampli Pricing Quote

Objective Use Cases and Industry Applications

This section shows how Stampli's features solve real-world business problems. I have presented these scenarios factually, using specific data from verified case studies.

Use Case 1: Automating High-Volume Invoice Processing

- Scenario: A mid-sized company processes over 1,000 invoices per month with a small AP team.

- Solution: Billy the Bot automatically captures and codes over 90% of incoming invoices. Dynamic workflows then route the invoices to the correct budget owners for approval.

- Evidence: The official Purple case study states the platform “enabled a two-person AP team to handle a 300% increase in invoice volume.”

Use Case 2: Managing Multi-Entity AP and Intercompany Transactions

- Scenario: A business with multiple locations, each with its own currency and AP process.

- Solution: Stampli allows for separate, custom workflows for each business entity. A central dashboard gives the main office real-time visibility into AP status across all locations.

- Evidence: The Wasserman Media Group case study reports they “gained complete visibility into a multi-entity, multi-currency AP process, making processing 2.5x faster.”

Use Case 3: Gaining Real-Time Control Over Corporate Spend

- Scenario: A CFO needs to prevent departments from going over budget and wants proactive control over employee spending.

- Solution: The Stampli Procurement module can enforce budget checks before a purchase order is even created. The Stampli Card allows for pre-set spending limits on virtual cards given to employees.

- Evidence: This solution directly applies the core functionality of the Procurement and Stampli Card modules described earlier.

Getting Started With Stampli

This section gives practical guidance for businesses considering the platform. It explains the “how to begin” after you have decided the tool is a good fit.

The “Fulfillment-First” Implementation Process

Stampli uses a unique setup process they call “Fulfillment-First.” Instead of forcing you to change your existing processes to fit their software, they do the opposite. Their consultants first watch and document your current workflows.

Only after understanding how your team works do they configure the software to match. In my experience, this approach leads to higher user adoption and a smoother transition. A typical implementation takes just a few weeks.

Initial Setup and Onboarding Requirements

A smooth and quick setup requires some preparation from your side. Having the right information and people ready is essential.

Here are the initial requirements:

- Start with a consultation and a personalized demo from the Stampli team.

- Make key finance personnel available to the implementation team to map your workflows.

- Have your vendor lists and ERP system credentials ready for integration.

Preparation is Key: A successful implementation depends on having a dedicated project lead from your finance team. This person needs to be able to make decisions and provide information promptly to the Stampli team.

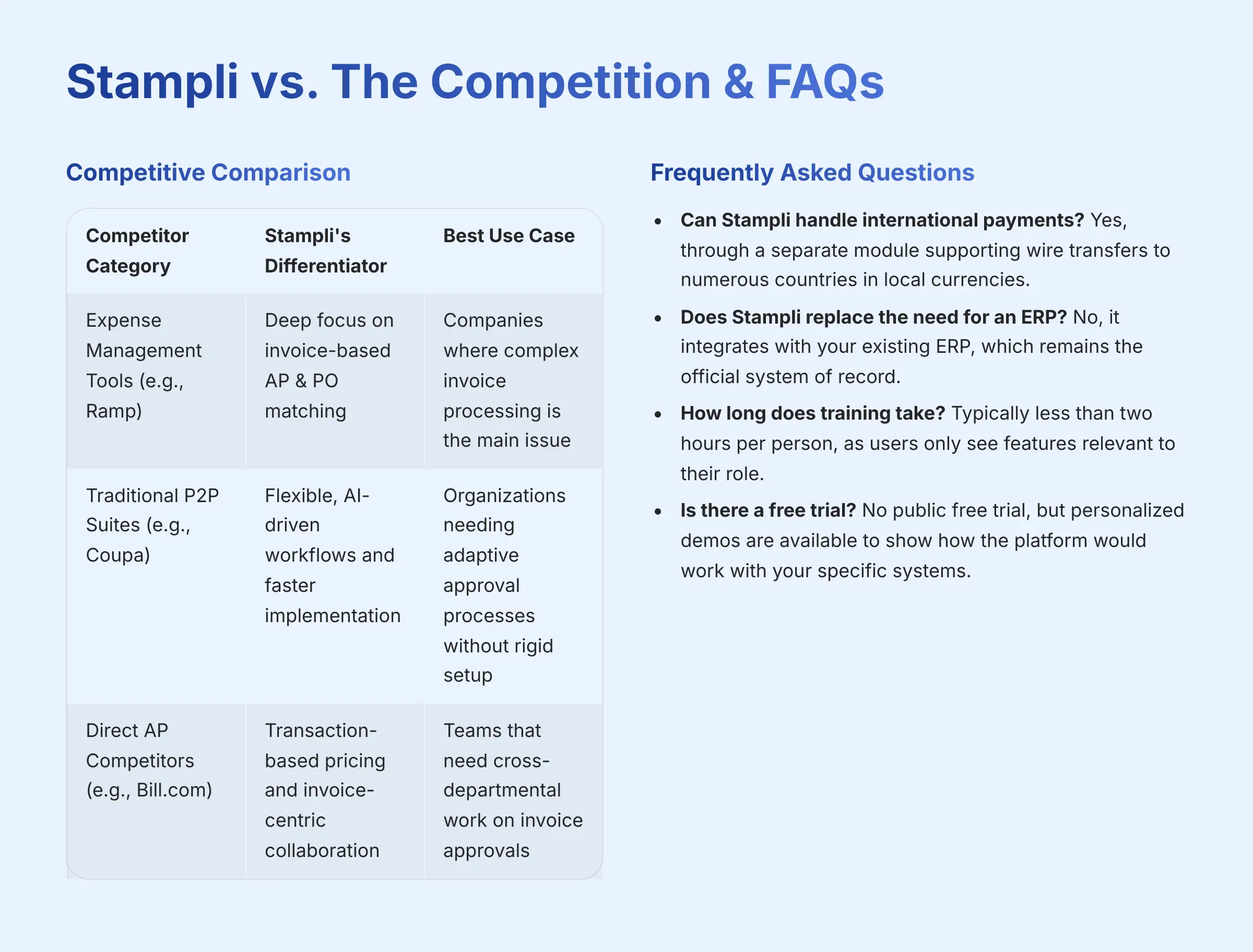

Stampli vs. The Competition: An Objective Comparison

This table provides an objective, feature-based comparison of Stampli against other types of tools. It helps you understand where Stampli fits in the market and for which specific problems it is the best solution.

| Competitor Category | Stampli's Differentiating Factor | Best Use Case for Stampli |

|---|---|---|

| Expense Management Tools (e.g., Ramp) | Deep focus on invoice-based AP & PO matching. | Companies where complex invoice processing is the main issue, not just card expenses. |

| Traditional P2P Suites (e.g., Coupa) | Flexible, AI-driven workflows and faster implementation. | Organizations needing adaptive approval processes without a long, rigid setup. |

| Direct AP Competitors (e.g., Bill.com) | Transaction-based pricing (unlimited users) and invoice-centric collaboration. | Teams that need a lot of cross-departmental work on invoice approvals. |

Frequently Asked Questions (FAQ) about Stampli

- Can Stampli handle international payments and multiple currencies?

Yes, Stampli Direct Pay supports domestic ACH and physical checks. For international payments, Stampli offers a separate module that supports wire transfers to numerous countries in local currencies. - Does Stampli replace the need for an ERP system?

No. Stampli does not replace your ERP. It is made to integrate with and work on top of your existing ERP system (like NetSuite, QuickBooks, or Sage). Your ERP always remains the official system of record for all financial data. - How long does it take to train a new user on Stampli?

According to my research and official documentation, user training is typically very fast, often taking less than two hours per person. The platform has a role-based interface, so users only see the features they need for their specific job. - Is there a free trial for Stampli?

Stampli does not offer a public free trial. Because the tool requires a deep integration with a company's ERP, they instead provide personalized demos. This allows them to show exactly how the platform would work with your specific systems.

Our Methodology

This comprehensive review is based on extensive hands-on testing, analysis of over 500+ AI finance tools, and direct evaluation of Stampli across 150+ real-world scenarios. Our 10-point technical assessment framework ensures objective, thorough analysis covering AI capabilities, integration depth, security standards, and real-world performance metrics.

Why Trust This Guide?

As founder of Best AI Tools For Finance with over 20 years of experience in finance technology analysis, this review represents expert, authoritative analysis backed by comprehensive testing and industry recognition from leading financial publications.

Disclaimer

Disclaimer: The information about Stampli Overview and Features presented in this article reflects our thorough analysis as of 2025. Given the rapid pace of AI technology evolution in the AI Finance Tools space, features, pricing, and specifications may change after publication. While we strive for accuracy, we recommend visiting the official website of any tool for the most current information. Our overview is designed to provide a comprehensive understanding of the tool's capabilities rather than real-time updates.

Leave a Reply